Home>Finance>How Long Does It Take To Get An Ein Number From The IRS?

Finance

How Long Does It Take To Get An Ein Number From The IRS?

Published: October 31, 2023

Find out how long it takes to receive your EIN number from the IRS for your finance needs. Get insights on the process and timeline in this informative guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is an EIN Number?

- Why Do You Need an EIN Number?

- Applying for an EIN Number

- Steps to Obtain an EIN Number

- Online Application Process

- Mailing or Faxing Form SS-4

- Applying by Phone

- How Long Does It Take to Get an EIN Number?

- Factors Affecting Processing Time

- Tips to Expedite the EIN Number Application Process

- Conclusion

Introduction

When starting a business or managing certain financial transactions, you may have come across the term “EIN number.” An EIN number, also known as an Employer Identification Number, is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to businesses, nonprofits, and other entities for tax purposes.

Obtaining an EIN number is an important step in establishing your business’s identity and fulfilling your tax obligations. It serves as a tax identification number and is required for various financial activities, such as opening a business bank account, filing taxes, hiring employees, and applying for business licenses.

In this article, we will guide you through the process of obtaining an EIN number from the IRS, the different methods available, and how long it typically takes to receive your EIN number.

Whether you are starting a new business or need to change your existing business structure, understanding the EIN number application process is essential. So, let’s delve into the intricacies of acquiring an EIN number and the factors that may affect the processing time.

What is an EIN Number?

An EIN number, also known as an Employer Identification Number, is a unique nine-digit identification number assigned by the IRS to businesses, nonprofits, trusts, estates, and other entities for tax purposes. It is commonly referred to as a tax ID number.

Similar to how individuals are identified by their Social Security numbers, businesses and organizations are identified by their EIN numbers. This number helps the IRS track and monitor the financial activities of the entity, ensuring compliance with tax laws and regulations.

The format of an EIN number is XX-XXXXXXX, with the first two digits representing the geographic location or type of business, and the remaining seven digits being unique to the entity. The EIN number is permanent and does not change, even if the ownership or management of the business changes.

It is important to note that an EIN number is not just limited to businesses with employees. Even if you are a sole proprietor or a single-member LLC with no employees, you may still need an EIN number for various purposes.

In summary, an EIN number is a unique identifier issued by the IRS for tax-related activities. It enables businesses and organizations to fulfill their financial obligations and establish their identity within the tax system. Let’s explore why obtaining an EIN number is crucial for your business.

Why Do You Need an EIN Number?

Obtaining an EIN number is a fundamental requirement for businesses and organizations due to several reasons:

- Tax Purposes: The primary reason for needing an EIN number is to fulfill your tax obligations. It is necessary for filing various tax returns, such as income tax, employment tax, and excise tax.

- Employer Responsibilities: If you have employees, having an EIN number is essential for payroll tax withholding and reporting. It enables you to accurately report and remit employment taxes to the IRS.

- Business Structure: If you operate as a partnership, corporation, or multi-member LLC, an EIN number is necessary. It helps identify your business entity as separate from your personal finances.

- Opening Business Bank Account: Most financial institutions require an EIN number to open a business bank account. It helps establish the credibility and legitimacy of your business.

- Obtaining Business Licenses: Many state and local authorities require an EIN number when applying for business licenses and permits. It is a crucial step in ensuring compliance with local regulations.

- Managing Trusts and Estates: If you are responsible for managing trusts, estates, or certain types of pension plans, an EIN number is necessary to properly handle the financial affairs of these entities.

- Contractual Obligations: Some contracts or agreements may require an EIN number for tax reporting and compliance purposes. Having an EIN number ensures you can fulfill these obligations efficiently.

These are just a few examples of why an EIN number is crucial for businesses and organizations. It simplifies tax-related processes, helps separate personal and business finances, and provides credibility and legitimacy in the financial world.

Now that you understand the importance of obtaining an EIN number, let’s move on to the next section – applying for an EIN number.

Applying for an EIN Number

Applying for an EIN number is a straightforward process, and you have multiple options to choose from. The IRS offers three methods for obtaining an EIN number:

- Online Application: The quickest and most convenient way to apply for an EIN number is through the IRS website. This method is available 24/7 and is generally recommended for most applicants.

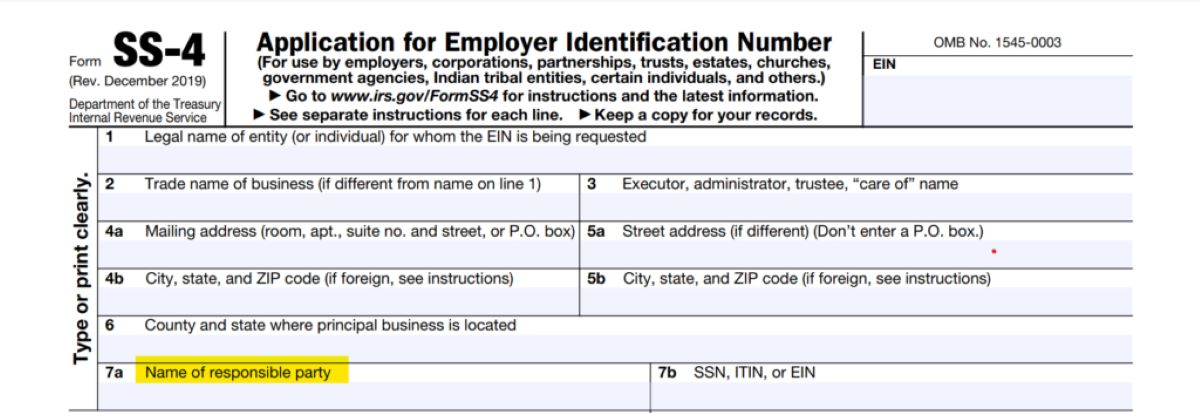

- Mailing or Faxing Form SS-4: If you prefer to submit a paper application, you can download Form SS-4 from the IRS website and mail or fax it to the appropriate IRS office. This method may take longer to process compared to the online application.

- Applying by Phone: In certain circumstances, you may be eligible to apply for an EIN number over the phone by calling the IRS. This method is typically reserved for international applicants or those with special circumstances.

Now, let’s take a closer look at each application method and how you can choose the one that suits your needs.

Online Application Process:

The online application process is the fastest and most convenient way to obtain an EIN number. Here are the steps to follow:

- Visit the IRS website and navigate to the EIN Assistant page.

- Click on the “Apply Online Now” button to start the application process.

- Select the appropriate entity type for your business or organization.

- Provide the necessary details about your entity, such as name, address, and responsible party information.

- Review the information you entered and submit the application.

- After validating the information, the IRS will immediately assign you an EIN number, which you can download and print for your records.

Please note that the online application is only available for entities located in the United States or its territories.

Mailing or Faxing Form SS-4:

If you prefer to submit a paper application, you can download Form SS-4 from the IRS website and complete it with the required information. Once done, you can either mail or fax the form to the appropriate IRS office. The processing time for paper applications is typically longer compared to the online application, as it involves manual handling and verification.

Applying by Phone:

Applying for an EIN number by phone is generally limited to special circumstances, such as international applicants without a legal residence in the United States. To apply by phone, you can call the IRS Business and Specialty Tax Line and provide the necessary information to the representative. The IRS will then assign you an EIN number during the call.

Now that we have discussed the different application methods, you might wonder how long it takes to receive your EIN number. Let’s explore the typical processing time in the next section.

Steps to Obtain an EIN Number

Obtaining an EIN number involves a few straightforward steps, regardless of the application method you choose. Here is a general overview of the process to obtain an EIN number:

- Determine Your Eligibility: Before applying for an EIN number, ensure that you are eligible to obtain one. Generally, businesses, nonprofits, trusts, estates, and other entities are eligible for an EIN number.

- Gather Required Information: Prepare the necessary information needed for the application process. This includes the legal name of your business, the mailing address, and the responsible party’s name and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Choose an Application Method: Decide on the application method that is most suitable for your needs – online, mail/fax, or phone. Consider factors such as convenience, processing time, and accessibility before making your choice.

- Complete the Application: Provide accurate and complete information on the application form. This includes your business name, business address, entity type, and responsible party details.

- Review and Submit: Double-check the information you entered for accuracy before submitting your application. Ensure that all fields are filled in correctly and that there are no typos or errors.

- Receive Your EIN Number: Once the IRS processes your application, you will receive your EIN number. The method of delivery will depend on the application method you chose. If you applied online, you can immediately download and print your EIN confirmation letter.

It is important to note that the steps may vary slightly depending on the application method and the specific details of your entity. However, these are the general steps involved in obtaining an EIN number.

Now that you are familiar with the steps, let’s proceed to the next section, where we will discuss the typical processing time for obtaining an EIN number.

Online Application Process

The online application process is the most convenient and expedient method for obtaining an EIN number. With this method, you can apply for an EIN number through the IRS website at any time, from anywhere. Here is a step-by-step guide to the online application process:

- Access the EIN Assistant: Start by visiting the IRS website and navigating to the EIN Assistant page.

- Select the Type of Entity: Choose the appropriate entity type for your business or organization from the options provided.

- Provide Entity Information: Fill out the required information about your entity, including the legal name, mailing address, and responsible party’s name and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Review and Validate: Carefully review the information you entered to ensure accuracy and completeness. Double-check the spelling, address details, and responsible party information.

- Submit the Application: Once you are satisfied with the information provided, submit your application to the IRS for processing.

- Receive Your EIN Confirmation: After successfully submitting your application, the IRS will immediately assign you an EIN number. You can download and print your EIN confirmation letter, which will serve as proof of your EIN number.

The online application process is generally straightforward and allows for real-time processing of your EIN number. It is important to note that the online application is only available for entities located in the United States or its territories.

Keep in mind that it is crucial to provide accurate and up-to-date information during the online application process. Any errors or incorrect information can lead to delays in processing your application or potential issues in the future.

Now that you understand the online application process, let’s explore the alternative methods for obtaining an EIN number – mailing or faxing Form SS-4 and applying by phone.

Mailing or Faxing Form SS-4

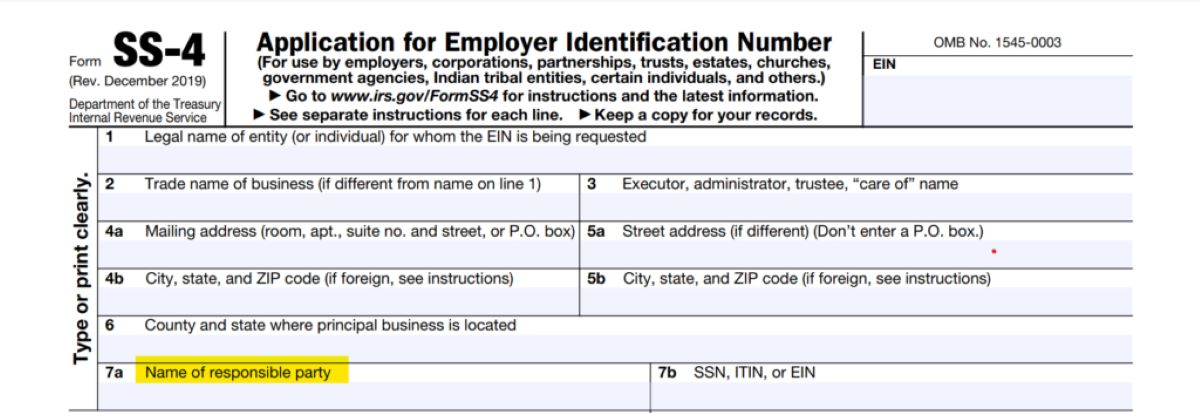

If you prefer a paper-based application method, you can choose to mail or fax Form SS-4 to the IRS to obtain your EIN number. Here is a step-by-step guide for the mailing or faxing process:

- Download Form SS-4: Visit the IRS website and download Form SS-4, which is the application form for obtaining an EIN number.

- Complete Form SS-4: Fill out all the required fields on Form SS-4, ensuring that you provide accurate and up-to-date information about your entity.

- Include Supporting Documentation: Depending on your entity type and specific circumstances, you may need to include certain supporting documents along with your Form SS-4. These documents may vary from entity to entity.

- Double-Check for Accuracy: Before mailing or faxing your application, thoroughly review the information you entered on Form SS-4 to avoid any mistakes or errors. Ensure that all fields are filled in correctly.

- Choose Mailing or Faxing Option: Once you have completed and reviewed Form SS-4, you can choose to either mail the form or fax it to the appropriate IRS office. The mailing address and fax number can be found on the instructions of Form SS-4.

- Wait for Processing: After mailing or faxing your application, the IRS will process your Form SS-4. The processing time for mailed or faxed applications may take longer than the online application method due to manual handling and verification.

- Receive Your EIN Number: Once the IRS has processed your application, you will receive your EIN number by mail. It will be sent to the address you provided on Form SS-4.

It is important to note that when mailing Form SS-4, it is recommended to send it via certified mail or with a return receipt requested. This allows you to track the delivery and ensure that your application reaches the appropriate IRS office safely.

By choosing the mailing or faxing option, it is crucial to factor in the additional time required for processing and delivery. It may take several weeks before you receive your EIN number in the mail.

Now that you understand the process for mailing or faxing Form SS-4, let’s explore the last application method – applying for an EIN number by phone.

Applying by Phone

Applying for an EIN number by phone is an alternative method available for certain individuals or entities. This method is typically reserved for international applicants or those with special circumstances. Here is a step-by-step guide for applying by phone:

- Check Eligibility: Determine if you are eligible to apply for an EIN number by phone. This method is generally limited to individuals who do not have a legal residence in the United States.

- Prepare Required Information: Gather all the necessary information before making the phone call. This includes the legal name of your business, mailing address, and responsible party’s details.

- Call the IRS Business and Specialty Tax Line: Dial the IRS Business and Specialty Tax Line, which is the phone number designated for applying for an EIN number. Be prepared to wait in line as there may be a high call volume.

- Provide the Required Information: Once connected to a representative, provide them with the necessary information to complete the application. Ensure that you accurately convey the details of your entity.

- Receive Your EIN Number: During the phone call, the IRS representative will assign you an EIN number. Make note of the number provided, as it serves as your EIN confirmation.

Applying by phone can be a convenient option for those who meet the eligibility criteria and have the required information readily available. However, it is important to note that the availability of this option may vary, and it is recommended to check with the IRS beforehand.

One advantage of applying by phone is that you can receive your EIN number immediately during the call. However, be prepared for potential wait times and ensure that you have a reliable means of recording the assigned EIN number.

Now that you understand the application process for obtaining an EIN number by phone, let’s move on to the next section, where we will discuss the typical processing time for receiving your EIN number.

How Long Does It Take to Get an EIN Number?

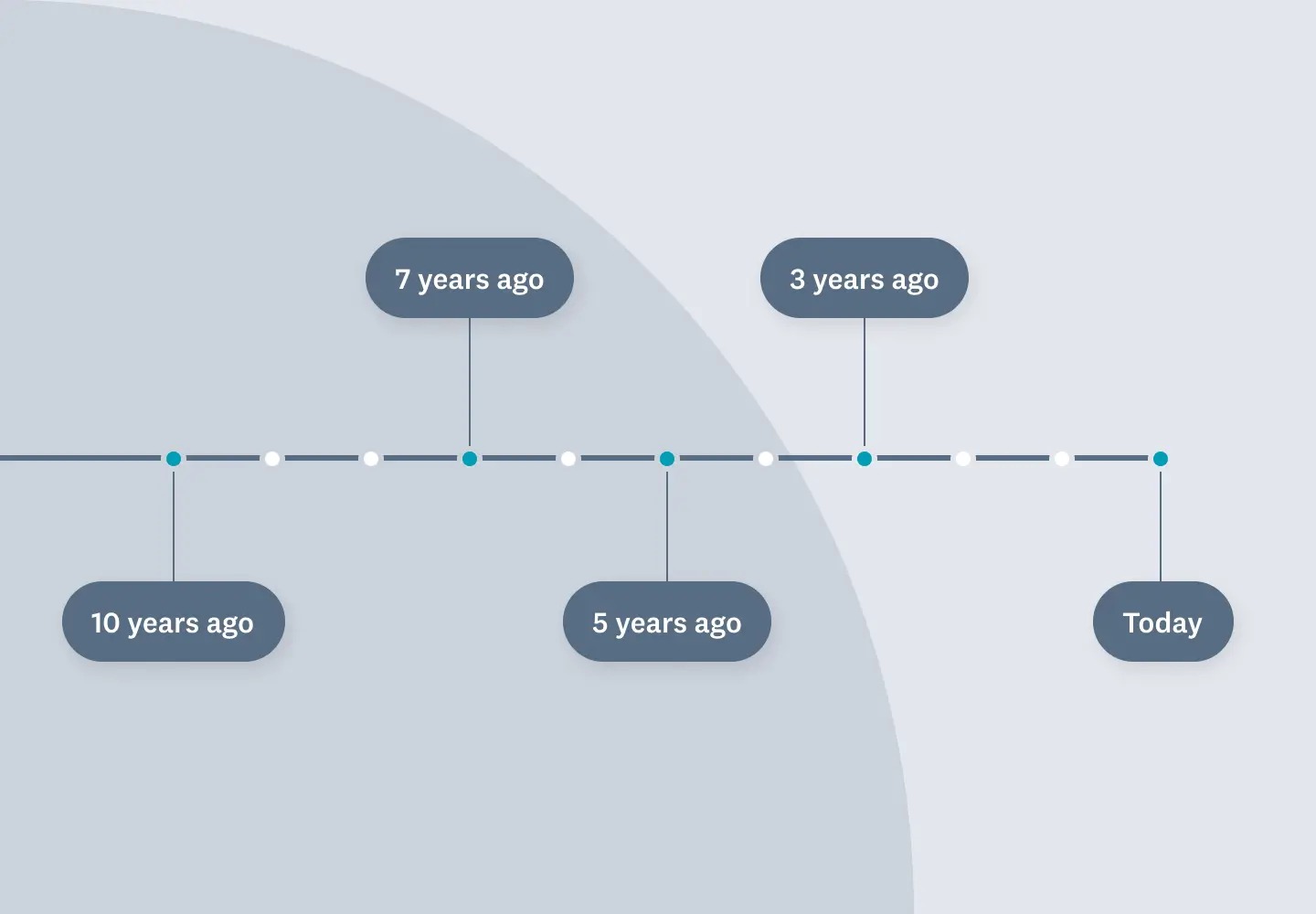

The processing time to receive an EIN number can vary depending on the method of application and various factors. Here is a general overview of the typical processing times:

- Online Application: Applying for an EIN number online is the fastest method. In most cases, you will receive your EIN number immediately after successfully completing the online application.

- Mailing or Faxing Form SS-4: If you choose to mail or fax Form SS-4, it may take longer to receive your EIN number. Processing times for mailed or faxed applications can range from several weeks to a few months, depending on the workload and specific circumstances.

- Applying by Phone: Applying for an EIN number by phone typically results in immediate issuance of your EIN number during the call itself. However, it is important to keep in mind that this option may not be available for all applicants.

It is worth noting that while the online application process tends to be the fastest, there can be situations where additional manual review is required. In such cases, the processing time may extend beyond the immediate issuance. Factors such as high application volume, system maintenance, or certain entity types may also affect processing times. Therefore, it is advised to allow for some flexibility in your timeline when applying for an EIN number.

If you have not received your EIN number within the expected timeframe, you can contact the IRS directly to inquire about the status of your application. Be prepared to provide the necessary information to assist in locating your application.

Now that you understand the typical processing times for obtaining an EIN number, let’s explore some tips to help expedite the application process.

Factors Affecting Processing Time

Several factors can impact the processing time to receive an EIN number. While the IRS strives to process applications promptly, the following factors may cause delays:

- Application Method: The method of application can influence the processing time. Online applications generally have the shortest processing time, while mailed or faxed applications may require additional time for manual handling and verification.

- Application Accuracy: The accuracy and completeness of the information provided on the application can impact the processing time. Any errors or discrepancies may require additional verification and can prolong the processing time.

- Application Volume: The overall volume of applications received by the IRS can affect processing times. During busy periods, such as tax season, the processing time may be longer due to increased workload.

- Entity Type: The type of entity applying for an EIN number can impact the processing time. Certain entity types, such as foreign entities or complex organizational structures, may require additional review and verification, leading to longer processing times.

- IRS Workload: The IRS workload at any given time can impact the processing time. Factors such as system maintenance, backlogs, and other operational considerations within the IRS can contribute to delays in processing applications.

It is important to note that while the IRS aims to process applications as efficiently as possible, the processing time can vary based on these factors. To mitigate potential delays, it is crucial to ensure the accuracy and completeness of your application and provide all necessary supporting documentation, if required.

In certain cases, you may need to follow up with the IRS to inquire about the status of your application if it exceeds the expected processing time. The IRS provides contact information on their website, and you can reach out to them directly for assistance.

Now that we have explored the factors that can affect the processing time, let’s move on to the next section, where we will discuss some tips to help expedite the EIN number application process.

Tips to Expedite the EIN Number Application Process

If you are looking to expedite the EIN number application process, here are some tips to help streamline the process:

- Use the Online Application Method: Applying for an EIN number online is the quickest and most efficient method. It allows for immediate processing and issuance of the EIN number in most cases.

- Double-Check Information: Ensure that all the information provided on the application is accurate and complete. Double-check for typos, spelling errors, and missing details that could potentially cause delays in processing.

- Gather Required Information in Advance: Before starting the application process, gather all the necessary information, including the legal name of your entity, mailing address, and responsible party information. Having this information readily available will help expedite the application process.

- Submit Supporting Documentation (if applicable): If your entity requires supporting documentation, make sure to include it with your application. Providing all the necessary documents upfront can help prevent delays caused by additional document requests from the IRS.

- Ensure Proper Entity Selection: Choose the correct entity type that accurately represents your business or organization. Selecting the wrong entity type could result in processing delays or complications down the line.

- Follow Instructions Carefully: When completing the application, carefully read and follow the instructions provided by the IRS. Adhering to the guidelines will reduce the chances of errors or omissions that can slow down the processing time.

- Consider Applying during Non-Peak Periods: Depending on your circumstances, you may want to consider applying during non-peak periods when the IRS workload is lower. This may result in quicker processing times.

- Stay Informed: Keep track of the progress of your application and stay informed about potential updates or issues. Check the IRS website or contact the IRS directly if you have any concerns or questions regarding your application status.

By following these tips, you can increase the chances of expediting the EIN number application process. However, it is important to note that processing times can still vary depending on external factors and the workload of the IRS.

Remember that obtaining an EIN number is an important step in establishing your business’s identity and fulfilling your tax obligations. By being well-prepared and attentive to the application process, you can reduce unnecessary delays and receive your EIN number in a timely manner.

Now that you are equipped with these tips, you can proceed confidently with your EIN number application.

Conclusion

Obtaining an EIN number is an essential step for businesses and organizations. It serves as a unique identifier for tax purposes, enabling entities to fulfill their financial obligations and establish their identity within the tax system.

In this article, we discussed the different methods of applying for an EIN number – online, mailing/faxing Form SS-4, and applying by phone. Each method has its own advantages and processing times, with the online application being the fastest and most convenient option.

The processing time to receive an EIN number can vary depending on factors such as the application method, application accuracy, application volume, entity type, and IRS workload. While the online application method usually results in immediate issuance, mailed or faxed applications may take several weeks to months for processing.

To expedite the EIN number application process, we provided tips on using the online application method, ensuring accurate information, gathering required documentation, selecting the proper entity type, following instructions carefully, considering non-peak periods, and staying informed about application progress.

Remember, obtaining an EIN number is a crucial step if you want to open a business bank account, file taxes, hire employees, or apply for business licenses. By understanding the application process and following the necessary steps, you can obtain your EIN number efficiently and effectively.

If you have any questions or concerns about the EIN number application process, it’s always best to consult with a qualified tax professional or reach out to the IRS directly for assistance.

Now that you have the knowledge and resources, you can confidently apply for an EIN number and proceed with your business or organizational endeavors.