Finance

How To Start Auto Insurance Company

Published: October 6, 2023

Looking to start your own auto insurance company? Get expert guidance on the financial aspect of launching your business with our comprehensive finance tips.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Research the Auto Insurance Market

- Step 2: Develop a Business Plan

- Step 3: Obtain Necessary Licenses and Permits

- Step 4: Determine Startup Costs and Secure Funding

- Step 5: Establish Business Structure and Register the Company

- Step 6: Set Up Operational Processes and Systems

- Step 7: Hire Employees and Train Them

- Step 8: Create Insurance Policies and Pricing Models

- Step 9: Build Relationships with Insurance Underwriters

- Step 10: Market and Advertise Your Auto Insurance Company

- Step 11: Provide Excellent Customer Service

- Step 12: Stay Updated on Industry Trends and Regulations

- Conclusion

Introduction

Welcome to the world of auto insurance! In today’s fast-paced society, owning a car is a necessity for many individuals, and with car ownership comes the need for auto insurance. If you have a passion for finance and are considering starting your own business, venturing into the auto insurance industry might be a lucrative opportunity for you.

Before diving headfirst into this venture, it is crucial to understand the ins and outs of the auto insurance market. This article will guide you through the necessary steps to start your own auto insurance company, from research and planning to obtaining licenses and permits, to marketing your company to potential customers.

Auto insurance provides financial protection to vehicle owners in case of accidents, theft, or other unforeseen events. It is a highly regulated sector with specific legal requirements that vary from state to state and country to country. Understanding the intricacies of the auto insurance market is crucial to establishing a successful business.

In this article, we will explore the essential steps you need to take to start your own auto insurance company. From researching the market and developing a business plan to obtaining licenses and permits, establishing your business structure, hiring employees, and creating insurance policies and pricing models, we will cover all the necessary aspects of launching your own auto insurance venture.

Moreover, we will emphasize the importance of providing excellent customer service to build and maintain strong relationships with your policyholders. Additionally, we will touch on the significance of staying updated on industry trends and regulations to ensure the long-term success of your company.

Starting an auto insurance company requires careful planning, financial investment, and diligent execution. However, with the right knowledge, resources, and determination, you can establish yourself as a prominent player in the auto insurance market.

So, strap in and get ready to embark on this exciting journey as we walk you through the step-by-step process of starting your own auto insurance company.

Step 1: Research the Auto Insurance Market

The first step in starting your own auto insurance company is to thoroughly research the market. Understanding the current landscape, trends, and competition in the auto insurance industry is essential for making informed decisions and developing a unique value proposition for your company.

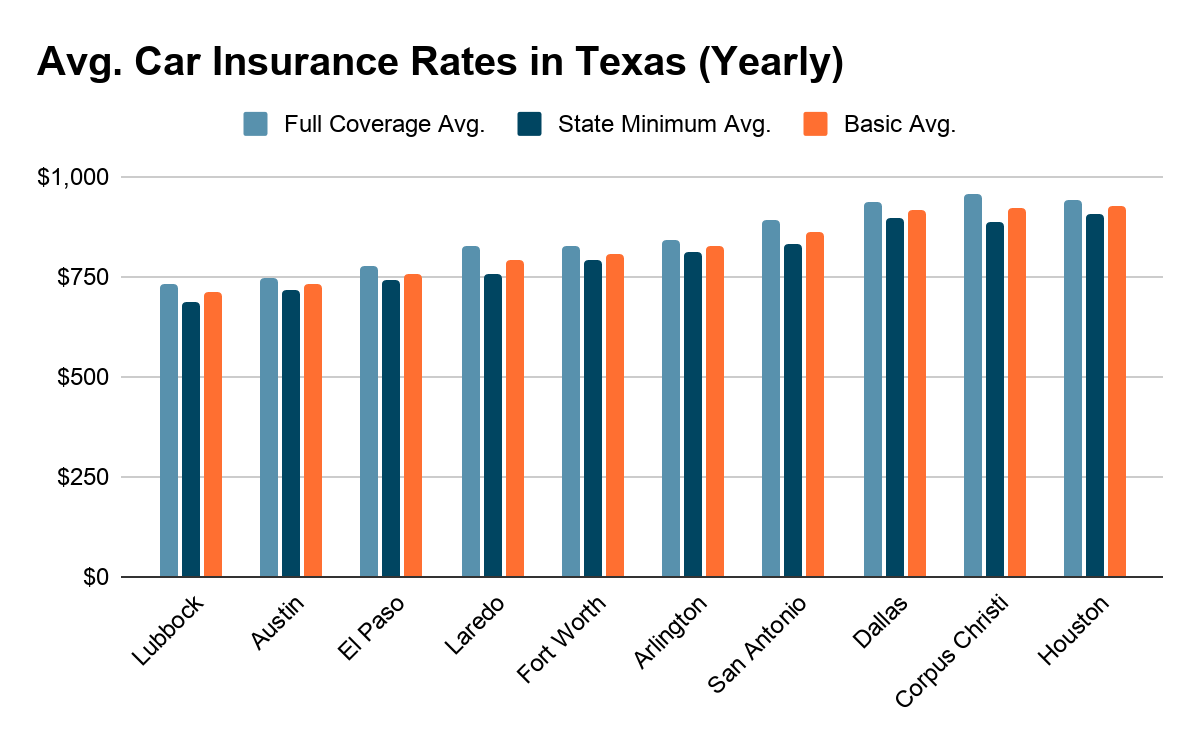

Start by evaluating the demand for auto insurance in your target market. Consider factors such as population demographics, economic conditions, and the number of cars on the roads. This will help you determine the potential customer base and identify any gaps or opportunities in the market.

Next, analyze the existing auto insurance providers in your area. Study their business models, insurance policies, pricing strategies, and customer service offerings. This will give you insights into what works well and what you can improve upon to differentiate your company from the competition.

Make use of online resources, industry reports, and market research data to gather information on market trends, consumer preferences, and emerging technologies. Stay updated on regulatory changes and reforms within the industry, as these can have a significant impact on your business operations.

Consider partnering with a market research firm or consulting with industry professionals to gain deeper insights and validate your findings. Conduct surveys or focus groups to directly engage with potential customers and understand their needs and pain points when it comes to auto insurance.

Additionally, familiarize yourself with the various types of auto insurance coverage available. Research different policy options, such as liability coverage, collision coverage, comprehensive coverage, and uninsured/underinsured motorist coverage. Understand how these policies work and the level of protection they offer to policyholders.

By conducting thorough market research, you will not only gain valuable insights into the industry but also identify opportunities to differentiate your auto insurance company. This knowledge will serve as the foundation for developing a robust business plan and making informed decisions throughout the startup process.

Remember, the key to success in the auto insurance industry lies in understanding the market dynamics, customer preferences, and the competitive landscape. Armed with this knowledge, you will be well-equipped to navigate the challenges and seize the opportunities that come your way.

Step 2: Develop a Business Plan

Once you have thoroughly researched the auto insurance market, the next step is to develop a comprehensive business plan that outlines your company’s vision, goals, strategies, and financial projections.

A well-crafted business plan serves as a roadmap for your auto insurance company, guiding you through the startup phase and helping you stay focused on your objectives. It also provides useful insights for potential investors and lenders who may be interested in supporting your venture.

Start by defining your company’s mission and vision statements. Clearly articulate the purpose and values of your business, along with the long-term goals you aim to achieve. This will serve as the foundation upon which you build your company’s brand and culture.

Next, identify and analyze your target market. Define your ideal customer profile and understand their needs, preferences, and pain points when it comes to auto insurance. This knowledge will help you tailor your products and services to meet their specific requirements.

Outline your company’s unique value proposition. What sets you apart from the competition? Are you offering more comprehensive coverage, better customer service, or innovative technology solutions? Clearly communicate how your auto insurance company will provide value to its customers.

Develop a marketing strategy that outlines how you will promote your auto insurance products and attract customers. Identify the most effective channels for reaching your target audience, whether it’s through digital marketing, traditional advertising, strategic partnerships, or direct sales efforts.

Financial projections are a critical component of any business plan. Estimate your startup costs, including licensing fees, office space, technology infrastructure, and employee salaries. Create a projected income statement, cash flow statement, and balance sheet to demonstrate the financial viability of your company.

Furthermore, outline your pricing strategy. Determine how you will price your auto insurance policies to remain competitive while ensuring profitability. Consider factors such as risk assessment, policyholder demographics, claims history, and overhead costs.

Lastly, don’t forget to include an executive summary at the beginning of your business plan. This concise overview should highlight the key points of your plan and pique the interest of readers, compelling them to delve further into the details.

Developing a solid business plan not only helps you clarify your goals and strategies but also demonstrates your commitment and professionalism to potential investors or lending institutions. It is a crucial document that will guide the growth and success of your auto insurance company.

Step 3: Obtain Necessary Licenses and Permits

Before you can officially start operating your auto insurance company, you will need to obtain the necessary licenses and permits required by the regulatory authorities. Insurance is a highly regulated industry, and compliance with legal obligations is essential.

The specific licenses and permits you will need depend on the jurisdiction where you plan to operate. Research the requirements of the insurance regulatory body in your target market to ensure that you meet all the necessary criteria.

In the United States, for example, the requirements for obtaining an insurance license vary from state to state. You may need to pass certain exams, complete pre-licensing courses, provide proof of financial responsibility, and undergo a background check.

Consult with insurance professionals or legal experts who are familiar with the licensing requirements in your jurisdiction. They can guide you through the process and help you navigate any complexities that may arise.

In addition to insurance licenses, you may also need to obtain general business licenses and permits required by your local government. These can include a business registration certificate, tax registration, and any specific permits related to operating an insurance agency.

Ensure that you have a clear understanding of the ongoing compliance obligations once you obtain your licenses and permits. Familiarize yourself with the reporting requirements, renewal processes, and any continuing education requirements that you may need to fulfill to maintain your licenses.

It is important to note that in many jurisdictions, insurance companies are also required to demonstrate financial stability and maintain certain minimum capitalization levels. Be prepared to provide financial statements and undergo periodic financial audits to comply with these regulations.

Complying with all necessary licenses and permits is critical to operating your auto insurance company legally and gaining the trust of potential customers. Failure to obtain the required licenses or maintain compliance can lead to severe penalties and the revocation of your ability to operate.

So, make sure to thoroughly research the licensing requirements in your jurisdiction, gather all the necessary documentation, and complete the application process meticulously. By doing so, you will be on the right path to running a legitimate and successful auto insurance company.

Step 4: Determine Startup Costs and Secure Funding

No business can get off the ground without adequate funding, and starting an auto insurance company is no exception. Determining your startup costs and securing funding is a crucial step towards turning your vision into reality.

Start by assessing all the expenses involved in launching your auto insurance company. This includes one-time costs such as licensing fees, legal and professional fees, technology infrastructure, office space, equipment, and marketing expenses.

In addition to upfront costs, consider the ongoing operational expenses such as employee salaries, rent, utilities, insurance premiums, and marketing and advertising budgets.

Create a detailed budget that outlines all these costs and projections for at least the first year of operations. This will give you a clear picture of the financial resources you will need to start and sustain your business.

Once you have ascertained your startup costs, explore different funding options to secure the necessary capital. This could include personal savings, loans from banks or financial institutions, investment from angel investors or venture capitalists, or crowdfunding campaigns.

Prepare a comprehensive business plan and financial projections to present to potential investors or lenders. Clearly communicate the value proposition, market potential, and growth opportunities of your auto insurance company to instill confidence in their investment decision.

Consider participating in startup incubation programs or seeking mentorship from industry professionals or successful entrepreneurs in the insurance sector. They may be able to provide valuable guidance, connections, or even funding opportunities.

Be prepared to contribute your own capital to the business. Putting in your own money shows your commitment and dedication to the success of your auto insurance company, instilling confidence in potential investors or lenders.

Ensure you have a solid financial plan in place to manage cash flow effectively and meet your financial obligations. Develop strategies to mitigate risks and plan for contingencies, as startup businesses often face unforeseen challenges that can affect their financial stability.

Remember, securing funding can be a time-consuming and challenging process. Be prepared to face rejection and adapt your strategy as needed. Stay focused and determined, and explore all available options to secure the necessary funding to launch and grow your auto insurance company.

Step 5: Establish Business Structure and Register the Company

Now that you have determined the financial aspects of starting your auto insurance company, it’s time to establish the legal structure of your business and register it with the appropriate authorities.

Decide on the most suitable business structure for your auto insurance company. The most common options include sole proprietorship, partnership, limited liability company (LLC), or corporation. Each structure has its own advantages and disadvantages, so it’s important to carefully evaluate which one aligns with your goals and offers the desired level of liability protection.

Consult with legal professionals or business advisors to ensure you understand the legal and tax implications of each business structure. They can guide you in making an informed decision based on your specific circumstances.

Once you have chosen a business structure, register your company’s name with the appropriate government agency. Conduct a thorough search to ensure the name is unique and not already in use by another business. Registering your company name protects your brand and prevents others from operating under the same name in your jurisdiction.

Obtain an Employer Identification Number (EIN) from the Internal Revenue Service (IRS) if you plan to hire employees. The EIN is used for tax purposes and is necessary for reporting employment taxes and other financial obligations.

Register your business with the relevant regulatory agencies. In the insurance industry, this may include registering with the state insurance department or any other regulatory authority in your jurisdiction. Provide all required documentation and fulfill any additional requirements specified by the regulatory body.

Ensure compliance with all legal and regulatory obligations related to your auto insurance company. This includes obtaining any necessary permits or licenses specifically related to managing an insurance agency or selling insurance products.

Consult with legal professionals to draft any necessary contracts, agreements, or policies that govern your company’s operations, including agent contracts, policyholder agreements, and data protection policies.

Remember to establish proper bookkeeping and record-keeping systems from the start. This will help you stay organized, comply with financial reporting requirements, and facilitate the smooth management of your auto insurance company.

By establishing the right business structure and registering your company properly, you not only ensure compliance with legal obligations but also set a strong foundation for the growth and success of your auto insurance company.

Step 6: Set Up Operational Processes and Systems

With the legal and structural foundations in place for your auto insurance company, it’s time to focus on setting up efficient operational processes and systems. This step is crucial to ensure smooth and effective functioning of your business.

Begin by identifying the core operational processes involved in running your auto insurance company. This typically includes areas such as underwriting, policy issuance, claims handling, customer service, billing, and reporting.

Develop detailed workflows for each process, outlining the steps involved, key responsibilities, and the necessary documentation or tools required at each stage. This will streamline operations, improve efficiency, and minimize errors or discrepancies.

Invest in suitable technology solutions to support your operational processes. Consider implementing software systems specifically designed for insurance companies, such as customer relationship management (CRM) software, policy management systems, claims processing software, and accounting tools.

Automate tasks wherever possible to save time and reduce human error. For example, use electronic document management systems to digitize and store policyholder documents securely and improve accessibility. Implement online claim filing systems to streamline the claims process for your customers.

Establish clear internal communication channels and protocols to ensure effective coordination among team members. Regular team meetings, project management tools, and collaboration software can help facilitate communication and enhance productivity.

Implement robust data security measures to protect customer information and maintain compliance with data protection regulations. This includes establishing secure data storage, utilizing encryption technologies, and implementing strict access controls.

Ensure your employees are properly trained on the operational processes and systems in place. Provide comprehensive training programs to familiarize them with your company’s policies, procedures, and quality standards. Ongoing training and professional development opportunities will help them stay updated on industry trends and best practices.

Regularly review and analyze your operational processes to identify areas for improvement. Seek feedback from employees and policyholders to identify pain points or areas of inefficiency. Continuously strive to optimize your processes and systems to enhance customer satisfaction and maximize operational performance.

Remember, setting up efficient operational processes and systems is integral to the success of your auto insurance company. By streamlining workflows, implementing advanced technology solutions, and fostering a culture of continuous improvement, you will position your company for growth and success in a competitive market.

Step 7: Hire Employees and Train Them

As your auto insurance company begins to take shape, it’s time to build your team by hiring skilled professionals who can contribute to the success of your business. Hiring the right talent and providing proper training are crucial steps in creating a competent and motivated workforce.

Start by identifying the roles and positions you need to fill based on your business requirements. This may include insurance agents, underwriters, claims handlers, customer service representatives, administrative staff, and IT professionals.

Develop clear job descriptions that outline the responsibilities, qualifications, and experience required for each role. Ensure that the job descriptions align with the goals and values of your company to attract candidates who share your vision.

Advertise job openings through various channels, such as online job boards, social media platforms, industry-specific networks, and local recruitment agencies. Utilize your professional network and industry connections to identify suitable candidates with relevant experience in the insurance industry.

Conduct thorough interviews to assess the skills, knowledge, and cultural fit of potential candidates. Look for individuals who possess the necessary industry knowledge, strong communication skills, problem-solving abilities, and a customer-centric mindset.

When evaluating candidates, consider their potential for growth and adaptability in a rapidly changing industry. Look for individuals who show a willingness to learn and keep up with emerging trends and regulations in the auto insurance sector.

Once you have selected your team members, provide them with comprehensive training to ensure they understand their roles and responsibilities within your auto insurance company.

Create a training program that covers the technical aspects of the insurance industry, such as policy coverage, underwriting guidelines, claims handling procedures, and regulatory compliance. Additionally, provide training on customer service skills, effective communication, and problem-solving techniques.

Consider investing in professional development opportunities, such as industry conferences, workshops, and online courses, to enhance the skills and knowledge of your employees.

Foster a positive work culture by encouraging teamwork, open communication, and continuous learning. Create an environment where employees feel supported, empowered, and motivated to perform at their best.

Regularly evaluate the performance of your team members and provide constructive feedback to help them grow and improve. Implement reward systems and recognition programs to acknowledge and appreciate their efforts.

Remember, your employees are the backbone of your auto insurance company. By hiring talented individuals and providing them with proper training and support, you are building a strong foundation for your business’s success.

Step 8: Create Insurance Policies and Pricing Models

Creating well-designed insurance policies and establishing effective pricing models are essential for your auto insurance company to attract and retain customers while ensuring profitability. This step requires careful consideration of risk assessment, market trends, and customer expectations.

Begin by determining the types of insurance policies you will offer. This may include liability coverage, collision coverage, comprehensive coverage, underinsured/uninsured motorist coverage, and additional options like rental car coverage or roadside assistance.

Research industry best practices and regulatory requirements to ensure your policies comply with legal standards while providing comprehensive coverage. Develop policy terms and conditions that are clear, transparent, and easy for customers to understand.

Consider offering customization options to meet individual policyholder needs. By allowing customers to tailor their coverage based on factors like deductibles, coverage limits, and additional endorsements, you can provide a personalized experience that meets their specific requirements.

Assess the risk associated with different policyholders to determine appropriate pricing. Consider factors such as age, driving history, vehicle type, geographical location, and credit score. Develop rating algorithms or use actuarial tools to calculate accurate premiums that reflect the level of risk for each policyholder.

Establish a pricing model that balances affordability for customers with profitability for your company. Consider industry benchmarks, market competition, and target profit margins when setting premium rates. Regularly evaluate and adjust pricing based on market dynamics and financial performance.

Ensure you comply with insurance regulatory laws regarding pricing transparency and fairness. Clearly communicate pricing factors and explain premium calculations to your customers, building trust and transparency within your business relationships.

Consider implementing incentives or discounts to attract and retain customers. This could include safe driver discounts, bundling options with other insurance policies, or loyalty rewards programs. These strategies can help differentiate your company from competitors and provide added value to policyholders.

Monitor industry trends and emerging technologies that could influence your insurance policies and pricing models. Stay updated on new coverage options, advancements in risk assessment and underwriting, and changes in regulatory requirements that may impact your offerings.

Regularly review and analyze your policy performance and claim experience. Assess the effectiveness of your pricing models by evaluating loss ratios, profitability, and customer satisfaction levels. Make necessary adjustments and refinements to your policies and pricing to ensure they remain competitive and profitable.

Creating comprehensive and well-priced insurance policies is a critical aspect of running a successful auto insurance company. By understanding market trends, assessing risk accurately, and providing clear and transparent policies, you can position your company as a trusted provider in the industry.

Step 9: Build Relationships with Insurance Underwriters

Building strong relationships with insurance underwriters is crucial for the success of your auto insurance company. Underwriters play a vital role in assessing and managing risks, determining coverage terms, and setting premiums. Collaborating effectively with underwriters can lead to favorable outcomes for both your company and policyholders.

Start by identifying reputable insurance underwriters in the market. Research their expertise, financial stability, and reputation. Look for underwriters who specialize in auto insurance and have a strong track record of providing competitive coverage options.

Establish open lines of communication with underwriters. Attend industry events, conferences, and networking sessions to connect with them directly. Cultivate relationships by demonstrating your knowledge of the industry, your commitment to customer service, and your focus on risk management.

Clearly articulate your company’s value proposition and unique selling points to underwriters. Highlight how your auto insurance company differentiates itself from competitors and how you can bring value to their business through a mutually beneficial partnership.

Be prepared to provide accurate and detailed information about your company’s financial stability, loss ratios, claims history, and risk management strategies. Demonstrating a solid understanding of your company’s risk profile will instill confidence in underwriters and facilitate better collaboration.

Collaborate with underwriters to assess risk and develop appropriate coverage options. Provide underwriters with access to accurate data and information to support their decision-making process. This will help them assess risks more effectively and design coverage that meets the unique needs of your policyholders.

Regularly review and assess the performance of underwriters. Evaluate their responsiveness, flexibility, and ability to meet your company’s needs. Establish clear performance metrics and communicate expectations to underwriters to ensure aligned goals and a satisfying working relationship.

Collaborate with underwriters to stay informed of market trends, regulatory changes, and emerging risks in the auto insurance industry. Regularly engage in discussions about industry developments, new products, and pricing strategies to stay competitive.

Develop a mutual understanding of each other’s business goals and risk appetites. Strive for a symbiotic partnership where both your auto insurance company and the underwriters benefit from their expertise, market access, and risk assessment capabilities.

Nurture long-term relationships with underwriters based on trust, transparency, and open communication. Foster a positive working environment where both parties feel comfortable discussing challenges, exploring solutions, and adapting to market dynamics.

Remember, underwriters are invaluable partners in the success of your auto insurance company. By building strong relationships with them, you gain access to their expertise, market insights, and risk assessment capabilities, which can help you provide competitive coverage options and better serve your policyholders.

Step 10: Market and Advertise Your Auto Insurance Company

Effective marketing and advertising are key to establishing brand awareness, attracting customers, and growing your auto insurance company. By implementing a well-rounded marketing strategy, you can reach your target audience, differentiate your company from competitors, and build a strong customer base.

Start by defining your target market and understanding the demographics, behaviors, and preferences of your potential customers. This will help you tailor your marketing efforts to effectively reach and engage with your target audience.

Create a compelling brand identity that reflects the values, mission, and unique selling points of your auto insurance company. Develop a memorable logo, tagline, and brand messaging that resonate with your target audience and differentiate your brand from competitors.

Invest in a professional and user-friendly website that showcases your company’s offerings, policy information, and customer testimonials. Optimize your website for search engines (SEO) to improve visibility in online searches and increase organic traffic to your site.

Utilize digital marketing channels such as social media platforms, paid advertising, content marketing, and email marketing to reach a wider audience. Develop engaging content that educates, informs, and adds value to potential customers, positioning your company as an authority in the auto insurance industry.

Consider partnering with complementary businesses, such as car dealerships, auto repair shops, or car rental agencies, to expand your reach and gain access to their customer base.

Participate in industry events, trade shows, and community activities to increase awareness of your brand. Sponsor local events or sports teams to enhance visibility and demonstrate your commitment to the community.

Leverage customer referrals by offering incentives or rewards for policyholders who refer new customers to your company. Positive word-of-mouth recommendations carry significant weight in the insurance industry and can help drive new business.

Monitor and analyze the performance of your marketing efforts using metrics such as website traffic, online conversions, email open rates, and customer acquisition cost. Continuously refine your marketing strategy based on the data and insights gathered.

Stay up-to-date with industry trends and emerging marketing techniques, such as influencer marketing or video marketing, to adapt your strategy and stay ahead of the competition.

Remember, marketing and advertising play a vital role in effectively promoting your auto insurance company. By utilizing a combination of traditional and digital marketing tactics and consistently monitoring performance, you can raise brand awareness, connect with potential customers, and drive business growth.

Step 11: Provide Excellent Customer Service

In the competitive world of auto insurance, providing excellent customer service is essential for building customer loyalty, fostering positive relationships, and differentiating your company from competitors.

Start by developing a customer-centric culture within your organization. Make sure your employees understand the importance of delivering exceptional customer service and are trained to meet the needs and expectations of policyholders.

Establish clear and efficient communication channels for customers to connect with your company. This could include phone, email, live chat, or even social media platforms. Respond promptly to customer inquiries and provide solutions to their problems in a timely manner.

Create personalized experiences for your policyholders. Address them by name, understand their unique circumstances, and tailor your services to their specific needs. Show empathy and understanding when dealing with their concerns or issues.

Streamline your claims process to make it as simple and hassle-free as possible for your policyholders. Invest in technology and automation to expedite claims handling, communicate updates promptly, and ensure transparency throughout the process.

Provide clear and transparent communication about policy terms, coverage details, premiums, and any potential changes. Avoid using jargon or complex language that may confuse or alienate customers. Be proactive in educating policyholders about their coverage and any updates or changes to their policies.

Solicit and value customer feedback. Regularly ask for feedback on their experiences with your company, whether it’s through surveys, reviews, or direct communication. Take their feedback seriously and use it to improve your products, services, and overall customer experience.

Create loyalty programs or incentives to reward long-term customers. Offer discounts, policy upgrades, or exclusive benefits as a token of appreciation for their loyalty and to encourage continued partnership with your company.

Train and empower your customer service representatives to handle difficult situations and resolve conflicts. Provide them with the necessary tools, knowledge, and autonomy to address customer concerns and find satisfactory solutions.

Monitor customer satisfaction metrics, such as Net Promoter Score (NPS), customer retention rate, and customer reviews. Regularly assess these indicators to gauge the effectiveness of your customer service efforts and make necessary improvements.

Continuously invest in technology solutions that enhance the customer experience. Implement self-service portals, mobile apps, and online policy management tools to provide convenience and accessibility for your policyholders.

Above all, consistently deliver on your promises. Honesty, integrity, and reliability are integral to building customer trust. Be transparent about the limitations of your policies and ensure that your customers know exactly what they are getting.

Remember, customer satisfaction is the key to success in the auto insurance industry. By providing excellent customer service, you can not only retain existing policyholders but also attract new customers through positive word-of-mouth and recommendations.

Step 12: Stay Updated on Industry Trends and Regulations

In the ever-evolving world of auto insurance, it is crucial to stay updated on industry trends and regulations to ensure the long-term success and compliance of your company. By staying informed and adapting to changes, you can stay ahead of the competition and effectively serve the needs of your customers.

Regularly monitor industry publications, news outlets, and professional networks to stay informed about the latest trends, technologies, and innovations in the auto insurance sector. Keep an eye on emerging market disruptors, such as new players or insurtech startups, that may impact the industry landscape.

Participate in industry conferences, seminars, and webinars to gain insights from industry experts and thought leaders. Attend workshops and training sessions to enhance your knowledge and skills in areas such as underwriting, risk assessment, claims handling, and regulatory compliance.

Join professional organizations and associations related to the insurance industry to network with industry peers and gain access to valuable resources and updates. Engage in discussions and exchange ideas with other professionals to learn from their experiences and stay abreast of industry best practices.

Establish relationships with regulatory bodies and stay up-to-date on any changes or updates to insurance laws and regulations. Understand the implications of regulatory requirements on your business operations and ensure full compliance.

Regularly review and assess your company’s internal processes and policies to align with any new or updated regulatory requirements. Train your employees to adhere to these regulations and continuously educate them on any changes or updates.

Monitor the use of emerging technologies in the insurance industry, such as data analytics, artificial intelligence, and machine learning. Understand how these technologies can be leveraged to improve efficiency, customer experience, and risk assessment in your auto insurance company.

Keep an eye on market trends and customer preferences to stay ahead of evolving customer needs. Analyze data and customer feedback to identify potential gaps or opportunities in your products and services, and make strategic adjustments accordingly.

Stay informed about consumer behavior and purchasing trends to adapt your marketing and advertising strategies. Be receptive to changing customer expectations and preferences, and adjust your offerings to meet their needs.

Incorporate a culture of continuous learning within your organization. Encourage your employees to stay updated on industry trends and regulations through ongoing training and professional development opportunities. Foster an environment where knowledge sharing and staying informed are valued.

By staying informed about industry trends and regulations, you can position your auto insurance company as an industry leader and effectively address the evolving needs of your customers. Embrace change and innovation, and use your knowledge to drive your company’s growth and success.

Conclusion

Starting an auto insurance company requires careful planning, research, and execution. By following the comprehensive steps outlined in this article, you can lay a solid foundation for your business and increase the likelihood of long-term success in the competitive auto insurance industry.

From conducting thorough market research and developing a comprehensive business plan to obtaining necessary licenses, securing funding, and establishing operational processes, each step plays a critical role in shaping your company’s direction and operations.

Building strong relationships with insurance underwriters, delivering excellent customer service, and staying updated on industry trends and regulations are equally important factors that contribute to the growth and success of your auto insurance company.

Remember that the auto insurance industry is dynamic, constantly evolving, and heavily regulated. Continuously adapt to changes, stay updated on emerging technologies, and consistently evaluate and improve your policies, pricing models, and customer service to meet the evolving needs of your customers.

Creating a strong brand presence, marketing your company effectively, and fostering strong relationships with customers and underwriters are key strategies that will help you achieve success in a competitive market.

Always prioritize customer satisfaction and provide excellent customer service to not only retain policyholders but also attract new customers through positive word-of-mouth referrals.

As you embark on this exciting entrepreneurial journey, remember to remain resilient, adaptable, and committed to ongoing learning and improvement. By implementing these steps and carefully navigating the auto insurance landscape, you can establish your auto insurance company as a trusted provider and thrive in this ever-changing industry.