Home>Finance>Revolving Door: Definition In Business And Government

Finance

Revolving Door: Definition In Business And Government

Published: January 21, 2024

Explore the revolving door phenomenon in finance, where professionals seamlessly transition between roles in business and government. Understand its impact and implications for the industry.

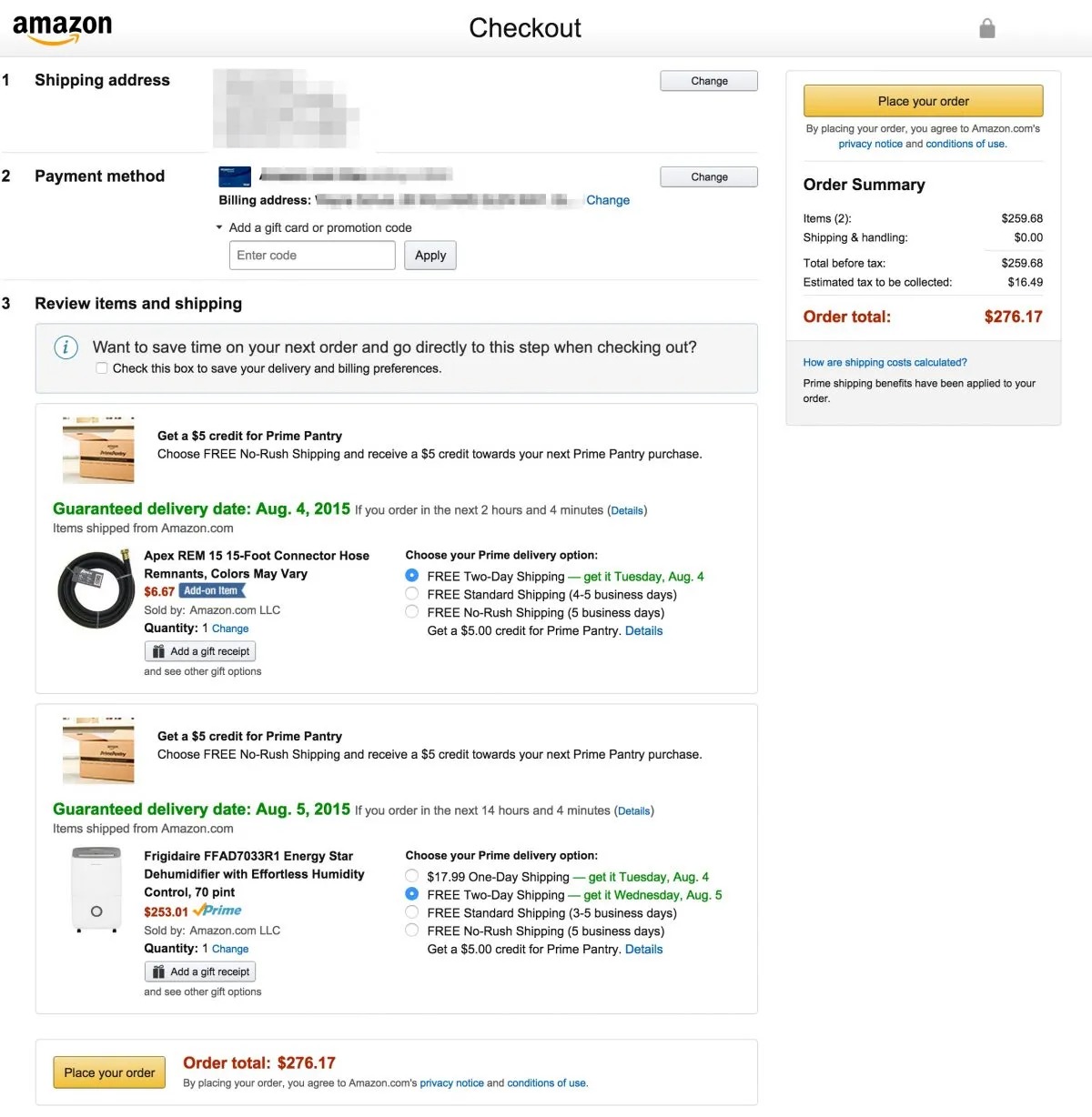

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

The Revolving Door: Definition in Business and Government

Welcome to the FINANCE category of our blog! Today, we will delve into the concept of the revolving door in business and government. What exactly does the term “revolving door” mean? Why is it significant? And how does it impact the financial sector and government institutions?

Key Takeaways:

- The revolving door refers to the movement of individuals between the private sector and government roles.

- This phenomenon can lead to potential conflicts of interest and influence over public policy decisions.

The term “revolving door” metaphorically describes the interchange of personnel between government positions and private sector employment, especially within industries regulated by the government. In essence, it signifies the movement of individuals from roles in government agencies or elected positions to corporate positions, and vice versa. This movement occurs when individuals leave public service jobs to work in industries they previously regulated, or when private sector employees transition into public roles where they may shape policy decisions that impact their former employers.

Why is the Revolving Door Significant?

The concept of the revolving door is a topic of great significance in finance, politics, and regulatory governance. Here’s why:

- Influence over policy decisions: As individuals transition between government and private sector roles, they can bring with them a wealth of knowledge and connections. This knowledge and influence can be utilized to shape policies or regulations in favor of their former or future employers. This potential for bias creates questions about fairness, transparency, and the overall integrity of the decision-making process.

- Conflicts of interest: When individuals move between government and private sector roles, there is a risk of conflicts of interest arising. Since they have insider knowledge of both sectors, conflicts may arise when they favor their own interests or the interests of their future employers over the public interest. Such conflicts can undermine public trust and hinder the effectiveness of government policies.

The Impact on Finance and Government

Now, let’s explore the impact of the revolving door in both the finance industry and government institutions:

In Finance

The finance industry is highly regulated and requires interactions with government agencies at various levels. The revolving door between finance and government can lead to:

- Regulatory capture: As former government officials join the finance industry, they may use their connections and insider knowledge to influence regulatory bodies in favor of their new employers.

- Reduced independence: The movement of personnel between government and finance roles can erode the independence of regulatory agencies, as decision-makers may be influenced by their future employment prospects.

- Unequal access to resources: The revolving door can perpetuate existing power imbalances, with well-connected individuals often getting preferred treatment or access to resources over others.

In Government

The revolving door can also impact the functioning of government institutions:

- Loss of expertise: When experienced professionals leave government positions for the private sector, government institutions may suffer from a loss of expertise and institutional memory.

- Lack of diversity: If the revolving door primarily benefits certain industries or corporations, it can lead to a lack of diversity in government decision-making, potentially overlooking the needs of other sectors or the general public.

- Perception of corruption: The revolving door can create a perception of corruption and influence peddling, undermining public trust in government institutions.

In conclusion, the revolving door between business and government is a complex issue with potential implications for the finance industry and the functioning of government institutions. Understanding its impact and finding ways to address the potential conflicts of interest and influence is crucial to ensure the integrity and fairness of public policies and regulations.