Finance

What Does 0 Minimum Payment Mean

Published: February 25, 2024

Learn what a 0 minimum payment means in finance and how it affects your financial situation. Understand the implications and how to manage it effectively. Gain insights into navigating 0 minimum payments in your financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Minimum Payments in Financial Management

Managing credit card debt is a crucial aspect of personal finance. When individuals utilize credit cards for purchases or to manage unexpected expenses, they often encounter the concept of minimum payments. The minimum payment is the smallest amount a cardholder must pay by the due date to keep the account in good standing. It typically comprises a portion of the outstanding balance, fees, and interest charges.

Understanding the implications of minimum payments is essential for maintaining financial stability. In this article, we will delve into the significance of minimum payments, particularly focusing on the implications of a 0 minimum payment. We will explore the factors influencing minimum payments and provide valuable tips for effectively managing this aspect of personal finance.

By comprehending the intricacies of minimum payments, individuals can make informed decisions regarding their credit card usage and debt management. Whether you are a seasoned credit card user or just starting to build your credit history, grasping the fundamentals of minimum payments is pivotal for your financial well-being. Let's embark on this insightful journey to unravel the significance of minimum payments and their impact on personal finance.

Understanding the Concept of Minimum Payment

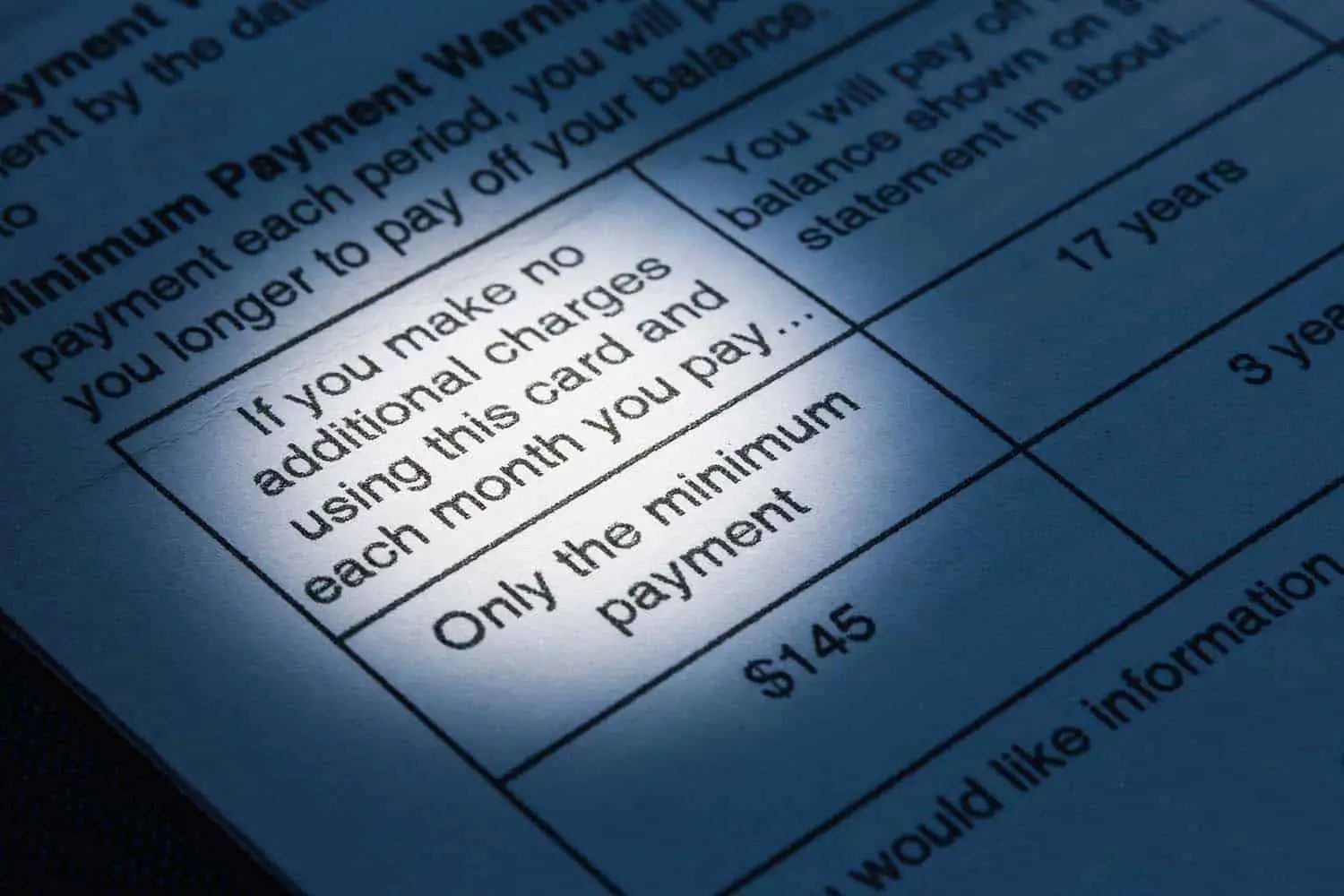

Minimum payments are the smallest amount that credit card holders are required to pay each month to maintain their accounts in good standing. This amount is calculated based on a percentage of the outstanding balance, along with any interest and fees accrued during the billing cycle. While making the minimum payment by the due date prevents the account from being considered delinquent, it is important to note that carrying a balance and consistently making minimum payments can lead to long-term debt and substantial interest payments.

When individuals receive their credit card statements, they often encounter the minimum payment amount prominently displayed. This figure may seem appealing, especially if finances are tight, as it offers immediate relief by allowing the cardholder to pay a fraction of the total balance. However, it is crucial to recognize that by solely making minimum payments, the overall debt may linger for an extended period, and the interest accrued can significantly inflate the total amount owed.

Moreover, understanding the components that contribute to the minimum payment is essential. In addition to the outstanding balance, factors such as interest rates, annual fees, and any applicable penalties or late fees influence the minimum payment amount. By comprehending these elements, individuals can gain insight into the dynamics of their credit card debt and make informed decisions regarding their repayment strategies.

It is imperative for individuals to recognize that while minimum payments offer short-term relief, they may lead to long-term financial strain. By delving into the intricacies of minimum payments, individuals can develop a comprehensive understanding of their financial obligations and proactively manage their credit card debt to achieve greater financial stability.

The Implications of a 0 Minimum Payment

Encountering a 0 minimum payment on a credit card statement may initially appear advantageous, as it seemingly alleviates the immediate burden of making a payment. However, delving deeper into the implications of a 0 minimum payment reveals crucial insights into the financial landscape. A 0 minimum payment typically arises when the calculated minimum payment amount, based on the outstanding balance, interest, and fees, amounts to zero or an insignificant figure.

While a 0 minimum payment may provide temporary relief, it is essential to recognize its long-term repercussions. Firstly, a 0 minimum payment does not signify that the outstanding balance has been eradicated. Instead, it indicates that the calculated minimum payment for that particular billing cycle is minimal or nonexistent. Consequently, the remaining balance, along with any accruing interest and fees, continues to contribute to the overall debt burden.

Moreover, a 0 minimum payment can lead to prolonged debt repayment. By only paying the minimum or encountering a 0 minimum payment, individuals may find themselves trapped in a cycle of debt, as the interest continues to accrue on the remaining balance. This can result in a substantial increase in the total amount owed, making it challenging to achieve debt freedom in the long run.

Furthermore, encountering a 0 minimum payment may indicate financial distress or a precarious financial situation. It serves as a red flag, signaling that the individual’s debt burden may be escalating, and their ability to manage their financial obligations is strained. Addressing a 0 minimum payment necessitates a comprehensive evaluation of one’s financial standing and the implementation of effective debt management strategies to mitigate the risk of escalating debt and financial instability.

Understanding the implications of a 0 minimum payment empowers individuals to proactively address their financial challenges and implement measures to alleviate debt burdens. By recognizing the significance of a 0 minimum payment and its potential long-term consequences, individuals can make informed decisions to regain control of their financial well-being and work towards achieving sustainable debt management.

Factors Affecting Minimum Payments

Several key factors influence the calculation of minimum payments on credit card statements. Understanding these elements is crucial for individuals seeking to manage their credit card debt effectively. The following are significant factors that contribute to the determination of minimum payments:

- Outstanding Balance: The outstanding balance on a credit card is a primary determinant of the minimum payment. Typically, the minimum payment is calculated as a percentage of the total outstanding balance, ensuring that cardholders make consistent progress in repaying their debt.

- Interest Rates: The annual percentage rate (APR) on the credit card significantly impacts the minimum payment. Higher interest rates lead to larger minimum payments, as a greater portion of the payment is allocated to interest rather than reducing the principal balance.

- Fees and Penalties: Additional fees, such as late payment fees or over-limit fees, contribute to the minimum payment amount. These fees increase the total amount owed and consequently influence the minimum payment calculation.

- Grace Periods: The presence or absence of a grace period, during which no interest is charged on new purchases if the previous month’s balance is paid in full, affects the minimum payment. Without a grace period, interest accrues immediately on new purchases, impacting the minimum payment for the subsequent billing cycle.

- Credit Utilization Ratio: The ratio of the outstanding balance to the credit limit, known as the credit utilization ratio, influences the minimum payment. Higher credit utilization ratios may lead to larger minimum payments and can impact credit scores.

By comprehending these factors, individuals can gain insight into the dynamics of minimum payments and make informed decisions regarding their credit card usage and debt repayment strategies. Moreover, understanding the interplay of these elements empowers individuals to proactively manage their credit card debt and work towards achieving financial stability.

Tips for Managing Minimum Payments

Effectively managing minimum payments is integral to maintaining financial stability and mitigating long-term debt burdens. Implementing strategic approaches to navigate minimum payments can empower individuals to proactively address their credit card debt. The following tips offer valuable insights for managing minimum payments:

- Pay More Than the Minimum: While the minimum payment is the required amount to keep the account in good standing, striving to pay more than the minimum can expedite debt repayment and reduce interest charges. Allocating additional funds towards the outstanding balance helps diminish the overall debt burden.

- Create a Budget: Developing a comprehensive budget that prioritizes debt repayment enables individuals to allocate funds towards minimum payments and strategically manage their finances. A well-structured budget facilitates disciplined financial management and fosters responsible spending habits.

- Understand the Terms and Conditions: Familiarizing oneself with the terms and conditions of the credit card agreement is essential. This includes comprehending the calculation of minimum payments, interest rates, and potential fees. Clarity regarding these aspects empowers individuals to make informed financial decisions.

- Seek Debt Consolidation Options: Exploring debt consolidation options, such as balance transfers to credit cards with lower interest rates, or obtaining a consolidation loan, can streamline debt repayment. Consolidation strategies may offer reduced interest rates, making it easier to manage minimum payments.

- Communicate with Creditors: In instances of financial hardship, communicating with creditors can be beneficial. Some creditors offer hardship programs or modified payment arrangements, providing temporary relief and enabling individuals to manage minimum payments effectively.

- Monitor Credit Card Usage: Prudent monitoring of credit card usage helps individuals avoid accruing additional debt. Responsible spending habits and conscious utilization of credit cards contribute to maintaining manageable minimum payments.

- Strategically Prioritize Payments: Prioritizing high-interest debts and allocating funds accordingly can optimize debt repayment. By focusing on high-interest accounts, individuals can minimize interest charges and expedite their journey towards debt freedom.

By incorporating these tips into their financial management practices, individuals can navigate minimum payments with confidence and work towards achieving sustainable debt management. Proactive debt repayment strategies and responsible financial decision-making are pivotal in alleviating debt burdens and fostering long-term financial well-being.

Conclusion

Understanding the intricacies of minimum payments is paramount for individuals navigating the realm of credit card debt and personal finance. The concept of minimum payments extends beyond the routine task of meeting the required monthly amount; it encompasses the dynamics of debt management, interest accrual, and long-term financial implications. By comprehending the significance of minimum payments and their impact on financial well-being, individuals can implement informed strategies to effectively manage their credit card debt.

Encountering a 0 minimum payment serves as a pivotal indicator, prompting individuals to evaluate their financial standing and proactively address potential debt escalation. It underscores the importance of implementing prudent debt management practices and striving to pay more than the minimum to expedite debt repayment and reduce interest charges.

The factors influencing minimum payments, including outstanding balances, interest rates, fees, and credit utilization ratios, contribute to the complexity of debt management. By gaining insight into these elements, individuals can make informed decisions regarding their credit card usage and repayment strategies, fostering responsible financial habits and sustainable debt management.

Empowering individuals with valuable tips for managing minimum payments enables them to navigate their financial obligations with confidence. From creating structured budgets to exploring debt consolidation options and communicating with creditors, these strategies facilitate proactive debt management and responsible financial decision-making.

In conclusion, comprehending the nuances of minimum payments is instrumental in fostering financial stability and mitigating long-term debt burdens. By embracing informed approaches to manage minimum payments and implementing prudent debt repayment strategies, individuals can embark on a journey towards sustainable financial well-being and achieve greater control over their credit card debt.