Finance

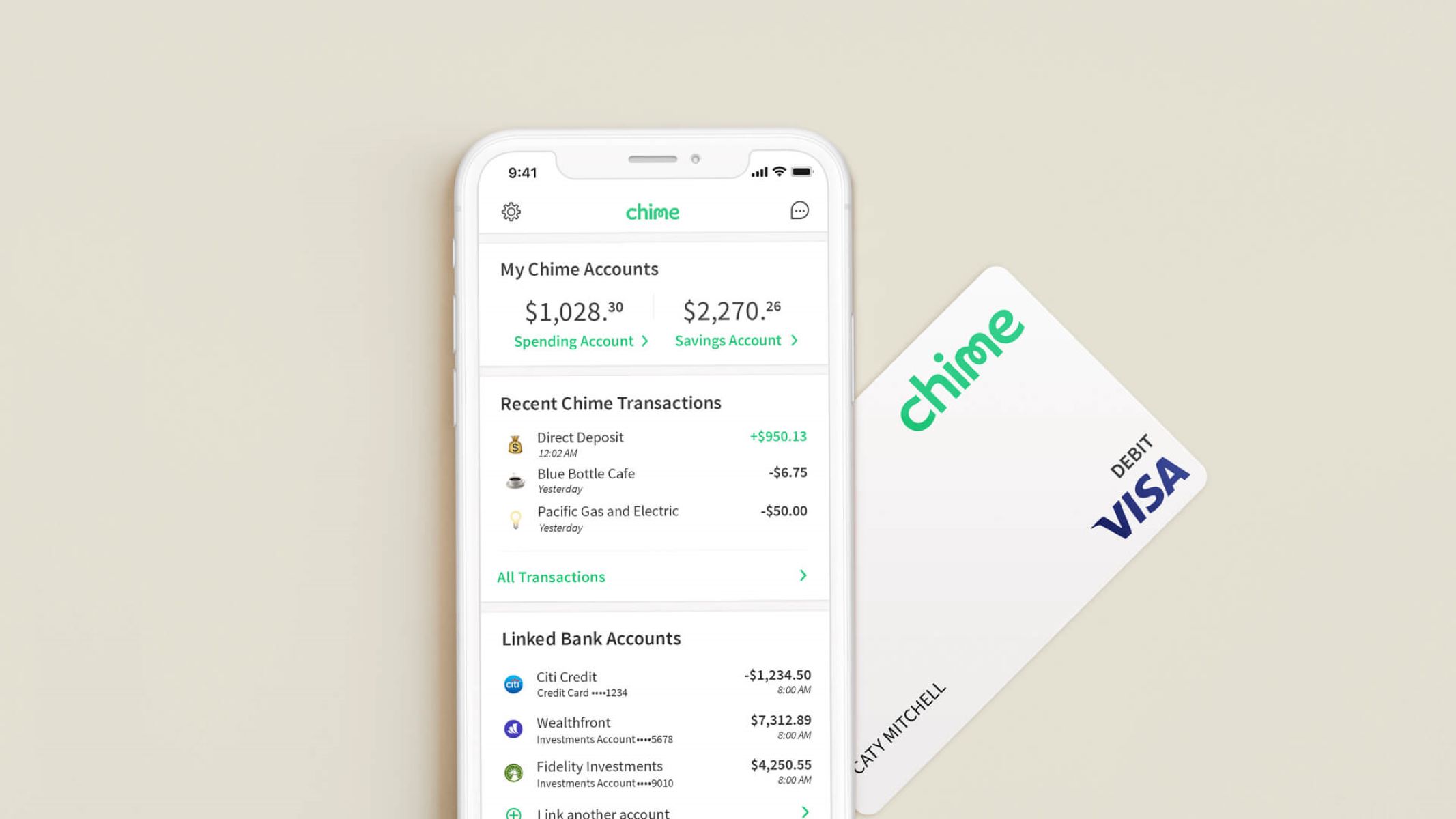

How To Get Chime Credit Card

Modified: March 1, 2024

Learn how to obtain a Chime credit card for your financial needs. Manage your personal finances with ease and convenience in just a few simple steps.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Researching Chime Credit Card Options

- Step 2: Meeting Chime Credit Card Requirements

- Step 3: Applying for a Chime Credit Card

- Step 4: Activating Your Chime Credit Card

- Step 5: Managing and Using Your Chime Credit Card

- Step 6: Repaying Your Chime Credit Card Balance

- Step 7: Maximizing the Benefits of Chime Credit Card

- Conclusion

Introduction

Welcome to the world of Chime Credit Card, where convenience, flexibility, and financial empowerment intersect. With a Chime Credit Card, you gain access to a wide range of benefits and features designed to make your financial life easier. Whether you’re looking to build credit, earn rewards, or take advantage of no fees, Chime Credit Card has you covered.

In this article, we will guide you through the process of obtaining a Chime Credit Card and share tips on how to maximize its benefits. From researching your options to managing your card balance, we’ll cover everything you need to know to make the most of your Chime Credit Card experience.

Before we dive into the details, let’s take a moment to understand what sets Chime Credit Card apart. Chime is not a traditional bank, but a modern and tech-forward financial platform. Chime offers innovative services that prioritize ease of use, affordability, and customer satisfaction. When you choose a Chime Credit Card, you’re selecting a product that aligns with these values and provides an elevated banking experience.

Now, let’s get started and explore how you can obtain and leverage the benefits of a Chime Credit Card. Whether you’re new to the world of credit cards or a seasoned user, this guide will equip you with the knowledge to navigate the Chime Credit Card landscape confidently.

Step 1: Researching Chime Credit Card Options

When it comes to obtaining a Chime Credit Card, the first step is to explore the different options available to you. Chime offers a variety of credit cards, each with its own features and benefits. By researching the options, you can find the card that aligns with your needs and financial goals.

Start by visiting the Chime website or mobile app, where you will find detailed information about their credit card offerings. Take the time to review the features, benefits, and terms and conditions of each card. Consider factors such as interest rates, annual fees, rewards programs, and any other perks that may be of interest to you.

One popular option is the Chime Credit Builder Visa Credit Card. This card is specifically designed for individuals who are looking to establish or rebuild their credit history. With responsible use, this card can help you improve your credit score and gain access to better financial opportunities in the future.

If you’re someone who enjoys earning rewards on your purchases, the Chime Rewards Visa Debit Card may be the perfect fit for you. With this card, you can earn cashback on everyday purchases and enjoy perks such as access to exclusive deals and offers.

Another option to consider is the Chime Credit Card, which offers a straightforward and transparent approach to credit. With no annual fees, no hidden charges, and a competitive interest rate, this card allows you to make purchases and build credit responsibly without worrying about excessive costs.

During your research, pay attention to the eligibility requirements for each card. Review factors such as minimum credit scores or income thresholds to ensure you meet the criteria. By understanding the requirements, you can narrow down your options and focus on the cards that are most suitable for your financial situation.

Once you have explored the different Chime Credit Card options and determined which one aligns with your needs, you can move on to the next step: meeting the specific requirements to qualify for the card of your choice.

Step 2: Meeting Chime Credit Card Requirements

Before you can apply for a Chime Credit Card, it’s important to ensure that you meet the specific requirements set by Chime. Meeting these requirements increases your chances of being approved for the card and sets you on the path to enjoying the benefits it offers.

One of the primary requirements to consider is your credit score. While Chime does offer credit cards for individuals with less-than-perfect credit, a higher credit score will improve your chances of being approved for a card with better terms and benefits. It’s recommended to have a credit score of at least 600 or higher to qualify for most Chime Credit Cards.

Aside from your credit score, Chime may also consider your income and employment status when evaluating your application. The specific income requirements will vary depending on the card you are applying for. Chime typically prefers applicants to have a steady source of income to ensure they can handle credit responsibly.

Additionally, Chime typically requires applicants to have a U.S. Social Security Number (SSN). This is used to verify your identity and ensure compliance with financial regulations. If you do not have an SSN, you may need to explore alternative options or consider applying for a secured credit card.

It’s important to note that meeting the requirements does not guarantee approval for a Chime Credit Card. Chime has its own internal criteria for evaluating applications, and factors such as your credit history and overall financial profile will also play a role in the decision-making process.

If you meet the requirements and feel confident in your eligibility, you can proceed to the next step: applying for a Chime Credit Card. Make sure you have all the necessary documents and information ready before starting the application process to streamline the process and increase your chances of success.

Step 3: Applying for a Chime Credit Card

Once you have researched the available Chime Credit Card options and ensured that you meet the requirements, it’s time to apply for a Chime Credit Card. Applying for a Chime Credit Card is a straightforward process that can be completed online through the Chime website or mobile app.

Here are the steps to follow when applying for a Chime Credit Card:

- Visit the Chime website or open the Chime mobile app: Access the Chime platform using your preferred device and navigate to the credit card application page. If you don’t already have a Chime account, you will need to create one before proceeding.

- Provide your personal information: Fill out the application form with accurate and up-to-date information. This usually includes basic personal details such as your name, date of birth, address, and contact information.

- Verify your identity: As part of the application process, Chime will require you to verify your identity. This may involve providing your Social Security Number (SSN) or other identifying documents.

- Submit your application: Once you have filled out the application form and completed the necessary identity verification, review the information you have provided and submit your application. Keep in mind that submitting an application does not guarantee approval.

After you have submitted your application, Chime will review your information and determine your eligibility for a credit card. The review process usually takes a few business days. If your application is approved, you will receive a notification from Chime with further instructions on how to proceed.

If your application is not approved, don’t be discouraged. Chime may provide you with information on why your application was declined. Take the time to understand the reasons and consider taking steps to improve your creditworthiness before reapplying.

Remember, it’s essential to be truthful and accurate when applying for a Chime Credit Card. Providing false information can lead to your application being rejected or your account being closed in the future.

Once your application is approved and you receive your Chime Credit Card, it’s time to move on to the next step: activating your card and getting ready to use it for your financial needs.

Step 4: Activating Your Chime Credit Card

Congratulations on receiving your Chime Credit Card! Now that you have it, the next step is to activate your card before you can start using it for your financial transactions.

Activating your Chime Credit Card is a simple process that can be done in a few minutes. Here’s how to activate your card:

- Retrieve your Chime Credit Card: Locate your physical Chime Credit Card that was sent to you by mail. It will typically arrive in an unmarked envelope for security purposes.

- Visit the Chime website or open the Chime mobile app: Access the Chime platform using your preferred device, and log in to your Chime account.

- Access the card activation page: Navigate to the card activation page, which can usually be found within your account settings or in a dedicated section for card management.

- Enter the required information: Provide the necessary details to activate your card. This typically includes the 16-digit card number, the expiration date, and the security code (CVV) found on the back of the card.

- Confirm activation: Review the information you have entered to ensure accuracy, and click on the activation button to confirm. Within a few moments, your Chime Credit Card should be successfully activated and ready to use.

It’s important to note that some Chime Credit Cards may also require a PIN (Personal Identification Number) for added security. If your card requires a PIN, you can typically create one during the activation process. Remember to choose a PIN that is unique and easy for you to remember but difficult for others to guess.

Once your Chime Credit Card is activated, you can start using it for various transactions, such as making purchases online or in-store and paying bills. You can also link your Chime Credit Card to your digital wallet, such as Google Pay or Apple Pay, for convenient and secure mobile payments.

Keep in mind that responsible usage of your Chime Credit Card can help you build and improve your credit score over time. Make timely payments, keep your credit utilization low, and only use your card for purchases you can afford to repay.

Now that your Chime Credit Card is activated and ready for use, it’s time to move on to the next step: managing and using your card wisely.

Step 5: Managing and Using Your Chime Credit Card

Now that you have activated your Chime Credit Card, it’s important to effectively manage and use it to make the most of its benefits. Here are some essential tips for managing and utilizing your Chime Credit Card:

- Stay on top of your transactions: Regularly monitor your Chime Credit Card transactions to ensure accuracy and detect any fraudulent activity. Chime provides real-time transaction alerts and notifications through their mobile app, helping you stay informed about your card activity.

- Create a budget: Establish a budget to track your spending and ensure that you can comfortably manage your credit card payments. Knowing your financial limits and sticking to a budget will help you avoid overspending and accumulating unnecessary debt.

- Pay your bills on time: Make your Chime Credit Card payments on or before the due date to avoid late payment fees and negative impacts on your credit score. Setting up automatic payments or reminders can help you stay organized and ensure timely payments.

- Keep your credit utilization low: Aim to keep your credit utilization ratio—the percentage of available credit you use—low. By keeping your usage below 30% of your credit limit, you demonstrate responsible credit management and can potentially boost your credit score.

- Take advantage of rewards: If your Chime Credit Card offers rewards or cashback, make sure to take full advantage of them. You can earn rewards on everyday purchases and save money or redeem your rewards for various benefits.

- Review your statements: Regularly review your Chime Credit Card statements to check for any discrepancies or errors. If you notice any unauthorized charges or inaccuracies, reach out to Chime customer support immediately to address the issue.

- Use additional security features: Chime offers additional security features, such as the ability to lock and unlock your card instantly through their mobile app. Take advantage of these features to safeguard your card and prevent unauthorized use.

By effectively managing and using your Chime Credit Card, you can build a positive credit history, earn rewards, and enjoy the benefits that come with responsible credit card ownership.

Remember, it’s important to be mindful of your financial health and only use your Chime Credit Card for expenses you can afford to repay. Responsible credit card usage can contribute to a stronger financial foundation and open doors to future financial opportunities.

Now that you are equipped with the knowledge to manage and use your Chime Credit Card wisely, let’s move on to the next step: repaying your Chime Credit Card balance and maintaining a healthy credit profile.

Step 6: Repaying Your Chime Credit Card Balance

Repaying your Chime Credit Card balance is crucial to maintaining a healthy credit profile and avoiding unnecessary interest charges. By staying on top of your payments, you can effectively manage your credit card debt. Here are some tips for repaying your Chime Credit Card balance:

- Pay more than the minimum payment: While making the minimum payment each month is required, it’s wise to pay more if you can. By paying more than the minimum, you can reduce your outstanding balance faster and potentially save on interest charges.

- Create a repayment plan: If you have a large credit card balance, consider creating a repayment plan. Outline a timeline and allocate a certain amount of money each month towards paying off your Chime Credit Card balance. This disciplined approach will help you systematically reduce your debt.

- Avoid unnecessary purchases: While using your credit card for necessary expenses is acceptable, it’s important to avoid unnecessary purchases that can increase your balance. Prioritize your needs over wants to keep your credit card balance manageable.

- Utilize balance transfer options: If you have a high-interest rate on your Chime Credit Card, look into balance transfer options. By transferring your balance to a card with a lower interest rate, you can potentially save on interest charges and repay your debt more effectively.

- Set up automatic payments: To ensure that you never miss a payment, consider setting up automatic payments. By automating your credit card payments, you can avoid late fees and maintain a positive payment history.

- Track your progress: Keep track of your repayment progress by monitoring your credit card statements and checking your remaining balance. This will give you a clear picture of how far you’ve come and motivate you to continue making progress.

- Reach out for assistance if needed: If you find yourself struggling to repay your Chime Credit Card balance, don’t hesitate to reach out to Chime customer support. They may be able to provide guidance or explore options to assist you during challenging times.

By implementing these strategies, you can take control of your Chime Credit Card debt and work towards financial freedom. Remember, responsible credit card repayment not only improves your credit score but also sets a foundation for your overall financial well-being.

Now that you have a clear roadmap for repaying your Chime Credit Card balance, let’s move forward to the final step: maximizing the benefits of your Chime Credit Card.

Step 7: Maximizing the Benefits of Chime Credit Card

As a Chime Credit Card holder, you have access to a variety of benefits and features. To make the most of your Chime Credit Card, follow these tips to maximize its benefits:

- Earn and redeem rewards: If your Chime Credit Card offers a rewards program, take advantage of it. Earn rewards on your everyday purchases and explore the redemption options available to you, such as cashback, travel rewards, or gift cards. Make sure to understand the terms and conditions of the rewards program to optimize your earning potential.

- Utilize additional perks and benefits: Explore the additional perks and benefits that come with your Chime Credit Card. This may include features like purchase protection, extended warranty coverage, or access to exclusive offers and discounts. Take advantage of these perks to enhance your overall cardholder experience.

- Monitor your credit score: Regularly check your credit score to track your financial progress. Chime offers a free credit score monitoring feature that allows you to keep tabs on your score and take steps to improve it over time. This can be valuable in understanding where you stand financially and identifying areas for improvement.

- Avoid unnecessary fees: Chime Credit Cards are known for their transparent fee structure, but it’s still important to be aware of any applicable fees. Familiarize yourself with Chime’s fee schedule and strive to avoid unnecessary fees by making timely payments, staying within your credit limit, and avoiding cash advances.

- Stay informed about updates and new features: Chime continuously enhances its services and introduces new features. Stay informed about updates through the Chime website, mobile app, or email notifications. By staying up-to-date, you can take advantage of new features that may improve your overall cardholder experience.

- Engage with the Chime community: Chime has a vibrant online community where users share their experiences, tips, and insights. Engage with the community to learn from others, ask questions, and discover creative ways to make the most of your Chime Credit Card. You may find unique strategies or recommendations that enrich your cardholder experience.

By implementing these strategies, you can optimize the benefits and features of your Chime Credit Card. This will ensure that you are taking full advantage of what the card has to offer and maximizing your financial potential.

As you continue to use your Chime Credit Card responsibly and reap its benefits, remember to monitor your financial health, regularly review your credit card statements, and make adjustments as needed to align with your financial goals.

Congratulations on completing all the steps to obtain and maximize the benefits of your Chime Credit Card. By following this guide, you are on your way to a successful and rewarding financial journey.

Conclusion

Congratulations on reaching the end of this comprehensive guide on how to obtain and maximize the benefits of a Chime Credit Card! By following the steps outlined in this article, you are well-equipped to embark on your Chime Credit Card journey with confidence and knowledge.

We began by researching the different Chime Credit Card options available to you, ensuring that you find the card that best suits your needs. We then discussed the importance of meeting the specific requirements set by Chime to qualify for a credit card.

Next, we explored the process of applying for a Chime Credit Card and how to activate it once you receive it. We also delved into the importance of effectively managing and utilizing your card, including tips on tracking your transactions, creating a budget, and paying your balance on time.

Repaying your Chime Credit Card balance in a responsible manner was the focus of the sixth step. We provided strategies for making more than the minimum payment, setting up a repayment plan, and avoiding unnecessary purchases.

Finally, we discussed how you can maximize the benefits of your Chime Credit Card, including earning and redeeming rewards, utilizing additional perks and benefits, and staying informed about updates and new features.

By following these steps and incorporating the tips and strategies provided, you can make the most of your Chime Credit Card experience. Remember, responsible credit card usage is essential for maintaining a healthy financial profile and achieving your long-term financial goals.

Thank you for reading this guide, and we wish you all the best as you embark on your Chime Credit Card journey!