Home>Finance>How To Find Your Credit Utilization On Discover

Finance

How To Find Your Credit Utilization On Discover

Published: March 6, 2024

Learn how to easily find and manage your credit utilization on Discover, and take control of your finances with our step-by-step guide. Understanding and optimizing your credit utilization is crucial for financial success. Discover how to do it today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding and managing your credit utilization is a crucial aspect of maintaining a healthy financial profile. It plays a significant role in determining your credit score and overall financial well-being. As a Discover cardholder, accessing and monitoring your credit utilization is essential for making informed financial decisions and optimizing your credit health.

Credit utilization refers to the percentage of your available credit that you are currently using. It is a key factor in credit scoring models and is often considered alongside payment history when evaluating an individual's creditworthiness. This article will guide you through the process of finding your credit utilization on Discover, empowering you to take control of this vital aspect of your financial life.

By gaining a deeper understanding of credit utilization and learning how to effectively manage it, you can work towards improving your credit score and enhancing your financial stability. With the right knowledge and tools at your disposal, you can make informed decisions that positively impact your financial future. Let's delve into the world of credit utilization and discover how it influences your financial well-being.

What is Credit Utilization?

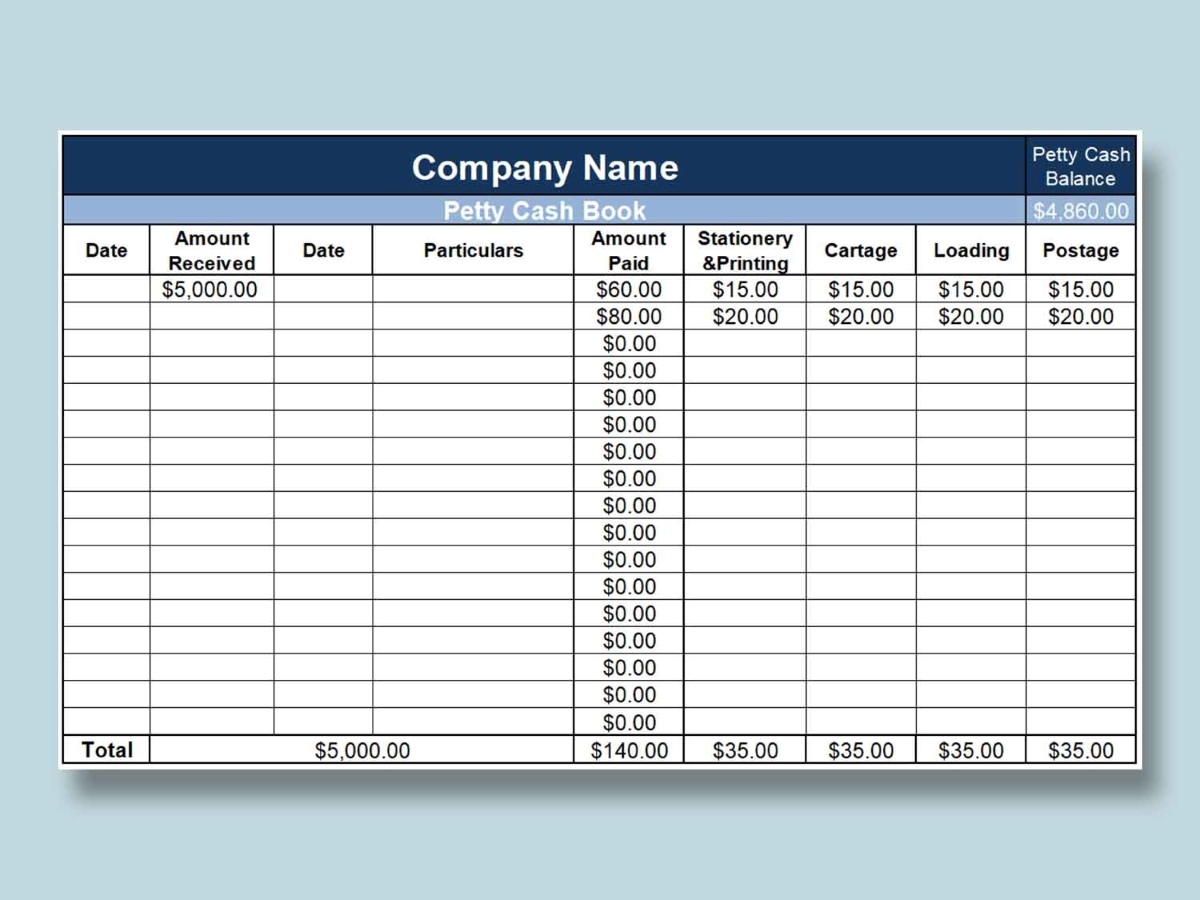

Credit utilization, also known as the balance-to-limit ratio, is a fundamental concept in the realm of personal finance and credit management. It measures the amount of credit you are currently using compared to the total amount of credit available to you. This ratio is expressed as a percentage and is a crucial factor in determining your credit score.

For example, if you have a credit card with a $5,000 limit and you have a balance of $1,000, your credit utilization rate would be 20%. In general, a lower credit utilization ratio is considered favorable as it indicates that you are not overly reliant on credit and are effectively managing your finances.

Credit utilization applies to revolving credit accounts, such as credit cards and lines of credit, and does not factor in installment loans, such as mortgages or car loans. Lenders and credit scoring models view lower credit utilization as a positive indicator of financial responsibility and stability.

Understanding your credit utilization is essential for maintaining a healthy credit profile and improving your overall financial standing. By keeping your credit utilization low, you demonstrate to potential lenders that you can responsibly manage credit and are not overly reliant on borrowed funds. This, in turn, can positively impact your credit score and increase your eligibility for favorable loan terms and credit offerings.

As you navigate the world of personal finance, grasping the significance of credit utilization empowers you to make informed decisions regarding your credit usage and overall financial health. By maintaining a low credit utilization ratio, you can work towards achieving a strong credit score and securing your financial future.

Why is Credit Utilization Important?

Credit utilization holds significant weight in the determination of your credit score, making it a crucial factor in your overall financial well-being. As one of the key components considered by credit scoring models, such as FICO and VantageScore, credit utilization directly impacts your creditworthiness and ability to access favorable financial products and terms.

A low credit utilization ratio signals to lenders that you are using credit responsibly and not overly reliant on borrowed funds. This can enhance your perceived financial stability and increase your eligibility for loans, credit cards, and other financial opportunities. On the other hand, a high credit utilization ratio may raise concerns among lenders, potentially leading to higher interest rates or denials of credit applications.

Furthermore, credit utilization has a direct impact on your credit score. Maintaining a low credit utilization ratio demonstrates prudent financial management and can contribute to a higher credit score. Conversely, a high credit utilization ratio can lower your credit score, potentially limiting your access to credit and increasing the cost of borrowing.

Understanding the importance of credit utilization empowers you to take proactive steps in managing your credit effectively. By maintaining a low credit utilization ratio, you can positively influence your credit score, improve your financial standing, and access better financial opportunities. With this knowledge, you can make informed decisions that support your long-term financial goals and overall credit health.

How to Find Your Credit Utilization on Discover

Discover offers convenient ways for cardholders to access their credit utilization information, empowering them to stay informed about their financial standing. To find your credit utilization on Discover, you can utilize the following methods:

- Online Account Management: Log in to your Discover account through the official website or mobile app. Navigate to the credit card account dashboard, where you can view your current balance, available credit, and credit utilization ratio. Discover provides clear and intuitive interfaces to help you easily access this vital information.

- Customer Service: If you prefer personalized assistance, you can contact Discover’s customer service team via phone or online chat. Representatives can provide you with detailed information about your credit utilization, answer any questions you may have, and offer guidance on managing your credit effectively.

- Monthly Statements: Your monthly statements from Discover include a comprehensive overview of your credit card account, including your current balance, available credit, and credit utilization ratio. Reviewing your statements regularly can help you track changes in your credit utilization and identify opportunities for improvement.

By leveraging these accessible resources, Discover cardholders can easily monitor their credit utilization and gain valuable insights into their financial habits. This transparency fosters informed decision-making and empowers individuals to take proactive steps in managing their credit effectively.

Discover’s commitment to providing cardholders with user-friendly tools and support underscores its dedication to promoting financial well-being. By regularly checking your credit utilization on Discover, you can stay attuned to your financial health and work towards optimizing your credit profile.

Understanding Your Credit Utilization

Once you have accessed your credit utilization information on Discover, it is essential to comprehend how this metric impacts your overall financial standing. Your credit utilization ratio serves as a reflection of your credit management habits and plays a pivotal role in shaping your credit score.

A low credit utilization ratio, ideally below 30%, indicates that you are effectively managing your available credit and not relying heavily on borrowed funds. This can positively influence your credit score, signaling to lenders that you are a responsible borrower. On the other hand, a high credit utilization ratio may raise concerns among lenders and potentially lower your credit score.

Understanding your credit utilization empowers you to make informed decisions about your credit usage. By maintaining a low credit utilization ratio, you can position yourself as a favorable candidate for loans, credit cards, and other financial products. Additionally, being mindful of your credit utilization allows you to identify areas for improvement and take proactive steps to manage your credit more effectively.

It is important to note that credit utilization is not a static metric and can fluctuate based on your spending and payment patterns. Regularly monitoring your credit utilization on Discover enables you to stay informed about changes and take corrective actions if necessary. By staying attuned to your credit utilization, you can work towards optimizing this aspect of your financial profile and ultimately enhancing your creditworthiness.

Ultimately, understanding your credit utilization empowers you to take control of this critical aspect of your financial life. By leveraging the insights provided by Discover, you can make informed decisions that support your long-term financial goals and contribute to a healthy credit profile.

Tips for Managing Your Credit Utilization

Effectively managing your credit utilization is essential for maintaining a healthy credit profile and optimizing your financial well-being. Consider the following tips to proactively manage your credit utilization on Discover:

- Regularly Monitor Your Credit Utilization: Stay informed about your credit utilization by regularly checking your Discover account. By monitoring this metric, you can identify any significant changes and take appropriate actions to manage your credit effectively.

- Pay Your Balances in Full and On Time: Aim to pay your credit card balances in full and on time each month. This practice not only demonstrates responsible credit management but also helps maintain a low credit utilization ratio.

- Consider Increasing Your Credit Limit: If feasible, consider requesting a credit limit increase from Discover. A higher credit limit can lower your credit utilization ratio, provided that your spending remains consistent.

- Use Credit Wisely: Be mindful of your credit usage and avoid maxing out your credit cards. Utilize credit for necessary expenses and strive to keep your balances well below your credit limits.

- Strategically Distribute Your Spending: If you have multiple credit cards, consider distributing your spending across them to maintain lower individual credit utilization ratios on each card.

- Address Outstanding Balances: If you have outstanding balances on multiple credit cards, consider devising a plan to reduce these balances strategically. This can positively impact your overall credit utilization and financial health.

By implementing these strategies, Discover cardholders can actively manage their credit utilization and work towards maintaining a favorable credit profile. These proactive measures can contribute to a healthy credit score and increase eligibility for beneficial financial opportunities.

Ultimately, by adopting responsible credit management practices and staying informed about your credit utilization, you can pave the way for long-term financial stability and enhanced creditworthiness.

Conclusion

Understanding and managing your credit utilization on Discover is an integral part of maintaining a healthy financial outlook. By comprehending the significance of credit utilization and leveraging the tools provided by Discover, you can actively monitor and manage this crucial aspect of your credit profile.

As you navigate the realm of personal finance, it is essential to recognize the impact of credit utilization on your credit score and overall financial well-being. By maintaining a low credit utilization ratio, you can position yourself as a responsible borrower and increase your eligibility for favorable financial products and terms.

Discover’s commitment to empowering cardholders with accessible resources for monitoring credit utilization underscores its dedication to promoting financial literacy and well-being. By regularly accessing your credit utilization information and implementing effective credit management strategies, you can work towards optimizing your credit profile and securing a strong financial foundation.

Remember that credit utilization is a dynamic metric that can fluctuate based on your financial habits. By staying informed and proactive, you can take control of this aspect of your financial life and strive towards achieving a healthy credit profile.

Ultimately, by understanding the nuances of credit utilization and actively managing it, you can set yourself on a path towards long-term financial stability and enhanced creditworthiness. With the right knowledge and tools at your disposal, you can make informed decisions that support your financial goals and pave the way for a brighter financial future.