Finance

How To Find Monthly Minimum Payment On A Loan

Published: February 27, 2024

Learn how to calculate the monthly minimum payment on a loan with our finance guide. Understand the process and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Understanding the Monthly Minimum Payment on a Loan

- Deciphering the Components of Monthly Minimum Payments

- Influential Variables in Determining Monthly Minimum Payments

- Navigating the Methodologies for Determining Minimum Payments

- Strategies for Prudent Financial Management

- Navigating Monthly Minimum Payments with Confidence

Introduction

Understanding the Monthly Minimum Payment on a Loan

When it comes to managing personal finances, understanding the concept of monthly minimum payments on loans is crucial. Whether you're repaying a mortgage, car loan, student loan, or credit card debt, knowing how the minimum payment is calculated and the factors that influence it can help you make informed financial decisions. This article will delve into the intricacies of monthly minimum payments, offering insights into how they are determined, the factors that affect them, and tips for managing them effectively.

Navigating the world of loans and debt repayment can be daunting, especially for those new to personal finance. Many individuals find themselves grappling with questions such as, "What exactly is the monthly minimum payment?" and "How can I calculate it for different types of loans?" This article aims to demystify these concepts, empowering readers to take control of their financial obligations and make informed choices regarding their loans.

Understanding the monthly minimum payment is not only essential for meeting financial obligations but also for avoiding potential pitfalls such as late fees, increased interest charges, and negative impacts on credit scores. By gaining a comprehensive understanding of this fundamental aspect of loan repayment, individuals can proactively manage their finances and work towards achieving their long-term financial goals.

Throughout this article, we will explore the factors that influence the monthly minimum payment, provide insights into calculating it for various types of loans, and offer practical tips for effectively managing these payments. By the end, readers will have a solid grasp of the nuances surrounding monthly minimum payments, empowering them to navigate their financial responsibilities with confidence and foresight.

Understanding Monthly Minimum Payment

Deciphering the Components of Monthly Minimum Payments

At its core, the monthly minimum payment on a loan represents the smallest amount a borrower must repay to the lender each month to avoid defaulting on the loan. This payment typically includes a portion of the principal amount borrowed, the accrued interest, and any applicable fees. While the minimum payment may seem like a fixed figure, it can fluctuate based on various factors, including the outstanding balance, interest rate, and the terms of the loan agreement.

When borrowers make only the minimum payment, a significant portion often goes towards covering the interest accrued, with a smaller fraction contributing to reducing the principal balance. Consequently, making minimum payments over an extended period can result in a longer repayment term and higher overall interest costs. Understanding this dynamic is crucial for borrowers aiming to minimize the total interest paid and expedite the loan repayment process.

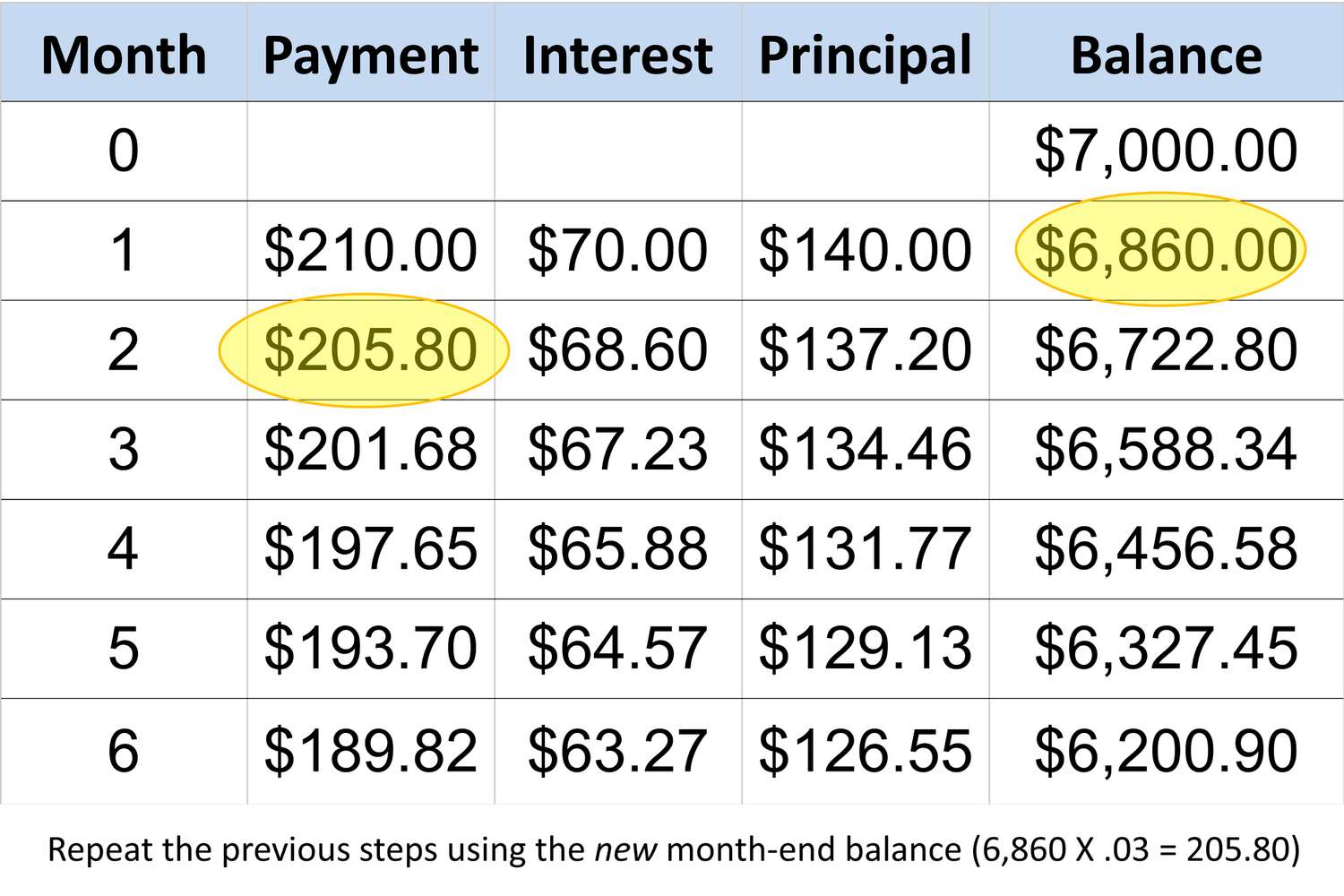

For credit card debt, the monthly minimum payment is typically calculated as a percentage of the outstanding balance, subject to a minimum amount. This approach allows credit card issuers to ensure steady cash flow while providing borrowers with flexibility in managing their monthly obligations. However, it’s essential for borrowers to recognize that solely making minimum payments on credit card balances can lead to prolonged debt and substantial interest expenses.

On the other hand, installment loans, such as auto loans and personal loans, often feature fixed monthly minimum payments throughout the repayment term. These payments are structured to ensure that the loan is fully amortized over the agreed-upon period, with each installment covering both principal and interest. By adhering to the prescribed minimum payment schedule, borrowers can steadily reduce their outstanding balance and ultimately retire the debt.

Understanding the composition of monthly minimum payments is pivotal for borrowers seeking to manage their finances prudently. By recognizing how these payments are allocated towards interest and principal, individuals can make informed decisions about accelerating their loan repayment, optimizing their financial resources, and minimizing the overall cost of borrowing.

Factors Affecting Monthly Minimum Payment

Influential Variables in Determining Monthly Minimum Payments

Several key factors influence the calculation of the monthly minimum payment on a loan, each playing a significant role in shaping the borrower’s financial obligations. Understanding these variables is essential for borrowers aiming to manage their monthly payments effectively and optimize their overall loan repayment strategy.

- Outstanding Balance: The amount owed on the loan directly impacts the minimum payment. As the outstanding balance decreases, the minimum payment also reduces, reflecting the diminishing principal amount and the associated interest.

- Interest Rate: The interest rate on the loan is a critical determinant of the minimum payment. Higher interest rates lead to larger portions of the payment being allocated to interest, potentially extending the repayment period and increasing the overall interest cost.

- Loan Term: The duration of the loan plays a pivotal role in calculating the minimum payment. Shorter loan terms often result in higher monthly minimum payments, as the principal amount must be repaid over a compressed timeframe.

- Loan Type: Different types of loans, such as fixed-rate mortgages, adjustable-rate mortgages, and credit card debt, have distinct methodologies for determining the minimum payment. Understanding the specific requirements of each loan type is crucial for managing monthly obligations effectively.

- Payment Frequency: The frequency of required payments, whether monthly, bi-weekly, or otherwise, can impact the minimum payment calculation. Loans with more frequent payment schedules may feature smaller minimum payments per installment.

By comprehending the interplay of these factors, borrowers can gain valuable insights into the dynamics of monthly minimum payments. This understanding enables individuals to make informed decisions regarding their loan repayment strategy, potentially accelerating the payoff timeline and minimizing the total interest expense.

Furthermore, borrowers can leverage this knowledge to assess the impact of potential changes in their financial circumstances, such as fluctuations in income or interest rate adjustments. By proactively evaluating the variables influencing their minimum payments, individuals can adapt their repayment approach to align with their evolving financial situation, fostering greater financial stability and control.

Calculating Monthly Minimum Payment

Navigating the Methodologies for Determining Minimum Payments

The process of calculating the monthly minimum payment on a loan varies across different types of debt instruments, each governed by distinct formulas and considerations. Understanding these methodologies is essential for borrowers seeking to ascertain their monthly obligations accurately and plan their finances effectively.

For credit card debt, the minimum payment is commonly calculated as a percentage of the outstanding balance, typically ranging from 1% to 3% of the total amount owed. This percentage-based approach ensures that the minimum payment adjusts in tandem with fluctuations in the outstanding balance, providing borrowers with a degree of flexibility in managing their monthly obligations. Additionally, credit card issuers often impose a minimum dollar amount for the monthly payment, ensuring that the borrower’s repayment remains commensurate with the outstanding balance.

When it comes to installment loans, such as mortgages and auto loans, the calculation of the monthly minimum payment involves amortization principles. These loans feature fixed monthly payments structured to ensure that the loan is fully amortized over the agreed-upon term. The minimum payment is designed to cover both the interest accrued for the period and a portion of the principal, gradually reducing the outstanding balance with each installment.

For adjustable-rate mortgages (ARMs), the minimum payment calculation can be more complex due to the variability of interest rates. Lenders typically provide borrowers with detailed schedules illustrating the minimum payment for each adjustment period, factoring in the prevailing interest rate and the remaining loan term. Understanding the intricacies of ARMs and the potential fluctuations in minimum payments is crucial for borrowers navigating these dynamic loan products.

When borrowers seek to calculate the monthly minimum payment for their loans, leveraging online calculators and financial tools can streamline the process and provide accurate estimates. By inputting relevant details such as the loan amount, interest rate, and term, individuals can obtain a clear breakdown of their minimum payment obligations, empowering them to plan their finances proactively and manage their monthly expenses effectively.

By comprehending the distinct methodologies for calculating monthly minimum payments across various loan types, borrowers can gain clarity on their financial obligations, enabling them to budget strategically and optimize their loan repayment approach.

Tips for Managing Monthly Minimum Payments

Strategies for Prudent Financial Management

Effectively managing monthly minimum payments on loans is crucial for maintaining financial stability and minimizing the overall cost of borrowing. By implementing strategic approaches and adopting prudent financial habits, borrowers can navigate their repayment obligations with confidence and optimize their long-term financial well-being.

- Pay More Than the Minimum: Whenever feasible, strive to pay more than the minimum amount due. By allocating additional funds towards loan repayment, borrowers can expedite the reduction of the principal balance, thereby diminishing the overall interest expense and shortening the repayment timeline.

- Consolidate and Refinance: Explore options for consolidating high-interest debts or refinancing existing loans at more favorable terms. This can potentially result in lower monthly minimum payments, reduced interest costs, and simplified debt management.

- Create a Budget: Develop a comprehensive budget that prioritizes loan payments while accounting for other essential expenses. By diligently adhering to a well-structured budget, borrowers can ensure that they allocate sufficient funds towards meeting their monthly minimum payment obligations.

- Monitor Interest Rates: Stay informed about prevailing interest rates, particularly for variable-rate loans. Being aware of potential rate adjustments allows borrowers to anticipate changes in their minimum payments and adjust their financial plans accordingly.

- Communicate with Lenders: In cases of financial hardship or unexpected challenges, proactively engage with lenders to discuss viable solutions. Many lenders offer hardship programs or alternative payment arrangements to assist borrowers facing difficulties in meeting their minimum payment obligations.

- Automate Payments: Consider setting up automatic payments for the monthly minimum amounts. This can help avoid missed payments, late fees, and potential negative impacts on credit scores, providing peace of mind and streamlining the repayment process.

- Seek Financial Guidance: If navigating loan repayment becomes overwhelming, seek guidance from financial advisors or credit counseling services. These professionals can offer tailored strategies and insights to help manage monthly minimum payments effectively.

By implementing these tips and integrating them into their financial management practices, borrowers can proactively address their monthly minimum payment obligations, optimize their loan repayment strategies, and work towards achieving greater financial freedom and security.

Conclusion

Navigating Monthly Minimum Payments with Confidence

Understanding the intricacies of monthly minimum payments on loans is a fundamental aspect of prudent financial management. By delving into the components, factors, calculation methodologies, and effective management strategies associated with minimum payments, borrowers can equip themselves with the knowledge and insights necessary to navigate their loan repayment obligations with confidence and foresight.

From credit card debt to installment loans and adjustable-rate mortgages, the dynamics of minimum payments vary across different types of loans, each presenting unique considerations and challenges. By comprehending the interplay of factors such as outstanding balances, interest rates, and loan terms, individuals can make informed decisions regarding their repayment strategies, potentially minimizing the overall cost of borrowing and expediting their path to financial freedom.

Moreover, by adopting proactive financial habits such as paying more than the minimum, monitoring interest rates, and engaging with lenders when facing financial difficulties, borrowers can effectively manage their monthly minimum payments and maintain financial stability. The implementation of these strategies empowers individuals to take control of their financial obligations, optimize their repayment approach, and work towards achieving their long-term financial goals.

As borrowers navigate the landscape of loan repayment, it is crucial to recognize the significance of prudent financial planning, budgeting, and strategic decision-making. By leveraging the insights and tips provided in this article, individuals can proactively address their monthly minimum payment obligations, fostering greater financial stability, and working towards a future defined by financial well-being and security.

Ultimately, by embracing a proactive and informed approach to managing monthly minimum payments, borrowers can pave the way for a sound financial future, unencumbered by excessive debt and marked by prudent financial decision-making.