Finance

What Are Debt Capital Markets

Modified: December 30, 2023

Learn about debt capital markets and their significance in finance. Explore the key concepts, processes, and participants involved in this important field of financial markets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Debt capital markets play a pivotal role in the global financial landscape. As nations, corporations, and individuals seek funding for various projects and operations, debt capital markets provide a platform for raising capital through the issuance and trading of debt securities.

In simple terms, debt capital markets refer to the financial markets where debt instruments are bought and sold. These markets enable borrowers, such as governments and corporations, to raise funds by issuing debt securities to investors, who become creditors to the borrowers.

The importance of debt capital markets cannot be overstated. They facilitate the flow of capital from savers to borrowers, providing essential liquidity in the financial system. Debt capital markets are closely intertwined with the broader capital markets and are a critical component of the overall financial ecosystem.

This article will explore various aspects of debt capital markets, including their definition, roles, participants, instruments, functioning, advantages, and disadvantages. Additionally, we will examine real-life examples and case studies to highlight the practical applications of these markets. Furthermore, we will discuss current trends and future prospects to shed light on the evolving nature of debt capital markets.

Whether you are an investor looking for opportunities or a borrower seeking funding, understanding debt capital markets is crucial for navigating the complex world of finance. So, let’s dive in and explore the fascinating realm of debt capital markets.

Definition of Debt Capital Markets

Debt capital markets encompass the financial markets where debt instruments, such as bonds and loans, are issued, bought, and sold. These markets serve as a crucial avenue for borrowers to raise capital and for investors to deploy their funds in fixed-income securities.

Debt instruments are contractual obligations that represent a loan provided by the investor to the issuer. In return for the loan, the issuer promises regular interest payments and the repayment of the principal amount at maturity. Debt capital markets facilitate the issuance and trading of these instruments, providing avenues for both primary issuance and secondary market trading.

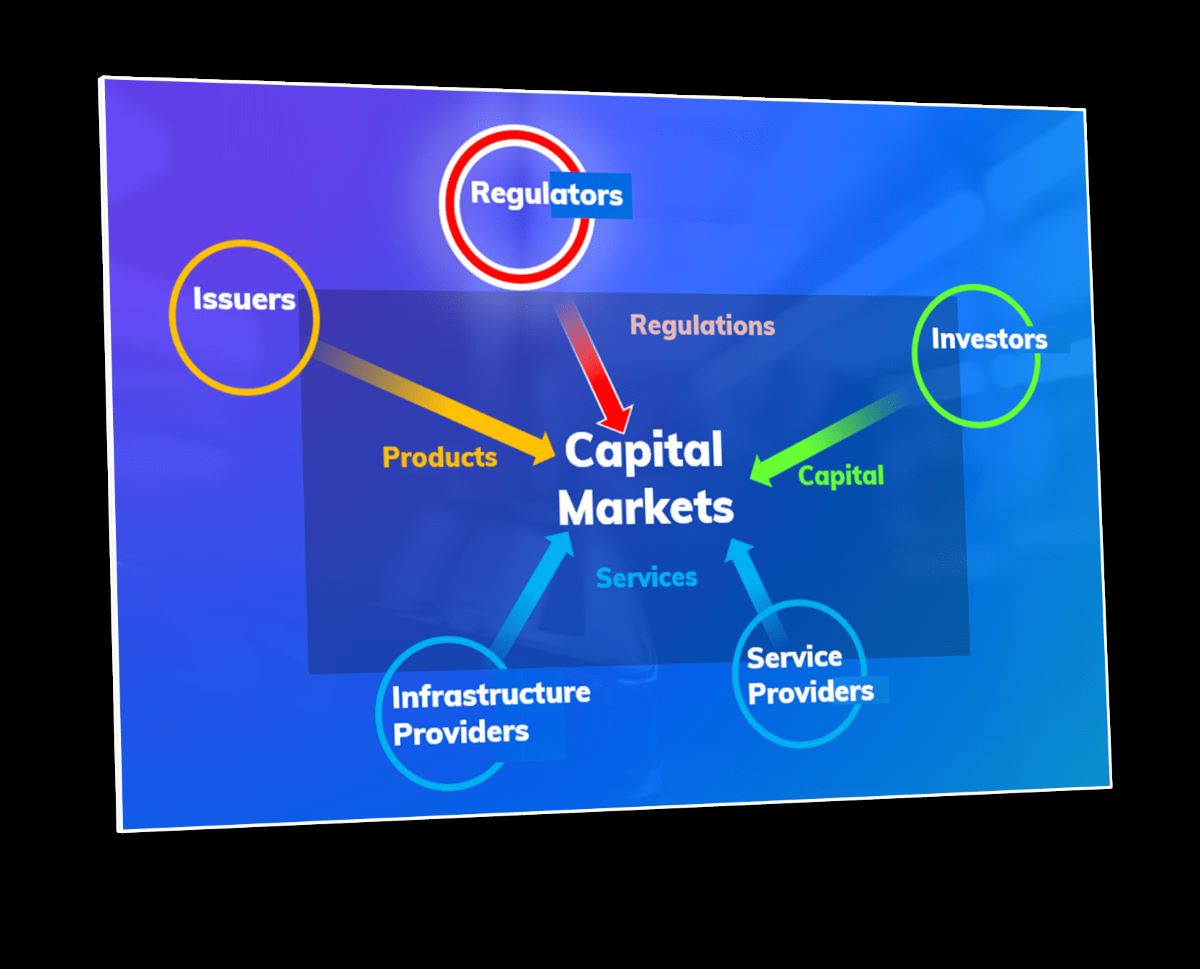

Debt capital markets are characterized by various features, including issuers, investors, intermediaries, and regulatory frameworks. Issuers can be governments, corporations, municipalities, or financial institutions seeking financing for their projects, operations, or investments. Investors, on the other hand, can be individuals, institutional investors, or other financial entities looking to deploy their capital in fixed-income securities.

Intermediaries, such as investment banks and broker-dealers, play a vital role in debt capital markets. They assist in the underwriting and distribution of debt securities, facilitating the process of matching borrowers with investors. These intermediaries also provide advisory services and market-making activities, ensuring liquidity in the debt capital markets.

The regulatory framework governing debt capital markets varies across jurisdictions. Regulatory bodies, such as securities commissions and central banks, establish rules and regulations to ensure fair and transparent trading practices. They also monitor compliance and enforce guidelines to protect investors and maintain the stability of the financial system.

Debt capital markets offer a wide range of advantages for both borrowers and investors. Borrowers can access funds at competitive interest rates, diversify their funding sources, and tailor their debt securities to meet specific financing needs. Investors, on the other hand, have the opportunity to earn fixed income, diversify their investment portfolios, and participate in the growth and stability of various sectors and economies.

Overall, debt capital markets serve as an essential component of the financial system, providing a platform for efficient capital allocation and risk management. Through the issuance and trading of debt securities, these markets contribute to economic growth, stability, and financial inclusivity.

Roles and Participants in Debt Capital Markets

Debt capital markets involve various roles and participants that are integral to their smooth functioning and efficiency. Understanding the key players in these markets can provide valuable insights into how debt financing operates.

1. Issuers

The primary participants in debt capital markets are the issuers. These can be governments, corporations, municipalities, or financial institutions that seek to raise funds by issuing debt securities. Issuers can vary in size, creditworthiness, and purpose of raising capital. They are responsible for structuring the terms of the debt securities, including interest rates, maturity dates, and repayment schedules.

2. Investors

Investors are crucial participants in debt capital markets. They provide the necessary capital to the issuers by purchasing the debt securities. Investors can be individuals, institutional investors, such as pension funds and insurance companies, or other financial entities. They analyze the risk-return characteristics of the debt securities and make investment decisions accordingly. Investors play a vital role in determining the demand and pricing of debt instruments.

3. Intermediaries

Intermediaries, such as investment banks, broker-dealers, and underwriters, act as facilitators in debt capital markets. They play a significant role in the issuance and distribution of debt securities. Intermediaries assist issuers in structuring their offerings, identifying potential investors, and conducting the underwriting process. They also provide advisory services, market-making activities, and secondary market liquidity to enhance the efficiency of debt capital markets.

4. Credit Rating Agencies

Credit rating agencies assess the creditworthiness of issuers and assign ratings to their debt securities. These ratings provide an independent evaluation of the issuer’s ability to meet its payment obligations. Investors rely on these ratings to make informed investment decisions. Credit rating agencies play a crucial role in ensuring transparency and providing valuable information to market participants.

5. Regulatory Bodies

Regulatory bodies, such as securities commissions and central banks, oversee and regulate debt capital markets. They establish rules and regulations to ensure market integrity, investor protection, and financial stability. Regulatory bodies monitor compliance with disclosure requirements, enforce fair trading practices, and intervene when necessary to maintain the soundness of the financial system.

6. Clearing and Settlement Systems

Clearing and settlement systems are infrastructure entities that facilitate the smooth transfer and finalization of transactions in debt capital markets. These systems ensure the timely and secure delivery of debt securities and the settlement of funds between buyers and sellers. Clearing and settlement systems play a crucial role in minimizing risks and enhancing the overall efficiency of debt capital markets.

Effective coordination and collaboration among these roles and participants are essential for the successful functioning of debt capital markets. Each participant has a unique role to play, contributing to the overall liquidity, transparency, and stability of these markets.

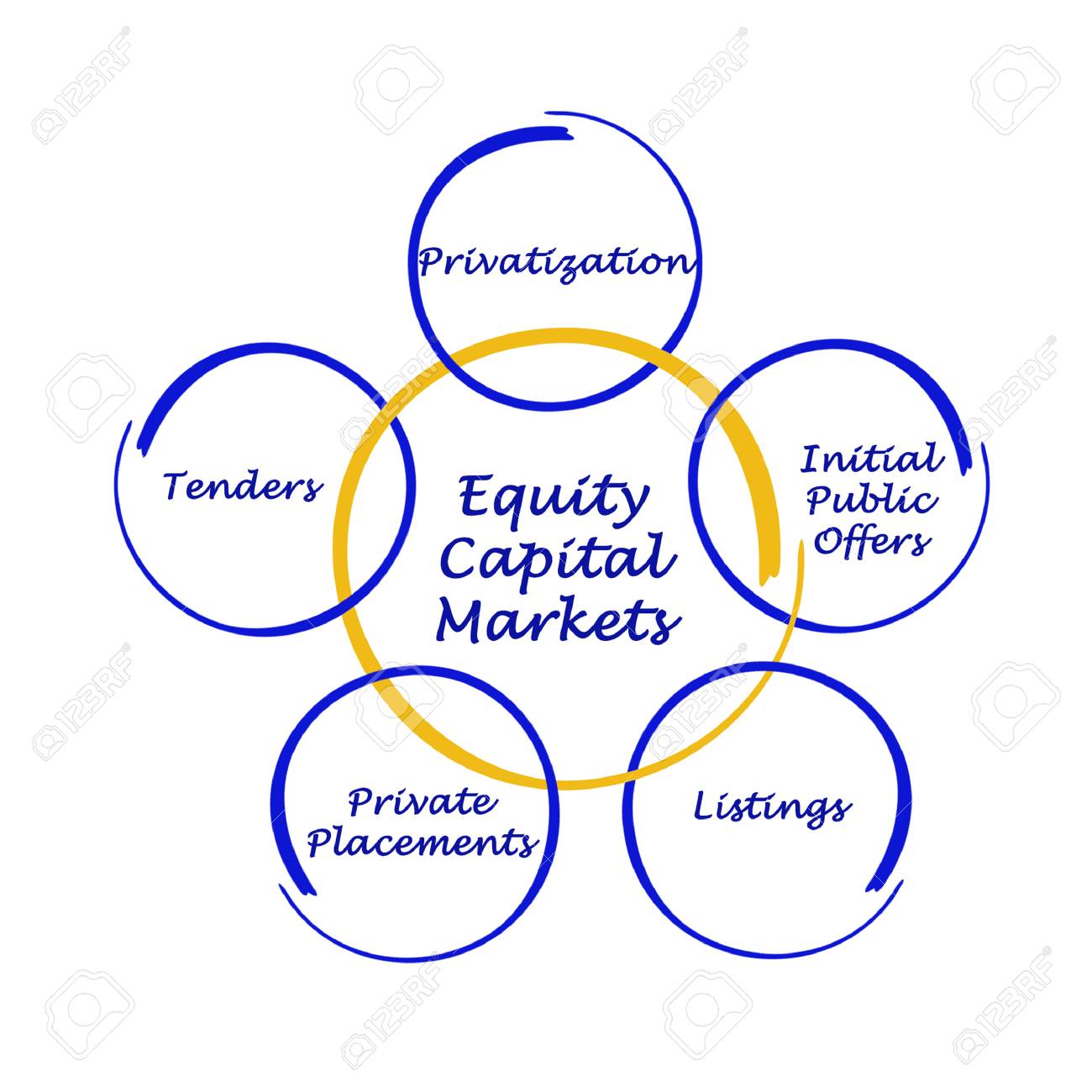

Debt Instruments and Securities

Debt capital markets feature a wide array of instruments and securities that serve as vehicles for borrowers to raise capital and investors to deploy their funds. These instruments come in different forms, offering various features and benefits to both issuers and investors.

1. Bonds

Bonds are one of the most common debt instruments in the capital markets. They are long-term debt securities typically issued by governments, municipalities, and corporations. Bonds have fixed coupon payments, representing the interest paid to investors, and a maturity date, at which the principal amount is repaid. They can be traded on secondary markets, offering liquidity to investors.

2. Treasury Bills

Treasury bills, also known as T-bills, are short-term debt instruments issued by governments to raise funds for short periods, usually less than a year. They are considered relatively low-risk investments as they are backed by government credit. T-bills are typically sold at a discount to their face value and do not pay periodic interest. Instead, investors receive the full face value upon maturity, effectively providing them with a return in the form of the discount earned at purchase.

3. Commercial Paper

Commercial paper is a short-term debt instrument issued by corporations to meet their immediate financing needs. It typically matures within 270 days and is often used to fund working capital requirements. Commercial paper is typically issued at a discount to its face value and does not pay periodic interest. Investors earn their return by receiving the full face value at maturity.

4. Loans

Loans are debt instruments where a borrower borrows funds from a lender and agrees to repay the principal plus interest over a specified period. Loans can be syndicated loans, where a group of lenders collectively provides the funds, or bilateral loans, where a single lender provides the financing. Loans may have fixed or variable interest rates and can be secured or unsecured, depending on the agreement between the borrower and lender.

5. Mortgage-Backed Securities

Mortgage-backed securities (MBS) are debt securities backed by a pool of mortgages. They represent an ownership interest in the cash flows generated by the underlying mortgage loans. MBS provide investors with exposure to the residential or commercial real estate markets and can be traded on secondary markets.

6. Asset-Backed Securities

Asset-backed securities (ABS) are debt securities backed by a pool of financial assets, such as loans, credit card receivables, or auto loans. The cash flows generated by the underlying assets are used to pay interest and principal to investors. ABS provide a way for issuers to monetize their assets while diversifying risk for investors.

These are just a few examples of debt instruments and securities that are prevalent in debt capital markets. Each instrument has its own risk-return profile, maturity, and liquidity characteristics, providing issuers and investors with a range of options to meet their specific needs and investment objectives.

Functioning of Debt Capital Markets

The functioning of debt capital markets can be divided into two main processes: primary market issuance and secondary market trading. Both processes play a crucial role in facilitating the flow of capital between borrowers and investors.

1. Primary Market Issuance

The primary market is where debt securities are initially brought to market through the process of issuance. During this stage, issuers, such as governments or corporations, sell new debt securities to raise funds. The primary market issuance involves several key steps:

- Financial Planning: Issuers assess their financing needs, determine the appropriate size and type of debt securities, and evaluate market conditions.

- Underwriting: Issuers may seek the assistance of investment banks or underwriters to help structure the offering, determine the pricing, and distribute the debt securities to potential investors.

- Marketing and Investor Solicitation: Issuers actively market the debt securities to potential investors through roadshows, presentations, and other communication channels. Investors evaluate the securities’ risk-return profile and submit their purchase bids.

- Allocation and Pricing: Once the investor bids are received, issuers, with the help of underwriters, allocate the debt securities based on the bids and determine the final price at which the securities will be sold.

- Legal and Documentation: Issuers ensure compliance with regulatory requirements, prepare the necessary legal documentation, and finalize the contractual terms and conditions of the debt securities.

2. Secondary Market Trading

The secondary market is where already-issued debt securities are bought and sold among investors. Secondary market trading provides liquidity and allows investors to adjust their portfolios, find new investment opportunities, or exit existing positions. This market operates through various trading platforms, such as exchanges or Over-The-Counter (OTC) markets. The key features of secondary market trading include:

- Price Determination: Prices of debt securities in the secondary market are influenced by factors such as market demand, interest rate movements, creditworthiness of the issuer, and overall market sentiment.

- Liquidity: The secondary market provides investors with the ability to buy or sell their debt securities at any time. This enhances market efficiency and allows investors to adjust their positions based on changing market conditions or investment objectives.

- Market Transparency: Real-time pricing information, trading volumes, and other market data are readily available to investors, ensuring transparency and informed decision-making.

- Trading Mechanisms: Secondary market trading can occur through various mechanisms, including auction-based trading, dealer-to-client trading, or electronic platforms. This allows for flexibility and accessibility for investors.

The functioning of debt capital markets relies on the participation and interaction of issuers, investors, intermediaries, and market infrastructure entities. Efficient functioning ensures capital flows between borrowers and investors, promotes liquidity, and contributes to overall market stability.

Advantages and Disadvantages of Debt Capital Markets

Debt capital markets offer various advantages and disadvantages to both borrowers and investors. Understanding these pros and cons is essential for making informed financial decisions and assessing the suitability of debt capital market participation.

Advantages of Debt Capital Markets:

1. Access to Capital:

Debt capital markets provide an avenue for borrowers to access a wide pool of capital from diverse investors. This allows businesses, governments, and municipalities to finance their projects and operations effectively.

2. Flexible Financing Options:

Debt capital markets offer flexibility in terms of financing options. Borrowers can tailor their debt securities to match specific funding needs, such as short-term financing through commercial paper or long-term funding with bonds.

3. Diversification of Funding Sources:

By accessing debt capital markets, borrowers can diversify their funding sources. Relying on multiple investors and debt instruments reduces dependence on a single lender and spreads the potential risk of default.

4. Fixed Income for Investors:

Debt capital markets provide investors with an opportunity to earn fixed income through the interest payments made by borrowers. This can be attractive for those seeking stable returns and cash flow generation.

5. Liquidity:

The secondary market in debt capital markets provides liquidity to investors, allowing them to buy or sell their debt securities based on market conditions or investment needs. This enhances market efficiency and enables investors to easily adjust their portfolios.

Disadvantages of Debt Capital Markets:

1. Interest Payments and Principal Repayment:

Borrowers are obligated to make regular interest payments and repay the principal amount at maturity. These fixed obligations can put a strain on the cash flow and financial flexibility of borrowers, particularly in periods of economic difficulty.

2. Credit Risk:

Investing in debt securities inherently involves credit risk. Investors face the possibility of borrowers defaulting on their interest payments or principal repayment. Higher-risk borrowers may offer higher interest rates, but they also carry a higher risk of default.

3. Interest Rate Risk:

The value of debt securities can fluctuate based on changes in interest rates. If interest rates rise, existing debt securities with fixed interest rates may become less attractive to investors, leading to potential price declines in the secondary market.

4. Regulatory and Compliance Factors:

Debt capital markets are subject to various regulatory requirements and compliance obligations. Issuers and investors must adhere to these rules to ensure transparency, fair trading practices, and investor protection. Regulatory changes can impact the costs, process, and attractiveness of participating in debt capital markets.

5. Market Volatility:

Debt capital markets can be subject to volatility, influenced by factors such as economic conditions, market sentiment, and geopolitical events. Sudden market fluctuations can impact the pricing and liquidity of debt securities, potentially affecting investor portfolios.

Overall, debt capital markets offer numerous advantages in terms of capital access, financing options, and income generation. However, they also come with certain risks and compliance considerations that must be carefully evaluated by both borrowers and investors.

Examples and Case Studies

Examining real-life examples and case studies can provide valuable insights into the practical applications of debt capital markets and their impact on various entities:

1. Government Bonds:

Government bonds are widely issued by countries to fund infrastructure projects, healthcare, and social welfare programs. For example, the United States Treasury regularly issues Treasury bonds to finance government initiatives and manage national debt. These bonds are publicly traded in the secondary market, offering investors a reliable fixed-income investment option.

2. Corporate Bonds:

Corporations utilize debt capital markets to raise funds for expansion, mergers and acquisitions, or operational requirements. For instance, in 2020, Apple Inc. issued $8.5 billion worth of corporate bonds to finance its capital return program and other corporate purposes. This allowed the company to benefit from the low-interest rate environment while providing investors with an opportunity to earn yield on their investments.

3. Municipal Bonds:

Local governments and municipalities often issue municipal bonds to raise capital for public infrastructure projects, education, and healthcare facilities. One example is the city of New York issuing municipal bonds to finance the construction of schools and hospitals. Investors who purchase these bonds are not only supporting the development of important community assets but also earning tax-exempt income.

4. Asset-Backed Securities:

Asset-backed securities (ABS) play a significant role in facilitating financing across industries. For instance, mortgage-backed securities (MBS) were at the center of the subprime mortgage crisis in 2008. The securitization of mortgage loans allowed financial institutions to raise funds by selling MBS to investors. However, the subsequent collapse of the U.S. housing market led to a significant decline in the value of these securities and had severe implications for global financial markets.

5. Green Bonds:

Green bonds are debt securities specifically issued to fund environmentally friendly projects. These bonds provide an avenue for investors to support sustainable initiatives while earning returns. An example is the issuance of green bonds by the International Finance Corporation (IFC) to finance renewable energy projects, such as wind farms and solar power plants.

These examples highlight the diverse range of applications and outcomes in debt capital markets. From government financing to corporate expansion and sustainable initiatives, debt capital markets serve as a vital source of funding for various entities and projects.

Current Trends and Future Outlook

Debt capital markets are continuously evolving to adapt to the changing landscape of the global financial industry. Several current trends and future developments are shaping the future of these markets:

1. Sustainable Investing:

There is a growing focus on sustainable investing, and debt capital markets are no exception. The issuance of green bonds and other sustainable debt instruments has gained significant traction in recent years. Investors are increasingly seeking opportunities to support projects that have a positive environmental and social impact, leading to a rise in sustainable debt issuance.

2. Technology and Innovation:

Technological advancements are reshaping the debt capital markets landscape. The use of blockchain technology, smart contracts, and artificial intelligence is streamlining processes, enhancing transparency, and improving efficiency. Digital platforms are emerging to facilitate the issuance, trading, and settlement of debt securities, providing investors with easier access to the market.

3. Rise of ESG Criteria:

Environmental, Social, and Governance (ESG) criteria are increasingly considered by investors in their decision-making process. Debt issuers are incorporating ESG factors into their financing strategies and reporting. This trend is driving the demand for ESG-focused debt instruments and influencing the behavior of market participants.

4. Increased Role of Non-traditional Issuers:

While governments and corporations have been the dominant issuers in debt capital markets, non-traditional participants are increasingly entering the market. Start-ups, small and medium-sized enterprises, and even municipalities are seeking alternative sources of financing by tapping into the debt capital markets.

5. Regulatory Changes:

The regulatory environment governing debt capital markets is constantly evolving. Regulatory changes aim to enhance market transparency, protect investors, and ensure financial stability. Market participants need to stay abreast of regulatory developments and comply with the evolving guidelines governing debt issuances and trading activities.

Future Outlook:

The future of debt capital markets looks promising, driven by ongoing innovation and market dynamics. Some key areas to watch include:

1. Sustainable Debt and Social Bonds:

The issuance of sustainable debt and social bonds is expected to continue growing as investors prioritize ESG considerations and governments commit to environmental goals. This trend will contribute to the development of a more sustainable economy.

2. Increased Digitization:

Technology will play an increasingly significant role in debt capital markets. The utilization of blockchain, automation, and data analytics will streamline processes, improve efficiency, and enhance transparency. Digital platforms will provide investors with greater access to debt capital markets.

3. Regulatory Reforms:

Regulators will continue to refine and adapt rules governing debt capital markets to ensure investor protection, market integrity, and financial stability. These reforms may include increased disclosure requirements, standardized practices, and enhanced risk management frameworks.

4. Emerging Market Opportunities:

Debt capital markets in emerging economies are poised for growth. As these economies continue to develop and integrate into the global financial system, there will be increased opportunities for issuers and investors to participate in debt capital markets.

In summary, debt capital markets are evolving in response to sustainability goals, technological advancements, changing investor preferences, and regulatory reforms. The future of these markets looks promising, offering opportunities for diverse issuers and investors to access capital, support sustainable initiatives, and drive economic growth.

Conclusion

Debt capital markets play a vital role in the global financial landscape, providing a platform for borrowers to raise capital and investors to deploy their funds. These markets facilitate the issuance and trading of debt securities, offering various advantages such as access to capital, flexible financing options, and diversification of funding sources.

Participants in debt capital markets, including issuers, investors, intermediaries, and regulatory bodies, each play a crucial role in the functioning and efficiency of these markets. From government bonds and corporate debt to asset-backed securities and green bonds, a wide array of debt instruments are available to meet diverse financing needs.

However, it is important to consider the potential disadvantages of debt capital markets, including credit risk, interest rate risk, and regulatory compliance factors. These markets are also influenced by current trends, such as sustainable investing, technological advancements, and the rise of ESG criteria. By staying attuned to these trends and future developments, market participants can navigate the evolving landscape and capitalize on emerging opportunities.

In conclusion, debt capital markets are dynamic and essential components of the financial system. They facilitate efficient capital allocation, risk management, and economic growth. Whether you are a borrower seeking funding or an investor looking for fixed-income opportunities, understanding the functions, advantages, and challenges of debt capital markets is crucial for informed decision-making and successful financial outcomes.