Finance

How To Contest A Late Fee

Published: February 22, 2024

Learn how to contest a late fee and manage your finances effectively with our expert tips and advice. Take control of your financial situation today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

**

Introduction

**

Late fees can be a frustrating aspect of managing personal finances. Whether it's a credit card payment, a loan installment, or a utility bill, unexpected circumstances can sometimes lead to missing a payment deadline. Late fees not only add to the financial burden but can also negatively impact your credit score. However, there are steps you can take to contest a late fee and potentially have it waived or reduced.

In this comprehensive guide, we will explore the various strategies and approaches you can use to contest a late fee. From understanding the nature of late fees to reviewing the terms and conditions of your agreement, and from contacting the creditor to seeking legal assistance, we will provide you with the knowledge and tools to navigate this process effectively.

Contesting a late fee requires a combination of understanding your rights as a consumer, effective communication with the creditor, and in some cases, seeking professional advice. By following the steps outlined in this guide, you can empower yourself to address late fees assertively and protect your financial well-being.

Let's delve into the intricacies of contesting late fees and equip ourselves with the information needed to navigate this aspect of personal finance effectively.

Understanding Late Fees

Before contesting a late fee, it’s essential to understand what it entails and how it affects your financial obligations. A late fee is a penalty charged by creditors when a payment is not made by the due date specified in the agreement. This fee is typically outlined in the terms and conditions of the financial arrangement, such as a credit card agreement or a loan contract.

Late fees can vary in amount and are often calculated as a percentage of the overdue payment or a flat fee. It’s crucial to review the specific terms of your agreement to ascertain the exact late fee structure. Understanding the details of the late fee, including the amount and the conditions under which it applies, is the first step in contesting it effectively.

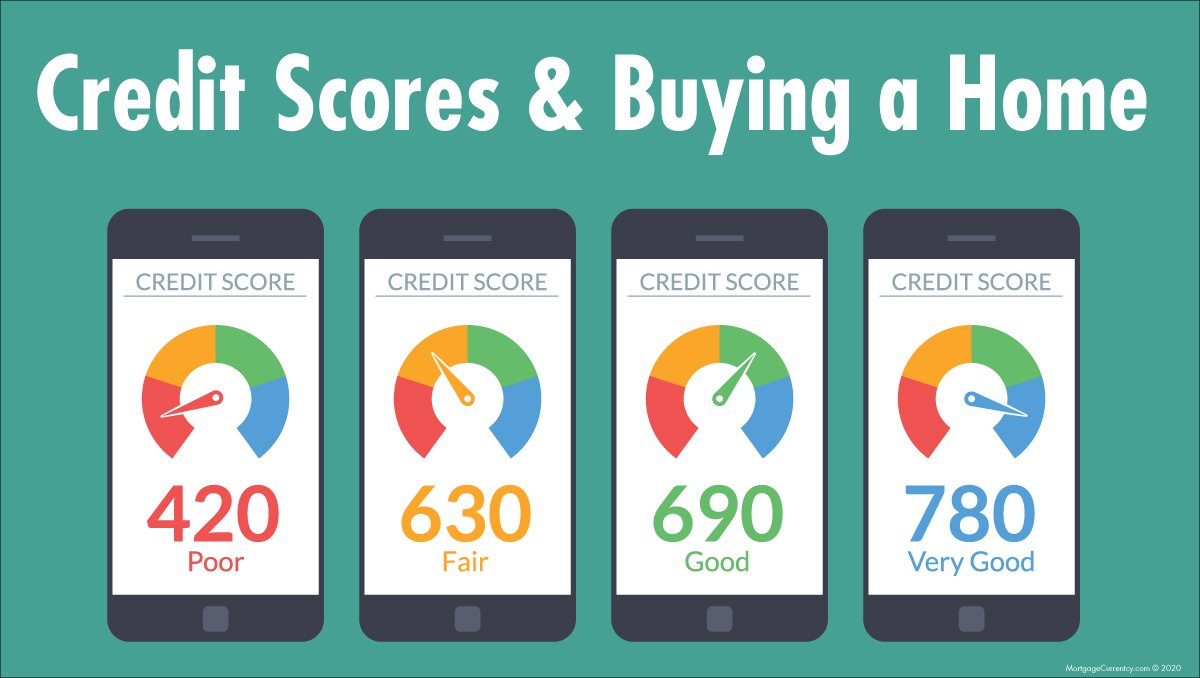

Moreover, late fees can have implications beyond the immediate financial penalty. They can contribute to a negative impact on your credit score, potentially leading to higher interest rates on future loans and affecting your overall financial standing. Recognizing the broader repercussions of late fees underscores the importance of addressing them proactively.

By understanding the nature and implications of late fees, you can approach the process of contesting them with clarity and purpose. This knowledge forms the foundation for engaging with creditors and seeking a resolution that aligns with your financial circumstances.

Next, we will delve into the crucial step of reviewing the terms and conditions of your financial agreement to identify the specific provisions related to late fees.

Reviewing the Terms and Conditions

When contesting a late fee, a thorough review of the terms and conditions governing your financial agreement is paramount. These terms and conditions outline the rights and responsibilities of both parties involved, including provisions related to late payments and associated penalties.

Start by locating a copy of the original agreement, whether it’s a credit card agreement, a loan contract, or a service subscription. Carefully examine the section that pertains to late payments and fees. Pay close attention to the language used, including any grace periods, the calculation method for late fees, and any provisions for waiving or reducing penalties under certain circumstances.

Understanding the specific language and clauses related to late fees empowers you with the knowledge to contest them effectively. If the terms and conditions stipulate conditions under which late fees can be waived or reduced, you can leverage this information in your communication with the creditor.

Additionally, familiarize yourself with any consumer protection regulations or laws that may apply to late fees in your jurisdiction. By being informed about the legal framework surrounding late fees, you can assert your rights confidently when engaging with the creditor.

Reviewing the terms and conditions also provides insight into the creditor’s obligations regarding fee disclosures and notifications. If you believe that the late fee was assessed unfairly or without proper notification, this knowledge can form the basis of your contestation.

Armed with a comprehensive understanding of the terms and conditions, you are better equipped to engage with the creditor and present a well-informed case for contesting the late fee. In the next section, we will explore the importance of proactive communication with the creditor when addressing late fees.

Contacting the Creditor

Effective communication with the creditor is a critical step in contesting a late fee. Whether it’s a financial institution, a service provider, or a utility company, initiating contact with the creditor demonstrates your commitment to resolving the issue and can pave the way for a favorable outcome.

When reaching out to the creditor, it’s important to maintain a polite and professional tone. Clearly explain the circumstances that led to the late payment, emphasizing any factors that were beyond your control. Whether it was an unexpected expense, a technical issue, or a personal hardship, providing context for the late payment can humanize the situation and potentially elicit empathy from the creditor.

Referencing the specific terms and conditions outlined in the agreement, especially any provisions related to waiving or reducing late fees under certain conditions, can strengthen your case. If the agreement includes a grace period or specifies conditions for fee waivers, highlight these aspects in your communication to support your request for leniency.

Furthermore, if you have a history of timely payments and a positive relationship with the creditor, don’t hesitate to emphasize this point. Demonstrating your reliability as a customer can bolster your appeal for a waiver or reduction of the late fee.

It’s also advisable to inquire about any hardship programs or goodwill policies that the creditor may offer. Some institutions have procedures in place to assist customers facing temporary financial challenges, and exploring these options can potentially lead to a favorable resolution.

When contacting the creditor, consider utilizing multiple channels of communication, such as phone calls, emails, and secure messaging platforms if available. Documenting all interactions and retaining copies of correspondence is essential for maintaining a record of your efforts to contest the late fee.

By initiating proactive and respectful communication with the creditor, you lay the groundwork for a constructive dialogue aimed at addressing the late fee. In the following section, we will delve into the strategies for negotiating a waiver or reduction of the late fee based on the insights gained from contacting the creditor.

Negotiating a Waiver or Reduction

When contesting a late fee, the process of negotiation plays a pivotal role in reaching a mutually beneficial resolution with the creditor. Armed with a thorough understanding of the terms and conditions and having initiated contact, you can now focus on presenting a compelling case for a waiver or reduction of the late fee.

Begin by reiterating the circumstances that led to the late payment, emphasizing any mitigating factors that contributed to the situation. Express your commitment to honoring your financial obligations and highlight your history of responsible payment behavior, if applicable. By framing the discussion around your dedication to fulfilling your financial responsibilities, you can convey a sense of accountability and reliability to the creditor.

Reference any relevant provisions in the agreement that support your request for a waiver or reduction of the late fee. If the terms and conditions specify conditions under which fees can be waived or reduced, leverage this information to bolster your negotiation stance. Emphasize that you are seeking a fair and equitable resolution in line with the agreement’s provisions.

During the negotiation, remain open to potential compromises. While aiming for a complete waiver of the late fee is ideal, being receptive to a partial reduction demonstrates a willingness to find a middle ground. Propose a specific reduction amount or percentage that you believe aligns with the circumstances and remains reasonable from your perspective.

If the creditor initially declines your request, consider escalating the matter to a supervisor or a designated escalation point within the organization. Express your willingness to work towards a resolution and seek assistance from higher levels of authority within the creditor’s hierarchy. Oftentimes, escalating the discussion can lead to a reconsideration of your request and a more favorable outcome.

Throughout the negotiation process, maintain a respectful and composed demeanor, even if the discussions become challenging. Professional conduct can contribute to fostering a constructive dialogue and increasing the likelihood of reaching a satisfactory agreement.

By skillfully navigating the negotiation process and leveraging the insights gained from contacting the creditor, you can position yourself to secure a waiver or reduction of the late fee. In the subsequent section, we will explore the option of seeking legal assistance if the negotiation process does not yield a favorable outcome.

Seeking Legal Assistance

If the negotiation process with the creditor does not result in a favorable resolution regarding the contested late fee, seeking legal assistance may become necessary. Legal guidance can provide valuable support in navigating the complexities of consumer rights, contractual obligations, and potential avenues for addressing the late fee dispute.

When considering legal assistance, start by consulting with a qualified attorney who specializes in consumer law or financial disputes. An experienced legal professional can offer insights into the legal aspects of your situation, assess the validity of your contestation, and provide guidance on the potential courses of action available to you.

Legal experts can review the terms and conditions of the financial agreement, assess the circumstances surrounding the late fee, and determine whether there are grounds for legal recourse. They can also evaluate any consumer protection laws or regulations that may apply to your specific situation, providing clarity on your rights and the creditor’s obligations.

If the late fee dispute escalates and legal action becomes necessary, an attorney can represent your interests and advocate on your behalf. Whether it involves formal mediation, arbitration, or potential litigation, having legal representation can bolster your position and increase the likelihood of achieving a favorable outcome.

Furthermore, legal professionals can engage in direct communication with the creditor, leveraging their expertise to navigate the complexities of legal language and negotiation strategies. Their involvement can bring a higher level of credibility and authority to your contestation, potentially prompting the creditor to reconsider their stance on the late fee.

It’s important to approach legal assistance as a strategic step in addressing the late fee dispute, especially if the financial implications and potential impact on your creditworthiness are significant. By seeking legal guidance, you demonstrate a commitment to upholding your rights as a consumer and pursuing a fair resolution to the dispute.

While legal assistance represents a more formal and potentially escalated approach to contesting a late fee, it can be a crucial recourse when other avenues have been exhausted. In the concluding section, we will summarize the key considerations and actions to take when contesting a late fee, empowering you to navigate this aspect of personal finance effectively.

Conclusion

Contesting a late fee is a multifaceted process that requires a combination of knowledge, communication, and strategic advocacy. By understanding the nature of late fees and reviewing the terms and conditions of your financial agreement, you lay the groundwork for contesting these penalties effectively.

Initiating proactive and respectful communication with the creditor is a crucial step in presenting your case for a waiver or reduction of the late fee. By leveraging your understanding of the agreement’s provisions and maintaining a composed and professional demeanor, you can navigate the negotiation process with confidence.

If the negotiation process does not yield a satisfactory outcome, seeking legal assistance can provide valuable support in addressing the late fee dispute. Consulting with a qualified attorney who specializes in consumer law can offer insights, guidance, and potential representation in formal proceedings if necessary.

Throughout this process, it’s essential to remain persistent and assertive in advocating for a fair and equitable resolution. Documenting all interactions, retaining copies of correspondence, and maintaining a composed and professional demeanor can contribute to a comprehensive and effective approach to contesting late fees.

Ultimately, contesting a late fee is a demonstration of your commitment to upholding your rights as a consumer and pursuing a fair resolution to financial disputes. By arming yourself with knowledge, engaging in proactive communication, and, if needed, seeking legal guidance, you can navigate the complexities of late fee contestation with confidence and determination.

Remember that addressing late fees is a vital aspect of maintaining your financial well-being and upholding your rights as a responsible borrower and consumer. By following the steps outlined in this guide, you can equip yourself with the tools and strategies needed to contest late fees assertively and protect your financial interests.