Home>Finance>How Much Working Capital Should A Business Have

Finance

How Much Working Capital Should A Business Have

Published: December 19, 2023

Find out the ideal amount of working capital a business should possess for optimal financial stability and success. Gain valuable insights into finance and planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Working Capital

- Importance of Working Capital

- Factors Affecting Working Capital Needs

- Industry Standards for Working Capital

- Methods for Calculating Working Capital

- Analyzing Working Capital Ratios

- Strategies for Managing Working Capital

- Common Pitfalls in Working Capital Management

- Case Studies: Companies with Effective Working Capital Management

- Conclusion

Introduction

Welcome to the world of finance! In today’s dynamic business environment, one of the key aspects that determines the success and sustainability of a company is its ability to effectively manage working capital. But what exactly is working capital, and why is it so important?

Working capital refers to the capital or funds that a company has readily available to cover its day-to-day operations. It encompasses the company’s current assets (such as cash, inventory, and accounts receivable) and current liabilities (such as accounts payable and short-term debt). In simpler terms, working capital represents the liquid assets a business possesses to meet its short-term obligations.

The significance of working capital cannot be overstated. It is the lifeblood of a business, ensuring smooth operations and enabling growth. Adequate working capital allows companies to manage their cash flow effectively, cover daily expenses, meet short-term financial obligations, and seize growth opportunities. Without sufficient working capital, a company may struggle to pay its bills, purchase necessary raw materials, or even meet payroll, which can ultimately lead to financial distress or bankruptcy.

Various factors affect a company’s working capital needs, including industry dynamics, the company’s growth rate, seasonality, and the efficiency of its operations. It is crucial for companies to understand and manage their working capital requirements effectively to optimize their financial performance and sustain long-term success.

In this article, we will delve deeper into the intricacies of working capital, exploring its importance, factors affecting its needs, industry standards, methods for calculating it, and strategies for effective management. By the end, you will have a comprehensive understanding of the role working capital plays in a company’s financial health and be equipped with the knowledge to make informed decisions regarding its management.

Definition of Working Capital

Working capital is a fundamental concept in finance that refers to the amount of capital a company has available to handle its day-to-day operations. It represents the difference between a company’s current assets (such as cash, inventory, and accounts receivable) and its current liabilities (such as accounts payable and short-term debt).

Working capital is a measure of a company’s short-term financial health and its ability to cover its immediate obligations. It provides the necessary liquidity to meet expenses like salaries, rent, utility bills, and purchase of raw materials. Proper management of working capital ensures that a company can smoothly run its operations and seize growth opportunities.

There are two types of working capital: gross working capital and net working capital. Gross working capital refers to the total current assets a company possesses, while net working capital is calculated by subtracting current liabilities from current assets. Net working capital is considered a more accurate measure of a company’s liquidity.

It is important to note that the ideal amount of working capital varies from industry to industry and depends on company-specific factors such as sales patterns, payment terms, inventory turnover, and capital expenditure requirements.

Working capital management involves optimizing the company’s cash flow, ensuring that there is enough capital to cover day-to-day expenses, while also minimizing the amount of cash tied up in inventory and accounts receivable. By effectively managing working capital, a company can improve its financial efficiency, reduce borrowing costs, and enhance its overall profitability.

Next, let’s take a closer look at why working capital is of utmost importance for businesses of all sizes and industries.

Importance of Working Capital

Working capital is a critical aspect of financial management for businesses of all sizes and industries. It plays a vital role in ensuring the smooth operation and survival of a company. Here are some key reasons why working capital is important:

- Meeting daily operational needs: Adequate working capital ensures that a company has enough funds to cover its day-to-day operational expenses. It allows for the payment of salaries, rents, utility bills, and the purchase of necessary raw materials. Without sufficient working capital, a company may struggle to meet these essential obligations and face disruptions in its operations.

- Managing cash flow: Positive working capital ensures that a company has enough cash on hand to manage its cash flow effectively. It provides a buffer to cover any unexpected expenses or delays in customer payments. Efficient cash flow management is crucial for businesses to meet their financial obligations, maintain vendor relationships, and invest in growth opportunities.

- Seizing growth opportunities: With adequate working capital, a company can take advantage of growth opportunities that arise. It allows companies to invest in new projects, expand their product lines, enter new markets, or acquire competitors. Having the necessary funds readily available puts a business in a stronger position to capitalize on these opportunities and drive long-term success.

- Maintaining a competitive edge: Effective working capital management can provide a competitive advantage by allowing a company to offer attractive payment terms to customers. For instance, offering longer credit periods or discounts for early payments can help businesses attract and retain customers, improving cash flow and profitability.

- Building supplier relationships: Timely payments to suppliers and maintaining positive relationships are crucial for a company’s operations. Sufficient working capital enables businesses to honor their payment obligations and build strong partnerships with suppliers. This can lead to preferential treatment, better prices, and improved reliability in the supply chain.

In summary, working capital is of utmost importance as it ensures the smooth functioning of operations, enables effective cash flow management, facilitates growth opportunities, maintains competitiveness, and helps to build strong supplier relationships. Now that we understand the significance of working capital, let’s explore the various factors that affect a company’s working capital needs.

Factors Affecting Working Capital Needs

Several factors influence a company’s working capital needs. Understanding these factors is crucial as they determine the amount of working capital required to sustain day-to-day operations and support growth. Here are the key factors that affect working capital needs:

- Industry dynamics: Different industries have varying working capital requirements. For instance, manufacturing and retail businesses often require higher levels of working capital due to the need to maintain inventory levels. Service-based industries, on the other hand, may have lower working capital needs as they typically have fewer inventory requirements.

- Sales patterns: The sales pattern of a business can significantly impact its working capital needs. Companies experiencing seasonal or cyclical sales fluctuations may require more working capital during peak seasons to meet increased demand and maintain inventory levels.

- Payment terms: The terms given to customers and received from suppliers can affect working capital. Longer credit terms provided to customers can delay the inflow of cash and increase the need for working capital. Conversely, shorter payment terms with suppliers can help reduce the amount of working capital required.

- Inventory turnover: The speed at which a company sells its inventory has implications for working capital needs. Faster inventory turnover reduces the amount of capital tied up in inventory, freeing up cash for other operational needs.

- Efficiency of operations: A company’s operational efficiency can impact its working capital requirements. Efficient processes, including effective inventory management, cash flow forecasting, and timely collection of accounts receivable, can help optimize working capital utilization.

- Capital expenditure requirements: The need for investment in fixed assets and long-term projects can impact working capital needs. Companies undergoing significant expansion or capital-intensive projects may require additional working capital to cover associated costs.

- Supplier relationships: The relationships a business has with its suppliers can affect its working capital needs. Negotiating favorable payment terms, such as extended credit periods or discounts for early payments, can help reduce the amount of working capital required.

It is important for companies to analyze and assess these factors to determine their unique working capital needs. By understanding the dynamics of their industry, sales patterns, payment terms, inventory turnover, operational efficiency, capital expenditure requirements, and supplier relationships, businesses can effectively manage their working capital and ensure optimal financial health.

Next, let’s explore the industry standards and benchmarks for working capital to gain further insights into managing this crucial aspect of financial management.

Industry Standards for Working Capital

While the ideal amount of working capital varies from company to company and depends on various factors, industry standards and benchmarks can provide valuable guidelines for businesses to assess their working capital levels. These standards help companies compare their performance with industry peers and identify areas for improvement. However, it is important to note that industry averages should be viewed as general guidelines and not absolute rules. Here are some industry standards for working capital:

1. Current Ratio: The current ratio is a common benchmark used to assess a company’s ability to cover its short-term obligations. It is calculated by dividing a company’s current assets by its current liabilities. While there is no universally accepted target, a current ratio of 2:1 is often considered healthy.

2. Quick Ratio: The quick ratio, also known as the acid-test ratio, measures a company’s ability to meet its short-term obligations using its most liquid assets. It excludes inventory from current assets, as inventory may not be easily converted into cash in a short period. The quick ratio is typically recommended to be at least 1:1.

3. Days Sales Outstanding (DSO): DSO is a measure of the average number of days it takes for a company to collect payment from its customers after a sale has been made. A lower DSO indicates more efficient accounts receivable management. Industry averages for DSO can vary significantly, depending on factors such as the nature of the business and the credit terms offered.

4. Inventory Turnover: Inventory turnover measures how quickly a company sells its inventory. It is calculated by dividing the cost of goods sold by the average inventory value. Higher inventory turnover generally indicates better inventory management and a more efficient use of working capital. Industry benchmarks for inventory turnover can vary widely, depending on the industry and specific business model.

5. Payables Period: The payables period measures the average number of days it takes for a company to pay its suppliers. A longer payables period can help improve working capital by allowing a company to hold onto cash for a longer period. However, it is important to maintain good relationships with suppliers to avoid any adverse impacts on supply chains.

Industry standards for working capital metrics can serve as useful reference points for businesses to evaluate their performance. However, it is essential to consider the specific circumstances and dynamics of each company and the industry in which it operates. Ultimately, the goal should be to optimize working capital levels based on the unique needs and objectives of the business.

Now that we have explored industry benchmarks, let’s move on to discussing the different methods for calculating working capital.

Methods for Calculating Working Capital

Calculating working capital is crucial for businesses to understand their financial health and determine the adequacy of their current assets in covering short-term liabilities. There are two common methods used to calculate working capital: the balance sheet method and the operating cycle method.

1. Balance Sheet Method: The balance sheet method is the most straightforward way to calculate working capital. It involves subtracting a company’s current liabilities from its current assets. The formula for working capital is:

Working Capital = Current Assets – Current Liabilities

This method provides a snapshot of the company’s working capital position at a specific point in time. It helps evaluate the liquidity and financial flexibility of a business.

2. Operating Cycle Method: The operating cycle method takes into account the time it takes for a business to convert its resources into cash through its operating activities. It considers the time it takes to purchase inventory, convert it into finished goods, sell them, collect accounts receivable, and settle any outstanding liabilities. The formula for calculating working capital using the operating cycle is:

Working Capital = Inventory + Accounts Receivable – Accounts Payable

This method provides a more dynamic view of working capital by considering the specific time frame required to complete the operating cycle.

It is essential to note that both methods have their merits and limitations. The balance sheet method provides a snapshot of the overall working capital position, but it does not consider the specific time frame for converting assets into cash. On the other hand, the operating cycle method focuses on the specific time required to complete the operating cycle but might not capture the overall working capital position at any given point in time.

It is advisable to use a combination of both methods and consider other financial indicators to gain a comprehensive understanding of a company’s working capital needs. Additionally, businesses should regularly monitor and update their working capital calculations to reflect changes in their operational and financial circumstances.

Now that we have explored the methods for calculating working capital, let’s move on to understanding how working capital ratios can provide valuable insights into a company’s financial health.

Analyzing Working Capital Ratios

Working capital ratios are financial metrics that provide valuable insights into a company’s liquidity, operational efficiency, and financial health. These ratios analyze the relationship between a company’s current assets and current liabilities and help assess its ability to meet short-term obligations. Here are some key working capital ratios:

- Current Ratio: The current ratio is a widely used ratio that measures a company’s ability to cover its short-term liabilities with its current assets. It is calculated by dividing current assets by current liabilities. The higher the current ratio, the better equipped a company is to meet its short-term obligations.

- Quick Ratio: Also known as the acid-test ratio, the quick ratio focuses on a company’s most liquid assets (cash, marketable securities, and accounts receivable) in relation to its current liabilities. By excluding inventory from current assets, the quick ratio provides a more conservative measure of liquidity. A higher quick ratio indicates a greater ability to meet short-term liabilities without relying on inventory sales.

- Working Capital Turnover: This ratio measures the efficiency of a company in utilizing its working capital to generate sales. It is calculated by dividing net sales by average working capital. A higher working capital turnover ratio indicates that a company is efficiently utilizing its working capital to generate revenue.

- Days Sales Outstanding (DSO): DSO measures the average number of days it takes for a company to collect payment from its customers after a sale. It is calculated by dividing accounts receivable by average daily sales. A lower DSO indicates faster collection of receivables and better management of working capital.

- Inventory Turnover: Inventory turnover measures how efficiently a company is managing its inventory. It is calculated by dividing the cost of goods sold by average inventory. A higher inventory turnover ratio signifies that a company is effectively managing its inventory levels and minimizing the amount of working capital tied up in inventory.

By analyzing these ratios, businesses can gain valuable insights into their working capital management, liquidity position, and operational efficiency. Comparing these ratios to industry benchmarks or historical data can provide further context and help identify areas for improvement.

However, it is essential to note that these ratios should not be analyzed in isolation. They should be assessed in conjunction with other financial indicators and consider the unique characteristics and circumstances of the business. Additionally, trends over time should be monitored to identify any significant changes or potential issues that may require attention.

Next, let’s discuss some strategies for effectively managing working capital and optimizing its utilization within a company.

Strategies for Managing Working Capital

Effectively managing working capital is crucial for maintaining the financial health and stability of a business. Implementing strategic approaches can optimize the utilization of working capital and improve overall operational efficiency. Here are some key strategies for managing working capital:

- Inventory management: A comprehensive inventory management system is essential to prevent overstocking or stockouts. Analyze demand patterns, optimize order quantities, and implement just-in-time inventory practices to minimize the amount of working capital tied up in inventory.

- Accounts receivable management: Implement efficient credit and collection policies to shorten the collection period and improve cash inflows. Monitor aging receivables closely, offer incentives for early payment, and establish clear credit terms and collection procedures.

- Payables management: Negotiate favorable payment terms with suppliers without compromising relationships. Take advantage of early payment discounts and optimize the payment schedule to maximize cash flow and extend payment periods where appropriate.

- Tight cash flow management: Regularly monitor and forecast cash flows to identify potential gaps or surpluses. Maintain a cash flow buffer to cover unexpected expenses and ensure smooth operations.

- Efficient working capital financing: Evaluate and explore financing options to optimize working capital. Consider short-term financing solutions like trade credit, bank lines of credit, or factoring to bridge any gaps in cash flow.

- Streamlining processes: Identify and eliminate any bottlenecks or inefficiencies in processes that tie up working capital. Streamline order-to-cash and procure-to-pay processes, leverage technology to automate manual tasks, and implement effective inventory and supply chain management systems.

- Forecasting and planning: Develop robust forecasting models to anticipate future working capital needs. Use historical data and industry trends to project sales, expenses, and cash flow. Regularly review and adjust forecasts to stay ahead of changes in the business environment.

- Continuous monitoring and improvement: Regularly monitor key working capital metrics, such as current ratio, quick ratio, DSO, and inventory turnover. Compare performance against industry benchmarks and set targets for improvement. Continuously review and refine working capital management strategies to adapt to changing market conditions.

By implementing these strategies, businesses can effectively manage their working capital, optimize cash flow, and enhance their financial performance. It is important to note that these strategies should be tailored to the specific circumstances and objectives of each company. Regular assessment, monitoring, and adjustment of working capital management practices are essential for long-term success.

Now, let’s explore some common pitfalls in working capital management that businesses should be aware of and avoid.

Common Pitfalls in Working Capital Management

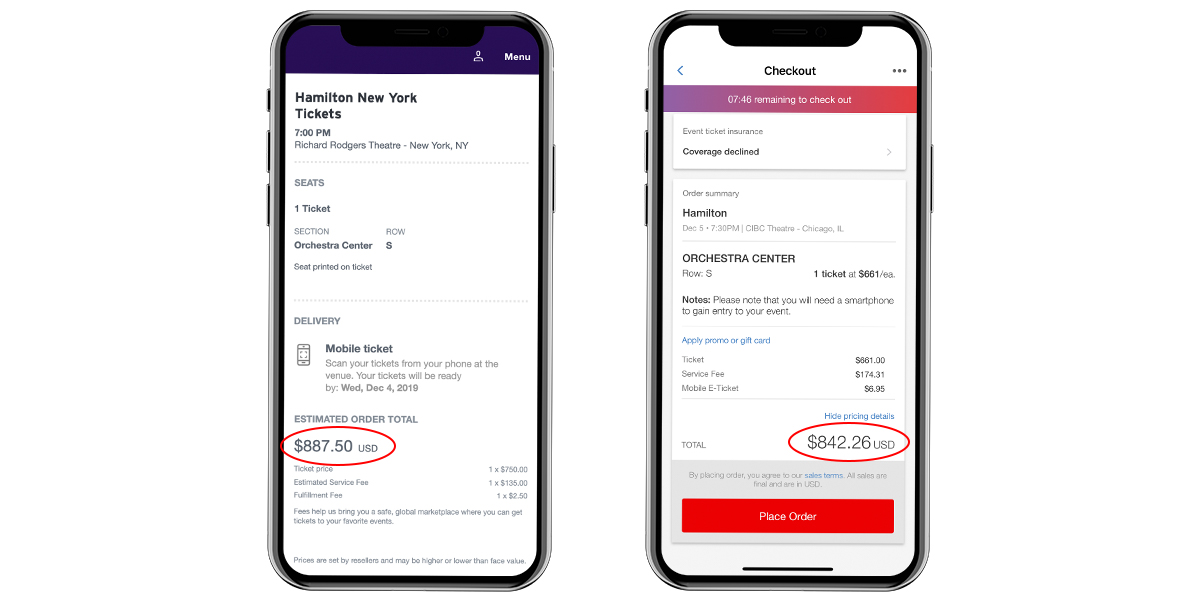

Proper working capital management is crucial for the financial health and stability of a business. However, there are several common pitfalls that companies should be aware of to avoid any detrimental impact on their operations. Here are some of the common pitfalls in working capital management:

- Inadequate cash flow forecasting: Failing to accurately forecast cash flow can lead to liquidity issues and the inability to meet financial obligations. It is essential to regularly monitor and update cash flow forecasts to ensure sufficient working capital.

- Excessive inventory levels: Overstocking inventory ties up working capital and increases carrying costs. It is crucial to analyze demand patterns, optimize ordering quantities, and implement efficient inventory management practices to avoid excess inventory.

- Poor accounts receivable management: Inefficient collection procedures and lax credit policies can lead to extended payment periods and delayed cash inflows. Implementing strict credit controls, monitoring aging receivables, and actively pursuing collections are key to avoid cash flow disruptions.

- Over-reliance on short-term financing: While short-term financing options like bank lines of credit or factoring can help bridge temporary cash flow gaps, over-reliance on such financing can lead to excessive interest costs. It is important to strike a balance between short-term financing and optimizing working capital through efficient management practices.

- Inefficient payables management: Failing to negotiate favorable payment terms with suppliers or failing to take advantage of early payment discounts can result in an unnecessary drain on working capital. Implementing effective payables management strategies can improve liquidity and cash flow.

- Lack of working capital monitoring: Failing to regularly monitor key working capital metrics can indicate potential issues before they evolve into significant problems. Constantly track and assess working capital ratios, cash flow, and other key indicators to ensure timely identification of any concerning trends or areas that need improvement.

- Ignoring technology and automation: Manual and inefficient processes can consume valuable time and resources, delaying cash conversion cycles and increasing working capital requirements. Embrace technology and automation solutions to streamline processes, enhance operational efficiency, and optimize working capital utilization.

- Ignoring supplier relationships: Poor relationships with suppliers can result in strained payment terms and hamper the availability of raw materials. Maintaining strong supplier relationships and effective communication are essential for ensuring smooth supply chains and favorable payment terms.

By being aware of these common pitfalls, businesses can actively avoid them and improve their working capital management practices. It is important to continually review and refine strategies, stay informed about industry trends, and adapt to evolving market conditions to maintain a healthy balance of working capital.

Now, let’s take a look at some case studies of companies that have effectively managed their working capital to achieve financial success.

Case Studies: Companies with Effective Working Capital Management

Examining real-life examples of companies that have successfully managed their working capital can provide valuable insights and inspire best practices for others. Let’s take a look at two case studies of companies that have exemplified effective working capital management:

Case Study 1: Company X

Company X, a manufacturing company, implemented a comprehensive working capital management strategy that significantly improved its financial performance. Here are some key aspects of their approach:

- Efficient inventory management: Company X closely analyzed demand patterns, optimized their order quantities, and invested in inventory management software to gain better control over their inventory levels. This resulted in a reduction in excess stock and improved cash flow.

- Strict accounts receivable monitoring: Company X established clear credit policies, implemented effective invoicing procedures, and closely monitored customer payment patterns. By diligently pursuing collections and maintaining discipline with credit terms, they were able to reduce their average Days Sales Outstanding (DSO) and improve cash inflows.

- Negotiating favorable payment terms: Company X actively engaged with their suppliers and negotiated longer payment terms without compromising supplier relationships. This allowed them to optimize their cash outflows and improve working capital utilization.

- Continuous process improvement: The company focused on identifying and eliminating bottlenecks in their processes to streamline operations. By leveraging technology and automation, they reduced manual errors and improved operational efficiency, leading to enhanced working capital management.

As a result of their effective working capital management practices, Company X experienced improved cash flow, increased profitability, and maintained a healthy balance sheet.

Case Study 2: Company Y

Company Y, a service-based company, implemented innovative strategies to optimize their working capital. Here are some key highlights of their approach:

- Customized payment terms: Company Y worked closely with their clients to establish customized payment terms that aligned with their service delivery cycle. This allowed them to optimize their cash inflows and reduce the need for short-term financing.

- Rigorous cash flow forecasting: The company developed a robust cash flow forecasting system that provided them with visibility into future cash needs. This enabled them to proactively manage their working capital and identify potential shortfalls, allowing for timely action to ensure financial stability.

- Focused cost control: Company Y actively monitored and controlled costs throughout their operations, ensuring that expenses were in line with revenue forecasts. This disciplined approach helped them optimize their working capital utilization and maintain a healthy cash flow.

- Strategic supplier partnerships: The company built strong relationships with their key suppliers, facilitating open communication and negotiation of competitive payment terms. This enabled them to effectively manage their payables and optimize cash outflows.

Through their effective management of working capital, Company Y achieved a strong financial position, maintained positive cash flow, and consistently met their financial obligations.

These case studies demonstrate that companies that prioritize and implement effective working capital management strategies can achieve improved financial performance, enhanced cash flow, and sustainable growth. By adopting similar approaches and tailoring them to their specific circumstances, businesses can optimize their working capital utilization and drive long-term success.

Now, let’s wrap up our discussion on working capital management.

Conclusion

Working capital is a critical aspect of financial management that impacts the day-to-day operations and overall financial health of a business. It is the lifeblood that ensures smooth operations, covers expenses, and drives growth opportunities. Effectively managing working capital is essential for companies of all sizes and industries to maintain liquidity, meet short-term obligations, and maximize profitability.

In this article, we explored the definition of working capital and discussed its importance in supporting operational needs, managing cash flow, seizing growth opportunities, maintaining competitiveness, and building strong supplier relationships.

We also discussed the factors that affect working capital needs, including industry dynamics, sales patterns, payment terms, inventory turnover, efficiency of operations, and capital expenditure requirements. Understanding these factors helps businesses determine their unique working capital requirements and optimize their financial performance.

Furthermore, we explored industry standards for working capital and the methods for calculating it, including the balance sheet method and the operating cycle method. We also explored how analyzing working capital ratios can provide valuable insights into a company’s financial health and operational efficiency.

To effectively manage working capital, we discussed various strategies, such as inventory management, accounts receivable and payables management, tight cash flow management, efficient working capital financing, process optimization, forecasting and planning, and continuous monitoring. Avoiding common pitfalls in working capital management is also crucial to maintain financial stability.

To illustrate the importance and benefits of effective working capital management, we discussed case studies of companies that successfully implemented strategies to optimize their working capital utilization and achieve financial success. These case studies demonstrated the positive impact of implementing sound working capital management practices.

In conclusion, working capital management is a dynamic and integral part of financial management. By understanding the concepts, implementing effective strategies, and continuously monitoring and adapting to changing market conditions, businesses can optimize their working capital utilization, improve cash flow, and enhance their overall financial performance.

By actively managing working capital, businesses position themselves for long-term success and ensure their ability to adapt and thrive in a competitive marketplace.