Finance

How To Pass A Credit Check

Modified: February 25, 2024

Learn how to pass a credit check and secure financing with our comprehensive guide. Boost your chances of approval and take control of your financial future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Checks

- Preparing Your Credit Report

- Checking for Errors on Your Credit Report

- Paying Off Outstanding Debts

- Building a Positive Credit History

- Minimizing Credit Applications

- Maintaining a Stable Employment History

- Providing Sufficient Proof of Income

- Paying Bills on Time

- Reducing Your Debt-to-Income Ratio

- Keeping Credit Utilization Low

- Seeking Professional Help

- Conclusion

Introduction

In today’s financial landscape, credit checks play a crucial role in determining an individual’s eligibility for various financial opportunities. Whether you’re applying for a loan, a mortgage, or a credit card, your creditworthiness will be assessed through a credit check. Passing a credit check is essential to secure favorable interest rates, higher credit limits, and other financial benefits.

Understanding how credit checks work and taking steps to improve your credit profile can greatly increase your chances of success. This article will provide you with valuable insights and strategies to pass a credit check with flying colors.

It’s important to note that a credit check examines your credit history, which includes factors such as payment history, outstanding debts, credit utilization, and length of credit history. Your credit score, which is a numerical representation of your creditworthiness, is also taken into consideration. By proactively managing these aspects of your financial life, you can significantly improve your chances of passing a credit check.

So, whether you’re preparing to apply for a new credit card, a car loan, or a mortgage, read on to discover the key steps you can take to pass a credit check successfully.

Understanding Credit Checks

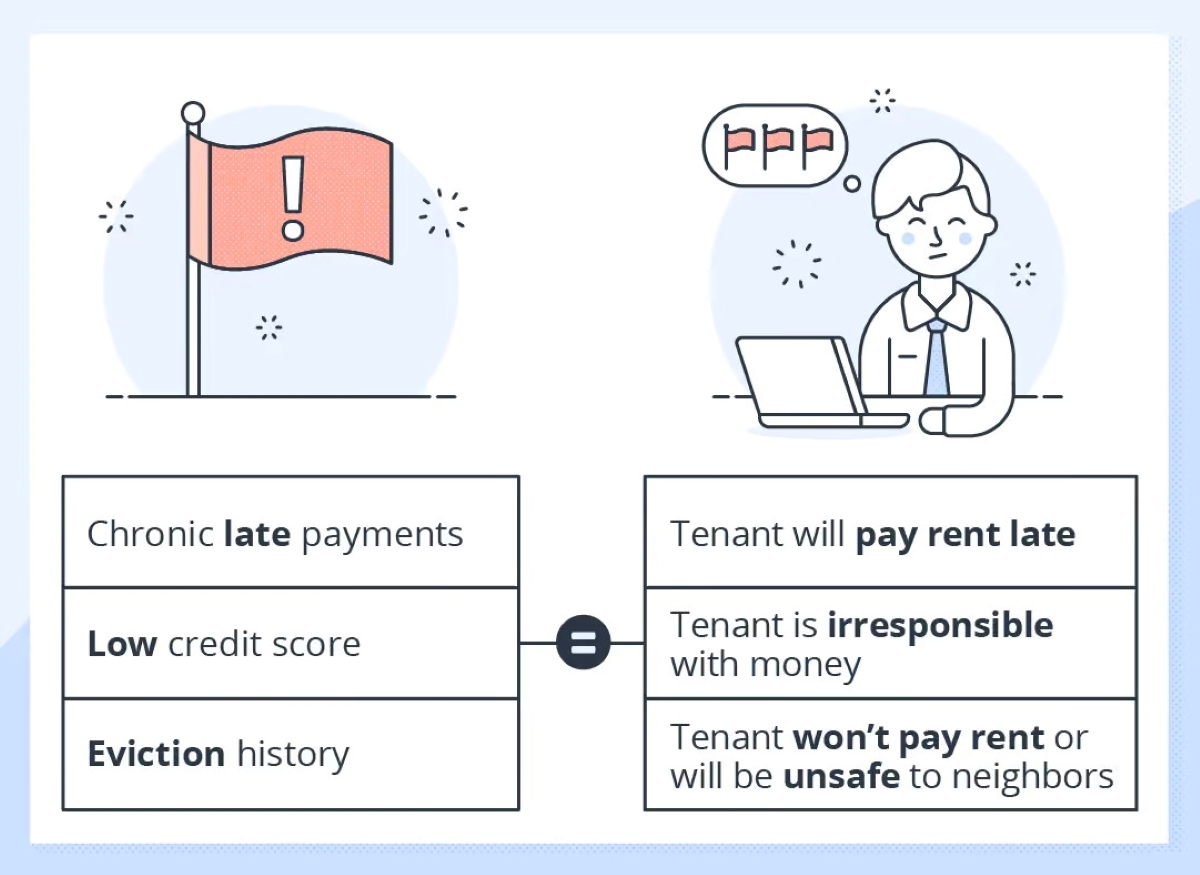

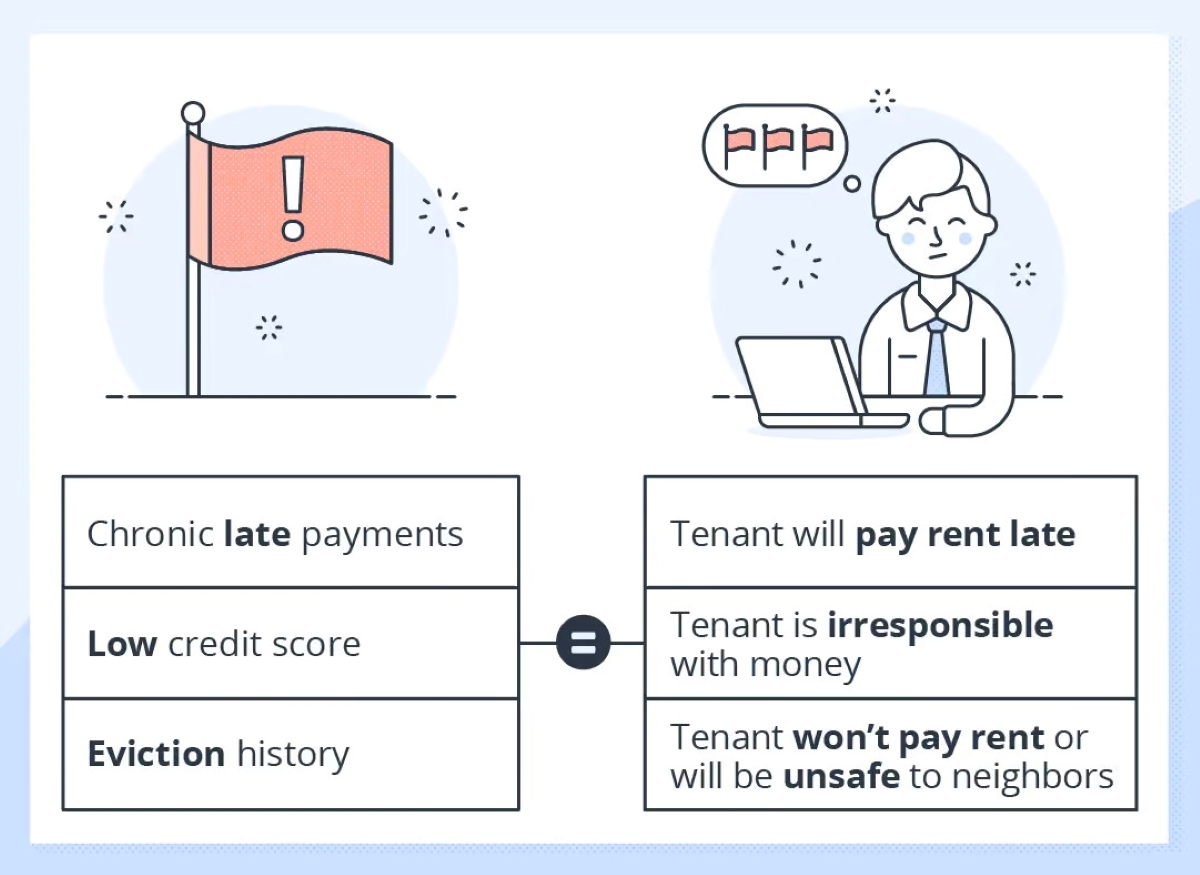

Before diving into the strategies for passing a credit check, it’s important to understand what a credit check actually entails. A credit check is a process conducted by financial institutions, lenders, or credit card issuers to assess an individual’s creditworthiness and evaluate the risk of lending money to them.

During a credit check, the lender or institution reviews your credit report and credit score to gauge your financial responsibility and ability to repay debts. The credit report contains information such as your payment history, current debts, credit limits, and any negative marks like late payments or defaults.

Based on this information, the lender determines whether to approve your credit application, loan, or mortgage, and at what terms. A high credit score and a positive credit history increase your chances of approval and may result in favorable loan terms, such as lower interest rates.

It’s important to note that there are two types of credit checks: hard inquiries and soft inquiries. Hard inquiries occur when you initiate a credit application, such as applying for a loan or a new credit card. These inquiries can temporarily impact your credit score. Soft inquiries, on the other hand, are typically initiated by lenders for pre-approved offers or background checks. Soft inquiries do not affect your credit score.

Now that you have a better understanding of what a credit check entails, let’s explore the steps you can take to improve your chances of passing with flying colors.

Preparing Your Credit Report

One of the first steps you should take when preparing to pass a credit check is to review and prepare your credit report. Your credit report is a detailed record of your credit history and serves as the basis for credit checks conducted by lenders or financial institutions.

Start by obtaining a copy of your credit report from one of the major credit bureaus, such as Equifax, Experian, or TransUnion. You are entitled to a free copy of your credit report once a year, so take advantage of this opportunity to review your financial standing.

Once you have your credit report in hand, carefully review it for any errors or inaccuracies. Incorrect information on your credit report can negatively impact your credit score and hamper your chances of passing a credit check. Look for any discrepancies in your personal information, accounts, payment history, or credit limits.

If you spot any errors, it’s important to dispute them with the credit bureau. Contact the credit bureau in writing, providing clear documentation to support your claim. The credit bureau will investigate the matter and make the necessary corrections if the error is found.

Alongside reviewing and correcting errors, it’s essential to address any outstanding debts or negative marks on your credit report. Make a plan to pay off any overdue balances or collections accounts and work towards improving your payment history.

In addition to addressing negative marks, it’s important to ensure that your credit report is reflective of your current financial situation. If you have closed accounts that are still showing as open or outdated information, contact the credit bureau to have them updated.

Taking the time to thoroughly review and prepare your credit report will not only help you pass a credit check but also provide you with an accurate representation of your financial standing. By addressing inaccuracies and ensuring that your credit report is up to date, you’ll be in a stronger position to demonstrate your creditworthiness to lenders.

Checking for Errors on Your Credit Report

When preparing to pass a credit check, one crucial step is to carefully check your credit report for any errors or inaccuracies. Errors on your credit report can have a detrimental impact on your credit score and may lead to a lower likelihood of passing a credit check.

Start by obtaining a copy of your credit report from one of the major credit bureaus, such as Equifax, Experian, or TransUnion. You are entitled to a free copy of your credit report once a year, so take advantage of this opportunity to review your financial standing.

Once you have your credit report, review it thoroughly, paying close attention to the following areas:

- Personal Information: Check for any incorrect personal details, such as your name, address, or social security number. Even a minor error in personal information could lead to confusion or misidentification.

- Account Information: Go through each account listed on your credit report and carefully verify the details. Ensure that the account balances, credit limits, and payment history are accurately reflected. Look for any accounts that you don’t recognize, as this could be a sign of identity theft.

- Payment History: Examine the payment history for each account. Verify that any reported late payments or missed payments are accurate. If you believe there’s an error in the payment history, gather any supporting documentation and be prepared to dispute it.

- Public Records: Check for any bankruptcies, tax liens, or judgments listed on your credit report. Ensure that any items that have been resolved or should have been removed are no longer appearing.

- Credit Inquiries: Pay attention to the inquiries section, which lists the entities that have accessed your credit report. Verify that you recognize each inquiry and inquire about any inquiries that you don’t recall.

If you come across any errors or inaccuracies while reviewing your credit report, it’s important to take action to correct them. You can initiate a dispute with the credit bureau reporting the error, providing them with clear documentation to support your claim.

Remember, addressing errors on your credit report can significantly improve your credit score and increase your chance of passing a credit check. Be diligent in checking your credit report regularly to ensure its accuracy and protect your creditworthiness.

Paying Off Outstanding Debts

When it comes to passing a credit check, one of the most effective strategies is to pay off outstanding debts. Outstanding debts can have a negative impact on your credit score and signal financial instability to lenders. By prioritizing debt repayment, you can improve your credit profile and increase your chances of passing a credit check.

Start by creating a comprehensive list of all your outstanding debts. This includes credit card balances, loans, medical bills, or any other forms of debt. Once you have a clear picture of your debt obligations, develop a repayment plan.

Consider using a debt repayment strategy that best suits your financial situation. The two popular methods are the snowball method and the avalanche method. The snowball method entails paying off the smallest debts first, while the avalanche method focuses on paying off debts with the highest interest rates first. Choose the approach that aligns with your goals and motivates you to stay on track.

To accelerate your debt repayment, consider reallocating your budget and cutting back on unnecessary expenses. Devote any extra funds towards paying down your debts. Additionally, explore opportunities to generate additional income to expedite the repayment process.

Another effective strategy is to negotiate with your creditors. Reach out to them and try to negotiate more favorable terms, such as reduced interest rates or payment plans that fit your budget. Many creditors are willing to work with you to find a mutually beneficial solution.

As you make progress with your debt repayment, don’t forget to update your credit report accordingly. Contact the credit bureaus to ensure that your reduced balances and paid-off debts are accurately reflected in your credit report. This step will positively impact your credit score and demonstrate your commitment to financial responsibility.

Remember, paying off outstanding debts not only improves your credit profile, but it also has long-term benefits for your financial well-being. By reducing your debt burden, you’ll have more financial flexibility and be better positioned to handle future credit obligations.

Building a Positive Credit History

Building a positive credit history is essential for passing a credit check and demonstrating your creditworthiness to lenders. A strong credit history shows that you have a track record of responsible borrowing and repayment, which increases your odds of passing a credit check with flying colors. Here are some strategies to help you build a positive credit history:

- Open a credit account: If you don’t already have any credit accounts, consider opening one to start building your credit history. This could be a credit card or a small personal loan. Make sure to use the credit responsibly and make timely payments to showcase your financial reliability.

- Make payments on time: Paying all your bills and credit obligations on time is crucial for building a positive credit history. Late payments can negatively impact your credit score and raise red flags for lenders. Set up reminders or automatic payments to ensure you never miss a payment.

- Keep credit utilization low: Credit utilization refers to the percentage of your available credit that you’re using. Aim to keep this below 30% to demonstrate responsible credit management. For example, if you have a credit card with a $1,000 limit, aim to keep your balance below $300.

- Keep accounts active: It’s important to have active credit accounts to establish a credit history. Avoid closing old credit cards unless absolutely necessary, as the length of your credit history plays a role in your credit score. Even if you don’t use these accounts frequently, periodic activity can help maintain a positive credit history.

- Diversify your credit mix: Having a mix of different types of credit can strengthen your credit history. This includes a combination of credit cards, loans, and mortgages, showing lenders that you can manage various forms of credit responsibly.

- Monitor your credit regularly: Regularly checking your credit report allows you to identify any errors or issues that need to be addressed. Monitoring your credit also helps you stay aware of your financial standing and take proactive steps to maintain a positive credit history.

Building a positive credit history takes time and consistency. By following these strategies and being responsible with your credit, you can establish a strong credit profile that increases your chances of passing a credit check and securing favorable financial opportunities in the future.

Minimizing Credit Applications

When preparing to pass a credit check, it’s important to minimize the number of credit applications you make. Each time you apply for new credit, the lender conducts a hard inquiry on your credit report, which can temporarily lower your credit score. Excessive applications or a history of rejections can raise concerns for lenders and reduce your chances of passing a credit check. Here are some strategies to help you minimize credit applications:

- Assess your financial needs: Before applying for new credit, carefully evaluate whether you truly need it. Avoid applying for credit impulsively or taking on unnecessary debt. Instead, focus on managing your existing credit responsibly.

- Research and compare options: Do thorough research and compare different lenders and credit products before making a credit application. Look for options that align with your needs and have a higher chance of approval. This approach reduces the need for multiple applications.

- Check pre-approval offers: Some lenders offer pre-approval or pre-screened credit offers. These offers indicate that you meet their initial criteria and have a higher likelihood of approval. Utilize these offers to minimize the number of credit applications.

- Apply selectively: Only apply for credit when you’ve done your due diligence and believe you have a good chance of approval. Apply for credit strategically and avoid submitting multiple applications within a short period.

- Space out applications: Spacing out your credit applications by at least several months allows your credit score to recover from the impact of a hard inquiry. Applying for credit sparingly over time demonstrates responsible borrowing and minimizes the negative effect on your credit score.

Minimizing credit applications not only improves your chances of passing a credit check, but it also helps maintain a healthy credit profile. By being selective and strategic with your credit applications, you can protect your credit score and increase your likelihood of being approved when it matters most.

Maintaining a Stable Employment History

Having a stable employment history is an important factor that lenders consider when conducting a credit check. A consistent and reliable source of income gives lenders confidence that you have the means to repay any credit or loans. Here are some strategies to help you maintain a stable employment history:

- Commit to long-term employment: Demonstrate your commitment to your current job by staying with the same employer for an extended period. Lenders appreciate job stability and view it as a positive indicator of financial responsibility.

- Avoid frequent job changes: While it’s understandable that career growth and changes are a normal part of professional life, too many job changes in a short span can raise concerns for lenders. Aim for stability and avoid unnecessary job hopping.

- Communicate career changes: If you do decide to change jobs, notify your lender or financial institution about the change. Providing updated employment information demonstrates transparency and allows them to have an accurate picture of your current employment situation.

- Be prepared to provide documentation: Lenders may require documentation of your employment history, such as pay stubs, tax returns, or employment verification letters. Keep these documents organized and readily available to provide when necessary.

- Stay on top of your performance: Maintain a strong work ethic and strive for excellence in your employment. Building a solid reputation as a reliable and dependable employee can positively impact how lenders perceive you during a credit check.

- Show career progression: Continuously update your skills and seek opportunities for career advancement. A track record of career growth and professional development reflects positively on your financial stability and can enhance your creditworthiness.

Remember, a stable employment history indicates to lenders that you have a consistent income and are capable of repaying any credit or loans. By focusing on job stability and maintaining a strong work record, you increase your chances of passing a credit check and accessing favorable financial opportunities.

Providing Sufficient Proof of Income

When going through a credit check, it’s vital to provide sufficient proof of income to lenders. A steady and reliable income stream reassures lenders that you have the means to repay any credit or loans extended to you. Here are some strategies to help you provide sufficient proof of income:

- Pay stubs: Pay stubs are one of the most common forms of proof of income. Make sure to keep your pay stubs organized and readily available. They provide detailed information about your earnings, deductions, and employer contributions.

- Employment verification letter: An employment verification letter is a formal document from your employer that confirms your employment status, position, salary, and any other relevant details. This letter carries significant weight in proving your income and can be requested from your HR department.

- Bank statements: Providing your bank statements showcases your income and financial stability. Make sure to provide several months’ worth of statements to demonstrate a consistent income flow into your accounts.

- Tax returns: Tax returns, specifically the Form 1040, highlight your reported income for the previous year. For self-employed individuals, providing several years of tax returns can help establish a stable income pattern.

- Contracts or invoices: If you’re self-employed or work on a contractual basis, providing copies of contracts or invoices can serve as proof of your income. These documents demonstrate that you have a source of income and can showcase your earning potential.

- Profit and loss statements: For business owners, profit and loss statements provide a comprehensive overview of your business’s financial performance. These statements can be used to support your income claims and demonstrate the stability of your business.

Ensure that the documents you provide are up-to-date, accurate, and clearly showcase your income. It’s crucial to be transparent and honest during the credit check process. Lenders rely on these documents to assess your creditworthiness and decide whether to approve your credit application.

By providing sufficient proof of income, you increase your chances of passing a credit check and build confidence with lenders that you have the financial capabilities to manage debt responsibly.

Paying Bills on Time

Paying your bills on time is a crucial aspect of passing a credit check and maintaining good credit standing. Timely bill payments demonstrate responsible financial behavior and showcase your ability to manage credit obligations. Here are some strategies to help you stay on top of your bill payments:

- Create a budget: Start by creating a monthly budget that includes all of your expenses, such as rent/mortgage payments, utilities, credit card bills, and loans. This allows you to allocate funds accordingly and avoid missing payment due dates.

- Set up reminders: Use technology to your advantage by setting up reminders for bill payments. You can set calendar alerts on your phone or use budgeting apps that send notifications when payments are due.

- Automate payments: Consider automating your bill payments through your bank or credit card issuer. This ensures that payments are made on time, even if you forget to manually initiate them. However, it’s important to regularly review your accounts to ensure sufficient funds are available.

- Designate specific payment days: Choose specific days of the month to review and pay your bills. By establishing a routine, you can develop a habit of consistently paying bills on time.

- Consider payment options: Explore different payment methods to find what works best for you. Some companies and service providers may offer online bill payment options, allowing you to conveniently submit payments from the comfort of your home.

- Anticipate delays: Take into account potential delays in processing payments, particularly if you’re mailing checks or using slower payment methods. Adjust your payment schedule accordingly to ensure your payments arrive before the due dates.

- Address any financial challenges: If you’re facing financial difficulties and anticipate difficulty in making payments, reach out to your creditors or service providers. They may be able to offer temporary payment arrangements or alternative options to help you stay on track.

Paying your bills on time not only helps you pass a credit check but also helps you maintain a positive credit history and avoid late payment penalties. By staying organized, utilizing reminders and automation, and communicating with your creditors, you can ensure that your bills are consistently paid on time.

Reducing Your Debt-to-Income Ratio

Reducing your debt-to-income ratio is a crucial step in passing a credit check and demonstrating your financial health to lenders. Your debt-to-income ratio compares the amount of debt you have to your overall income. Lowering this ratio shows lenders that you have a manageable level of debt relative to your income. Here are some strategies to help you reduce your debt-to-income ratio:

- Create a budget and analyze your expenses: Start by evaluating your current financial situation. Create a detailed budget that outlines your income and all of your expenses. This will provide you with a clear understanding of where your money is going and allow you to identify areas where you can cut back on spending.

- Pay more than the minimum payment: If you have credit card balances or loans, paying only the minimum amount due prolongs the time it takes to pay off your debt and contributes to a higher debt-to-income ratio. Whenever possible, pay more than the minimum payment to speed up the repayment process.

- Develop a debt repayment plan: Prioritize your debt repayments by focusing on high-interest debts first. Consider the snowball method or the avalanche method to systematically pay off your debts and gain momentum as you see progress.

- Reduce unnecessary expenses: Take a close look at your spending habits and identify areas where you can cut back. This might involve sacrificing luxuries, dining out less frequently, or finding cost-effective alternatives for entertainment and everyday expenses.

- Consider debt consolidation: Debt consolidation allows you to combine multiple debts into a single loan with a potentially lower interest rate. This simplifies repayment and can help lower your debt-to-income ratio. However, be cautious and weigh the pros and cons before pursuing consolidation.

- Explore balance transfers: If you have high-interest credit card debt, consider transferring the balance to a card with a lower interest rate. This strategy can save you money on interest payments and help you pay off your debt more efficiently.

- Seek professional advice: If you’re struggling to manage your debt effectively, consider consulting with a financial advisor or credit counselor. They can provide guidance tailored to your specific situation and help you develop a personalized plan to reduce your debt-to-income ratio.

By following these strategies and actively working towards reducing your debt, you can lower your debt-to-income ratio and improve your financial standing. This not only increases your chances of passing a credit check but also helps you achieve long-term financial stability and freedom from excessive debt.

Keeping Credit Utilization Low

Keeping your credit utilization low is a key factor in passing a credit check and maintaining a healthy credit profile. Credit utilization refers to the percentage of your available credit that you are currently using. Lenders often view low credit utilization as a sign of responsible credit management. Here are some strategies to help you keep your credit utilization low:

- Pay off balances in full: Make it a priority to pay off your credit card balances in full each month. This ensures that you’re not carrying any revolving debt from month to month, which can contribute to higher credit utilization ratios.

- Spread out credit card spending: If you do need to make larger purchases, consider spreading them out across multiple billing cycles. By doing so, you can avoid maxing out any single credit card and keep your credit utilization ratio low.

- Increase credit limits: Another way to lower your credit utilization ratio is by requesting a credit limit increase on your credit cards. This can be done by contacting your credit card issuer and providing them with updated income and financial information.

- Monitor your credit utilization ratio: Regularly keep track of your credit utilization ratio across all your credit accounts. Aim to keep your overall utilization below 30%. If you notice that your credit utilization is creeping up, consider adjusting your spending or increasing your payments to bring it back down.

- Diversify your credit: Having a diverse mix of credit accounts, such as credit cards and installment loans, can help keep your credit utilization low. By having access to multiple credit sources, you can spread out your balances and avoid relying heavily on one type of credit.

- Avoid closing old credit accounts: Closing old credit accounts may seem like a good idea, but it can actually harm your credit utilization. Keep your old accounts open, even if you don’t use them regularly, to maintain a longer credit history and a larger pool of available credit.

By keeping your credit utilization low, you demonstrate responsible credit management and increase your chances of passing a credit check. Lenders view low credit utilization as a positive signal of financial stability, which can result in more favorable terms and opportunities for future credit.

Seeking Professional Help

If you’re struggling to navigate the complexities of passing a credit check or managing your finances, seeking professional help can be a valuable option. Financial professionals and credit counseling agencies can provide expert guidance tailored to your specific situation. Here are some ways in which seeking professional help can benefit you:

- Credit counseling: Credit counseling agencies offer guidance and support for improving your credit health. They can review your credit report, help you understand its contents, and provide personalized advice on how to improve your credit profile. They may also offer debt management plans to help you repay your debts more effectively.

- Financial advisors: A financial advisor can provide comprehensive guidance on various financial matters, including passing a credit check. They can help you develop a realistic budget, create a debt repayment plan, and provide suggestions on how to improve your overall financial standing.

- Debt settlement: If you’re overwhelmed with debt, a professional debt settlement company can negotiate with your creditors on your behalf to reduce the amount you owe. They can help you develop a repayment plan that is more manageable, potentially saving you money and helping you become debt-free sooner.

- Bankruptcy attorney: If you’re facing significant financial challenges and have explored other options without success, consulting with a bankruptcy attorney may be necessary. They can help you understand the implications of bankruptcy and guide you through the process, ensuring that you meet all legal requirements.

When seeking professional help, it’s important to do thorough research and choose reputable individuals or agencies. Look for professionals with appropriate certifications, positive reviews, and a track record of helping clients in similar situations. Additionally, be aware of any fees associated with their services and ensure they are transparent about their process and the potential outcomes.

Remember, seeking professional help shows a proactive approach to managing your financial well-being and can provide you with the expertise and support needed to navigate the challenges of passing a credit check successfully.

Conclusion

Passing a credit check is crucial for accessing various financial opportunities such as loans, mortgages, and credit cards. By implementing the strategies discussed in this article, you can greatly increase your chances of passing a credit check with flying colors and establishing a strong credit profile.

Start by understanding the importance of credit checks and how they are used by lenders to assess your creditworthiness. Review your credit report regularly, checking for errors and addressing any outstanding debts or negative marks. Build a positive credit history by responsibly managing your credit accounts, paying bills on time, and keeping your credit utilization low.

Additionally, maintaining a stable employment history and providing sufficient proof of income demonstrates financial reliability to lenders. Minimizing credit applications and seeking professional help when needed can also be beneficial for passing a credit check.

Remember, passing a credit check is not just about securing financial opportunities; it’s about building a strong foundation for your financial future. By implementing these strategies and being proactive with your financial management, you’ll not only pass credit checks but also lay the groundwork for long-term financial success.

Keep in mind that each individual’s financial situation is unique, and it may take time to see significant improvements. Patience, persistence, and consistency are key. Begin incorporating these strategies into your financial routine and watch as your creditworthiness and financial well-being improve over time.