Home>Finance>Consensus Estimate: Definition, How It Works, And Example

Finance

Consensus Estimate: Definition, How It Works, And Example

Published: November 1, 2023

Learn about consensus estimates in finance, including their definition, how they work, and see an example. Gain a better understanding of financial forecasting.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Consensus Estimate: Definition, How It Works, and Example

Welcome to our Finance category, where we delve into various aspects of the financial world to help you gain a deeper understanding of key concepts. Today, we will be exploring the intriguing world of consensus estimates. What exactly are consensus estimates? How do they work? And why are they crucial in the financial realm? In this blog post, we will provide clear answers to these questions and more, ensuring you walk away with a solid understanding of this essential financial tool.

Key Takeaways:

- The consensus estimate is a prediction or forecast made by financial analysts about the future performance of a specific company or economic indicator.

- It is derived from the average of various independent estimates provided by knowledgeable analysts who closely monitor the company or indicator.

Now, let’s dive deeper into the definition and workings of the consensus estimate.

A consensus estimate, in simple terms, is a prediction or forecast made by financial analysts regarding the future performance of a particular company or economic indicator. It serves as an indicator of what the market expects a company’s earnings, revenue, or other financial metrics to be in the upcoming reporting period.

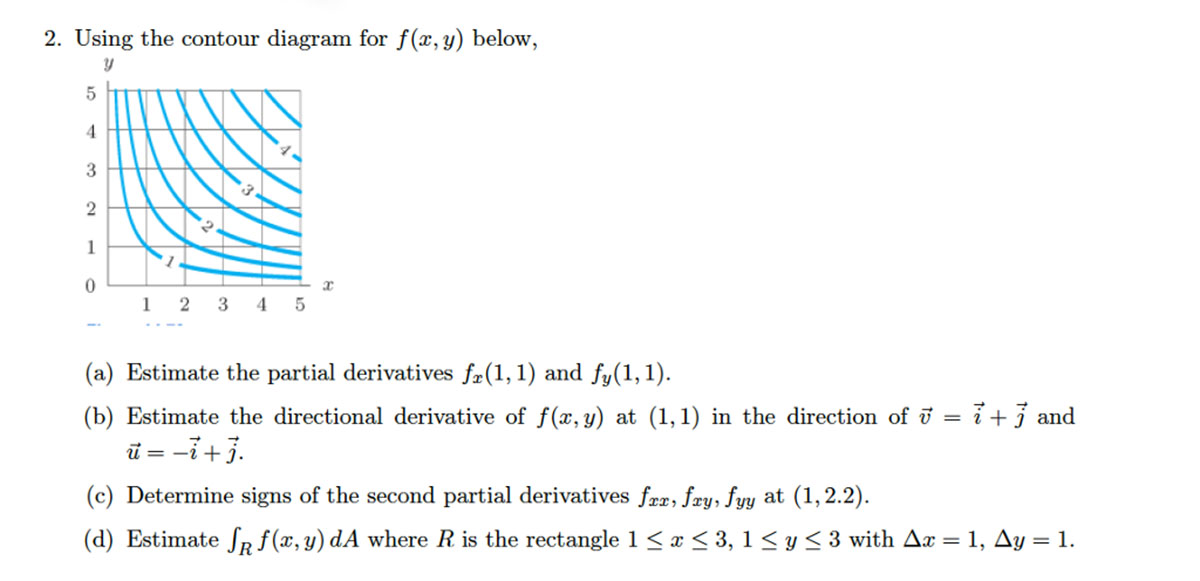

How It Works:

The process of generating a consensus estimate typically involves financial analysts closely monitoring a specific company or economic indicator. These analysts evaluate a wide range of data and information, including financial statements, market trends, and industry outlooks. Based on their analysis, they make individual forecasts of the company’s or indicator’s future performance.

These individual estimates are then collected and aggregated to form the consensus estimate. This aggregation is done by taking the average of all the estimates provided by the analysts, which helps eliminate potential biases and outliers that may exist in individual forecasts.

Once the consensus estimate has been derived, it serves as a benchmark against which a company’s actual performance is evaluated. If a company’s actual results surpass the consensus estimate, it is generally seen as a positive sign, potentially leading to increased investor confidence and stock price appreciation. On the other hand, if a company falls short of the consensus estimate, it may face scrutiny from investors and analysts, resulting in a decline in stock price.

Example:

Let’s consider a hypothetical example to illustrate how the consensus estimate works. Company XYZ, a technology firm, is scheduled to release its quarterly earnings report. Several financial analysts, who closely follow the company, provide their individual estimates of the company’s earnings per share (EPS).

Analyst 1 predicts an EPS of $0.75, Analyst 2 predicts $0.80, Analyst 3 predicts $0.85, and Analyst 4 predicts $0.70. The consensus estimate for Company XYZ’s EPS would be calculated by taking the average of these four estimates, resulting in a consensus estimate of $0.77.

When Company XYZ releases its actual earnings report, let’s say they report an EPS of $0.82, surpassing the consensus estimate of $0.77. This positive earnings surprise may generate increased investor interest in the company, potentially leading to a boost in its stock price.

Conversely, if Company XYZ reports an EPS of $0.72, falling short of the consensus estimate, investors may lose confidence, and the stock price could face downward pressure.

Conclusion

The consensus estimate plays a vital role in the financial world, serving as a barometer of market expectations for a company’s future performance. By aggregating the predictions of multiple expert analysts, it provides a consensus view that helps investors navigate the ever-changing landscape of the stock market.

Remember, when analyzing a company’s financial performance, it’s essential to consider the consensus estimate, as it provides insights into the market sentiment surrounding that company. Keep an eye on how a company’s performance aligns with the consensus estimate, as it can provide valuable indicators and guide investment decisions.

And that brings us to the end of our discussion on the consensus estimate. We hope this blog post has shed light on this crucial aspect of financial analysis and helped you gain a better understanding of its definition, how it works, and its significance in the world of finance.