Finance

How Long Is A Bank Of America Billing Cycle

Published: March 7, 2024

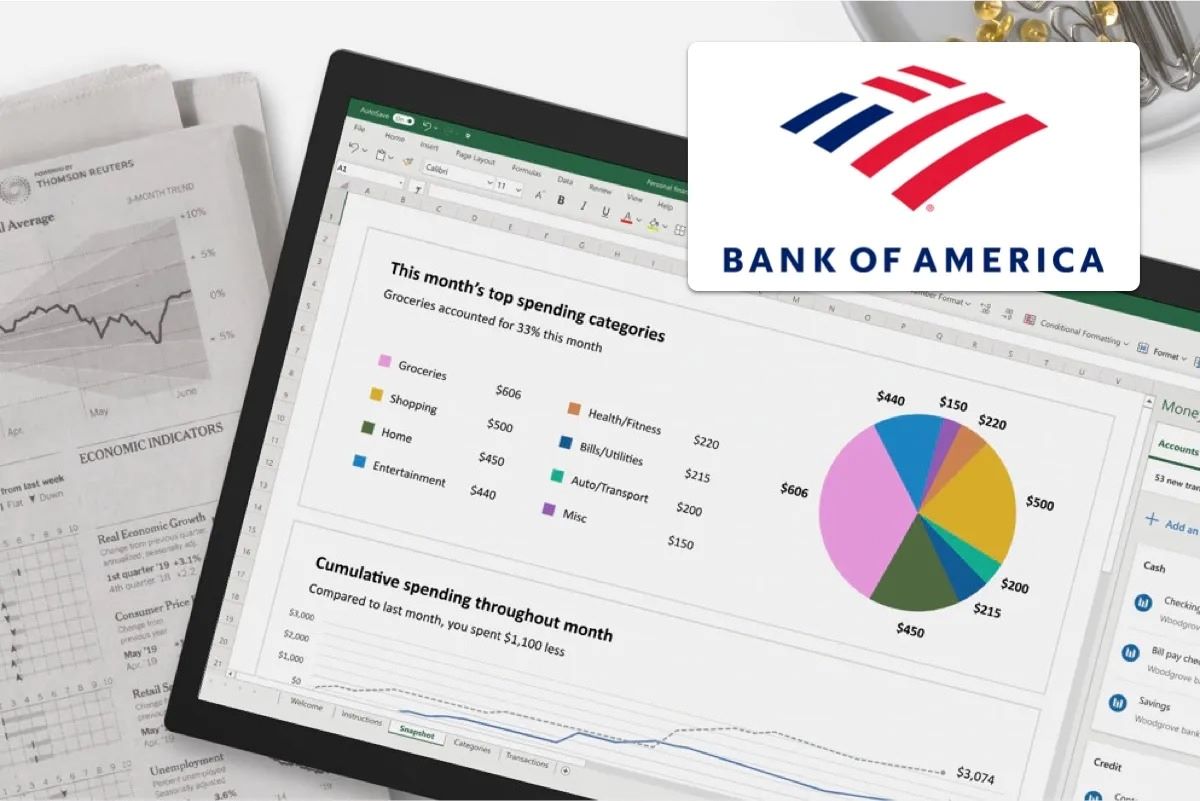

Learn about the length of a Bank of America billing cycle and how it affects your finances. Understand the duration and timing of your billing cycle for better financial planning.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Dynamics of Bank of America Billing Cycles

When it comes to managing your finances, understanding the intricacies of credit card billing cycles is crucial. As a Bank of America cardholder, comprehending the duration of your billing cycle is essential for making timely payments and managing your expenses effectively. This article aims to delve into the specifics of Bank of America billing cycles, shedding light on their length, influencing factors, and practical tips for efficient management.

Navigating the world of credit card billing cycles can be daunting, especially for individuals new to the realm of personal finance. However, with the right knowledge and strategies, you can harness the power of your billing cycle to optimize your financial management. Whether you're striving to build a robust credit score, minimize interest charges, or streamline your budgeting process, mastering the nuances of your Bank of America billing cycle is a pivotal step toward financial empowerment.

Throughout this article, we will explore the factors that can impact the length of your Bank of America billing cycle, elucidate how you can ascertain the duration of your specific cycle, and offer actionable tips for effectively managing your billing cycle to maximize its benefits. By the end of this journey, you will be equipped with valuable insights to navigate your Bank of America billing cycle with confidence and finesse, empowering you to take charge of your financial well-being.

Understanding Bank of America Billing Cycles

Bank of America billing cycles are the recurring time periods during which your credit card transactions are recorded and compiled to generate your monthly statement. These cycles typically encompass a full month, with the specific start and end dates varying based on your account opening date and the policies of Bank of America. Understanding the nuances of these billing cycles is integral to managing your credit card expenses effectively and optimizing your financial planning.

During a billing cycle, all the purchases, payments, credits, and fees associated with your Bank of America credit card are tallied to determine the outstanding balance and the minimum payment due. This period also dictates the timeframe within which you can make purchases and have them included in the subsequent billing statement. By comprehending the start and end dates of your billing cycle, you can strategically time your expenditures and payments to align with your financial goals and obligations.

It’s important to note that the billing cycle may not align precisely with the calendar month. For example, if your billing cycle starts on the 15th of each month, transactions made from the 15th of one month to the 14th of the next month will be consolidated into a single billing cycle. This misalignment with the calendar month can sometimes lead to confusion, making it essential for cardholders to stay informed about their specific billing cycle details.

Moreover, Bank of America may offer different types of credit cards, each with its unique billing cycle structures. Whether you hold a cashback rewards card, a travel rewards card, or a premium credit card, the billing cycle specifics may vary based on the features and terms of your card. Familiarizing yourself with the intricacies of your particular card’s billing cycle can empower you to leverage its benefits optimally and avoid potential pitfalls such as late payments or accruing excessive interest charges.

By gaining a comprehensive understanding of Bank of America billing cycles, you can harness this knowledge to make informed financial decisions, cultivate responsible spending habits, and proactively manage your credit card obligations. This knowledge forms the foundation for optimizing your financial well-being and leveraging the perks of your Bank of America credit card to their fullest potential.

Factors Affecting the Length of Bank of America Billing Cycles

Several factors can influence the duration of your Bank of America billing cycle, impacting the timeframe within which your credit card transactions are consolidated for billing purposes. Understanding these factors is crucial for effectively managing your finances and optimizing your credit card usage. Here are key elements that can affect the length of your Bank of America billing cycle:

- Account Opening Date: The date when you opened your Bank of America credit card account plays a significant role in determining the start and end dates of your billing cycle. For instance, if your account was opened on the 5th of the month, your billing cycle might run from the 5th of one month to the 4th of the next month.

- Card Type: Different types of Bank of America credit cards, such as rewards cards, premium cards, or student cards, may have varying billing cycle structures. The specific features and benefits associated with your card can influence the length and dynamics of your billing cycle.

- Statement Generation Date: The date on which Bank of America generates your monthly statement can impact the length of your billing cycle. This date is pivotal, as it marks the end of your billing cycle and the beginning of the new cycle, shaping the timeframe for your credit card activities.

- Payment Due Date: The deadline for making your credit card payment, often referred to as the payment due date, is intricately linked to your billing cycle. Understanding this date is essential for managing your payments within the billing cycle and avoiding late fees or penalties.

- Account Management Policies: Bank of America’s internal policies and operational procedures can also influence the length and structure of billing cycles. Changes in the bank’s policies or terms of service may impact the duration of billing cycles for cardholders.

By considering these factors, you can gain insights into the dynamics of your Bank of America billing cycle and proactively manage your credit card activities within the designated timeframe. This understanding empowers you to align your financial actions with the specifics of your billing cycle, optimizing your payment strategies and leveraging the benefits of your credit card effectively.

How to Check the Length of Your Bank of America Billing Cycle

As a Bank of America credit card holder, staying informed about the duration of your billing cycle is essential for managing your finances and making timely payments. Fortunately, Bank of America provides multiple avenues for you to ascertain the specifics of your billing cycle, enabling you to stay on top of your credit card obligations. Here are several methods to check the length of your Bank of America billing cycle:

- Online Account Management: Access your Bank of America online account through the bank’s official website or mobile app. Once logged in, navigate to the credit card section to view your account details, including the start and end dates of your billing cycle. The online platform offers a convenient and user-friendly interface for accessing essential account information.

- Customer Service Assistance: Reach out to Bank of America’s customer service team via phone or online chat to inquire about the specifics of your billing cycle. The dedicated representatives can provide comprehensive details about your billing cycle, payment due dates, and other account-related queries, offering personalized assistance to address your concerns.

- Paper Statements: If you receive paper statements for your Bank of America credit card, the start and end dates of your billing cycle will be clearly indicated on each statement. Reviewing these statements can help you track the duration of your billing cycle and plan your financial activities accordingly.

- Automated Alerts and Notifications: Bank of America offers automated alerts and notifications for credit card account holders. You can set up alerts to receive reminders about your billing cycle start and end dates, payment due dates, and other crucial account information, ensuring that you stay informed and organized.

By utilizing these resources, you can easily access the details of your Bank of America billing cycle, empowering you to plan your expenditures, payments, and budgeting strategies effectively. Staying proactive and well-informed about your billing cycle enables you to navigate your credit card obligations with confidence and precision, fostering healthy financial habits and responsible money management.

Tips for Managing Your Bank of America Billing Cycle

Effectively managing your Bank of America billing cycle is pivotal for maintaining financial stability and optimizing the benefits of your credit card. By implementing strategic practices and staying mindful of key considerations, you can navigate your billing cycle with confidence and efficiency. Here are valuable tips to help you manage your Bank of America billing cycle effectively:

- Payment Reminders: Set up payment reminders or alerts to ensure that you never miss the payment due date for your Bank of America credit card. Timely payments are essential for avoiding late fees and maintaining a positive credit history.

- Strategic Spending: Align your discretionary spending with the start and end dates of your billing cycle. By timing your purchases strategically, you can maximize the interest-free period and optimize your credit utilization ratio.

- Review Statements Regularly: Routinely review your monthly statements to track your expenses, monitor for any unauthorized charges, and verify the accuracy of the transactions included in the billing cycle.

- Utilize Online Tools: Take advantage of Bank of America’s online account management tools to track your billing cycle, monitor your credit card activity, and access educational resources for financial planning and budgeting.

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum amount due on your credit card. By paying off a larger portion of your balance, you can reduce interest charges and expedite your journey toward debt freedom.

- Understand Rewards and Benefits: If your Bank of America credit card offers rewards, cashback, or other benefits, familiarize yourself with the specific terms and redemption options. Leveraging these perks can enhance the value of your card usage within the billing cycle.

- Monitor Credit Utilization: Keep an eye on your credit utilization ratio, which is the percentage of your available credit that you are using. Maintaining a low utilization ratio can positively impact your credit score and financial health.

- Address Discrepancies Promptly: If you notice any discrepancies or irregularities in your billing cycle or statements, promptly contact Bank of America’s customer service to address the issues and seek resolution.

By incorporating these tips into your financial management practices, you can proactively engage with your Bank of America billing cycle, optimize your credit card usage, and foster responsible financial habits. Navigating your billing cycle with vigilance and informed decision-making empowers you to harness the benefits of your credit card while maintaining control over your financial well-being.

Conclusion

Mastering the dynamics of your Bank of America billing cycle is a fundamental aspect of prudent financial management. By understanding the intricacies of billing cycles, including their length, influencing factors, and management strategies, you can wield greater control over your credit card usage and optimize your financial well-being. Whether you are striving to minimize interest charges, build a strong credit history, or maximize the benefits of your rewards card, the insights gained from comprehending your billing cycle can propel you toward achieving your financial goals.

As you navigate your Bank of America billing cycle, remember to leverage the available resources, such as online account management tools, customer service assistance, and automated alerts, to stay informed and organized. By proactively monitoring your billing cycle, strategically timing your payments and expenditures, and embracing responsible financial habits, you can harness the full potential of your credit card while avoiding common pitfalls such as late fees and high interest costs.

Ultimately, your billing cycle serves as a foundational element in your financial journey, shaping the rhythm of your credit card activities and influencing your overall monetary well-being. By implementing the tips and strategies outlined in this article, you can embark on a path of empowered financial management, where your Bank of America credit card becomes a valuable tool for achieving your aspirations while maintaining fiscal prudence.

Embrace the knowledge gained from understanding your billing cycle, and let it serve as a cornerstone for your ongoing financial success. With informed decision-making and proactive engagement, you can navigate your Bank of America billing cycle with confidence, unlocking the potential for greater financial stability and prosperity.