Finance

How To Start A Private Equity

Published: January 22, 2024

Learn how to start a private equity business and navigate the world of finance with expert tips and strategies. Explore the key steps to launch your own successful private equity venture.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the dynamic world of private equity, where strategic investments fuel the growth of promising companies and generate substantial returns for investors. This article serves as a comprehensive guide for individuals seeking to delve into the realm of private equity, offering valuable insights into the intricacies of this investment approach.

Venturing into the domain of private equity entails navigating a landscape characterized by high-stakes decision-making, calculated risk-taking, and the pursuit of long-term value creation. Aspiring private equity professionals must possess a keen understanding of financial markets, a discerning eye for lucrative investment opportunities, and the ability to orchestrate complex deals that yield favorable outcomes for all stakeholders involved.

Throughout this guide, we will explore the various stages of the private equity investment process, from identifying potential investment targets to structuring deals, managing investments, and ultimately realizing profitable exits. By shedding light on each phase of this multifaceted journey, readers will gain a holistic understanding of the mechanisms that drive success in the realm of private equity.

Whether you are an ambitious investor looking to deploy capital in high-potential ventures or an entrepreneur seeking strategic partnerships to propel your business to new heights, the principles and practices elucidated in this guide will equip you with the knowledge and acumen necessary to thrive in the realm of private equity.

Join us as we embark on an illuminating exploration of private equity, unraveling its intricacies and unveiling the strategies that underpin its remarkable potential for wealth creation and business expansion. Let's dive into the captivating world of private equity and uncover the pathways to unlocking value and fostering growth in the corporate landscape.

Understanding Private Equity

Private equity represents a form of investment that involves the allocation of capital to privately-held companies with the goal of nurturing their growth and enhancing their overall value. Unlike public equity, which involves trading shares of publicly-listed companies on stock exchanges, private equity transactions are conducted directly between investors and private businesses.

At the heart of private equity lies the concept of active ownership, wherein investors take on a hands-on role in shaping the strategic direction of the companies in which they invest. This often entails collaborating with management teams to implement operational improvements, pursue expansion opportunities, and optimize the overall performance of the business.

Private equity investments are typically structured as a partnership between investors and the management of the target company, fostering a collaborative approach to driving sustainable growth and profitability. The investment horizon for private equity transactions is relatively long-term, with investors aiming to realize substantial returns over an extended period, often spanning five to ten years.

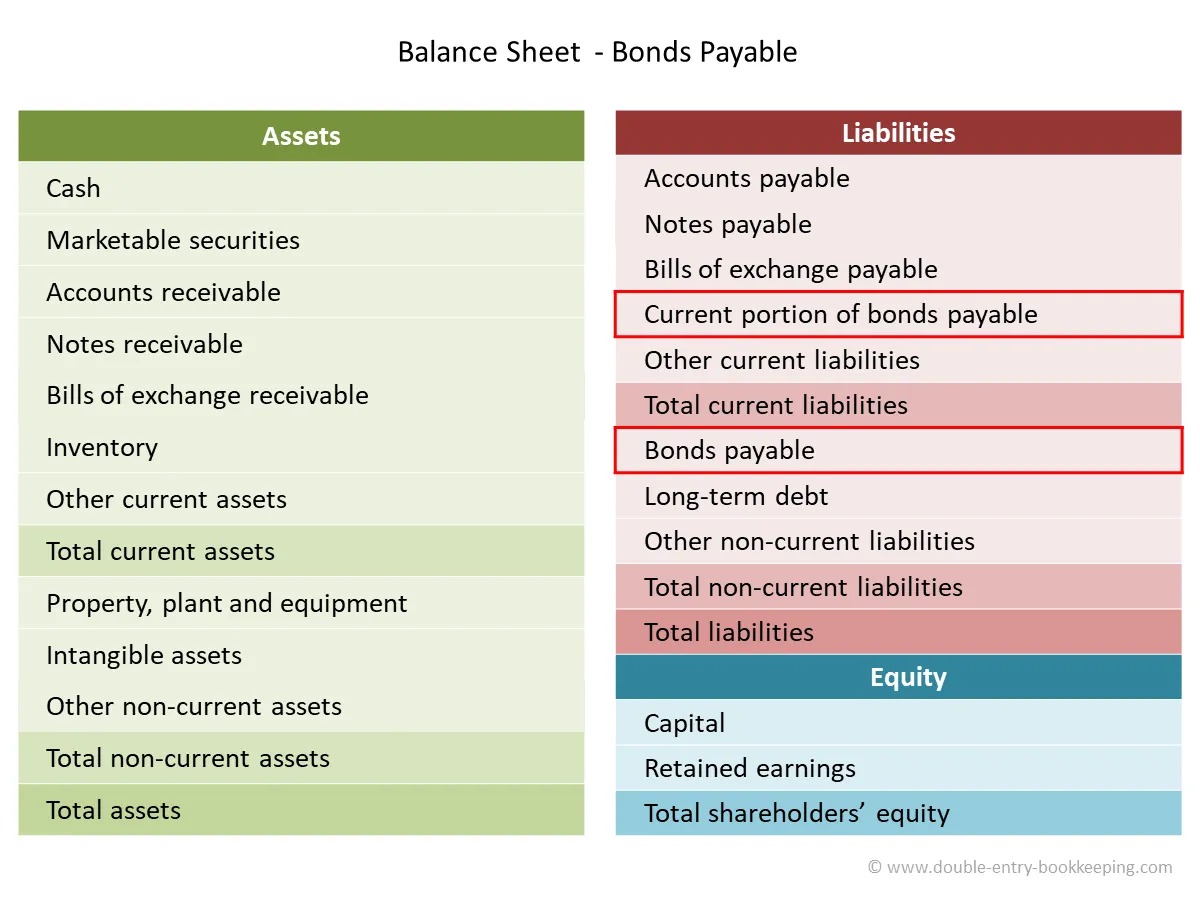

One of the defining features of private equity is the utilization of leverage, wherein investors deploy a combination of equity and debt to finance acquisitions and catalyze the growth of portfolio companies. This strategic use of leverage amplifies the potential returns on investment, albeit with an associated increase in risk.

Private equity encompasses a diverse array of investment strategies, including venture capital, growth equity, buyouts, and distressed investments, each tailored to address distinct market opportunities and business scenarios. Whether fueling the expansion of early-stage startups, facilitating the succession of family-owned enterprises, or revitalizing underperforming businesses, private equity plays a pivotal role in fostering innovation, driving economic development, and generating value across industries.

By comprehending the fundamental principles and dynamics of private equity, investors and entrepreneurs can harness the transformative power of strategic investments to propel businesses toward sustainable growth and profitability. In the subsequent sections, we will delve deeper into the intricacies of private equity, unraveling the nuances of identifying investment opportunities, raising capital, structuring deals, and managing investments to unlock their full potential.

Identifying Investment Opportunities

Identifying lucrative investment opportunities is a cornerstone of successful private equity endeavors, necessitating a meticulous approach to evaluating potential targets and discerning businesses poised for sustainable growth and value creation. This pivotal phase entails conducting comprehensive due diligence, leveraging industry expertise, and astutely recognizing enterprises with untapped potential.

Market Research and Trend Analysis: The quest for promising investment prospects commences with in-depth market research and trend analysis. By scrutinizing industry dynamics, consumer behavior, and macroeconomic indicators, private equity professionals can pinpoint sectors and niches poised for expansion, innovation, and disruption.

Scalability and Competitive Advantage: Prospective investments should exhibit a clear pathway to scalability and possess a sustainable competitive advantage within their respective markets. Whether through proprietary technology, differentiated offerings, or robust brand equity, businesses with defensible positions are primed for long-term success and value appreciation.

Operational and Financial Performance: A comprehensive assessment of the operational and financial performance of target companies is imperative. Key performance indicators, historical financial data, and growth projections serve as critical metrics for evaluating the viability and potential of investment opportunities.

Management Team and Governance Structure: The caliber of the management team and the effectiveness of the governance structure significantly influence the attractiveness of potential investments. Seasoned leadership, a clear strategic vision, and robust corporate governance practices instill confidence in the ability of the company to execute its growth plans and navigate challenges effectively.

Alignment with Investment Thesis: Aligning prospective investments with the overarching investment thesis and strategic objectives of the private equity firm is paramount. Investments should complement the existing portfolio, contribute to diversification goals, and offer opportunities for value creation through synergies and strategic initiatives.

By rigorously evaluating investment opportunities through a multidimensional lens, private equity professionals can identify ventures poised for sustainable growth, operational excellence, and value accretion. The astute selection of investment targets sets the stage for the subsequent phases of the private equity investment process, including raising capital, structuring deals, and steering the growth and performance of portfolio companies.

Raising Capital

Raising capital is a pivotal undertaking in the realm of private equity, necessitating adept navigation of financial markets, cultivation of investor relationships, and articulation of compelling investment theses. Private equity firms seeking to deploy capital into high-potential ventures must orchestrate robust fundraising efforts to secure the financial resources essential for executing strategic investments and driving value creation.

Investor Relations and Fundraising Strategy: Establishing and nurturing strong investor relations is foundational to successful capital raising. Private equity firms cultivate relationships with institutional investors, pension funds, endowments, family offices, and high-net-worth individuals, articulating their investment strategies, track record, and value proposition to garner support for their fundraising endeavors.

Thesis Communication and Due Diligence: Articulating a clear and compelling investment thesis is instrumental in instilling confidence in potential limited partners. Private equity firms elucidate their strategic focus, sector preferences, and value creation strategies, substantiating their theses through rigorous due diligence, market insights, and historical performance metrics.

Structuring Investment Vehicles: Private equity firms structure investment vehicles, such as limited partnerships, to pool capital from investors and deploy it into targeted investment opportunities. The terms of these vehicles, including management fees, carried interest, and investment horizons, are meticulously crafted to align with the interests of both the fund managers and the investors.

Regulatory Compliance and Legal Framework: Adhering to regulatory requirements and legal frameworks is paramount in the fundraising process. Private equity firms navigate securities laws, compliance standards, and disclosure obligations to ensure the transparency and integrity of their fundraising activities, fostering trust and confidence among prospective investors.

Capital Deployment and Value Creation: Upon successfully raising capital, private equity firms embark on the strategic deployment of funds into identified investment opportunities. The proactive pursuit of value creation initiatives, operational enhancements, and growth strategies within portfolio companies is central to maximizing returns and delivering on the investment promises articulated during the fundraising phase.

By adeptly navigating the intricacies of capital raising, private equity firms can mobilize the financial resources necessary to execute their investment strategies, foster business growth, and generate compelling returns for their investors. The successful alignment of investor interests with value creation objectives forms the bedrock of enduring partnerships and mutually beneficial outcomes in the realm of private equity.

Structuring the Deal

The process of structuring a private equity deal is a multifaceted endeavor that demands astute negotiation, meticulous due diligence, and the formulation of terms and conditions that align the interests of all stakeholders involved. This phase entails crafting a comprehensive framework for the investment, delineating the rights and responsibilities of the parties, and establishing the strategic direction for driving value creation within the target company.

Valuation and Transaction Terms: Valuing the target company and defining the transaction terms are foundational to structuring a private equity deal. Through rigorous financial analysis, market comparables, and industry benchmarks, the fair value of the business is ascertained, and the terms of the investment, including the purchase price, equity stake, and potential earn-out provisions, are delineated.

Governing Agreements and Governance Structure: Drafting governing agreements, such as the shareholder agreement and the articles of association, is integral to establishing the governance structure and outlining the decision-making mechanisms within the target company. Clarity on board composition, voting rights, and management authority ensures effective oversight and strategic alignment.

Debt Financing and Capital Structure: Private equity deals often involve the strategic utilization of debt financing to optimize the capital structure of the target company. Balancing the mix of equity and debt, negotiating favorable lending terms, and structuring the financing stack to maximize returns while mitigating financial risk are critical considerations in deal structuring.

Management Incentives and Alignment: Aligning the interests of the management team with the investment objectives is paramount. Structuring equity participation plans, performance-based incentives, and retention mechanisms for key executives fosters a cohesive partnership and incentivizes the pursuit of value creation initiatives post-transaction.

Exit Strategy and Value Realization: The formulation of a clear exit strategy is integral to deal structuring, delineating the pathways for value realization and liquidity events. Whether through an initial public offering (IPO), strategic sale, or secondary buyout, defining the exit horizon and optimizing the timing of the exit are pivotal considerations in structuring the deal.

By adeptly navigating the complexities of deal structuring, private equity professionals can forge robust investment frameworks that lay the groundwork for driving growth, operational enhancements, and value creation within portfolio companies. The strategic alignment of interests, meticulous attention to detail, and adept negotiation culminate in the formulation of deals that catalyze sustainable business expansion and generate compelling returns for all stakeholders involved.

Managing and Growing the Investment

Once a private equity deal is consummated, the subsequent phase encompasses the active management and strategic nurturing of the investment to realize its full potential. This pivotal stage demands adept leadership, operational acumen, and the implementation of value creation initiatives aimed at fostering sustainable growth, operational excellence, and enhanced market positioning for the portfolio company.

Operational Optimization and Strategic Initiatives: Private equity professionals collaborate closely with the management team of the portfolio company to identify and implement operational enhancements, efficiency improvements, and strategic initiatives aimed at driving revenue growth, margin expansion, and overall business performance.

Expansion and Market Penetration: Pursuing expansion opportunities, including geographic diversification, product line extensions, and market penetration strategies, forms a core component of managing and growing the investment. By capitalizing on growth avenues, private equity firms seek to fortify the competitive positioning of the portfolio company and unlock new revenue streams.

Talent Acquisition and Leadership Development: Cultivating a high-performing team and nurturing leadership talent are pivotal to the long-term success of the investment. Private equity professionals collaborate with the management team to attract top-tier talent, foster a culture of excellence, and develop robust leadership capabilities to steer the company toward sustained growth and profitability.

Capital Expenditure and Strategic Investments: Allocating capital toward strategic investments, capital expenditure initiatives, and research and development endeavors is instrumental in fortifying the operational infrastructure and fueling innovation within the portfolio company. These investments lay the groundwork for long-term competitiveness and resilience in the marketplace.

Financial Management and Reporting: Rigorous financial management, performance tracking, and transparent reporting mechanisms are imperative in ensuring the accountability and transparency of the investment. Private equity professionals institute robust financial controls, KPI monitoring, and reporting frameworks to gauge the progress and performance of the portfolio company.

By actively managing and nurturing the investment, private equity professionals can unleash the latent potential of the portfolio company, propelling it toward sustained growth, enhanced market positioning, and the realization of compelling value creation objectives. The adept execution of value enhancement strategies, strategic guidance, and operational stewardship culminates in the transformation of promising businesses into industry leaders, generating substantial returns for investors and stakeholders alike.

Exiting the Investment

The culmination of a private equity investment is marked by the strategic exit from the investment, wherein the private equity firm realizes the value created within the portfolio company and crystallizes compelling returns for its investors. This phase encompasses a deliberate assessment of exit options, meticulous planning, and the execution of value realization strategies aimed at optimizing the investment’s financial outcomes.

Exit Options and Timing: Private equity professionals evaluate a spectrum of exit options, including initial public offerings (IPOs), strategic sales, secondary buyouts, and recapitalizations, to identify the most favorable pathway for realizing the investment’s value. Timing the exit to capitalize on favorable market conditions and industry dynamics is pivotal to maximizing returns.

Value Enhancement and Pre-Exit Initiatives: Prior to the exit, private equity firms may implement additional value enhancement initiatives, such as operational optimizations, strategic acquisitions, or market expansion strategies, to fortify the company’s performance and bolster its attractiveness to potential acquirers or public investors.

Preparation for Liquidity Events: Private equity professionals meticulously prepare the portfolio company for liquidity events, ensuring robust financial reporting, compliance standards, and governance practices. These efforts instill confidence in prospective buyers or public shareholders, facilitating a seamless transition and enhancing the company’s market appeal.

Negotiation and Transaction Execution: The negotiation and execution of the exit transaction demand adept deal-making, strategic positioning, and the realization of optimal value for the investment. Private equity professionals leverage their negotiation prowess and industry insights to orchestrate favorable transaction terms and secure the best possible outcome for all stakeholders involved.

Realization of Returns and Investor Distributions: Upon the successful exit from the investment, private equity firms realize the returns generated within the portfolio company and distribute the proceeds to their investors. This marks the culmination of the investment cycle, rewarding limited partners for their trust and confidence in the private equity firm’s value creation capabilities.

The strategic exit from a private equity investment represents the culmination of a journey marked by astute investment decisions, operational stewardship, and value creation initiatives. By adeptly navigating the complexities of the exit process, private equity professionals unlock the full potential of the investment, generate compelling returns, and cement their track record as shrewd stewards of capital and architects of enduring value in the corporate landscape.

Conclusion

The realm of private equity embodies a captivating journey characterized by astute investment decisions, strategic partnerships, and the relentless pursuit of value creation. As we conclude this comprehensive guide, it is evident that private equity transcends mere financial transactions, encapsulating a dynamic interplay of operational acumen, entrepreneurial vision, and the orchestration of transformative growth initiatives.

From the inception of identifying investment opportunities to the culmination of exiting the investment, the private equity investment process unfolds as a symphony of due diligence, negotiation, and operational stewardship, culminating in the realization of compelling returns and the fortification of promising businesses. The intrinsic value of private equity lies not only in its potential for wealth generation but also in its capacity to foster innovation, drive economic development, and propel businesses toward sustainable growth and market leadership.

For investors seeking to deploy capital in high-potential ventures and entrepreneurs aspiring to propel their businesses to new heights, the principles elucidated in this guide serve as a compass for navigating the complexities of private equity. By embracing the tenets of active ownership, strategic collaboration, and the relentless pursuit of operational excellence, stakeholders can harness the transformative power of private equity to unlock value, foster growth, and chart a trajectory toward enduring success.

As the landscape of private equity continues to evolve, the principles of astute investment selection, adept capital raising, strategic deal structuring, proactive investment management, and deliberate exit planning remain foundational to the realization of sustainable value creation. The enduring impact of private equity transcends financial metrics, resonating in the stories of businesses revitalized, industries transformed, and economies invigorated by the infusion of innovative capital and strategic guidance.

In essence, the world of private equity beckons as a realm of boundless potential, where the convergence of capital, expertise, and vision engenders a symphony of growth, innovation, and enduring value. As we reflect on the multifaceted journey of private equity, we are reminded of its remarkable capacity to shape industries, empower entrepreneurs, and forge enduring legacies of success.

Embrace the spirit of private equity, and embark on a transformative odyssey that transcends the realms of finance, propelling businesses toward new horizons of prosperity, resilience, and enduring market leadership.