Home>Finance>Why Is Delivery Important In Futures Contracts?

Finance

Why Is Delivery Important In Futures Contracts?

Published: December 24, 2023

Discover why delivery is crucial in futures contracts and its significance in finance, despite the low number of contracts that actually result in delivery.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, futures contracts play a critical role in facilitating trading and hedging activities. These contracts, which involve the purchase or sale of a specific asset at a predetermined price and date in the future, are widely used by individuals, investors, and businesses to manage risk and speculate on price movements.

While the majority of futures contracts are settled financially – meaning that the parties involved exchange the difference in cash rather than the physical asset – the concept of delivery is still crucial. Delivery refers to the actual transfer of the underlying asset from the seller to the buyer upon contract expiration. Even though only a small percentage of futures contracts actually end in delivery, the importance of this process cannot be overstated.

In this article, we will explore why delivery is important in futures contracts, despite the fact that only a few contracts result in the physical transfer of assets. By understanding the role of delivery, we can gain insights into the functioning of futures markets and the benefits they provide to participants.

Definition of Futures Contracts

Before delving into the importance of delivery in futures contracts, it is essential to have a clear understanding of what futures contracts are. A futures contract is a standardized agreement between two parties to buy or sell a specified asset at a predetermined price and date in the future.

These contracts are traded on exchanges, such as the Chicago Mercantile Exchange (CME) or the New York Mercantile Exchange (NYMEX). The assets underlying futures contracts can include commodities (such as oil, gold, or wheat), financial instruments (like stocks or bonds), or even intangible assets (such as stock market indices or foreign currencies).

One of the key characteristics of futures contracts is their standardization. This means that all contract specifications, including the quantity, quality, and delivery terms, are predetermined and set by the exchange. This standardization ensures that all market participants operate under the same rules and can easily buy or sell contracts with each other.

Futures contracts also have an expiry date – the date at which the contract expires. Beyond this date, the contract can no longer be traded, and the parties involved must either settle the contract financially or, in some cases, go through the process of physical delivery.

It is important to note that most futures contracts are closed out or offset before the expiration date. In other words, the original buyer of a contract may sell it to a third party, thereby transferring their rights and obligations to that party. This process allows traders and investors to exit positions or take profits without ever having to take delivery or make physical settlement.

Now that we have a basic understanding of futures contracts, let’s explore why delivery, even though infrequent, is a crucial aspect of these financial instruments.

The Role of Delivery in Futures Contracts

Delivery plays a fundamental role in futures contracts, despite the fact that only a small percentage of contracts actually result in physical delivery. Understanding the role of delivery is essential for comprehending the functioning and significance of futures markets.

First and foremost, the presence of delivery in futures contracts ensures that these markets remain connected to the underlying physical assets or commodities. By providing the option for physical settlement, futures contracts maintain a link between the financial markets and the real-world supply and demand dynamics. This connection is vital for price discovery and efficient market operations.

Moreover, delivery serves as a pricing benchmark for futures contracts. The price at which physical delivery occurs, known as the delivery price or settlement price, influences the pricing of other related financial instruments and derivatives. It provides a baseline reference for traders and investors to assess the fair value of the asset and make informed investment decisions.

Delivery also plays a crucial role in maintaining market liquidity and efficiency. Even though the majority of futures contracts are closed out or offset before expiration, the presence of delivery ensures that there is always a tangible and enforceable obligation behind each contract. This enhances market integrity and encourages active participation from market participants, as they know that the contracts they enter into have real value and consequences.

Furthermore, delivery provides an essential risk management tool for certain market participants. For example, businesses involved in the production or consumption of physical commodities can use futures contracts with delivery provisions to hedge against price fluctuations. By locking in a future price for the underlying asset, they can protect themselves from adverse price movements and plan their operations more effectively.

Overall, the role of delivery in futures contracts goes beyond the actual physical transfer of assets. It serves as a foundation for price discovery, market integrity, and risk management, ensuring that futures markets function smoothly and provide valuable opportunities for participants.

The Connection Between Delivery and Price Discovery

One of the core functions of futures contracts is price discovery – the process by which market participants determine the fair value of an asset. Delivery plays a crucial role in this process, as it provides a mechanism for buyers and sellers to establish a consensus on the current market price.

When a futures contract is nearing expiration and physical delivery is an option, market participants closely monitor the delivery price or settlement price. This is the price at which the buyer and seller agree to exchange the underlying asset at contract maturity. The delivery price is influenced by various factors, including supply and demand dynamics, market sentiment, and the cost of carrying the physical asset to the delivery location.

By observing the delivery price and its fluctuations, traders and investors gain insights into the perceived value of the asset in the current market conditions. This information can then be used to gauge whether the spot price of the asset is overvalued or undervalued. If the delivery price deviates significantly from the prevailing spot price, it may signal an opportunity for arbitrage, where market participants can profit by exploiting the price difference between the futures and spot markets.

Additionally, the delivery price serves as a benchmark for pricing other financial instruments and derivatives. For example, options contracts, which provide the right but not the obligation to buy or sell an asset at a predetermined price, derive their value from the underlying futures contract. The delivery price provides a reference point for option traders to determine the option’s intrinsic value and premium.

Furthermore, the process of physical delivery itself contributes to price discovery. As the delivery date approaches, market participants who have chosen physical settlement must make arrangements for the transfer and transportation of the asset. This process incurs costs, including storage, insurance, and logistics, which can impact the overall value of the asset. These costs, along with market demand and supply factors, are factored into the delivery price and contribute to a more accurate reflection of the asset’s true market value.

In summary, the connection between delivery and price discovery is intertwined. Delivery provides a mechanism for market participants to establish a consensus on the current market price of the asset. It serves as a benchmark for pricing other financial instruments and derivatives and contributes to a more accurate reflection of the asset’s value in the market.

Ensuring Market Liquidity and Efficiency

Market liquidity and efficiency are crucial factors for the smooth functioning of futures markets. Without sufficient liquidity, markets can become illiquid, making it difficult for participants to enter or exit positions at desired prices. Delivery in futures contracts plays a vital role in ensuring market liquidity and efficiency.

Delivery provisions in futures contracts provide a tangible and enforceable obligation for market participants. This gives confidence to buyers and sellers that their contracts have real value and consequences. The presence of delivery encourages active participation in the market, as participants know that they are not just trading paper contracts, but they have the option to physically settle the contract if needed.

Market liquidity is significantly enhanced when there is a robust balance between participants willing to buy and sell contracts, including those open to delivery. The availability of delivery as an option reduces the risk of market manipulation or artificially inflated prices. It prevents situations where a few participants hold a significant number of contracts with no intention of taking delivery, which could distort market dynamics and pricing.

Efficiency in futures markets is also achieved through the process of delivery. While most futures contracts are offset or closed out before expiration through financial settlement, the presence of delivery ensures that the contracts represent a direct link to the underlying physical assets. This connection between financial markets and real-world assets allows for price discovery and accurate valuation of the assets, leading to efficient market operations.

Moreover, delivery provisions facilitate risk management and hedging activities. Participants who are involved in the production, consumption, or ownership of the underlying physical assets can utilize futures contracts with delivery options to hedge against price fluctuations. This enables them to lock in future prices, mitigate risks, and plan their operations more effectively.

Delivery in futures contracts also promotes transparency in the market. The delivery process involves the physical transfer of assets, which requires adherence to specific quality standards, storage facilities, and transportation logistics. Market participants can evaluate the delivery mechanisms and ensure that the assets meet the required specifications, adding transparency and trust to the market.

Overall, the inclusion of delivery provisions in futures contracts ensures market liquidity, prevents market manipulation, promotes efficient price discovery, and facilitates risk management. It enhances transparency, trust, and confidence among market participants, contributing to the overall effectiveness of futures markets.

Regulatory Requirements for Delivery

Futures markets are subject to various regulatory requirements to ensure fair and transparent trading practices. These regulations govern the delivery process in futures contracts and aim to protect the interests of market participants and maintain the integrity of the market.

One of the key regulatory requirements is the establishment of delivery standards. Regulatory authorities and exchanges set specific criteria regarding the quality, quantity, and specifications of the underlying assets eligible for delivery. These standards ensure that the assets delivered meet the agreed-upon specifications and maintain the overall integrity of the market.

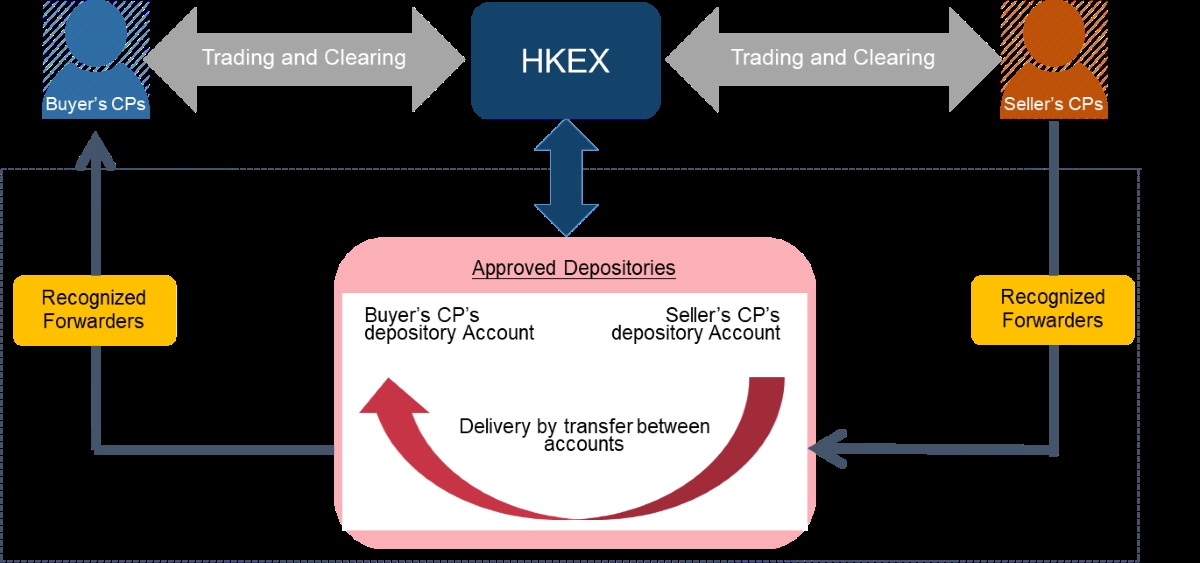

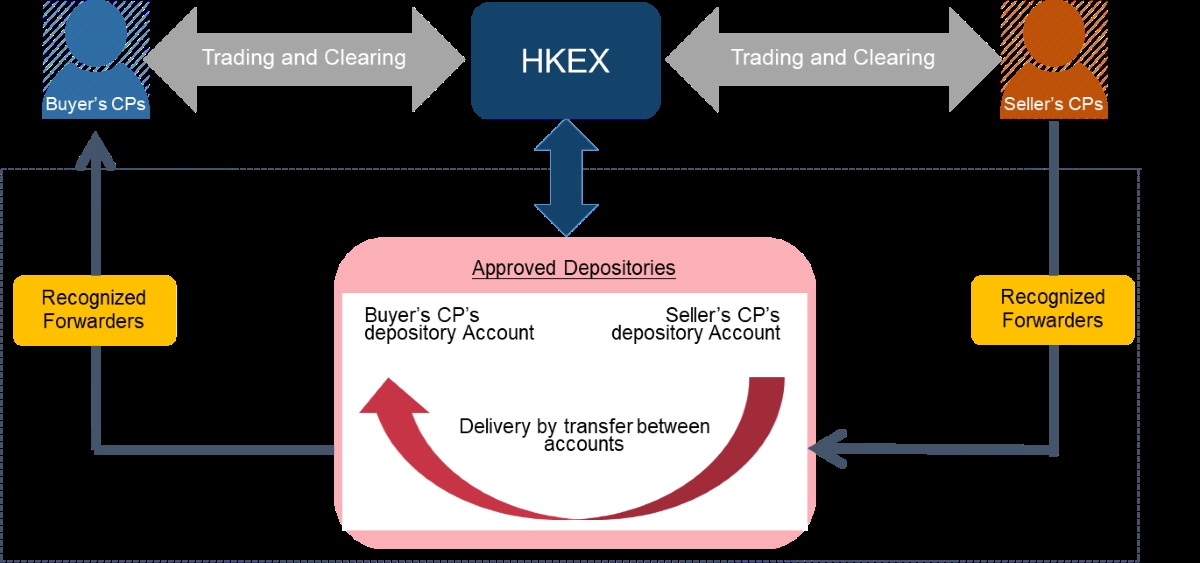

In addition to quality standards, regulatory authorities also establish rules and procedures for the delivery process. These rules include details on delivery timelines, delivery locations, and the documentation required for the transfer of assets. By outlining strict guidelines, regulatory bodies aim to ensure a smooth and reliable delivery process.

Regulators also play a role in monitoring the delivery process to prevent any fraudulent or manipulative practices. They enforce compliance with delivery requirements, oversee the inventory of deliverable assets, and conduct periodic audits to ensure that market participants are adhering to the regulations. This helps maintain market integrity and protects investors from potential misconduct.

Furthermore, regulatory authorities set position limits to prevent excessive concentration of contracts among market participants. These limits restrict the number of contracts that any individual or entity can hold to avoid a potential market manipulation or distortion of prices. Position limits promote fairness and prevent excessive influence on market dynamics.

Additionally, regulatory bodies may require reporting and record-keeping obligations for market participants engaging in delivery. This includes the submission of detailed reports on inventory, deliveries made, and any anomalies or irregularities observed in the process. This information aids regulatory oversight and ensures transparency in the market.

Lastly, regulatory bodies often have mechanisms in place to arbitrate disputes related to delivery in futures contracts. They provide a forum for resolving disagreements between buyers and sellers regarding the delivery process, quality discrepancies, or any other issues that may arise. This arbitration process helps protect the rights of market participants and ensures the fair resolution of disputes.

Overall, regulatory requirements for delivery in futures contracts provide a framework for fair and transparent trading practices. They establish delivery standards, monitor compliance, prevent market manipulation, and provide mechanisms for dispute resolution. These regulations are essential for maintaining the integrity of futures markets and safeguarding the interests of participants.

The Importance of Physical Delivery

Although the majority of futures contracts are settled financially without the physical transfer of assets, the option for physical delivery remains an important feature of these contracts. Physical delivery serves several key purposes and brings distinct advantages to market participants.

First and foremost, physical delivery ensures the link between the futures markets and the underlying physical assets or commodities. This connection guards against market detachment and maintains the integrity of price discovery. It allows futures markets to reflect the true supply and demand dynamics of the underlying assets, contributing to the efficient functioning of these markets.

Physical delivery also provides a tangible and enforceable obligation for market participants. Buyers and sellers are aware that their contracts carry real consequences, as they have the potential to take or make physical delivery of the underlying assets. This adds credibility and intrinsic value to the contracts, attracting more participants and fostering liquidity in the market.

Moreover, physical delivery offers risk management and hedging opportunities for businesses and investors. Participants involved in the production, consumption, or ownership of the underlying physical assets can utilize futures contracts with delivery provisions to hedge against price fluctuations. By entering into such contracts, they can lock in future prices and protect themselves from adverse market movements, ensuring stability in their operations or investments.

Physical delivery also plays a role in price convergence. Price convergence refers to the process by which the futures price and the spot price of an asset come closer to each other as the contract approaches expiration. When physical delivery is possible, the futures price tends to converge with the spot price since the arbitrage opportunity of buying at a lower future price and immediately selling in the spot market is available. This convergence helps eliminate pricing discrepancies and contributes to market efficiency.

Furthermore, physical delivery allows market participants to obtain the actual physical assets when needed. In certain scenarios, such as when the demand for a specific commodity exceeds the available supply or when the cost of acquiring the asset in the spot market is exceptionally high, physical delivery can provide a means to access the asset. This is particularly valuable for industries and businesses that rely on the physical assets for their operations.

It is important to note that even if a small percentage of futures contracts result in physical delivery, the option itself acts as a foundation for the overall market. It enhances liquidity, credibility, risk management capabilities, and the integrity of price discovery. Therefore, the importance of physical delivery in futures contracts cannot be underestimated.

Factors That Limit the Number of Deliveries

While physical delivery is an important aspect of futures contracts, the number of contracts that actually result in physical delivery is relatively low. Several factors contribute to this phenomenon, limiting the occurrence of deliveries in futures markets.

One crucial factor is the prevalence of financial settlement. Most futures contracts are settled financially, meaning that the parties involved exchange the difference in cash at contract expiration rather than physically transferring the underlying asset. Financial settlement provides flexibility and convenience to market participants, allowing them to close out or offset their positions without the need for physical delivery.

Another factor that limits the number of deliveries is the existence of speculators in futures markets. Speculators are market participants who aim to profit from price fluctuations without any intention of taking delivery of the underlying asset. They buy or sell futures contracts based on their expectations of price movements, seeking to benefit from the price difference. Speculators outnumber those who use futures contracts for commercial purposes, further reducing the likelihood of physical deliveries.

In addition to financial settlement and the presence of speculators, operational and logistical constraints can hinder the occurrence of deliveries. Physical delivery involves the transfer of the underlying asset from the seller to the buyer, along with the coordination of storage, transportation, and quality examinations. These operational aspects can be complex and costly, especially when dealing with certain physical commodities. Market participants may find it more convenient and cost-effective to settle their contracts financially rather than go through the logistics of physical delivery.

Market dynamics also play a role in limiting the number of deliveries. The supply and demand dynamics of the underlying asset can impact the likelihood of physical delivery. If the supply of the asset is limited or if the demand for the asset is significantly higher than the available supply, it can be difficult for buyers to find sellers who are willing and able to physically deliver the asset. In such scenarios, market participants may opt for financial settlement to avoid any potential delivery challenges.

Regulatory and exchange requirements can also restrict the number of deliveries. Regulatory bodies and exchanges often impose certain delivery standards and criteria that must be met for an asset to be eligible for delivery. These requirements aim to ensure the quality and integrity of the delivered assets. However, if the asset does not meet the specified criteria or if the delivery process does not align with the participants’ needs or preferences, they may choose financial settlement instead.

Overall, financial settlement, the presence of speculators, operational constraints, market dynamics, and regulatory requirements are all factors that limit the number of deliveries in futures contracts. While physical delivery remains an important aspect, the flexibility and convenience offered by financial settlement, combined with other market dynamics, often outweigh the advantages of physical delivery for many market participants.

Conclusion

Delivery, despite being a relatively rare occurrence in futures contracts, holds significant importance in the functioning of these markets. It serves as a vital link between financial markets and the underlying physical assets, facilitating price discovery and maintaining market integrity. The option for physical delivery provides credibility to futures contracts, attracting market participants and ensuring the existence of tangible value behind each contract.

The connection between delivery and price discovery is evident, as the delivery price influences pricing in related financial instruments and derivatives. Delivery also contributes to market liquidity and efficiency by providing a tangible and enforceable obligation, promoting active participation, and facilitating risk management through hedging strategies.

Regulatory requirements play a crucial role in governing the delivery process, ensuring adherence to quality standards, and promoting transparency and fair trading practices. These regulations protect the rights of market participants and maintain the overall integrity of futures markets.

However, various factors limit the number of deliveries in futures contracts. The prevalence of financial settlement, the presence of speculators, operational and logistical constraints, market dynamics, and regulatory requirements all influence market participants’ decision to opt for financial settlement instead of physical delivery.

In conclusion, while the majority of futures contracts are settled financially, the importance of delivery cannot be overlooked. Delivery ensures market liquidity, establishes a link between financial markets and the underlying assets, contributes to price discovery, and offers risk management opportunities. By understanding the role of delivery in futures contracts, market participants can navigate these markets more effectively, make informed decisions, and manage their risks accordingly.