Home>Finance>How Do I Know My Minimum Payment At Bank Of America

Finance

How Do I Know My Minimum Payment At Bank Of America

Published: February 25, 2024

Learn how to calculate your minimum payment at Bank of America and manage your finances effectively. Get the information you need to stay on top of your financial responsibilities.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment at Bank of America

If you're a Bank of America credit card holder, understanding your minimum payment is crucial for managing your finances and avoiding unnecessary fees. The minimum payment is the smallest amount you can pay on your credit card balance each month without incurring a late fee. However, it's essential to comprehend that making only the minimum payment can result in long-term debt and substantial interest charges.

In this article, we'll delve into the intricacies of Bank of America's minimum payment requirements, including how they are calculated and the factors that influence them. By gaining a comprehensive understanding of your minimum payment, you can make informed decisions about your financial obligations and work towards effectively managing your credit card debt.

Let's explore the factors that affect minimum payments and learn how to calculate your minimum payment accurately. Additionally, we'll provide valuable tips for managing your minimum payment to help you stay on top of your finances and avoid unnecessary interest charges and fees. Understanding the minimum payment at Bank of America is a crucial step towards achieving financial stability and responsible credit card management.

Understanding Minimum Payments

Minimum payments are the smallest amount you are required to pay each month on your credit card balance to maintain your account in good standing. For Bank of America credit card holders, this is a vital aspect of managing their financial obligations. It’s important to note that while making the minimum payment can help you avoid late fees and maintain a positive payment history, it may not significantly reduce your overall debt due to accruing interest.

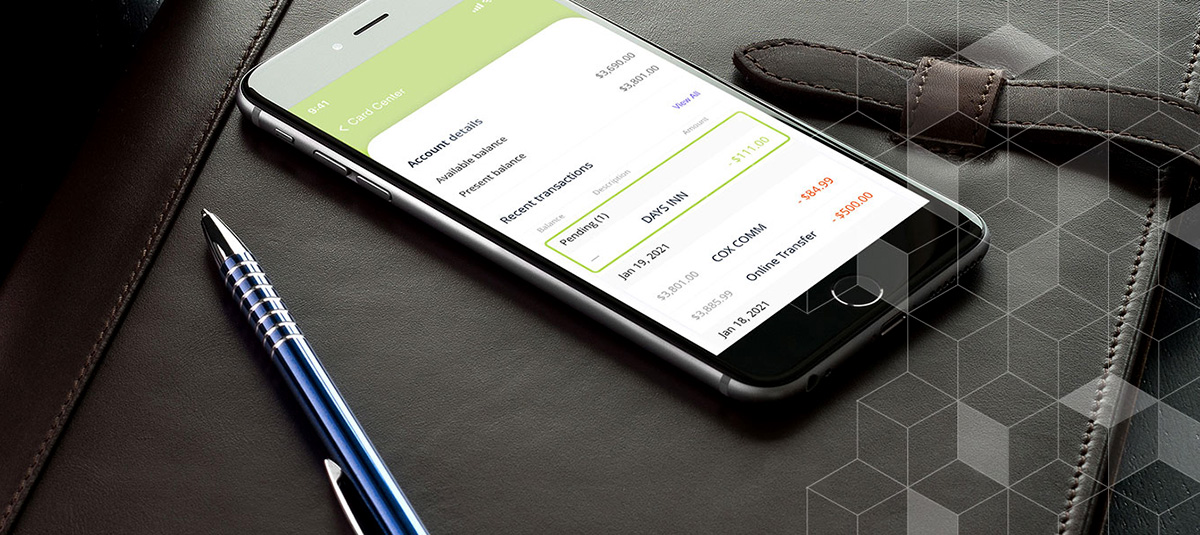

When you receive your credit card statement, the minimum payment amount is clearly indicated. This figure is calculated based on various factors, including your outstanding balance, interest rate, and any fees or charges incurred during the billing cycle. Understanding the components that contribute to your minimum payment can provide valuable insights into your financial responsibilities and help you make informed decisions about managing your credit card debt.

It’s essential to recognize that by paying only the minimum amount due, you may end up paying significantly more in interest over time, and it can take much longer to clear your balance. This is why it’s advisable to aim for paying more than the minimum whenever possible, thus reducing the overall interest accrued and working towards becoming debt-free more efficiently.

By comprehending the significance of minimum payments and their impact on your financial well-being, you can take proactive steps to manage your credit card debt responsibly. In the following sections, we will explore the factors that influence minimum payments and provide guidance on calculating and managing your minimum payment effectively.

Factors Affecting Minimum Payments

Several key factors influence the calculation of minimum payments on Bank of America credit cards. Understanding these elements can provide clarity on how your minimum payment is determined and empower you to make informed decisions regarding your financial obligations.

- Outstanding Balance: The total amount you owe on your credit card, including any purchases, cash advances, and balance transfers, directly impacts your minimum payment. A higher outstanding balance typically results in a larger minimum payment.

- Interest Rate: The annual percentage rate (APR) applied to your balance significantly influences your minimum payment. Higher interest rates lead to increased minimum payments, and a substantial portion of your minimum payment may go towards covering interest charges.

- Fees and Charges: Any applicable fees, such as late fees or over-limit fees, are factored into the minimum payment calculation. These additional charges can elevate your minimum payment amount for the billing cycle.

- Payment Due Date: The timing of your payment due date affects the minimum payment amount. If your payment is not received by the due date, you may incur a late fee, and the minimum payment for the subsequent billing cycle could be higher.

- Regulatory Requirements: Financial regulations and credit card industry standards may stipulate minimum payment calculations, ensuring that they cover a portion of the principal balance and accrued interest to facilitate debt repayment.

By considering these factors, Bank of America calculates your minimum payment to ensure that it covers a portion of the interest, fees, and a portion of the principal balance, promoting progress towards reducing your debt. It’s important to review your credit card statement carefully to understand how these factors contribute to your minimum payment and how they impact your overall financial obligations.

Understanding the interplay of these factors can empower you to take proactive steps in managing your credit card debt responsibly. In the subsequent section, we will delve into the process of calculating your minimum payment, providing clarity on how this essential financial obligation is determined.

Calculating Your Minimum Payment

Bank of America employs a specific methodology to calculate the minimum payment due on your credit card account. While the exact formula may vary based on the specific terms of your credit card agreement, it typically encompasses several key elements to ensure that your minimum payment covers essential aspects of your outstanding balance.

The most common approach involves setting the minimum payment as the sum of the interest accrued during the billing cycle, any fees or charges, and a percentage of the principal balance. This percentage is often calculated based on a predetermined rate, typically around 1-3% of the total balance. The total minimum payment is then determined by adding these components together, ensuring that it covers a portion of the interest and contributes to reducing the principal balance.

For example, if your outstanding balance is $2,000, and the minimum payment calculation includes 2% of the balance, the minimum payment would amount to $40, in addition to any accrued interest and applicable fees. It’s important to note that making only the minimum payment may result in a more prolonged repayment period and higher overall interest charges.

Bank of America provides transparent disclosure of the minimum payment calculation methodology in your credit card agreement and monthly statements, enabling you to understand how your minimum payment is determined. By familiarizing yourself with this process, you can gain clarity on your financial responsibilities and make informed decisions regarding your repayment strategy.

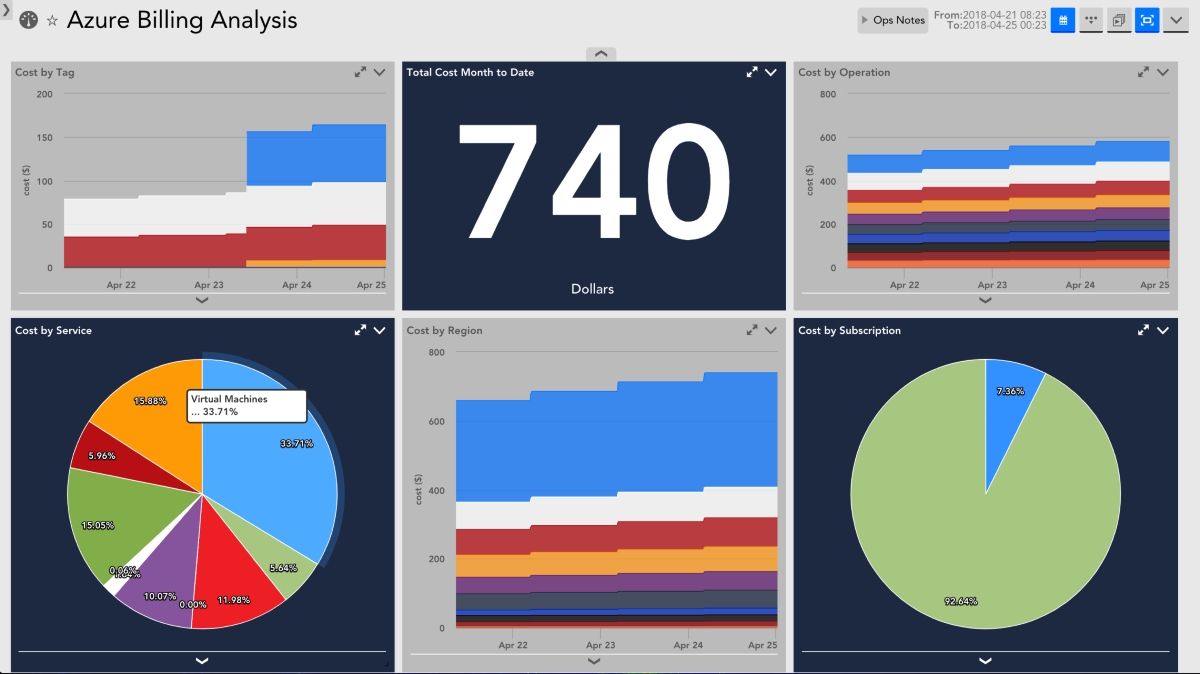

Additionally, leveraging online tools and resources offered by Bank of America, such as payment calculators and account management features, can facilitate a deeper understanding of your minimum payment and its implications. These tools often provide insights into how different payment amounts and strategies can impact your repayment timeline and overall interest costs.

By comprehending the methodology behind minimum payment calculations and utilizing available resources, you can effectively manage your credit card debt and work towards financial stability. In the subsequent section, we will provide valuable tips for managing your minimum payment, empowering you to navigate your financial obligations responsibly and proactively.

Tips for Managing Your Minimum Payment

Effectively managing your minimum payment at Bank of America is essential for maintaining financial stability and working towards debt reduction. By implementing proactive strategies and adopting responsible financial habits, you can navigate your credit card obligations with confidence and mitigate unnecessary interest charges. Here are valuable tips to help you manage your minimum payment effectively:

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due. By allocating additional funds towards your credit card balance, you can expedite debt repayment and reduce overall interest costs.

- Understand Your Interest Rate: Familiarize yourself with the interest rate applied to your credit card balance. By understanding how interest accrues, you can make informed decisions about repayment strategies and prioritize high-interest balances.

- Set Up Payment Reminders: Utilize payment reminders or automatic payments to ensure that you never miss a payment due date. Timely payments can help you avoid late fees and maintain a positive payment history.

- Monitor Your Spending: Keep track of your credit card expenditures and strive to maintain a budget. Responsible spending habits can help prevent excessive balances and make it easier to manage your minimum payment.

- Explore Balance Transfer Options: Consider transferring high-interest balances to a card with a lower APR, if feasible. This can potentially reduce interest costs and make it easier to manage your minimum payment.

- Utilize Online Account Management: Take advantage of Bank of America’s online account management tools to track your spending, view your statement, and gain insights into your minimum payment and overall financial status.

- Seek Financial Guidance: If you encounter challenges in managing your minimum payment or credit card debt, consider seeking financial counseling or guidance to explore viable solutions and repayment strategies.

By incorporating these tips into your financial management approach, you can navigate your minimum payment obligations with confidence and work towards achieving a stronger financial foundation. Understanding the nuances of minimum payments and implementing proactive strategies empowers you to take control of your credit card debt and move closer to your financial goals.

By embracing responsible financial habits and leveraging available resources, you can effectively manage your minimum payment at Bank of America and pave the way for enhanced financial well-being. Empower yourself with knowledge and proactive strategies to navigate your credit card obligations and achieve greater financial stability.