Finance

How To Get A Credit Card With EIN Number

Modified: December 29, 2023

Looking to get a credit card with an EIN number? Learn how to navigate the finance world with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Getting a credit card is an essential step in establishing credit history and gaining financial freedom. Traditionally, individuals have used their Social Security Number (SSN) when applying for a credit card. However, if you have a business or are self-employed, you may have heard about the option of obtaining a credit card with an Employer Identification Number (EIN). This can provide numerous benefits and flexibility for managing your business finances.

An EIN, also known as a Federal Tax Identification Number, is a unique nine-digit number issued by the Internal Revenue Service (IRS) to businesses and other entities for tax purposes. It’s similar to a Social Security Number but is specifically for businesses. While an EIN is primarily used for tax-related matters, it can also be utilized for various financial purposes, including applying for a credit card in the name of your business.

In this article, we will explore the process of obtaining a credit card with an EIN number. From understanding what an EIN is to the steps involved in applying for a credit card, we’ll provide you with all the information you need to know to make an informed decision. Additionally, we will offer some valuable tips for effectively using a credit card with an EIN number to maximize its benefits for your business.

What is an EIN Number?

An EIN, or Employer Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses and other entities for tax identification purposes. It serves as a means of identifying your business for various financial and legal transactions.

Similar to how individuals have Social Security Numbers (SSNs) for personal identification, businesses need EINs for taxation and administrative purposes. Whether you’re a sole proprietor, a partnership, a corporation, or even a non-profit organization, you will likely need an EIN.

EINs are used to file tax returns, pay federal taxes, open business bank accounts, apply for business licenses, and more. It is the primary identification number for your business when interacting with the IRS and other government agencies.

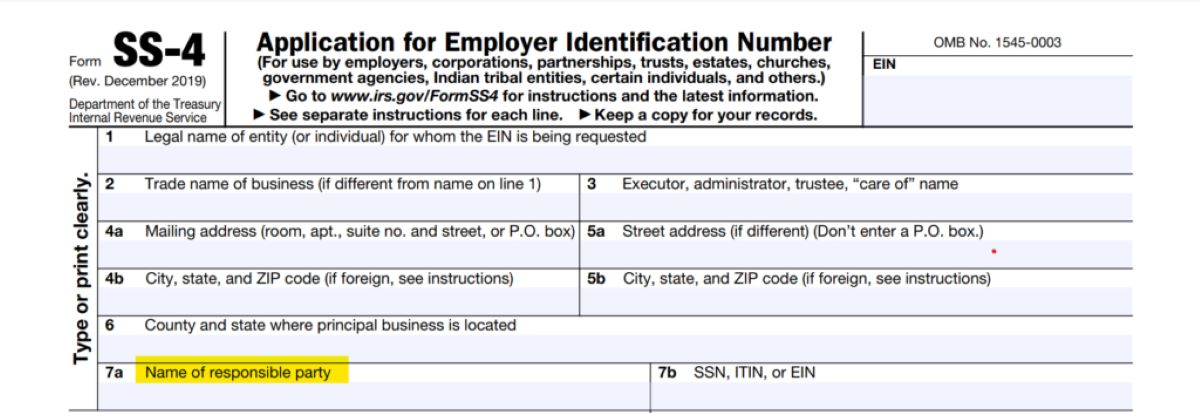

Obtaining an EIN is a relatively straightforward process. You can apply for an EIN online through the IRS website or by mail. The application typically requires information about the legal structure and purpose of your business, as well as your business name, address, and the responsible party’s details.

Once you receive your EIN, it becomes a permanent number for your business. However, it’s important to note that an EIN cannot be transferable or reused by another business entity. If there are significant changes in your business structure, such as forming a new partnership or converting to a different business type, you may need to obtain a new EIN.

Having an EIN provides several advantages for businesses. It allows you to separate your personal and business finances, establish credit for your business, hire employees, and comply with tax obligations. Additionally, it enables you to apply for a credit card specifically in your business’s name, which can be beneficial for various financial management purposes.

Now that we have a clear understanding of what an EIN is and its importance, let’s explore why you might want to get a credit card with an EIN number.

Why Get a Credit Card with an EIN Number?

Applying for a credit card with an EIN number offers several advantages for business owners and self-employed individuals. Here are a few reasons why you might consider getting a credit card specifically in your business’s name:

- Separation of personal and business expenses: Using a credit card in your business’s name allows you to keep your personal and business finances separate. This separation is crucial for accurate bookkeeping, budgeting, and tax purposes, making it easier to track and manage business expenses.

- Building business credit: Having a credit card in your business’s name helps establish and build credit history for your business. Timely payments and responsible credit card usage can improve your business’s credit score, making it easier to qualify for loans, favorable interest rates, and higher credit limits in the future.

- Tracking business expenses: With a dedicated business credit card, you can easily track and categorize your business expenses. Many credit card issuers provide detailed monthly statements and online tools that allow you to monitor and analyze your spending patterns, simplifying your accounting and bookkeeping processes.

- Access to business-specific benefits: Business credit cards often come with attractive perks and rewards tailored to business owners. These benefits may include cashback rewards on business-related purchases, travel rewards, discounts on business services, and access to exclusive business events or networking opportunities.

- Improved financial flexibility: Having a credit card with an EIN number gives you greater financial flexibility to navigate cash flow challenges or unexpected business expenses. It can serve as a revolving line of credit that you can tap into when needed, providing a safety net for your business.

It’s important to note that applying for a credit card with an EIN number does not require a personal guarantee. Unlike traditional credit cards, which are typically linked to personal credit, business credit cards with an EIN number focus more on your business’s creditworthiness and financial stability.

However, keep in mind that responsible credit card usage is essential. Make sure to pay your credit card bill on time, keep your credit utilization low, and avoid excessive debt. This will help maintain a positive credit history for your business and ensure that the benefits of having a credit card with an EIN number outweigh any potential drawbacks.

Now that we understand the benefits of obtaining a credit card with an EIN number, let’s explore important considerations before applying for one.

Things to Consider Before Applying

Before applying for a credit card with an EIN number, it’s essential to consider a few factors to ensure that it’s the right choice for your business. Here are some important considerations to keep in mind:

- Business financial stability: Evaluate the financial stability and cash flow of your business. Applying for a credit card requires responsible usage and timely repayment. Make sure your business can handle the additional credit and has the means to make consistent payments.

- Business credit history: Determine if your business has an established credit history. Some credit card issuers may require a minimum credit score or a certain amount of time in business before approving your application. If your business is new or doesn’t have a credit history, consider building credit with vendors or obtaining a secured credit card first.

- Card issuer’s requirements: Research credit card issuers that offer credit cards for businesses with an EIN number. Understand their eligibility criteria, fees, interest rates, and rewards programs. Comparing different options will help you choose a card that aligns with your business needs.

- Personal credit impact: While applying for a credit card with an EIN number focuses on your business’s creditworthiness, some credit card issuers may still check your personal credit as part of the application process. This can result in a hard inquiry on your personal credit report, which may temporarily impact your personal credit score.

- Card usage restrictions: Some business credit cards with an EIN number may have specific usage restrictions. Ensure that the card allows you to make the types of purchases necessary for your business. For example, if you frequently make international transactions, make sure the card doesn’t have foreign transaction fees or limitations.

- Responsibility and financial discipline: It’s crucial to use a credit card responsibly and maintain financial discipline. Establish clear guidelines and policies for card usage within your business to avoid misuse or overspending. Properly monitoring and reconciling your credit card statements will help you stay on top of your business’s financial activities.

Considering these factors will help you assess whether applying for a credit card with an EIN number is the right financial decision for your business. Once you’ve evaluated these considerations and determined that it aligns with your business goals, you can proceed with the application process.

Next, let’s explore the steps involved in getting a credit card with an EIN number.

Steps to Get a Credit Card with an EIN Number

Obtaining a credit card with an EIN number involves a series of steps. Here’s a step-by-step guide to help you navigate the process:

- Evaluate your business’s financial needs: Determine the specific financial needs and goals of your business. Assess factors such as credit limits, rewards programs, interest rates, and fees to find a credit card that aligns with your business’s requirements.

- Research credit card issuers: Look for credit card issuers that offer credit cards for businesses with an EIN number. Research their reputation, customer reviews, and terms and conditions to choose a reputable issuer that suits your business’s needs.

- Gather necessary documents: Prepare the required documentation to support your credit card application. This may include your business’s EIN, legal business documents such as articles of incorporation or partnership agreements, financial statements, and proof of address.

- Complete the application: Fill out the credit card application accurately and thoroughly. Provide all the necessary information, including your business’s legal name, address, ownership details, and the EIN. Be prepared to answer questions about your business’s financials, tax returns, and any outstanding debts.

- Submit the application: Once you have completed the application, submit it to the credit card issuer. Some issuers allow you to submit applications online, while others may require mailing or faxing the application and supporting documents.

- Wait for approval: After submitting your application, you will need to wait for the credit card issuer to review and process your application. The approval process can vary in duration, ranging from a few days to a few weeks. You may receive a notification by mail or email once a decision is made.

- Activate the credit card: Once your credit card application is approved, you will receive your credit card in the mail. Follow the instructions provided to activate the card, typically through an online or phone activation process.

- Establish responsible credit card habits: After receiving and activating your credit card, it’s essential to use it responsibly. Make timely payments, keep track of your expenses, and avoid carrying a high balance. Responsible card usage will help build positive credit history and maximize the benefits of having a credit card with an EIN number.

Remember to carefully review the terms and conditions of your credit card agreement. Be aware of any fees, interest rates, and payment due dates to avoid unnecessary charges and maintain a positive financial standing for your business.

With these steps, you can navigate the process of obtaining a credit card with an EIN number and start leveraging its benefits for your business. Next, let’s discuss the application process in more detail.

Applying for a Credit Card

When applying for a credit card with an EIN number, it’s important to follow the application process correctly to increase your chances of approval. Here are some important steps and considerations to keep in mind:

- Research credit card options: Research different credit card options available for businesses with an EIN number. Compare interest rates, fees, rewards programs, and other features to find the card that best suits your business’s needs and financial goals.

- Review eligibility requirements: Review the eligibility requirements set by the credit card issuer. Some may have specific criteria such as a certain credit score, time in business, or annual revenue thresholds. Make sure your business meets these requirements before applying.

- Gather required documents: Prepare all the necessary documents to support your credit card application. These may include your EIN number, business legal documents, financial statements, and proof of address. Having all the required documents ready beforehand will expedite the application process.

- Complete the application: Fill out the credit card application accurately and provide all the requested information. Be prepared to provide details about your business, including its legal name, address, ownership structure, and financial information.

- Provide additional documentation if needed: Some credit card issuers may require additional documentation, such as tax returns or bank statements, to assess your business’s financial stability. Be prepared to provide these documents if requested.

- Submit the application: Once you have completed the application and gathered the required documents, submit your application to the credit card issuer. Follow the specified submission method, whether it’s online, by mail, or through fax.

- Wait for the decision: After submitting your application, you will need to wait for the credit card issuer to review your application and make a decision. The time it takes to receive a decision can vary, so be patient and avoid applying for multiple credit cards simultaneously, as this can negatively impact your creditworthiness.

- Activate the credit card: If your credit card application is approved, you will receive the credit card in the mail. Follow the provided instructions to activate the card, usually through an online or phone activation process.

- Familiarize yourself with the terms and conditions: Before using your new credit card, carefully read and understand the terms and conditions of the credit card agreement. Pay attention to interest rates, fees, grace periods, and any rewards program details.

- Start using your credit card responsibly: Once your credit card is activated, use it responsibly by making timely payments and maintaining a low credit utilization ratio. Track your expenses and ensure that your business remains within its budget.

By following these steps, you can navigate the credit card application process smoothly and increase the likelihood of obtaining a credit card with an EIN number for your business.

Next, let’s delve into some useful tips for effectively using a credit card with an EIN number.

Tips for Using a Credit Card with an EIN Number

Using a credit card with an EIN number can be a powerful financial tool for your business. Here are some valuable tips to help you make the most of your credit card:

- Create a clear policy for card usage: Establish guidelines and policies for how the credit card should be used within your business. Clearly communicate these policies to employees who may have access to the card to avoid any misuse or unauthorized charges.

- Keep personal and business expenses separate: Use your business credit card solely for business-related expenses. Mixing personal and business expenses can complicate your financial records and make tax preparation more challenging.

- Track and categorize expenses diligently: Regularly review your credit card statements and categorize your expenses accurately. This will make it easier to monitor spending patterns, optimize your budget, and prepare financial reports.

- Pay your credit card bill on time: Late payments can result in fees and damage your creditworthiness. Set reminders or enroll in automatic payments to ensure that your credit card bill is paid on time each month.

- Keep your credit utilization low: Aim to keep your credit card utilization ratio (the percentage of your credit limit that you are using) below 30%. This demonstrates responsible credit card usage and can positively impact your business’s credit score.

- Maximize rewards and benefits: Take advantage of any rewards programs or benefits offered by your credit card issuer. These can include cash back on business expenses, travel rewards, or discounts on business services. Review and understand the terms and conditions of these programs to ensure you can optimize their benefits.

- Regularly review your credit card statement: Carefully review your monthly credit card statements to spot any errors or unauthorized charges. If you notice any discrepancies, contact your credit card issuer immediately to resolve the issue.

- Monitor your credit card activity: Keep a close eye on your credit card activity through online banking or mobile apps provided by your credit card issuer. This allows you to detect potential fraudulent transactions and address them promptly.

- Avoid excessive debt: While credit cards offer financial flexibility, it’s crucial to avoid accumulating excessive debt. Only charge expenses that you can comfortably pay off within a reasonable time frame to avoid falling into a cycle of high-interest debt.

- Regularly review your credit report: Maintain a habit of reviewing your business’s credit report to ensure the accuracy of the information and detect any potential issues. You can request a free copy of your credit report annually from the major credit bureaus.

By following these tips, you can effectively use your credit card with an EIN number to manage your business’s finances, build credit, and take advantage of the rewards and benefits offered.

Now, with a thorough understanding of obtaining and using a credit card with an EIN number, we can conclude our discussion.

Conclusion

Obtaining a credit card with an EIN number can be a valuable asset for your business. It allows you to separate personal and business expenses, build credit for your business, and enjoy specific benefits tailored to business owners. By following the steps outlined in this article, you can navigate the application process successfully and start leveraging the advantages of having a credit card in your business’s name.

However, it’s essential to consider the financial stability of your business, understand the eligibility requirements set by credit card issuers, and use your credit card responsibly. Responsible credit card usage, including making timely payments, monitoring expenses, and keeping credit utilization low, will help you maintain a positive credit history for your business and maximize the benefits of having a credit card with an EIN number.

Remember, different credit card issuers offer varying terms and benefits, so take the time to research and select the credit card that best fits your business’s needs. Regularly review your credit card statements, track your expenses, and take advantage of any rewards programs or benefits offered.

Ultimately, by using a credit card with an EIN number wisely, you can establish and strengthen your business’s creditworthiness, access financial flexibility when needed, and streamline your financial management processes.

Now armed with the knowledge provided in this article, you can confidently apply for a credit card with an EIN number and use it as a powerful tool to support the financial growth and success of your business.