Finance

How To Get A Business Loan Using EIN Number?

Modified: December 30, 2023

Learn how to secure a business loan using your EIN number and get the financing you need to grow your business. Gain insights into the world of finance and maximize your chances of loan approval.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding EIN (Employer Identification Number)

- Benefits of Using EIN for Business Loan

- Eligibility Requirements for Getting a Business Loan Using EIN

- Steps to Obtain a Business Loan Using EIN

- Documentation Needed for Applying for a Business Loan with EIN

- Tips for Successfully Obtaining a Business Loan with EIN

- Conclusion

Introduction

Securing funds is a crucial step in starting or growing a business. While traditional loans often require personal guarantees or collateral, there is an alternative solution available. By utilizing an Employer Identification Number (EIN), businesses can apply for loans without relying solely on personal credit or assets.

In this article, we will explore how to obtain a business loan using an EIN number. We will discuss the benefits of utilizing an EIN, eligibility requirements, the steps involved in the application process, required documentation, and provide tips for a successful loan application.

Whether you are a small business owner or an entrepreneur looking to finance your venture, understanding the process of obtaining a business loan using an EIN is essential. This unique identification number, issued by the IRS (Internal Revenue Service), is assigned to businesses for tax purposes. While it primarily serves as a tax identification number, it can also be used to establish credit and secure financing.

As we delve deeper into the process, you will discover the advantages of using an EIN for obtaining a business loan. We will also explore the eligibility requirements and the necessary steps involved in the application process. Understanding these details will empower you to efficiently navigate the loan application process and increase your chances of securing the funds you need.

So, without further ado, let’s explore how to get a business loan using an EIN number and unlock the potential for your business’s growth and success.

Understanding EIN (Employer Identification Number)

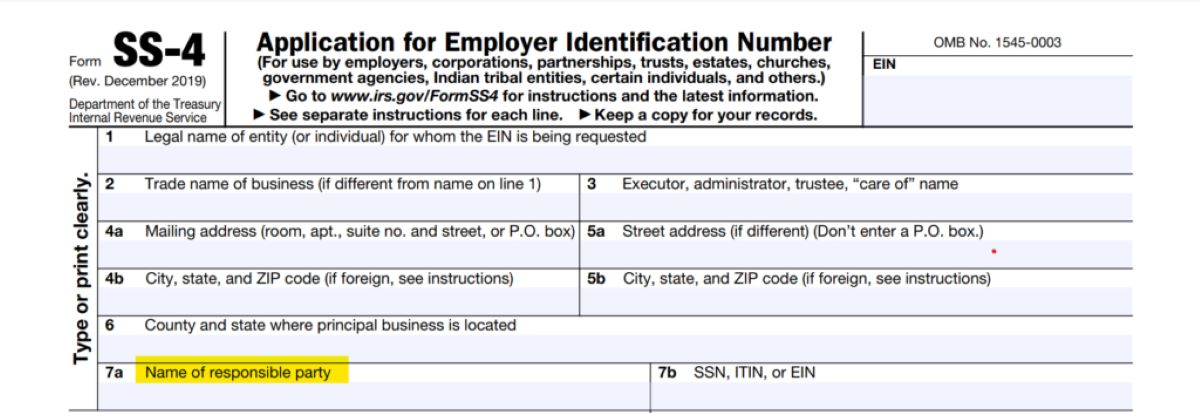

An Employer Identification Number (EIN), also known as a Federal Tax Identification Number, is a unique nine-digit number issued by the IRS to identify businesses for tax purposes. Similar to a Social Security number for individuals, the EIN helps the IRS track and identify businesses for tax reporting, filing, and other financial obligations.

The EIN is primarily used by employers who have employees, but it is also necessary for other types of businesses, such as sole proprietorships, partnerships, LLCs, corporations, and non-profit organizations. It is essential for conducting business activities, maintaining compliance with tax laws, and establishing credibility with lenders and creditors.

Obtaining an EIN is relatively straightforward. Business owners can apply online through the IRS website or submit a paper application by mail or fax. The process is free, and once approved, the business will receive its unique EIN. The EIN is non-transferable and remains the same throughout the lifetime of the business, even if the ownership or structure changes.

Using an EIN for business loans offers several advantages. Firstly, it separates personal and business finances, protecting the owner’s personal credit in case of business-related financial difficulties. Additionally, having an EIN allows businesses to establish a credit history, similar to an individual’s credit score, which can be used as leverage when applying for loans or lines of credit.

Moreover, an EIN provides a level of professionalism and legitimacy to the business. Lenders and creditors are more likely to take a business seriously if it has an EIN, as it signifies that the company is fully compliant with tax laws and is established as a legal entity.

Understanding the importance and benefits of an EIN is crucial for business owners who want to access financing options without solely relying on personal credit. Now that we have a solid understanding of what an EIN is and why it is valuable, let’s explore the advantages of using an EIN for obtaining a business loan.

Benefits of Using EIN for Business Loan

Utilizing an Employer Identification Number (EIN) for obtaining a business loan offers several advantages. Let’s explore the benefits of using an EIN to secure the funds your business needs:

- Separation of Personal and Business Finances: One of the primary benefits of using an EIN for a business loan is the separation of personal and business finances. This separation protects your personal credit score and assets in case of any business-related financial difficulties. Lenders will primarily evaluate the creditworthiness of the business rather than relying solely on personal credit history.

- Establishing Business Credit: Having an EIN allows you to build a separate credit history for your business. Just like individuals have personal credit scores, businesses can establish their own credit profile with an EIN. Timely payment of loans and responsible credit management can help strengthen your business’s creditworthiness over time, making it easier to secure future financing and better loan terms.

- Increased Financing Options: Using an EIN widens your range of financing options. You can explore various loan types, including lines of credit, term loans, equipment financing, and small business administration (SBA) loans. Since the loan is based on your business’s creditworthiness, you may be eligible for larger loan amounts, more favorable interest rates, and flexible repayment terms.

- Building Business Credibility: Having an EIN adds professionalism and credibility to your business. Lenders and creditors view businesses with an EIN as more legitimate and trustworthy, as it signifies that the business is legally established and compliant with tax laws. This increased credibility can improve your chances of obtaining loan approvals and build trust with potential partners and suppliers.

- Protecting Personal Assets: By using an EIN for a business loan, you shield your personal assets from being used as collateral. In the event of loan default or bankruptcy, the lender’s recourse is typically limited to business assets, reducing personal liability. This protects your personal finances and assets, providing a safety net for you and your family.

Overall, utilizing an EIN when applying for a business loan provides multiple benefits, including separating personal and business finances, establishing credit, expanding financing options, building business credibility, and protecting personal assets. Now that we understand the advantages of using an EIN, let’s explore the eligibility requirements for obtaining a business loan using this identifier.

Eligibility Requirements for Getting a Business Loan Using EIN

Obtaining a business loan using an Employer Identification Number (EIN) is a viable option for many businesses. However, there are some eligibility criteria that you need to meet. Let’s explore the requirements for getting a business loan using an EIN:

- Legal Business Entity: To be eligible for a business loan, you must have a legally recognized business entity. This can include sole proprietorships, partnerships, limited liability companies (LLCs), corporations, or non-profit organizations. Operating as a legitimate business entity is crucial for lenders to assess your credibility and repayment capacity.

- EIN from the IRS: You must have a valid EIN issued by the Internal Revenue Service (IRS). The EIN serves as your business’s identification number and is essential for tax reporting and financial transactions. If you haven’t obtained an EIN yet, you can easily apply for one online or through the IRS website.

- Business Age and History: Lenders often prefer businesses with a proven track record and established history. While some lenders may be willing to work with startups, others may require a certain level of business longevity. Typically, businesses with at least one year of operation and financial records are more likely to qualify for a business loan using an EIN.

- Revenue and Financial Stability: Lenders assess the financial stability of your business and its ability to repay the loan. They will evaluate your business’s revenue, profitability, cash flow, and financial records. Demonstrating consistent revenue and positive financial trends can increase your chances of loan approval.

- Business Plan and Purpose of Loan: Lenders want to understand how you plan to use the loan funds and how it aligns with your business goals. Having a well-developed business plan that outlines your objectives, market analysis, sales strategies, and financial projections demonstrates your commitment to the success of your business and increases your eligibility for a loan.

- Credit History and Personal Guarantees: While using an EIN reduces reliance on personal credit, lenders may still consider your personal credit history. It is essential to maintain good personal credit, as it can positively impact loan approval and interest rates. Additionally, some lenders may require personal guarantees, especially for smaller businesses or startups.

Meeting these eligibility requirements increases your chances of obtaining a business loan using an EIN. However, it’s important to note that each lender may have specific criteria and additional requirements beyond the ones mentioned above. It is advisable to research and compare different lenders to find the one that best fits your business’s needs and eligibility criteria.

Now that we have covered the eligibility requirements, let’s move on to the steps involved in obtaining a business loan using an EIN.

Steps to Obtain a Business Loan Using EIN

Securing a business loan using an Employer Identification Number (EIN) involves a series of well-defined steps. By following these steps diligently, you can increase your chances of obtaining the financing your business needs. Let’s explore the process:

- Evaluate Your Financing Needs: Begin by assessing your business’s financing requirements. Determine the loan amount, the purpose of the loan, and the repayment terms that best suit your business’s needs. This will help you align your loan application with the appropriate lenders.

- Research and Compare Lenders: Conduct thorough research to identify lenders that offer business loans to entities using an EIN. Look for reputable lenders with favorable terms, interest rates, and repayment options. Compare their eligibility criteria, loan programs, and customer reviews to find the best fit for your business.

- Gather Required Documentation: Lenders will require certain documents to assess your creditworthiness. Typical documentation includes financial statements, bank statements, tax returns, business licenses, and legal documents related to your business. Organize these documents in advance to expedite the loan application process.

- Submit Loan Application: Once you have selected a lender, complete their loan application form. Provide accurate and detailed information about your business, including its legal structure, revenue, expenses, and the purpose of the loan. Additionally, include your EIN to distinguish your business from personal credit applications.

- Wait for Loan Approval: After submitting your application, the lender will review the provided information and evaluate your creditworthiness. The timeframe for loan approval varies based on the lender and the complexity of your application. Some lenders may require additional documentation or conduct interviews before making a decision.

- Review Loan Terms: If your loan application is approved, carefully review the loan terms and conditions. Pay close attention to interest rates, fees, repayment schedules, and any other relevant provisions. Ensure that you fully understand the terms before accepting the loan offer.

- Sign Loan Agreement: Once you are comfortable with the loan terms, sign the loan agreement. This legally binds you to the terms and establishes your responsibility to repay the loan as agreed.

- Receive Loan Funds: After signing the loan agreement, the lender will disburse the loan funds to your business. The funds will generally be deposited into your business bank account, allowing you to utilize the funds as needed for your business purposes.

- Repay the Loan: Begin making timely loan repayments according to the agreed-upon schedule. Adhering to the repayment plan will help you maintain good standing with the lender and improve your business’s credit profile.

Following these steps will guide you through the process of obtaining a business loan using an EIN. Remember, it is essential to be thorough and organized throughout the application process to increase your likelihood of success.

Now that we have covered the steps involved in obtaining a business loan using an EIN, let’s move on to discussing the documentation needed for the loan application.

Documentation Needed for Applying for a Business Loan with EIN

When applying for a business loan using an Employer Identification Number (EIN), you will need to provide specific documentation to support your loan application. The required documentation may vary slightly between lenders, but here are some common documents you should have ready:

- Business Plan: A well-developed business plan is essential to demonstrate your understanding of your business, market, and financial projections. Include information about your business model, target market, competition, marketing strategies, and a comprehensive financial forecast.

- Financial Statements: Lenders will require financial statements to assess your business’s financial health. Prepare well-organized balance sheets, income statements, and cash flow statements for your business. These statements should preferably be audited or prepared by a certified accountant.

- Bank Statements: Provide several months of business bank statements to demonstrate your business’s cash flow and financial stability. Lenders will review these statements to assess your ability to handle loan repayments.

- Tax Returns: Include copies of your business’s tax returns for the past two to three years. These documents will provide lenders with insight into your business’s financial history and compliance with tax obligations.

- Legal Documents: Include any legal documents related to your business, such as the articles of incorporation or organization, operating agreements, or partnership agreements. These documents establish the legal structure of your business and its legitimacy.

- Business Licenses and Permits: Provide copies of all relevant business licenses and permits required for your industry and location. These documents serve as evidence of your business’s compliance with local regulations.

- Proof of EIN: Include a copy of the official IRS letter or documentation that verifies your business’s Employer Identification Number (EIN). This establishes your business’s identity and separate tax entity.

- Other Supporting Documentation: Depending on your specific circumstances and loan requirements, you may need additional documentation. This could include customer contracts, supplier agreements, landlord agreements, or collateral documentation.

Preparing these documents in advance will streamline the loan application process and demonstrate your business’s financial stability and compliance with regulatory requirements. It is crucial to ensure that all documents are accurate, up-to-date, and organized in a clear and easily accessible manner.

Now that we have discussed the documentation needed for applying for a business loan with an EIN, let’s move on to valuable tips that can increase your chances of successfully obtaining a business loan.

Tips for Successfully Obtaining a Business Loan with EIN

Obtaining a business loan using an Employer Identification Number (EIN) requires careful preparation and planning. To increase your chances of successfully securing a loan, consider the following tips:

- Maintain a Strong Credit Profile: Although the loan will mainly be evaluated based on your business’s creditworthiness, having a good personal credit history can still be advantageous. Regularly monitor your credit score and address any discrepancies or issues promptly.

- Improve Business Credit: Establishing and improving your business’s credit profile is essential. Paying bills and invoices on time, properly managing business credit cards, and maintaining healthy cash flow can positively impact your business’s creditworthiness and improve your loan prospects.

- Prepare Financial Statements: Ensure your financial statements are accurate, up-to-date, and well-structured. Organize your balance sheets, income statements, and cash flow statements professionally to provide lenders with a clear overview of your business’s financial health.

- Develop a Solid Business Plan: Craft a comprehensive business plan that outlines your goals, strategies, market analysis, and financial projections. Show lenders that you have a clear vision for your business and a thorough understanding of how the loan will contribute to its growth and success.

- Build Relationships with Lenders: Establishing relationships with lenders before seeking a loan can be advantageous. Attend networking events, join business associations, and engage in industry-specific communities to connect with potential lenders. Building relationships can lead to better loan terms and an increased likelihood of approval.

- Compare Lenders and Loan Options: Take the time to research and compare different lenders and loan options. Look beyond interest rates and consider factors such as repayment terms, fees, customer reviews, and lender expertise in your industry. Selecting the right lender who understands your business needs can greatly enhance your loan application’s chances of success.

- Prepare a Loan Proposal: Craft a compelling loan proposal that highlights the purpose of the loan, repayment plans, and projections for growth. Include supporting documents such as market research, industry analysis, and customer testimonials to strengthen your case.

- Be Prepared for Collateral Requests: Depending on the loan amount and lender requirements, be prepared to offer collateral to secure the loan. Collateral can be in the form of business assets, personal assets, or a personal guarantee. Understand the potential risks and ensure you can fulfill the collateral requirements if necessary.

- Seek Professional Advice: If you are unsure about the loan application process or need assistance, consider consulting with professionals such as accountants, financial advisors, or business consultants. Their expertise can help you navigate the loan application process effectively.

By following these valuable tips, you can increase your chances of successfully obtaining a business loan using an EIN. Remember, thorough preparation, sound financial management, and a clear understanding of your business’s needs are the keys to a successful loan application.

Now that we have explored the tips for a successful loan application, let’s summarize the key points covered in this article.

Conclusion

Obtaining a business loan using an Employer Identification Number (EIN) provides business owners with an alternative financing option that separates personal and business finances. By leveraging the advantages of an EIN, such as establishing business credit, increasing financing options, and protecting personal assets, entrepreneurs can secure the funds they need to fuel their business’s growth and success.

In this article, we discussed the importance of understanding an EIN and its benefits for obtaining a business loan. We explored the eligibility requirements, including being a legal business entity, having a valid EIN, demonstrating financial stability, and presenting a solid business plan. We also outlined the steps involved in applying for a business loan using an EIN, including evaluating financing needs, researching lenders, gathering documentation, submitting the application, and signing the loan agreement.

Additionally, we highlighted the documentation needed for the loan application, such as financial statements, bank statements, tax returns, and legal documents. We provided valuable tips to increase the chances of successfully obtaining a business loan, including improving credit profiles, preparing financial statements, developing a strong business plan, and building relationships with lenders.

Remember, each lender may have specific requirements and additional criteria, so it is crucial to research and compare lenders to find the best fit for your business’s needs. Seeking professional advice when necessary and being thorough and well-prepared throughout the application process will greatly enhance your chances of success.

Now that you have a comprehensive understanding of how to obtain a business loan using an EIN, it’s time to take action. Harness the power of your EIN to navigate the loan application process confidently and secure the financing needed to drive your business forward.