Finance

How To Pass A Rental Credit Check

Modified: February 21, 2024

Learn how to successfully pass a rental credit check with our comprehensive finance guide. Increase your chances of approval and secure your dream rental property.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Rental Credit Checks

- Steps to Prepare for a Rental Credit Check

- Checking Your Credit Score and Report

- Addressing Negative Credit Issues

- Gathering Necessary Documentation

- Contacting Previous Landlords for References

- Providing Proof of Employment and Income

- Understanding Rental Requirements and Criteria

- Submitting the Rental Application

- Conclusion

Introduction

When searching for a rental property, one crucial step in the process is the rental credit check. Landlords and property managers use these checks to assess an applicant’s financial responsibility and determine the likelihood of timely rental payments. For potential tenants, passing a rental credit check is vital for securing the desired rental property.

Understanding the rental credit check process and knowing how to prepare for it can greatly increase your chances of success. This article will guide you through the steps to pass a rental credit check and help you navigate the process with confidence.

It’s important to note that a rental credit check typically involves an evaluation of your credit score and report, as well as other factors such as employment and rental history. The purpose is to ensure that you are a reliable tenant who will fulfill the financial obligations of the lease agreement.

By taking proactive steps to improve your credit and gather the necessary documentation, you can increase your chances of passing a rental credit check and securing the rental property of your choice. This article will provide you with valuable insights and tips on how to successfully navigate the rental credit check process.

Understanding Rental Credit Checks

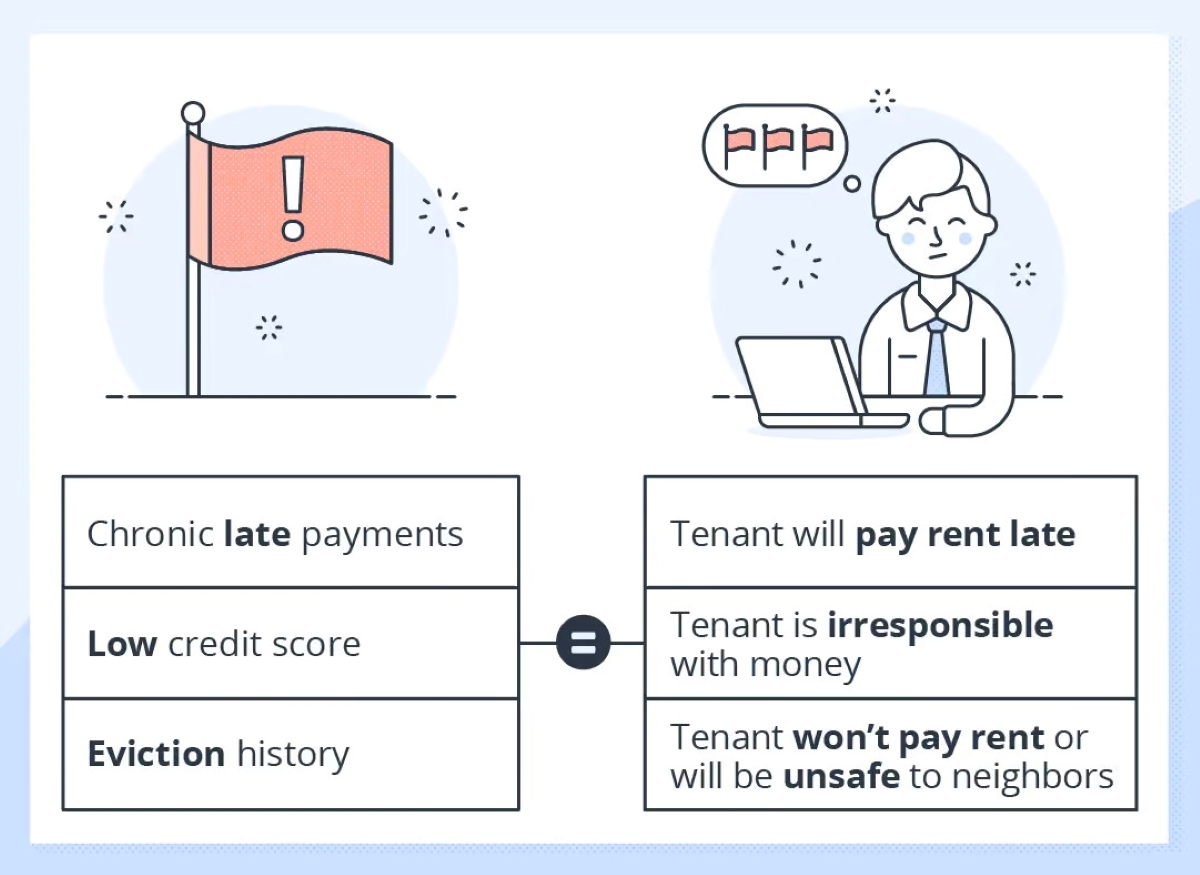

Rental credit checks, also known as tenant credit checks, are conducted by landlords or property management companies as part of the screening process to assess the financial reliability of potential tenants. These checks provide insights into an individual’s credit history, payment behavior, and potential financial risks.

During a rental credit check, the landlord or property manager will typically review your credit score and credit report from one or more credit bureaus, such as Experian, TransUnion, or Equifax. They will examine factors such as your payment history, outstanding debts, credit utilization, and the presence of any negative information such as bankruptcies or evictions.

The purpose of the rental credit check is to determine the level of risk associated with renting a property to you. Landlords want to ensure that you have a good track record of making timely payments and managing your financial obligations. A higher credit score and positive credit history are generally indicative of a responsible tenant.

It’s essential to understand that different landlords and property management companies may have varying criteria for the minimum acceptable credit score. Some may have a specific cutoff score, while others may consider factors such as income or rental history as mitigating factors.

Even if you have less-than-perfect credit, it is still possible to pass a rental credit check. Understanding what landlords look for and taking proactive steps to address any credit issues can improve your chances of success. The next section will provide you with actionable steps to prepare for the rental credit check process.

Steps to Prepare for a Rental Credit Check

Preparing for a rental credit check is essential to increase your chances of passing the screening process and securing your desired rental property. Here are some steps you can take to ensure you are well-prepared:

- Check Your Credit Score and Report: Start by obtaining a copy of your credit report from one of the major credit bureaus. Review it carefully for any errors or discrepancies. It’s also a good idea to check your credit score, as this will give you an idea of where you stand.

- Address Negative Credit Issues: If you identify any negative marks on your credit report, such as late payments or collections, it’s crucial to address them before applying for a rental. Contact the creditor or collection agency to discuss potential options for resolving the issues.

- Gather Necessary Documentation: Landlords often require documentation during the rental application process. Gather important documents such as pay stubs, bank statements, and tax returns to verify your income and demonstrate financial stability.

- Contact Previous Landlords for References: Reach out to your previous landlords and request references or letters of recommendation. Positive references can greatly enhance your application and reassure landlords about your reliability as a tenant.

- Provide Proof of Employment and Income: Landlords want to ensure that you have a stable source of income to cover your rental payments. Be prepared to provide proof of employment, such as an offer letter or recent pay stubs, to demonstrate your financial capacity.

- Understand Rental Requirements and Criteria: Familiarize yourself with the rental requirements and criteria set by the landlord or property management company. This includes understanding the income requirements, pet policies, and any other specific conditions for tenancy.

- Submit the Rental Application: Complete the rental application accurately and include all required information. Double-check the application for any errors or missing details before submitting it.

By following these steps, you can proactively prepare for a rental credit check and present yourself as a responsible and trustworthy tenant. Keep in mind that each landlord may have specific preferences and requirements, so it’s always a good idea to inquire about any additional documentation or information they may need.

Checking Your Credit Score and Report

Before starting the rental application process and undergoing a rental credit check, it’s crucial to know your credit score and review your credit report. Understanding your credit profile will help you identify any potential issues and take necessary steps to improve your chances of passing the credit check.

There are several ways to check your credit score. Many credit card companies provide access to their customers, and there are also numerous online platforms that offer free credit score checks. Additionally, you can request a free annual credit report from each of the major credit bureaus – Experian, TransUnion, and Equifax – through AnnualCreditReport.com.

When reviewing your credit report, pay close attention to the following factors:

- Payment History: Your history of making timely payments is a crucial component of your credit score. Look for any missed or late payments and ensure that they are accurately reported.

- Credit Utilization: This refers to how much of your available credit you are using. Aim to keep your credit utilization ratio below 30% to show responsible credit management.

- Credit Accounts: Take note of all your open credit accounts, including credit cards, loans, and any other lines of credit. Verify that they are all accurate and belong to you.

- Public Records: Look for any derogatory marks such as bankruptcies, foreclosures, or tax liens. These can have a negative impact on your creditworthiness.

- Inquiries: Check for any recent credit inquiries. Multiple inquiries within a short period can affect your credit score, so ensure they are all valid.

If you identify any errors or inaccuracies in your credit report, it’s essential to dispute them with the credit bureau and the relevant creditors to have them corrected. This process may take some time, so it’s advisable to start early and provide any supporting documentation to strengthen your case.

Understanding your credit score and report allows you to have a clear picture of your financial standing. It also gives you an opportunity to address any negative items before they impact your rental credit check. By proactively managing your credit, you can position yourself as a desirable and responsible tenant to landlords and property managers.

Addressing Negative Credit Issues

If you discover negative credit issues while reviewing your credit report, it’s crucial to address them before undergoing a rental credit check. Taking proactive steps to resolve these issues can improve your creditworthiness and increase your chances of passing the credit check. Here are some strategies for addressing negative credit issues:

- Dispute Errors: If you find any errors or inaccuracies on your credit report, such as incorrect late payments or accounts that don’t belong to you, it’s important to dispute them with the credit bureaus. File a dispute online or send a written letter outlining the errors along with supporting documentation.

- Pay Off Outstanding Debts: Paying off any outstanding debts is an effective way to improve your credit. Prioritize paying off collections, charge-offs, or past due accounts. Contact the creditors directly to negotiate payment arrangements or settlements if needed.

- Establish Positive Credit: Building positive credit can help offset negative marks on your credit report. Consider applying for a secured credit card or becoming an authorized user on someone else’s credit card with a good payment history. Make timely payments and keep your credit utilization low.

- Create a Payment Plan: If you’re struggling to pay off debts, reach out to your creditors to discuss a payment plan. They may be willing to work with you to set up a manageable repayment schedule, which can help improve your credit over time.

- Seek Professional Assistance: If you’re overwhelmed or unsure how to navigate credit issues, consider seeking guidance from a reputable credit counseling agency. They can provide advice, develop a debt repayment plan, and negotiate with creditors on your behalf.

It’s important to note that improving your credit takes time and patience. Negative credit issues may not be resolved overnight, but taking steps to address them shows responsibility and a commitment to improving your financial standing.

Remember that different landlords have varying criteria for evaluating creditworthiness. Some may be more understanding of past financial challenges if you can demonstrate recent positive financial behavior and stability.

By actively addressing negative credit issues and implementing responsible credit management habits, you are taking significant strides towards improving your creditworthiness and increasing your chances of passing a rental credit check.

Gathering Necessary Documentation

When applying for a rental property and undergoing a credit check, landlords often require certain documentation to assess your financial stability and suitability as a tenant. Gathering the necessary documentation in advance can streamline the application process and increase your chances of success. Here are the essential documents you should gather:

- Proof of Income: Landlords want assurance that you have a steady source of income to cover your rent payments. Gather recent pay stubs, bank statements showing regular deposits, or a letter from your employer stating your employment status and income.

- Identification: Provide a copy of your valid identification, such as a driver’s license or passport, to confirm your identity.

- Rental History: Collect information on your previous rental history, including contact information for past landlords. This allows prospective landlords to verify your rental history and obtain references.

- References: Consider gathering personal and professional references to vouch for your character and reliability. These references should be individuals who can speak to your responsibility and ability to meet financial obligations.

- Bank Statements: Provide recent bank statements to demonstrate your financial stability and ability to handle expenses. This can give landlords a better idea of your financial habits and whether you are capable of paying rent on time.

- Proof of Insurance: Some landlords may require tenants to have rental insurance. It’s a good idea to have proof of insurance coverage readily available in case it’s requested.

- Criminal Background Check: In some cases, landlords may require a criminal background check. Be prepared to provide consent and any necessary information to facilitate the check.

Organizing these documents in a folder or digital format will make it easy to provide them to landlords or property management companies during the application process. Ensure that all documentation is up-to-date and accurate.

By gathering these necessary documents, you will demonstrate preparedness and professionalism to prospective landlords. This can increase their confidence in your ability to fulfill the financial responsibilities of a tenancy, potentially improving your chances of passing the rental credit check.

Contacting Previous Landlords for References

When applying for a rental property, contacting previous landlords for references is an important step in demonstrating your reliability and suitability as a tenant. Landlords value the opinions and feedback of those who have had firsthand experience renting to you. Here’s how you can effectively reach out to your previous landlords for references:

- Compile Contact Information: Gather the contact information of your previous landlords, including their names, phone numbers, email addresses, and the addresses of the properties you rented from them.

- Prepare a Professional Request: Craft a polite and professional email or letter to request a reference. Introduce yourself, mention the property you rented, and explain that you are applying for a new rental. Mention that you valued your time as their tenant and would appreciate their feedback as a reference.

- Highlight Positive Aspects: In your request, remind your former landlord of your positive rental history, such as paying rent on time, maintaining the premises, and being a responsible tenant. This will help them recall your tenancy in a positive light.

- Offer Assistance: Extend the offer to provide your previous landlord with any necessary documents or information they may need to write an accurate reference, such as the dates of your tenancy or your contact details.

- Follow Up: If you don’t receive a response after a reasonable amount of time, consider sending a friendly follow-up email or making a polite phone call. Remember to be patient and understanding, as they may be busy or may require more time to gather their thoughts.

- Express Gratitude: Regardless of whether your previous landlord provides a positive or neutral reference, always express your appreciation for their time and consideration. Maintaining a positive and professional attitude will reflect well on your character.

It’s important to proactively contact previous landlords well in advance of submitting your rental application. Doing so allows them enough time to respond and provide their references.

By reaching out to your previous landlords for references, you are demonstrating transparency and a willingness to provide insights into your rental history. Positive references can be invaluable in convincing potential landlords of your reliability and responsibility as a tenant.

Remember, the more positive references you have, the stronger your rental application becomes. However, if you anticipate a less-than-positive reference from a previous landlord, it’s still essential to contact them. Honesty and proactive communication can help explain any potential concerns and present you as an accountable tenant who has learned from past experiences.

Providing Proof of Employment and Income

When applying for a rental property, providing proof of employment and income is a crucial step in demonstrating your financial stability and ability to afford the rent. Landlords want to ensure that you have a reliable source of income to meet your financial obligations. Here’s how you can provide proof of employment and income:

- Pay Stubs: Include recent pay stubs that show your year-to-date earnings and any deductions. These pay stubs should reflect a consistent and stable income.

- Employment Verification Letter: Request an employment verification letter from your employer. This letter should mention your job title, employment start date, and current income. It should be printed on company letterhead and signed by an authorized representative of the company.

- Income Tax Returns: Submit copies of your previous year’s income tax returns, as they provide a comprehensive overview of your income. Landlords may request this documentation, especially if you are self-employed or have variable income.

- Bank Statements: Provide recent bank statements that show regular income deposits. This can help verify the consistency and stability of your income.

- Offer Letters and Contracts: If you recently started a new job, include an offer letter or employment contract that outlines your position, salary, and start date. This can assure landlords of your income stability.

When providing proof of employment and income, it’s essential to ensure that the documents are current and accurately represent your financial situation. Avoid providing altered or fake documents, as this can lead to immediate disqualification from the rental application process.

If you are self-employed or have irregular income, consider providing additional documentation such as invoices, client contracts, or profit and loss statements. These can help demonstrate your financial capacity and stability in the absence of traditional employment verification.

Always communicate with your potential landlord or property manager to understand their specific requirements for proof of employment and income. This ensures that you provide the documentation that aligns with their expectations.

By providing solid proof of employment and income, you instill confidence in landlords that you have the financial means to fulfill your rental obligations. This can significantly increase your chances of passing the rental credit check and securing your desired rental property.

Understanding Rental Requirements and Criteria

When applying for a rental property, it’s important to have a clear understanding of the rental requirements and criteria set by the landlord or property management company. Each landlord may have specific criteria to evaluate potential tenants, and being aware of these requirements can help you align your application accordingly. Here are some common factors that landlords consider:

- Income Requirements: Landlords often set income requirements to ensure that tenants can afford the rental payments. This requirement may be stated as a specific income threshold or as a percentage of the rent. Make sure you have a clear understanding of the income requirement and confirm that you meet or exceed it.

- Credit Score: Landlords typically establish a minimum credit score threshold for applicants. This helps them assess an individual’s financial responsibility. Find out the specific credit score requirement and check if your score meets or exceeds it. If your credit score falls short, consider taking steps to improve it or communicate with the landlord to discuss alternative options or mitigating circumstances.

- Rental History: Landlords value a positive rental history. They may inquire about your previous rental experiences, including the length of tenancy, any eviction history, or complaints filed against you. Be prepared to provide details about your rental history and contact information for previous landlords.

- Background Checks: Some landlords may conduct background checks to screen for criminal history or verify identity. Ensure that you are transparent about any relevant information and provide consent for these checks if required.

- Pet Policies: If you have pets, understand the landlord’s policies regarding pets. They may have restrictions on the type, size, or number of pets allowed, as well as additional fees or deposits. Be honest about your pets and make sure you are comfortable with the pet policies before applying.

- Lease Terms and Preferences: Familiarize yourself with the lease terms and preferences set by the landlord. This includes the duration of the lease, any specific conditions or restrictions, and whether they allow subleasing or modifications to the property.

Understanding the rental requirements and criteria upfront enables you to assess your eligibility for a particular rental property. It also allows you to prepare a comprehensive application that addresses the landlord’s concerns and aligns with their expectations.

If you have any questions or concerns about the rental requirements, seek clarification from the landlord or property management company. Open communication can help establish rapport and ensure that you are both on the same page during the application process.

By understanding and meeting the rental requirements and criteria, you can position yourself as a desirable tenant, increasing your chances of being approved for the rental property you desire.

Submitting the Rental Application

After gathering all the necessary documentation and ensuring you meet the rental requirements, it is time to submit your rental application. This step in the process is vital as it allows landlords to review your information and make an informed decision on whether to approve your application. Here are some important points to consider when submitting your rental application:

- Complete the Application: Fill out the rental application accurately and thoroughly. Provide all the required information and double-check for any errors or missing details. Incomplete applications can delay the process or even lead to rejection.

- Attach Supporting Documents: Include all the necessary supporting documents, such as proof of income, identification, rental history, and references. Ensure that these documents are organized and clearly labeled for easy reference.

- Pay the Application Fee: Some landlords may require an application fee to cover the cost of screening. Be prepared to pay this fee, usually payable via check, money order, or online payment.

- Be Responsive: If the landlord or property manager requests additional information or follows up with any questions, respond promptly and provide the requested information. Timely communication demonstrates your enthusiasm and cooperation.

- Follow Up: After submitting your application, consider sending a follow-up email or making a phone call to confirm receipt. Express your continued interest in the property and inquire about the timeline for the application review process.

It’s important to note that rental applications are typically reviewed on a first-come, first-served basis. Therefore, submitting your application promptly and ensuring it is complete and accurate can give you an advantage over other applicants.

Keep in mind that the application review process may take time, especially if there are multiple applicants or additional verification is required. Be patient and avoid applying for multiple properties simultaneously, as it can become overwhelming and challenging to keep track of each application.

Lastly, remember that being respectful and professional throughout the application process can leave a positive impression on the landlord. Treat all interactions as an opportunity to showcase your reliability, responsibility, and compatibility as a tenant.

By carefully reviewing and completing the rental application, attaching the necessary documents, and maintaining open communication, you increase your chances of a successful application and ultimately securing the rental property.

Conclusion

Successfully passing a rental credit check is a crucial step in securing the rental property of your choice. By understanding the rental credit check process and taking proactive steps to prepare, you can improve your chances of approval and stand out among other applicants.

Throughout this article, we have discussed the key aspects of passing a rental credit check, including understanding the process, addressing negative credit issues, gathering necessary documentation, contacting previous landlords for references, providing proof of employment and income, and understanding rental requirements and criteria.

It’s essential to thoroughly review your credit score and report, address any negative credit issues, and gather all the necessary documentation, such as proof of income, rental history, and identification. Contacting previous landlords for references and providing proof of employment and income help establish your reliability as a tenant. Additionally, understanding the rental requirements and criteria set by landlords allows you to align your application accordingly.

When submitting the rental application, completing it accurately and attaching all required documents are crucial steps. Being responsive to any follow-up questions and paying the application fee also demonstrate your seriousness as an applicant.

Remember, the rental credit check process may take time, so it’s important to be patient. While there is no guarantee of approval, by being prepared and presenting yourself as a responsible, reliable tenant, you increase your chances of securing your desired rental property.

Lastly, maintain a positive attitude throughout the process, respect all communication, and continue searching for alternative options while waiting for the application review.

Good luck with your rental credit check process, and may you find the perfect rental property that meets your needs and preferences!