Finance

How Often Does SDIV Pay Dividends?

Published: January 2, 2024

Find out the frequency of dividend payments for SDIV in the finance sector. Stay informed about dividend updates and maximize your investment returns.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing, dividends play a crucial role in generating income for investors. Dividends are typically distributed by companies to their shareholders as a reward for owning their stock. One popular investment vehicle that focuses on dividend-paying stocks is the Global X SuperDividend ETF (SDIV).

SDIV is a widely recognized exchange-traded fund that aims to provide investors with exposure to a diversified portfolio of high dividend-yielding stocks from around the world. As a dividend-focused ETF, SDIV offers investors the potential for both income and capital appreciation.

In this article, we will explore the frequency at which SDIV pays dividends, factors that can influence dividend frequency, and take a look at historical dividend payments made by SDIV.

Understanding how often SDIV pays dividends is crucial for investors looking to generate a steady stream of income and plan their investment strategies accordingly. Additionally, it can provide insights into the fund’s performance and the stability of its dividend payments.

Whether you’re an income-focused investor or simply curious about SDIV’s dividend payment frequency, let’s dive in and uncover the details behind SDIV’s dividend payments.

Understanding SDIV Dividends

Before delving into the dividend payment frequency of SDIV, it’s important to have a clear understanding of how dividends work within the context of this ETF.

SDIV is designed to provide investors with exposure to a global portfolio of high dividend-yielding stocks. The fund consists of companies from various sectors and regions, all of which have a track record of paying consistent dividends. By investing in SDIV, investors can gain access to a diversified pool of dividend-paying assets without having to select individual stocks themselves.

Dividends are typically paid out by companies from their profits, and they represent a portion of the earnings that are shared with shareholders. SDIV accumulates these dividends from the underlying holdings in its portfolio and distributes them to its own shareholders.

The dividends received by SDIV are usually reinvested back into the fund or paid out to investors on a regular basis. This means that as an investor in SDIV, you can potentially receive dividend income at regular intervals, depending on the dividend payment frequency of the fund.

It’s worth noting that the amount of dividends received by SDIV can vary over time, influenced by factors such as changes in the dividend policies of underlying companies, market conditions, and the fund’s investment strategy. Therefore, the dividend yield of SDIV may fluctuate, and investors should keep this in mind when considering the investment.

Now that we have a basic understanding of SDIV’s dividend framework, let’s explore how often the fund pays dividends to its shareholders.

SDIV Dividend Payment Frequency

SDIV follows a quarterly dividend payment schedule, meaning that it pays dividends to shareholders once every quarter. This regular distribution of dividends provides investors with a predictable income stream and allows them to plan their finances accordingly.

As an investor in SDIV, you can expect to receive dividend payments in the form of cash, additional shares of the fund, or a combination of both. The specific dividend payment method may vary depending on the discretion of the fund management.

It’s important to note that the amount of dividends paid out by SDIV can fluctuate from one quarter to another. This variability is influenced by several factors, including the performance and profitability of the underlying companies in the fund’s portfolio.

It’s recommended that investors who are interested in SDIV closely monitor and keep track of the dividend payment schedule. This way, they can stay informed about upcoming dividend payments and make necessary adjustments to their investment strategies.

Additionally, it’s crucial to consider that the dividend yield of SDIV is subject to market conditions and the overall performance of the underlying securities. While SDIV aims to invest in high dividend-yielding stocks, there is no guarantee that the dividend payments will remain constant or increase over time.

Investors who rely on dividend income should consider the potential risks associated with fluctuations in dividend payments and conduct thorough research before making investment decisions.

Now that we have explored the dividend payment frequency of SDIV, let’s delve into the factors that can influence the frequency and stability of dividend payments.

Factors Affecting Dividend Frequency

The frequency at which SDIV pays dividends can be influenced by various factors. Understanding these factors can provide insights into the stability and predictability of dividend payments. Here are some key factors that can affect the dividend frequency of SDIV:

- Earnings of Underlying Companies: The dividend payments of SDIV are dependent on the earnings generated by the companies in its portfolio. If the underlying companies experience strong earnings growth, it is more likely that they will distribute dividends, leading to a higher dividend frequency for SDIV.

- Market Conditions: External market conditions can impact the dividend frequency of SDIV. During periods of economic downturns or market volatility, companies may choose to cut or eliminate dividend payments to conserve cash. Consequently, this can result in a decrease in the dividend frequency of SDIV.

- Dividend Policies: The dividend policies of the underlying companies can play a significant role in determining the dividend frequency of SDIV. Some companies have a consistent and established history of paying dividends on a regular basis, while others may have more irregular dividend payment patterns. SDIV’s dividend frequency will reflect the dividend policies of the companies in its portfolio.

- Fund Management Strategy: The fund managers of SDIV have the discretion to adjust the allocation of the portfolio and make investment decisions based on market conditions and their strategy. Changes in the portfolio composition can impact the dividend frequency of SDIV.

- Regulatory and Tax Considerations: Regulatory and tax factors can also influence the dividend frequency of SDIV. Changes in tax laws or regulations, both domestically and internationally, can impact the dividend payments made by the companies in SDIV’s portfolio, thus affecting the dividend frequency of the fund.

It’s important to note that these factors can interact and vary over time, resulting in changes to the dividend frequency of SDIV. Investors should stay informed about these factors and monitor any updates or announcements from SDIV and its underlying companies to assess the potential impact on dividend payments.

Now that we understand the factors that can affect the dividend frequency of SDIV, let’s examine the historical dividend payments made by SDIV to get a better sense of its dividend track record.

Historical Dividend Payments by SDIV

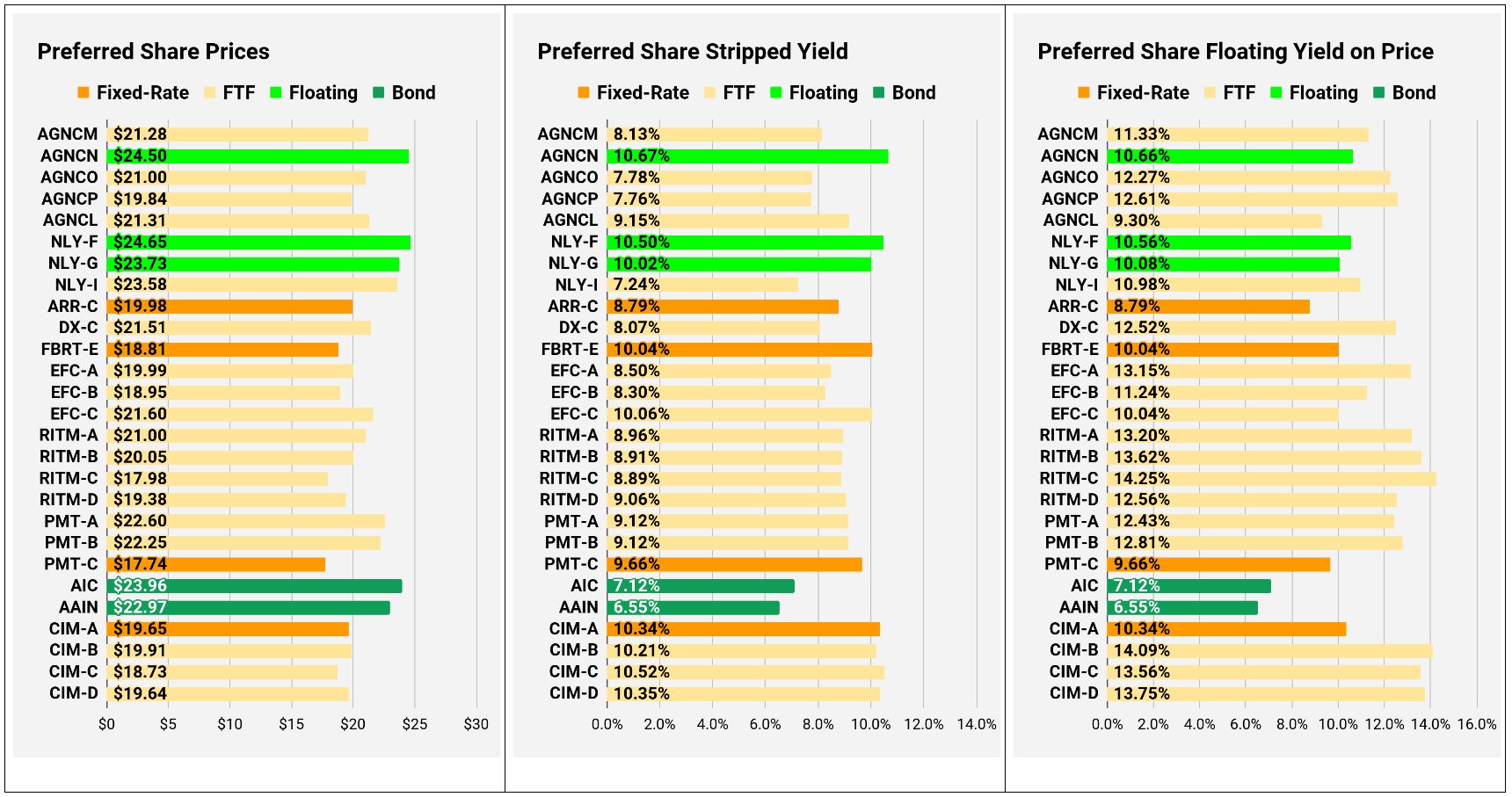

Examining the historical dividend payments made by SDIV can provide valuable insights into the fund’s track record of distributing dividends to its shareholders. While past performance is not indicative of future results, it can help investors assess the consistency and reliability of dividend payments. Here is a snapshot of the historical dividend payments made by SDIV:

- 2019: In 2019, SDIV paid dividends on a quarterly basis. The total dividend distribution for the year amounted to $2.70 per share, with individual quarterly payments ranging from $0.54 to $0.69 per share.

- 2020: In 2020, SDIV also maintained its quarterly dividend payment frequency. The total dividend distribution for the year was $2.51 per share, with quarterly payments ranging from $0.43 to $0.71 per share.

- 2021: As of the time of writing, the dividend payments for 2021 have been consistent with the quarterly pattern. SDIV has distributed dividends ranging from $0.42 to $0.48 per share for the first three quarters of the year.

It’s important to note that the dividend payments made by SDIV can vary from year to year and quarter to quarter. These variations are influenced by the factors mentioned earlier, such as the earnings of the underlying companies and market conditions.

Investors interested in SDIV should regularly review the dividend payment history to assess the fund’s dividend-generating potential. By analyzing the historical dividend data, investors can gain insights into the consistency, stability, and potential growth of dividend payments.

However, it’s essential to remember that historical dividend payments are not a guarantee of future dividends. Market conditions and other factors can impact the dividend frequency and distribution amount in the future.

Before making any investment decisions, it is advisable to consult with a financial advisor or conduct thorough research to fully understand the risks and potential rewards associated with investing in SDIV and other dividend-focused investment vehicles.

Now, let’s summarize the key points discussed in the article.

Conclusion

Understanding the dividend payment frequency of SDIV is crucial for investors looking to generate a steady stream of income from their investments. SDIV follows a quarterly dividend payment schedule, providing shareholders with regular income distributions.

Factors such as the earnings of the underlying companies, market conditions, dividend policies, fund management strategy, and regulatory considerations can all impact the dividend frequency of SDIV. It’s important for investors to stay informed about these factors and regularly monitor any updates or announcements from SDIV and its underlying companies.

While analyzing the historical dividend payments made by SDIV can provide insights into the fund’s dividend track record, it’s important to remember that past performance is not indicative of future results. Investors should consider the potential risks associated with fluctuations in dividend payments and conduct thorough research before making investment decisions.

Investing in SDIV or any dividend-focused investment vehicle requires careful consideration and assessment of individual financial goals and risk tolerance. Consulting with a financial advisor can provide personalized guidance and help investors make informed decisions.

In conclusion, SDIV offers investors the opportunity to gain exposure to a diversified portfolio of high dividend-yielding stocks. By understanding the dividend payment frequency, factors influencing dividend payments, and analyzing the historical dividend payments, investors can make informed decisions and potentially generate a consistent income stream from their investments.