Finance

How To Check Child’s Credit

Modified: January 10, 2024

Learn how to check your child's credit and protect their financial future. Understand the importance of monitoring their financial information early on to prevent any unforeseen issues.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Why Check a Child’s Credit?

- How Children’s Credit Can Be Compromised

- Signs of Identity Theft in Children

- Steps to Check a Child’s Credit

- Option 1: Contact the Credit Bureaus

- Option 2: Use a Credit Monitoring Service

- Option 3: Submit a Manual Request to the Credit Bureaus

- Steps to Dispute Errors on a Child’s Credit Report

- Conclusion

Introduction

As parents, we often focus on safeguarding our children’s physical and emotional well-being. However, in today’s digital age, protecting their financial health is equally important. One aspect of financial security that is often overlooked is checking a child’s credit. While it may seem unusual to think that children could have a credit history, it is becoming increasingly common for their identities to be targeted by fraudsters.

Child identity theft is a serious issue that can have long-lasting consequences. Criminals can use a child’s Social Security number to open credit accounts, take out loans, and engage in other fraudulent activities. Unfortunately, the theft may go unnoticed for years, and by the time the child becomes an adult and applies for their first credit card or loan, the damage may already be done.

That’s why it’s crucial for parents to take proactive measures to check their child’s credit and ensure their financial future remains untarnished. By monitoring a child’s credit, any signs of fraudulent activity can be detected early on, allowing for timely action to prevent further harm.

This article will provide valuable insights into why it is necessary to check a child’s credit, how their credit can be compromised, signs of identity theft in children, and the steps parents can take to check and protect their child’s credit.

Why Check a Child’s Credit?

Checking a child’s credit may seem like an unconventional practice, but it serves a vital purpose in today’s digital world. Here are a few reasons why it is crucial to regularly monitor a child’s credit:

- Early detection of identity theft: Child identity theft is a growing concern. By checking a child’s credit, parents can detect any unauthorized activity at an early stage. This allows them to take immediate action and prevent further damage to their child’s credit history.

- Prevention of long-lasting financial consequences: If a child’s identity is compromised and fraudulent accounts are opened in their name, it can lead to significant financial consequences in the future. By monitoring their credit, parents can minimize the risk of their child facing debt and tarnished credit as they enter adulthood.

- Opportunity to resolve errors: Checking a child’s credit report provides an opportunity to identify and rectify any errors or discrepancies. These errors can range from incorrect personal information to fraudulent accounts. Resolving such issues promptly ensures the child’s credit information is accurate and reflects their true financial standing.

- Educational opportunity: Engaging in the process of checking a child’s credit can serve as an educational opportunity. It allows parents to teach their children about the importance of financial responsibility and the potential risks of identity theft.

- Fostering trust and open communication: By involving children in the process of monitoring their credit, parents can create an environment of trust and open communication. It sends a strong message that their financial well-being is a priority, and encourages them to be vigilant about protecting their personal information.

While it may seem unusual or even unnecessary to check a child’s credit, the benefits far outweigh any perceived inconvenience. By taking these proactive measures, parents can safeguard their child’s financial future and instill valuable lessons about personal finance and security.

How Children’s Credit Can Be Compromised

Children’s credit can be compromised in various ways, making them vulnerable to identity theft. Here are some common ways in which this can occur:

- Social Security number theft: Criminals can obtain a child’s Social Security number through various means, such as data breaches or even from their own family members. With this key piece of information, they can open fraudulent credit accounts in the child’s name.

- Family fraud: Unfortunately, sometimes the very people who are supposed to protect children can be the ones who compromise their credit. Family members, including parents or guardians, may use a child’s identity to open credit accounts or apply for loans without their knowledge.

- Data breaches: Children’s personal information can be exposed in large-scale data breaches affecting various institutions, such as schools, healthcare providers, or even government agencies. This stolen information can then be used to commit identity theft.

- Online scams and phishing: Children are exposed to online scams and phishing attempts, which aim to trick them or their parents into sharing sensitive information. These scams can result in the child’s personal information being compromised.

- Medical identity theft: Children’s medical records often contain personally identifiable information that can be used by criminals to commit identity theft. Medical identity theft can lead to financial fraud and unauthorized use of a child’s credit.

It’s important for parents to be aware of these potential risks and take steps to protect their child’s personal information. By understanding how children’s credit can be compromised, parents can implement preventive measures and monitor their child’s credit to detect any fraudulent activity at an early stage.

Signs of Identity Theft in Children

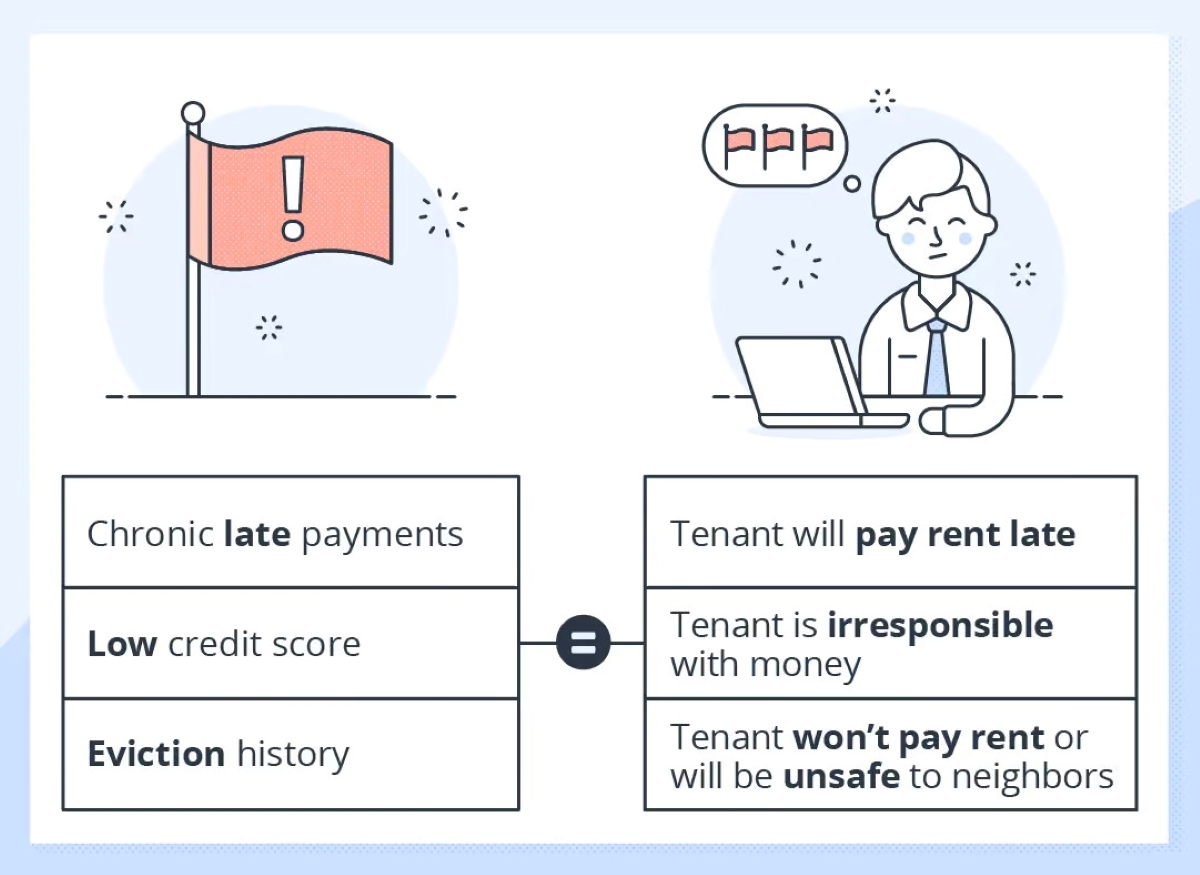

Identity theft in children can be challenging to detect since they often lack financial accounts or credit history. However, there are several signs that may indicate their personal information has been compromised. Here are some red flags to watch out for:

- Unsolicited credit offers: If your child starts receiving credit card offers or other financial offers in the mail, it could indicate that someone has used their information to open accounts. This is especially suspicious if the child is too young to have a legitimate need for such offers.

- Notification from the IRS or other government agencies: If you receive communication from the IRS or other government agencies stating that your child’s Social Security number has been used on multiple tax returns or for employment purposes, it is a clear indication of identity theft.

- Collection calls: If debt collectors start contacting your child, demanding payment for accounts they never opened or for services they didn’t receive, it’s a sign that their identity has been compromised.

- Inaccurate personal information: When reviewing your child’s credit report, look for any incorrect personal information, such as an unknown address, phone number, or variations in their name spelling. These discrepancies may indicate identity theft.

- Unexpected denial of government benefits: If your child is denied government benefits, such as Medicaid or Social Security benefits, due to benefits already being claimed under their Social Security number, it could signify that someone else is using their identity.

- Blacklisted Social Security number: Discovering that your child’s Social Security number has been flagged by credit bureaus or government agencies as being linked to identity theft is a definite cause for concern.

If you notice any of these signs or have reasons to suspect that your child’s identity has been compromised, it is crucial to take immediate action to protect their credit and personal information. This includes contacting the credit bureaus, reporting the identity theft to the authorities, and initiating the necessary steps to dispute and rectify any fraudulent accounts or activity.

By being vigilant and monitoring for these signs, parents can take the necessary steps to detect and resolve identity theft in their children as early as possible, ensuring minimal damage to their financial future.

Steps to Check a Child’s Credit

Checking a child’s credit requires a proactive approach and a few steps to ensure their financial well-being. Here are the steps you can take to check your child’s credit:

- Gather necessary information: Start by collecting your child’s personal information, including their full name, date of birth, and Social Security number. You may also need supporting documents, such as their birth certificate or Social Security card.

- Option 1: Contact the Credit Bureaus: Reach out to each of the three major credit bureaus – Experian, Equifax, and TransUnion – to request a credit check for your child. Contact information for each bureau can be found on their respective websites. Provide the required documentation and follow their procedures for checking a child’s credit report.

- Option 2: Use a Credit Monitoring Service: Consider enrolling in a credit monitoring service that offers family plans. These services allow you to monitor and check your child’s credit regularly. They provide real-time alerts for any suspicious activity and can help you take necessary action if identity theft is detected.

- Option 3: Submit a Manual Request to the Credit Bureaus: If you encounter any difficulties with the previous options, you can submit a manual request to the credit bureaus. This involves providing the necessary documentation and explaining the reason for your request. While this method might require more effort, it can be an effective way to check your child’s credit.

- Review the credit report: Once you receive the credit report, carefully review it for any signs of fraudulent activity or errors. Look for unknown accounts, balances, or inquiries that your child couldn’t have initiated.

- Keep a record: Maintain a record of the credit reports and any actions taken. This documentation can be valuable if you need to dispute any inaccuracies or fraudulent accounts in the future.

Remember, it’s essential to regularly check your child’s credit since any suspicious activity may go undetected for years. By taking these steps, you can stay vigilant and protect your child’s financial health from potential identity theft.

Option 1: Contact the Credit Bureaus

One of the primary options to check a child’s credit is by contacting the three major credit bureaus: Experian, Equifax, and TransUnion. Follow these steps to initiate the process:

- Collect necessary documents: Gather your child’s identifying information, such as their full name, date of birth, and Social Security number. You may also need to provide supporting documents, such as their birth certificate or Social Security card, to validate your request.

- Visit the credit bureau websites: Go to the websites of Experian, Equifax, and TransUnion. Navigate to the section specifically dedicated to checking a child’s credit report. These sections often contain detailed instructions on the required documents and procedures.

- Complete the necessary forms: Fill out the forms provided by each credit bureau, providing accurate information and following the specified guidelines. Ensure you include all the required documents when submitting the forms.

- Submit the request: Once you have completed the necessary forms and gathered all the required documents, submit your request to each credit bureau. Take note of any reference numbers or confirmation receipts provided as they may be useful for future correspondence.

- Wait for the credit reports: The credit bureaus will process your request and generate a credit report for your child. It may take a few weeks or longer to receive the reports, so be patient during this waiting period.

- Review the credit reports: Once you receive the credit reports, carefully review them for any inaccuracies, unknown accounts, or suspicious activity. Look for any discrepancies that could indicate identity theft or errors that need to be rectified.

- Take necessary action: If you notice any signs of fraudulent activity or errors on the credit reports, contact the credit bureaus immediately to report and dispute the inaccuracies. They will guide you on the steps to take to correct the information and secure your child’s credit.

By contacting the credit bureaus directly, you can obtain your child’s credit report and gain insights into their credit history. Regularly checking their credit will help you detect any fraudulent activity early on and take prompt action to protect their financial well-being.

Option 2: Use a Credit Monitoring Service

Another effective option for checking a child’s credit is to enlist the services of a reputable credit monitoring service. Here’s how this option works:

- Research and choose a credit monitoring service: Conduct thorough research to identify credit monitoring services that offer family plans or include options to monitor a child’s credit. Look for services with positive reviews and a solid reputation for providing comprehensive credit monitoring.

- Enroll in the family plan: Once you have selected a suitable credit monitoring service, enroll in their family plan. This plan typically allows you to monitor the credit reports and activities of multiple family members, including your child.

- Provide necessary information: During the enrollment process, you will need to provide the required information for your child, such as their name, date of birth, and Social Security number. This information is used to set up credit monitoring services specifically for your child.

- Receive real-time alerts: Once enrolled, the credit monitoring service will continuously monitor your child’s credit activity. If any suspicious activity or potential identity theft is detected, you will receive real-time alerts via email, text, or through their platform.

- Take immediate action: If you receive an alert indicating potential fraud or unauthorized activity on your child’s credit, take immediate action. Contact the credit monitoring service for guidance on the next steps to protect your child’s financial well-being.

- Regularly review credit reports: In addition to receiving alerts, credit monitoring services typically provide access to credit reports for you and your child. Regularly review these reports to identify any discrepancies or signs of identity theft.

- Resolve any issues: If you discover any fraudulent accounts or errors on your child’s credit report, the credit monitoring service can assist you in disputing and resolving these issues. They will guide you through the necessary steps to rectify the situation.

Using a credit monitoring service provides an added layer of protection for your child’s credit. With real-time alerts and continuous monitoring, you can detect any suspicious activity at an early stage and take swift action to mitigate the impact of identity theft.

Remember to choose a reputable and reliable credit monitoring service that offers comprehensive coverage and keeps your child’s sensitive information secure. Regularly review your options to ensure you have the most effective credit monitoring service for your child’s needs.

Option 3: Submit a Manual Request to the Credit Bureaus

If you encounter difficulties or prefer an alternative approach to checking your child’s credit, you can submit a manual request directly to the credit bureaus. Here are the steps involved:

- Gather necessary documentation: Collect the required documents to verify your identity as the parent or legal guardian, as well as your child’s information. This may include birth certificates, Social Security cards, and any supporting documentation requested by the credit bureaus.

- Contact the credit bureaus: Reach out to each of the three major credit bureaus – Experian, Equifax, and TransUnion – to inquire about their process for submitting a manual request to check your child’s credit. Visit their respective websites or call their customer service departments to obtain the necessary information.

- Complete the manual request forms: Obtain the appropriate forms from each credit bureau and complete them accurately. Include all the required information and supporting documentation as indicated by the credit bureau’s guidelines.

- Submit the request: Once you have completed the forms and gathered the necessary documentation, submit your manual request to each credit bureau. Pay attention to any specific instructions on where to send the forms and what additional documents may be needed.

- Wait for the credit reports: After submitting your manual request, allow the credit bureaus some time to process your request and generate a credit report for your child. The processing time may vary, so be patient during this waiting period.

- Review the credit reports: Once you receive the credit reports, carefully review them for any discrepancies, inaccuracies, or signs of fraudulent activity. Note any unknown accounts or unfamiliar information that could indicate identity theft.

- Take necessary action: If you identify any suspicious activity or errors on the credit reports, contact the credit bureaus immediately to initiate a dispute. Follow their guidance on the steps to take in order to address and resolve any inaccuracies or fraudulent accounts found.

Submitting a manual request to the credit bureaus gives you direct control over the process of checking your child’s credit. While it may require additional effort compared to other options, it can be an effective method to gain insight into your child’s credit history and detect any potential identity theft.

Stay in communication with the credit bureaus regarding your manual request and ensure that you follow up on any actions required to address any issues found on your child’s credit report. By doing so, you can actively protect your child’s credit and financial well-being.

Steps to Dispute Errors on a Child’s Credit Report

If you discover errors or fraudulent accounts on your child’s credit report, it’s crucial to take immediate action to dispute and rectify these issues. Follow these steps to dispute errors on your child’s credit report:

- Contact the credit bureaus: Reach out to each of the credit bureaus – Experian, Equifax, and TransUnion – that have reported the erroneous information on your child’s credit report. Contact their customer service departments or visit their websites to initiate a dispute.

- Provide supporting documentation: Gather any supporting documentation that proves the errors or fraudulent accounts on your child’s credit report. This may include birth certificates, Social Security cards, or any other evidence that supports your claim.

- Submit a written dispute: Draft a formal written dispute explaining the errors or fraudulent activity on your child’s credit report. Be concise, clear, and include specific details. Attach copies of the supporting documentation you have gathered as evidence.

- Send the dispute: Send the written dispute via certified mail with a return receipt requested to ensure it is delivered and that you have proof of delivery. Keep copies of the dispute letter and any related documents for your records.

- Follow up on the dispute: After sending the dispute, give the credit bureaus some time to investigate the matter. They have 30 days to respond to your dispute as per the Fair Credit Reporting Act (FCRA).

- Review the updated credit report: Once the credit bureaus have completed their investigation, review the updated credit report they provide. Verify that the errors or fraudulent accounts have been corrected or removed.

- Continue monitoring: After disputing the errors, it’s essential to continue monitoring your child’s credit report periodically to ensure that the issues have been resolved and there are no new cases of identity theft.

- Notify relevant parties: If you have identified fraudulent accounts on your child’s credit report, notify the involved creditors or financial institutions about the fraud. Provide them with any necessary documentation and work with them to close the fraudulent accounts.

- Consider a credit freeze: To further protect your child’s credit, consider placing a credit freeze on their profile. A credit freeze restricts access to their credit report, making it more difficult for potential identity thieves to open new accounts in their name.

Disputing errors on your child’s credit report requires persistence and thorough documentation. By following these steps and staying vigilant, you can rectify inaccuracies and ensure your child’s credit remains accurate and protected from identity theft.

Conclusion

Safeguarding your child’s credit is an essential part of their financial well-being. With the increasing prevalence of child identity theft, it is crucial for parents to take proactive steps to check and monitor their child’s credit. By doing so, you can detect any signs of fraudulent activity at an early stage, protect their financial future, and ensure their credit remains untarnished.

In this article, we explored the importance of checking a child’s credit, as well as the various methods available to do so. Whether you choose to contact the credit bureaus directly, utilize a credit monitoring service, or submit a manual request, each approach has its advantages in helping you stay informed about your child’s credit status.

We also discussed the potential ways in which children’s credit can be compromised, including social security number theft, family fraud, data breaches, online scams, and medical identity theft. Understanding these risks can help parents take necessary precautions to safeguard their child’s personal information.

Additionally, we delved into the signs of identity theft in children, such as unsolicited credit offers, notification from government agencies, collection calls, and inaccurate personal information. Being aware of these indicators enables parents to identify potential identity theft and take swift action to protect their child’s credit.

We outlined the steps to check a child’s credit, including contacting the credit bureaus, utilizing credit monitoring services, and submitting manual requests. Each option offers a different approach and level of convenience, allowing parents to choose the one that best suits their needs.

Lastly, we discussed how to dispute errors on a child’s credit report and emphasized the importance of ongoing monitoring to ensure the issues have been resolved and to protect against future identity theft.

By taking these steps proactively and staying vigilant, you can significantly minimize the risk of identity theft and protect your child’s financial future. Remember, checking a child’s credit is not just about their present financial well-being, but also about instilling valuable lessons about personal finance and security.

So, take the necessary measures today to check your child’s credit and provide them with a solid foundation for a secure financial future.