Finance

How Thick Is A Credit Card In Mm

Published: November 4, 2023

Discover the exact thickness of a credit card in mm and learn how it relates to your finances. Uncover the importance of understanding credit card dimensions and how it impacts your financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where convenience meets financial flexibility. Credit cards have become an integral part of our everyday lives, enabling us to make purchases, pay bills, and access funds conveniently. While we often focus on the rewards and benefits associated with credit cards, there’s one aspect that often goes unnoticed – the thickness of these cards.

Have you ever wondered how thick a credit card is? On the surface, it may seem like a trivial aspect, but credit card thickness actually plays a vital role in its durability and functionality. From the materials used to manufacture the card to the impact it has on compatibility with payment terminals, understanding credit card thickness can provide valuable insights into these financial tools.

In this article, we will delve into the world of credit card thickness, exploring the standard measurements, variations, and the factors that affect how thick a credit card is. We’ll also discuss the importance of credit card thickness and how it can impact your finances.

So, let’s put on our detective hats and uncover the secrets behind the thickness of credit cards – an often overlooked aspect that holds more significance than you might think.

Background Information

Credit cards have been around since the 1950s, revolutionizing the way we make payments. Initially introduced as a convenience for customers, credit cards quickly gained popularity due to their ease of use and ability to defer payment for purchases. Over the years, credit cards have evolved to offer various rewards, benefits, and security features to enhance the overall user experience.

When it comes to the construction of a credit card, it is typically made from a PVC (polyvinyl chloride) plastic material. PVC offers durability, flexibility, and resistance to wear and tear, making it an ideal choice for credit card manufacturing.

Although credit cards come in different shapes and sizes, there is a standardized width and length set by the International Organization for Standardization (ISO). This standard ensures compatibility with card payment terminals worldwide, allowing users to make transactions seamlessly, regardless of their location.

However, the thickness of credit cards can vary, and this is influenced by a range of factors, including the type of card, the issuer’s preferences, and the technologies incorporated into the card. Understanding these factors will shed light on the variations in credit card thickness and how they impact your overall experience as a cardholder.

Now that we have a basic understanding of the background information, let’s dive deeper into the standard thickness of a credit card and explore the variations and factors that affect it.

The Standard Thickness of a Credit Card

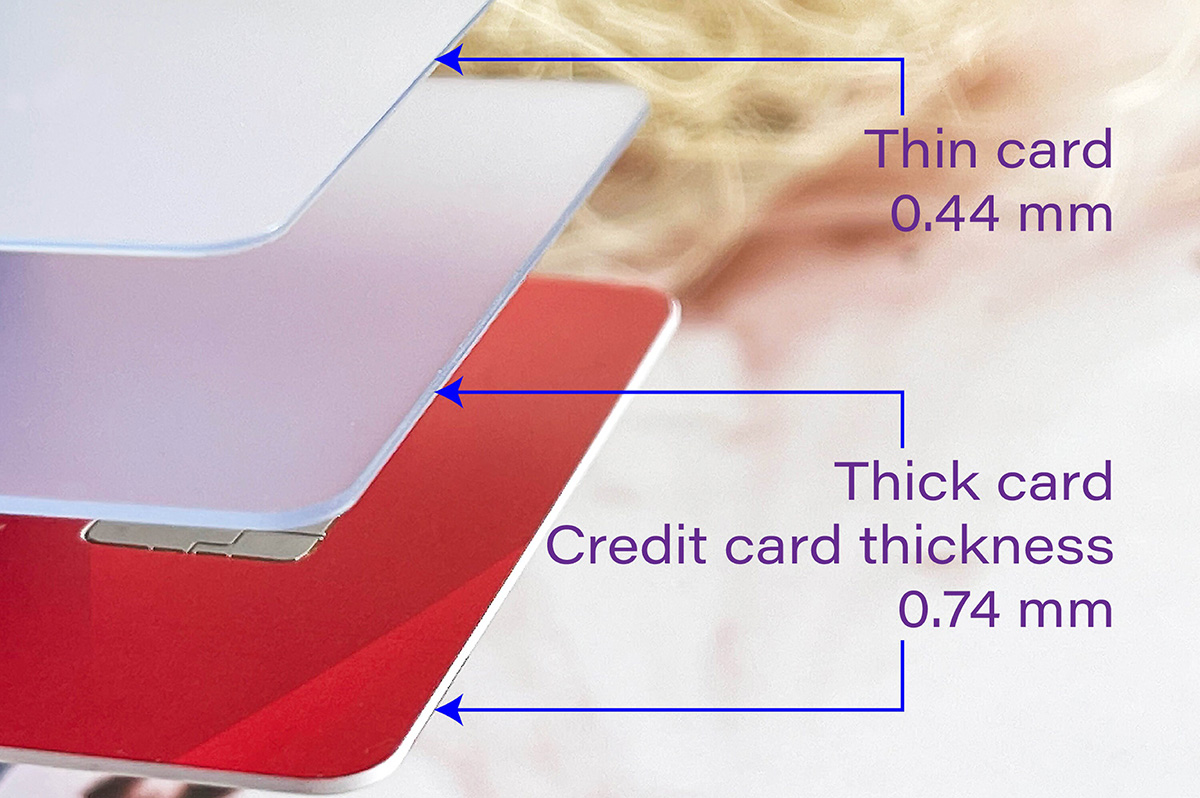

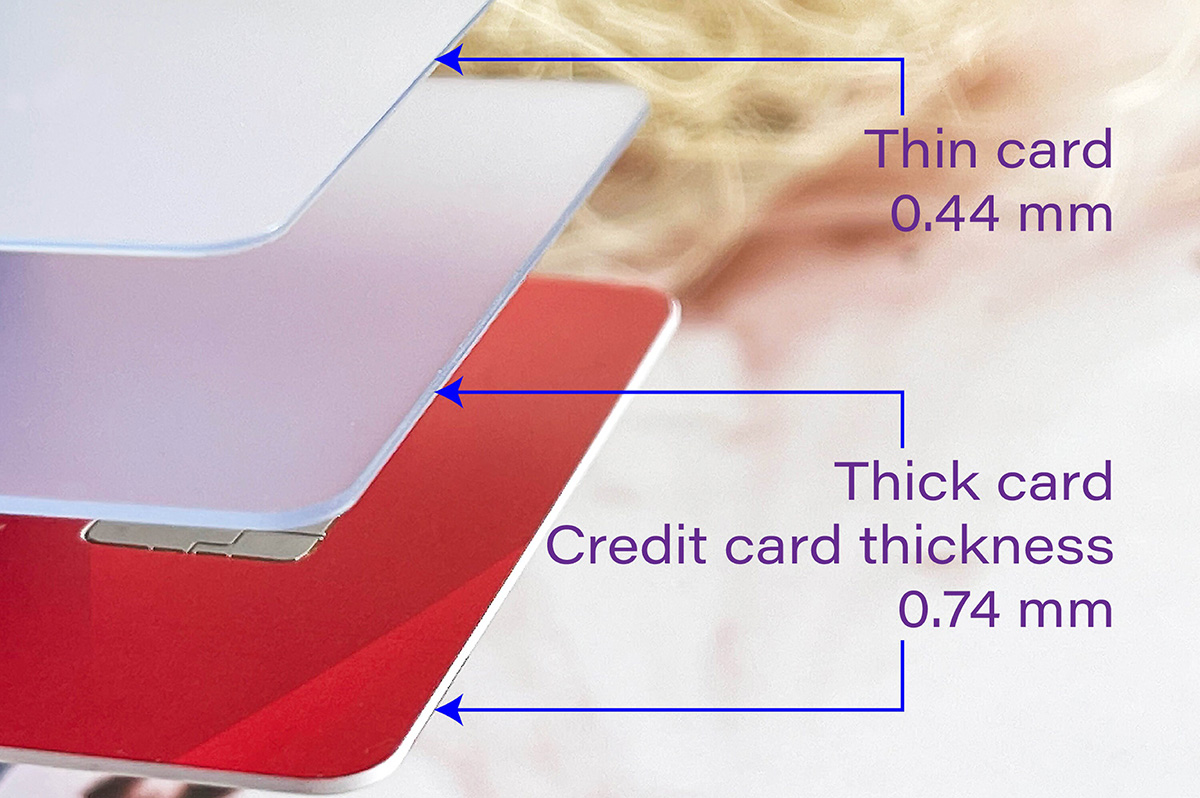

When it comes to credit cards, there is a generally accepted standard thickness that ensures compatibility with payment terminals and ease of use for consumers. The standard thickness of a credit card is approximately 0.76 millimeters (mm) or 30 thousandths of an inch.

This thickness provides a balance between durability and flexibility. A credit card needs to be sturdy enough to withstand everyday wear and tear, such as being carried in wallets, swiped through card readers, and inserted into chip-enabled terminals. At the same time, it also needs to be flexible enough to fit into various card slots and be easily carried without causing inconvenience to the cardholder.

The ISO standard for credit card thickness also helps in maintaining consistency across different card issuers and payment systems. Regardless of which bank or financial institution issues your credit card, the thickness will adhere to this standard, ensuring that the card can be used universally.

It’s important to note that while there is a standard thickness, variations can still occur within this range. Different card issuers may have slight differences in thickness due to factors such as proprietary technologies and design preferences.

Overall, the standard thickness of a credit card is designed to provide durability, flexibility, and universal compatibility, making it convenient for both the cardholder and the businesses accepting the card for payment.

Variations in Credit Card Thickness

Although there is a standard thickness for credit cards, there can still be variations in thickness across different card issuers and types of cards. These variations can be influenced by several factors, including the materials used, additional features incorporated into the card, and the issuer’s preferences.

One factor that can contribute to variations in credit card thickness is the presence of additional layers or technologies within the card. For example, some credit cards have embedded microchips for enhanced security and compatibility with chip-enabled terminals. These chips, along with other security measures, can add thickness to the card.

Similarly, cards with features such as contactless payment technology (such as RFID) or wireless communication capabilities may have slightly thicker layers to accommodate these functionalities. The inclusion of such features aims to enhance convenience and security for cardholders but may result in a slightly thicker card.

Additionally, certain types of credit cards, such as premium or luxury cards, may have variations in thickness for branding or aesthetic purposes. These cards often boast unique designs, materials, or finishes, which can result in a thicker or more substantial feel.

Furthermore, regional differences can also contribute to variations in credit card thickness. In some countries or regions, different standards or preferences may be followed, resulting in slight variations in thickness compared to the international standard.

While slight variations in credit card thickness are generally negligible and do not affect everyday use, it’s essential to be aware of these differences, especially when using the card in specialized devices or card readers that have particularly tight tolerances.

Overall, while the standard thickness of a credit card is widely accepted and followed, variations in thickness can occur due to additional features, branding considerations, and regional preferences.

Factors Affecting Credit Card Thickness

Several factors can influence the thickness of a credit card. These factors vary from the materials used in its construction to the design and features incorporated into the card. Understanding these factors can give us insights into why credit card thickness can differ from card to card.

1. Materials: The choice of materials used to manufacture credit cards plays a significant role in determining their thickness. Most credit cards are made from PVC (polyvinyl chloride) plastic, which offers a balance of durability, flexibility, and cost-effectiveness. However, the addition of different layers or special materials, such as metal or composite elements, can increase the thickness of the card.

2. Additional Features: The inclusion of additional features, such as embedded microchips for chip-enabled transactions or contactless payment technology, can impact the thickness of a credit card. These features require space within the card for the necessary components, leading to a slightly thicker card compared to traditional magnetic stripe cards.

3. Brand Preference: Some card issuers may have specific preferences regarding the thickness of their credit cards. This preference could be driven by branding considerations, aiming to create a unique and memorable card for their customers. As a result, certain issuers may opt for a slightly thicker card to differentiate themselves in the market.

4. Regional Standards: The standards for credit card thickness can also vary regionally. Different countries or regions may have their own guidelines or preferences when it comes to credit card thickness. Local payment systems or technological requirements can influence the thickness of cards issued in specific regions.

5. Technological Advancements: The constant evolution of technology and security measures in the financial industry can also impact credit card thickness. As new features and technologies are developed, such as enhanced security measures or biometric authentication, considerations need to be made regarding the placement and integration of these components without compromising the overall card size and thickness.

It’s important to note that while these factors can influence credit card thickness, they generally result in minor variations that do not significantly affect the card’s functionality or usability. Card issuers strive to maintain a balance between durability, flexibility, and innovation to deliver the best card experience to their customers.

Importance of Credit Card Thickness

While credit card thickness may seem like a minor detail, it holds important implications for both cardholders and merchants. The thickness of a credit card can impact its durability, compatibility with payment terminals, and overall user experience. Here are a few reasons why credit card thickness is of significance:

1. Durability: A thicker credit card is generally more durable and resistant to wear and tear. Thinner cards may be more prone to bending or breaking, especially if they are flexed or subjected to rough handling. A thicker card provides added rigidity and strength, ensuring that it can withstand daily use without issues.

2. Compatibility: Credit card thickness plays a crucial role in compatibility with payment terminals. Various machines, such as point-of-sale devices or card readers, are designed to accept cards within a specific thickness range. If a card is too thick or too thin, it may not fit properly or fail to make a secure connection, resulting in payment errors or declined transactions. A standard thickness ensures widespread acceptance and seamless transactions.

3. User Experience: The thickness of a credit card can significantly impact the overall user experience. A card that is too thick may be challenging to fit into wallets or card slots, causing discomfort and inconvenience for the cardholder. On the other hand, a card that is too thin may feel flimsy and cheap, diminishing the perceived value and satisfaction of using the card.

4. Perception and Branding: Credit card thickness can also have marketing and branding implications. A thicker credit card may convey a sense of quality, exclusivity, and prestige, especially for premium or luxury cards. The tactile experience of holding a thicker card can contribute to the cardholder’s perception of the issuer’s brand and overall value proposition.

5. Card Security: In some cases, added thickness in credit cards can accommodate additional security features, such as embedded microchips or contactless payment technology. These features enhance the security of transactions and protect cardholder data, providing peace of mind for both consumers and merchants.

Overall, credit card thickness plays a significant role in the durability, compatibility, user experience, branding, and security of the cards. While it may be overlooked, understanding and appreciating the importance of credit card thickness can help us make informed decisions as consumers and ensure a seamless payment experience.

Measuring Credit Card Thickness

Measuring the thickness of a credit card is quite straightforward and requires minimal tools. While the standard thickness of a credit card is approximately 0.76 millimeters (mm) or 30 thousandths of an inch, it’s always a good idea to measure an individual card to verify its thickness. Here’s a simple method to measure the thickness of a credit card:

- Gather the necessary tools: To measure the thickness of a credit card, you’ll need a precision caliper or a digital micrometer. These tools provide accurate measurements and are commonly used for precise dimensional measurements.

- Prepare the credit card: Take a single credit card that you want to measure and ensure it is clean and free from any debris or dirt.

- Position the card: Lay the credit card flat on a clean surface, ensuring that it lies completely flat without any warping or curling.

- Use the caliper or micrometer: Open the jaws of the caliper or micrometer and position them at opposite ends of the credit card. Gently close the jaws until they make contact with both sides of the card.

- Take the measurement: Read the measurement displayed on the caliper or micrometer. This reading corresponds to the thickness of the credit card in millimeters or inches (depending on the unit of measurement on the tool).

Remember to take multiple measurements across different areas of the card to ensure accuracy. It’s also a good idea to measure multiple cards to account for any variations in thickness that may exist within a batch of cards or across different issuers.

By measuring the thickness of a credit card, you can confirm if it falls within the acceptable range and make any necessary adjustments regarding the card’s storage or use. Additionally, measuring the thickness can be useful if you’re designing custom cardholders or accessories that need to accommodate specific card dimensions.

Remember to handle credit cards with care during the measuring process to avoid causing any damage or warping. With the proper tools and attention to detail, measuring credit card thickness can be a simple and informative process.

Conclusion

While often overlooked, the thickness of a credit card holds significance in terms of durability, compatibility, and user experience. The standard thickness of a credit card is approximately 0.76 millimeters (mm) or 30 thousandths of an inch, ensuring universal acceptance and convenient usage.

However, variations in credit card thickness can occur due to factors such as additional features, branding considerations, regional standards, and technological advancements. These variations, though generally minor, can affect durability, compatibility with payment terminals, and the overall user experience.

Understanding the importance of credit card thickness can help you make well-informed decisions regarding the selection and usage of credit cards. A thicker card offers enhanced durability and can withstand everyday wear and tear. It also improves compatibility with payment terminals, reducing the likelihood of payment errors or declines.

The thickness of a credit card can also contribute to the overall perception and branding of the issuer. Thicker cards may convey a sense of quality, exclusivity, and prestige, enhancing the overall cardholder experience.

Measuring the thickness of a credit card is a simple process that can be done using precision calipers or digital micrometers. Accurate measurements contribute to a better understanding of the card’s dimensions and can be useful for designing cardholders or accessories that accommodate specific card thicknesses.

In conclusion, credit card thickness plays a vital role in ensuring durability, compatibility, user experience, and branding. It is an often-overlooked aspect that deserves attention and consideration to enhance the overall functionality and enjoyment of using credit cards.