Finance

What Is An IRS 147C Letter?

Published: November 1, 2023

Discover what an IRS 147C letter is and how it impacts your finances. Gain insights into this essential document for tax purposes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our comprehensive guide on IRS 147C letters. If you’ve received one of these letters or are curious about what they entail, you’ve come to the right place. This article will provide you with a clear understanding of what an IRS 147C letter is, why you may receive one, and how to obtain it.

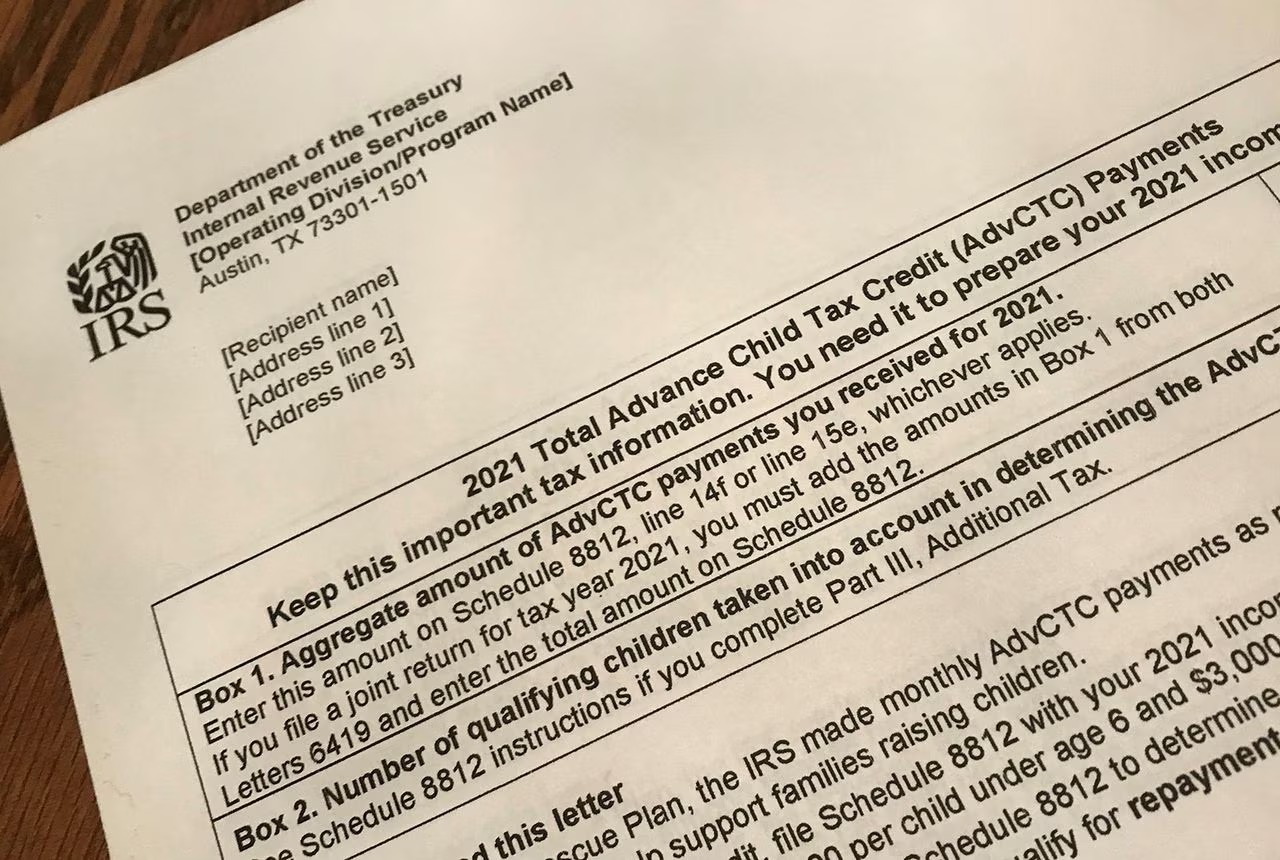

The Internal Revenue Service (IRS) plays a crucial role in the collection of taxes and enforcing tax laws in the United States. As a taxpayer, it is essential to stay informed about various communications and correspondences from the IRS to ensure compliance and avoid any potential issues.

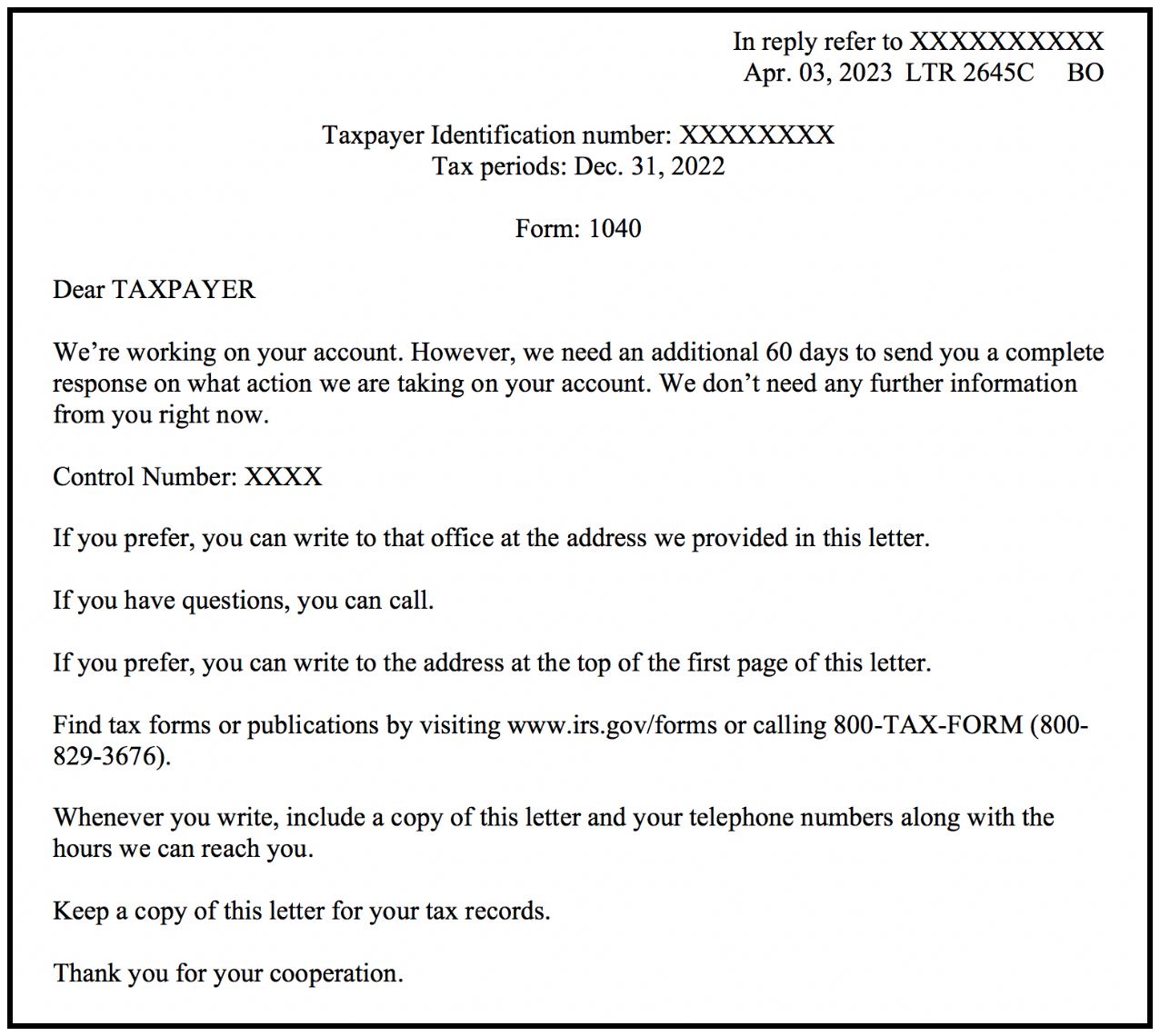

An IRS 147C letter is one such correspondence that can be sent to individuals or businesses. It contains vital information related to your tax identification number (TIN) or employer identification number (EIN). The purpose of this letter is to verify your TIN/EIN and confirm your tax status with the IRS.

Understanding the significance of an IRS 147C letter and how to respond to it is essential for maintaining good standing with the IRS. In the following sections, we will delve into the details of these letters, including the reasons for receiving one, how to obtain it, and its various uses.

What is an IRS 147C Letter?

An IRS 147C letter is a correspondence sent by the Internal Revenue Service (IRS) to individuals or businesses. It contains important information regarding your tax identification number (TIN) or employer identification number (EIN). The primary purpose of this letter is to verify the accuracy and validity of your TIN/EIN and confirm your tax status with the IRS.

The IRS issues 147C letters to provide taxpayers with documentation that confirms their TIN/EIN and tax filing information. This letter serves as official proof of your tax identification and can be used for various administrative or legal purposes.

The letter typically includes your full name or business name, along with your TIN or EIN. It may also provide additional information, such as your address or the date the TIN/EIN was assigned. The IRS 147C letter is an important document that should be kept in a safe place as it may be required for future reference or in dealings with the IRS.

It is important to note that the IRS 147C letter is not a notice of a tax issue or a request for payment. Instead, it is a confirmation letter that provides official documentation of your TIN or EIN. If you receive an IRS 147C letter, it is crucial to carefully review its contents and ensure all information is accurate. If you notice any discrepancies or errors, you should contact the IRS promptly to rectify the situation.

Next, we will explore the reasons why you may receive an IRS 147C letter and what actions you should take when you receive one.

Reasons for Receiving an IRS 147C Letter

There are several reasons why you may receive an IRS 147C letter. Understanding these reasons can help you determine the appropriate steps to take when you receive one. Here are some common situations in which the IRS may issue a 147C letter:

- Verification of TIN/EIN: The most common reason for receiving an IRS 147C letter is to verify your tax identification number (TIN) or employer identification number (EIN). This letter acts as official confirmation from the IRS regarding the accuracy and validity of your TIN or EIN. It is essential to ensure that all the information provided in the letter is correct.

- Application or Registration: If you recently filed an application or registration with the IRS that involves obtaining a TIN or EIN, you may receive a 147C letter as part of the verification process. This letter serves to confirm the details of your application and ensure that the assigned TIN or EIN matches the information provided.

- Change or Update: If you have recently made changes to your tax-related information, such as updating your business name, address, or other details, the IRS may send you a 147C letter to confirm these changes. It is crucial to review the letter carefully and ensure that all the updated information is accurate.

- Inquiry or Request: In some cases, you may contact the IRS with an inquiry or request regarding your TIN or EIN, and as a response, they may send you a 147C letter. This letter will provide the information you requested and serve as official documentation of your TIN or EIN.

Receiving an IRS 147C letter does not necessarily indicate any wrongdoing or tax issues. It is a standard procedure undertaken by the IRS to verify and confirm taxpayer information. However, it is crucial to respond promptly and accurately to the letter to maintain your compliance with tax regulations.

Next, let’s explore how you can obtain an IRS 147C letter if you need one for your records or for other official purposes.

How to Obtain an IRS 147C Letter

If you need to obtain an IRS 147C letter for your records or for any official purposes, there are a few steps you can follow to acquire it:

- Contact the IRS: The first step is to reach out to the IRS directly. You can do this by calling the IRS Business and Specialty Tax Line at the toll-free number provided on the IRS website. Be prepared to provide your TIN or EIN and any other necessary information to verify your identity.

- Request the 147C Letter: Once you are connected with an IRS representative, you can request a 147C letter. Let the representative know the reason for your request and provide any additional details they may require. They will guide you through the process and let you know if any supporting documentation is needed.

- Wait for Confirmation: After requesting the 147C letter, the IRS representative will provide you with instructions on how to proceed. They may inform you of any additional steps you need to take or documents you need to submit. Be patient during this process, as it may take some time for the IRS to generate and send the letter.

- Receive and Verify the Letter: Once the IRS generates the 147C letter, you will receive it via mail. Take the time to carefully review the letter and ensure that all the information provided is accurate. If you notice any discrepancies, contact the IRS immediately to rectify the situation.

- Keep a Copy: It is essential to keep a copy of the IRS 147C letter for your records. Store it in a safe place along with other important tax-related documents. The letter may be requested in the future for various purposes, such as verifying your TIN or EIN during business transactions or resolving any tax-related issues.

Remember, obtaining an IRS 147C letter may require some time and communication with the IRS. Be proactive and provide all the necessary information and documentation requested to expedite the process. If you have any questions or need assistance, do not hesitate to reach out to the IRS representative assisting you.

In the next section, we will explore the different uses of an IRS 147C letter and how it can benefit you in various situations.

Uses of an IRS 147C Letter

An IRS 147C letter serves various important purposes and can be utilized in different situations. Here are some common uses of a 147C letter:

- Verification of TIN/EIN: The primary use of an IRS 147C letter is to verify your tax identification number (TIN) or employer identification number (EIN). This letter serves as official documentation to confirm your TIN/EIN and can be used as proof of your tax status when dealing with financial institutions, government agencies, or business partners.

- Business Transactions: When engaging in business transactions, such as opening a bank account, applying for loans, or entering into contracts, you may be required to provide a valid TIN or EIN. An IRS 147C letter can be used as evidence of your TIN/EIN and facilitates smooth business transactions.

- Tax Compliance: Keeping a copy of the IRS 147C letter in your records can aid in ensuring tax compliance. This letter provides confirmation of your TIN/EIN, which is essential for accurately reporting your income and fulfilling your tax obligations. It serves as an official document that supports the information you provide in your tax filings.

- Employment Documentation: If you are an employer, the IRS 147C letter can be used to verify your business’s EIN and ensure compliance with employment tax regulations. This letter may be required when hiring new employees, conducting payroll processes, or fulfilling other employment-related obligations.

- Legal Requirements: In certain legal situations, such as court proceedings or government audits, you may be asked to provide documentation of your TIN or EIN. An IRS 147C letter can serve as an official document to meet these legal requirements and provide accurate information to the relevant parties.

It is important to keep the IRS 147C letter in a safe and easily accessible place, along with your other important tax-related documents. This ensures that you can readily provide the letter when necessary and have the supporting documentation to maintain your compliance with tax regulations.

Now that we have explored the uses of an IRS 147C letter, let’s move on to the important information you should include in a request for this letter.

Important Information to Include in a Request for an IRS 147C Letter

When submitting a request for an IRS 147C letter, it is crucial to provide accurate and complete information to ensure a smooth and successful process. Here are the important details you should include in your request:

- Tax Identification Number (TIN) or Employer Identification Number (EIN): Clearly state your TIN or EIN in the request. This is the primary information that the IRS needs to generate the 147C letter.

- Full Legal Name or Business Name: Provide your full legal name or the name of your business exactly as it appears on official tax documents. This ensures that the letter will accurately reflect your name or the name of your business.

- Address: Include your current mailing address where the IRS should send the 147C letter. Double-check the address for accuracy to avoid any delays or miscommunication.

- Reason for Request: Briefly explain the reason why you need the 147C letter. Whether it’s for tax compliance, business transactions, or other official purposes, clearly state the purpose of your request to assist the IRS representative in processing your request.

- Contact Information: Provide your contact information, such as a phone number and email address, so the IRS can reach out to you if they need additional information or clarification regarding your request.

It is important to ensure that all the information you provide is accurate and up-to-date. Any errors or discrepancies may result in delays in receiving the 147C letter or incorrect information being included in the letter.

Once you have compiled all the necessary information, contact the IRS through their designated phone line or other communication channels to submit your request. Follow any instructions given by the IRS representative and provide any additional documentation they may require to expedite the process.

Now that we have covered the essential information to include in your request for an IRS 147C letter, let’s move on to the frequently asked questions related to this topic.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions about IRS 147C letters:

- 1. What should I do if I receive an IRS 147C letter?

- 2. How long does it take to receive an IRS 147C letter?

- 3. Can I use an IRS 147C letter as proof of my TIN/EIN?

- 4. Can I request an IRS 147C letter online?

- 5. What should I do if there is a mistake in my IRS 147C letter?

- 6. How long should I keep my IRS 147C letter?

- 7. Can I use an IRS 147C letter for identity verification?

If you receive an IRS 147C letter, carefully review the contents to ensure that all the information provided is accurate. If you notice any discrepancies, contact the IRS immediately to rectify the situation. Keep a copy of the letter for your records.

The time it takes to receive an IRS 147C letter can vary. It depends on factors such as the current workload of the IRS and the complexity of your request. It is recommended to be patient during this process and follow up with the IRS if necessary.

Yes, an IRS 147C letter serves as official documentation of your TIN or EIN and can be used as proof of your tax identification. It is recognized by various institutions, including financial institutions, government agencies, and business partners.

Currently, the IRS does not provide an online method for requesting an IRS 147C letter. You can contact the IRS Business and Specialty Tax Line to request the letter, and they will guide you through the process.

If you notice any mistakes or inaccuracies in your IRS 147C letter, promptly contact the IRS to rectify the situation. Provide them with the correct information and any supporting documentation that may be necessary to correct the error.

It is important to keep a copy of your IRS 147C letter in a safe and easily accessible place for future reference. Retain it along with your other important tax-related documents, as you may need to provide the letter in various situations, such as business transactions or resolving tax-related issues.

An IRS 147C letter primarily serves as proof of your tax identification rather than a form of identity verification. However, some entities may accept it as supporting documentation for identity verification purposes. It is recommended to check with the specific entity or institution regarding their requirements.

If you have any additional questions or concerns regarding IRS 147C letters, it is best to contact the IRS directly for personalized assistance and guidance.

Now, let’s conclude this article on IRS 147C letters.

Conclusion

Understanding and navigating the intricacies of IRS 147C letters is essential for maintaining compliance with tax regulations and ensuring smooth business transactions. These letters serve as official documentation of your tax identification number (TIN) or employer identification number (EIN). They provide verification of your TIN/EIN and can be used for various administrative, legal, and financial purposes.

When you receive an IRS 147C letter, carefully review its contents and verify that all the information provided is accurate. If you notice any errors or discrepancies, contact the IRS promptly to rectify the situation.

If you need to obtain an IRS 147C letter, reach out to the IRS directly through their designated phone line. Provide accurate and complete information, including your TIN/EIN, full legal name or business name, address, and reason for the request. Follow the instructions provided by the IRS representative and keep a copy of the 147C letter for your records.

An IRS 147C letter can be used as proof of your TIN/EIN in various situations, such as business transactions, tax compliance, employment documentation, and meeting legal requirements. It is important to keep the letter in a safe place along with other important tax-related documents.

If you have any questions or concerns regarding IRS 147C letters, it is advisable to contact the IRS directly for personalized assistance and guidance.

We hope that this comprehensive guide has provided you with valuable insights into IRS 147C letters, their significance, how to obtain them, and their various uses. Stay informed and proactive in your tax-related matters to ensure a seamless experience with the IRS.