Finance

How To Cancel A Chime Credit Card

Published: October 25, 2023

Learn how to cancel your Chime credit card and manage your finances effectively with these step-by-step instructions. Take control of your financial health today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

If you’ve found yourself needing to cancel your Chime credit card, rest assured that the process is straightforward and can be done with a few simple steps. Whether you’ve lost your card, want to switch to a different bank, or need to close your account for any other reason, Chime provides a hassle-free way to cancel your credit card.

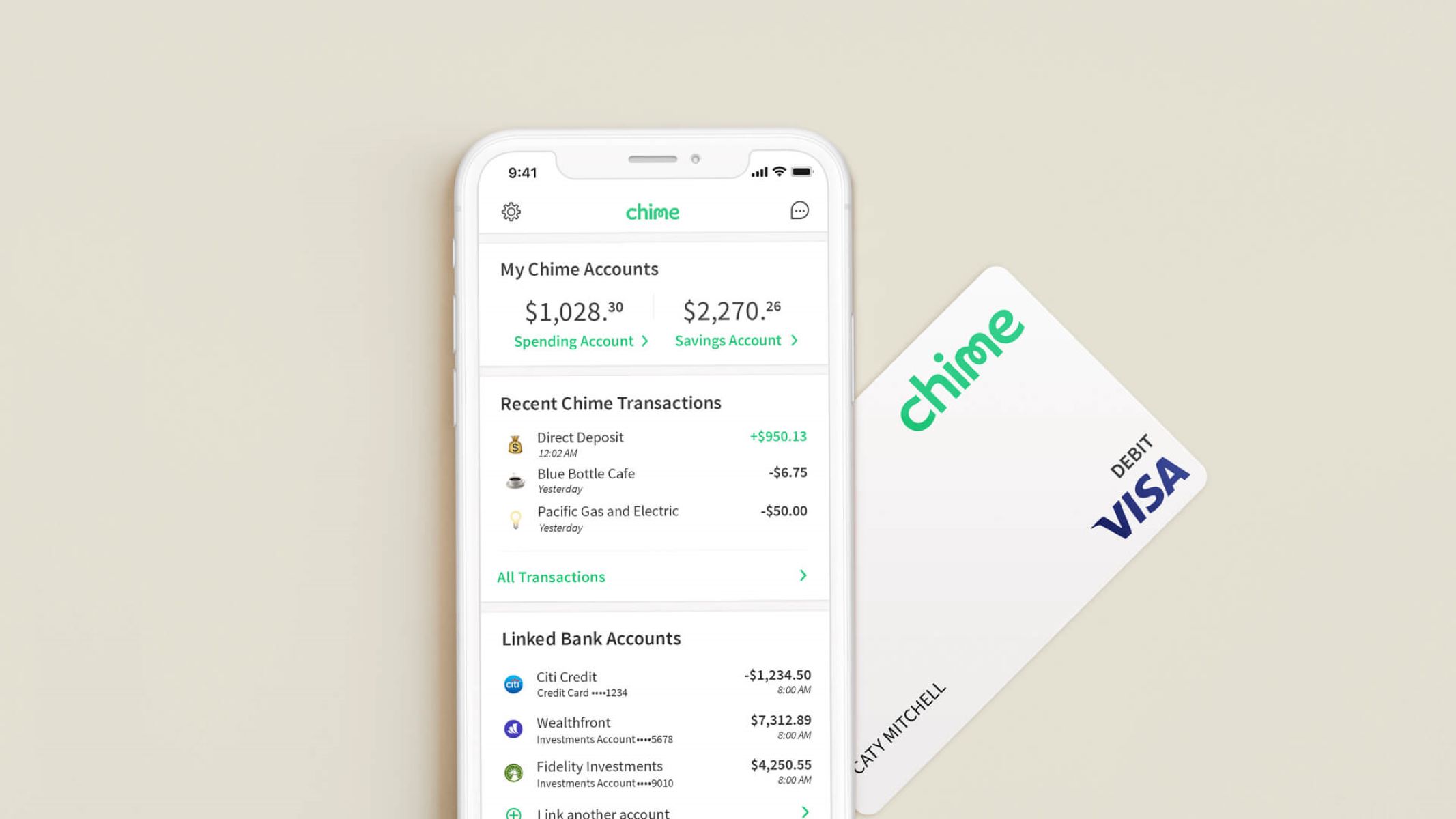

Chime, a popular online banking platform, offers various financial services, including credit cards. Their credit cards come with features like no annual fees, cashback rewards, and a user-friendly mobile app. However, situations may arise where you need to cancel your Chime credit card.

In this guide, we will walk you through the step-by-step process of cancelling your Chime credit card. It is important to note that before cancelling your Chime credit card, you should ensure you have settled any outstanding balances or pending transactions.

Now, let’s dive into the steps you need to follow to cancel your Chime credit card.

Step 1: Contact Chime Customer Service

The first step to canceling your Chime credit card is to get in touch with Chime customer service. You can reach out to them through various channels, including phone, email, or the Chime mobile app.

To contact Chime customer service, you can:

- Call their toll-free number: 1-844-244-6363

- Email them at: support@chime.com

- Message them directly through the Chime mobile app

When reaching out to customer service, be prepared to provide necessary details such as your account information, cardholder name, and any other identification information they may require. This step is crucial to verify your identity and ensure that you have the authorization to cancel the credit card associated with your account.

Once you have initiated contact with Chime customer service, they will guide you through the cancellation process and provide further instructions.

Remember, it is important to be patient and courteous during your communication with customer service representatives. They are there to assist you and ensure a smooth cancellation process.

Step 2: Gather Necessary Information

Before proceeding with the cancellation of your Chime credit card, it is important to gather all the necessary information that may be required during the process. This will ensure a smooth and efficient cancellation experience.

Here are some key pieces of information you may need to have on hand:

- Your Chime account details: This includes your account number, username, and password.

- Credit card information: You will need the card number, expiration date, and CVV (card verification value) for the credit card you wish to cancel.

- Personal identification: Be prepared to provide identification information, such as your full name, date of birth, and social security number. This may help in verifying your identity during the cancellation process.

- Reason for cancellation: While not always required, it can be helpful to have a clear reason for canceling your Chime credit card. This information may be requested by the customer service representative.

By having all the necessary information readily available, you can expedite the cancellation process and reduce the time spent on gathering information later on.

It’s also worth noting that it’s always a good idea to review your credit card statement and make note of any pending transactions or outstanding balances that need to be addressed before canceling the card.

With the necessary information in hand, you’ll be well-prepared to move on to the next step of the cancellation process.

Step 3: Request Card Cancellation

After contacting Chime customer service and gathering all the necessary information, it’s time to formally request the cancellation of your Chime credit card.

During your conversation with the customer service representative, clearly state your intention to cancel the credit card associated with your Chime account. Make sure to provide all the requested information and answer any additional questions that may be asked to verify your identity.

It’s important to be aware that Chime may try to retain you as a customer and may offer alternatives or solutions to address your concerns or issues. If you are determined to cancel the card, politely decline any offers and reiterate your request for card cancellation.

Once the representative confirms that the cancellation request has been processed, ask for a reference number or any other documentation that serves as proof of your cancellation request. This can be helpful for future reference if any issues arise.

Keep in mind that there may be certain terms and conditions associated with canceling your Chime credit card, such as potential fees or penalties. Make sure to ask the representative about any relevant details to ensure a clear understanding of the process.

By clearly communicating your request for card cancellation and addressing any inquiries from the customer service representative, you are one step closer to finalizing the cancellation of your Chime credit card.

Step 4: Follow Instructions and Provide Verification

After requesting the cancellation of your Chime credit card, the customer service representative will provide you with detailed instructions on how to proceed. It is crucial to carefully follow these instructions to ensure a smooth cancellation process.

Typically, you will be asked to verify your identity and provide any additional documentation that may be required to complete the cancellation process. The representative may ask for proof of identity, such as a government-issued ID or a scanned copy of your driver’s license or passport.

Make sure to provide the requested information promptly and accurately. This helps to streamline the verification process and ensures that there are no delays in canceling your Chime credit card.

If you are asked to fill out any forms or submit any documents, carefully review them to ensure that all the required fields are completed correctly. Pay close attention to any deadlines or timeframes provided by the representative and make sure to meet them accordingly. This will help expedite the cancellation process.

During this step, it is also essential to maintain open lines of communication with the customer service representative. If you have any questions or concerns about the instructions or verification process, don’t hesitate to ask for clarification. Clear and timely communication can help resolve any potential issues and ensure a successful cancellation.

Remember to keep any reference numbers or documentation provided by the representative for future reference. Having this information on hand can be helpful if you need to follow up on the cancellation status or address any further concerns.

By following the instructions and providing the necessary verification, you are actively participating in the cancellation process and taking the final steps towards closing your Chime credit card.

Step 5: Confirm Card Cancellation

Once you have completed the necessary steps to cancel your Chime credit card, it’s important to confirm that the cancellation request has been successfully processed.

Typically, Chime will provide confirmation of the card cancellation via email or through a notification in your account. Keep an eye on your email inbox or the Chime mobile app for any updates regarding the status of your credit card cancellation.

If you don’t receive any confirmation within the expected timeframe, it is recommended to reach out to Chime customer service again to verify the status of your cancellation request. They will be able to provide you with the necessary information or address any concerns you may have.

Remember, it may take a few business days for the cancellation to be fully processed and reflected in your Chime account. During this time, it is important to monitor your account to ensure that no unauthorized transactions or charges occur.

Once you receive confirmation that your Chime credit card has been successfully canceled, it is recommended to destroy the physical card to prevent any misuse. Cut up the card or shred it to ensure that the information cannot be accessed or retrieved by anyone.

Furthermore, it’s a good practice to remove any saved payment information associated with your Chime credit card from online platforms or merchants that you no longer wish to use for future transactions.

By confirming the cancellation of your Chime credit card and taking necessary precautions, you can have peace of mind knowing that your account is secure and that your card has been successfully canceled.

Tips for a Smooth Cancellation Process

Cancelling a credit card, including a Chime credit card, can sometimes be a daunting process. To ensure a smooth cancellation experience, here are some helpful tips:

- Be Prepared: Before contacting Chime customer service, gather all the necessary information, such as your account details, credit card information, and personal identification. This will help expedite the cancellation process.

- Communicate Clearly: When speaking with customer service representatives, clearly state your intention to cancel your Chime credit card. Provide all the requested information and answer any additional questions to verify your identity.

- Be Persistent: If the representative offers alternatives or tries to retain you as a customer, politely decline and reiterate your request for card cancellation, if that is your desire.

- Follow Instructions Carefully: Pay close attention to the instructions provided by the customer service representative. Follow them accurately and promptly submit any required documentation or forms.

- Maintain Open Communication: Stay in contact with customer service throughout the cancellation process. Ask questions and seek clarification if needed. This can help resolve any concerns or issues that may arise.

- Monitor Your Account: After initiating the cancellation process, keep an eye on your Chime account for any updates or notifications regarding the status of your cancellation request. Report any unauthorized transactions immediately.

- Destroy Physical Card: Once your Chime credit card cancellation has been confirmed, safely destroy the physical card to prevent any potential misuse. Cut it up or shred it to ensure that the information cannot be accessed.

- Review Automatic Payments: If you had any recurring or automatic payments set up with your Chime credit card, make sure to update or transfer them to an alternative payment method to avoid any disruptions.

By following these tips, you can navigate the cancellation process smoothly and efficiently, ensuring a hassle-free experience.

Conclusion

Cancelling a Chime credit card may become necessary for various reasons, and Chime has provided a straightforward process to facilitate this. By following the steps outlined in this guide, you can easily navigate the cancellation process while maintaining a seamless experience.

Remember to contact Chime customer service to initiate the cancellation request. Gather all the necessary information, provide accurate verification, and follow the instructions provided. Confirm the cancellation and take necessary precautions to secure your account.

Throughout the entire process, it is essential to maintain open communication, be patient, and follow the guidelines. By doing so, you ensure that the cancellation process is smooth and successful.

If you have any remaining concerns or questions, don’t hesitate to reach out to Chime customer service. They are there to assist you and address any inquiries you may have.

Finally, after canceling your Chime credit card, take the time to review your financial situation and evaluate alternative banking options if necessary. It’s important to choose the banking solution that best fits your needs and goals.

We hope this guide has provided you with valuable insights into canceling a Chime credit card. Remember, always prioritize the security and protection of your financial information, and be proactive in managing your accounts.