Finance

How To Not Pay Landlord Late Fee

Published: February 23, 2024

Learn how to avoid paying late fees to your landlord and manage your finances better with our expert tips and advice. Take control of your finances today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Welcome to the ultimate guide on avoiding late fees when renting a property. Late fees can be a significant financial burden, and it’s crucial to understand the steps you can take to prevent them. Whether you’re a first-time renter or have experienced the frustration of late fees in the past, this comprehensive guide will provide you with practical strategies to ensure you never pay a landlord late fee again.

Late fees are charges imposed by landlords when tenants fail to pay their rent on time. These fees can quickly accumulate, leading to unnecessary financial strain. By implementing the tips outlined in this guide, you can safeguard your finances and maintain a positive relationship with your landlord.

From understanding your lease terms to planning ahead for unexpected expenses, each section of this guide is designed to empower you with the knowledge and tools necessary to stay on top of your rental payments. By taking proactive measures and staying organized, you can avoid the stress and financial implications associated with late fees.

Let’s delve into the strategies that will help you navigate the rental process with confidence and ensure that paying your rent on time becomes a seamless part of your financial routine.

Know Your Lease Terms

Know Your Lease Terms

Before delving into strategies for avoiding late fees, it’s essential to thoroughly understand the lease agreement governing your rental arrangement. The lease outlines crucial details such as the monthly rent amount, the due date, and any late fee policies. Take the time to review this document carefully to familiarize yourself with the specific terms and conditions set by your landlord.

Pay close attention to the section that addresses late fees. Understand the amount of the late fee, the grace period (if any), and the repercussions of consistently late payments. Some leases may include a provision that waives the late fee for the first offense, while others may impose a late fee immediately after the due date has passed. By being aware of these terms, you can avoid any surprises and plan your payments accordingly.

If you have any questions or uncertainties regarding the lease terms, don’t hesitate to reach out to your landlord or property management company for clarification. It’s crucial to have a clear understanding of your financial obligations to prevent any misunderstandings that could lead to late fees.

Furthermore, familiarize yourself with the acceptable methods of payment outlined in the lease. Some landlords may prefer electronic transfers, while others may accept checks or money orders. By adhering to the specified payment methods, you can ensure that your rent is submitted in a timely manner, reducing the risk of incurring late fees.

Understanding the lease terms is the foundational step in avoiding late fees. By arming yourself with this knowledge, you can navigate the rental process with confidence and proactively manage your financial responsibilities.

Set Up Automatic Payments

Set Up Automatic Payments

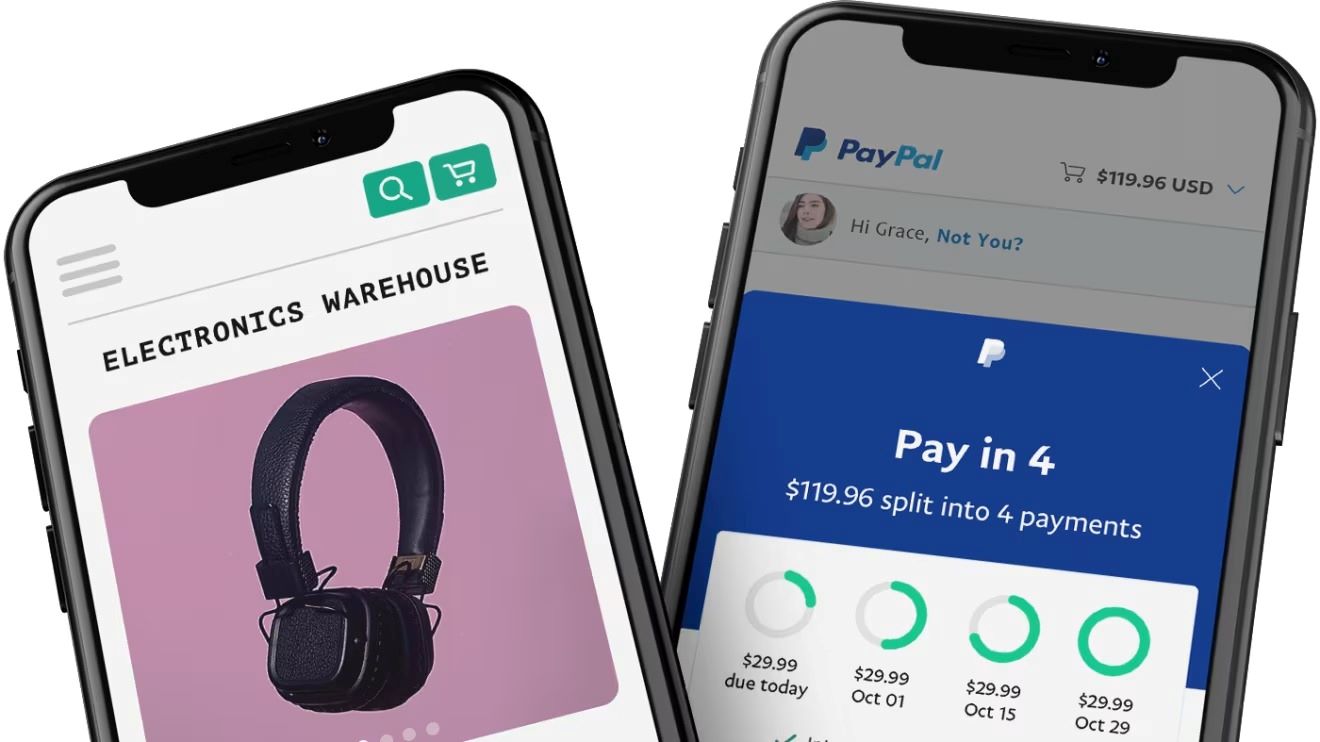

One of the most effective ways to avoid late fees is by setting up automatic payments for your rent. Many banks and financial institutions offer this convenient service, allowing you to schedule automatic transfers from your checking account to your landlord’s account on a specified date each month.

By opting for automatic payments, you eliminate the risk of forgetting to submit your rent on time. This proactive approach ensures that your payment is processed consistently, providing peace of mind and preventing the accrual of late fees. Additionally, automatic payments save you the time and effort required to manually initiate the transaction each month, streamlining the rental payment process.

Before setting up automatic payments, confirm with your landlord or property management company that this method of payment is acceptable and aligns with the terms outlined in your lease agreement. Once you have the green light, contact your bank to initiate the automatic payment setup. Be sure to input the correct payment amount and due date to avoid any discrepancies.

While automatic payments offer convenience and reliability, it’s essential to monitor your account balance to ensure that the necessary funds are available for the rent transfer. By maintaining a sufficient balance in your checking account, you can prevent any potential payment rejections or overdraft fees.

Embracing automatic payments not only safeguards you from late fees but also fosters a consistent and responsible approach to managing your rental obligations. This proactive strategy exemplifies your commitment to fulfilling your financial responsibilities and upholding a positive tenant-landlord relationship.

Communicate with Your Landlord

Communicate with Your Landlord

Effective communication with your landlord is a key factor in preventing late fees and addressing any potential payment challenges. Establishing open and transparent communication channels can help mitigate the impact of unforeseen circumstances and demonstrate your commitment to meeting your rental obligations.

If you anticipate difficulty in submitting your rent on time due to a temporary financial setback or an unexpected expense, proactively reach out to your landlord to discuss the situation. By initiating this conversation well in advance of the due date, you can explore potential solutions and demonstrate your proactive approach to resolving the issue.

During your discussion, express your commitment to fulfilling your rental payment and propose a feasible plan to address the temporary setback. Whether it involves a slight adjustment to the payment timeline or an agreed-upon arrangement, clear communication can often lead to a mutually beneficial resolution that avoids the imposition of late fees.

Furthermore, if you encounter any challenges with the payment process, such as a technical issue with the online payment portal or a delay in the processing of your transaction, promptly inform your landlord of the situation. Providing timely updates and seeking assistance if needed can help prevent misunderstandings and demonstrate your diligence in addressing any payment-related issues.

By fostering a communicative and cooperative relationship with your landlord, you can navigate potential payment hurdles with transparency and accountability. This proactive approach not only minimizes the risk of late fees but also contributes to a positive and respectful rapport with your landlord.

Keep Track of Rent Due Dates

Keep Track of Rent Due Dates

Staying organized and mindful of your rent due dates is essential in avoiding late fees. Implementing effective strategies to keep track of these crucial deadlines can help you maintain a proactive approach to your rental payments.

Utilize a calendar, whether digital or physical, to mark the specific date each month when your rent is due. Set up recurring reminders well in advance of the due date to ensure that you have ample time to prepare and submit your payment. This proactive approach can help you stay ahead of your financial obligations and minimize the risk of overlooking the deadline.

If you prefer digital solutions, consider leveraging the capabilities of calendar applications that offer customizable reminders and alerts. These tools can be tailored to suit your preferences, providing timely notifications to prompt you to initiate the rent payment process.

Additionally, consider syncing your rent due dates with your personal financial planning. Aligning these dates with your budgeting and income schedule can facilitate a more seamless and organized approach to managing your rental payments. By integrating rent due dates into your overall financial calendar, you can prioritize these obligations and allocate the necessary funds in a timely manner.

Regularly reviewing your lease agreement to reaffirm the due date and any associated grace periods can also contribute to your awareness of the payment timeline. By remaining vigilant and informed, you can avoid any misunderstandings regarding the due date and ensure that your rent is submitted punctually.

By proactively tracking your rent due dates and integrating them into your organizational systems, you can establish a consistent and reliable approach to meeting your financial responsibilities as a tenant.

Plan Ahead for Unexpected Expenses

Plan Ahead for Unexpected Expenses

Anticipating and preparing for unforeseen financial challenges is a prudent approach to safeguarding yourself against potential late fees. As a responsible tenant, it’s essential to incorporate contingency planning into your financial strategy to mitigate the impact of unexpected expenses.

Building an emergency fund serves as a crucial safety net when faced with sudden financial burdens, such as car repairs, medical expenses, or home maintenance issues. By setting aside a portion of your income each month, you can gradually accumulate a reserve that can be utilized to address unforeseen costs without jeopardizing your ability to pay your rent on time.

When creating your budget, allocate funds specifically designated for your emergency fund, prioritizing its growth alongside your other financial commitments. This proactive approach can provide peace of mind, knowing that you have a financial buffer to rely on in challenging circumstances.

Additionally, consider exploring rental insurance options that offer coverage for unexpected events, such as job loss or medical emergencies, which may impact your ability to meet your rental obligations. Understanding the scope of coverage provided by rental insurance can offer valuable reassurance and financial protection in times of uncertainty.

Furthermore, maintaining open lines of communication with your landlord and proactively addressing any potential financial hardships can contribute to a collaborative approach to navigating unexpected expenses. By discussing your situation with your landlord in a transparent and respectful manner, you can explore mutually beneficial solutions that alleviate the impact of temporary financial challenges.

By incorporating proactive financial planning and contingency measures into your approach as a tenant, you can fortify your financial resilience and minimize the risk of late fees resulting from unforeseen expenses.

Conclusion

Conclusion

Congratulations! You’ve now equipped yourself with a comprehensive set of strategies to navigate the rental process with confidence and avoid the burden of late fees. By understanding your lease terms, setting up automatic payments, maintaining open communication with your landlord, tracking rent due dates, and planning for unexpected expenses, you’ve taken proactive steps to safeguard your financial well-being as a tenant.

Remember, staying informed about your lease agreement and adhering to its terms is fundamental to preventing late fees. Utilizing technology to automate your rent payments and establishing clear communication channels with your landlord can streamline the rental payment process and foster a positive tenant-landlord relationship.

Consistent vigilance in tracking rent due dates and integrating them into your financial planning ensures that you remain proactive and organized in meeting your rental obligations. Additionally, proactive financial planning, including the creation of an emergency fund and exploring rental insurance options, bolsters your resilience in the face of unexpected expenses, reducing the likelihood of late payments.

By implementing these strategies and maintaining a proactive and communicative approach, you can navigate the rental landscape with confidence, ensuring that paying your rent on time becomes a seamless and stress-free aspect of your financial routine. Embracing these practices not only safeguards you from late fees but also fosters a responsible and respectful tenant-landlord dynamic.

Armed with these insights, you are well-prepared to uphold your financial commitments and cultivate a positive and harmonious rental experience. Here’s to a future of seamless and stress-free rental payments!