Finance

How To Pay My Rent With A Credit Card

Published: October 26, 2023

Discover how you can conveniently pay your rent using a credit card and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Paying rent is a necessary expense that can sometimes be a financial burden. However, if you have a credit card with a sufficient credit limit, you may have the option to pay your rent using this convenient payment method. By paying your rent with a credit card, you can enjoy various benefits such as earning rewards, building credit, and gaining flexibility in your financial management.

In this article, we will explore the benefits of paying rent with a credit card, factors to consider before using this payment method, steps to pay your rent using a credit card, how to choose the right credit card for rent payments, potential drawbacks to be aware of, and tips for maximizing rewards and avoiding fees.

It’s essential to note that not all landlords or rental management companies accept credit card payments. However, if this option is available, it can provide you with advantages that are worth considering.

Before diving into the details, it’s important to understand that paying rent with a credit card should be done responsibly and within your means. If you have the financial discipline to pay off your credit card balance in full each month, this payment method can be an excellent opportunity to leverage your credit card rewards and potentially improve your financial situation.

Now, let’s delve into the benefits of paying rent with a credit card and the considerations you need to keep in mind before making this financial decision.

Benefits of Paying Rent with a Credit Card

Paying your rent with a credit card can offer a range of benefits that make it an attractive option for many individuals. Here are some key advantages to consider:

- Rewards and Cash Back: One of the most significant advantages of paying rent with a credit card is the opportunity to earn rewards or cash back. Many credit cards offer reward programs where you can earn points, miles, or cash back on your purchases. By using your credit card to pay rent, you can accumulate rewards that can be redeemed for travel, merchandise, statement credits, or even cash in some cases. This can help you offset some of the cost of your rent or provide you with additional benefits for your everyday spending.

- Building Credit: Consistently making on-time payments towards your rent can help you build or improve your credit history. Rent payments typically don’t directly affect your credit score, but if you use a credit card to pay your rent and consistently pay off your credit card balance, it can have a positive impact on your credit utilization rate and demonstrate responsible credit management.

- Financial Flexibility: Paying rent with a credit card can provide you with increased financial flexibility. If your rent due date doesn’t align with your paycheck schedule, using a credit card allows you to pay your landlord on time and then manage your credit card payments within your preferred timeframe. This can help you avoid late fees or potential eviction due to missed rent payments.

- Security and Fraud Protection: Credit cards often come with robust security features and fraud protection, offering you peace of mind when making large transactions like paying rent. If any unauthorized charges occur, you have the ability to dispute those charges and have them removed from your statement. Additionally, credit card companies have monitoring systems in place to detect and prevent fraudulent activity, giving you an extra layer of protection.

- Convenience and Record-Keeping: Paying rent with a credit card eliminates the need for writing checks or making cash withdrawals. It simplifies the payment process, streamlining your monthly financial obligations. Additionally, credit card statements provide a detailed record of your transactions, allowing you to easily track your rent payments and maintain accurate financial records for budgeting or tax purposes.

These benefits make paying rent with a credit card an appealing option for those who want to earn rewards, improve their credit score, and enjoy the convenience and security that credit cards offer. However, there are some considerations to keep in mind before deciding to pay your rent with a credit card, which we will explore in the next section.

Considerations Before Paying Rent with a Credit Card

While paying rent with a credit card can be advantageous, there are several factors you should consider before deciding to use this payment method:

- Accepted Payment Method: It’s important to determine whether your landlord or rental management company accepts credit card payments. Some landlords may charge additional fees for credit card payments or only accept specific types of cards. Make sure to clarify their policies and understand any associated costs before proceeding.

- Transaction Fees: Some landlords or property management companies may charge transaction fees for paying rent with a credit card. These fees can vary and may impact the overall benefit of using a credit card. Evaluate the cost-effectiveness of paying with a credit card, including any potential fees, compared to other payment methods available to you.

- Interest and Debt: If you carry a balance on your credit card and don’t pay it off in full each month, the interest charges can negate the benefits of paying rent with a credit card. High interest rates on credit cards can accumulate quickly, leading to debt if not managed responsibly. Before using your credit card for rent payments, ensure that you have a plan in place to pay off the balance promptly to avoid incurring high interest charges.

- Credit Utilization: Utilizing a significant portion of your available credit limit by charging your monthly rent can impact your credit utilization ratio. This ratio measures the amount of credit you are using compared to your total available credit. It is recommended to keep your credit utilization below 30% to maintain a healthy credit score. If paying rent with a credit card pushes you beyond this threshold, it could temporarily lower your credit score.

- Reward Redemption: Consider how you plan to redeem the rewards you earn from your credit card. If you pay your rent with a credit card to accumulate rewards but find it challenging to redeem them for valuable rewards that align with your preferences, it may not be as beneficial as anticipated. Ensure that the rewards program associated with your credit card offers desirable redemption options that suit your needs.

- Financial Discipline: It is crucial to assess your financial habits and discipline before opting for this payment method. If you struggle with managing credit card payments or tend to carry a balance, paying rent with a credit card may not be the best approach. Missing credit card payments or falling into debt can have severe consequences on your credit score and overall financial well-being.

By carefully considering these factors, you can make an informed decision about whether paying rent with a credit card aligns with your financial goals and circumstances. Next, let’s explore the steps involved in paying rent using a credit card.

Steps to Pay Rent with a Credit Card

If you’ve decided to pay your rent with a credit card, follow these steps to ensure a smooth and efficient process:

- Check with your landlord: Confirm with your landlord or rental management company if they accept credit card payments. Inquire about any specific payment methods they prefer or any associated fees.

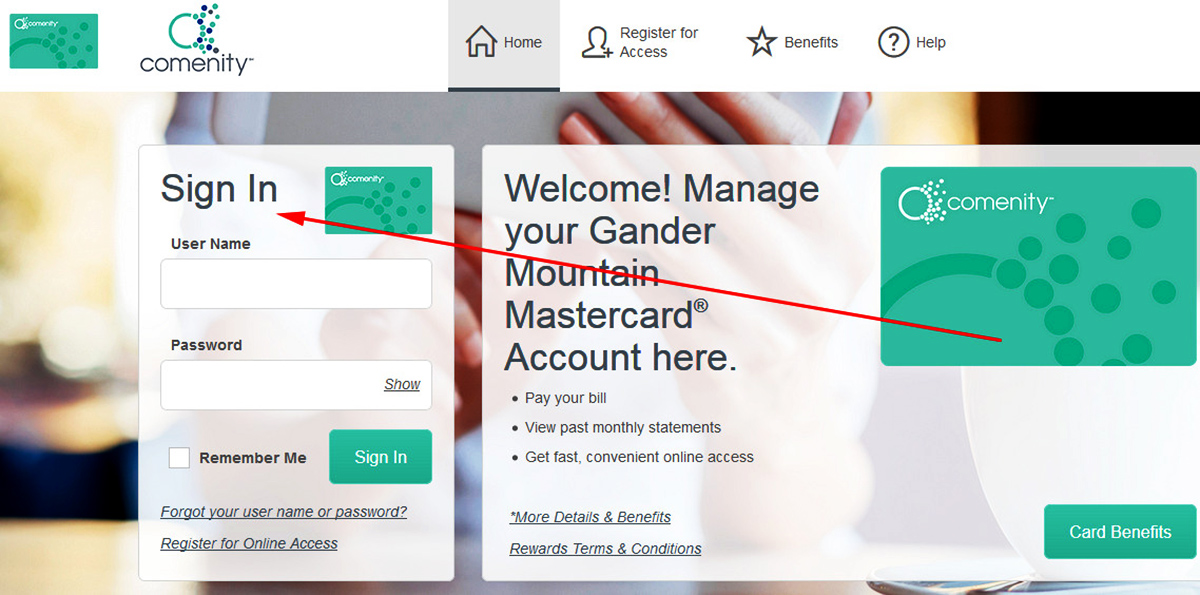

- Choose a payment service: If your landlord does not directly accept credit card payments, consider using a third-party payment service that allows you to pay your rent using a credit card. There are several online platforms available, such as Plastiq or RentPayment, that facilitate credit card rent payments for a fee.

- Register an account: Depending on the payment service you choose, you may need to register an account and provide the necessary information, including your credit card details and rental property information.

- Set up recurring payments: If you prefer to automate your rent payments, set up recurring payments through the chosen payment service. This ensures that your rent is paid consistently and on time each month.

- Verify payment details: Before initiating a payment, double-check the rental amount, payment due date, and any additional fees or charges associated with using a credit card. Ensure that you have sufficient credit on your card to cover the payment.

- Initiate the payment: Once you have confirmed all the details, initiate the payment through the payment service. Some services may require you to provide your landlord’s information or account details to ensure the payment reaches the correct recipient.

- Keep payment confirmation: After completing the payment, make sure to save the payment confirmation or receipt provided by the payment service. This documentation serves as proof of payment in case any issues or discrepancies arise in the future.

Following these steps will help you successfully pay your rent using a credit card and avoid any potential issues or delays. However, it’s essential to choose the right credit card for rent payments to maximize the benefits. In the next section, we will explore key factors to consider when selecting a credit card for this purpose.

Choosing the Right Credit Card for Paying Rent

When it comes to paying rent with a credit card, selecting the right credit card is crucial to maximize your benefits. Here are some key factors to consider when choosing a credit card for rent payments:

- Rewards Program: Look for a credit card that offers a generous rewards program, ideally with bonus categories that align with your spending habits. Consider cards that provide cash back, points, or miles that can be easily redeemed and offer competitive rewards rates.

- Annual Fee: Evaluate whether the potential rewards and benefits outweigh any annual fees associated with the credit card. Some credit cards offer no annual fee options, while others provide enhanced rewards and perks but come with an annual fee. Calculate the net value of the rewards after considering the cost of the annual fee.

- Introductory Offers: Take advantage of any sign-up bonuses or introductory offers provided by the credit card. These offers can include bonus rewards or promotional interest rates, which can significantly boost the value of paying rent with your credit card during the promotional period.

- Interest Rate: If there is a possibility that you may carry a balance on your credit card, consider a card with a low-interest rate to minimize interest charges. It’s essential to prioritize paying off your credit card balance in full each month to avoid accruing interest and debt.

- Credit Limit: Check the credit limit on the credit card you are considering. Ensure that it is sufficient to cover your monthly rent payment without exceeding the recommended credit utilization ratio. Having a higher credit limit can provide you with flexibility and prevent potential issues with insufficient credit to pay your rent.

- Card Acceptance: Confirm that the credit card you choose is widely accepted by the payment service or directly by your landlord. Some credit card networks, such as Visa or Mastercard, are more universally accepted than others.

- Additional Benefits: Explore the additional benefits offered by the credit card, such as travel insurance, purchase protection, extended warranties, or access to exclusive events or airport lounges. These perks can enhance the overall value of the credit card beyond just the rewards program.

Consider your spending habits, financial goals, and preferences when assessing credit card options for paying rent. Research and compare different credit cards to find the one that aligns with your needs and provides the greatest benefits.

Now that we’ve discussed choosing the right credit card, it’s essential to be aware of potential drawbacks associated with paying rent with a credit card. We’ll explore these drawbacks in the next section.

Potential Drawbacks of Paying Rent with a Credit Card

While there are benefits to paying rent with a credit card, it’s important to be aware of potential drawbacks that could arise from using this payment method:

- Transaction Fees: Some landlords or payment services charge transaction fees for using a credit card to pay rent. These fees can range from a flat rate to a percentage of the transaction amount. Consider whether the rewards earned from your credit card outweigh these fees and if it aligns with your financial goals.

- Interest Charges: If you don’t pay off your credit card balance in full each month, interest charges will accumulate. The interest rate on credit cards can be significantly higher than other types of loans, leading to hefty interest expenses if you carry a balance. Make sure to budget accordingly and prioritize paying off your credit card balance to avoid incurring unnecessary debt.

- Credit Utilization: Paying a significant portion of your rent with a credit card can increase your credit utilization ratio. This ratio measures the amount of credit you are using compared to your total credit limit. Utilizing a high percentage of your available credit can temporarily lower your credit score. If you plan to apply for new credit or loans in the near future, this could have an impact on your creditworthiness.

- Impact on Landlord Relationship: Some landlords may prefer traditional payment methods, such as checks or direct bank transfers, due to the associated fees or administrative hurdles of credit card payments. Paying rent with a credit card without their approval or understanding could strain your landlord-tenant relationship. It’s advisable to communicate openly with your landlord and obtain their permission before initiating credit card payments.

- Potential Rejection: Not all landlords or rental management companies accept credit card payments. Before committing to paying rent with a credit card, ensure that the option is available and feasible in your specific rental agreement. If credit card payments are not accepted, you’ll need to explore alternative payment methods.

- Debt Accumulation: Using a credit card without proper financial discipline can lead to debt accumulation. If you have a habit of overspending or struggle with managing credit card payments, paying rent with a credit card may exacerbate these issues. It is crucial to evaluate your financial habits and ensure that you can responsibly manage your credit card payments.

Considering these potential drawbacks will help you make an informed decision about whether paying rent with a credit card is the right choice for you. However, if you decide to proceed, there are tips you can follow to maximize your rewards and minimize potential fees. Let’s explore these tips in the next section.

Tips for Maximizing Rewards and Avoiding Fees

If you’ve decided to pay your rent with a credit card, here are some valuable tips to help you maximize your rewards and avoid unnecessary fees:

- Choose the right credit card: Select a credit card that offers high rewards on everyday spending categories, including rent payments. Look for cards that provide bonus points or cash back specifically for recurring bills or large purchases.

- Understand the rewards program: Familiarize yourself with the rules and redemption options of your credit card’s rewards program. Some credit cards provide higher redemption value when used for travel, while others offer statement credits or cash back. Use your rewards strategically to maximize their value.

- Make on-time payments: Pay your credit card bill on time and in full each month to avoid late payment fees and interest charges. Paying off the balance ensures that you are maximizing the rewards without incurring unnecessary debt.

- Consider promotional offers: Take advantage of any promotional offers or sign-up bonuses provided by your credit card issuer. These can include bonus rewards or introductory interest rates, which can provide additional value when paying rent with your credit card.

- Budget and plan for rent payments: Make sure you have enough funds to cover your rent payment when it’s time to pay your credit card bill. Creating a budget and tracking your expenses can help you avoid overspending and ensure you have the necessary funds available each month.

- Monitor your credit utilization: Keep an eye on your credit utilization ratio to avoid negatively impacting your credit score. If paying rent with your credit card pushes your credit utilization above the recommended threshold, consider making additional payments or asking for a credit limit increase.

- Utilize payment services wisely: If you need to use a third-party payment service to pay your rent with a credit card, compare the fees and services offered by different providers. Some may charge lower transaction fees or offer additional benefits that can enhance the overall value of paying rent with a credit card.

- Review your credit card statements: Regularly review your credit card statements to ensure accuracy and detect any potential errors or unauthorized charges. Promptly report and dispute any discrepancies to protect yourself from financial harm.

- Reevaluate periodically: As your financial situation or credit card needs may change over time, periodically reassess the benefits and drawbacks of paying rent with a credit card. It’s important to ensure the chosen credit card and payment method still align with your current goals and circumstances.

By following these tips, you can make the most of paying rent with a credit card while avoiding unnecessary fees and maximizing your rewards. Before concluding, let’s summarize the main points discussed in this article.

Conclusion

Paying rent with a credit card can offer numerous benefits, including earning rewards, building credit, and enjoying financial flexibility. However, it’s crucial to consider certain factors before deciding to use this payment method.

Firstly, ensure that your landlord or rental management company accepts credit card payments and be aware of any associated transaction fees. Evaluate your ability to pay off your credit card balance each month to avoid interest charges and debt accumulation. Understand the potential impact on your credit utilization ratio and the importance of maintaining a healthy credit score. Communicate openly with your landlord and obtain their approval before initiating credit card payments.

When choosing a credit card for paying rent, consider the rewards program, annual fees, interest rates, credit limit, and additional benefits offered by the card. It’s essential to select a credit card that aligns with your spending habits and financial goals.

To maximize rewards and avoid fees, make on-time payments, utilize promotional offers, budget effectively for rent payments, and monitor your credit utilization ratio. Evaluate different payment services to minimize transaction fees, and regularly review your credit card statements for accuracy.

Ultimately, paying rent with a credit card can be a beneficial strategy if managed responsibly and within your means. It provides an opportunity to leverage rewards, build credit, and enjoy the convenience and security offered by credit cards. By considering the pros and cons and following best practices, you can make an informed decision that aligns with your financial objectives.

Remember, everyone’s financial situation is unique, so carefully evaluate whether paying rent with a credit card is the right choice for you. With a thoughtful approach, you can make the most of this payment method and potentially enhance your overall financial well-being.