Finance

How To Create Your Own Pension

Published: November 27, 2023

Learn how to create your own pension and secure your financial future. Get valuable tips and guidance on managing your finances and planning for retirement from our finance experts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Assessing your financial goals and retirement needs

- Step 2: Determining your risk tolerance

- Step 3: Building a diversified investment portfolio

- Step 4: Setting a savings plan and contribution schedule

- Step 5: Evaluating retirement income options

- Step 6: Monitoring and adjusting your pension plan

- Conclusion

Introduction

Planning for retirement is a crucial step in ensuring financial security and peace of mind in your golden years. While traditional pension plans offered by employers are becoming less common, individuals now have the opportunity to create their own pension plan. This allows for more control and flexibility in managing retirement income.

Creating your own pension plan involves a strategic approach to saving and investing, tailored to meet your specific financial goals and retirement needs. By taking the time to carefully plan and implement a personalized pension plan, you can build a solid foundation for a comfortable and worry-free retirement.

In this article, we will guide you through the process of creating your own pension plan step by step. From assessing your financial goals to monitoring and adjusting your plan, we will cover all the essential elements to help you build a secure and sustainable retirement income.

Whether you are just starting to plan for retirement or looking to enhance your existing savings approach, this comprehensive guide will provide you with the knowledge and tools to create your own pension plan.

Step 1: Assessing your financial goals and retirement needs

The first step in creating your own pension plan is to assess your financial goals and retirement needs. This involves evaluating your current financial situation, determining the lifestyle you desire for your retirement years, and estimating the expenses you will incur.

Start by taking stock of your current income, assets, and liabilities. Calculate your net worth and review your budget to understand your current savings rate and potential areas for improvement. Consider factors such as your current age, expected retirement age, and any projected changes in your income or expenses.

Next, envision your ideal retirement lifestyle. Think about the activities you want to pursue, the places you want to travel to, and any potential healthcare or long-term care needs. Consider how your expenses may change in retirement, such as a potential decrease in housing and transportation costs, or an increase in healthcare expenses.

Once you have a clear understanding of your financial goals and retirement needs, you can then estimate the amount of income you will require during retirement. This can be done by determining your desired annual retirement income and adjusting it for inflation. Keep in mind that retirement may span several decades, so it is important to plan for the long term.

Remember to consider any potential sources of income during retirement, such as Social Security benefits or rental income. These additional sources can help reduce the amount of income you need to generate from your pension plan.

By assessing your financial goals and retirement needs, you will have a solid foundation for creating your own pension plan. This step will help you determine the target amount of savings you need to accumulate and guide your investment and savings strategy going forward.

Step 2: Determining your risk tolerance

When creating your own pension plan, it’s important to consider your risk tolerance. Risk tolerance refers to your ability and willingness to take on investment risks in pursuit of potentially higher returns.

Understanding your risk tolerance is crucial because it will influence the asset allocation and investment strategy you choose for your pension plan. Different investment options carry varying levels of risk and potential returns, so it’s important to align your investment choices with your risk tolerance.

One way to determine your risk tolerance is to assess your investment time horizon. If you have several decades until retirement, you may be able to tolerate more risk as you have a longer time horizon to ride out market fluctuations. Conversely, if you are nearing retirement, you may want to reduce your exposure to risk and focus on preserving your capital.

Another factor to consider is your emotional comfort with market volatility. If you can handle short-term fluctuations in the value of your investments without feeling anxious or making impulsive decisions, you may have a higher risk tolerance. However, if market downturns cause you significant stress or sleepless nights, a more conservative approach may be suitable for you.

It’s also important to consider your financial circumstances and goals. If you have a stable income and a strong financial foundation, you may be more comfortable taking on higher risk investments. On the other hand, if your income is unpredictable or you have significant financial obligations, a more conservative approach may be more appropriate.

There are various tools and questionnaires available online that can help you assess your risk tolerance. These tools generally ask about your investment experience, time horizon, and feelings towards market volatility to determine your risk profile.

Keep in mind that risk tolerance is not a static concept; it can change over time. As you move closer to retirement, it’s important to reassess your risk tolerance periodically and make any necessary adjustments to your investment strategy accordingly.

By determining your risk tolerance, you can build an investment portfolio that aligns with your comfort level and helps you achieve your long-term financial goals.

Step 3: Building a diversified investment portfolio

Creating a diversified investment portfolio is a critical step in building your own pension plan. Diversification involves spreading your investments across different asset classes, geographical regions, and industries to minimize risk and maximize potential returns.

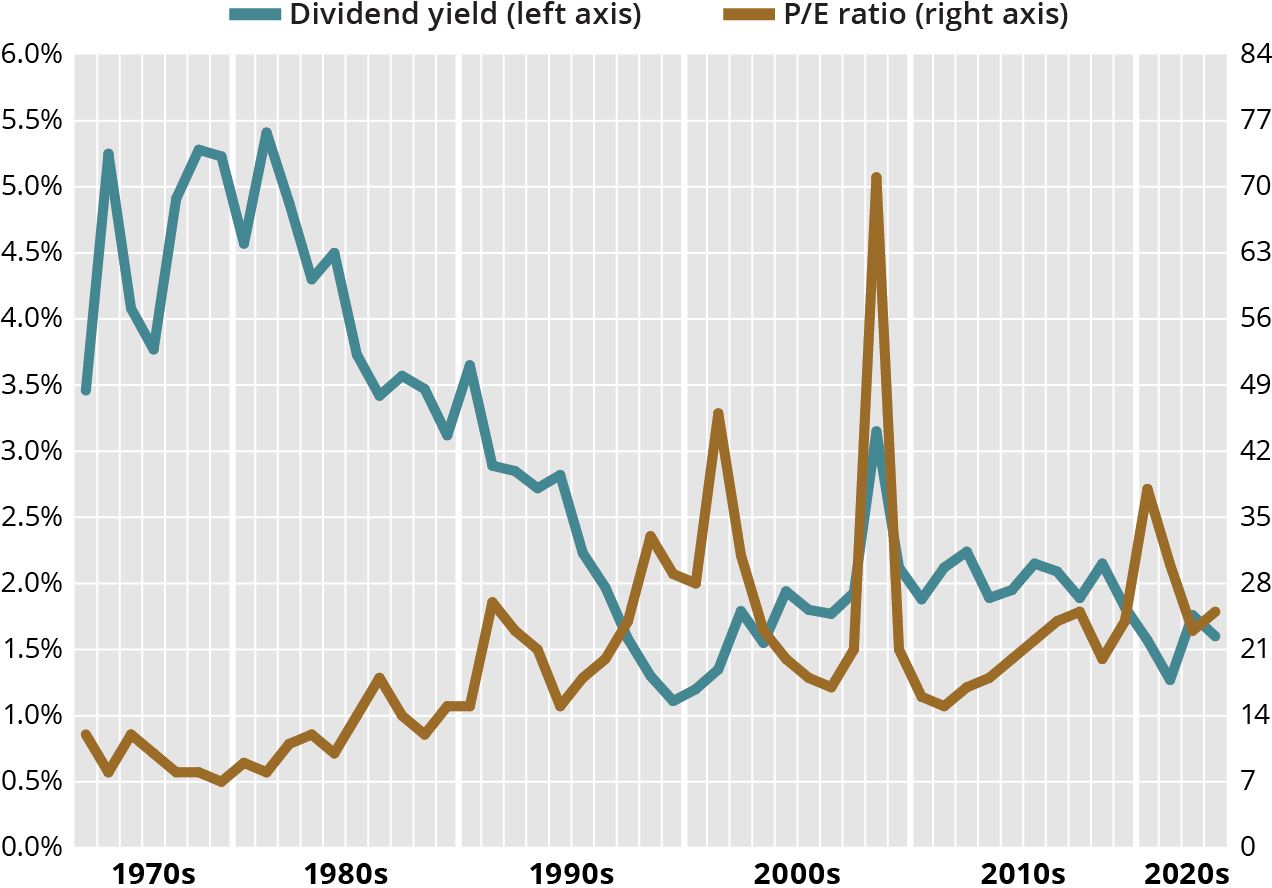

When constructing your portfolio, it’s important to consider your risk tolerance, investment goals, and time horizon. A well-diversified portfolio typically includes a mix of stocks, bonds, and other asset classes that balance the risk-reward trade-off.

Stocks offer potential for higher returns but come with higher volatility. Bonds, on the other hand, provide income and stability but may have lower returns. By combining these different asset classes, you can potentially mitigate the impact of market downturns on your pension plan.

In addition to asset allocation, it’s also crucial to diversify within each asset class. This can be achieved by investing in a variety of industries, sectors, and geographical regions. For example, you may allocate a portion of your stock portfolio to technology companies, healthcare companies, and international stocks to reduce the concentration risk.

Another aspect of diversification is considering the size and style of the companies you invest in. Large-cap, mid-cap, and small-cap stocks each have their own characteristics and risk profiles. By spreading your investments across companies of different sizes, you can further reduce the impact of any individual stock on your overall portfolio performance.

Furthermore, consider including alternative investments such as real estate, commodities, or private equity in your pension plan. These assets can provide further diversification and potential return enhancement, although they may come with higher risk and less liquidity.

Regular portfolio rebalancing is essential to maintain diversification. Over time, certain assets within your portfolio may outperform or underperform, leading to an imbalanced allocation. Rebalancing involves selling assets that have performed well and increasing exposure to underperforming assets to realign with your target asset allocation.

It’s important to note that building a diversified portfolio does not eliminate the risk of investment losses. However, it can help reduce the impact of market volatility and provide a more stable path towards generating retirement income.

Consulting with a financial advisor or investment professional can be beneficial in determining the most appropriate asset allocation and investment options for your pension plan.

Step 4: Setting a savings plan and contribution schedule

Setting a savings plan and contribution schedule is a crucial step in creating your own pension plan. This step involves determining how much you need to save and establishing a structured approach to consistently contribute to your retirement funds.

Start by calculating the target amount you need to save for your retirement, based on your financial goals and retirement needs. Consider factors such as your desired retirement age, life expectancy, and expected annual expenses. Ideally, aim to save enough to replace a significant portion of your pre-retirement income to maintain your desired lifestyle.

Once you have determined the target savings amount, break it down into smaller, manageable goals. Set annual or monthly savings targets that you can comfortably meet. This will make the savings process more achievable and less overwhelming.

Consider automating your savings by setting up regular contributions to your pension plan. This can be done through employer-sponsored retirement accounts such as a 401(k) or individual retirement accounts (IRAs). Take advantage of any employer matching contributions, as this can significantly boost your overall retirement savings.

If you don’t have access to an employer-sponsored retirement plan, explore other tax-advantaged savings options such as a traditional or Roth IRA. These accounts offer tax benefits, and contributions can be deducted from your taxable income or grow tax-free, depending on the account type.

Review your budget to identify areas where you can reduce expenses and allocate more funds towards your retirement savings. Cut back on unnecessary expenses and prioritize saving for your future self. Consider redirecting windfalls, such as bonuses or tax refunds, towards your pension plan to accelerate your savings growth.

As you progress through your career and experience salary increases, aim to increase your contributions accordingly. This will help you stay on track with your retirement savings goals and ensure that you are consistently saving a significant percentage of your income.

Regularly monitor and reassess your savings plan and contribution schedule. As your financial circumstances change and as you near retirement, you may need to adjust your targets and contribution amounts. Keep your plan flexible and adaptable to accommodate unexpected expenses or changes in income.

By setting a savings plan and contribution schedule, you will establish a disciplined approach to saving for your retirement. Consistency and persistence are key in building a substantial pension plan that can provide for your financial needs in your later years.

Step 5: Evaluating retirement income options

As you approach retirement, it’s important to evaluate and understand the various retirement income options available to you. This step involves exploring different methods of converting your pension plan assets into a steady stream of income to support your retirement lifestyle.

One common option is to annuitize a portion of your pension plan. An annuity is a financial product that provides regular payments to you over a specified period or for the rest of your life. Annuities can offer a guaranteed income stream, providing you with peace of mind and financial stability. However, be sure to carefully review the terms and conditions, as annuities can come with fees and restrictions.

Another option is to take systematic withdrawals from your pension plan. This involves withdrawing a predetermined amount from your savings on a regular basis. This approach allows for flexibility and control over your retirement income, but it also requires careful planning to ensure your savings last throughout your retirement.

Consider other potential sources of retirement income, such as Social Security benefits, rental income from properties, or part-time work. These additional income streams can supplement your pension plan and help cover your expenses.

It’s important to evaluate the tax implications of different income options. Some withdrawals may be subject to income tax, while others may be taxed at a different rate. Consult with a tax advisor to understand the tax consequences of each option and optimize your retirement income strategy.

Take into account your longevity when evaluating retirement income options. Consider how long you anticipate living and whether you want to leave a financial legacy for your loved ones. Some options, such as annuities with survivorship benefits, can provide income for your spouse or beneficiaries after your passing.

Consult with a financial planner or retirement specialist to discuss and evaluate the various retirement income options available to you. They can provide personalized advice based on your unique circumstances and help you make informed decisions.

Regularly review and reassess your retirement income strategy as your circumstances and goals change. Adjustments may be necessary to ensure your pension plan assets are optimally utilized and provide the income you need to support your desired retirement lifestyle.

By carefully evaluating your retirement income options, you can confidently choose the approach that aligns with your financial goals and provides the stability and security you desire during your retirement years.

Step 6: Monitoring and adjusting your pension plan

Creating your own pension plan doesn’t end with setting it up. It is important to actively monitor and adjust your plan as needed to ensure its continued effectiveness and alignment with your changing financial circumstances.

Regular monitoring involves reviewing the performance of your pension plan investments. Keep a close eye on the asset allocation and performance of your investment portfolio. Assess whether it is meeting your expected returns and if it is keeping up with inflation. Consider rebalancing your portfolio periodically to maintain your desired asset allocation.

Stay informed about the market conditions and economic trends that may impact your pension plan. Changes in interest rates, stock market fluctuations, and global events can all have an impact on your investments. Stay vigilant and be prepared to make adjustments when necessary.

Review your savings and contribution schedule periodically to ensure that you are on track to reach your retirement goals. If you experience changes in income or expenses, reassess how much you are saving and adjust your contributions accordingly. Regularly revisit your retirement needs and reassess whether your current savings plan is adequate.

Consider seeking guidance from a financial advisor or retirement specialist who can provide professional advice and help you make informed decisions. They can offer insights on investment strategies, tax optimization, and retirement income options that align with your goals.

Keep track of any changes in legislation or tax laws that may impact your pension plan. These changes can have significant implications for your retirement savings strategy. Stay informed and adjust your plan as needed to maximize your benefits within the legal framework.

It is crucial to periodically assess your risk tolerance and adjust your investment strategy accordingly. As you approach retirement, you may want to gradually shift your asset allocation to a more conservative approach to protect your capital. Consider reallocating a portion of your investments to less volatile assets to safeguard your pension plan against market downturns.

Life circumstances can change unexpectedly. Major life events such as marriage, divorce, the birth of a child, or the death of a loved one can influence your pension plan. Review and update your beneficiaries, estate plans, and any necessary legal documents regularly to ensure they reflect your current situation and intentions.

By actively monitoring and adjusting your pension plan, you can adapt to changing circumstances and ensure that your retirement savings continue to work for you. Regularly reviewing and fine-tuning your plan will help you stay on track and maintain financial security throughout your retirement years.

Conclusion

Creating your own pension plan is a proactive approach to securing your financial future and enjoying a comfortable retirement. By following the steps outlined in this guide, you can build a solid foundation for your pension plan and steer your retirement savings in the right direction.

Assessing your financial goals and retirement needs provides a clear roadmap for your savings journey. Determining your risk tolerance ensures that your investment strategy aligns with your comfort level and long-term objectives. Building a diversified investment portfolio helps mitigate risk and optimize potential returns.

Setting a savings plan and contribution schedule instills discipline and helps you reach your retirement savings goals. Evaluating retirement income options allows you to choose the best strategy to convert your pension plan assets into a reliable income stream. Monitoring and adjusting your pension plan ensures that it remains effective and adaptable to changing circumstances.

Remember that creating your own pension plan requires regular review and reassessment. Stay proactive in managing your retirement funds, stay informed about market conditions, and seek professional advice as needed.

Ultimately, taking control of your retirement savings gives you the power to shape your financial future. With diligent planning, disciplined savings, and a well-executed investment strategy, you can create a personalized pension plan that provides long-lasting financial security and allows you to enjoy your retirement years to the fullest.