Home>Finance>How To Calculate Minimum Payment For HELOC At Bank Of America

Finance

How To Calculate Minimum Payment For HELOC At Bank Of America

Published: February 27, 2024

Learn how to calculate the minimum payment for a Home Equity Line of Credit (HELOC) at Bank of America. Get expert financial advice on managing your HELOC payments.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the realm of personal finance, the concept of borrowing against the equity in one’s home has gained substantial traction. Home Equity Line of Credit (HELOC) is a flexible financial tool that enables homeowners to access funds by leveraging the value of their property. This revolving line of credit, often viewed as a lifeline during financial exigencies, offers a myriad of benefits. However, it is imperative for borrowers to comprehend the intricacies associated with HELOC, including the calculation of the minimum payment. In this article, we will delve into the fundamental aspects of HELOC and elucidate the methodology for determining the minimum payment, with a specific focus on Bank of America’s HELOC offerings.

Understanding the nuances of HELOC is pivotal for individuals contemplating this financial option. By unraveling the underlying principles and variables that influence the minimum payment, borrowers can make informed decisions and effectively manage their financial obligations. Moreover, gaining insight into the calculation process empowers borrowers to strategize their repayment approach and navigate the financial landscape with prudence.

As we embark on this elucidative journey, it is essential to grasp the underlying dynamics of HELOC and the pivotal factors that dictate the minimum payment. Subsequently, we will explore the precise methodology for computing the minimum payment, complemented by a comprehensive example to bolster understanding. By the denouement of this discourse, readers will be equipped with a comprehensive understanding of HELOC minimum payments, thereby fostering financial acumen and informed decision-making.

Understanding HELOC

Home Equity Line of Credit (HELOC) is a form of revolving credit that allows homeowners to borrow against the equity in their property. Unlike a traditional loan, HELOC operates as a line of credit, affording borrowers the flexibility to withdraw funds as needed, up to a predetermined credit limit. This financial instrument is secured by the value of the home, making it an attractive option for individuals seeking access to funds while leveraging their property’s equity.

HELOC typically encompasses a draw period, during which borrowers can access funds at their discretion, followed by a repayment period. The draw period, characterized by its flexibility, enables borrowers to withdraw funds as necessitated, with the option to pay only the interest accrued on the borrowed amount. Subsequently, the repayment period commences, wherein borrowers are required to repay the outstanding balance, encompassing both the principal and interest, over a specified timeframe.

The interest rates associated with HELOC are often variable, meaning they are subject to fluctuation based on prevailing market conditions. This dynamic nature necessitates a comprehensive understanding of the interest rate structure and its potential impact on repayment obligations. Moreover, the credit limit, determined by factors such as the property’s appraised value and the lender’s criteria, delineates the maximum amount that can be borrowed through the HELOC.

HELOC serves as a versatile financial tool, catering to diverse financial needs, including home renovations, debt consolidation, educational expenses, and unforeseen financial exigencies. The accessibility and flexibility inherent in HELOC make it an appealing option for homeowners seeking financial agility and leveraging their home equity to meet various financial obligations.

Understanding the fundamental mechanics of HELOC, including its revolving nature, variable interest rates, and the interplay between the draw and repayment periods, is instrumental in navigating this financial avenue judiciously. With a comprehensive grasp of HELOC’s intricacies, borrowers can harness its potential while prudently managing their financial responsibilities.

Factors Affecting Minimum Payment

Several pivotal factors influence the calculation of the minimum payment for a Home Equity Line of Credit (HELOC). Understanding these determinants is essential for borrowers seeking to comprehend the dynamics of their repayment obligations and effectively manage their financial responsibilities. The following factors play a significant role in shaping the minimum payment requirements for HELOC:

- Outstanding Balance: The outstanding balance on the HELOC, comprising the borrowed amount and accrued interest, directly impacts the minimum payment. As the outstanding balance fluctuates, so does the minimum payment, reflecting the amount required to gradually repay the borrowed funds.

- Interest Rate: The interest rate attached to the HELOC profoundly influences the minimum payment. Given that HELOC interest rates are often variable, changes in the prevailing interest rates can lead to adjustments in the minimum payment, thereby necessitating a nuanced understanding of the interest rate dynamics.

- Repayment Period: The duration of the repayment period delineates the timeframe within which the outstanding balance must be repaid. This temporal parameter influences the minimum payment, as a shorter repayment period necessitates higher minimum payments to expedite the repayment process.

- Payment Structure: The payment structure, encompassing the option to pay interest-only during the draw period and the subsequent transition to repaying the principal and interest, shapes the minimum payment requirements. The shift from interest-only payments to comprehensive repayment impacts the minimum payment, reflecting the altered repayment dynamics.

- Market Conditions: Fluctuations in the broader economic landscape and prevailing market conditions can impact the minimum payment through their influence on variable interest rates. Awareness of market dynamics is crucial for anticipating potential changes in the minimum payment and devising prudent financial strategies.

By comprehending the interplay of these factors and their collective impact on the minimum payment for HELOC, borrowers can navigate the repayment process adeptly and make informed financial decisions. The confluence of outstanding balance, interest rates, repayment period, payment structure, and market conditions underscores the multifaceted nature of HELOC minimum payments, necessitating a holistic understanding of these determinants.

Calculating Minimum Payment for HELOC

Calculating the minimum payment for a Home Equity Line of Credit (HELOC) entails a comprehensive understanding of the underlying methodology and variables that govern this financial obligation. The minimum payment encompasses the sum required to cover the interest accrued on the outstanding balance and, if applicable, a portion of the principal amount. This calculation is contingent upon several key factors, including the outstanding balance, the interest rate, and the payment structure. The following steps elucidate the process of computing the minimum payment for a HELOC:

- Determine the Outstanding Balance: The first step in calculating the minimum payment is ascertaining the outstanding balance on the HELOC. This encompasses the total amount borrowed and any accrued interest, providing the foundational figure for the minimum payment computation.

- Evaluate the Interest Rate: Understanding the prevailing interest rate associated with the HELOC is crucial for computing the minimum payment. In the case of variable interest rates, it is essential to factor in the current rate and anticipate potential fluctuations that can impact the minimum payment.

- Assess the Payment Structure: The payment structure, particularly the transition from interest-only payments to encompassing both principal and interest, influences the minimum payment calculation. The shift in payment dynamics necessitates recalibrating the minimum payment to accommodate the comprehensive repayment obligation.

- Compute the Minimum Payment: The minimum payment is typically determined by adding the accrued interest to a portion of the principal amount. This can be calculated using various methods, such as a percentage of the outstanding balance or a predetermined minimum payment threshold set by the lender.

By amalgamating these steps and factoring in the interplay of the outstanding balance, interest rate, and payment structure, borrowers can derive the minimum payment for their HELOC. It is imperative to recalibrate the minimum payment calculation in response to changes in the outstanding balance, interest rate adjustments, and shifts in the payment structure to ensure accurate and prudent financial planning.

Furthermore, leveraging online calculators and resources provided by financial institutions can streamline the minimum payment computation process, offering transparency and clarity regarding the repayment obligations associated with the HELOC. By harnessing these tools and understanding the intricacies of minimum payment calculation, borrowers can navigate their HELOC repayment journey with confidence and financial acumen.

Example Calculation

To elucidate the process of computing the minimum payment for a Home Equity Line of Credit (HELOC) at Bank of America, consider the following hypothetical scenario:

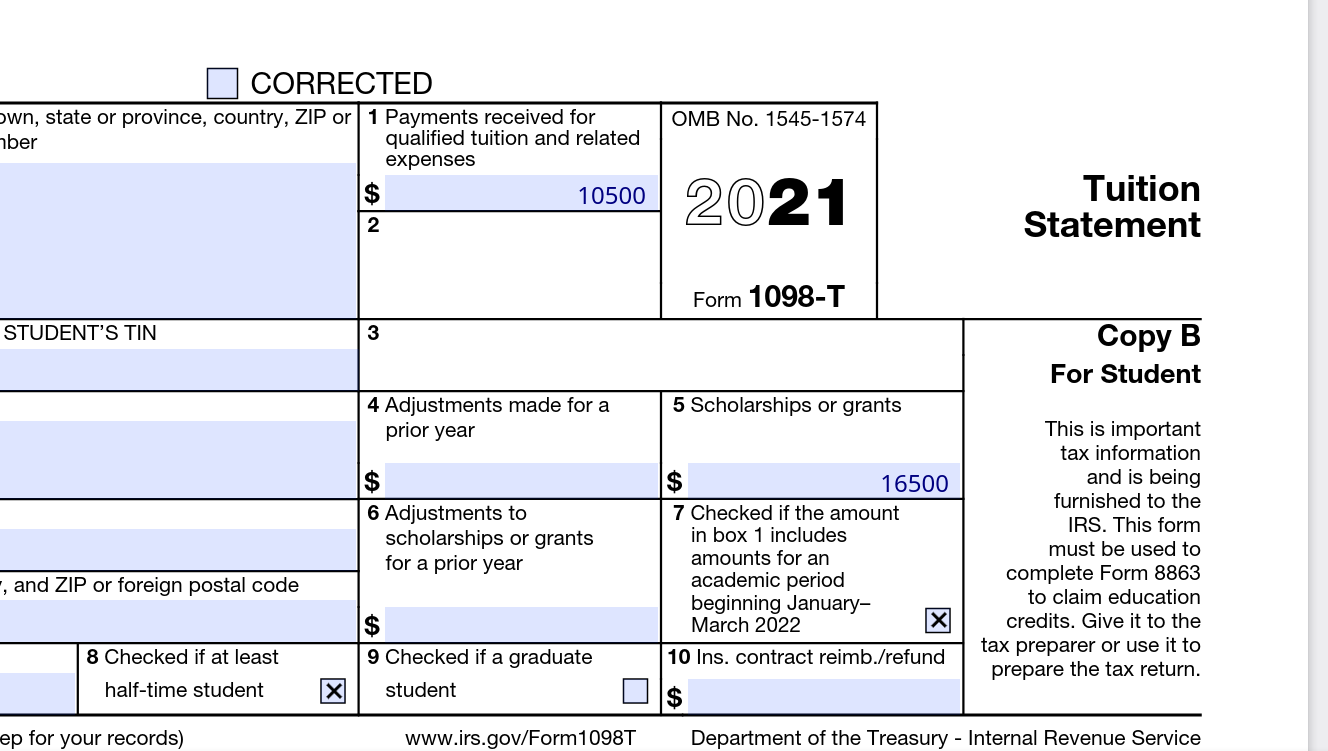

Outstanding Balance: $50,000

Interest Rate: 5% (Variable)

Payment Structure: Transitioned from interest-only payments to encompassing both principal and interest

Given the above parameters, the minimum payment for the HELOC can be calculated using the following steps:

- Step 1: Determine the Outstanding Balance

The outstanding balance on the HELOC amounts to $50,000, representing the total borrowed funds and any accrued interest. - Step 2: Evaluate the Interest Rate

With a variable interest rate of 5%, it is essential to consider the current rate and potential fluctuations that may impact the minimum payment in subsequent periods. - Step 3: Assess the Payment Structure

As the payment structure has transitioned from interest-only payments to encompassing both principal and interest, recalibrating the minimum payment is essential to accommodate the comprehensive repayment obligation. - Step 4: Compute the Minimum Payment

The minimum payment can be calculated by adding the accrued interest to a portion of the principal amount. For instance, a common approach is to compute the minimum payment as a percentage of the outstanding balance, ensuring that it covers the accrued interest and contributes to the gradual repayment of the principal amount.

Utilizing the aforementioned parameters and the specified calculation methodology, the minimum payment for the HELOC at Bank of America can be determined. This example underscores the intricate interplay of the outstanding balance, interest rate, and payment structure in shaping the minimum payment, thereby offering insight into the practical application of minimum payment computation within the context of a HELOC.

By comprehending this example and the associated nuances, borrowers can gain clarity regarding the minimum payment calculation process, enabling them to navigate their HELOC repayment obligations with acumen and informed decision-making.

Conclusion

Home Equity Line of Credit (HELOC) stands as a versatile financial instrument, offering homeowners the flexibility to leverage their property’s equity for diverse financial needs. Understanding the intricacies of HELOC, including the calculation of the minimum payment, is paramount for borrowers seeking to navigate this financial avenue judiciously. The factors influencing the minimum payment, such as the outstanding balance, interest rate, repayment period, payment structure, and market conditions, collectively shape the repayment obligations associated with HELOC.

By comprehending the dynamics of minimum payment calculation and the interplay of key variables, borrowers can adeptly manage their financial responsibilities and make informed decisions regarding their HELOC. The methodology for computing the minimum payment, encompassing the evaluation of the outstanding balance, interest rate, and payment structure, serves as a foundational framework for borrowers to ascertain their repayment obligations accurately.

Furthermore, exemplifying the minimum payment calculation through a hypothetical scenario elucidates the practical application of the computation process, offering clarity and insight into the nuanced dynamics of HELOC repayment. Leveraging this understanding, borrowers can navigate their HELOC journey with prudence, ensuring that they meet their financial obligations while harnessing the benefits of this flexible financial tool.

In essence, comprehending the intricacies of HELOC and the methodology for calculating the minimum payment empowers borrowers to exercise financial acumen, strategically manage their repayment obligations, and harness the potential of HELOC to meet their diverse financial needs. By fostering a comprehensive understanding of HELOC and its associated minimum payment dynamics, borrowers can embark on their financial journey with confidence and informed decision-making, thereby leveraging the benefits of this versatile financial instrument effectively.