Home>Finance>Discount Rate Defined: How It’s Used By The Fed And In Cash-Flow Analysis

Finance

Discount Rate Defined: How It’s Used By The Fed And In Cash-Flow Analysis

Published: November 12, 2023

Learn how discount rate impacts financial decisions in both monetary policy and cash-flow analysis. Explore the role of finance in defining discount rates.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Discount Rate Defined: How It’s Used by the Fed and in Cash-Flow Analysis

Finance is an essential aspect of our lives, driving economic growth and shaping the world around us. Understanding key concepts like the discount rate can provide valuable insights into the financial landscape. In this blog post, we will explore what a discount rate is, how it is used by the Federal Reserve (Fed), and its significance in cash-flow analysis.

Key Takeaways:

- The discount rate is the interest rate at which the Federal Reserve lends money to banks and financial institutions.

- In cash-flow analysis, the discount rate is used to determine the present value of future cash flows.

So, what exactly is a discount rate? The discount rate can be defined as the interest rate at which the Federal Reserve lends money to banks and financial institutions. It plays a crucial role in monetary policy, influencing the overall economy by affecting borrowing costs and liquidity in the financial system. By adjusting the discount rate, the Fed aims to manage inflation, stabilize prices, and stimulate economic growth.

How is the discount rate used by the Fed?

The Fed uses the discount rate as a tool to control the money supply in the economy. By adjusting the discount rate, the Fed can encourage or discourage borrowing and lending activities. When the discount rate is lowered, banks can borrow funds at a lower cost, leading to increased lending to individuals and businesses. This stimulates economic activity and can help boost employment. However, if the discount rate is increased, borrowing becomes more expensive, leading to a decrease in lending activities and a potential slowdown in economic growth.

It is important to note that changes in the discount rate have a ripple effect throughout the financial system. These changes can impact interest rates on mortgages, loans, and credit cards, influencing consumer spending and investment decisions. As a result, the discount rate directly affects the cost of borrowing for individuals and businesses, shaping their financial strategies and decisions.

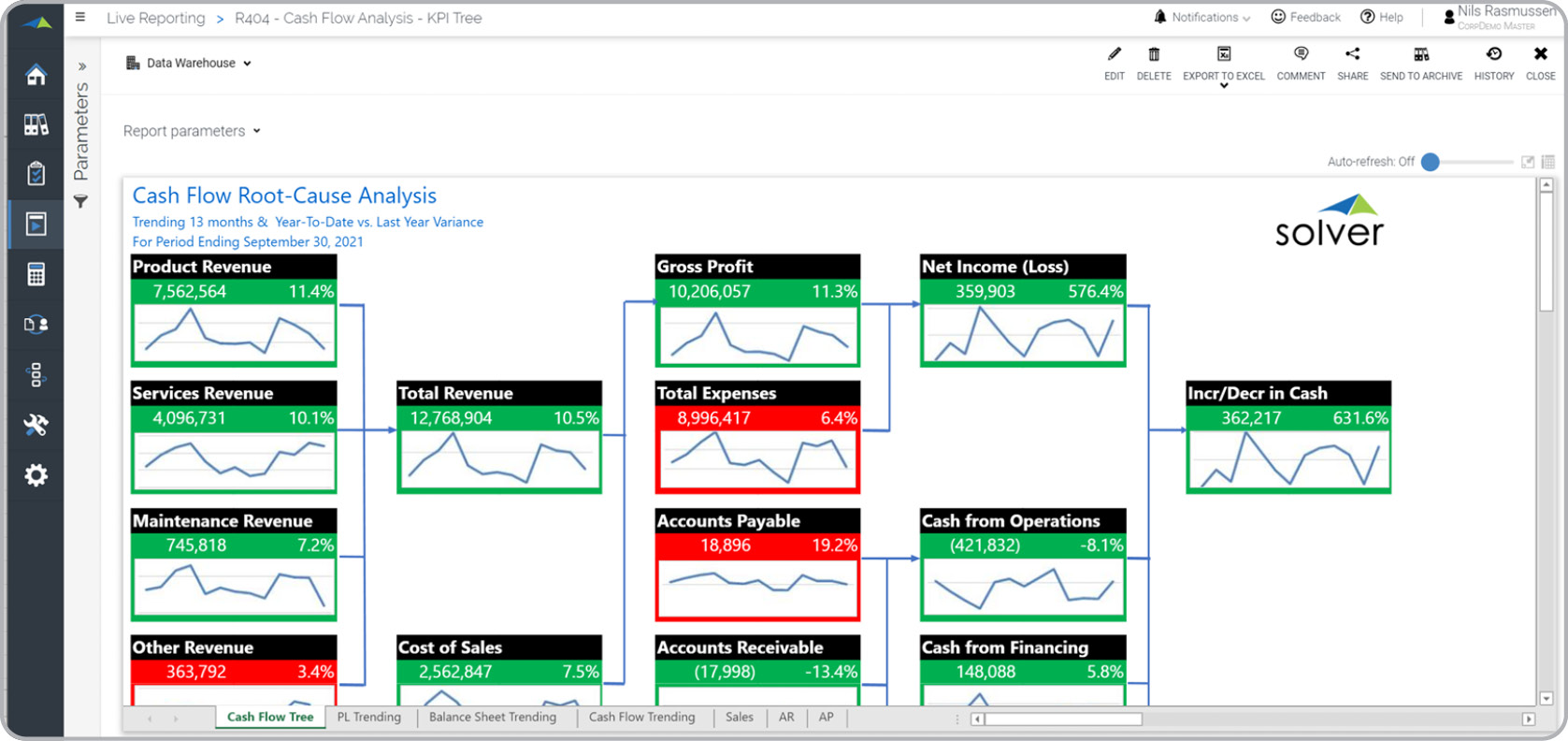

Significance of the discount rate in cash-flow analysis

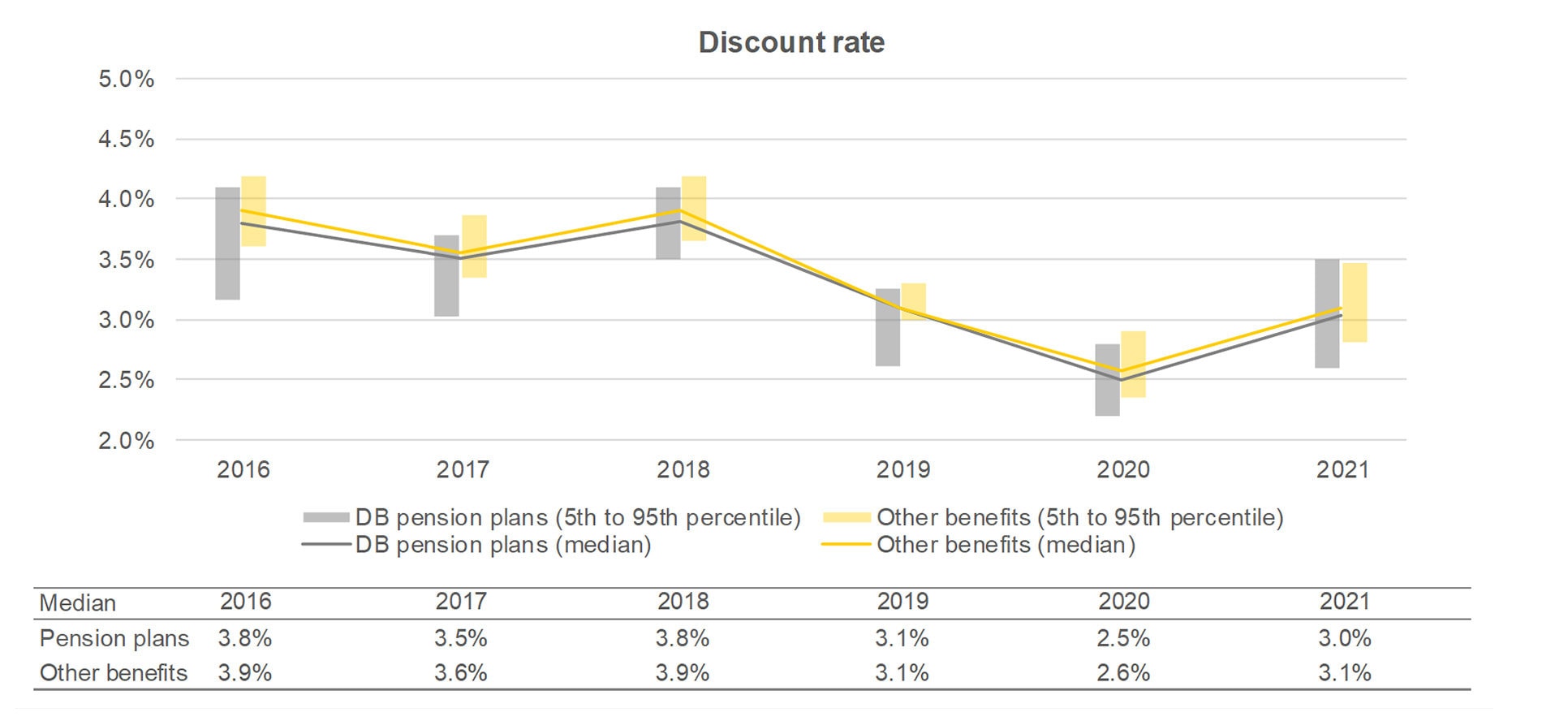

Besides its role in monetary policy, the discount rate also holds significant importance in cash-flow analysis. In finance, cash-flow analysis involves evaluating future cash flows and determining their present value. The discount rate is used to adjust future cash flows to their present value, considering the time value of money.

The concept of time value of money is based on the principle that a dollar received in the future is worth less than a dollar received today. This is because money has the potential to earn interest or be invested to generate returns. Therefore, future cash flows are discounted or reduced to their present value based on the discount rate, reflecting the opportunity cost of waiting to receive the cash.

By discounting the future cash flows, investors and analysts can compare the present value of expected returns to the initial investment or cost. This enables better decision-making when evaluating investment opportunities, potential business projects, or financial instruments.

In conclusion, the discount rate is a fundamental concept within the field of finance. Understanding its role in monetary policy and its significance in cash-flow analysis can empower individuals and businesses to make more informed financial decisions. Whether you’re an investor, lender, or a savvy individual, grasping the concept of the discount rate can be your key to maneuvering the dynamic world of finance.