Home>Finance>How Much Of A Difference Does Your Credit Utilization Have On Your Score Over 50% And Below 50%

Finance

How Much Of A Difference Does Your Credit Utilization Have On Your Score Over 50% And Below 50%

Published: March 6, 2024

Learn how credit utilization impacts your finance score and the difference between utilization over 50% and below 50%. Improve your score today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Impact of Credit Utilization on Your Credit Score

- Exploring the Significance of Credit Utilization in Credit Scoring

- How Credit Utilization Influences Your Credit Score

- The Impact of High Credit Utilization on Your Credit Score

- The Benefits of Maintaining Low Credit Utilization

- Proactive Approaches to Optimize Your Credit Utilization Ratio

- Elevating Your Financial Health Through Informed Credit Utilization Practices

Introduction

Understanding the Impact of Credit Utilization on Your Credit Score

Credit utilization plays a pivotal role in determining an individual's credit score. It refers to the ratio of the amount of credit being used to the total credit available. This factor holds significant weight in credit scoring models and can substantially influence a person's creditworthiness. Understanding the impact of credit utilization on your credit score is essential for making informed financial decisions and improving your overall financial health.

Maintaining a low credit utilization ratio is crucial for a healthy credit score. Lenders and financial institutions use this metric to assess an individual's ability to manage credit responsibly. A high credit utilization ratio can signal financial distress or over-reliance on credit, potentially leading to a lower credit score. On the other hand, a low credit utilization ratio demonstrates prudent financial management and can positively impact one's credit score.

In this article, we will delve into the nuances of credit utilization and its effects on credit scores, particularly focusing on the difference between credit utilization over 50% and below 50%. By examining these distinct scenarios, we aim to provide valuable insights into how credit utilization levels can influence credit scores and offer strategies for optimizing credit utilization to enhance overall creditworthiness. Understanding these dynamics can empower individuals to make informed decisions and take proactive steps to improve their credit profiles.

Understanding Credit Utilization

Exploring the Significance of Credit Utilization in Credit Scoring

Credit utilization, often referred to as the credit utilization ratio, is a critical component of credit scoring models utilized by major credit bureaus. This metric measures the proportion of available credit that an individual is currently using. It is calculated by dividing the total outstanding balances on credit accounts by the total credit limit across all accounts and is typically expressed as a percentage.

For example, if a person has a total credit limit of $10,000 and carries a combined balance of $3,000 on their credit cards, their credit utilization ratio would be 30% ($3,000 ÷ $10,000 = 0.30, or 30%).

The credit utilization ratio provides insights into an individual’s borrowing behavior and financial management practices. Lenders and credit scoring models consider lower credit utilization ratios to be indicative of responsible credit usage and financial stability. Conversely, higher credit utilization ratios may raise concerns about a person’s ability to manage their debts effectively, potentially leading to a negative impact on their credit score.

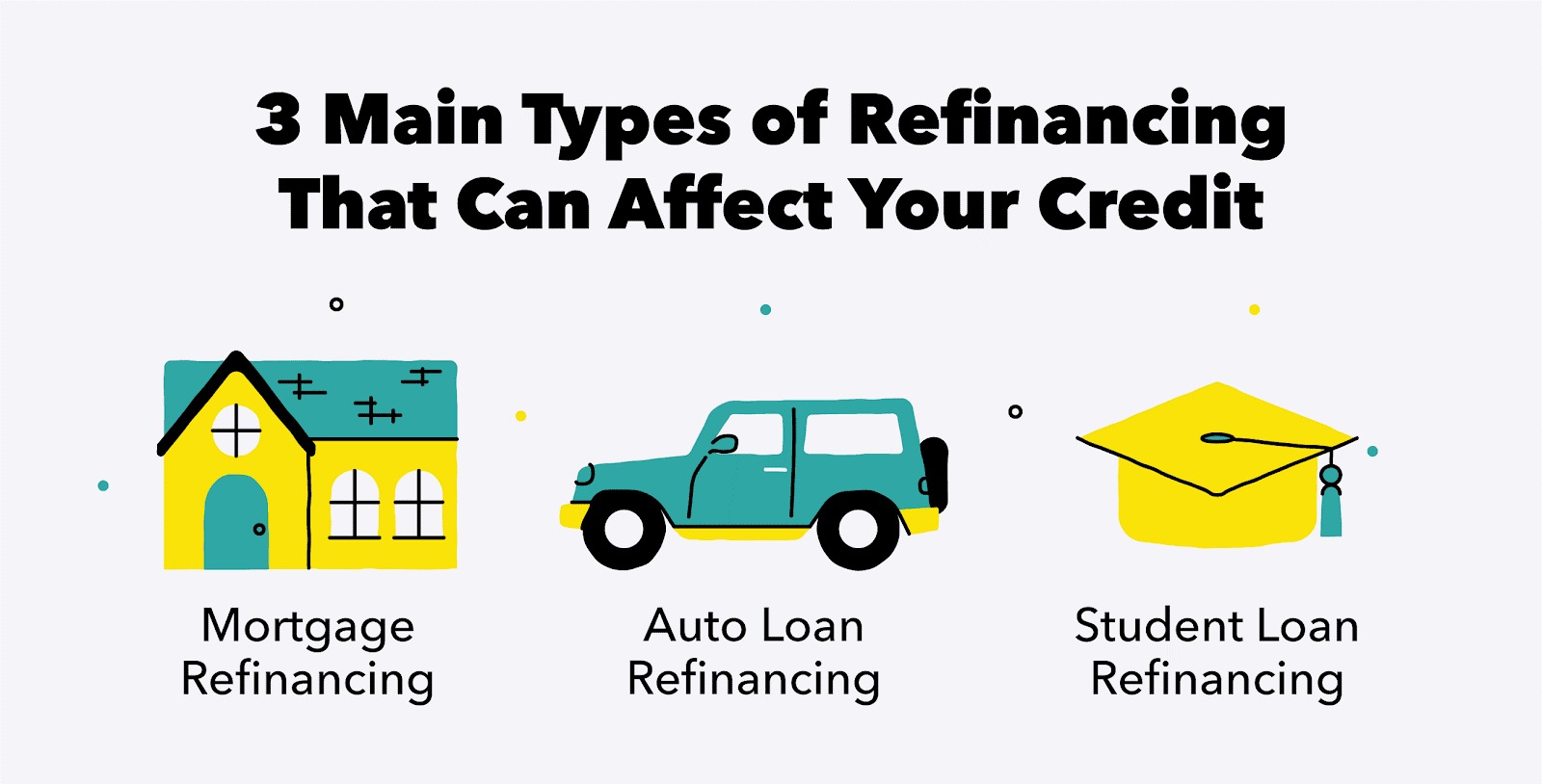

It’s important to note that credit utilization is evaluated across all revolving credit accounts, including credit cards and lines of credit. Mortgage loans, auto loans, and other installment loans are not factored into the credit utilization calculation.

Understanding the significance of credit utilization is paramount for individuals seeking to maintain or improve their credit scores. By managing credit utilization effectively, individuals can demonstrate responsible financial behavior and enhance their overall creditworthiness, opening doors to favorable lending terms and financial opportunities.

Impact of Credit Utilization on Your Score

How Credit Utilization Influences Your Credit Score

The impact of credit utilization on an individual’s credit score cannot be overstated. Credit scoring models, including the widely used FICO and VantageScore systems, consider credit utilization as a crucial factor in assessing creditworthiness. This metric provides valuable insights into an individual’s financial behavior and can significantly influence their credit score.

High credit utilization, indicating that a large portion of available credit is being utilized, can have a detrimental effect on a person’s credit score. Lenders may interpret high credit utilization as a sign of financial strain or excessive reliance on credit, potentially raising concerns about the individual’s ability to manage additional debt responsibly. As a result, a high credit utilization ratio often leads to a decrease in credit scores.

Conversely, maintaining a low credit utilization ratio can have a positive impact on credit scores. Individuals who consistently utilize a small portion of their available credit demonstrate responsible financial management, which is reflected in their credit scores. By keeping credit utilization low, individuals can potentially see an improvement in their credit scores over time.

It’s important to recognize that credit utilization is a dynamic factor that can influence credit scores in real-time. As credit card balances and credit limits change, so does the credit utilization ratio. Consequently, individuals should be mindful of their credit utilization levels and strive to keep them within optimal ranges to support healthy credit scores.

Understanding the impact of credit utilization on credit scores empowers individuals to make informed decisions about their credit usage and overall financial management. By proactively managing credit utilization, individuals can work towards achieving and maintaining strong credit scores, which can have far-reaching benefits in various financial endeavors.

Credit Utilization Over 50%

The Impact of High Credit Utilization on Your Credit Score

When an individual’s credit utilization exceeds 50%, it can have a significant impact on their credit score. High credit utilization, especially surpassing the halfway mark, is generally viewed unfavorably by credit scoring models and lenders. This level of credit utilization can raise concerns about an individual’s financial stability and their ability to manage debt responsibly.

Exceeding the 50% threshold for credit utilization can signal an increased risk of potential default or financial distress. Lenders may interpret high credit utilization as a red flag, potentially resulting in a negative impact on an individual’s credit score. As a result, individuals with credit utilization over 50% may experience a decline in their credit scores, limiting their access to favorable lending terms and financial opportunities.

Furthermore, high credit utilization over 50% can also lead to increased interest expenses and financial strain. Carrying large balances on credit accounts can result in higher interest payments, further exacerbating the financial burden and potentially leading to a cycle of debt accumulation.

It’s essential for individuals with credit utilization exceeding 50% to take proactive steps to address this situation. By strategically managing their credit utilization and reducing outstanding balances, they can mitigate the adverse effects on their credit scores. Additionally, exploring options such as increasing credit limits or consolidating balances through responsible means can help individuals work towards improving their credit utilization and overall financial health.

Understanding the implications of high credit utilization over 50% underscores the importance of actively monitoring and managing credit usage. By addressing elevated credit utilization levels, individuals can strive to restore balance to their credit profiles and pave the way for enhanced creditworthiness.

Credit Utilization Below 50%

The Benefits of Maintaining Low Credit Utilization

When an individual’s credit utilization remains below 50%, it can yield several positive outcomes for their credit score and overall financial well-being. Low credit utilization is indicative of responsible credit management and financial prudence, which can contribute to a favorable credit profile.

Maintaining credit utilization below 50% demonstrates to lenders and credit scoring models that an individual is effectively managing their available credit. This responsible approach to credit usage can lead to a positive impact on the individual’s credit score, potentially resulting in higher creditworthiness and improved access to lending opportunities with favorable terms.

Individuals with credit utilization below 50% are perceived as lower-risk borrowers, as they are not heavily reliant on their available credit lines. This can enhance their credibility in the eyes of lenders and may lead to more favorable interest rates and credit offers. Additionally, maintaining low credit utilization can contribute to overall financial stability and reduce the risk of accumulating high-interest debt.

Furthermore, individuals with credit utilization below 50% may experience greater flexibility in managing their finances. Lower credit utilization levels provide a cushion of available credit, offering a safety net for unexpected expenses or financial emergencies. This can contribute to reduced financial stress and a more secure financial position.

It’s important for individuals to recognize the value of maintaining low credit utilization and to strive for a healthy balance between credit usage and available credit limits. By consistently managing credit utilization below 50%, individuals can position themselves for improved credit scores and enhanced financial opportunities.

Understanding the benefits of maintaining credit utilization below 50% underscores the significance of prudent credit management. By exercising restraint in credit usage and leveraging available credit responsibly, individuals can pave the way for a more robust and resilient financial future.

Strategies for Improving Credit Utilization

Proactive Approaches to Optimize Your Credit Utilization Ratio

Improving credit utilization is a pivotal step towards enhancing one’s credit score and overall financial well-being. By implementing strategic approaches to manage and reduce credit utilization, individuals can positively impact their credit profiles and strengthen their creditworthiness.

- Pay Down Balances: One of the most effective strategies for improving credit utilization is to pay down outstanding balances on credit accounts. By reducing the amount of credit being utilized, individuals can lower their credit utilization ratio, potentially leading to an improvement in their credit scores. Prioritizing the repayment of high-interest debts and consistently chipping away at outstanding balances can contribute to a healthier credit utilization ratio.

- Request Credit Limit Increases: Another approach involves requesting credit limit increases on existing credit accounts. By increasing the total available credit without accruing additional debt, individuals can lower their credit utilization ratio. It’s important to approach this strategy prudently and avoid utilizing the increased credit limits to incur additional debt, as responsible credit management is essential.

- Use Credit Wisely: Adopting responsible credit usage habits is crucial for optimizing credit utilization. Avoiding unnecessary or excessive spending on credit accounts and maintaining a disciplined approach to credit usage can contribute to lower credit utilization levels. By using credit wisely and refraining from maxing out credit lines, individuals can demonstrate prudent financial behavior and improve their credit utilization ratio.

- Monitor and Adjust Regularly: Regularly monitoring credit utilization and making adjustments as needed is essential for maintaining optimal levels. By staying informed about credit balances and limits, individuals can proactively manage their credit utilization to align with their financial goals. Periodic reviews of credit utilization can help identify areas for improvement and guide strategic adjustments.

By implementing these proactive strategies, individuals can work towards optimizing their credit utilization and fortifying their overall financial standing. Taking deliberate steps to manage credit utilization effectively can lead to tangible improvements in credit scores and enhanced financial opportunities.

Conclusion

Elevating Your Financial Health Through Informed Credit Utilization Practices

Credit utilization stands as a cornerstone of credit scoring, wielding significant influence over individuals’ credit scores and overall financial well-being. Understanding the nuances of credit utilization, particularly the impact of levels exceeding and staying below 50%, provides a roadmap for individuals to navigate the realm of credit management effectively.

High credit utilization, especially surpassing the 50% threshold, can trigger concerns among lenders and credit scoring models, potentially leading to adverse effects on credit scores. Conversely, maintaining credit utilization below 50% signals responsible credit management and can contribute to enhanced credit scores and improved access to favorable financial opportunities.

By embracing proactive strategies such as paying down balances, seeking credit limit increases judiciously, and cultivating wise credit usage habits, individuals can work towards optimizing their credit utilization ratios. These efforts, coupled with regular monitoring and adjustments, can pave the way for a healthier credit profile and a more robust financial foundation.

Ultimately, the journey towards improving credit utilization is a testament to individuals’ commitment to financial prudence and responsible credit management. By leveraging the insights and strategies outlined in this article, individuals can empower themselves to make informed decisions, elevate their credit scores, and embark on a path towards enduring financial success.

Embracing a holistic approach to credit utilization not only fosters stronger credit scores but also cultivates a mindset of financial mindfulness and empowerment. As individuals harness the power of optimized credit utilization, they position themselves for greater financial resilience and the pursuit of their long-term aspirations.