Finance

What Is My Affirm Credit Limit

Published: January 6, 2024

Discover your Affirm credit limit for finance needs. Get insights on how to calculate, increase, and manage your credit limit with Affirm.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

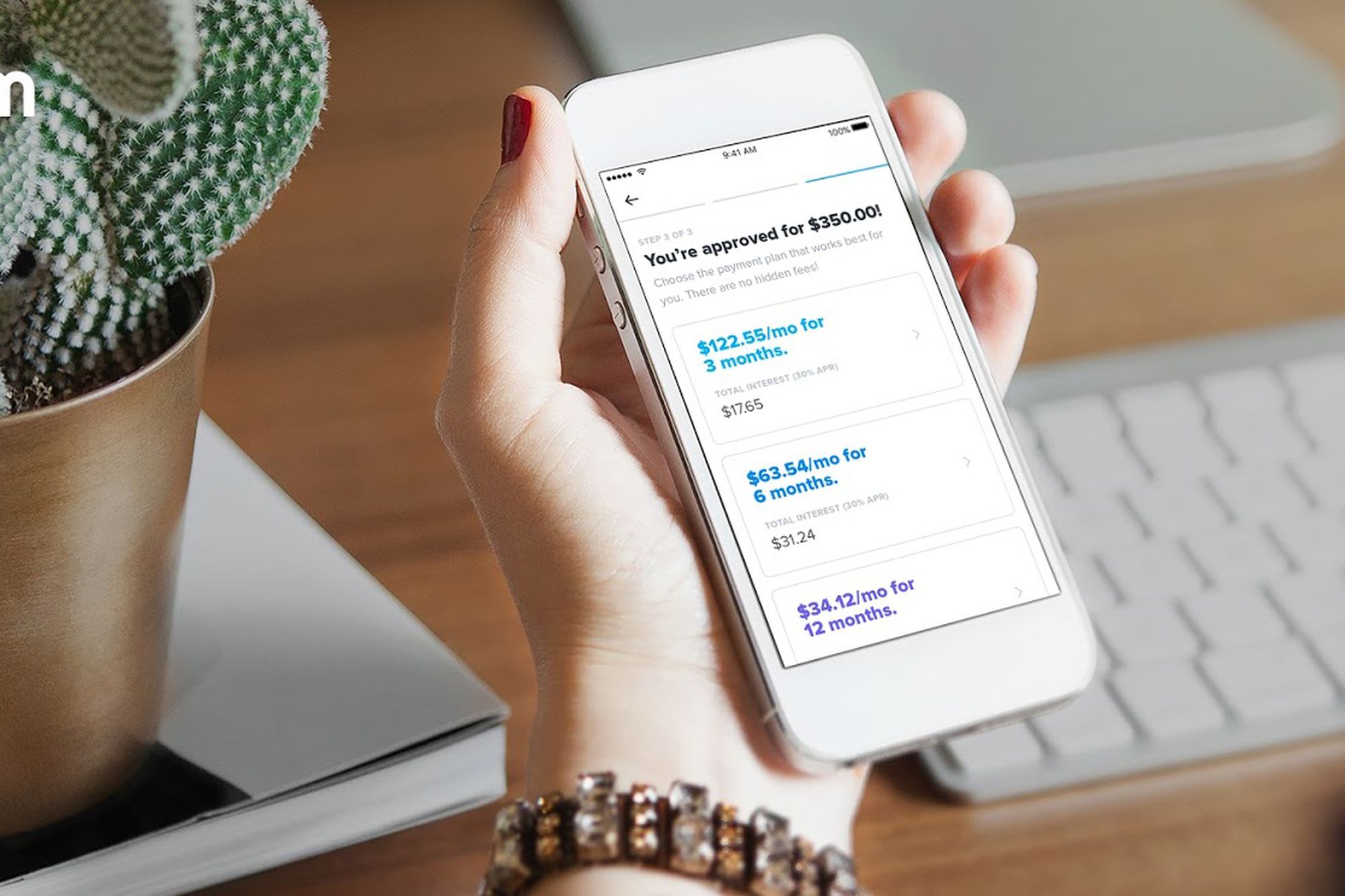

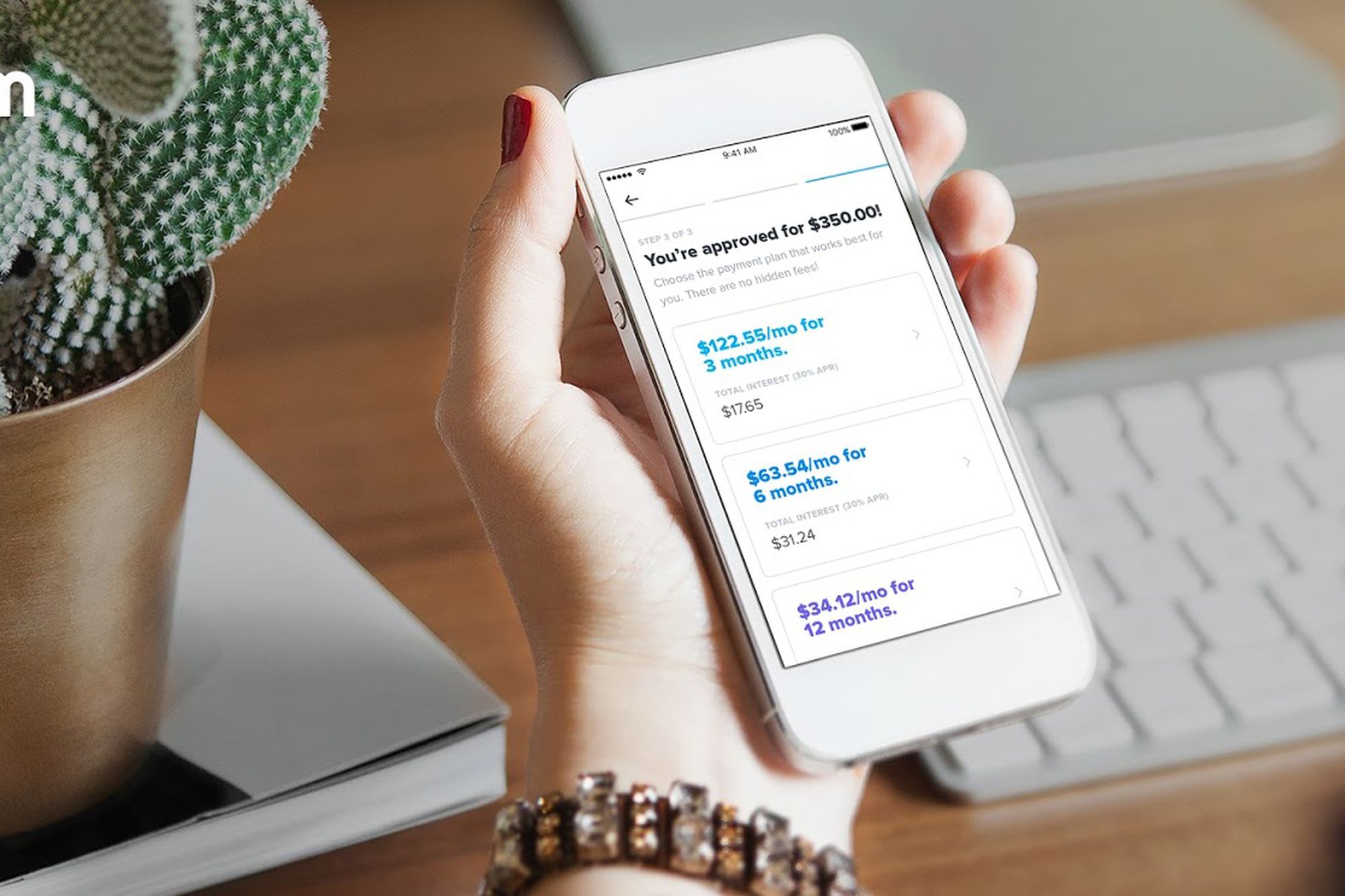

Welcome to the world of Affirm, a popular online lender that offers consumers a flexible and transparent way to finance their purchases. Affirm provides a unique credit solution that allows customers to make purchases now and pay for them later in manageable installments. However, before diving into the world of Affirm, it’s important to understand one key aspect: the Affirm credit limit.

The Affirm credit limit is the maximum amount of credit that Affirm will extend to an individual for financing their purchases. It determines the purchasing power and flexibility that you have when using Affirm for your online shopping needs. Understanding your credit limit is essential to ensure that you can make the most of the Affirm platform and avoid any unexpected surprises during the checkout process.

In this article, we will take an in-depth look at the Affirm credit limit, including how it is determined, the factors that can affect it, and strategies you can use to increase it. Whether you’re a new user of the Affirm platform or a seasoned shopper, this information will help you navigate the world of Affirm financing with confidence.

Understanding Affirm Credit Limit

The Affirm credit limit is a crucial aspect of your financing experience with Affirm. It determines the maximum amount of credit that you can utilize to make purchases through the platform. The credit limit is not a fixed amount for every user and can vary based on different factors.

Affirm determines your credit limit by evaluating various factors, such as your creditworthiness and purchasing history. They will assess your financial profile, including your credit score, income level, and payment history, to gauge your creditworthiness and determine the appropriate credit limit for you.

It’s important to note that Affirm does not perform a hard credit check, which means that checking your credit limit will not impact your credit score. This is a significant advantage for users who may be concerned about the potential negative impact on their credit history.

Once your credit limit is established, you can start making purchases through the Affirm platform within that limit. Keep in mind that your credit limit is not a fixed value and may change over time. Affirm regularly reviews and updates credit limits based on user behavior, repayment history, and other relevant factors.

Understanding your Affirm credit limit is essential to manage your finances effectively and make informed purchasing decisions. It helps you ensure that you can afford the payments on your purchases and avoid any potential financial strain in the future.

Next, let’s explore the various factors that can impact your Affirm credit limit.

Factors Affecting Affirm Credit Limit

Several factors can influence your Affirm credit limit. While Affirm considers multiple variables when determining your creditworthiness, the primary factors that can affect your credit limit include:

- Credit Score: Your credit score is a key factor that Affirm takes into consideration. A higher credit score demonstrates responsible borrowing and repayment habits, which can result in a higher credit limit. If you have a lower credit score, your credit limit may be lower, but you can still qualify for Affirm financing.

- Income Level: Affirm considers your income level to assess your ability to make timely payments. A higher income level can contribute to a higher credit limit, as it indicates a greater capacity to handle credit obligations.

- Purchasing History: How often and how responsibly you have used Affirm in the past can influence your credit limit. If you have a track record of making timely payments and responsibly managing your Affirm purchases, it may result in an increased credit limit.

- Repayment History: Your history of making on-time payments plays a crucial role in determining your creditworthiness. If you consistently make your Affirm payments on time, it reinforces your financial responsibility and can lead to a higher credit limit.

- Loan Amount: The size of the loan you’re requesting can also impact your credit limit. Affirm may assign a lower credit limit for larger loan amounts to manage risk appropriately.

It’s important to note that these factors are not the sole determinants of your Affirm credit limit. Affirm employs a proprietary algorithm that takes into account various data points and financial indicators to assess your creditworthiness and determine your credit limit.

Understanding the factors that influence your credit limit can empower you to make informed financial decisions and take steps to improve your creditworthiness over time. Next, let’s explore how you can check your Affirm credit limit.

How to Check Your Affirm Credit Limit

Checking your Affirm credit limit is a straightforward process that can be done directly through the Affirm website or mobile app. Here are the steps to follow:

- Log in to Your Affirm Account: Visit the Affirm website or open the Affirm app on your mobile device and log in to your account using your registered email address and password.

- Access Your Account Settings: Once you’re logged in, navigate to your account settings. On the website, you can usually find this option by clicking on your profile icon in the top-right corner of the page. On the app, you may need to tap on the menu icon, usually located in the top-left corner of the screen.

- Check Your Credit Limit: Within your account settings, you should find an option to view your credit limit. Click or tap on this option to see your current credit limit displayed on the screen.

- Review Your Details: Take the time to review the information displayed along with your credit limit. This may include details about your repayment history, available credit, and any relevant account notifications or updates.

- Contact Affirm Customer Service: If you have any questions or concerns about your credit limit, or if you believe there may be an error, reach out to Affirm customer service. They will be able to provide you with further assistance and clarification regarding your specific credit limit.

It’s a good practice to periodically check your Affirm credit limit, especially if you’re planning a significant purchase or need to make sure you’re within your available credit limit. By doing so, you can make informed decisions regarding your Affirm financing options.

Next, let’s explore some strategies you can use to increase your Affirm credit limit.

Strategies to Increase Your Affirm Credit Limit

If you’re looking to increase your Affirm credit limit, there are a few strategies you can employ to improve your chances. While the credit limit increase is ultimately at the discretion of Affirm, following these tips can help demonstrate your creditworthiness and potentially lead to a higher credit limit:

- Make Timely Payments: Consistently making on-time payments for your Affirm purchases is crucial. This demonstrates your financial responsibility and reliability, which can positively influence Affirm’s decision to increase your credit limit.

- Pay Off Outstanding Balances: If you have any outstanding balances with Affirm, it’s best to pay them off as soon as possible. This shows your ability to manage your debts and can be seen as a positive factor when considering a credit limit increase.

- Build a Strong Credit Profile: Utilize other credit-building strategies, such as responsibly managing your credit cards and loans, to improve your overall credit profile. This can help boost your creditworthiness, which in turn can positively impact your Affirm credit limit.

- Provide Accurate Financial Information: Ensure that the information you provide to Affirm regarding your income, employment, and other financial details is accurate and up to date. Providing correct information helps Affirm assess your creditworthiness more accurately.

- Apply for a Lower-Amount Purchase: If you’re initially approved for a lower credit limit, consider making smaller purchases through Affirm and consistently paying them off on time. This can demonstrate responsible usage and prompt Affirm to consider increasing your credit limit over time.

- Check for Prequalified Offers: Keep an eye out for any prequalified offers from Affirm. These offers indicate that Affirm has already assessed your creditworthiness and is willing to extend additional credit. Taking advantage of these offers can help you secure a higher credit limit.

Remember, improving your credit limit is a gradual process, and it may take time to see significant changes. Patience, responsible financial behavior, and consistent payments are key to increasing your Affirm credit limit.

Now that you’re equipped with strategies to increase your credit limit, let’s summarize what we’ve covered so far.

Conclusion

Understanding your Affirm credit limit is essential for effectively utilizing Affirm’s financing options and making informed purchasing decisions. Your credit limit determines the maximum amount of credit that Affirm will extend to you, based on factors such as your credit score, income level, and purchasing history.

Factors that can affect your Affirm credit limit include your credit score, income level, purchasing history, repayment history, and the size of the loan you are requesting. By maintaining a good credit score, having a steady income, responsibly managing your Affirm purchases, and making timely payments, you can increase your chances of obtaining a higher credit limit.

Checking your Affirm credit limit is a straightforward process that can be done through the Affirm website or mobile app. By periodically reviewing your credit limit, you can ensure that you are within your available credit and make well-informed financing decisions.

Additionally, there are strategies you can employ to increase your Affirm credit limit, such as making timely payments, paying off outstanding balances, building a strong credit profile, providing accurate financial information, applying for lower-amount purchases, and taking advantage of prequalified offers.

Remember that increasing your credit limit is a gradual process that requires responsible financial behavior and consistency. By following these strategies and demonstrating your creditworthiness, you can improve your chances of obtaining a higher Affirm credit limit over time.

Now that you have a better understanding of the Affirm credit limit, you can make the most of Affirm’s convenient financing options while staying within your financial means.