Finance

How To Do Bookkeeping For A Restaurant

Modified: December 30, 2023

Learn how to do bookkeeping for a restaurant and manage your finances effectively. Get expert tips and advice to streamline your restaurant's financial operations.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Importance of Bookkeeping for Restaurants

- Setting Up a Bookkeeping System

- Daily Sales Reporting and Cash Handling

- Tracking Expenses and Purchasing

- Managing Payroll and Employee Benefits

- Analyzing Financial Statements

- Compliance with Tax and Accounting Regulations

- Using Technology for Efficient Bookkeeping

- Tips for Successful Restaurant Bookkeeping

- Conclusion

Introduction

Welcome to the bustling world of the restaurant industry, where delicious cuisines and memorable dining experiences are crafted daily. Whether you own a small cafe or a high-end fine dining establishment, one crucial aspect of running a successful restaurant is effective bookkeeping. While it may not be the most glamorous task, proper financial management is vital for the long-term growth and sustainability of your business.

In this article, we will explore the importance of bookkeeping for restaurants and provide you with a comprehensive guide on how to set up and maintain an efficient bookkeeping system. From daily sales reporting to tracking expenses, managing payroll, and analyzing financial statements, we will cover all the essential elements you need to know to keep your restaurant’s finances in order.

By implementing sound bookkeeping practices, you can make informed decisions, identify areas for improvement, and ensure the financial health of your restaurant. Furthermore, accurate bookkeeping is crucial for complying with tax regulations, maintaining transparency with stakeholders, and securing funding for future expansion.

Whether you are a seasoned restaurateur or just starting your culinary journey, this guide will provide you with the knowledge and tools needed to streamline your bookkeeping processes and focus on what you do best – creating exceptional dining experiences for your customers.

Importance of Bookkeeping for Restaurants

Bookkeeping is the foundation of financial management for any business, and restaurants are no exception. Here are some reasons why proper bookkeeping is essential for the success of your restaurant:

1. Financial Control: By maintaining accurate and up-to-date financial records, you gain better control over your restaurant’s finances. You can track revenue, expenses, and profitability, which allows you to make informed decisions regarding pricing, menu changes, and cost-cutting initiatives.

2. Budgeting and Planning: A well-structured bookkeeping system enables you to develop realistic budgets and set financial goals for your restaurant. By tracking actual financial performance against your projections, you can identify areas of improvement, adjust your strategies, and ensure the financial stability of your business.

3. Inventory Management: Effective bookkeeping allows you to monitor and control your inventory levels efficiently. By tracking inventory usage and costs, you can minimize waste, identify theft or pilferage, and ensure optimal stock levels to meet customer demand.

4. Vendor Relationships: Accurate bookkeeping helps you build strong relationships with your vendors. Timely payment of invoices and maintaining good credit can help negotiate favorable terms, discounts, or extended payment terms, improving your overall cash flow.

5. Staff Management: Proper bookkeeping enables you to manage your payroll and employee benefits effectively. You can accurately track employee hours, calculate wages, and ensure compliance with labor laws. This ensures that your team is paid correctly and on time, which boosts employee morale and reduces the risk of legal complications.

6. Tax Compliance: Keeping accurate financial records is crucial for complying with tax regulations and filing accurate tax returns. Proper bookkeeping ensures that you have all the necessary documentation and can provide accurate financial reports to your accountant or tax professional.

7. Business Growth and Expansion: Sound financial management through proper bookkeeping is essential if you plan to grow or expand your restaurant. It provides a clear picture of your restaurant’s financial health, making it easier to secure funding from investors, lenders, or even potential partners.

In summary, bookkeeping is the backbone of financial control and management in the restaurant industry. It helps you make informed decisions, streamline operations, control costs, manage cash flow, and ultimately, achieve long-term success for your restaurant.

Setting Up a Bookkeeping System

Establishing a solid bookkeeping system for your restaurant is crucial for maintaining accurate financial records and ensuring the smooth operation of your business. Here are the key steps to set up an efficient bookkeeping system:

- Choose an Accounting Method: The first step is to select an accounting method – either accrual or cash basis. Accrual accounting records revenue and expenses when they are earned or incurred, while cash basis accounting records transactions when cash is received or spent. Consult with a professional accountant to determine the most suitable method for your business.

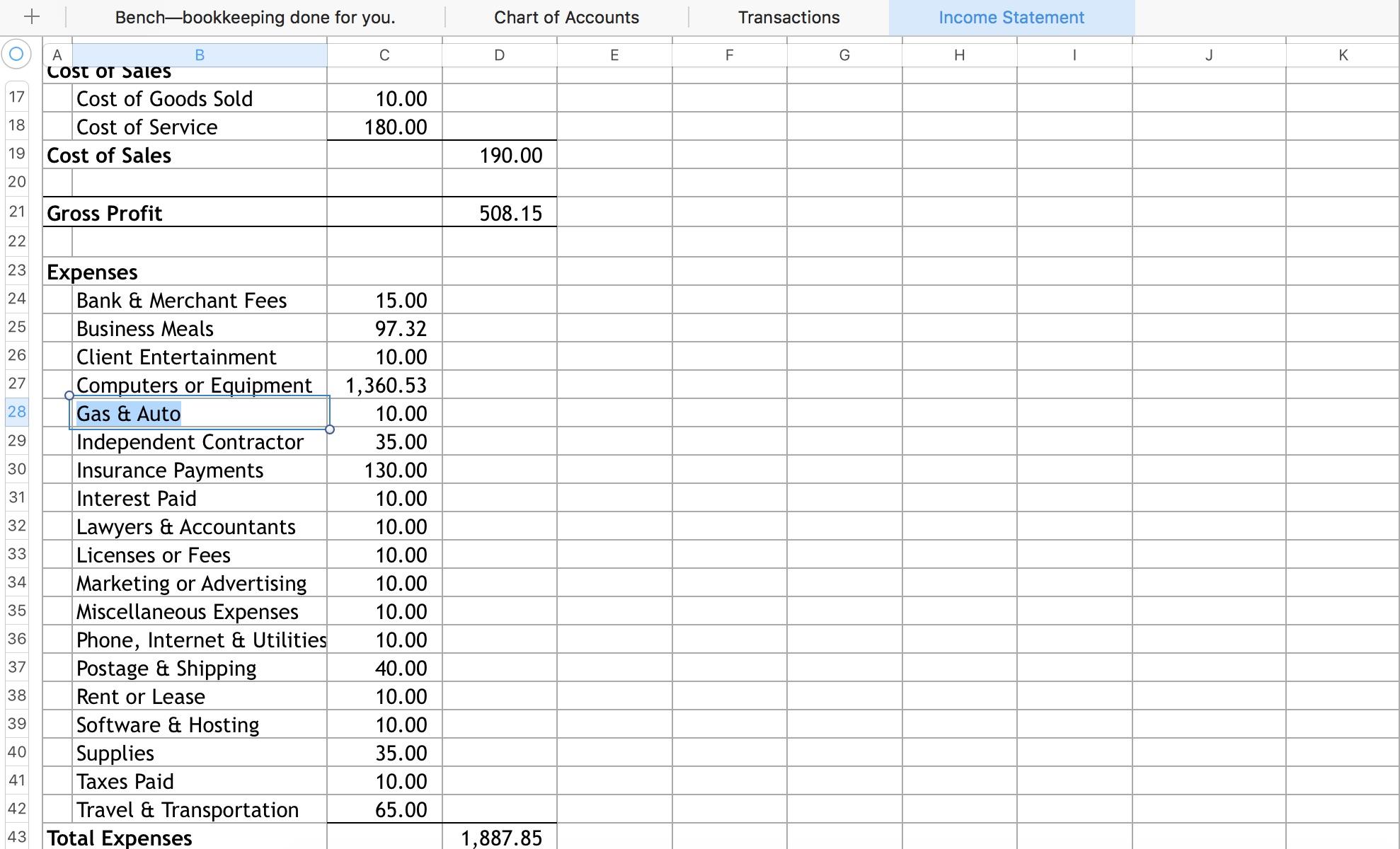

- Create Chart of Accounts: Develop a chart of accounts, which is a categorized list of all your financial accounts. This will include revenue accounts (such as food sales, beverage sales), expense accounts (such as payroll, supplies, utilities), and asset and liability accounts.

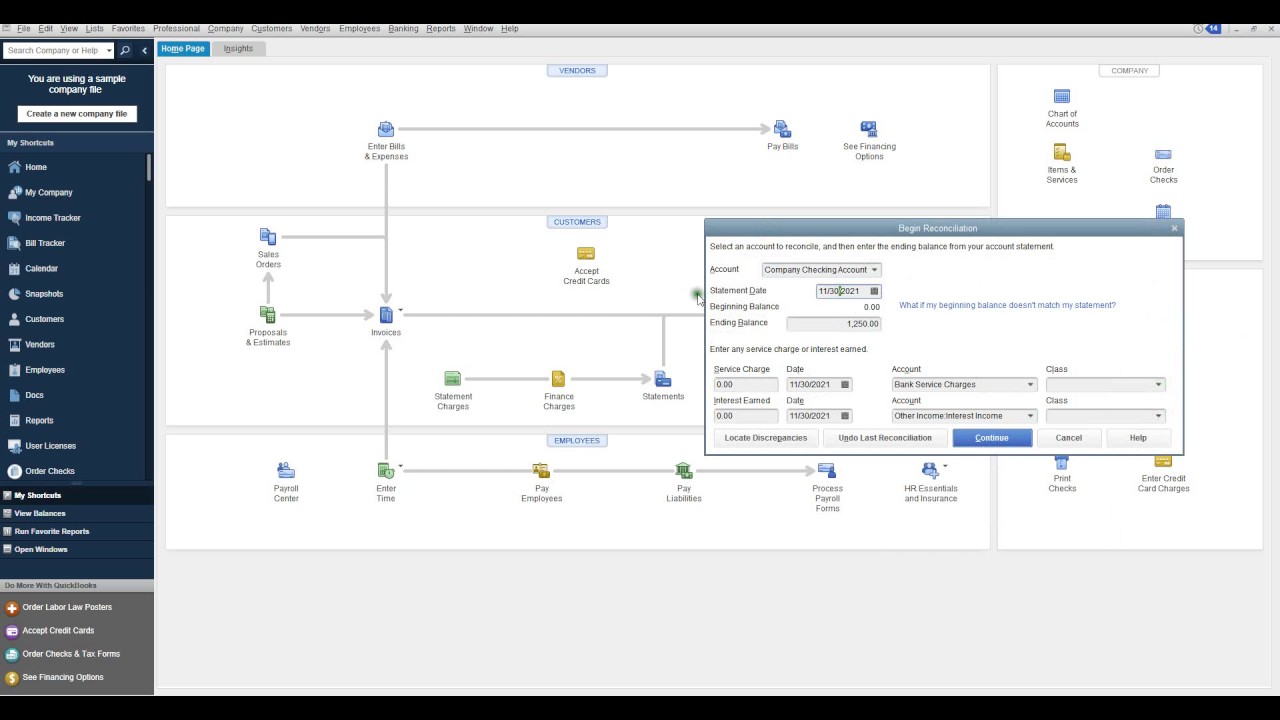

- Set Up Accounting Software: Invest in accounting software that is specifically designed for the restaurant industry. These software solutions can automate many bookkeeping tasks, such as recording sales, tracking expenses, and generating financial reports. Examples of popular accounting software for restaurants include QuickBooks, Xero, and FreshBooks.

- Organize Financial Documents: Create a system to organize and store your financial documents, such as receipts, invoices, bank statements, and payroll records. Utilize digital document management systems or cloud storage for easy access and backup.

- Establish Daily Sales Reporting: Implement a process to record and reconcile daily sales. This can be done through point-of-sale (POS) systems, where transactions are automatically recorded and sales reports are generated. Ensure that you have a secure cash handling procedure to prevent theft or fraud.

- Maintain Expense Tracking: Keep track of all your expenses, categorizing them based on your chart of accounts. Regularly reconcile bank and credit card statements to ensure accuracy and to identify any discrepancies.

- Create a Payroll System: Develop a system to manage employee payroll, including tracking hours worked, calculating wages, and handling deductions and taxes. Consider using specialized payroll software or outsourcing payroll processing to ensure accuracy and compliance.

- Generate Financial Reports: Regularly generate financial reports like profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into the financial health of your restaurant, allowing you to make data-driven decisions and monitor progress towards your financial goals.

Remember, while setting up a bookkeeping system may initially require some time and effort, it is an investment that will save you from potential financial stress and provide a solid foundation for your restaurant’s success.

Daily Sales Reporting and Cash Handling

Accurate daily sales reporting and proper cash handling procedures are essential for maintaining transparency, preventing fraud, and tracking the financial performance of your restaurant. Here are some key considerations in this area:

1. Point-of-Sale (POS) Systems: Implementing a reliable POS system is crucial for accurately recording sales transactions. POS systems not only process orders and payments but also provide detailed reports on sales, inventory, and customer data. Choose a POS system that suits your restaurant’s needs and integrates with your accounting software for streamlined data management.

2. Cash Register Management: Proper cash handling procedures are critical to prevent discrepancies and ensure the security of your cash transactions. Assign trusted employees to handle cash registers and enforce strict protocols, including regular cash drawer counts and separation of duties to minimize the risk of theft or mismanagement.

3. Daily Sales Reconciliation: At the end of each business day, it’s important to reconcile your daily sales records with the cash in the register. This involves balancing the cash and credit card sales against the recorded sales in your POS system. Any discrepancies should be investigated and resolved promptly.

4. Secure Cash Storage: Establish a secure location to store cash, such as a locked safe or cash drawer. Limit access to authorized personnel only and implement strict cash handling policies to minimize the risk of theft or loss.

5. Void and Refund Procedures: Clearly define procedures for voided transactions and refunds. Keep a comprehensive record of all voids and refunds, including details of the reason and authorization, to ensure transparency and accountability.

6. Cashless Payment Options: With the rise in popularity of cashless payments, consider accepting credit/debit cards, mobile payment apps, or contactless payments. Not only does this provide convenience for customers, but it also reduces the reliance on cash transactions and the associated risks.

7. Sales Reporting and Analysis: Regularly review and analyze your sales reports to identify trends, popular menu items, and peak hours of operation. This information can help you make data-driven decisions regarding staffing levels, menu offerings, and promotional activities.

8. Employee Training: Ensure that your staff is adequately trained in cash handling procedures, including proper cash register usage, void and refund protocols, and customer payment processing. Regularly remind and reinforce the importance of honesty, accuracy, and compliance with cash handling policies to maintain financial integrity.

By implementing robust daily sales reporting and cash handling procedures, you can effectively track your restaurant’s revenue, protect against financial risks, and ensure that your financial records accurately reflect the financial performance of your business.

Tracking Expenses and Purchasing

Tracking expenses and managing purchasing is essential for maintaining control over costs, optimizing profitability, and ensuring the smooth operation of your restaurant. Here are some key practices to effectively track expenses and manage purchasing:

1. Develop an Expense Tracking System: Create a system to track all your expenses, such as rent, utilities, ingredients, and supplies. Categorize expenses to gain insight into specific cost areas and identify opportunities for cost reduction.

2. Use Software or Spreadsheets: Utilize accounting software or spreadsheets to record and categorize expenses. This makes it easier to generate expense reports, monitor spending patterns, and compare actual expenses against budgeted amounts.

3. Implement a Purchase Order System: Establish a process for ordering and receiving goods. Use purchase orders to document the items, quantities, and prices agreed upon with suppliers. This helps ensure accurate inventory tracking and prevents unauthorized purchases or discrepancies.

4. Vendor Evaluation and Negotiations: Regularly assess your vendors based on factors such as price, quality, reliability, and on-time deliveries. Negotiate contracts or pricing to secure favorable terms, discounts, or volume rebates.

5. Inventory Management: Efficient inventory management is crucial for controlling costs. Regularly track inventory levels, minimize overstocking or wastage, and implement First-In-First-Out (FIFO) practices to prevent spoilage or expiration of ingredients.

6. Analyze Food and Beverage Costs: Calculate food and beverage costs as a percentage of sales to monitor profitability. Regularly review menu item profitability and adjust pricing or recipes to optimize margins. Identify high-cost menu items and explore alternatives or negotiate better deals with suppliers.

7. Control Overhead Expenses: Keep a close eye on overhead expenses such as rent, utilities, insurance, and marketing. Regularly review contracts or service agreements and explore cost-saving measures, such as energy-efficient appliances or bundling services for discounted rates.

8. Expense Documentation: Maintain proper documentation of all expenses, including invoices, receipts, and bank statements. This ensures accurate record-keeping and provides supporting evidence for tax purposes or audits.

9. Regular Financial Reviews: Conduct regular financial reviews to assess the overall financial health of your restaurant. Review expense reports, analyze spending trends, and identify areas for improvement. This allows you to make informed decisions to enhance profitability and control costs.

10. Employee Expense Monitoring: Implement policies and procedures for employee expenses, such as reimbursements or company credit cards. Monitor expenses, set spending limits, and require proper documentation to prevent misuse or unauthorized spending.

By diligently tracking expenses and effectively managing purchasing, you can identify cost-saving opportunities, streamline operations, and maximize profitability for your restaurant.

Managing Payroll and Employee Benefits

Managing payroll and employee benefits is a crucial aspect of running a restaurant. Ensuring accurate and timely payment to your staff while complying with labor laws and providing competitive benefits is vital for both employee satisfaction and legal compliance. Here are key considerations for effectively managing payroll and employee benefits:

1. Employee Classification: Ensure that each employee is correctly classified as either hourly or salaried, exempt or non-exempt. Classify employees in accordance with applicable labor laws to determine overtime eligibility and benefit entitlements.

2. Payroll Records: Maintain accurate records of employee hours worked, wages earned, and deductions. Utilize a reliable payroll system to automate calculations and generate pay stubs that detail the breakdown of wages and deductions.

3. Payroll Processing: Establish a regular payroll schedule to ensure timely payment of wages. Adhere to federal, state, and local regulations regarding pay frequency and distribution methods. Consider using payroll software or outsourcing payroll processing for accuracy and efficiency.

4. Deductions and Withholdings: Familiarize yourself with the various deductions and withholdings required by law, such as taxes, Social Security contributions, and employee benefits. Ensure proper calculation and remittance of these deductions to avoid legal issues.

5. Employee Benefits: Evaluate and provide competitive employee benefits such as health insurance, retirement plans, paid time off, and employee discounts or perks. Understand the legal requirements, tax implications, and costs associated with offering these benefits.

6. Compliance with Labor Laws: Stay up-to-date with labor laws and regulations, including minimum wage laws, overtime rules, breaks, and meal periods. Regularly review and update your policies and practices to ensure compliance and mitigate the risk of costly penalties or lawsuits.

7. Recordkeeping: Maintain organized and secure records of employee payroll information, tax forms, benefit enrollment, and other related documents. Retain these records for the required period as mandated by law.

8. Employee Self-Service: Implement an employee self-service portal or platform where employees can access their payroll information, tax forms, and benefit details. This empowers employees to view and manage their personal information, reducing administrative inquiries.

9. Communication and Transparency: Clearly communicate payroll policies, procedures, and benefit offerings to your employees. Provide them with resources or support channels to address any payroll-related questions or concerns, fostering transparency and trust.

10. Regular Audit and Review: Conduct periodic audits and reviews of your payroll processes, records, and benefit programs. This helps identify errors or discrepancies, ensure compliance, and identify opportunities for improvement.

Effectively managing payroll and employee benefits is crucial for maintaining a happy and motivated workforce while complying with legal requirements. By implementing sound practices and staying abreast of labor laws, you can ensure fair compensation and attractive benefits for your restaurant staff.

Analyzing Financial Statements

Analyzing financial statements is a critical task for understanding the financial health and performance of your restaurant. Financial statements provide valuable insights into your restaurant’s profitability, liquidity, and overall financial position. Here are the key aspects to consider when analyzing financial statements:

1. Profit and Loss Statement (Income Statement): The profit and loss statement summarizes your restaurant’s revenues, costs, and expenses over a specific period. Analyze this statement to identify trends in sales, cost of goods sold, and operating expenses. It helps you assess your restaurant’s profitability and identify areas for cost reduction or efficiency improvement.

2. Balance Sheet: The balance sheet provides a snapshot of your restaurant’s financial position, showing its assets, liabilities, and owner’s equity. Analyze the balance sheet to evaluate liquidity, solvency, and leverage. Pay attention to cash and inventory levels, debt obligations, and owner’s equity to assess the overall financial stability of your restaurant.

3. Cash Flow Statement: The cash flow statement tracks the flow of cash in and out of your restaurant. It reveals the operating cash generated, cash used for investing activities, and cash obtained from financing sources. Analyzing this statement helps you understand the cash flow dynamics of your restaurant and identify potential cash flow issues or opportunities for investment.

4. Key Performance Indicators (KPIs): Identify and track key performance indicators specific to the restaurant industry. Some common KPIs include food and labor costs as a percentage of sales, table turnover rate, and average check size. Comparing these KPIs to industry benchmarks or historical data helps you gauge the efficiency and effectiveness of your operations.

5. Ratio Analysis: Calculate and analyze key financial ratios to assess the financial health of your restaurant. Common ratios include the gross profit margin, operating profit margin, return on assets, and current ratio. These ratios provide insights into profitability, efficiency, liquidity, and overall performance, allowing you to compare your restaurant’s performance against industry standards or competitors.

6. Trend Analysis: Compare financial statements and ratios over multiple periods to identify trends and patterns. Look for improvements or declines in revenue, expenses, and profitability. This analysis helps you understand the impact of changes in pricing, menu offerings, or external factors on your restaurant’s financial performance.

7. Variance Analysis: Compare actual financial results to budgeted or forecasted amounts. Analyze the variances and investigate the reasons behind them. This allows you to identify areas where you exceeded or fell short of expectations, helping you make informed decisions and adjustments to future budgets or operational strategies.

8. Seek Professional Guidance: Consider consulting with an accountant or financial advisor to assist in the analysis of financial statements. They can provide an objective assessment of your restaurant’s financial health and offer valuable insights or recommendations for improvement.

Regularly analyzing financial statements provides you with a comprehensive understanding of your restaurant’s financial performance, enabling you to make informed decisions, address financial challenges, and capitalize on growth opportunities.

Compliance with Tax and Accounting Regulations

Complying with tax and accounting regulations is a fundamental responsibility for any restaurant owner. Failure to meet these obligations can result in severe penalties, fines, or even legal consequences. Here are key considerations to ensure compliance with tax and accounting regulations:

1. Registration and Licensing: Ensure that your restaurant is properly registered with the appropriate governing bodies and has obtained the necessary licenses and permits. This includes registering for federal, state, and local tax identification numbers, as well as obtaining any required food or liquor licenses.

2. Sales Tax: Understand and comply with sales tax regulations in your jurisdiction. Collect and remit sales tax on applicable goods and services. Maintain accurate records of sales transactions and sales taxes collected to support your filings and facilitate audits, if necessary.

3. Payroll Taxes: Accurately calculate, withhold, and remit payroll taxes, including federal income tax, Social Security tax, and Medicare tax. Stay up-to-date with changes in withholding rates, tax brackets, and reporting requirements. File payroll tax reports and issue W-2 forms to employees as required by law.

4. Reporting and Filing Requirements: File annual tax returns, such as income tax returns for your business entity and personal tax returns if you are a sole proprietor or a pass-through entity. Familiarize yourself with tax forms specific to the restaurant industry, such as Form 8027 for large employers in the food and beverage industry.

5. Accurate Financial Records: Maintain accurate and complete financial records, including income and expense records, bank statements, receipts, and invoices. Organize and store these records for the required period as mandated by tax and accounting regulations. Utilize bookkeeping software or consult with an accountant to ensure proper recordkeeping.

6. Compliance with GAAP: Adhere to Generally Accepted Accounting Principles (GAAP) in the preparation and presentation of your financial statements. GAAP ensures consistency, comparability, and accuracy in financial reporting, which is important for regulatory compliance and investor confidence.

7. Independent Audits: Consider engaging an independent auditor to review and verify your financial statements. An external audit provides an objective assessment of your financial records and adds credibility to your financial reporting process.

8. Stay Informed: Keep abreast of changes in tax laws, accounting standards, and reporting requirements. Regularly seek professional guidance from an accountant or tax advisor to ensure you are up-to-date with the latest regulations and to address any specific compliance concerns for your restaurant.

Adhering to tax and accounting regulations is essential for maintaining the financial integrity of your restaurant. By satisfying these obligations, you can avoid costly penalties, maintain trust with stakeholders, and focus on the growth and success of your business.

Using Technology for Efficient Bookkeeping

In today’s digital age, leveraging technology is key to efficient bookkeeping for your restaurant. Implementing the right tools can streamline your financial processes, enhance accuracy, and save you valuable time. Here are some ways to use technology for efficient bookkeeping:

1. Accounting Software: Invest in restaurant-specific accounting software, such as QuickBooks, Xero, or FreshBooks. These platforms offer features tailored to the unique needs of the hospitality industry, including automated data entry, inventory management, and financial reporting. The software can integrate with your POS system, streamlining the recording of sales and expense transactions.

2. Cloud-Based Bookkeeping: Take advantage of cloud-based bookkeeping platforms that offer anytime, anywhere access to your financial data. Cloud storage eliminates the need for physical paperwork and allows you to securely store and backup your financial records. It also enables collaboration with your accountant or bookkeeper, ensuring real-time updates and seamless communication.

3. Receipt Scanning and Expense Tracking: Utilize mobile apps or software that allow you to scan and digitally store receipts. These tools can automatically extract important data, such as the vendor, date, and amount, and categorize it for easy expense tracking. This eliminates the need for manual entry and reduces the risk of lost or misplaced receipts.

4. Automated Bank Feeds: Connect your accounting software with your bank accounts to automate bank feeds. This functionality imports your financial transactions directly into your bookkeeping software, saving time and minimizing errors associated with manual data entry.

5. Time and Attendance Software: Use time and attendance software to accurately track employee hours and automate payroll calculations. These systems integrate with your bookkeeping software, ensuring accuracy in wage calculation and adhering to labor laws regarding overtime and breaks.

6. Data Analytics and Reporting: Leverage data analytics tools to gain valuable insights from your financial data. These tools can generate custom reports, perform trend analysis, and identify key performance indicators (KPIs). Analyzing the data can help you make data-driven decisions and identify areas for improvement within your restaurant’s operations.

7. Integrations with Third-Party Apps: Explore integrations between your accounting software and other restaurant management tools. For example, integration with inventory management software can automatically update inventory levels based on sales data, improving accuracy and efficiency in cost of goods sold calculations.

8. Mobile Access: Choose software solutions that offer mobile apps, allowing you to access and manage your financial data on the go. This is particularly beneficial when you need to review real-time sales figures, approve expenses, or track financial performance while away from your restaurant.

By leveraging technology, you can automate repetitive tasks, reduce the risk of errors, and streamline your bookkeeping processes. This allows you to focus more on strategic financial management and ultimately drive the success of your restaurant.

Tips for Successful Restaurant Bookkeeping

Effective bookkeeping is vital for the financial health and success of your restaurant. Here are some tips to ensure successful bookkeeping practices:

1. Stay Organized: Maintain a system for organizing financial documents, such as receipts, invoices, and bank statements. Keep physical and digital copies in a secure and easily accessible location. This organization will save time during audits, tax filing, and financial analysis.

2. Regularly Reconcile Accounts: Reconcile your bank and credit card accounts on a regular basis to ensure accuracy and identify any discrepancies. This helps to catch errors, prevent fraud, and maintain a clear picture of your restaurant’s financial transactions.

3. Separate Personal and Business Finances: Keep personal and business finances separate. Have separate bank accounts and credit cards specifically for your restaurant. This separation simplifies your bookkeeping process and ensures accurate financial reporting.

4. Track Income and Expenses Daily: Record your daily sales and expenses in a timely manner. This practice helps maintain accurate records and provides a clear understanding of your restaurant’s financial performance. Consider using technology, such as a POS system, to streamline this process.

5. Categorize Expenses Properly: Categorize expenses accurately and consistently. Use a chart of accounts that aligns with your specific restaurant’s needs. Proper categorization allows for better expense analysis, aids in budgeting, and ensures proper tax deductions.

6. Monitor Cash Flow: Keep a close eye on your restaurant’s cash flow by tracking incoming and outgoing cash. Regularly review cash flow statements and take steps to improve cash flow when necessary. This will help you plan for upcoming expenses, manage working capital, and avoid cash shortages.

7. Implement Internal Controls: Establish internal controls to prevent fraud and errors. This includes segregation of duties, regular reconciliation of financial records, and implementing approval processes for financial transactions.

8. Seek Professional Guidance: Consult with a qualified accountant or bookkeeper to ensure compliance with tax regulations and to receive expert advice on financial management. They can help you navigate complexities, such as payroll taxes, financial reporting, and tax deductions specific to the restaurant industry.

9. Review and Analyze Financial Reports: Regularly review financial reports, such as profit and loss statements and balance sheets. Analyze trends, identify areas for improvement, and make data-driven decisions based on the insights gained from your financial analysis.

10. Stay Informed: Stay up-to-date with changes in tax laws, accounting regulations, and industry trends. Attend seminars or workshops, read relevant publications, and engage in professional development to ensure your bookkeeping practices remain accurate and compliant.

By implementing these tips, you can establish effective bookkeeping practices that provide a solid foundation for financial management, strategic decision-making, and the overall success of your restaurant.

Conclusion

In conclusion, effective bookkeeping is a vital aspect of managing a successful restaurant. It provides you with the financial information and insights necessary to make informed decisions, control costs, and ensure compliance with tax and accounting regulations. By following the tips and best practices outlined in this article, you can establish a strong foundation for your restaurant’s financial management.

Setting up a bookkeeping system, including the use of accounting software and cloud-based solutions, allows you to streamline your financial processes and maintain organized records. Daily sales reporting and cash handling procedures ensure transparency and accuracy in your financial transactions. Tracking expenses, managing inventory, and controlling overhead costs help optimize profitability and minimize waste.

Furthermore, managing payroll and employee benefits not only ensures legal compliance but also fosters a positive work environment. Analyzing financial statements, calculating key ratios, and conducting trend analysis provide you with valuable insights into your restaurant’s financial performance and help identify areas for improvement.

Complying with tax and accounting regulations is paramount to avoid penalties and maintain the financial integrity of your restaurant. Utilizing technology tools and seeking professional guidance simplifies complex processes, minimizes errors, and saves you valuable time.

By implementing successful bookkeeping practices, you gain control over your restaurant’s financial health, make informed decisions, and position your business for long-term growth and success. Remember, bookkeeping is not just a necessary task but a strategic tool that allows you to navigate the competitive restaurant industry and achieve your financial goals.