Finance

How To Manage Credit Card Spending

Modified: February 21, 2024

Learn effective strategies to manage your credit card spending and improve your personal finance. Take control of your finances today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of credit cards, where convenience and purchasing power are just a swipe away. Credit cards have become an integral part of our daily lives, offering us the ability to make purchases without carrying cash and providing access to a range of financial benefits. However, managing credit card spending can be a tricky task, especially if you’re not mindful of your financial habits.

In this article, we will explore various strategies to help you manage your credit card spending effectively. By understanding the intricacies of credit card usage, evaluating your spending habits, and implementing practical tips, you will be on your way to maintaining a healthy relationship with credit cards and avoiding financial pitfalls.

Whether you’re a seasoned credit card user or just starting out, it’s important to remember that responsible credit card management is crucial for your financial well-being. Let’s dive in and discover how you can take control of your credit card spending and make informed financial decisions.

Understanding your Credit Card

Before delving into effective strategies for managing your credit card spending, it’s important to have a solid understanding of how credit cards work. A credit card is essentially a form of borrowing that allows you to make purchases up to a certain credit limit. Instead of using your own money, you are essentially borrowing money from the credit card issuer, which you will need to repay by the due date to avoid interest charges and fees.

When you receive a credit card, it’s crucial to familiarize yourself with the terms and conditions, including the annual percentage rate (APR), grace period, and any applicable fees. The APR represents the interest rate applied to your outstanding balance if you do not pay it off in full by the due date. The grace period, typically around 21-25 days, is the period within which you can pay off your balance without incurring any interest charges. Understanding these key features will help you make informed decisions about your credit card usage and avoid unnecessary expenses.

Additionally, it’s important to be mindful of the various types of credit cards available and their specific features. Some credit cards offer rewards programs, such as cash back or travel rewards, while others may have lower interest rates or introductory offers. Consider your spending habits and financial goals to choose a credit card that aligns with your needs.

Lastly, it’s crucial to understand the concept of your credit limit. Your credit limit represents the maximum amount you are allowed to charge on your credit card. Exceeding your credit limit can result in fees and penalties, and it can also negatively impact your credit score. It’s important to keep your credit utilization ratio – the percentage of your credit limit you are using – low to maintain a healthy credit profile.

By thoroughly understanding the features and terms of your credit card, you can make informed decisions about your spending and ensure that you use your credit card wisely.

Evaluating your Spending Habits

Understanding your spending habits is a crucial step in managing your credit card spending effectively. Take some time to evaluate your current financial situation and identify any patterns or areas where you may be overspending.

Start by analyzing your credit card statements from the past few months. Look for recurring expenses, such as subscriptions or memberships, that you may no longer need or use. Consider if any of these expenses can be eliminated or reduced to free up more funds for savings or paying off your credit card balance.

Next, categorize your expenses into different categories, such as groceries, dining out, entertainment, utilities, and transportation. This will give you a clear picture of where your money is going and help identify any areas where you may be overspending.

Use budgeting tools or mobile apps to track your expenses in real-time. These tools can help you set spending limits for different categories and provide insights into your spending patterns. By being aware of your spending habits, you can make conscious decisions about where to cut back and where to allocate more funds.

It’s also important to identify any triggers or emotional reasons that may lead to impulsive purchases. Are you prone to retail therapy? Do you succumb to sales and discounts? Understanding these triggers can help you develop strategies to overcome them and make more mindful purchasing decisions.

Lastly, consider your financial goals. Are you saving for a down payment on a house, planning for retirement, or paying off debt? Keeping your goals in mind can provide the motivation needed to make smarter spending choices and focus on long-term financial stability.

By evaluating your spending habits and becoming aware of where your money is going, you can make informed decisions to curb unnecessary expenses and better manage your credit card spending.

Setting a Budget

Setting a budget is a crucial step in managing your credit card spending and overall financial well-being. A budget provides a framework for how much money you can allocate towards different expenses and helps you stay on track with your financial goals.

Start by determining your monthly income and subtracting fixed expenses, such as rent or mortgage payments, utility bills, and insurance premiums. This will give you a clear picture of how much discretionary income you have left to allocate towards other expenses.

Next, prioritize your spending categories based on their importance and allocate funds accordingly. This will vary depending on your individual circumstances and financial goals. For example, you may allocate a higher portion of your budget towards savings, debt repayment, or other financial priorities.

When setting a budget, it’s important to be realistic and flexible. Aim to strike a balance between frugality and enjoyment. Allow yourself some room for discretionary spending, but also be mindful of your financial goals.

Consider using budgeting apps or spreadsheets to track your income and expenses. These tools can help you monitor your spending, identify any areas of overspending, and make adjustments as needed.

Remember, a budget is not set in stone. It’s a living document that can be adjusted as your income and expenses change. Regularly review and update your budget to ensure it remains aligned with your financial goals and priorities.

Setting and following a budget will help you make more informed decisions about your credit card spending and prevent you from overspending. It will also provide a sense of control and empower you to achieve financial stability and build a strong financial future.

Tracking your Expenses

Tracking your expenses is a crucial component of effective credit card spending management. By keeping a record of your spending, you can gain insights into your financial habits and identify areas where adjustments can be made.

Start by consistently recording your expenses, either manually in a notebook or by using a budgeting app. Make it a habit to document every purchase, no matter how small. This will allow you to see exactly where your money is going and provide a clear overview of your spending patterns.

When tracking your expenses, be diligent about categorizing them. Create categories that align with your budget and financial goals, such as groceries, dining out, entertainment, transportation, and so on. This will make it easier to analyze your spending and identify any areas where you may be overspending.

Consider utilizing technological tools such as expense tracking apps that can automatically categorize and consolidate your spending data. These apps can provide real-time insights into your spending habits and alert you when you approach or exceed your budget limits.

Regularly review your spending records and analyze your expenses. Look for any trends or patterns that may indicate areas of improvement. For example, you might notice that you’re spending a significant amount on eating out or online shopping. Identifying these patterns can help you make conscious decisions to cut back and reallocate funds towards other financial priorities.

Tracking your expenses also allows you to identify any unauthorized or fraudulent charges on your credit card. By regularly monitoring your statements and comparing them with your expense records, you can quickly spot any discrepancies and report them to your credit card provider.

Remember, tracking your expenses is an ongoing process. It requires discipline and consistency. However, the insights gained from this practice are invaluable and can significantly contribute to better credit card spending management and overall financial well-being.

Prioritizing your Payments

When it comes to managing your credit card spending, prioritizing your payments is crucial to maintaining a healthy financial position. By understanding which payments to prioritize, you can avoid unnecessary fees, penalties, and negative impacts on your credit score. Here are some key considerations to keep in mind:

1. Pay on time: One of the most important aspects of credit card management is ensuring that you make your payments on time. Late payments can result in late fees and a negative impact on your credit score. Set up payment reminders or consider automatic payments to avoid missing due dates.

2. Pay the minimum balance: While it’s important to make at least the minimum payment due each month, it’s ideal to pay off the entire balance to avoid interest charges. Paying only the minimum will result in accruing interest on the remaining balance, which can quickly add up over time.

3. Prioritize high-interest debts: If you have multiple credit cards or outstanding debts, prioritize paying down those with the highest interest rates first. This strategy, known as the debt avalanche method, can save you money in the long run by minimizing the amount of interest you pay.

4. Consider balance transfers: If you have a high-interest credit card balance, you may want to explore the option of transferring the balance to a card with a lower interest rate. This can help you save on interest and pay down your debt more efficiently.

5. Communicate with your credit card issuer: In times of financial difficulty, such as job loss or unexpected expenses, it’s important to communicate with your credit card issuer. They may be able to offer temporary assistance, such as waiving late fees or adjusting your payment due dates.

6. Avoid maxing out your credit cards: Maxing out your credit cards, or utilizing a high percentage of your available credit limit, can negatively impact your credit score. Aim to keep your credit utilization ratio below 30% to maintain a healthy credit profile.

By prioritizing your payments and staying on top of your credit card obligations, you can avoid unnecessary fees, maintain a good credit score, and ultimately achieve financial stability.

Avoiding Impulse Purchases

Impulse purchases can wreak havoc on your credit card spending and derail your financial goals. To effectively manage your credit card spending, it’s important to develop strategies to curb impulsive buying habits. Here are some tips to help you avoid impulse purchases:

1. Create a waiting period: Before making a purchase, give yourself a waiting period, such as 24 hours or a week, depending on the item’s cost. This allows you time to consider whether the purchase is necessary or if it’s simply a fleeting desire.

2. Make a shopping list: Whether you’re grocery shopping or buying other items, create a list and stick to it. Having a clear plan will help you focus on essential items and resist the temptation to make impulse purchases.

3. Use cash or debit cards: Consider using cash or a debit card instead of credit cards for your day-to-day expenses. By using cash, you have a tangible reminder of your spending and are less likely to overspend.

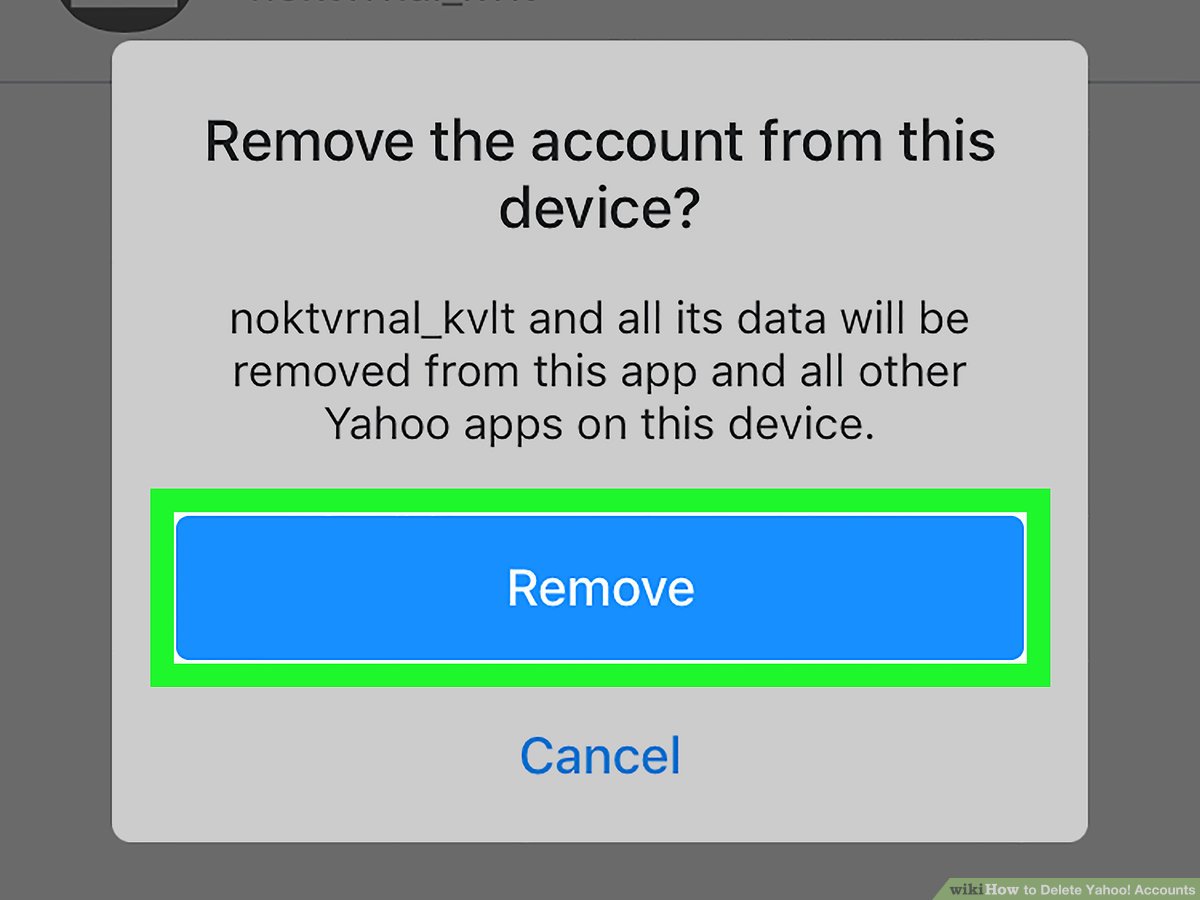

4. Unsubscribe from tempting emails and alerts: If you find yourself constantly tempted by promotional emails and alerts, unsubscribe from them. Minimizing exposure to tempting offers can help you stay focused on your financial goals.

5. Identify emotional triggers: Be aware of any emotional triggers that may lead to impulsive purchases. Are you shopping to cope with stress or emotions? Finding alternative ways to deal with these triggers, such as exercising, practicing mindfulness, or seeking support from loved ones, can help you avoid impulse buying.

6. Set spending limits: Determine a monthly spending limit for discretionary purchases and stick to it. Setting boundaries helps you make more intentional decisions about your spending and avoid exceeding your budget.

7. Comparison shop: Before making a purchase, take the time to research and compare prices from different retailers. This can help you find the best deal and ensure that you’re not overspending on an impulse purchase.

8. Reflect on your financial goals: Whenever you feel the urge to make an impulse purchase, take a moment to reflect on your financial goals and priorities. Ask yourself if the purchase aligns with your long-term objectives and if it’s worth sacrificing progress towards those goals.

By implementing these strategies and being mindful of your spending habits, you can overcome impulsive buying tendencies and make more deliberate decisions about your credit card spending.

Using Credit Card Rewards Wisely

Many credit cards offer reward programs that can provide a range of benefits, such as cash back, travel rewards, or points redeemable for merchandise. When used wisely, credit card rewards can be a valuable tool to maximize your purchasing power and save money. Here’s how to make the most of your credit card rewards:

1. Choose the right rewards program: Select a credit card with a rewards program that aligns with your spending habits and financial goals. For example, if you frequently travel, a card with travel rewards may be more beneficial, while a cash back card might be preferable if you prefer immediate savings.

2. Understand the rewards structure: Familiarize yourself with how the rewards program operates. Be aware of the earning rate, any spending categories that offer bonus points, and any restrictions or limitations on redeeming rewards.

3. Pay attention to expiration dates: Rewards points often come with expiration dates. Make sure to keep track of these dates and use your points before they expire to maximize their value.

4. Redeem strategically: Consider the best way to redeem your rewards. Some options may offer better value than others. For example, redeeming for cash back might be more advantageous for certain individuals, while others may find greater value in using their points for travel or merchandise.

5. Consolidate your rewards: If you have multiple credit cards with different rewards programs, consider consolidating your rewards into a single account. This can help you accumulate points faster and make it easier to track and manage your rewards.

6. Be mindful of spending to earn rewards: While it’s tempting to spend more to earn more rewards, be cautious not to overspend or carry a balance that incurs interest charges. The cost of interest can offset the value of the rewards earned.

7. Monitor special promotions: Keep an eye out for special promotions or limited-time deals offered by your credit card issuer. These promotions may offer additional ways to earn bonus rewards or provide extra perks that can be advantageous to you.

8. Use rewards strategically: Consider using your rewards for high-value purchases or experiences that align with your goals. For example, saving your rewards for flights, hotel stays, or other significant expenses can maximize their impact.

By understanding the ins and outs of your credit card rewards program and using your rewards wisely, you can leverage these benefits to your advantage and enhance your overall financial well-being.

Monitoring your Credit Score

Your credit score is a vital factor in your financial health and can significantly affect your ability to obtain loans, secure favorable interest rates, and even rent an apartment. Monitoring your credit score regularly allows you to stay informed about your creditworthiness and take the necessary steps to improve it. Here’s why and how you should monitor your credit score:

1. Understanding your creditworthiness: Your credit score is a reflection of your overall creditworthiness. By monitoring it, you can gain insights into how lenders perceive you as a borrower. A high credit score indicates good credit management, while a low score may indicate a need for improvement.

2. Identifying errors and inaccuracies: Monitoring your credit score allows you to spot any errors or inaccuracies on your credit report. Inaccurate information can negatively impact your score, so being vigilant and disputing any errors can help maintain an accurate and fair credit profile.

3. Detecting signs of identity theft: Regular monitoring of your credit score can help you identify any signs of identity theft or fraudulent activity. If you notice any unexpected changes or unfamiliar accounts on your credit report, it could indicate that someone has fraudulently used your information.

4. Taking proactive steps to improve your score: Monitoring your credit score provides insights into areas where you can improve your creditworthiness. Identifying the factors affecting your score, such as high credit utilization or late payments, allows you to take proactive measures to address them and improve your credit score over time.

5. Ensuring accuracy for future financial endeavors: Whether you plan to apply for a mortgage, auto loan, or credit card, having a good credit score is crucial. By monitoring your credit score, you can ensure its accuracy and take steps to improve it if necessary, increasing your chances of obtaining favorable terms and rates in the future.

To monitor your credit score, you can take advantage of free credit score services offered by various credit reporting agencies or use third-party platforms that provide regular updates. Additionally, consider obtaining a free copy of your credit report from each of the major credit bureaus annually to review the details of your credit history.

By monitoring your credit score regularly, you can stay informed about your creditworthiness, detect any errors or fraudulent activity, and take the necessary steps to improve your score over time.

Seeking Professional Help if Needed

Managing credit card spending and maintaining financial well-being can sometimes be challenging. If you find yourself struggling to effectively manage your credit card expenses or improve your financial situation, it may be beneficial to seek professional help. Here are some instances where professional assistance can make a difference:

1. Credit counseling services: Credit counseling agencies can provide guidance and support in managing your credit card spending. They can help you create a budget, negotiate with creditors, and develop a debt management plan. Credit counselors can offer personalized advice based on your unique financial situation.

2. Financial advisors: If you require comprehensive financial guidance beyond credit card spending, working with a financial advisor can be beneficial. A financial advisor can help you create a holistic financial plan, manage investments, and make informed decisions about your overall financial well-being.

3. Debt consolidation companies: If you find yourself overwhelmed with credit card debt, debt consolidation companies can assist in combining multiple debts into a single loan with more favorable terms. They can negotiate with creditors on your behalf and help develop a repayment plan that suits your financial situation.

4. Bankruptcy attorneys: In extreme cases where credit card spending has led to overwhelming debt and an inability to pay, consulting with a bankruptcy attorney may be necessary. Bankruptcy attorneys can help navigate the complex legal process and determine the best course of action to alleviate financial burdens.

It’s important to approach seeking professional help with caution. Research different professionals or agencies, and ensure they have a good reputation and valid credentials. Additionally, be prepared to ask questions about fees, services provided, and any potential conflicts of interest.

Remember, seeking professional help is not a sign of failure but a proactive step towards improving your financial well-being. These experts can provide valuable insights, guidance, and support during challenging times and help you regain control of your credit card spending and overall financial situation.

Conclusion

Managing credit card spending is essential for maintaining a healthy financial life. By understanding your credit card, evaluating your spending habits, setting a budget, and tracking your expenses, you can develop responsible financial habits and avoid falling into debt traps.

Prioritizing your payments, avoiding impulse purchases, and using credit card rewards wisely are key strategies that can help you make informed decisions about your spending and maximize the benefits of your credit cards.

Monitoring your credit score regularly and seeking professional help when needed are crucial steps in maintaining a solid financial foundation. By staying vigilant and taking proactive measures to improve your creditworthiness, you can open up opportunities for better financial resources and borrowing options in the future.

Remember, managing credit card spending is an ongoing process that requires discipline, self-awareness, and a commitment to financial well-being. By implementing the strategies outlined in this article and staying mindful of your financial goals, you can take control of your credit card spending and pave the way for a brighter financial future.