Home>Finance>How To Perform A Balance Transfer With Wells Fargo

Finance

How To Perform A Balance Transfer With Wells Fargo

Published: February 18, 2024

Learn how to perform a balance transfer with Wells Fargo to manage your finances more effectively. Take advantage of this convenient option to save on interest and consolidate your debts.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of balance transfers with Wells Fargo! If you're looking to take control of your finances and manage your credit card debt more effectively, you've come to the right place. In this article, we'll explore the ins and outs of performing a balance transfer with Wells Fargo, a leading financial institution known for its commitment to customer satisfaction and innovative banking solutions.

Navigating the world of credit card debt can be overwhelming, but with the right knowledge and tools at your disposal, you can take proactive steps toward financial freedom. A balance transfer offers a strategic way to consolidate your credit card balances onto a single card with a lower interest rate, potentially saving you money and simplifying your monthly payments.

Understanding the nuances of balance transfers, including the benefits, eligibility requirements, and step-by-step process, is crucial to making informed decisions about your financial well-being. Whether you're considering a balance transfer to reduce your interest payments, streamline your debts, or reorganize your financial obligations, Wells Fargo provides a reliable platform to help you achieve your goals.

In the sections that follow, we'll delve into the intricacies of balance transfers with Wells Fargo, shedding light on the eligibility criteria, essential requirements, and actionable tips for a successful transfer. By the end of this comprehensive guide, you'll have the knowledge and confidence to embark on a seamless balance transfer journey with Wells Fargo, paving the way for a more secure and manageable financial future. So, let's embark on this enlightening exploration of balance transfers with Wells Fargo and unlock the potential for greater financial control and stability.

Understanding Balance Transfers

Before delving into the specifics of performing a balance transfer with Wells Fargo, it’s essential to grasp the fundamental concept of balance transfers and their role in managing credit card debt. A balance transfer involves moving the outstanding balance from one or multiple credit cards to another credit card, typically with a lower interest rate. This process allows individuals to consolidate their debts, potentially saving money on interest and simplifying their repayment strategy.

When considering a balance transfer, it’s crucial to assess the interest rates and terms offered by the receiving credit card issuer, as well as any associated fees. By transferring balances to a card with a lower interest rate, individuals can reduce the overall cost of their debt and expedite the repayment process. Additionally, consolidating multiple balances onto a single card streamlines the payment process, making it easier to track and manage outstanding debts.

It’s important to note that balance transfers are not a one-size-fits-all solution and require careful consideration of individual financial circumstances. While they can be an effective tool for reducing interest payments and simplifying debt management, it’s essential to weigh the potential benefits against any associated fees and the impact on credit scores. By understanding the intricacies of balance transfers, individuals can make informed decisions that align with their long-term financial goals.

Furthermore, maintaining responsible financial habits, such as making timely payments and avoiding accruing additional debt, is crucial when utilizing balance transfers as part of a debt management strategy. By approaching balance transfers with a clear understanding of their implications and potential benefits, individuals can leverage this financial tool to take control of their credit card debt and work toward a more stable financial future.

Benefits of Balance Transfers with Wells Fargo

When it comes to exploring the benefits of performing a balance transfer, Wells Fargo offers a range of advantages that can empower individuals to take charge of their financial well-being. As one of the leading financial institutions in the United States, Wells Fargo provides a platform for seamless and efficient balance transfers, accompanied by valuable perks and features.

- Competitive Interest Rates: Wells Fargo is known for offering competitive interest rates on balance transfers, making it an attractive option for individuals looking to reduce their interest payments and save money over time. By consolidating high-interest credit card balances onto a Wells Fargo credit card with a lower APR, individuals can potentially lower the overall cost of their debt.

- Streamlined Debt Management: With Wells Fargo, individuals can consolidate multiple credit card balances onto a single card, streamlining the repayment process and simplifying their financial obligations. This consolidation can make it easier to track and manage outstanding debts, leading to greater financial organization and control.

- Reward Programs and Incentives: Wells Fargo offers a variety of credit cards with reward programs and incentives, allowing individuals to earn cash back, travel rewards, or other perks while managing their consolidated balances. This added value enhances the overall benefits of performing a balance transfer with Wells Fargo.

- Financial Tools and Resources: Wells Fargo provides access to a suite of financial tools and resources, empowering individuals to make informed decisions about their credit card debt and overall financial health. From online account management to personalized financial guidance, Wells Fargo supports customers in their journey toward financial stability.

By leveraging the benefits of balance transfers with Wells Fargo, individuals can take proactive steps toward managing their credit card debt more effectively, reducing their interest payments, and working toward a more secure financial future. With competitive interest rates, streamlined debt management, valuable reward programs, and robust financial tools, Wells Fargo is dedicated to empowering customers to achieve their financial goals through strategic balance transfers.

Eligibility and Requirements

Before embarking on a balance transfer with Wells Fargo, it’s essential to understand the eligibility criteria and necessary requirements for a successful transfer. Meeting these qualifications is vital to ensure a seamless and efficient transfer process, allowing individuals to take full advantage of the benefits offered by Wells Fargo’s balance transfer services.

- Credit Score: Wells Fargo typically requires applicants to have a good to excellent credit score to qualify for a balance transfer. A strong credit history demonstrates responsible financial behavior and increases the likelihood of approval for the transfer.

- Existing Wells Fargo Account: While not always mandatory, having an existing relationship with Wells Fargo, such as a checking or savings account, can enhance the likelihood of approval for a balance transfer. This existing relationship may also provide additional benefits or expedite the transfer process.

- Available Credit Limit: Applicants must have a sufficient available credit limit on their Wells Fargo credit card to accommodate the desired balance transfer amount. It’s important to consider the available credit limit when determining the feasibility of consolidating multiple balances onto a Wells Fargo credit card.

- Identification and Personal Information: As with any financial transaction, applicants will need to provide personal identification and relevant financial information to initiate the balance transfer process. This may include government-issued identification, proof of income, and details of existing credit card balances to be transferred.

Meeting the eligibility criteria and fulfilling the necessary requirements is essential to ensure a smooth and successful balance transfer with Wells Fargo. By maintaining a strong credit score, leveraging an existing relationship with Wells Fargo, considering available credit limits, and providing accurate personal information, individuals can position themselves for a seamless transfer experience.

It’s important to note that specific eligibility requirements and documentation may vary based on individual circumstances and Wells Fargo’s policies. Therefore, it’s advisable to consult with Wells Fargo’s customer service or review the detailed terms and conditions to gain a comprehensive understanding of the eligibility criteria and requirements specific to your situation.

How to Perform a Balance Transfer

Performing a balance transfer with Wells Fargo involves a series of straightforward steps designed to simplify the process and ensure a seamless transfer of credit card balances. By following these essential guidelines, individuals can initiate and complete a balance transfer with confidence, leveraging Wells Fargo’s efficient platform to consolidate their debts and optimize their financial management.

- Evaluate Your Credit Card Debt: Begin by assessing your existing credit card debt, including the outstanding balances, interest rates, and any associated fees. Understanding the full scope of your debt will help you determine the amount you wish to transfer to a Wells Fargo credit card.

- Choose the Right Wells Fargo Credit Card: Research and select a Wells Fargo credit card that aligns with your balance transfer needs. Consider factors such as introductory APR offers, ongoing interest rates, rewards programs, and any associated fees to make an informed decision.

- Initiate the Transfer: Once you have chosen the most suitable Wells Fargo credit card for your balance transfer, initiate the transfer process through the Wells Fargo online banking portal, mobile app, or by contacting customer service. Provide the details of the credit card balances you wish to transfer, ensuring accuracy and completeness.

- Review Terms and Conditions: Take the time to review the terms and conditions of the balance transfer, including any introductory APR offers, transfer fees, and the timeline for completing the transfer. Understanding these details will help you make informed decisions and set realistic expectations for the transfer process.

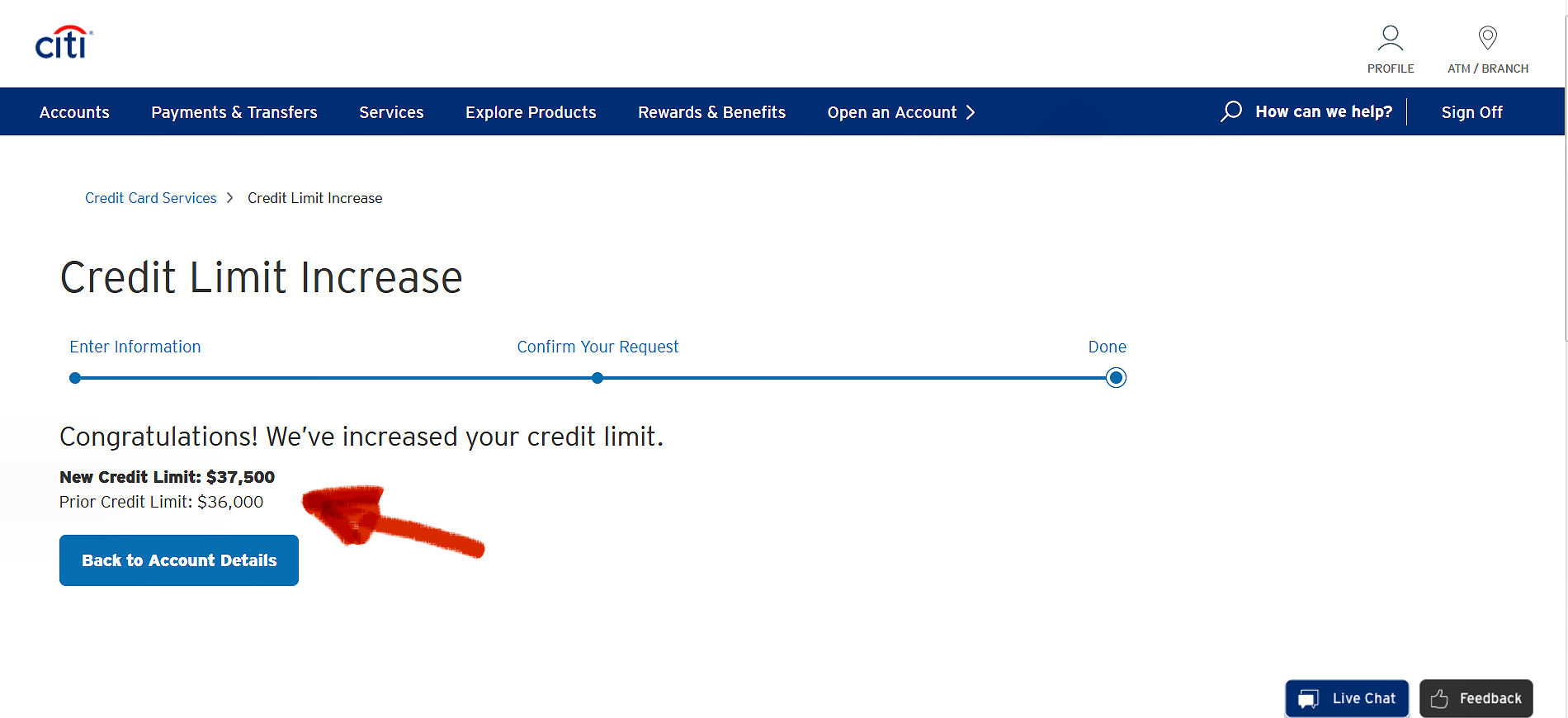

- Monitor the Transfer: After initiating the transfer, monitor the progress through your Wells Fargo account to ensure that the balances are successfully moved to your Wells Fargo credit card. Keep track of the transfer timeline and verify that the transferred balances reflect accurately on your account.

- Manage Repayments: With the balances successfully transferred to your Wells Fargo credit card, manage your repayments diligently by making timely payments and adhering to the terms of the balance transfer. By staying proactive in your repayment strategy, you can take full advantage of the benefits of the transfer and work toward reducing your credit card debt.

By following these steps, individuals can navigate the process of performing a balance transfer with Wells Fargo efficiently and effectively. From evaluating existing credit card debt to managing repayments on the transferred balances, each step plays a crucial role in leveraging Wells Fargo’s balance transfer services to achieve greater financial control and stability.

Tips for a Successful Balance Transfer

Embarking on a balance transfer journey with Wells Fargo requires thoughtful planning and strategic decision-making to ensure a successful and rewarding experience. By incorporating the following tips into your balance transfer strategy, you can maximize the benefits of Wells Fargo’s services and navigate the process with confidence and efficiency.

- Understand the Terms and Conditions: Familiarize yourself with the terms and conditions of the balance transfer, including introductory APR offers, transfer fees, and the timeline for completing the transfer. Clear comprehension of these details will empower you to make informed decisions and set realistic expectations for the transfer process.

- Opt for a Suitable Credit Card: Select a Wells Fargo credit card that aligns with your balance transfer needs, taking into account factors such as introductory APR offers, ongoing interest rates, rewards programs, and any associated fees. Choosing the right credit card lays the foundation for a successful balance transfer experience.

- Monitor Transfer Progress: Regularly monitor the progress of the balance transfer through your Wells Fargo account to ensure that the transferred balances reflect accurately on your credit card. Stay informed about the transfer timeline and promptly address any discrepancies or concerns that may arise.

- Manage Repayments Proactively: Take a proactive approach to managing your repayments on the transferred balances by making timely payments and adhering to the terms of the balance transfer. Responsible repayment behavior is key to maximizing the benefits of the transfer and working toward reducing your credit card debt.

- Consider Your Financial Goals: Align the balance transfer with your broader financial goals and budgetary considerations. Whether your objective is to reduce interest payments, consolidate debts, or streamline your financial obligations, ensure that the balance transfer strategy supports your overarching financial objectives.

- Maintain Responsible Financial Habits: Beyond the balance transfer, maintain responsible financial habits by avoiding accruing additional debt, making timely payments on all outstanding balances, and staying attuned to your overall financial health. These habits contribute to a sustainable and successful financial journey.

By integrating these tips into your approach to balance transfers with Wells Fargo, you can enhance the effectiveness and impact of the transfer, ultimately positioning yourself for greater financial control and stability. Thoughtful consideration, proactive management, and a focus on long-term financial well-being are the cornerstones of a successful balance transfer experience with Wells Fargo.

Conclusion

Congratulations on completing this enlightening exploration of balance transfers with Wells Fargo. Throughout this journey, we’ve delved into the intricacies of balance transfers, from understanding the fundamental concept to leveraging the benefits and navigating the process with confidence. By gaining a comprehensive understanding of balance transfers and the role they play in managing credit card debt, you’ve equipped yourself with valuable insights to make informed financial decisions and take proactive steps toward a more stable and secure financial future.

Wells Fargo, as a trusted financial partner, offers a range of advantages for individuals seeking to perform a balance transfer. From competitive interest rates and streamlined debt management to valuable reward programs and robust financial tools, Wells Fargo is dedicated to empowering customers to achieve their financial goals through strategic balance transfers. By leveraging these benefits and adhering to the essential tips for a successful transfer, you can optimize the impact of your balance transfer experience and work toward reducing your credit card debt more effectively.

As you consider embarking on a balance transfer journey with Wells Fargo, it’s essential to approach the process with careful consideration, clear goals, and a commitment to responsible financial management. By evaluating your credit card debt, choosing the right credit card, and proactively managing the transfer and subsequent repayments, you can harness the full potential of Wells Fargo’s balance transfer services and pave the way for a more secure and manageable financial future.

Remember that a successful balance transfer goes beyond the immediate consolidation of debts; it is a strategic step toward achieving greater financial control, reducing interest payments, and aligning your financial decisions with your long-term goals. By staying informed, proactive, and mindful of your financial well-being, you can leverage balance transfers as a powerful tool in your journey toward financial stability and prosperity.

With the knowledge and insights gained from this guide, you are well-prepared to embark on a seamless and rewarding balance transfer experience with Wells Fargo. As you navigate this financial endeavor, may your path be guided by informed decisions, prudent financial management, and the pursuit of a more secure and prosperous future. Here’s to your continued financial success and empowerment through strategic balance transfers with Wells Fargo.