Finance

How Much Do Accountants Charge For Bookkeeping

Modified: December 30, 2023

Learn about the cost of bookkeeping services from accountants and stay on top of your finances. Find out how much accountants charge for bookkeeping.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to running a successful business, maintaining accurate and up-to-date financial records is crucial. This is where the expertise of professional accountants comes into play. Accountants not only ensure that your books are accurately maintained, but they also provide valuable insights and guidance to help you make informed financial decisions.

But how much do accountants charge for bookkeeping services? The cost can vary depending on various factors, including the complexity of your financial situation, the size of your business, and the specific services you require. In this article, we will explore the different factors that can affect accountant charges for bookkeeping and provide helpful insights to help you make an informed decision.

It’s important to note that while there is no one-size-fits-all answer to the question of how much accountants charge, understanding the factors that influence pricing can give you a better idea of what to expect when hiring a professional accountant for your bookkeeping needs.

Accountants typically charge for their services based on either hourly rates or fixed fees. Hourly rates are calculated based on the amount of time an accountant spends working on your books, while fixed fees are predetermined amounts agreed upon between you and the accountant.

When choosing between hourly rates and fixed fees, it’s important to consider the complexity of your financial situation and the level of ongoing support you require. Hourly rates may be more suitable for businesses with fluctuating needs or irregular financial transactions. On the other hand, fixed fees can provide predictability and stability for businesses with consistent bookkeeping requirements.

Next, let’s take a closer look at the average cost of bookkeeping services. According to industry data, the average hourly rate for bookkeeping services ranges from $30 to $50 per hour. Keep in mind that this is just an average, and rates may vary depending on factors such as location and the experience level of the accountant.

Factors Affecting Accountant Charges for Bookkeeping

Several factors can influence the charges imposed by accountants for bookkeeping services. Understanding these factors will help you assess the cost and value of hiring an accountant. Here are the main factors to consider:

- Business Size and Complexity: The size and complexity of your business can significantly impact the cost of bookkeeping services. Larger businesses with more extensive financial transactions and multiple entities may require more time and expertise to handle their bookkeeping needs, resulting in higher charges.

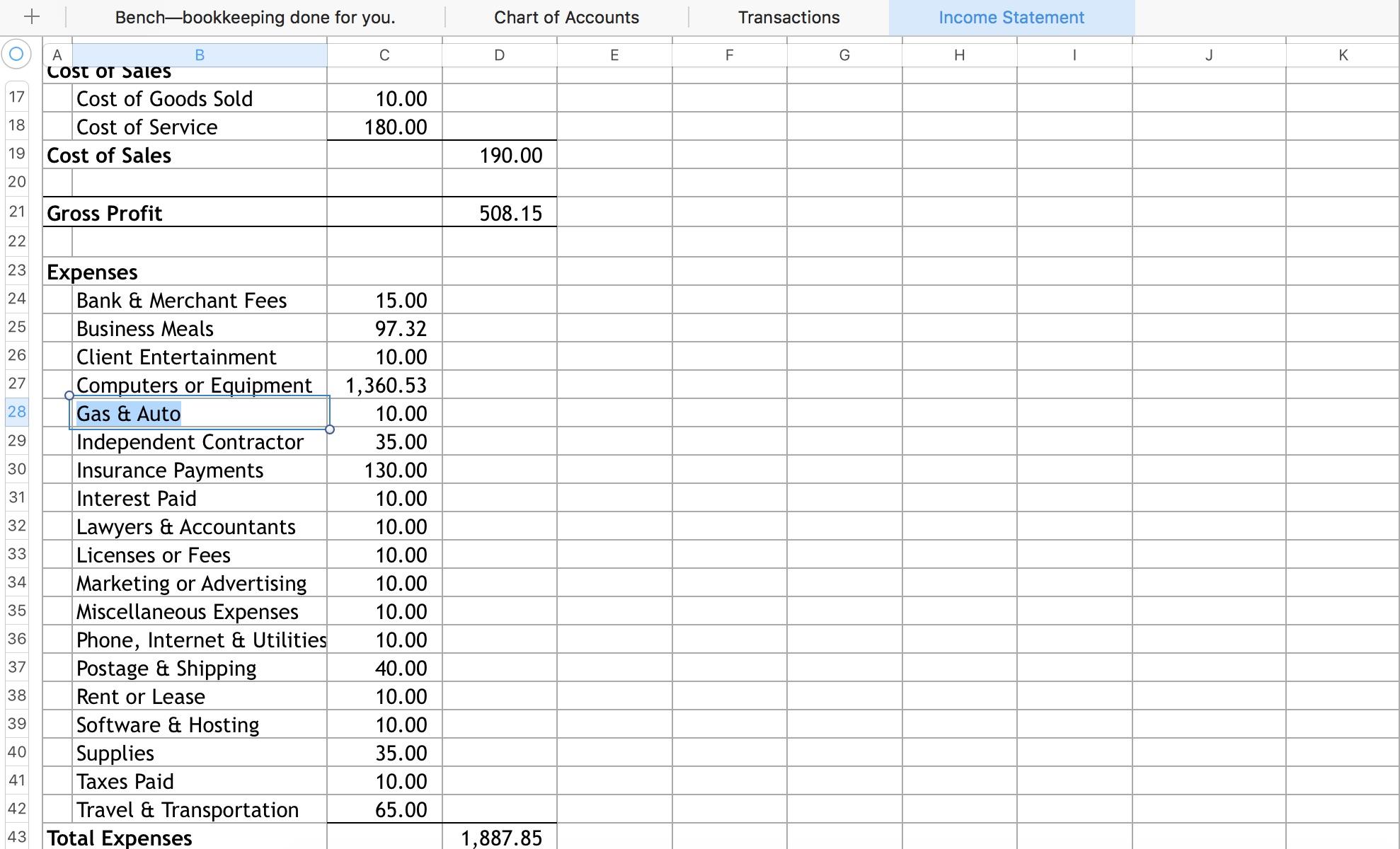

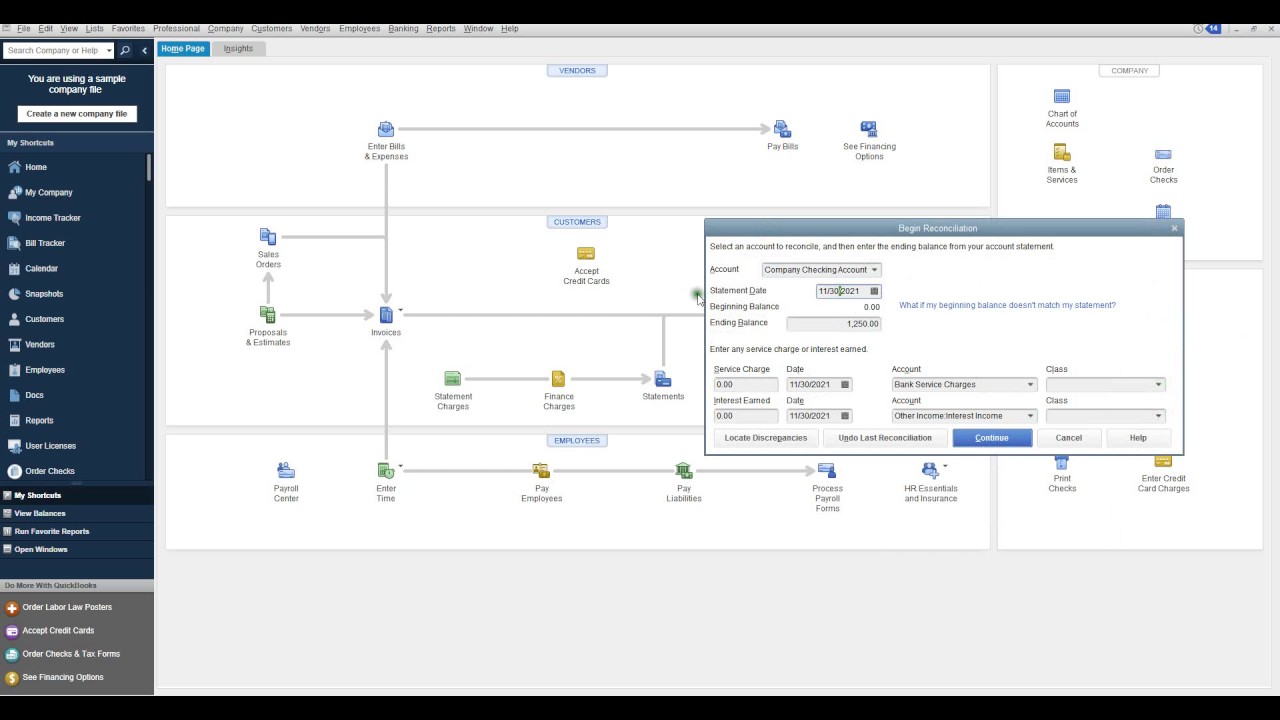

- Level of Bookkeeping Services: The level of bookkeeping services you require will also play a role in determining the cost. Basic services such as transaction recording and bank reconciliation are typically more affordable than more advanced services like financial statement preparation, budgeting, and forecasting.

- Frequency and Turnaround Time: The frequency at which you require bookkeeping services and the turnaround time expectations can affect the pricing. For instance, if you need your books to be updated on a daily or weekly basis with a quick turnaround, the accountant may charge a premium for the increased workload and time sensitivity.

- Software and Technology: The software and technology used by the accountant can impact the cost. If the accountant utilizes advanced bookkeeping software or cloud-based solutions, it can result in increased efficiency and accuracy. However, these tools may come with additional expenses that could be reflected in the overall charges.

- Experience and Expertise: The experience and expertise of the accountant will also influence the charges. Accountants with years of experience and specialized knowledge in your industry may command higher rates. However, their expertise can provide added value in terms of accuracy, compliance, and strategic financial advice.

- Geographical Location: The geographical location of your business can affect the charges imposed by accountants. Accountants in major cities or areas with a high cost of living may have higher rates compared to those in smaller towns or rural regions.

It’s essential to discuss these factors with potential accountants to understand how they will impact the pricing for your specific needs. A professional accountant will be transparent about their rates and provide a clear breakdown of the services included in their charges.

Next, let’s explore the difference between hourly rates and fixed fees and how they can impact the cost of bookkeeping services.

Hourly Rates vs. Fixed Fees

When it comes to accountant charges for bookkeeping, there are typically two pricing structures: hourly rates and fixed fees. Understanding the differences between the two can help you choose the most suitable option for your business.

Hourly Rates:

Accountants who charge by the hour will bill you based on the time they spend working on your bookkeeping tasks. The hourly rate will vary depending on factors such as the accountant’s experience, location, and the complexity of the work involved. Hourly rates can range from $30 to $150 or more.

The advantage of hourly rates is that you only pay for the actual time spent on your bookkeeping tasks. This can be beneficial if you have fluctuating needs or irregular financial transactions. However, keep in mind that unforeseen complications or delays may extend the time required, resulting in higher costs.

Fixed Fees:

With fixed fees, you agree upon a predetermined amount for the bookkeeping services. The fee is typically based on an estimate of the accountant’s average time and effort required for your specific needs. Fixed fees provide predictability and stability, allowing you to budget accurately for your bookkeeping expenses.

Fixed fees are particularly beneficial for businesses with consistent bookkeeping requirements. Knowing the exact cost in advance can help you plan your finances more effectively. However, it’s crucial to discuss the scope of services included in the fixed fee to ensure you are getting all the necessary support.

Some accountants may offer a combination of hourly rates and fixed fees, where certain services are billed at an hourly rate while others have a fixed fee. This hybrid approach can provide flexibility and customization to meet your unique needs.

When deciding between hourly rates and fixed fees, consider factors such as the complexity of your financial situation, the level of ongoing support needed, and your budgetary preferences. Discuss these options with potential accountants to find the pricing structure that aligns best with your business requirements.

Next, let’s explore the average cost of bookkeeping services to give you a better idea of what to expect in terms of pricing.

Average Cost of Bookkeeping Services

When considering hiring an accountant for your bookkeeping needs, it’s helpful to have a general understanding of the average cost of bookkeeping services. While the exact cost will depend on various factors, including the size and complexity of your business, here is a rough estimate to give you an idea of what to expect:

- Hourly Rates: The average hourly rate for bookkeeping services typically ranges from $30 to $50 per hour. However, keep in mind that rates may vary based on factors such as location and the accountant’s experience level.

- Fixed Fees: Fixed fees for bookkeeping services can range from $200 to $500 or more per month, depending on the level of services required and the complexity of your financial situation.

It’s important to note that these figures are averages and should be used as a general guideline. The actual cost may be higher or lower depending on your specific needs and the market rates in your area.

Factors that can influence the cost within the given range include the size of your business, the number of financial transactions, the complexity of your financial records, and the level of ongoing support required. The more time and effort the accountant needs to dedicate to your bookkeeping tasks, the higher the cost is likely to be.

Additionally, it’s important to consider that some accountants may charge additional fees for specific services that are outside the scope of regular bookkeeping, such as tax preparation, payroll processing, or financial analysis. These additional services can have a varying impact on the overall cost, depending on your business needs.

It’s highly recommended to contact several accountants and request quotes based on your specific requirements. By comparing the cost and the services included in their packages, you can find an accountant that not only fits your budget but also offers the necessary expertise to meet your bookkeeping needs.

Next, let’s explore the impact of additional services on the pricing of bookkeeping services.

Additional Services and their Impact on Pricing

While basic bookkeeping services cover essential tasks such as recording transactions and reconciling accounts, you may require additional services to meet your specific business needs. These additional services can have an impact on the pricing of bookkeeping services. Here are some common additional services and how they can affect the cost:

- Tax Preparation: If you need assistance with tax preparation, including filing income tax returns and preparing financial statements for tax purposes, the accountant may charge an additional fee. The complexity of your tax situation and the number of tax forms required will impact the cost.

- Payroll Processing: If the accountant handles your payroll needs, including calculating employee wages, processing payroll taxes, and preparing payroll reports, this service may come at an additional cost. The number of employees and the complexity of your payroll system will affect the pricing.

- Financial Reporting and Analysis: If you require more advanced financial reporting and analysis, such as creating customized financial reports or performing in-depth financial analysis, the accountant may charge an extra fee. The extent of analysis and reporting required will influence the cost.

- Budgeting and Forecasting: If you need help with creating budgets and forecasts for your business, the accountant may provide this service for an additional fee. The complexity of your business and the level of detail required in the budgeting and forecasting process will impact the cost.

- Advisory Services: Some accountants offer advisory services, providing strategic financial advice and guiding you in making informed business decisions. This can include assistance with growth strategies, cash flow management, and financial planning. This service may result in a higher fee due to the additional expertise and time commitment.

It’s important to discuss your specific needs with the accountant and determine which additional services are necessary for your business. The accountant can then provide a detailed breakdown of the pricing for each service to ensure transparency and help you make informed decisions.

Keep in mind that while additional services can increase the cost of bookkeeping, they can also provide significant value and support for your business. By investing in these services, you can gain access to expert advice and insights that can help drive your business growth and success.

Next, let’s discuss the factors to consider when choosing the right accountant for your bookkeeping needs.

Choosing the Right Accountant for Bookkeeping Needs

Choosing the right accountant for your bookkeeping needs is crucial to ensure accurate financial records, compliance with regulations, and valuable financial insights. Here are some factors to consider when selecting an accountant:

- Experience and Specialization: Look for an accountant with relevant experience and specialization in bookkeeping. Consider their industry expertise and familiarity with businesses similar to yours. This ensures that they understand the specific challenges and requirements of your industry.

- Reputation and References: Research the reputation of the accountant or accounting firm. Check for client reviews or testimonials, and ask for references to get firsthand feedback on their services. A reputable accountant with a track record of satisfied clients is more likely to meet your expectations.

- Communication and Accessibility: Effective communication with your accountant is crucial for a successful working relationship. Ensure that the accountant is responsive, accessible, and able to communicate complex financial information in a clear and understandable manner.

- Technology and Software: Inquire about the technology and software the accountant uses for bookkeeping. Opt for an accountant who employs accounting software and tools that align with your business needs. This can streamline processes and provide real-time access to financial data.

- Cost and Value: Consider the cost of the accountant’s services in relation to the value provided. Evaluate the range of services included in their packages and whether they offer customization based on your specific needs. It’s important to strike a balance between affordability and the level of expertise and support required.

- Personal Connection: Building a rapport with your accountant is essential for a collaborative and trusting relationship. Schedule an initial consultation or interview with potential accountants to assess their approach, personality, and compatibility with your business’s values and goals.

- Credentials and Certifications: Verify that the accountant holds relevant credentials and certifications, such as being a Certified Public Accountant (CPA) or a member of a professional accounting association. These qualifications demonstrate their commitment to professionalism and adherence to industry standards.

Take the time to interview multiple accountants and compare their offerings and expertise. Consider seeking recommendations from trusted business partners or colleagues who have had positive experiences with their accountants. Ultimately, choosing the right accountant can have a significant impact on the financial success of your business.

Now, let’s conclude our discussion on accountant charges for bookkeeping services.

Conclusion

Accountant charges for bookkeeping services can vary based on several factors, including the size and complexity of your business, the level of services required, and the accountant’s experience and expertise. By understanding these factors, you can make an informed decision and choose the accountant that aligns best with your needs and budget.

Hourly rates and fixed fees are the two main pricing structures for bookkeeping services. Hourly rates offer flexibility but can result in variable costs, while fixed fees provide predictability and stability. The choice between the two depends on your business’s specific requirements.

The average cost of bookkeeping services can range from $30 to $50 per hour or $200 to $500 or more per month for fixed fees. Additional services such as tax preparation, payroll processing, financial reporting, and advisory services may come at an additional cost.

When selecting an accountant, consider factors such as their experience, reputation, communication skills, technology usage, and cost in relation to the value provided. Building a personal connection with your accountant is also important for fostering a collaborative and productive relationship.

Remember to request quotes from multiple accountants and discuss the scope of services included in their charges. This will help you find the best accountant to meet your bookkeeping needs and contribute to your business’s financial success.

In conclusion, investing in professional bookkeeping services can provide significant benefits in terms of accurate financial records, compliance, and valuable financial insights. By understanding the factors that affect accountant charges for bookkeeping and carefully selecting the right accountant, you can ensure that your financial records are in capable hands.