Home>Finance>How Much Should Small Businesses Set Aside For Taxes?

Finance

How Much Should Small Businesses Set Aside For Taxes?

Modified: February 21, 2024

Discover how small businesses can determine the ideal amount to set aside for taxes and ensure financial stability. Expert advice on finance and tax planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Tax Obligations for Small Businesses

- Factors Influencing Tax Payments

- Choosing the Right Business Entity for Tax Planning

- The Importance of Accurate Bookkeeping

- Calculating Estimated Tax Payments

- Tax Deductions and Credits for Small Businesses

- Strategies for Minimizing Tax Liability

- The Role of a Tax Professional in Small Business Taxes

- Conclusion

Introduction

When it comes to running a small business, taxes are an inevitable part of the equation. As a small business owner, it is crucial to understand your tax obligations and plan accordingly so that you can ensure compliance while maximizing your financial stability.

Small business taxes can be complex and overwhelming, especially if you don’t have a solid understanding of the tax laws and regulations. However, by learning about key factors that influence tax payments and implementing effective tax planning strategies, you can minimize your tax liability and avoid any potential tax-related pitfalls.

In this article, we will explore the importance of setting aside funds for taxes, factors that influence tax payments, and strategies for minimizing your tax liability as a small business owner. Whether you are starting a new business or have been in operation for years, understanding and managing your tax obligations is essential for the financial health and success of your business.

Before we delve into the details, it’s important to note that while this article offers general guidance, it is essential to consult with a qualified tax professional or accountant to ensure that you are making the best decisions for your specific business needs.

Understanding Tax Obligations for Small Businesses

As a small business owner, it is crucial to have a clear understanding of your tax obligations. This includes knowing which taxes you are required to pay and when they are due.

The most common types of taxes that small businesses are responsible for include:

- Income Tax: This is the tax on the profits earned by your business. The tax rate will depend on your business entity (sole proprietorship, partnership, corporation) and the amount of taxable income.

- Self-Employment Tax: If you are a sole proprietor, you are required to pay self-employment tax, which covers Social Security and Medicare taxes. This tax is separate from income tax.

- Employment Taxes: If you have employees, you are responsible for withholding and paying their share of Social Security and Medicare taxes, as well as federal and state unemployment taxes.

- Sales Tax: Depending on your location and the nature of your business, you may be required to collect and remit sales tax on the goods or services you sell.

- Excise Taxes: Certain industries, such as alcohol, tobacco, and gasoline, are subject to excise taxes. If your business is involved in such activities, you will need to understand and comply with these specific tax requirements.

It is important to note that tax obligations vary depending on the business structure and location. For example, sole proprietors and partnerships report business income on their personal tax returns, while corporations have separate tax returns. Additionally, different states have different tax requirements, so it’s crucial to familiarize yourself with the specific regulations that apply to your business.

To ensure compliance with tax laws, it is essential to keep accurate financial records, including income, expenses, and any relevant supporting documents. These records will serve as the basis for calculating your taxable income and deductible expenses.

By staying organized and informed about your tax obligations, you can avoid penalties, audits, and other potential issues that could negatively impact your business’s financial health. Furthermore, understanding your tax obligations allows you to plan and budget accordingly, ensuring that you have sufficient funds set aside for tax payments.

Factors Influencing Tax Payments

Several factors influence the amount of taxes a small business is required to pay. Understanding these factors can help you plan your finances and set aside the appropriate funds for tax payments.

1. Business Structure: The type of business entity you have chosen, whether it’s a sole proprietorship, partnership, S corporation, or C corporation, will affect your tax obligations. Each business structure has different tax rules and rates. For example, a sole proprietor reports business income on their personal tax return, while a corporation files a separate tax return.

2. Revenue and Profitability: The amount of revenue and profitability of your business will directly impact your tax liability. Generally, the higher your income and profits, the higher your tax obligation will be. This is because taxes are usually calculated based on a percentage of your taxable income.

3. Expenses and Deductions: The expenses incurred for your business can be deducted from your revenue, reducing your taxable income. It is essential to keep track of all eligible business expenses, such as rent, utilities, employee salaries, and marketing costs. Taking advantage of available deductions can significantly lower your tax liability.

4. Depreciation and Amortization: If your business owns assets, such as equipment or property, you may be eligible to depreciate or amortize these assets over their useful life. By spreading out the cost of these assets over time, you can reduce your taxable income and, consequently, lower your tax payments.

5. Tax Credits and Incentives: There are various tax credits and incentives available for small businesses. These can include research and development credits, energy efficiency credits, and hiring incentives. Taking advantage of these credits can help offset your tax liability and potentially result in tax savings.

6. State and Local Taxes: In addition to federal taxes, small businesses are also subject to state and local taxes. The tax rates and regulations can vary significantly from one jurisdiction to another. It is important to understand the specific requirements and rates applicable to your business’s location.

By considering these factors and consulting with a tax professional, you can better estimate your tax liability and set aside the appropriate funds to meet your tax obligations. It is always a good practice to plan ahead and budget for taxes, ensuring you have the necessary funds available when tax payments are due.

Choosing the Right Business Entity for Tax Planning

One of the most critical decisions you will make as a small business owner is choosing the right business entity. The business structure you select will not only affect how you operate your business but also have significant implications for your tax planning.

Here are some common business entities and their tax implications:

- Sole Proprietorship: This is the simplest and most common form of business ownership. As a sole proprietor, you are personally responsible for your business’s profits and losses. Your business income is reported on your personal tax return. While this structure provides simplicity, it also means that you are personally liable for any business debts.

- Partnership: A partnership is formed when two or more individuals join together to run a business. Similar to a sole proprietorship, profits and losses pass through to the partners, who report them on their personal tax returns. Each partner’s share of the partnership’s income is taxed at their individual tax rates. It is important to have a well-drafted partnership agreement that outlines each partner’s responsibilities, profit distributions, and liability.

- Corporation: A corporation is a separate legal entity from its owners. It offers limited liability protection to its shareholders, meaning that their personal assets are generally protected from business liabilities. Corporations can choose to be taxed as either a C corporation or an S corporation. C corporations are subject to double taxation, where profits are taxed at the corporate level and again when dividends are distributed to shareholders. S corporations, on the other hand, pass through income and losses to shareholders, who report them on their personal tax returns.

- Limited Liability Company (LLC): An LLC is a hybrid business entity that provides limited liability protection to its owners, known as members. LLCs offer flexibility in terms of tax treatment, allowing owners to choose how they want to be taxed. By default, an LLC is taxed as either a sole proprietorship (for single-member LLCs) or a partnership (for multi-member LLCs). However, LLCs can also elect to be taxed as corporations.

Choosing the right business entity is crucial for tax planning purposes. It is important to consider factors such as liability protection, ease of administration, and tax implications. Consulting with a tax professional or an attorney experienced in small business taxes can help you make an informed decision based on your specific needs and goals.

Remember, tax planning is an ongoing process, and as your business evolves, you may need to reassess your business structure to ensure that it aligns with your changing goals and circumstances. Reviewing your business entity and tax strategies periodically with a professional can help optimize your tax planning and ensure that you are taking full advantage of available opportunities.

The Importance of Accurate Bookkeeping

Accurate bookkeeping is a fundamental aspect of managing your small business finances effectively and playing a crucial role in your tax planning and compliance. By maintaining accurate and organized financial records, you can track your income, expenses, and other financial transactions, which not only helps you make informed business decisions but also ensures that you are fully prepared for tax obligations.

Here are some reasons why accurate bookkeeping is essential for small businesses:

- Tax Compliance: Accurate bookkeeping is vital for meeting your tax obligations. It allows you to calculate your taxable income, claim eligible deductions, and accurately report your financial information on your tax returns. If you are ever audited by the tax authorities, having well-organized and accurate financial records will prove invaluable in demonstrating your compliance and reducing the risk of penalties or fines.

- Financial Decision-Making: By keeping accurate financial records, you can track your business’s financial health. A clear understanding of your income, expenses, and cash flow enables you to make more informed decisions about pricing, marketing strategies, inventory management, and investments. Accurate bookkeeping provides you with the necessary data to assess the profitability of your products or services, identify areas for cost savings, and plan for future growth.

- Budgeting and Forecasting: Accurate financial records serve as the foundation for creating realistic budgets and forecasts. By analyzing your past financial performance, you can make more accurate projections for the future. Budgets and forecasts can help you set financial goals, allocate resources effectively, and make necessary adjustments to ensure your business remains on track.

- Tracking Business Expenses: Maintaining accurate records of your business expenses is critical for tax deductions and expense management. By categorizing and documenting your business expenses, you can identify deductible expenses that can help lower your tax liability. Additionally, organized records allow you to monitor and control your expenses effectively, helping you identify areas of overspending or potential cost savings.

- Funding and Loans: When seeking funding or applying for business loans, accurate financial records are essential. Lenders and investors often require detailed financial statements, such as profit and loss statements, balance sheets, and cash flow statements, to evaluate your business’s creditworthiness. Having accurate and up-to-date financial records can improve your chances of securing financing and demonstrate your business’s financial stability and potential for growth.

Accurate bookkeeping can be a time-consuming task, but there are various accounting software and online tools available that can streamline the process and simplify record-keeping. If you are unsure about maintaining your books, consider hiring a professional bookkeeper or working with an accounting firm to ensure that your financial records are accurate and up-to-date.

Remember, accurate bookkeeping is not just about compliance; it is a valuable tool for managing and growing your business. By investing time and effort into maintaining organized financial records, you can gain valuable insights, make informed business decisions, and optimize your tax planning strategies.

Calculating Estimated Tax Payments

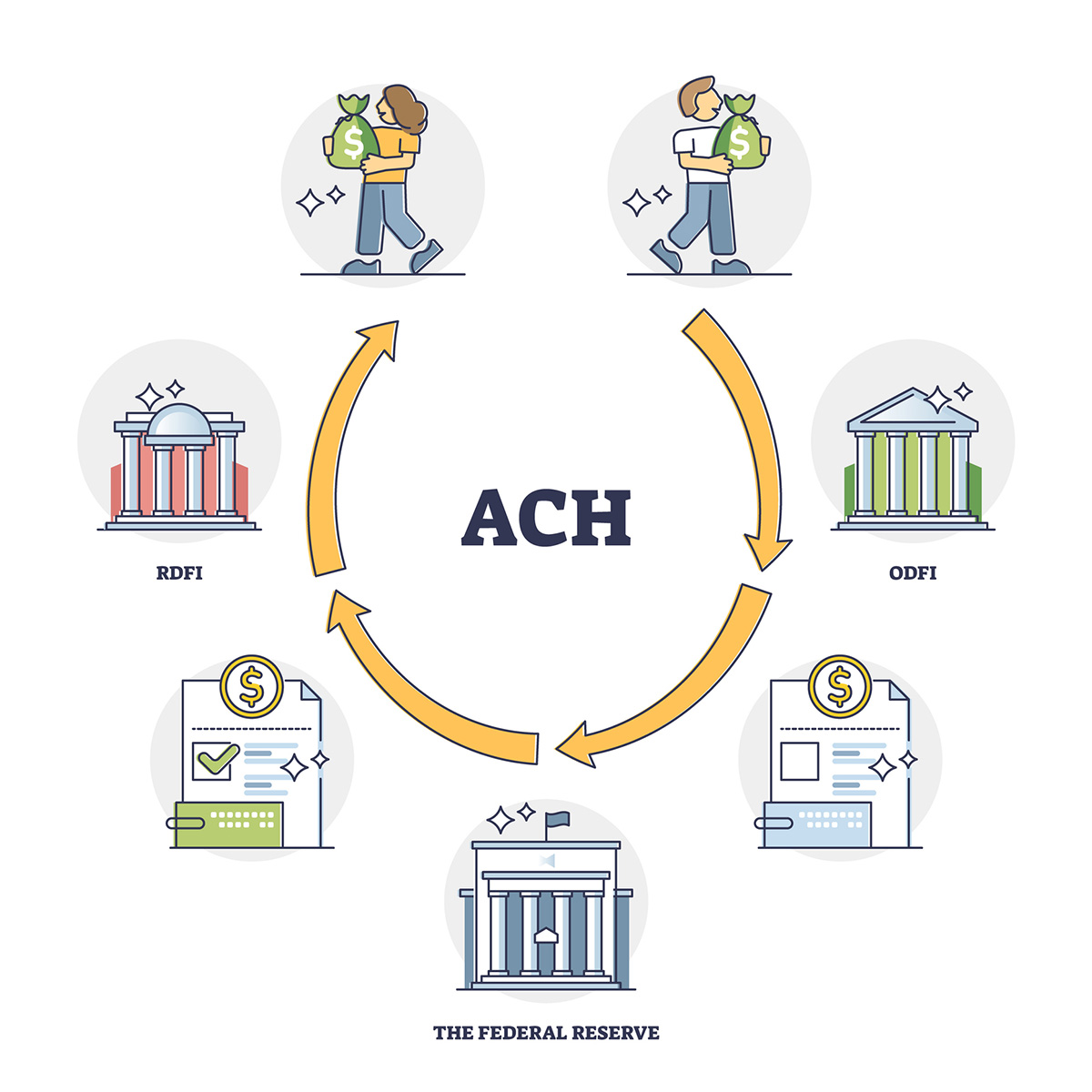

As a small business owner, it is important to understand how to calculate and make estimated tax payments throughout the year. Estimated tax payments are periodic payments made to the tax authorities to cover your tax liability when you do not have taxes withheld from your income, such as from wages or salaries.

Here are the key steps to help you calculate your estimated tax payments:

- Estimate your annual income: Start by estimating your business’s total annual income. This includes all sources of revenue, such as sales, services, and investments.

- Track your deductible expenses: Keep a record of all deductible business expenses. This can include operating expenses, supplies, rent, utilities, and employee salaries. Deductible expenses reduce your taxable income, so it’s important to accurately track and document them.

- Consider your tax deductions and credits: Take into account any tax deductions or credits you may be eligible for. This can include business-related deductions, such as equipment purchases, healthcare expenses, or research and development costs.

- Calculate your taxable income: Subtract your deductible expenses and any applicable deductions or credits from your estimated annual income. This will give you your estimated taxable income.

- Apply the appropriate tax rate: Review the tax brackets and rates applicable to your business structure. Depending on your taxable income and entity type, you will be subject to different tax rates.

- Determine the payment periods: Estimated tax payments are typically made quarterly, with due dates in April, June, September, and January of the following year. Calculate the amount you need to pay for each payment period based on your estimated tax liability.

To calculate the amount of each estimated tax payment, use IRS Form 1040-ES or consult with a tax professional. The form provides a worksheet to help you estimate your tax liability and determine the required payment amounts for each quarter.

It’s important to note that failing to make estimated tax payments or underpaying can result in penalties and interest charges. Therefore, it is crucial to accurately calculate and make your estimated tax payments on time to avoid any unnecessary financial burdens.

Keep in mind that these calculations are estimates, and your actual tax liability may vary. It’s always a good practice to monitor your business’s financial performance throughout the year and make adjustments to your estimated tax payments if necessary. Consulting with a tax professional can provide valuable insights and guidance to ensure accurate estimations and compliance with tax laws.

Tax Deductions and Credits for Small Businesses

As a small business owner, taking advantage of tax deductions and credits can significantly reduce your tax liability and improve your overall financial position. Understanding the available deductions and credits can help you maximize your tax savings and keep more money in your business’s pocket. Here are some common tax deductions and credits for small businesses:

1. Business Expenses: Deductible business expenses can include costs such as rent, utilities, supplies, advertising, travel expenses, and employee wages. Keep detailed records of these expenses and ensure they are ordinary and necessary for your business.

2. Home Office Deduction: If you use part of your home exclusively for your business, you may be eligible for a home office deduction. This deduction allows you to claim expenses related to the use of your home office, such as utilities, rent, or mortgage interest.

3. Equipment and Depreciation: You can deduct the cost of equipment and other assets used in your business over time through depreciation. Additionally, there are options for immediate expensing of certain equipment purchases through Section 179 deductions or bonus depreciation provisions.

4. Health Insurance Deduction: Small business owners who provide health insurance coverage for themselves, their employees, and their families may be able to deduct a portion of the premiums as a business expense.

5. Retirement Contributions: Contributing to retirement plans, such as a Simplified Employee Pension (SEP) IRA or a solo 401(k), can provide deductions for your business and help you save for retirement.

6. Research and Development (R&D) Tax Credit: If your business engages in qualified research activities, you may be eligible for the R&D tax credit. This credit incentivizes businesses to invest in research and development by allowing them to claim a percentage of their R&D expenses as a tax credit.

7. Work Opportunity Tax Credit (WOTC): The WOTC provides tax credits to businesses that hire individuals from targeted groups, such as veterans, ex-felons, or long-term unemployed individuals.

8. State and Local Tax Credits: Depending on your location, there may be additional tax credits available at the state and local level. These can include credits for job creation, energy efficiency, or investment in designated economic development areas.

It’s important to keep in mind that tax deductions and credits have specific eligibility requirements and limitations. Additionally, tax laws and regulations may change over time, so it’s essential to stay informed and consult with a tax professional to ensure that you are taking advantage of all available deductions and credits while remaining in compliance with the tax laws.

By understanding and leveraging these deductions and credits, you can effectively reduce your tax liability, improve your cash flow, and reinvest the savings back into your business’s growth and success.

Strategies for Minimizing Tax Liability

Minimizing tax liability is a common goal for small business owners. By implementing strategic tax planning strategies, you can legally reduce your tax burden and optimize your financial position. Here are some effective strategies for minimizing your tax liability:

1. Take Advantage of Deductions and Credits: Familiarize yourself with available tax deductions and credits for small businesses, as mentioned in the previous section. Ensure that you are keeping accurate records of deductible expenses and exploring eligibility for various credits. Regularly review tax laws and regulations to stay up-to-date on any new deductions or credits that may apply to your business.

2. Time Expenses and Income: Consider the timing of your business expenses and income. By strategically deferring or accelerating certain expenses or income, you can potentially lower your taxable income in a particular year or take advantage of tax benefits in the current year.

3. Plan for Depreciation and Capital Investments: Understand the tax rules for depreciation and take advantage of accelerated depreciation methods when applicable. Additionally, consider the tax implications of capital investments, such as equipment purchases, and utilize deductions, such as Section 179 or bonus depreciation, to offset the costs in the year of acquisition.

4. Consider Entity Structure: Evaluate whether your current business entity structure is the most tax-efficient for your business. As discussed earlier, different business structures have varying tax obligations and benefits. Consult with a tax professional to determine if changing your entity structure could result in lower tax liability.

5. Plan for Self-Employment Taxes: If you are self-employed, be mindful of the self-employment tax obligations, which cover Social Security and Medicare taxes. Understand the tax rules and consider strategies, such as contributing to retirement plans, to minimize the impact of self-employment taxes on your overall tax liability.

6. Utilize Retirement Plans: Contributing to a retirement plan, such as a SEP IRA or solo 401(k), not only helps you save for the future but also provides tax advantages. Contributions to retirement plans are typically tax-deductible, allowing you to reduce your taxable income while saving for retirement.

7. Keep Accurate and Organized Records: Proper bookkeeping and record-keeping are crucial for minimizing tax liability. Accurate financial records ensure you claim all eligible deductions, track deductible expenses, and comply with tax laws. Consider using accounting software or hiring a professional bookkeeper to maintain organized records and stay on top of your finances.

8. Consult with a Tax Professional: Tax laws and regulations can be complex and ever-changing. Working with a qualified tax professional or CPA who specializes in small business taxes can provide valuable guidance and help you navigate the tax landscape. They can help you identify tax-saving opportunities, ensure compliance, and assist with tax planning strategies tailored to your specific business needs.

Remember, tax planning is an ongoing process and requires proactive measures. By implementing these strategies and staying informed about changes in tax laws, you can optimize your tax position, reduce your tax liability, and keep more of your hard-earned money working for your business.

The Role of a Tax Professional in Small Business Taxes

Managing small business taxes can be complex and time-consuming. To navigate the intricacies of tax laws and ensure compliance, many small business owners enlist the help of a tax professional. A qualified tax professional, such as a certified public accountant (CPA) or tax attorney, plays a crucial role in handling small business taxes. Here’s how they can assist you:

1. Expertise and Knowledge: Tax professionals have in-depth knowledge and expertise in tax laws and regulations. They stay updated with any changes in tax codes, credits, and deductions that may impact your business. By leveraging their knowledge, they can guide you through the tax landscape and ensure that your tax planning is in line with the latest requirements.

2. Tax Planning and Strategy: A tax professional can provide strategic tax planning tailored to your business. They can analyze your financial situation, identify deductions and credits you may be eligible for, and recommend tax-saving strategies. With their insight, they can help you make informed decisions that minimize your tax liability and maximize your tax savings.

3. Proper Record-Keeping: Accurate record-keeping is essential for small business taxes. A tax professional can guide you on establishing effective bookkeeping practices to maintain accurate financial records. They can help you organize and track your income, expenses, and deductions, ensuring that you have the necessary documentation in case of an audit.

4. Filing Tax Returns: A tax professional can prepare and file your tax returns accurately and in a timely manner. They ensure that all necessary forms are completed correctly, deductions are claimed appropriately, and any credits are properly applied. By handling the filing process, they alleviate the stress and save you time, ensuring compliance with tax laws.

5. Audit Support: In the event of a tax audit or examination, a tax professional can provide valuable support. They have experience in dealing with tax authorities and can represent you during the audit process. They can help gather the required documentation, respond to inquiries, and navigate any potential issues that arise during the audit, ensuring that your rights as a taxpayer are protected.

6. Tax Compliance: Keeping up with tax compliance requirements is challenging for small business owners. Tax professionals ensure that you meet all tax deadlines, make accurate estimated tax payments, and comply with federal, state, and local tax regulations. They can help you avoid penalties and minimize the risk of potential tax-related issues.

7. Business Structure and Planning: Tax professionals can provide guidance on selecting the most tax-efficient business structure for your specific needs. They can evaluate the tax implications of different structures and advise on restructuring options if necessary. Additionally, they can assist with long-term tax planning, identifying opportunities for growth and maximizing tax benefits as your business evolves.

While involving a tax professional comes with a cost, the benefits often outweigh the expense. They can help you save time, reduce tax liability, and provide peace of mind knowing that your taxes are handled correctly. Consider consulting with a qualified tax professional to navigate the complexities of small business taxes and ensure that you are making the most of available tax benefits.

Conclusion

Navigating the world of small business taxes is crucial for the financial stability and success of your business. By understanding and proactively managing your tax obligations, you can minimize your tax liability and optimize your financial position.

In this article, we explored various aspects of small business taxes, including understanding tax obligations, factors influencing tax payments, choosing the right business entity for tax planning, the importance of accurate bookkeeping, calculating estimated tax payments, tax deductions and credits, strategies for minimizing tax liability, and the role of a tax professional.

Accurate bookkeeping and record-keeping are essential for keeping track of income, expenses, and deductions. By staying organized, you can ensure compliance with tax laws and optimize your tax planning strategies. Additionally, understanding the specific tax deductions and credits available for small businesses can significantly reduce your tax liability.

Implementing strategies to minimize your tax liability, such as timing income and expenses, considering entity structure, and consulting with a tax professional, can result in substantial tax savings for your business. A tax professional can provide expert guidance, assist with tax planning, handle tax filings, and ensure compliance with tax laws.

Remember, small business taxes are a complex and ever-changing landscape. It is essential to stay informed about any changes in tax codes and regulations that may impact your business. Consider working with a tax professional to ensure that your tax planning strategies remain up-to-date and aligned with your business goals.

By taking a proactive approach to small business taxes, you can enhance your financial stability, improve cash flow, and focus on what you do best – running and growing your business.