Home>Finance>How To Ask About Health Insurance In An Interview

Finance

How To Ask About Health Insurance In An Interview

Published: October 30, 2023

Learn how to effectively inquire about health insurance during a job interview in the finance industry. Get valuable tips and insights to make a great impression.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Asking about Health Insurance

- Preparation before the Interview

- Timing of the Question

- Proper Way to Ask about Health Insurance

- Additional Questions to Consider

- Assessing the Health Insurance Offered

- Clarifying Health Insurance Details

- Negotiating Health Insurance Benefits

- Importance of Considering Health Insurance in Job Decision

- Conclusion

Introduction

When preparing for a job interview, it’s crucial to gather all the necessary information about the company, the position, and the benefits they offer. One important aspect that often gets overlooked is health insurance. Asking about health insurance during an interview is essential for your own well-being and financial security.

Health insurance is a critical component of a comprehensive benefits package. It provides coverage for medical expenses and can protect you from exorbitant healthcare costs. In today’s unpredictable world, having a good health insurance plan is more important than ever.

Many job seekers may feel hesitant to ask about health insurance during an interview, assuming it is not appropriate or that it may reflect negatively on them. However, it is perfectly acceptable and even expected to inquire about the available health insurance options.

This article will guide you through the process of asking about health insurance in an interview. We will discuss the importance of addressing this topic, how to ask about it effectively, and additional questions to consider. We will also explore how to assess and negotiate health insurance benefits and the significance of considering health insurance when making a job decision.

By the end of this article, you will have a clear understanding of why inquiring about health insurance is essential and how to approach the topic professionally and confidently during an interview.

Importance of Asking about Health Insurance

Asking about health insurance during a job interview is crucial for several reasons. It not only affects your well-being but also has a significant impact on your finances and overall job satisfaction. Here are a few key reasons why inquiring about health insurance is important:

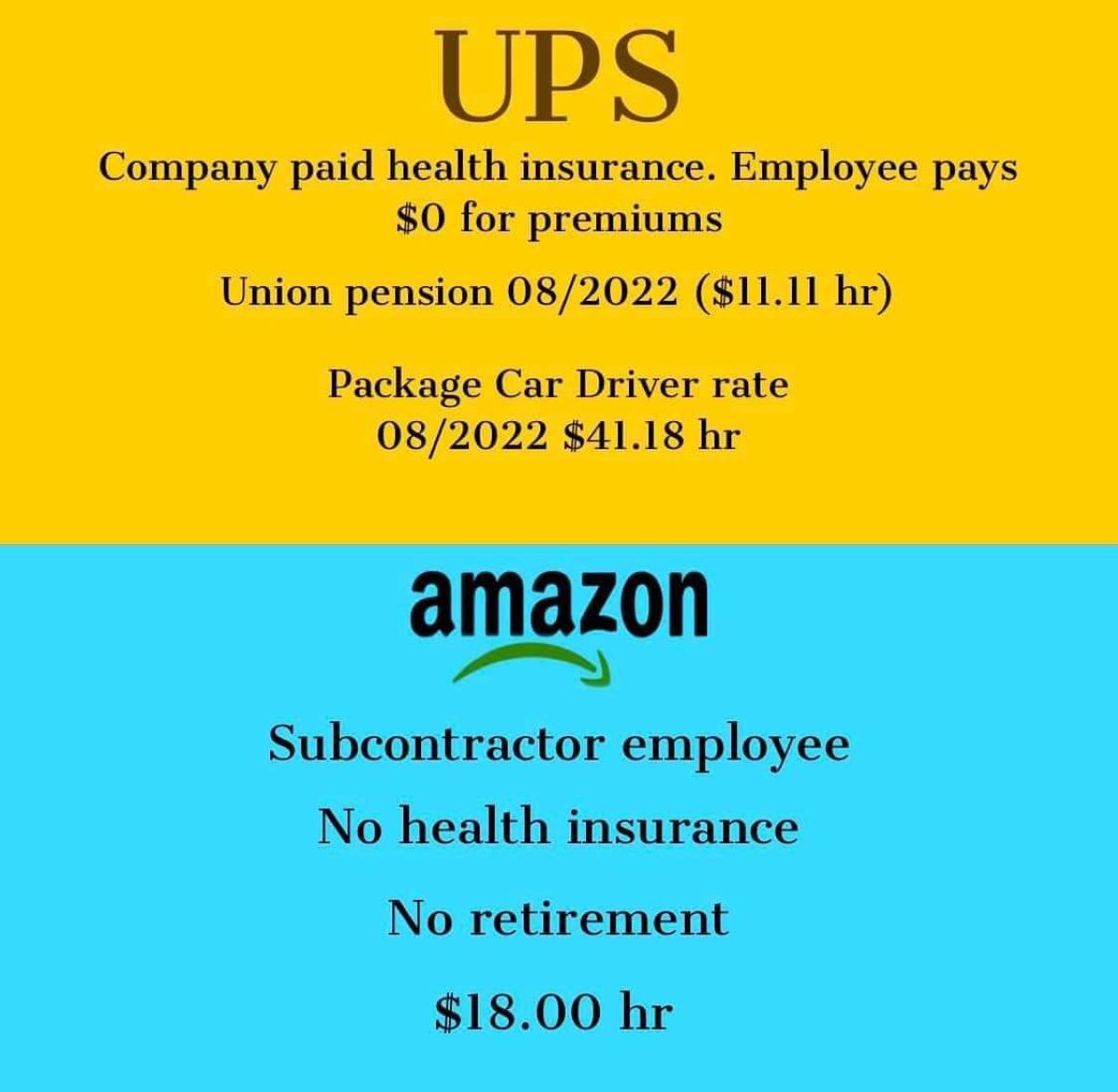

- Financial Protection: Healthcare costs can be staggering, especially in the event of unexpected illnesses or accidents. Having a comprehensive health insurance plan ensures that you are financially protected from such burdensome expenses. By asking about health insurance in an interview, you can gain peace of mind knowing that you will have coverage for medical care.

- Access to Quality Healthcare: Good health insurance gives you access to a network of healthcare providers and specialists. It ensures that you can receive timely and high-quality medical treatment without straining your finances. Knowing the details of the health insurance offered by the company allows you to assess the scope and quality of healthcare options available to you and your family.

- Job Security: The availability of health insurance can be an indicator of a company’s stability and commitment to its employees. A company that offers robust health insurance benefits demonstrates its dedication to the well-being of its workforce. Asking about health insurance shows that you value this aspect of the job and are concerned about long-term job security.

- Comparison with Other Job Offers: Inquiring about health insurance during an interview allows you to compare the benefits package with offers from other companies. This information helps you make an informed decision about which job opportunity aligns best with your needs and priorities. It enables you to assess the overall value of the compensation package and evaluate the broader benefits beyond just the salary.

- Preparation for the Future: Health insurance requirements and coverage can vary widely from company to company. Asking about health insurance gives you insight into the specific plans available, the premium costs, and the coverage details. This information can help you plan for the future and make informed decisions regarding your healthcare needs for yourself and your dependents.

By recognizing the importance of health insurance and asking about it during an interview, you demonstrate your commitment to your well-being and financial security. It shows that you are proactive and thoughtful in considering all aspects of a job opportunity, making you a more informed and desirable candidate in the eyes of the interviewer.

Preparation before the Interview

Before attending a job interview, it’s essential to be well-prepared, not just for the questions you will be asked, but also for the questions you need to ask. Here are some key steps to take in preparation for asking about health insurance during an interview:

- Research the Company: Familiarize yourself with the company’s website, mission statement, values, and any information about employee benefits they provide. Look for any mentions of health insurance or employee healthcare plans to get an idea of what they offer.

- Understand Your Own Needs: Take some time to assess your personal healthcare requirements. Consider factors such as pre-existing conditions, medications, and regular healthcare visits. Knowing your needs will enable you to ask targeted questions about coverage and ensure that the offered health insurance meets your specific requirements.

- Compare Plans: Research different types of health insurance plans and understand their benefits and limitations. Familiarize yourself with terms like deductible, co-pay, out-of-pocket maximum, and network providers. This knowledge will help you evaluate the health insurance options provided during the interview more effectively.

- Prepare a List of Questions: Make a list of specific questions about health insurance that you want to ask during the interview. Consider inquiring about the types of plans available, premium costs, coverage for dependents, and any additional benefits or wellness programs offered. Having a prepared list will help you remember all the important details and demonstrate your interest in the company’s benefits package.

- Practice Asking the Questions: Rehearse asking the questions about health insurance so that you feel confident and natural during the interview. Practice delivering the questions aloud or with a friend to ensure a smooth flow and eliminate any hesitation or nervousness.

By taking the time to research, understand your needs, and prepare a list of questions, you will feel more confident and prepared to ask about health insurance during the interview. This level of preparation shows your dedication and professionalism, making a positive impression on the interviewer.

Timing of the Question

Timing is crucial when it comes to asking about health insurance during a job interview. You want to choose the right moment to bring up this topic to ensure it is received positively and doesn’t disrupt the flow of the conversation. Here are some factors to consider regarding the timing of the question:

- Wait for the Right Moment: It’s generally best to wait until the interviewer has finished providing information about the position and the company. This allows you to demonstrate that you have actively listened to the details provided before shifting the focus to health insurance. Bringing up the topic too early may give the impression that you are solely interested in the benefits rather than the job itself.

- Use a Natural Transition: Look for a natural transition point in the conversation to introduce the topic of health insurance. For example, after discussing the responsibilities of the role or the company culture, you can smoothly transition by saying, “That all sounds great! I’m curious about the health insurance options available for employees. Can you tell me more about that?” This approach helps the question flow naturally and shows your genuine interest in the company’s benefits package.

- Ask as Part of Benefit Discussion: If the interviewer initiates a discussion about employee benefits, this is an ideal opportunity to ask about health insurance. When the topic naturally arises, you can express your appreciation for the comprehensive benefits package mentioned and inquire specifically about the health insurance options.

- Avoid Discussing Salary First: If possible, avoid asking about health insurance right after discussing salary. This can give the impression that you are primarily concerned about financial aspects rather than the job itself. Instead, focus on discussing the position, responsibilities, and company culture before transitioning the conversation to health insurance.

- Be Mindful of Interview Length: Consider the duration of the interview and the amount of time left. If the interview is running short on time, it may be better to prioritize questions related to the job itself. If you have relevant questions about health insurance, but time is limited, you can save those questions for a follow-up conversation should you progress to the next stage in the hiring process.

By selecting an appropriate moment in the conversation to ask about health insurance, you demonstrate tact, consideration, and a genuine interest in the company’s offerings. This helps to establish a positive rapport with the interviewer and ensures a more seamless flow of the interview process.

Proper Way to Ask about Health Insurance

Asking about health insurance during a job interview is important, but it’s essential to approach the topic in a professional and respectful manner. Here are some tips on the proper way to ask about health insurance:

- Be Polite and Respectful: Begin by expressing gratitude for the opportunity to interview and show appreciation for the information provided so far. Say something like, “Thank you for sharing all the details about the position. I’m really excited about the opportunity. I have a few questions about the benefits package, specifically the health insurance options, if that’s alright.”

- Show Genuine Interest: Demonstrate your genuine interest in the topic of health insurance and your understanding of its importance. You can say something like, “I believe that having a comprehensive health insurance plan is crucial for personal well-being and financial security. Can you please provide more information about the health insurance options the company offers?” This conveys that you value health insurance and recognize its significance in your career decision-making process.

- Be Specific: Ask specific questions about the health insurance options available. Inquire about the types of plans offered, the premium costs, the coverage for dependents, and any additional benefits or wellness programs provided. This shows that you have done your research and are genuinely interested in understanding the details of the offered health insurance.

- Avoid Salary Comparison: While it’s natural to consider the financial aspects of a job offer, try not to directly compare the health insurance benefits with your current or past employer’s benefits. Focus on understanding the specific offerings of the company you are interviewing with rather than making comparisons. This demonstrates your interest in their benefits package on its own merits.

- Listen Attentively: When the interviewer provides information about the health insurance options, listen attentively and take notes. This shows respect and interest in what the interviewer is saying. Engage in the conversation by asking follow-up questions or seeking clarification on any points that are unclear.

Remember, the goal is to gather information about the health insurance options available, not to negotiate or critique the benefits. By approaching the topic with professionalism, respect, and genuine interest, you create a positive impression and open a constructive dialogue about health insurance with the interviewer.

Additional Questions to Consider

When asking about health insurance during a job interview, it’s important to gather as much information as possible to make an informed decision. Here are some additional questions to consider asking:

- What is the waiting period for health insurance coverage? Some companies have a waiting period before new employees can enroll in the health insurance plan. Understanding the waiting period helps you plan for any potential gaps in coverage.

- Are there any restrictions on pre-existing conditions? Inquire about any limitations or exclusions for pre-existing conditions. Understanding how pre-existing conditions are handled ensures you have a clear understanding of coverage for any existing medical conditions you may have.

- What is the employer’s contribution towards the premium? Ask about the employer’s contribution towards the health insurance premium. This helps you evaluate the affordability of the plan and determine your out-of-pocket costs.

- Is there a choice of health insurance plans? Find out if the company offers multiple health insurance plan options, such as different levels of coverage or provider networks. Having a choice allows you to select a plan that best suits your needs.

- What is the coverage for dependents? If you have dependents, ask about the coverage options available for them. Inquire about the cost, eligibility criteria, and any additional benefits specific to dependents.

- Is dental and vision coverage included? In addition to medical coverage, it’s important to understand if the company also offers dental and vision insurance. Dental and vision care expenses can add up, so it’s beneficial to know if these services are included in the benefits package.

- Are there any wellness programs or preventative care benefits? Find out if the company has any wellness programs or preventative care benefits. These can include gym memberships, annual health check-ups, or reimbursements for wellness-related expenses. Knowing if these resources are available can contribute to your overall well-being.

- How are healthcare expenses reimbursed? Inquire about the process for submitting healthcare expense claims and obtaining reimbursements. This ensures that you are familiar with the administrative aspects of the health insurance plan.

- Is there a flexible spending account (FSA) or health savings account (HSA) option? Ask if the company offers an FSA or HSA, which allows you to set aside pre-tax funds to cover eligible healthcare expenses. These accounts can provide tax advantages and help you manage healthcare costs efficiently.

By asking these additional questions, you gain a comprehensive view of the health insurance options and additional benefits provided by the company. This information enables you to make an informed decision about whether the benefits package aligns with your healthcare needs and financial goals.

Assessing the Health Insurance Offered

Once you have gathered information about the health insurance options during a job interview, it’s important to carefully assess the coverage to determine if it meets your needs. Here are some key factors to consider when evaluating the health insurance offered:

- Coverage: Review the extent of coverage provided by the health insurance plan. Assess whether it includes hospitalization, doctor visits, prescription medications, preventive care, and specialty services. Ensure that the coverage aligns with your specific healthcare requirements.

- Network Providers: Check the network of healthcare providers included in the health insurance plan. Are your preferred doctors, hospitals, and specialists part of the network? If you have an existing healthcare provider that you want to continue seeing, ensure that they are covered by the plan.

- Costs: Evaluate the costs associated with the health insurance plan. Consider factors such as monthly premiums, deductibles, co-pays, and out-of-pocket maximums. Calculate how these costs align with your budget and financial situation.

- Flexibility: Assess the flexibility of the health insurance plan. Does it have options for different levels of coverage or provider networks? A plan that offers flexibility can better accommodate your changing healthcare needs and preferences.

- Add-Ons: Consider any additional benefits or add-ons that come with the health insurance plan. This could include dental and vision coverage, wellness programs, or other supplemental benefits that enhance your overall healthcare experience.

- Employee Contributions: Evaluate the portion of the health insurance premium that you would be responsible for. Compare it to your current or past contributions to determine if it is reasonable and affordable for you.

- Dependent Coverage: If you have dependents, carefully review the coverage options available for them. Consider the cost, eligibility criteria, and extent of coverage for dependents to ensure it meets the needs of your family.

- Pre-Existing Conditions: Understand how the health insurance plan handles pre-existing conditions. Determine if there are any waiting periods, exclusions, or limitations that may affect your specific medical conditions.

By carefully assessing the health insurance offered, you can determine if it is comprehensive, affordable, and meets your specific healthcare needs. This evaluation process helps ensure that you make an informed decision and choose a job opportunity that provides adequate and suitable health insurance coverage.

Clarifying Health Insurance Details

During a job interview, it’s essential to clarify any uncertainties or details regarding the health insurance offered. Asking specific questions helps ensure that you have a clear understanding of the coverage and can make an informed decision. Here are some points to consider when clarifying health insurance details:

- Plan Coverage: Seek clarification on the specific medical services and treatments covered by the health insurance plan. Ask about coverage for hospitalization, surgeries, specialist visits, prescription medications, mental health services, and preventive care. Understanding the extent of coverage helps you gauge the comprehensiveness of the plan.

- Provider Network: Inquire about the network of healthcare providers included in the plan. Ask for a list of in-network doctors, hospitals, and specialists. Understand if you have the flexibility to choose out-of-network providers and the associated costs.

- Costs Breakdown: Request a breakdown of the costs associated with the health insurance plan. Ask about monthly premiums, deductibles, co-pays, and out-of-pocket maximums. Understand how these costs are structured and their impact on your finances.

- Prescription Medication Coverage: Seek clarification on the coverage for prescription medications. Inquire about the formulary and any restrictions or limitations. Understand if there are specific medications that may require prior authorization or if there are any cost-saving options such as generic alternatives.

- Preventive Care: Determine the coverage for preventive care services such as vaccinations, routine screenings, and annual check-ups. Clarify if these services are covered with no out-of-pocket costs or if there are specific requirements or limitations.

- Emergency Coverage: Inquire about coverage for emergency medical care. Understand if there are any specific protocols or requirements when seeking emergency treatment and whether out-of-network emergencies are covered.

- Wellness Programs: If the company offers wellness programs, ask for more details about what these programs entail. Determine if there are any financial incentives or rewards for participating in wellness activities or if there are any resources available to support employees’ overall well-being.

- Claims Process: Seek clarification on how the claims process works, including how to submit claims and how reimbursements are processed. Understand any specific timelines or paperwork requirements associated with filing claims.

- Open Enrollment Period: Inquire about the open enrollment period for health insurance. Understand when you can make changes to your coverage, add dependents, or switch plans. This helps you plan for future adjustments to your health insurance needs.

By asking these specific questions to clarify health insurance details, you can ensure a complete understanding of the coverage, costs, and processes associated with the plan. This knowledge empowers you to make an educated decision about accepting a job offer and to manage your healthcare needs effectively.

Negotiating Health Insurance Benefits

When it comes to negotiating health insurance benefits during a job offer, it’s important to approach the conversation strategically while keeping in mind the overall compensation package. While health insurance benefits may not always be negotiable, there are still factors to consider to ensure you receive the best possible coverage. Here are some tips for negotiating health insurance benefits:

- Research Comparable Plans: Before entering into negotiations, research and compare health insurance plans offered by other companies within the same industry. This knowledge will give you a benchmark to assess the competitiveness of the benefits package being offered.

- Highlight the Value: Emphasize the importance of health insurance and the value it brings to employees. Clearly articulate how comprehensive health insurance coverage contributes to your overall well-being, productivity, and job satisfaction.

- Discuss Personal Circumstances: If you have unique healthcare needs, such as a chronic condition or a dependent with specific medical requirements, discuss these circumstances during the negotiation process. Explain the potential impact of the health insurance coverage on your ability to manage these healthcare needs effectively.

- Consider Other Compensation Factors: While focusing on health insurance benefits, take into account the overall compensation package. Keep in mind factors such as salary, retirement benefits, paid time off, and other non-monetary perks. Consider these elements collectively when evaluating the value of the job offer.

- Explore Alternative Options: If the initial health insurance offer is not as comprehensive as you would like, inquire about any alternative plans or additional coverage options the company may provide. They may have more robust plans available for employees to choose from.

- Be Open to Compromise: Be willing to explore options for compromise during the negotiation process. If the company is unable to offer changes to the health insurance benefits, consider negotiating other aspects of the compensation package to achieve a more favorable overall agreement.

- Consult with a Professional: If you’re unsure about the negotiation process or need assistance, consider consulting with a professional, such as an attorney or a benefits specialist. They can provide guidance and insights to help you navigate the negotiation effectively.

- Document Agreement Details: Once an agreement has been reached, ensure that all negotiated changes to the health insurance benefits are well-documented. This will help protect your interests and ensure that the agreed-upon benefits are properly implemented.

Remember that not all companies may be open to negotiation regarding health insurance benefits. It’s essential to approach the discussion with professionalism and respect, focusing on finding mutually beneficial solutions. Ultimately, the goal is to secure a health insurance plan that provides adequate coverage and meets your specific needs.

Importance of Considering Health Insurance in Job Decision

Health insurance plays a significant role in your overall well-being and financial security, making it a crucial factor to consider when making a job decision. Here are some reasons why health insurance should be given careful consideration:

- Protection against Healthcare Costs: Having a comprehensive health insurance plan provides protection against unexpected and high medical expenses. It safeguards you and your family from the financial burden that can arise from illness, accidents, or chronic conditions. Job offers with quality health insurance can give you peace of mind knowing that you are covered in times of need.

- Access to Quality Healthcare: Good health insurance allows you access to a wide network of healthcare providers and specialists. It ensures that you can receive timely and high-quality medical care without worrying about the financial implications. By choosing a job with robust health insurance, you gain the advantage of accessing quality healthcare services for both routine and critical needs.

- Better Overall Well-Being: Health insurance benefits extend beyond medical emergencies. They support your overall well-being by providing coverage for preventive care, vaccinations, wellness programs, mental health services, and more. By considering health insurance when making a job decision, you prioritize your long-term health and well-being.

- Job Security & Employee Satisfaction: A company that offers comprehensive health insurance demonstrates its commitment to the well-being and job security of its employees. By providing a strong benefits package, including health insurance, employers show their investment in their workforce’s long-term success and satisfaction. This can contribute to a positive and supportive work environment.

- Ability to Attract and Retain Talent: Competitive health insurance benefits can help companies attract and retain top talent. Employees value comprehensive health coverage and often consider it a significant factor in their job decision process. Employers who prioritize offering robust health insurance can better attract and retain skilled professionals.

- Family Considerations: If you have dependents or a family, health insurance becomes even more important. It ensures that your loved ones are covered and can access necessary medical care. Considering the health insurance options offered by a prospective employer allows you to evaluate the coverage and suitability for your family’s specific healthcare needs.

- Financial Planning: Health insurance is a critical component of financial planning. By carefully considering the health insurance benefits of a potential job, you can align your financial goals with your healthcare needs. This helps you make informed decisions about saving, budgeting, and managing expenses related to healthcare.

By factoring in health insurance when making a job decision, you prioritize your well-being, financial stability, and future planning. Remember to carefully review the health insurance benefits package, assess the coverage and costs, and consider how it aligns with your healthcare needs and personal circumstances. Taking health insurance into account ensures that you make a comprehensive and informed decision about your career and overall health.

Conclusion

Asking about health insurance during a job interview is an important step towards protecting your well-being and financial security. It allows you to gather crucial information about the coverage, costs, and benefits that come with the job. By properly preparing, timing your question, and asking in a professional manner, you can ensure a constructive conversation that demonstrates your interest in the company’s benefits package.

When evaluating the health insurance offered, consider factors such as coverage, provider networks, costs, and additional benefits. Clarify any uncertainties or details, and if possible, negotiate for a more favorable package. Remember to assess the health insurance benefits in the context of the overall compensation package and your personal healthcare needs.

Understanding the importance of health insurance in a job decision is vital. It provides protection against healthcare costs, grants access to quality healthcare, and contributes to your overall well-being. It also demonstrates the commitment of the employer to employee satisfaction and job security. By considering health insurance, you make an informed decision that supports your long-term health, financial well-being, and peace of mind.

In conclusion, don’t overlook the importance of asking about health insurance during a job interview. By being proactive and informed, you empower yourself to make the best choices for your health and career. So, when preparing for your next interview, remember to confidently and professionally inquire about health insurance benefits, and assess them alongside other key factors before making a final decision.