Finance

How Often Do I Have To Use My Credit Card

Published: October 26, 2023

Discover how often you need to use your credit card to improve your finance. Get expert advice and tips to effectively manage your credit card usage.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards! As a savvy consumer, you may be wondering how often you should use your credit card. This is an important question that can have a significant impact on your financial health and credit score. In this article, we’ll explore the factors you should consider when determining the frequency of your credit card usage.

Understanding credit card usage is essential for managing your personal finances effectively. Credit cards offer convenience and flexibility, allowing you to make purchases without carrying cash. Plus, they can help you build a positive credit history and earn rewards. However, it’s crucial to strike a balance and use your credit card responsibly.

When it comes to determining how often you should use your credit card, there are several factors to consider. Your financial goals, spending habits, and credit utilization ratio all play a role in finding the right frequency for you. Additionally, it’s important to be aware of the benefits and drawbacks of credit card usage to make an informed decision.

In this article, we will discuss the factors you should consider, the benefits of regular credit card usage, the drawbacks of excessive usage, and strategies for responsible credit card usage. We will also provide valuable tips on how to maximize credit card rewards to make the most of your spending. By the end of this article, you’ll have a clear understanding of how often you should use your credit card and how to use it wisely to achieve your financial goals.

Understanding Credit Card Usage

Credit card usage refers to the frequency and manner in which you make purchases using your credit card. It involves swiping, inserting, or tapping your card to pay for goods and services. Understanding credit card usage is crucial for effectively managing your finances and building a positive credit history.

When you use your credit card, you are essentially borrowing money from the issuing bank or financial institution. The amount you spend is added to your credit card balance, which you are required to repay within a specified period, usually on a monthly basis. If you fail to make the minimum payment or pay off the entire balance, you may incur interest charges, late fees, and damage to your credit score.

There are various ways to use a credit card. You can use it for everyday expenses, such as groceries, gas, and dining out, or for larger purchases like electronics or travel expenses. Some people prefer to use credit cards for all their transactions, while others use them sparingly for specific purposes, such as building credit or earning rewards.

It’s important to differentiate between credit card usage and credit card ownership. Simply having a credit card doesn’t mean you are using it regularly. Some individuals may have credit cards for emergencies or specific purposes but rarely use them for day-to-day purchases.

Using your credit card responsibly involves more than just making purchases. It also includes managing your credit card balance, making payments on time, and keeping your credit utilization ratio in check. Your credit utilization ratio is the percentage of your available credit that you are currently using. It’s recommended to keep this ratio below 30% to maintain a good credit score.

Now that we have a basic understanding of credit card usage, let’s explore how to determine the frequency that is right for you and factors to consider in the process.

Determining Credit Card Frequency

When it comes to determining how often you should use your credit card, there is no one-size-fits-all answer. The frequency of credit card usage varies from person to person based on individual financial goals, spending habits, and personal preferences. Here are some factors to consider when determining your ideal credit card frequency:

- Your Financial Goals: Consider your short-term and long-term financial goals. If you’re focused on paying off debt or saving for a specific purpose, such as a down payment on a house, you may want to limit your credit card usage to essential expenses only. On the other hand, if you’re looking to build credit history or earn rewards, using your credit card for regular purchases can be beneficial.

- Your Spending Habits: Take a close look at your spending habits. Are you someone who tends to overspend when using a credit card? If so, you may want to use your credit card sparingly to avoid falling into debt. However, if you have good self-control and can manage your expenses within your budget, using your credit card more frequently may be manageable.

- Your Credit Utilization Ratio: Your credit utilization ratio is an important factor in determining your credit score. It is the ratio of your credit card balance to your credit limit. Using your credit card frequently without paying off the balance can lead to a high credit utilization ratio, which can negatively impact your credit score. Keeping your credit utilization ratio below 30% is generally recommended.

- Rewards and Benefits: Many credit cards offer rewards programs that allow you to earn points, cashback, or travel miles. If you have a credit card with attractive rewards, you may want to use it more often to maximize these benefits. However, be sure to carefully read the terms and conditions of the rewards program to understand any limitations or requirements.

- Financial Stability: Consider your overall financial stability and ability to manage credit card payments. If you are confident in your ability to make timely payments and avoid accruing interest charges, using your credit card more frequently may not pose significant risks. On the other hand, if you have concerns about your financial stability or tend to miss payments, it may be wise to limit your credit card usage.

By considering these factors, you can determine the ideal frequency of your credit card usage. It’s important to find a balance that aligns with your financial goals, promotes responsible spending, and helps you build a strong credit history.

Factors to Consider

When determining the appropriate frequency of credit card usage, several factors come into play. Let’s take a closer look at some key considerations:

- Financial Goals: Consider your financial objectives. Are you trying to pay off existing debt, save money, or build your credit history? Your financial goals will influence how often you should use your credit card. For example, if you’re focused on paying off debt, it may be wise to limit credit card usage to essential expenses only.

- Spending Habits: Evaluate your spending habits. Are you someone who tends to overspend when using a credit card? If so, you might want to be more selective with your credit card usage or set strict spending limits for yourself. Understanding your spending patterns will help you determine the appropriate frequency of credit card usage.

- Credit Utilization Ratio: Your credit utilization ratio is the percentage of available credit you’re currently using. It plays a crucial role in your credit score calculation. Using your credit card frequently while maintaining a high balance can increase your credit utilization ratio, potentially impacting your credit score negatively. It’s generally advisable to keep your credit card balances below 30% of your credit limit.

- Rewards and Benefits: Some credit cards offer valuable rewards and benefits, such as cashback, travel points, or discounts on purchases. If your credit card offers enticing rewards, you may want to use it more often to take full advantage of these perks. However, be mindful of any potential annual fees or spending requirements associated with these rewards programs.

- Financial Stability: Assess your overall financial stability and ability to manage credit card payments. If you have a stable income and can consistently make timely payments, it may be more feasible to use your credit card more frequently without risking financial distress. On the other hand, if you’re facing financial uncertainty or have struggled with making payments in the past, it’s essential to prioritize responsible credit card usage.

- Interest Rates and Fees: Pay attention to the interest rates and fees associated with your credit card. If your card has high-interest rates or excessive fees, it may be wise to limit your usage to avoid incurring unnecessary costs. Be sure to read the terms and conditions of your credit card agreement to understand the specific charges that may apply.

By considering these factors, you can make an informed decision about how often to use your credit card. It’s important to strike a balance that aligns with your financial goals, promotes responsible spending, and helps you build a positive credit history.

Benefits of Regular Credit Card Usage

Regular credit card usage, when done responsibly, can offer several benefits that can enhance your financial well-being. Here are some advantages of using your credit card on a regular basis:

- Building Credit History: Using your credit card regularly and making timely payments can help establish and improve your credit history. A positive credit history is important when applying for loans, mortgages, or even renting an apartment. By demonstrating responsible credit card usage, you can build a solid credit profile.

- Earning Rewards: Many credit cards offer rewards programs that allow you to earn points, cashback, or travel miles for every dollar spent. By using your credit card for everyday purchases and paying off the balance in full each month, you can accumulate rewards that can be redeemed for various benefits, such as discounted flights, hotel stays, or even cashback on your statement.

- Convenience and Security: Credit cards provide convenience and security when making purchases. Instead of carrying cash, you can simply swipe or tap your card to complete transactions. Credit cards also offer protection against fraudulent charges and unauthorized transactions. If your card is lost or stolen, you can report it immediately to your card issuer, and they will handle the necessary steps to protect your account.

- Introductory Offers: Many credit cards come with introductory offers, such as 0% APR for a certain period or no annual fees for the first year. These promotions can help you save money on interest charges or avoid paying certain fees. By utilizing introductory offers, you can maximize the benefits of using your credit card.

- Financial Tracking and Budgeting: Credit card statements provide detailed information about your spending habits, including categories of purchases and the amount spent. This can be a valuable tool for tracking your expenses and creating a budget. By reviewing your credit card statement regularly, you can gain insights into your spending patterns and make adjustments to align with your financial goals.

It’s important to note that while these benefits can be advantageous, responsible credit card usage is key. This means paying off your balance in full each month, avoiding unnecessary debt, and keeping your credit utilization ratio low. By leveraging the benefits of regular credit card usage while using it responsibly, you can make the most of your credit card and improve your financial situation.

Drawbacks of Excessive Credit Card Usage

While credit cards offer numerous benefits, excessive credit card usage can lead to various drawbacks that can negatively impact your financial well-being. Here are some potential drawbacks to be aware of:

- Accruing Debt: One of the most significant drawbacks of excessive credit card usage is the potential to accumulate debt. If you consistently spend more than you can afford and carry a balance from month to month, you’ll be subject to high-interest charges. Over time, this can lead to a cycle of debt that becomes challenging to break.

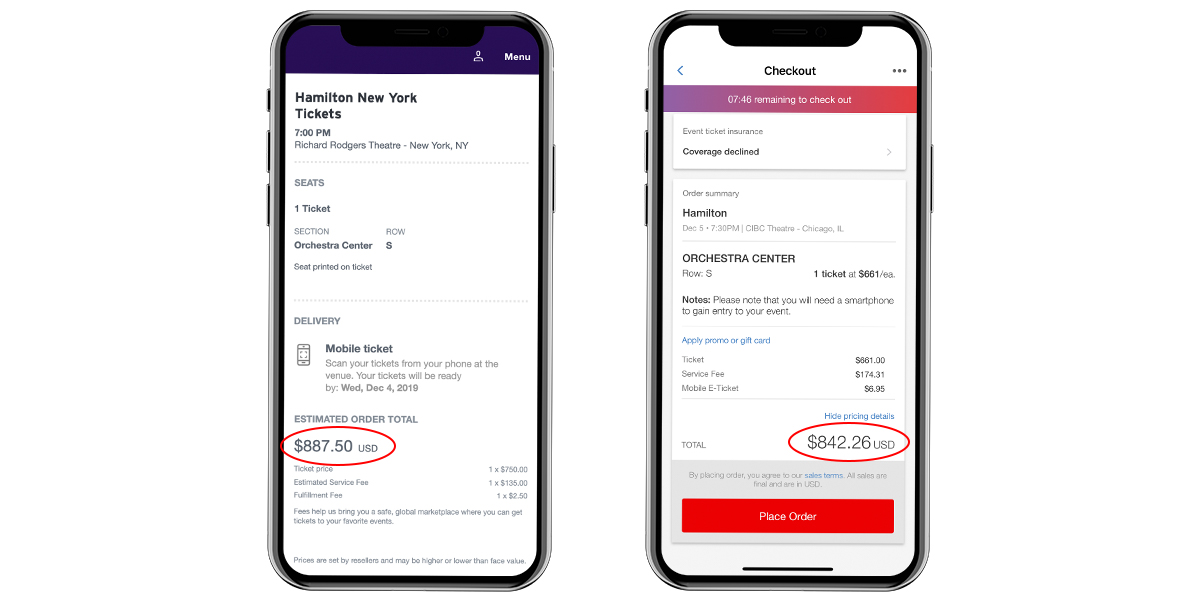

- Interest Charges: When you carry a balance on your credit card, interest charges apply. The higher your interest rate and the larger your balance, the more you’ll pay in interest over time. These additional costs can add up and make it more difficult to pay off your debt.

- Negative Impact on Credit Score: Excessive credit card usage can negatively impact your credit score. When your credit utilization ratio is consistently high, it signals to lenders that you may be relying too heavily on credit and could be a higher risk borrower. This can result in a lower credit score, which can affect your ability to obtain favorable interest rates or secure credit in the future.

- Overspending and Impulse Purchases: When you have easy access to credit, it can be tempting to make impulsive purchases or overspend beyond your means. This can lead to financial stress and difficulty in managing your overall budget. It’s essential to exercise self-control and make conscious decisions when using your credit card.

- Financial Stress: Excessive credit card usage can lead to financial stress, especially when you’re struggling to pay off high balances or keep up with interest charges. This stress can have a negative impact on your overall well-being and quality of life.

- Increased Risk of Fraud and Identity Theft: The more frequently you use your credit card, the higher the chances of encountering fraudulent activities or falling victim to identity theft. It’s crucial to monitor your credit card transactions regularly and report any suspicious activities immediately.

It’s important to find a balance when using your credit card to avoid these drawbacks. Use your credit card responsibly by staying within your budget, paying off your balance in full each month, and keeping your credit utilization ratio low. By doing so, you can enjoy the benefits of credit cards without falling into the pitfalls of excessive usage.

Strategies for Responsible Credit Card Usage

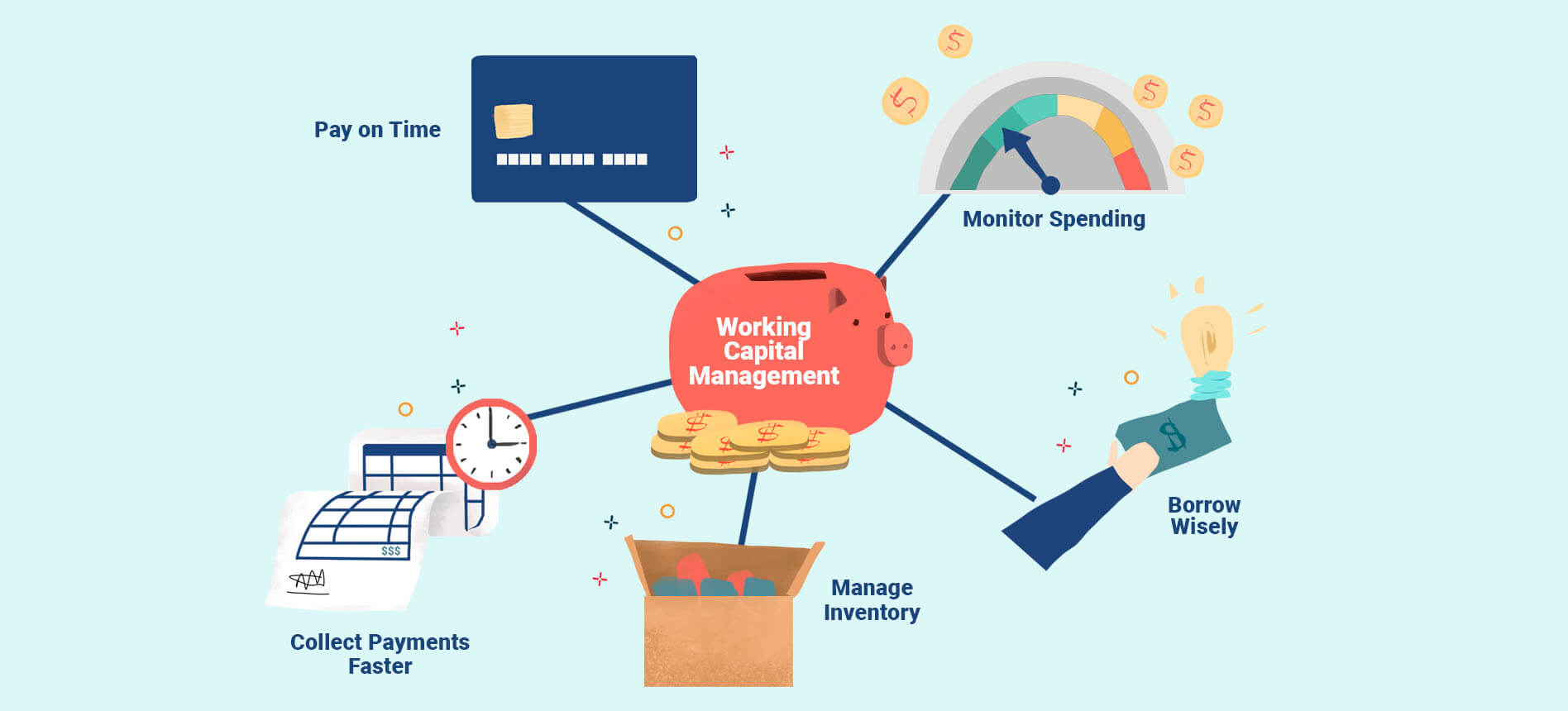

To reap the benefits of credit cards while avoiding the drawbacks, it’s essential to adopt responsible credit card usage strategies. Here are some strategies to help you use your credit card responsibly:

- Create a Budget: Start by creating a monthly budget that outlines your income and expenses. Allocate a specific portion of your budget for credit card payments and ensure that you’re able to meet this obligation without compromising other financial priorities.

- Pay Off the Balance in Full: Whenever possible, aim to pay off your credit card balance in full each month. By doing so, you can avoid accruing interest charges and maintain control over your spending habits. If paying off the entire balance is not feasible, strive to make more than the minimum payment to reduce the overall interest you’ll owe.

- Monitor Your Credit Card Activity: Regularly review your credit card statements and transactions to identify any unauthorized charges or errors. Monitoring your activity closely can help you detect and address any issues promptly, minimizing the potential negative impact on your finances.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This means not using more than 30% of your available credit limit. By keeping your credit utilization low, you demonstrate responsible credit card usage and reduce the risk of negatively impacting your credit score.

- Avoid Cash Advances: Cash advances on your credit card often come with high-interest rates and additional fees. It’s best to avoid using your credit card for cash withdrawals unless it’s absolutely necessary. Instead, use your debit card or withdraw cash from your bank account to minimize the associated costs.

- Set Spending Limits: Consider setting personal spending limits for different categories of expenses. This can help you stay within your budget and avoid overspending. You can use budgeting apps or the features provided by your credit card issuer to set spending alerts or restrictions.

- Choose the Right Credit Card: Select a credit card that aligns with your financial goals and spending habits. Look for cards with low interest rates, favorable rewards programs, and minimal fees. Read the terms and conditions carefully to understand the features and limitations of the card.

- Educate Yourself: Stay informed about credit card terms, policies, and financial management best practices. Educate yourself on interest rates, grace periods, late fees, and any other relevant information. The more you know, the better equipped you’ll be to make responsible credit card decisions.

By implementing these strategies, you can establish responsible credit card usage habits that align with your financial goals. Remember, responsible credit card usage is about maintaining control over your spending, using credit wisely, and staying in good financial standing.

Tips for Maximizing Credit Card Rewards

Using your credit card for everyday purchases can be a strategic way to maximize your credit card rewards. Here are some tips to help you make the most of your credit card rewards program:

- Choose the Right Rewards Program: Consider the type of rewards that align with your interests and lifestyle. Some credit cards offer cashback on purchases, while others provide travel points or rewards in specific categories such as dining or groceries. Select a rewards program that matches your spending habits and preferences.

- Understand the Rewards Structure: Familiarize yourself with how the rewards program works. Determine how many points or cashback you can earn for each dollar spent and whether there are any limits or restrictions. Read the terms and conditions to ensure you are aware of any expiration dates or redemption requirements.

- Maximize Bonus Categories: Many credit cards offer bonus rewards in certain categories, such as dining, gas, or travel. Plan your spending accordingly to take advantage of these bonus categories. Use your credit card for purchases within these categories whenever possible to earn more rewards.

- Use Your Card for Everyday Expenses: Use your credit card for everyday expenses like groceries, gas, and utility bills. By charging these expenses to your card, you can accumulate more rewards points or cashback over time. Just remember to stay within your budget and pay off your balance in full each month.

- Consider Stacking Rewards: Look for opportunities to stack rewards. Some retailers and online shopping platforms offer additional points or discounts when you combine their promotions with your credit card rewards program. Take advantage of these opportunities to maximize your rewards.

- Take Advantage of Sign-Up Bonuses: Many credit cards offer sign-up bonuses to new cardholders. These bonuses can include a large number of bonus points or a cashback incentive when you meet specific spending requirements in the first few months. If you’re considering a new credit card, explore the sign-up bonuses and choose one that aligns with your spending ability.

- Pay Attention to Limited-Time Offers: Credit card issuers often introduce limited-time offers, such as increased rewards rates or exclusive partnerships with merchants. Keep an eye out for these promotions and take advantage of them while they are available.

- Redeem Your Rewards Strategically: Plan how you’ll redeem your rewards to maximize their value. Consider redeeming them for high-value options like travel bookings or statement credits rather than lower-value options like merchandise or gift cards.

- Manage Multiple Rewards Cards: If you have multiple credit cards with different rewards programs, strategically use each card based on the bonus categories or benefits they offer. This way, you can optimize your rewards based on your spending habits and take advantage of the strengths of each card.

Remember, while maximizing credit card rewards can be beneficial, responsible usage is still key. Avoid overspending or carrying a balance solely to earn rewards. Pay off your balance in full each month to avoid interest charges and any negative impacts on your credit score. With careful planning and strategic usage, you can make the most of your credit card rewards and enjoy the extra perks they offer.

Conclusion

Determining how often to use your credit card is a personal decision that depends on your financial goals, spending habits, and credit management skills. While credit cards offer convenience, rewards, and other benefits, it’s crucial to use them responsibly to avoid falling into debt or damaging your credit score.

Understanding the factors to consider, such as your financial goals, spending habits, and credit utilization ratio, can help you determine the appropriate frequency of credit card usage. By evaluating these factors and being mindful of responsible credit card usage principles, you can strike a balance that aligns with your financial objectives and promotes healthy financial habits.

Regular credit card usage, when done responsibly, can help you build credit history, earn rewards, and provide convenient payment options. However, excessive credit card usage can lead to debt, higher interest charges, and potential financial stress. It’s important to set spending limits, monitor your credit activity, and pay off your balance in full each month whenever possible to minimize these risks.

Maximizing credit card rewards is another aspect to consider. By choosing the right rewards program, understanding the rewards structure, and strategically using your card, you can take advantage of the benefits offered by credit card rewards. However, it’s vital to maintain responsible usage and avoid overspending or carrying a balance solely for the sake of earning rewards.

In conclusion, credit cards can be powerful financial tools when used responsibly. By carefully considering your financial goals, spending habits, and credit card management strategies, you can make informed decisions about how often to use your credit card and leverage its benefits to achieve your financial aspirations.