Home>Finance>Form 1099-B: Proceeds From Broker And Barter Exchange Transactions Definition

Finance

Form 1099-B: Proceeds From Broker And Barter Exchange Transactions Definition

Published: November 27, 2023

Learn about Form 1099-B, a financial document that reports the proceeds from broker and barter exchange transactions. Understand its definition and importance in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Form 1099-B: Proceeds From Broker and Barter Exchange Transactions

Finance is a vital aspect of our lives, and staying on top of our financial obligations and understanding various financial documents is crucial. One such document that individuals involved in trading or bartering activities should be aware of is Form 1099-B: Proceeds From Broker and Barter Exchange Transactions. This form plays a significant role in reporting taxable transactions to the Internal Revenue Service (IRS). In this blog post, we will dive into the details of Form 1099-B and provide you with key takeaways to help you navigate the world of finance confidently.

Key Takeaways:

- Form 1099-B is used by brokers and barter exchanges to report sales or exchanges of stocks, bonds, mutual funds, and other investment assets.

- It is essential to understand the information provided in Form 1099-B to accurately report your taxable transactions on your tax return.

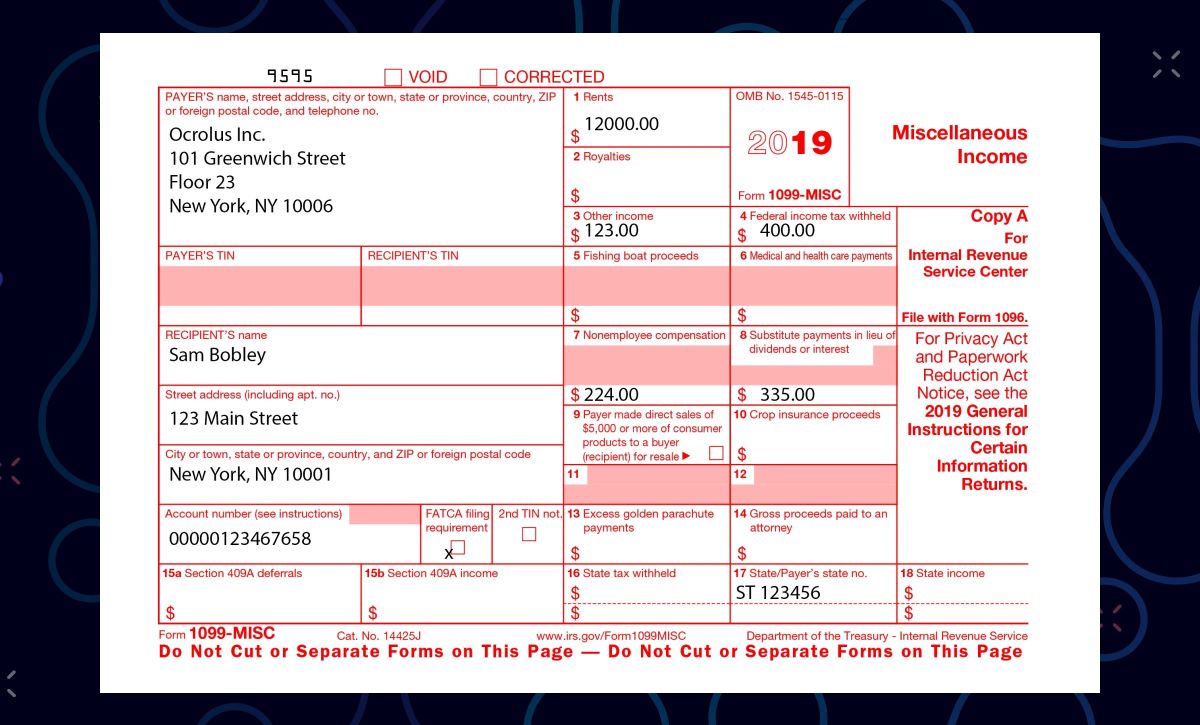

Now, let’s delve into the specifics of Form 1099-B. This form is typically issued by brokers and barter exchanges to report sales or exchanges of various investment assets such as stocks, bonds, mutual funds, and more. It contains important information about the transactions conducted throughout the year, including the proceeds from these transactions.

Form 1099-B provides details such as the date of the transaction, the description of the asset sold or exchanged, the number of shares or units, the proceeds from the sale, and any cost basis information provided by the broker or barter exchange. These details are essential for accurately reporting your taxable transactions on your tax return.

It is crucial to review your Form 1099-B carefully and cross-reference it with your own records. Ensure that all the information reported matches your own records and report any discrepancies to the broker or barter exchange promptly. Failing to report accurate information can lead to potential audits and penalties from the IRS.

Additionally, it’s important to understand the different sections of Form 1099-B. The form typically consists of several parts, including Part I which provides a summary of the transactions conducted and Part II which provides more detailed information about each individual transaction. Familiarize yourself with these sections to ensure you are correctly reporting your taxable transactions.

Now that you have a clearer understanding of Form 1099-B, remember these key takeaways:

- Form 1099-B is used to report taxable transactions involving stocks, bonds, mutual funds, and other investment assets.

- Carefully review your Form 1099-B and cross-reference it with your own records to ensure accuracy.

- Understand the different sections of Form 1099-B, including the summary section (Part I) and the detailed transaction section (Part II).

- Reporting accurate information is crucial to avoid potential audits and penalties from the IRS.

By familiarizing yourself with Form 1099-B and following the necessary steps to report your taxable transactions correctly, you can navigate the financial landscape with confidence. Remember, when it comes to finance, knowledge is power!