Finance

How To Find Out Your APR On Credit Card

Modified: March 3, 2024

Discover how to calculate your APR on credit cards and understand the impacts on your personal finances. Take control of your financial future with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, it is crucial to have a clear understanding of the different aspects that can impact your financial well-being. One important factor to consider is the Annual Percentage Rate (APR) on your credit cards. The APR represents the cost of borrowing money and is used to calculate the interest you will owe on any unpaid balances.

Understanding your credit card’s APR is vital, as it can have a significant impact on the overall cost of your debt. Being informed about your APR will help you make better financial decisions and plan your repayment strategies more effectively. In this article, we will explore various methods to find out the APR on your credit card.

Before diving into the specific methods, it’s important to note that credit card issuers are required to disclose the APR in the terms and conditions of your credit card agreement. This information can typically be found in the welcome packet you received when you first obtained the card or on the credit card issuer’s website. However, these methods may require some effort and time to locate the necessary information. Let’s explore some ways to find out your APR.

Understanding APR

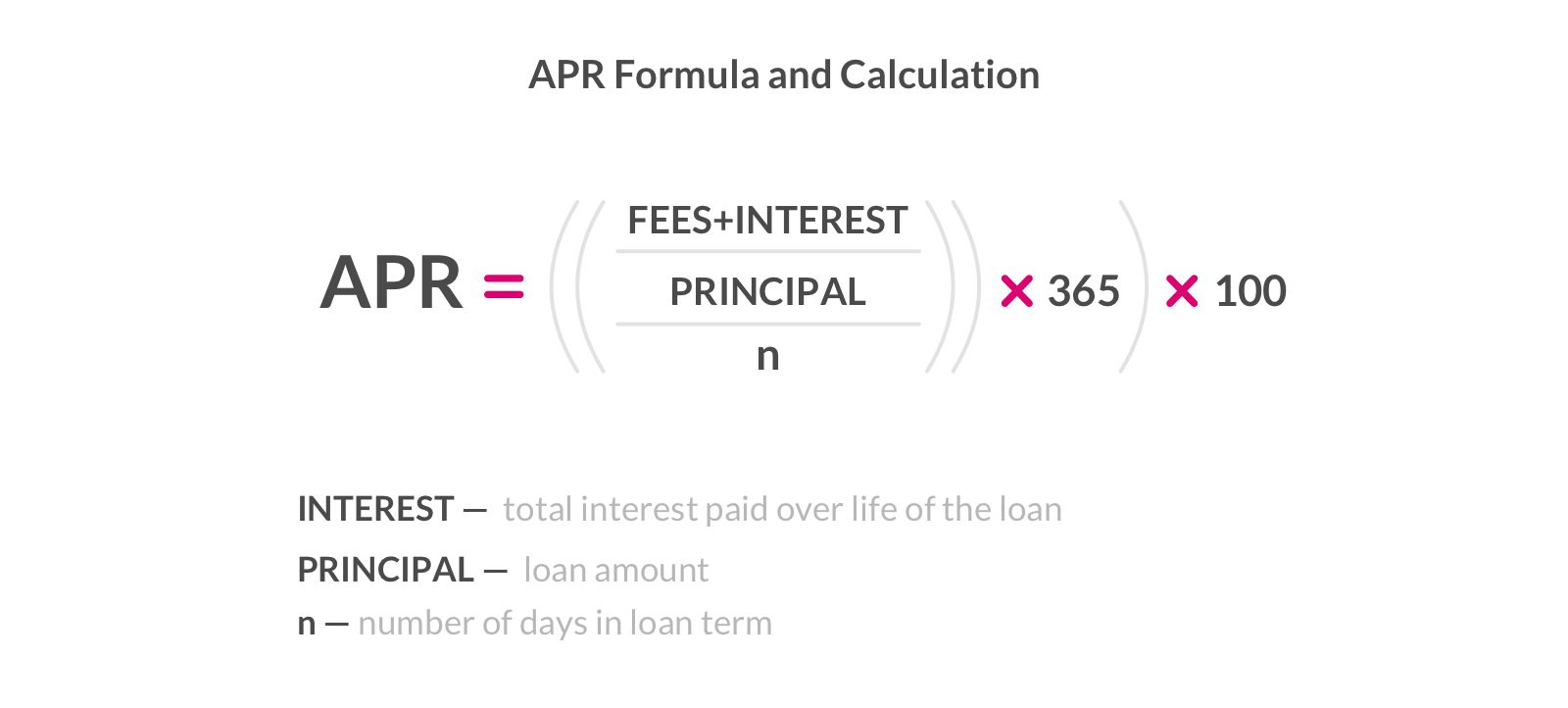

Before we discuss how to find out your APR on a credit card, it’s important to have a clear understanding of what APR is and how it is calculated. APR stands for Annual Percentage Rate, and it represents the cost of borrowing money over a year, expressed as a percentage. It includes both the interest rate and any additional fees or charges associated with the credit card.

While interest rates can vary among credit cards, the APR takes into account not only the interest charged but also any annual fees, balance transfer fees, cash advance fees, and other charges. This means that the APR provides a more accurate representation of the overall cost of borrowing on a credit card.

The APR on a credit card can be fixed or variable. A fixed APR remains the same throughout the life of the credit card, whereas a variable APR can fluctuate based on changes in the market or other factors. It’s important to check whether your credit card has a fixed or variable APR, as this can impact your repayment strategy and the total amount of interest you may pay over time.

It’s also worth noting that credit card companies use different methods to calculate interest. The most common method is the Average Daily Balance method, which takes into account the balance on your card each day of the billing cycle. By understanding how your credit card issuer calculates interest, you can better plan your payments to minimize interest charges.

Now that we have a clear understanding of what APR is and how it is calculated, let’s explore some methods to help you find out the APR on your credit card. This information will empower you to make informed financial decisions and manage your credit card debt more effectively.

Check your credit card statement

One of the easiest ways to find out the APR on your credit card is by checking your monthly credit card statement. The statement typically includes a section that outlines the important details of your account, including the APR.

When you receive your credit card statement, take a close look at the different sections or columns that display your account information. You may find a section labeled “Interest Charges” or “Annual Percentage Rate” that clearly states the APR for your credit card.

If you cannot find the APR listed on your statement, try looking for a section that provides a summary of your account terms or disclosures. The APR should be clearly stated in this section, along with other important details such as the grace period, minimum payment amount, and any applicable fees.

If you prefer a digital version of your credit card statement, you can access it through your credit card issuer’s online portal or mobile app. These platforms typically provide detailed account information, including the APR. Simply log in to your account and navigate to the section that displays your statement or account summary.

It’s important to review your credit card statement regularly to stay up to date with any changes in the APR or additional fees. Make it a habit to carefully examine each statement and familiarize yourself with the terms and conditions of your credit card agreement.

Checking your credit card statement is a quick and convenient way to find out the APR on your credit card. However, if you are unable to locate the information or have any doubts, it’s always a good idea to contact your credit card issuer directly for clarification.

Contact your credit card issuer

If you can’t find the APR on your credit card statement or have any doubts, another reliable method to find out your APR is by directly contacting your credit card issuer. The customer service department of your credit card issuer will have access to your account information and can provide you with the accurate APR for your credit card.

To contact your credit card issuer, you can find the customer service phone number on the back of your credit card or on their website. Alternatively, you can send them an email or utilize the live chat feature on their website if available.

When reaching out to your credit card issuer, make sure to have your credit card details readily available. This includes your credit card number, account number, and any other necessary identification information. This will help the customer service representative quickly locate your account and provide you with the accurate APR information you need.

Take this opportunity to ask any other questions you may have about your credit card, such as fees, grace periods, or any specific terms and conditions you want clarification on. The customer service representative will be able to provide you with a comprehensive understanding of your credit card agreement.

Remember to jot down any important information or notes during your conversation with the credit card issuer for future reference. This will help you stay organized and ensure you have the correct APR information for your records.

By contacting your credit card issuer directly, you can obtain the most up-to-date and accurate information regarding the APR on your credit card. Don’t hesitate to reach out to them for any clarification or assistance you may need.

Use online APR calculators

If you prefer a more hands-on approach to finding out the APR on your credit card, you can utilize online APR calculators. These tools are designed to help you estimate the APR based on the information you input, giving you a rough idea of what you can expect.

To use an online APR calculator, you will typically need to provide certain details about your credit card, such as the interest rate, any additional fees, and the type of interest calculation method used by your credit card issuer. Once you input this information, the calculator will process the data and provide you with an estimated APR.

Keep in mind that while online APR calculators can give you a ballpark figure, they may not be 100% accurate since they rely on the data you provide. Nevertheless, they can be useful for comparing different credit cards or understanding how changes in interest rates or fees can impact the overall APR.

You can easily find online APR calculators through a quick search engine query or by visiting reputable financial websites. Look for calculators specifically designed for credit card APR calculations to ensure accurate results.

When using an online APR calculator, it’s important to have your credit card agreement and recent statement on hand. This will allow you to input accurate and up-to-date information, resulting in a more precise estimate.

While online APR calculators can be a helpful tool, they should not replace the information provided by your credit card statement or direct communication with your credit card issuer. Consider them as a supplementary resource to gain a general understanding of how APR works and its potential implications.

By using online APR calculators, you can get a rough estimation of the APR on your credit card and better comprehend the impact it has on your finances. However, always refer to your credit card statement or contact your credit card issuer for the most accurate and up-to-date information.

Consult a financial advisor

If you want personalized advice and guidance regarding the APR on your credit card, it may be beneficial to consult a financial advisor. Financial advisors are professionals with expertise in various aspects of personal finance, including credit cards and borrowing strategies.

When working with a financial advisor, they can help you analyze your specific financial situation and provide recommendations tailored to your needs. They can review your credit card statements, understand your repayment goals, and assess the impact of the APR on your overall financial well-being.

A financial advisor will not only provide insights on your current credit card’s APR but also help you understand how it fits into your overall financial plan. They can offer advice on debt management, repayment strategies, and even suggest alternative credit cards with more favorable APRs to consider.

Furthermore, a financial advisor can provide comprehensive guidance on improving your creditworthiness, which can ultimately help you secure better credit card offers with lower APRs in the future. They can assist you in establishing healthy credit habits, managing your credit utilization ratio, and monitoring your credit report for accuracy.

When seeking a financial advisor, make sure to choose one who specializes in personal finance and has experience with credit cards and debt management. You can ask for recommendations from friends, family, or trusted professionals, or search for certified financial planners in your area.

Before engaging with a financial advisor, ensure you understand their fee structure and any potential conflicts of interest. It’s important to have a clear understanding of the services they will provide and the value they can bring to your financial journey.

By consulting a financial advisor, you can gain valuable insights into the APR on your credit card and receive personalized advice on managing your credit card debt more effectively. Their expertise and guidance can help you make informed financial decisions and create a path towards a healthier financial future.

Conclusion

Understanding the Annual Percentage Rate (APR) on your credit card is essential for managing your finances effectively. By knowing your APR, you can make informed decisions about borrowing, plan your repayment strategies, and minimize the cost of your debt.

There are several methods you can use to find out the APR on your credit card. Checking your credit card statement is a simple and convenient option, as it typically includes a section that outlines the important details of your account, including the APR. If you can’t find the APR on your statement, contacting your credit card issuer directly is a reliable way to obtain the accurate information you need.

Alternatively, you can use online APR calculators to estimate the APR based on the information you provide. While these calculators can be helpful for comparison or understanding potential changes in interest rates and fees, they may not be 100% accurate.

If you prefer personalized advice and guidance, consulting a financial advisor is a wise choice. A financial advisor can analyze your specific situation, offer tailored recommendations, and help you manage your credit card debt in a way that aligns with your overall financial goals.

In conclusion, understanding your credit card’s APR is crucial for making informed financial decisions. Whether you check your statement, contact your credit card issuer, use online calculators, or seek guidance from a financial advisor, taking the time to find out your APR will empower you to take control of your financial well-being and work towards a healthier and more stable financial future.