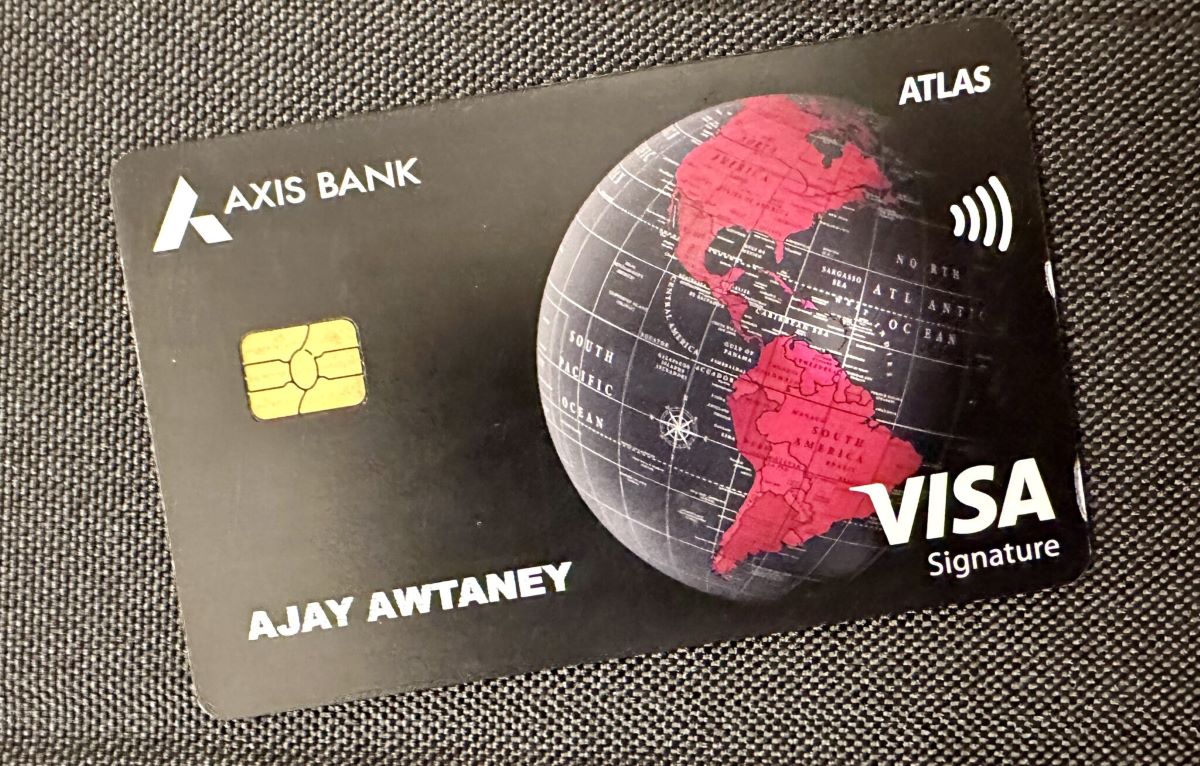

Home>Finance>How To Know Axis Bank Credit Card Billing Cycle?

Finance

How To Know Axis Bank Credit Card Billing Cycle?

Published: March 7, 2024

Learn how to determine your Axis Bank credit card billing cycle and manage your finances effectively. Understanding your billing cycle is crucial for staying on top of your credit card payments and maintaining financial stability. Discover the steps to take control of your credit card billing cycle and avoid unnecessary fees.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding your credit card billing cycle is crucial for managing your finances effectively. For Axis Bank credit cardholders, being aware of the billing cycle ensures that payments are made on time and helps in planning expenses efficiently. The billing cycle determines the period for which your credit card transactions are recorded and the due date for bill payments. By gaining a comprehensive understanding of the Axis Bank credit card billing cycle, you can avoid late payment fees and optimize the use of your credit card.

In this article, we will delve into the specifics of the Axis Bank credit card billing cycle, including its significance and the methods available to check it. By the end, you will have a clear grasp of how the billing cycle works and the various ways to stay updated on your credit card billing details. Whether you’re a seasoned credit card user or new to the world of plastic money, this guide will equip you with the knowledge needed to navigate the Axis Bank credit card billing cycle with confidence.

Understanding Axis Bank Credit Card Billing Cycle

The Axis Bank credit card billing cycle is a recurring timeframe during which all the transactions made using the credit card are recorded. It typically spans for a month, although the exact duration may vary based on the specific terms of your credit card agreement. The billing cycle begins on the statement date and ends on the next statement date. During this period, all purchases, payments, and other transactions made using the credit card are compiled to generate the monthly statement.

One of the key components of the billing cycle is the statement date. This is the date on which your monthly credit card statement is generated, detailing all the transactions and the total amount due. It’s important to note that the statement date is not the same as the payment due date. The payment due date is the deadline for clearing the outstanding balance without incurring any late payment charges.

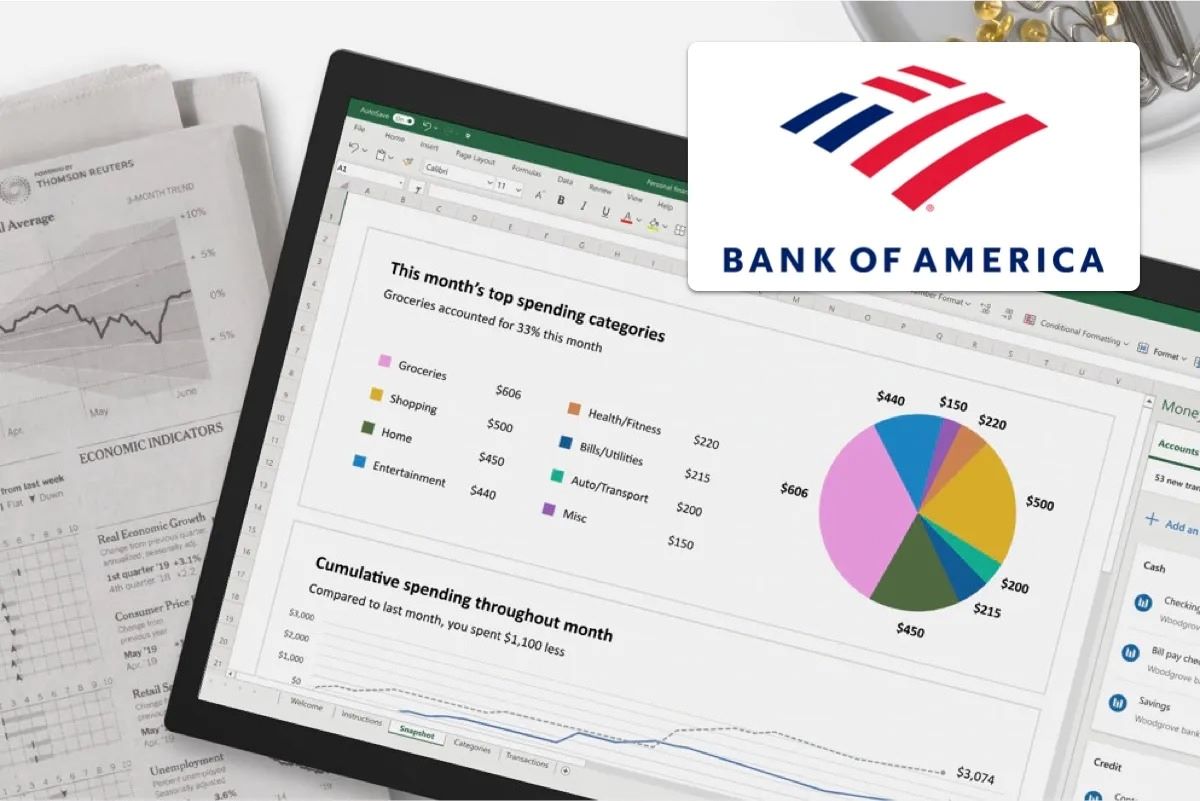

Understanding the billing cycle is essential for managing your credit card expenses effectively. By knowing the start and end dates of the cycle, you can plan your spending and budgeting accordingly. Additionally, being aware of when the statement is generated allows you to review your transactions and ensure their accuracy before the payment due date.

Moreover, comprehending the billing cycle empowers you to optimize the benefits offered by your Axis Bank credit card. For instance, if your card provides cashback or rewards on certain categories of spending during specific periods, knowing the billing cycle helps you capitalize on these offers by aligning your purchases accordingly.

Overall, a clear understanding of the Axis Bank credit card billing cycle enables you to stay in control of your finances, avoid unnecessary fees, and make the most of the features provided by your credit card.

Ways to Check Axis Bank Credit Card Billing Cycle

As an Axis Bank credit cardholder, staying informed about your billing cycle is essential for managing your finances effectively. Fortunately, the bank offers multiple convenient methods to check your credit card billing cycle, ensuring that you have easy access to this crucial information. Here are the various ways to stay updated on your Axis Bank credit card billing cycle:

- Internet Banking: Accessing your Axis Bank credit card details through internet banking provides a convenient way to check your billing cycle. Once logged in, navigate to the credit card section, where you can view your current billing cycle, statement date, and payment due date. This method allows you to monitor your credit card activity from the comfort of your home or office, offering flexibility and ease of access.

- Mobile App: The Axis Bank mobile app is a powerful tool for managing your credit card account on the go. By logging into the app, you can swiftly access your credit card details, including the billing cycle information. The app offers a user-friendly interface, making it simple to navigate to the specific section that displays your billing cycle dates and other relevant details.

- Customer Service: If you prefer personalized assistance, you can contact Axis Bank’s customer service helpline to inquire about your credit card billing cycle. The dedicated customer support team can provide you with the necessary information, guiding you through the specifics of your billing cycle and addressing any related queries you may have.

- Monthly Statements: Your monthly credit card statements from Axis Bank contain comprehensive details about your billing cycle, including the statement date and payment due date. Reviewing these statements regularly allows you to track the billing cycle for each period and ensures that you are aware of the upcoming payment deadlines.

By utilizing these methods, you can effortlessly monitor your Axis Bank credit card billing cycle, enabling you to plan your finances efficiently and make timely payments. Whether you prefer digital platforms or direct assistance, the bank offers versatile options to accommodate your preferences for accessing billing cycle information.

Conclusion

Understanding and staying updated on your Axis Bank credit card billing cycle is a fundamental aspect of responsible financial management. By familiarizing yourself with the billing cycle, you gain the ability to track your expenses, plan your budget, and ensure timely payments, thereby avoiding unnecessary fees and charges.

Throughout this guide, we’ve explored the significance of the billing cycle and the methods available to check it. From internet banking and mobile apps to customer service assistance and monthly statements, Axis Bank offers a range of accessible options for cardholders to stay informed about their billing cycle details.

By leveraging these resources, you can proactively manage your credit card account, align your spending with the billing cycle, and take full advantage of the benefits offered by your Axis Bank credit card. Whether you’re a seasoned credit card user or new to the world of plastic money, the knowledge gained from understanding the billing cycle empowers you to make informed financial decisions and maintain control over your credit card expenses.

In conclusion, being cognizant of your Axis Bank credit card billing cycle is not only a prudent financial practice but also a means to optimize the utility of your credit card while avoiding potential pitfalls. By staying attuned to your billing cycle, you can navigate your credit card usage with confidence, ensuring a seamless and rewarding experience as a cardholder with Axis Bank.