Finance

How Often Does ARCC Pay Dividends?

Published: January 3, 2024

Discover how often ARCC pays dividends and stay updated on the latest finance news. Explore our comprehensive guide to dividends and investment strategies.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of investing, where you can grow your wealth and secure your financial future. In this arena, understanding how dividends work is essential. As an investor, you may have come across the term “dividends” and wondered what it means and how it can benefit you.

In this article, we will delve into the world of dividends, focusing specifically on the dividend payment schedule of Ares Capital Corporation (ARCC). Ares Capital is a renowned business development company that specializes in providing financing solutions to middle-market companies. Dividends are a crucial aspect of ARCC’s financial strategy and play a significant role in attracting investors.

Dividends are essentially a distribution of a company’s earnings to its shareholders. Companies like ARCC pay dividends regularly, typically on a quarterly basis, as a way to reward shareholders for their investments. These distributions can come in the form of cash, additional shares, or other valuable assets, depending on the company’s policies.

Understanding the dividend schedule of ARCC is important for investors, as it allows them to plan their investments accordingly. Knowing when to expect dividend payments can help investors manage their cash flow and make informed decisions about reinvesting or utilizing the funds.

Now, let’s dive deeper into how often ARCC pays dividends and explore the historical dividend payments of this prominent business development company.

Understanding ARCC Dividends

Before we explore the dividend payment schedule of ARCC, it’s important to have a clear understanding of how dividends are determined and calculated. As mentioned earlier, dividends are a distribution of a company’s earnings to its shareholders. However, the amount and frequency of dividend payments can vary depending on several factors.

ARCC follows a policy of distributing the majority of its taxable income as dividends to its shareholders. This means that the company strives to pay out a significant portion of its earnings in the form of dividends. As a result, ARCC has become an attractive investment option for those seeking regular income from their investments.

The dividend amount paid by ARCC is typically tied to the company’s performance and profitability. As a business development company, ARCC generates its income by providing loans and other financial solutions to middle-market companies. The interest and fees earned from these investments contribute to ARCC’s earnings and ultimately determine the dividend payments.

In addition to profitability, ARCC’s dividend policy takes into consideration the company’s cash flow, liquidity, and regulatory requirements. It is crucial for ARCC to maintain a healthy balance between distributing dividends and retaining sufficient funds for growth opportunities and potential economic downturns.

ARCC typically pays dividends on a quarterly basis, although the specific dates may vary from one year to another. The company’s dividend payments are subject to approval by its Board of Directors, who take into consideration several factors before making a final decision on the dividend amount and timing.

Now that we have a better understanding of ARCC’s dividend policy and the factors influencing dividend payments, let’s explore the dividend payment schedule in more detail.

Dividend Schedule

The dividend schedule of ARCC outlines the specific dates and frequency of dividend payments made by the company to its shareholders. Investors rely on this schedule to anticipate when they can expect to receive their dividend payments, allowing them to plan their finances accordingly.

ARCC follows a quarterly dividend payment schedule. This means that the company pays dividends four times a year, usually at equal intervals throughout the year. While the exact dates may vary from year to year, ARCC strives to maintain consistency in its dividend payment schedule.

Typically, the dividend payment dates for ARCC fall in the months of March, June, September, and December. The company announces the specific dates well in advance, providing shareholders with ample time to prepare for the receipt of their dividend payments.

It’s worth noting that the dividend payment dates are separate from other important dates related to dividends, such as the ex-dividend date and the record date. The ex-dividend date is the first day that a stock trades without the value of its upcoming dividend. Investors who purchase the stock on or after the ex-dividend date are not eligible to receive the dividend for that specific payment period.

The record date, on the other hand, is the date on which a shareholder must be registered in the company’s books as a shareholder in order to receive the dividend payment. This means that investors need to be shareholders of ARCC before the record date to be eligible for the dividend.

Understanding the dividend schedule and these related dates is crucial for investors who wish to maximize their dividend income. By planning their investments and purchases accordingly, investors can ensure they meet the requirements to receive the dividend payments.

Now that we have explored the dividend schedule of ARCC, let’s take a look at the historical dividend payments made by the company.

Historical Dividend Payments

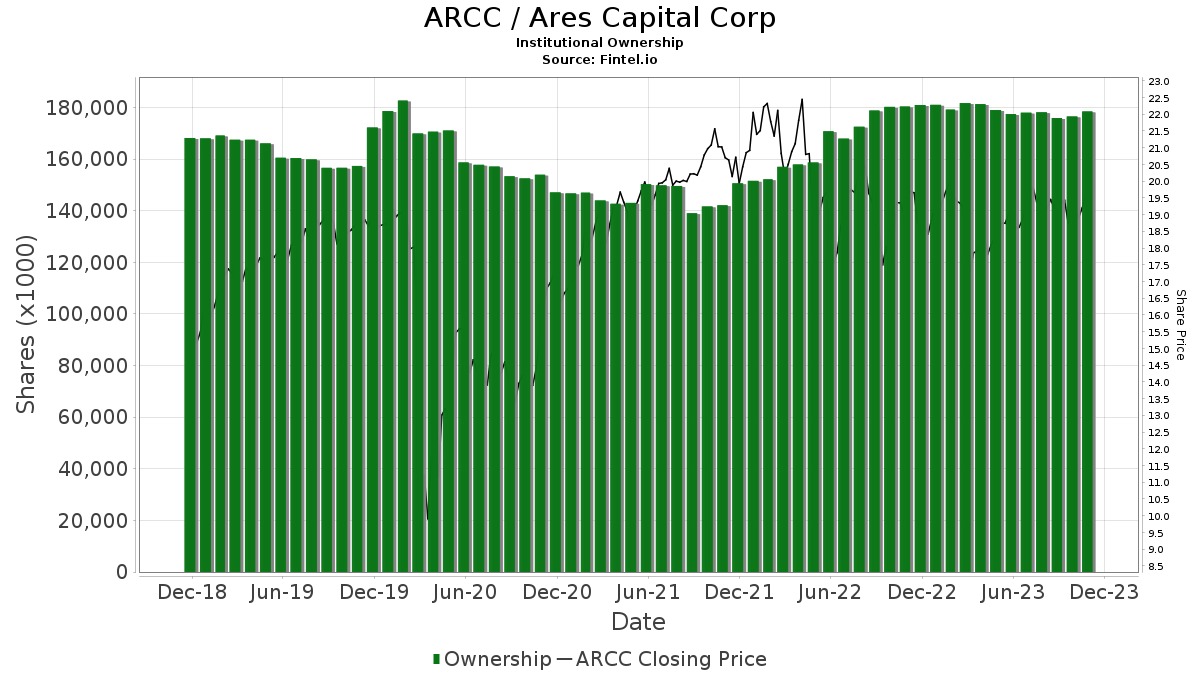

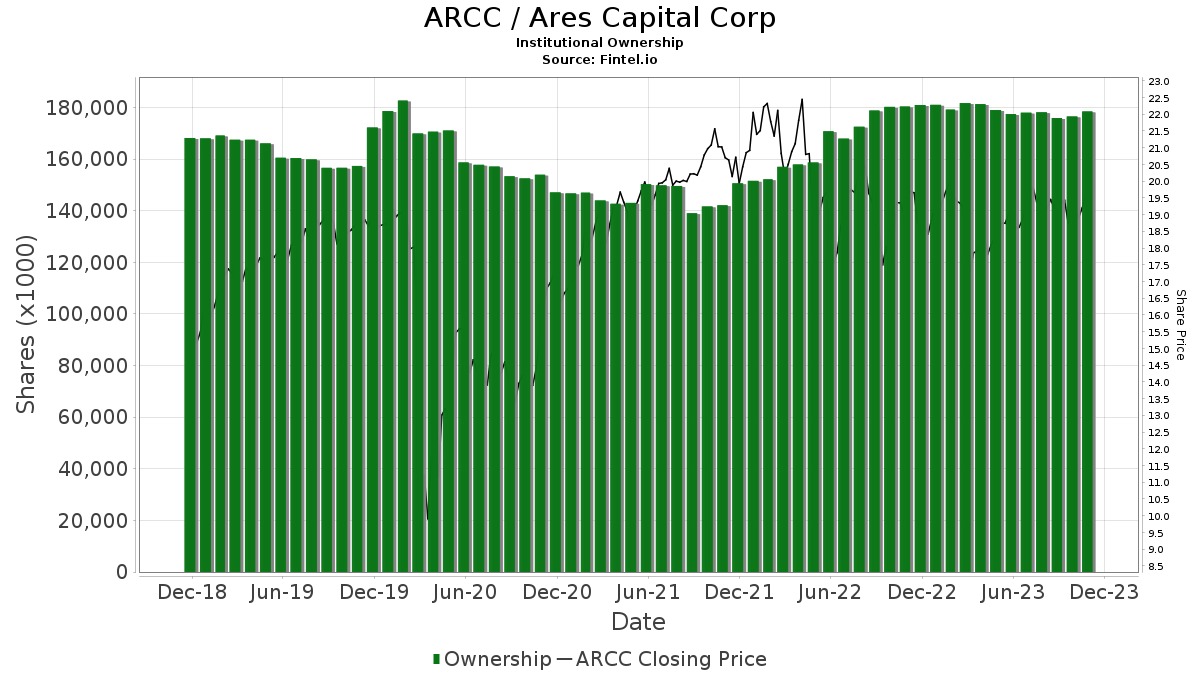

Examining the historical dividend payments of ARCC provides valuable insight into the company’s commitment to rewarding its shareholders. By analyzing past dividend trends, investors can gain a better understanding of ARCC’s dividend stability and growth potential.

Over the years, ARCC has established a track record of consistent dividend payments. The company’s dedication to delivering reliable income to its shareholders has solidified its reputation as a reliable dividend-paying stock.

Looking at the historical data, we can see that ARCC has steadily increased its dividend payments over time. This indicates the company’s confidence in its financial performance and its ability to generate sustainable earnings, even in a volatile market environment.

Let’s take a closer look at an example of ARCC’s historical dividend payments:

- In 2015, ARCC paid a quarterly dividend of $0.38 per share.

- In 2016, the dividend was increased to $0.39 per share.

- In 2017, the dividend was further increased to $0.40 per share.

- In 2018, ARCC raised the dividend to $0.41 per share.

- In 2019, ARCC increased the dividend once again to $0.42 per share.

- In 2020, despite the challenges posed by the global pandemic, ARCC maintained its dividend at $0.42 per share.

This historical dividend pattern demonstrates ARCC’s commitment to providing consistent dividend growth and income to its shareholders. It also showcases the resilience of the company in navigating through challenging market conditions while still prioritizing shareholder returns.

However, it’s important to note that past dividend performance does not guarantee future results. Market conditions, as well as the company’s financial performance, can impact future dividend payments. Therefore, investors should conduct thorough research and consider multiple factors before making their investment decisions.

Now that we have examined the historical dividend payments of ARCC, let’s explore the factors that influence the frequency of dividend distributions.

Factors Influencing Dividend Frequency

There are several factors that influence the frequency of dividend distributions by companies like ARCC. Understanding these factors can provide investors with insights into why some companies may pay dividends more frequently than others.

1. Profitability: The financial health and profitability of a company play a significant role in determining its ability to pay dividends. Companies with consistent and strong earnings are more likely to distribute dividends on a regular basis, such as quarterly or even monthly. ARCC, with its consistent dividend payments, demonstrates its profitability and ability to generate sustainable earnings.

2. Cash Flow: Companies need to have sufficient cash flow to meet dividend obligations. Positive cash flow allows companies to allocate funds for dividend payments without impacting their operations or financial stability. Strong cash flow management is a crucial factor in determining the frequency of dividend distributions.

3. Growth Opportunities: Companies in growth industries or those experiencing significant expansion may choose to reinvest their earnings back into the business rather than pay dividends. They may prioritize using their profits to fund research and development, acquisitions, or capital expenditures to fuel future growth. As a result, these companies may have a lower frequency of dividend payments.

4. Regulatory Requirements: Companies operating in regulated industries, such as financial services, may have specific requirements or limitations on dividend distributions. Compliance with regulatory obligations can influence the frequency at which these companies pay dividends. ARCC, being a business development company, is subject to regulatory guidelines that influence its dividend distribution practices.

5. Management’s Strategy: Ultimately, the decision on dividend frequency lies in the hands of the company’s management and its board of directors. Management assesses factors like financial performance, cash flow, growth objectives, and shareholder expectations when determining the frequency of dividend payments. Their strategy and vision for the company’s growth and profitability will significantly impact the dividend distribution approach.

It’s important for investors to consider these factors when evaluating a company’s dividend frequency. While regular and consistent dividend payments may be appealing, investors should also assess the overall financial health, growth prospects, and long-term sustainability of the company.

With an understanding of the factors influencing dividend frequency, let’s summarize the key points discussed in this article.

Conclusion

Dividends are an important aspect of investing, providing shareholders with a steady stream of income and serving as a measure of a company’s financial strength and stability. Ares Capital Corporation (ARCC), a renowned business development company, follows a quarterly dividend payment schedule, rewarding its shareholders with consistent and reliable dividend distributions.

ARCC’s commitment to paying dividends is evident through its historical dividend payments, which have shown a consistent increase over the years. This track record of consistent dividend growth reflects the company’s confidence in its financial performance and its dedication to providing shareholders with a reliable source of income.

Several factors influence the frequency of dividend distributions, including profitability, cash flow, growth opportunities, regulatory requirements, and the management’s strategic decisions. Understanding these factors allows investors to analyze and evaluate a company’s dividend policy, helping them make informed investment decisions.

While past dividend performance can provide insights into a company’s commitment to rewarding shareholders, it’s essential to remember that future dividend payments are subject to market conditions and the company’s financial performance. Conducting thorough research and considering multiple factors is crucial before making investment decisions.

By understanding the dividend schedule, historical dividend payments, and the factors influencing dividend frequency, investors can better navigate the world of dividends and make informed choices. Whether you’re a seasoned investor or just starting your investment journey, keeping a close eye on dividend payments and their frequency can help you optimize your investment strategy and achieve your financial goals.