Finance

How To Calculate Inflation In Excel

Published: November 24, 2023

Learn how to calculate inflation using Excel with this comprehensive guide. Perfect for those in the finance industry looking to improve their data analysis skills.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Inflation

- Importance of Calculating Inflation

- Gathering Data for Inflation Calculation

- Using Excel Functions for Inflation Calculation

- Step 1: Setting Up the Data Table

- Step 2: Calculating Inflation Rate

- Step 3: Calculating Cumulative Inflation

- Step 4: Visualizing Inflation Data with Charts

- Conclusion

Introduction

Welcome to the world of finance, where numbers play a crucial role in understanding and predicting the dynamics of the economy. One key concept that often affects individuals, businesses, and governments alike is inflation. Inflation refers to the steady increase in the prices of goods and services over time, resulting in the eroding purchasing power of a currency.

Understanding inflation and its impact is essential for making informed financial decisions. Whether you are an individual planning your budget, a business strategizing pricing and cost structures, or an investor evaluating potential investments, being able to accurately calculate and analyze inflation is vital.

In this article, we will guide you through the process of calculating inflation using Microsoft Excel. Excel is a powerful tool that allows you to organize, analyze, and visualize data, making it an excellent choice for performing complex financial calculations, including inflation analysis.

By the end of this article, you will have a clear understanding of how to gather the necessary data, use Excel functions, and visualize inflation data. So, let’s dive into the world of Excel and explore how to calculate inflation!

Understanding Inflation

Inflation is a fundamental concept in economics that measures the general increase in the prices of goods and services over a period of time. It is usually expressed as a percentage, representing the rate at which the purchasing power of a currency decreases over time.

There are several factors that contribute to inflation, including supply and demand dynamics, monetary policy, and cost push factors. When the demand for goods and services outpaces supply, prices tend to rise. Additionally, when governments and central banks increase the money supply, it can lead to a decrease in the value of currency and result in inflation.

There are different types of inflation, such as demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when there is an excessive demand for goods and services, causing prices to rise. Cost-push inflation, on the other hand, arises due to an increase in production costs, such as labor, raw materials, or taxes. Built-in inflation refers to the notion that once people expect prices to rise, they anticipate it and demand higher wages, leading to a self-perpetuating cycle of increasing prices.

Inflation has both positive and negative effects on the economy. In moderate levels, inflation can stimulate economic growth by encouraging consumer spending and investment. It also allows for adjustments in wages and prices, providing flexibility within the economy. However, high levels of inflation can erode the value of money, reduce purchasing power, and create economic instability.

Understanding inflation and its impact is crucial for individuals and businesses. It directly affects the cost of living, savings, investments, and long-term financial planning. Monitoring and calculating inflation allows individuals and businesses to adjust their budgets, pricing strategies, and investment decisions to mitigate the impact of inflation.

Now that we have a basic understanding of inflation, let’s explore why it is important to calculate inflation accurately.

Importance of Calculating Inflation

Calculating inflation accurately is essential for individuals, businesses, and governments for several reasons. It provides valuable insights into the changing economic landscape and enables informed decision-making. Let’s explore the importance of calculating inflation in more detail:

- Budgeting and Financial Planning: Inflation can significantly impact your day-to-day expenses, savings, and long-term financial goals. By calculating inflation, you can accurately estimate future expenses, plan your budget, and make necessary adjustments to ensure your financial well-being.

- Investment decisions: Inflation can affect the returns on investments. By calculating inflation, you can identify investments that outperform inflation, preserve your purchasing power, and generate real returns. It helps you make informed choices about where to allocate your funds for long-term growth.

- Pricing strategies: Businesses need to adjust their prices to account for inflation and maintain profitability. Calculating inflation helps businesses determine the appropriate rate of price adjustments, ensuring that their products or services remain competitive and profitable.

- Wage negotiations: Inflation erodes the purchasing power of wages. Calculating inflation allows individuals and labor unions to negotiate higher wages that keep up with rising costs, ensuring the maintenance of the standard of living.

- Monetary and fiscal policy: Governments and central banks closely monitor inflation rates to formulate monetary and fiscal policies. Accurate inflation calculations help policymakers implement appropriate measures to manage inflation, stabilize the economy, and control the money supply.

- Cost of living adjustments: Many contracts and agreements include provisions for cost of living adjustments (COLA). Calculating inflation helps ensure that these adjustments accurately reflect changes in the cost of living, protecting the purchasing power of individuals receiving fixed payments.

By calculating and monitoring inflation, individuals and businesses can make well-informed financial decisions that take into account the impact of rising prices. It allows for better financial planning, investment strategies, and ensures the maintenance of purchasing power in an ever-changing economic environment.

Now that we understand the importance of calculating inflation, let’s move on to the next step: gathering the data needed for inflation calculation.

Gathering Data for Inflation Calculation

Gathering accurate and reliable data is crucial for calculating inflation effectively. Inflation calculations typically require historical price data for a basket of goods and services over a specified period. Here are the key steps to gather data for inflation calculation:

- Selecting the Price Index: The price index is a measure of average price changes for a specific set of goods and services. Commonly used price indexes include the Consumer Price Index (CPI), Producer Price Index (PPI), and Wholesale Price Index (WPI). Choose the appropriate price index based on your analysis objectives. For personal inflation calculations, the CPI is commonly used.

- Identifying the Basket of Goods and Services: The basket of goods and services represents a sample of goods and services that are commonly consumed. It should reflect the average consumption patterns of the population you are analyzing. The items in the basket may include food, housing, transportation, healthcare, and other essential commodities.

- Collecting Price Data: Obtain historical price data for the selected basket of goods and services. This data can be gathered from official government publications, statistical agencies, or reputable sources such as economic research institutions. Ensure that the data covers the desired period and is comprehensive enough to provide an accurate representation of price changes.

- Weighting the Items: Assign weights to each item in the basket based on their relative importance in the overall expenditure. These weights can be derived from national consumption surveys or other sources that provide insights into expenditure patterns.

- Updating the Basket: Periodically review and update the basket of goods and services to ensure that it remains representative of current consumption patterns. This is important as consumption habits and preferences change over time.

It is essential to ensure the accuracy and reliability of the data collected for inflation calculation. Cross-check the data from multiple sources and validate its authenticity. Any inaccuracies or biases in the data can significantly impact the accuracy of the inflation calculations.

Now that we have gathered the necessary data, let’s dive into the next step: using Excel functions for inflation calculation.

Using Excel Functions for Inflation Calculation

Excel provides a wide range of functions that can be used to calculate inflation accurately and efficiently. In this section, we will explore the step-by-step process of using Excel functions for inflation calculation:

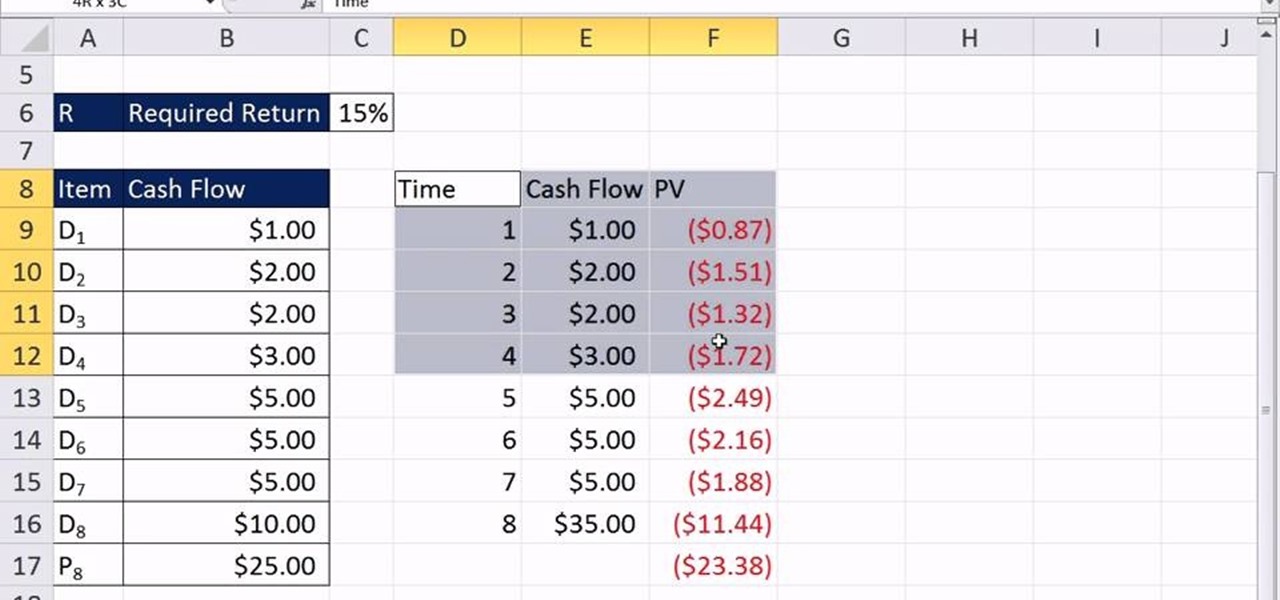

Step 1: Setting Up the Data Table

First, set up a data table in Excel with the historical price data for the selected basket of goods and services. Organize the data in columns, with each column representing a specific time period (e.g., months, years).

Step 2: Calculating Inflation Rate

To calculate the inflation rate for each period, use the Excel function =((New Value - Old Value) / Old Value) * 100. This formula calculates the percentage change between the new value and the old value.

For example, if cell A2 contains the old value and B2 contains the new value, enter the formula =((B2 - A2) / A2) * 100 in a new column to calculate the inflation rate for that period.

Step 3: Calculating Cumulative Inflation

To calculate the cumulative inflation, use the Excel function =PRODUCT(1+inflation_range/100)-1, where the inflation_range represents the range of cells containing the inflation rates. This formula calculates the cumulative percentage change in prices over multiple periods.

For example, if the inflation rates are in the range C2:C10, enter the formula =PRODUCT(1+C2:C10/100)-1 in a cell to calculate the cumulative inflation.

Step 4: Visualizing Inflation Data with Charts

Excel also provides various charting options to visualize inflation data effectively. Select the range of cells containing the inflation rates, including the headers. Then, click on the “Insert” tab, choose a chart type (e.g., line chart, column chart), and customize the chart as desired.

Charts are helpful in identifying trends, patterns, and fluctuations in inflation over time, allowing for easy interpretation and analysis of the data.

By following these steps and utilizing the appropriate Excel functions, you can accurately calculate inflation and gain insights into the changing price dynamics over time.

Now that you have learned how to use Excel functions for inflation calculation, let’s summarize the key points in the next section.

Step 1: Setting Up the Data Table

The first step in calculating inflation using Excel is to set up a data table that contains the historical price data for the selected basket of goods and services. This data table will serve as the foundation for the subsequent calculations.

Here’s how you can set up the data table:

- Create Columns: Begin by creating columns to represent the time periods for which you have price data. For example, you might have columns for different months or years.

- Labels and Headings: Assign labels and headings to each column to clearly indicate the time period or the specific items being tracked. This will make it easier to navigate and interpret the data.

- Enter Price Data: Populate the data table with the corresponding price data for each item in the basket and the respective time periods. Ensure that the prices are accurately entered for each period and item.

- Data Format: Format the columns to ensure that the price data is correctly displayed. Use currency formatting to reflect the appropriate currency and decimal places. This will improve readability and ensure consistency in calculations.

- Data Validation: If necessary, apply data validation rules to ensure the accuracy and integrity of the price data. You can set constraints, such as minimum and maximum values, to prevent input errors and maintain data integrity.

Setting up a well-structured and organized data table is crucial for the accuracy and effectiveness of your inflation calculations. It provides a clear visual representation of the price data and allows for easy reference and analysis.

Once you have set up the data table, you are ready to proceed to the next step in calculating inflation using Excel: determining the inflation rate for each period.

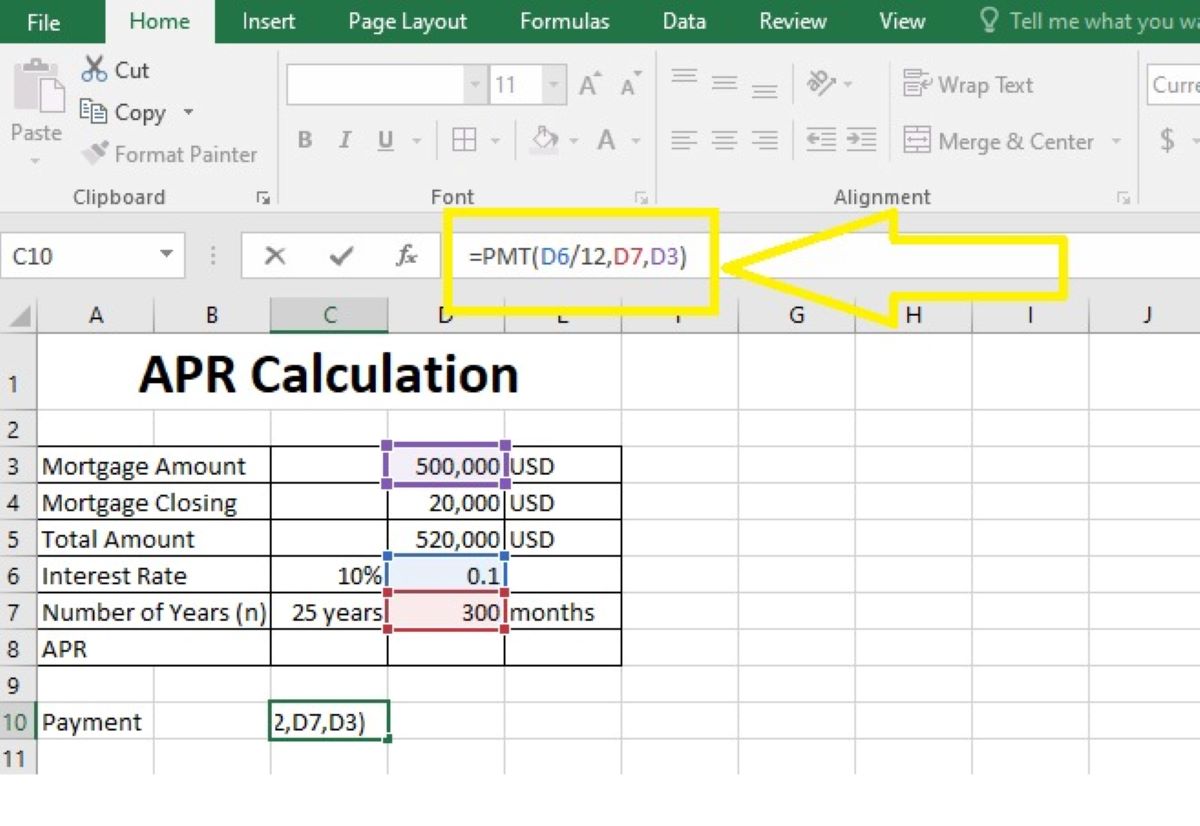

Step 2: Calculating Inflation Rate

The second step in calculating inflation using Excel is to determine the inflation rate for each period. The inflation rate measures the percentage change in prices between two time periods and provides insights into the rate at which prices are rising or falling.

To calculate the inflation rate using Excel, follow these steps:

- Select a Calculation Period: Choose the time period for which you want to calculate the inflation rate. For example, you may want to calculate the inflation rate on a monthly or yearly basis.

- Identify Old and New Values: Identify the old value (previous period) and the new value (current period) of the price for each item in your data table. For example, you may have the old value in column A and the new value in column B.

- Apply the Calculation Formula: In a new column, enter the formula

=((new value - old value) / old value) * 100. This formula calculates the percentage change between the old and new values to determine the inflation rate. - Copy the Formula: Once you have entered the formula for the first cell, copy and paste it to apply the formula to the remaining cells in the column. This will automatically calculate the inflation rate for each period.

By following these steps, you will have calculated the inflation rate for each period in your data table. This information can help you track the rate of price changes over time and understand the inflationary trends in your selected basket of goods and services.

With the inflation rate calculated, you can proceed to the next step: determining the cumulative inflation over multiple periods.

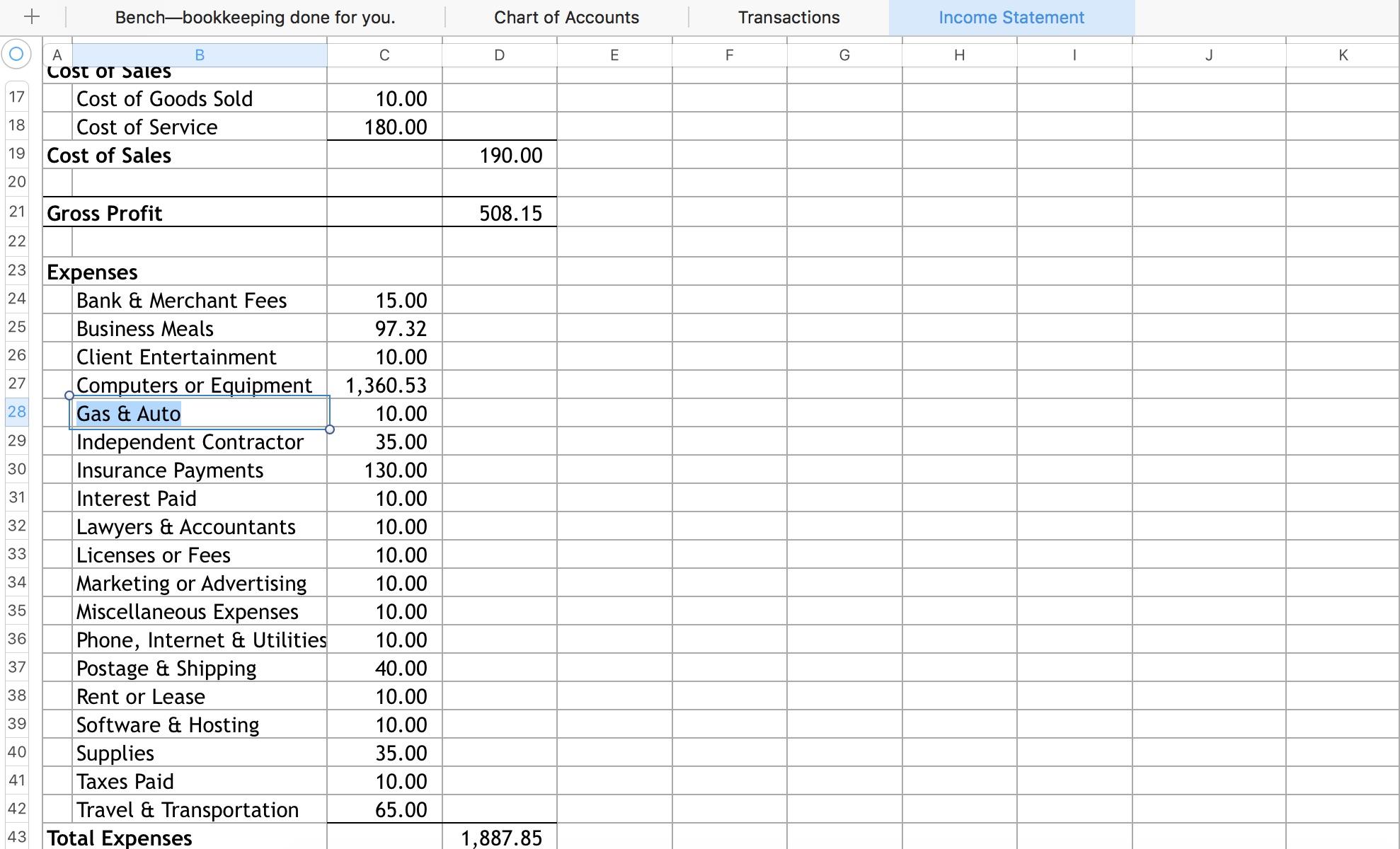

Step 3: Calculating Cumulative Inflation

Calculating cumulative inflation allows you to determine the overall change in prices over multiple periods. This step provides a comprehensive view of the total inflation experienced during the specified time frame.

To calculate the cumulative inflation using Excel, follow these steps:

- Select the Inflation Range: Identify the range of cells that contain the inflation rates calculated in step 2. This range should include all the inflation rate values for each period.

- Apply the Cumulative Inflation Formula: In a new cell, enter the formula

=PRODUCT(1+inflation_range/100)-1. Replace “inflation_range” with the range of cells containing the inflation rates. This formula calculates the cumulative percentage change in prices over multiple periods. - Format the Result: Format the cell with the cumulative inflation result as a percentage to reflect the cumulative change in prices accurately. You can do this by selecting the cell and applying percentage formatting from the formatting options in Excel.

After completing these steps, you will have calculated the cumulative inflation over the selected time period. The resulting value represents the overall percentage change in prices for the items in your selected basket of goods and services.

Calculating cumulative inflation provides a broader perspective on the overall impact of price changes. It allows individuals, businesses, and policymakers to assess the long-term effects of inflation and make informed decisions regarding budgeting, investment strategies, and economic policy.

Understanding how to calculate cumulative inflation is essential for gaining insights into the accumulated price changes over time. Now that you have calculated both the inflation rate and cumulative inflation, it’s time to visualize the inflation data using charts.

Step 4: Visualizing Inflation Data with Charts

Visualizing inflation data with charts can provide a clear and concise representation of the price changes over time. Excel offers a variety of charting options that allow you to create visually appealing and informative charts to better understand and interpret inflation data.

Here’s how you can visualize inflation data with charts using Excel:

- Select the Inflation Data: Identify the range of cells that contain the inflation rates, including the column headers. This range should include both the time periods and the corresponding inflation rates.

- Insert a Chart: Click on the “Insert” tab in Excel and choose the chart type that best suits your needs. Commonly used chart types for visualizing inflation data include line charts, column charts, or area charts.

- Customize the Chart: Once you have inserted the chart, customize it according to your preferences. You can modify the chart title, axis labels, legends, and colors to enhance clarity and aesthetics.

- Format the Chart: Apply formatting options such as gridlines, data labels, and trendlines to make the chart more informative and visually appealing. You can also adjust the scale of the axes to provide a better representation of the inflation data.

- Interpret the Chart: Analyze the chart to identify trends, patterns, and fluctuations in inflation over time. Look for periods of high inflation, periods of stability, or any significant deviations from the long-term average. These insights can inform decision-making and help you understand the impact of inflation on various aspects of the economy.

By visualizing inflation data with charts, you can gain a better understanding of the inflationary trends and patterns. Charts provide a visual representation that is often easier to interpret and can help you communicate your findings to others effectively.

Remember to choose the appropriate chart type based on your data and analysis objectives. Experiment with different chart styles and formats to find the one that best represents your inflation data.

Using charts to visualize inflation data adds depth and clarity to your analysis. Now that you have successfully visualized the inflation data, you have a comprehensive understanding of the inflation calculations using Excel.

In the next section, we will conclude our exploration of how to calculate inflation in Excel.

Conclusion

Congratulations! You have reached the end of our guide on calculating inflation in Excel. We have covered the essential steps to help you accurately calculate and analyze inflation data. Let’s recap the key points:

First, we discussed the importance of understanding inflation and its impact on individuals, businesses, and economies. Knowing how to calculate inflation allows for better financial planning, investment decisions, and pricing strategies.

We then explored the process of gathering data for inflation calculation. Selecting the appropriate price index, identifying the basket of goods and services, and collecting reliable price data are fundamental steps in this process.

Next, we delved into using Excel functions for inflation calculation. We covered step-by-step instructions on setting up the data table, calculating the inflation rate for each period, and determining the cumulative inflation over multiple periods.

Lastly, we discussed the importance of visualizing inflation data with charts. Creating charts in Excel provides a visual representation that facilitates interpretation, trend analysis, and communication of inflation trends and patterns.

By mastering these techniques, you can now confidently calculate and analyze inflation data using Excel. This knowledge empowers you to make informed financial decisions, adjust budgets, evaluate investment options, and navigate the impact of inflation on your personal and business finances.

Remember, accurate and up-to-date data is crucial for reliable inflation calculations. Keep track of changes in your basket of goods and services, and update your data periodically to ensure the accuracy of your analyses.

Now it’s time to put your skills into practice and utilize Excel’s powerful functions to calculate and analyze inflation. Use this knowledge to inform your financial decisions and gain insights into the ever-changing economic landscape.

Thank you for joining us on this journey to explore how to calculate inflation in Excel. We hope this guide has been informative and valuable to you.

Keep exploring, keep learning, and stay ahead in the world of finance!