Home>Finance>How To Add Someone To My Chase Checking Account

Finance

How To Add Someone To My Chase Checking Account

Published: October 27, 2023

Learn how to add someone to your Chase checking account and manage your finances more effectively with this step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

If you have a Chase checking account and want to add someone as a joint account holder, you may be wondering how to go about it. Adding someone to your Chase checking account is a convenient option when you want to share financial responsibilities or give someone access to your funds. Whether it’s a spouse, family member, or business partner, having a joint account can simplify your transactions and make managing your finances easier.

In this article, we will guide you through the step-by-step process of adding someone to your Chase checking account. We will discuss the requirements, necessary documentation, and how to contact Chase customer service to ensure a smooth and successful account addition.

Before diving into the steps, it’s important to note that adding someone to your Chase checking account grants them full access and control over the account. This means they will be able to withdraw funds, make transactions, and manage the account just as you can. It’s crucial to carefully consider and trust the person you are adding to your account, as their actions will directly impact your finances.

Now, let’s explore the steps involved in adding someone to your Chase checking account, ensuring that you have all the necessary information at hand and are fully prepared to complete the process smoothly.

Step 1: Check Account Requirements

Before proceeding with adding someone to your Chase checking account, it’s important to ensure that your account is eligible for joint ownership. Not all types of Chase checking accounts allow for joint account holders, so it’s crucial to review the account requirements beforehand.

To check the account requirements, you can either visit the nearest Chase branch or log in to your Chase online banking account. If you prefer the online method, follow these simple steps:

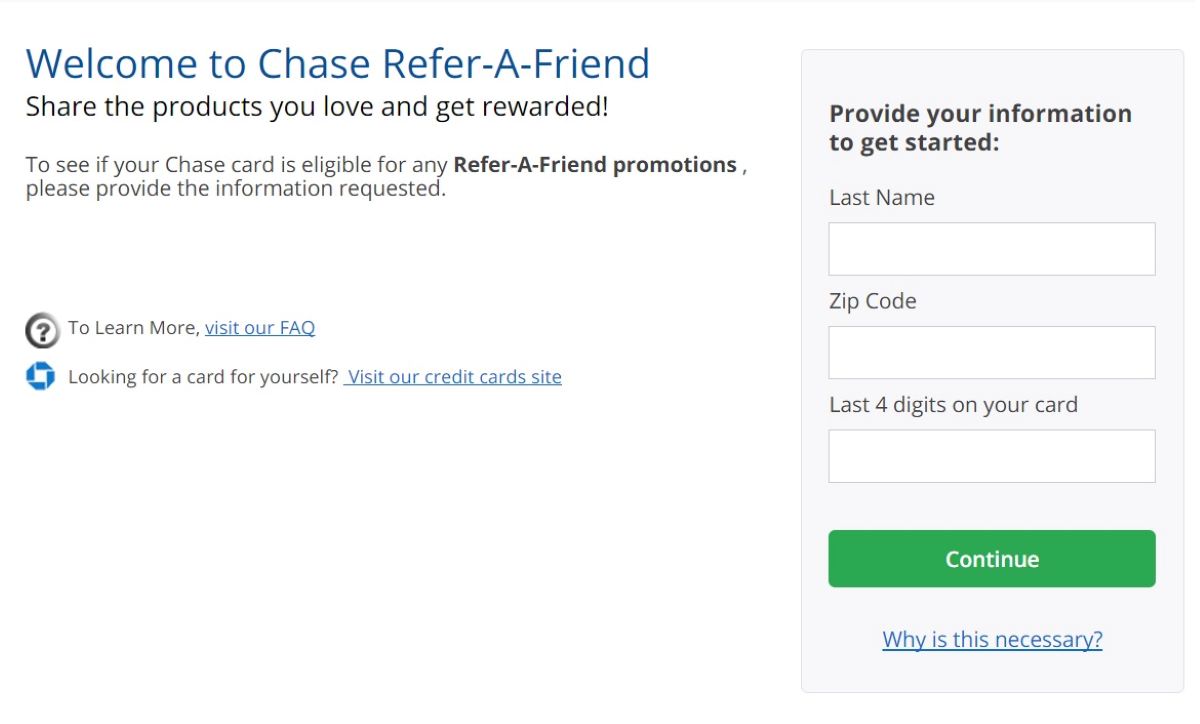

- Visit the Chase website and log in to your online banking account.

- Navigate to the “Checking & Savings” tab.

- Click on your checking account to access more details.

- Under the account details, look for information about joint account holders or additional account holders.

- If you cannot find any information or the option to add joint account holders, it’s recommended to visit a Chase branch or contact customer service for further assistance.

During this step, it’s also important to review any associated fees, charges, or minimum balance requirements that may be applicable when adding a joint account holder. Understanding these details will help you make an informed decision and avoid any surprises in the future.

Once you have confirmed that your Chase checking account is eligible for joint ownership, it’s time to move on to the next step: gathering the required information.

Step 2: Gather Required Information

Before adding someone as a joint account holder to your Chase checking account, you will need to gather the necessary information for both yourself and the person you wish to add. Having this information ready will expedite the process and ensure a smooth application. Here’s a checklist of the required details:

- Personal Information: Provide your full legal name, date of birth, and Social Security number. You will also need to gather the same information for the person you want to add to your account.

- Identification Documents: Ensure you have valid identification documents such as a driver’s license, passport, or state ID. The person you are adding as a joint account holder will also need to provide their identification documents.

- Contact Information: Have your current mailing address, email address, and phone number readily available. The person you wish to add will need to provide their contact information as well.

- Relationship: Be prepared to explain your relationship with the individual you want to add as a joint account holder. Chase may ask for clarification on the nature and purpose of the joint account.

- Income and Employment Details: It’s important to provide your current employment information, including employer name, address, and contact details. The person you are adding may also need to provide their income and employment details.

- Existing Chase Accounts: If you or the person you are adding already have other Chase accounts, be ready to provide the account numbers or any relevant details. This information will help establish a connection between the accounts.

By ensuring you have all the required information beforehand, you can avoid unnecessary delays and complete the documentation smoothly when you contact Chase customer service or visit a Chase branch to add someone to your checking account.

Step 3: Contact Chase Customer Service

Once you have gathered all the necessary information, it’s time to reach out to Chase customer service to initiate the process of adding someone to your Chase checking account. There are several ways to contact Chase customer service:

- Phone: You can call Chase customer service at the phone number provided on the back of your Chase debit card or on the Chase website. Be prepared to provide your account details and request to add a joint account holder.

- Online Chat: If you prefer to communicate online, you can initiate a chat conversation with a Chase representative through the Chase website. They will guide you through the process and provide any necessary instructions.

- Chase Branch: Visiting a local Chase branch allows you to speak directly with a representative who can assist you with adding someone to your Chase checking account. Make sure to bring all the required documentation and identification to expedite the process.

When contacting Chase customer service, it’s important to clearly communicate your intention to add someone as a joint account holder. Provide all the required information and be prepared to answer any additional questions they may have regarding your relationship with the individual you want to add.

Remember to keep a record of the date and time of your conversation, as well as the name of the representative you spoke with. This information may be helpful for future reference and follow-up.

Once you have initiated the process, the Chase customer service representative will guide you through the next steps, including submitting the necessary documentation to formalize the addition of a joint account holder. In the next step, we will discuss the documentation you will need to provide.

Step 4: Complete the Necessary Documentation

After contacting Chase customer service and expressing your intention to add someone as a joint account holder, the next step is to complete the required documentation. This documentation is necessary to formalize the addition of a joint account holder to your Chase checking account. Here’s a list of the commonly required documents:

- Joint Account Application Form: Chase may provide you with a joint account application form that needs to be filled out and signed by both you and the person you want to add. This form typically includes personal information, contact details, and a declaration of joint ownership.

- Identification Documents: Submit copies of valid identification documents for both yourself and the joint account holder. Acceptable identification typically includes a driver’s license, passport, or state ID.

- Social Security Numbers: Provide your Social Security number and the Social Security number of the joint account holder. This is required for verification purposes.

- Proof of Address: Chase may request proof of address for both you and the joint account holder. Suitable documents include utility bills, bank statements, or lease agreements.

- Proof of Relationship: In some cases, Chase may require proof of your relationship with the individual you want to add. This can be a marriage certificate, birth certificate, or any other relevant documentation.

- Additional Documentation: Depending on your specific circumstances, Chase may request additional documents such as income verification, employment details, or existing account information.

Be sure to carefully review the required documents provided by Chase and submit them in a timely manner. Any delays in completing and submitting the necessary documentation may prolong the process of adding a joint account holder to your Chase checking account.

If you have any questions or uncertainties regarding the required documentation, reach out to Chase customer service for clarification and guidance.

Once the documentation is completed, you can move on to the next step: submitting the documentation to Chase for review and approval.

Step 5: Submit the Documentation to Chase

Now that you have completed the necessary documentation to add someone as a joint account holder to your Chase checking account, it’s time to submit the paperwork to Chase for review and approval. Following this step will bring you one step closer to successfully adding a joint account holder to your existing account. Here’s how to submit the documentation:

- Online Submission: If you initiated the process through online banking or chat, Chase may provide you with a secure portal to upload the required documents. Follow the instructions and ensure that all documents are legible and clearly visible.

- In-Person Submission: If you visited a Chase branch to start the process, you can submit the completed documentation directly to the representative who assisted you. They will review the documents and provide you with further instructions if necessary.

- Secure Mail or Drop Box: Alternatively, Chase may offer the option to mail the documentation or drop it off in a secure box provided at their branches. Ensure that you provide the necessary details and follow any specific instructions given by Chase.

When submitting the documentation, it’s important to double-check that all required forms and supporting documents are included. Keep copies of all documents for your records, including any proof of delivery if submitting by mail.

After submitting the documentation, it typically takes a few business days for Chase to review the application and process the request. During this time, Chase may conduct further verification or reach out to you if any additional information is required.

Now that you have submitted the required documentation, the next step is to wait for confirmation and approval from Chase regarding the addition of the joint account holder to your Chase checking account.

Step 6: Wait for Confirmation and Approval

After submitting the necessary documentation to Chase to add someone as a joint account holder to your Chase checking account, the next step is to patiently wait for confirmation and approval. The timeline for receiving confirmation may vary, but typically it takes a few business days for Chase to review the application and make a decision. Here’s what you can expect during this waiting period:

- Review Process: Chase will carefully review the documentation you submitted, ensuring that all requirements are met and the information provided is accurate. They may conduct additional checks or verifications if necessary.

- Approval Decision: Once the review process is complete, Chase will make a decision regarding the addition of the joint account holder. You will be notified of the decision either through email, mail, or a notification within your Chase online banking account.

- Account Access: If your request to add a joint account holder is approved, the person you added will gain access to the joint checking account. They will be provided with their own debit card and will have full access and control over the account.

- Denial or Further Instructions: In some cases, Chase may deny the request to add a joint account holder. If this happens, you will be informed of the reasons behind the decision. Depending on the circumstances, Chase may provide alternative options or instructions to address the issue at hand.

During the waiting period, it’s important to be patient and avoid making any assumptions or taking action based on a pending application. If you have any questions or concerns regarding the status of your application, you can reach out to Chase customer service for assistance.

Once you receive confirmation and approval from Chase, you can move on to the final step: accessing and managing the joint account with the added account holder.

Step 7: Access and Manage the Joint Account

Congratulations! You have successfully added someone as a joint account holder to your Chase checking account. Now that the joint account is set up, it’s time to understand how to access and manage the account effectively with the added account holder. Here’s what you need to know:

- Account Access: The joint account holder will receive their own debit card and will have full access to the joint checking account. They can use the card to make purchases, withdraw cash, and perform other banking transactions.

- Online Banking: Both you and the joint account holder can access the joint checking account through Chase’s online banking platform. This allows you to view account balances, transaction history, and manage various account settings.

- Statements and Notifications: Chase will send account statements and notifications to both account holders, providing an overview of recent transactions, balances, and any important updates regarding the joint account.

- Transaction Monitoring: It is essential for both account holders to regularly monitor account activity to ensure accuracy and security. Keep an eye on transactions, report any unauthorized activity, and communicate with the joint account holder to maintain transparency.

- Communication: Open and frequent communication with the joint account holder is crucial for effective account management. Discuss financial goals, spending limits, and any other relevant matters to ensure smooth collaboration.

- Financial Planning and Budgeting: Take advantage of the joint account to enhance your financial planning and budgeting efforts. Share expenses, set savings goals, and track spending together to achieve a more organized approach to finances.

Remember, having a joint account means both account holders share equal responsibility for managing and maintaining the account. It’s essential to have trust, transparency, and clear communication to ensure a healthy financial relationship.

If at any point you need assistance or have questions regarding your joint account, don’t hesitate to contact Chase customer service or visit a Chase branch for guidance and support.

With these steps completed, you are now well-equipped to add someone to your Chase checking account and manage the joint account efficiently. Enjoy the benefits of shared finances and simplified banking with the added account holder!

Conclusion

Adding someone as a joint account holder to your Chase checking account can be a beneficial step in managing your finances and sharing financial responsibilities. By following the step-by-step process outlined in this article, you can seamlessly add a joint account holder and begin experiencing the convenience of a shared banking account.

Remember, before getting started, it’s important to check the account requirements for joint ownership and gather all the necessary information. Contacting Chase customer service is the next step, where you will provide the required documentation to initiate the account addition process.

After submitting the documentation, you will need to patiently wait for confirmation and approval from Chase. Once approved, both you and the joint account holder can access and manage the joint account using Chase’s online banking platform and individual debit cards.

To ensure successful account management, maintain open communication with the joint account holder, regularly review account activity, and actively participate in financial planning and budgeting efforts. By doing so, you can maximize the benefits of the joint account while fostering financial transparency and cooperation.

If you ever require assistance or have questions regarding your joint account, don’t hesitate to reach out to Chase customer service or visit a local Chase branch for guidance and support.

Now that you have a clear understanding of the step-by-step process, you can confidently add someone to your Chase checking account and embark on the journey of shared finances.

Remember, always consider your personal circumstances and financial goals when making decisions related to joint account ownership. Choose a trusted partner and ensure open communication to create a sound financial relationship.

With these guidelines, you are ready to add someone to your Chase checking account and enjoy the benefits of shared financial management.