Finance

How-To Transfer Money To Suncoast Credit Union

Published: January 11, 2024

Looking to transfer money to Suncoast Credit Union? Learn how to easily and securely transfer funds to your Suncoast account with our step-by-step guide. Finance made simple!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Transferring money to Suncoast Credit Union is a straightforward process that can be done through various methods to suit your convenience. Whether you prefer online banking, mobile banking, or in-person transfers, Suncoast Credit Union offers a range of options to make managing your finances easy.

In this article, we will guide you through the steps involved in transferring money to Suncoast Credit Union, ensuring a smooth and hassle-free experience. Whether you are transferring funds from another bank account or sending money to a Suncoast member, we have you covered with all the necessary information.

Before we delve into the specifics of each transfer method, it’s important to note that Suncoast Credit Union prioritizes the security of its members’ financial transactions. With robust encryption protocols and advanced security measures in place, you can have peace of mind while transferring money to and from your Suncoast account.

Regardless of the amount you want to transfer or the purpose behind the transaction, Suncoast Credit Union is committed to providing you with a seamless and reliable banking experience.

In the following sections, we will explore the different methods available to transfer money to Suncoast Credit Union. Whether you prefer the convenience of online banking, the flexibility of mobile banking, or the personalized service of in-person transfers, Suncoast Credit Union has options to suit your needs.

So let’s dive in and discover the step-by-step process for transferring money to Suncoast Credit Union, empowering you to take control of your finances and make secure transactions.

Step 1: Determine Transfer Method

The first step in transferring money to Suncoast Credit Union is to determine the transfer method that best suits your needs. Suncoast offers multiple options, each with its own advantages and considerations. Let’s take a closer look at the available transfer methods:

- Online Banking: If you prefer the convenience of managing your finances from the comfort of your own home, online banking is the ideal option for you. Suncoast Credit Union provides a user-friendly online banking platform that allows you to easily transfer funds between accounts, make payments, and manage your finances with just a few clicks.

- Mobile Banking: For those who prefer to do their banking on the go, Suncoast offers a robust mobile banking app. With this app, available for both iOS and Android devices, you can transfer money, check your account balance, and perform various banking tasks from the palm of your hand.

- In-Person Transfer: If you prefer a more personal touch and would like to discuss your transfer options with a representative, you can visit a Suncoast Credit Union branch near you. The friendly staff will assist you in transferring money to your Suncoast account, provide guidance, and answer any questions you may have.

Consider your preferences, lifestyle, and the urgency of the transfer when choosing the transfer method. Online and mobile banking options are typically the quickest and most convenient methods, while in-person transfers offer a more personalized experience.

Once you have determined the transfer method that suits your needs, we can move on to the next step: gathering the required information for the transfer.

Step 2: Gather Required Information

Before initiating a money transfer to Suncoast Credit Union, it’s crucial to gather all the necessary information to ensure a smooth and accurate transaction. The information you will need may vary depending on the transfer method and the source of the funds.

Here are the key pieces of information you should have on hand:

- Suncoast Credit Union Account Details: You will need your Suncoast Credit Union account number to initiate the transfer. If you don’t have this information readily available, you can find it on your account statement or by contacting the credit union directly.

- Recipient’s Information: If you are transferring money to another Suncoast member, you will need their full name and account number. If the transfer is from another bank, you will need the recipient’s bank account number and routing number. It’s essential to double-check this information to prevent any potential errors.

- Transfer Amount: Determine the exact amount of money you want to transfer. Take into account any applicable fees or charges that may be associated with the transfer.

- Purpose of Transfer: Having a clear understanding of the purpose behind the transfer can help you provide any additional information required for specific types of transactions, such as international transfers or loan payments.

- Verification Information: Depending on the transfer method and the source of funds, you may be required to provide additional verification information. This could include your personal identification details, such as your Social Security number or driver’s license number.

Gathering all the necessary information in advance will streamline the transfer process and minimize any potential delays or complications. Once you have gathered the required information, you’re ready to proceed with the transfer using your chosen method, whether it’s online banking, mobile banking, or an in-person visit to a Suncoast Credit Union branch.

Now that you have all the necessary information, let’s move on to the specific steps involved in each transfer method.

Step 3: Online Transfer

If you prefer the convenience and speed of online banking, transferring money to Suncoast Credit Union can be done easily through their online banking platform. Follow these steps to initiate an online transfer:

- Login to your Suncoast Credit Union Online Banking: Visit the Suncoast Credit Union website and log in to your online banking account using your username and password. If you haven’t set up online banking yet, you will need to register for an account.

- Select the “Transfer Money” Option: Once logged in, navigate to the “Transfer Money” section, usually found in the main menu or sidebar of your online banking dashboard.

- Choose the Transfer Type: Select the transfer type, such as “Internal Transfer” if you are sending money to another Suncoast member or “External Transfer” if you are transferring funds from another bank to your Suncoast account.

- Enter the Recipient’s Information: Provide the recipient’s full name, Suncoast account number, or the external bank account details based on your chosen transfer type. Double-check the information for accuracy.

- Specify the Transfer Amount: Enter the amount you wish to transfer. Be mindful of any transaction fees or minimum/maximum transfer limits that may apply.

- Review and Confirm: Carefully review all the details of the transfer, including the recipient’s information and the transfer amount. Ensure everything is accurate before proceeding.

- Authorize the Transfer: Once you are confident in the details, authorize the transfer by clicking the “Submit” or “Transfer” button. Some online banking platforms may require additional steps, such as entering a unique security code or confirming the transaction via email or text message.

- Confirmation and Receipt: After the transfer is completed, you will receive a confirmation message or receipt. Keep this for your records and as proof of the transaction.

It’s important to note that the exact steps and interface may vary depending on the specific online banking platform used by Suncoast Credit Union. If you encounter any difficulties during the online transfer process, don’t hesitate to reach out to the customer support team for assistance.

Now that you know how to transfer money to Suncoast Credit Union using the online banking platform, let’s explore the next method: mobile banking transfers.

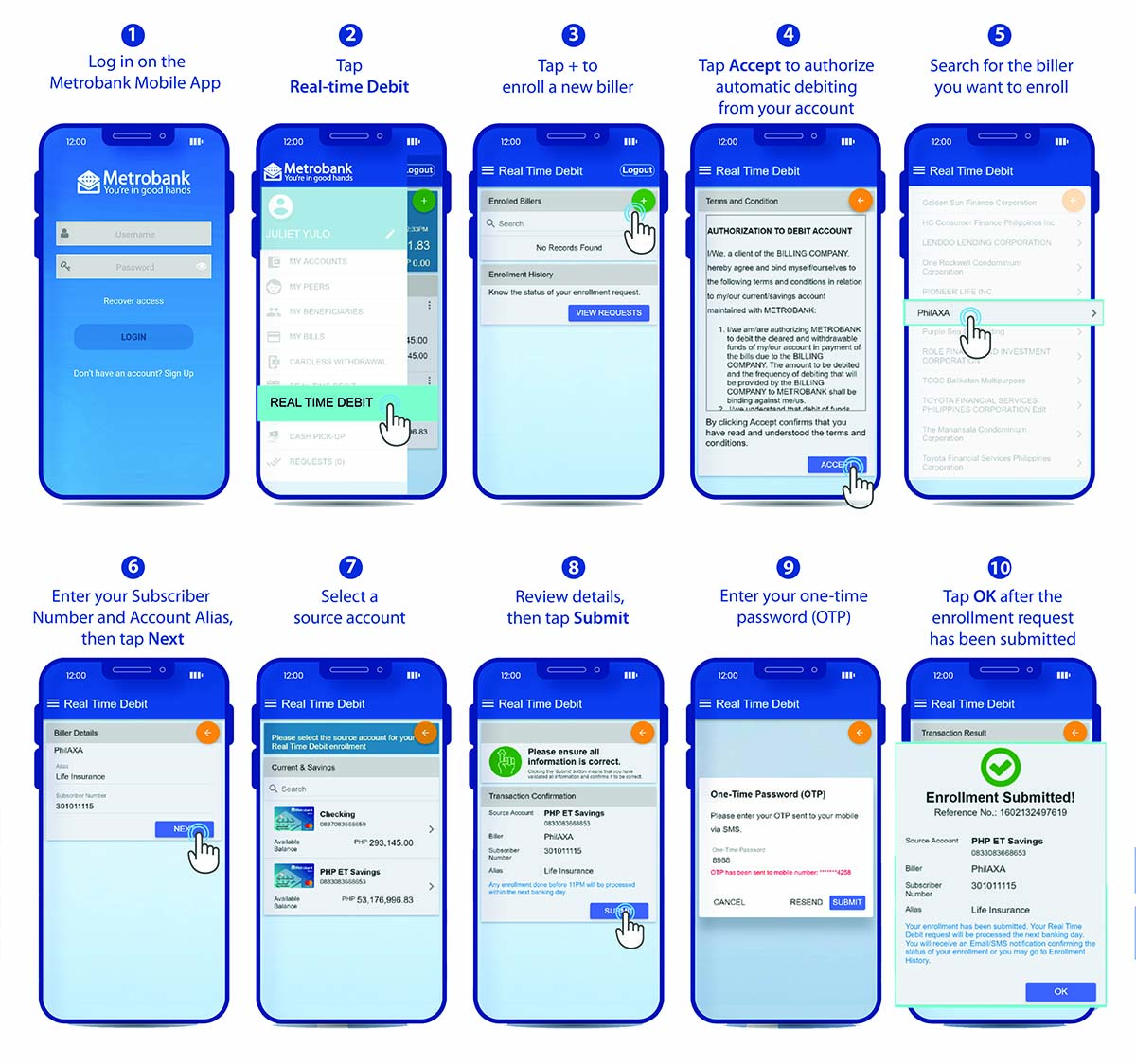

Step 4: Mobile Banking Transfer

If you prefer the flexibility and convenience of managing your finances on the go, Suncoast Credit Union offers a robust mobile banking app that facilitates money transfers with just a few taps. Follow these steps to initiate a transfer using the mobile banking app:

- Download and Install the Suncoast Mobile App: Visit the app store on your iOS or Android device and search for the Suncoast Mobile Banking app. Download and install the app onto your device.

- Login to your Suncoast Mobile Banking Account: Open the Suncoast Mobile App and log in using your online banking credentials (username and password). If you haven’t set up mobile banking yet, you will need to register for an account.

- Navigate to the “Transfer” or “Send Money” Section: Once logged in, find the “Transfer” or “Send Money” section in the app. This might be located in the main menu or on the home screen, depending on the app’s layout.

- Select the Transfer Type: Choose the type of transfer you wish to make, such as an internal transfer to another Suncoast member or an external transfer from another bank account to your Suncoast account.

- Enter the Recipient’s Information: Provide the necessary information, such as the recipient’s full name, Suncoast account number, or the external bank account details, depending on the selected transfer type. Ensure the information is accurate before proceeding.

- Specify the Transfer Amount: Enter the amount you want to transfer. Take note of any applicable fees or transfer limits that may affect your transaction.

- Review and Confirm: Carefully review all the details of the transfer, including the recipient’s information and the transfer amount. Confirm that everything is correct before proceeding.

- Authorize the Transfer: Once you are satisfied with the details, proceed to authorize the transfer by tapping the “Submit” or “Transfer” button. Some mobile banking apps may require additional security measures, such as fingerprint or face recognition, to confirm the transaction.

- Confirmation and Recordkeeping: After the transfer is completed, you will receive a confirmation message or notification. Keep this for your records and as proof of the transaction.

The steps outlined above are general guidelines for using the Suncoast Mobile Banking app. Be aware that the exact steps and interface may vary based on the specific mobile banking app version and device operating system. If you encounter any difficulties, consult the app’s user guide or contact Suncoast Credit Union’s customer support for assistance.

Now that you know how to transfer money to Suncoast Credit Union using the mobile banking app, let’s explore the next method: in-person transfers.

Step 5: In-Person Transfer

If you prefer a more personalized banking experience or need assistance with your money transfer, you can visit a Suncoast Credit Union branch to initiate an in-person transfer. Here’s how to transfer money to Suncoast Credit Union through an in-person visit:

- Locate a Suncoast Credit Union Branch: Use the Suncoast Credit Union website or mobile app to find the nearest branch location that is convenient for you to visit.

- Prepare the Required Documentation: Before visiting the branch, make sure you have the necessary documentation ready. This may include your identification documents, Suncoast account number, and any transfer-related information you may have.

- Visit the Branch: Head to the Suncoast Credit Union branch you selected. Remember to bring your identification documents and any other materials you prepared.

- Speak to a Representative: Once at the branch, inform the front desk or reception area staff that you would like to initiate a money transfer. They will guide you to a representative who can assist you with the process.

- Provide Transfer Details: Explain to the representative the details of your transfer, including the recipient’s information, transfer amount, and any other relevant details. Be prepared to provide any necessary documentation or fill out forms as required.

- Review and Confirm: Before finalizing the in-person transfer, carefully review all the details provided by the representative. Ensure that the transfer information is accurate to avoid any potential errors.

- Authorize the Transfer: Once you are satisfied and confident with the transfer details, provide the necessary authorization for the transaction to take place, whether it’s through a signature, confirmation code, or other means.

- Receipt and Confirmation: Upon completion of the in-person transfer, the representative will provide you with a receipt or confirmation of the transaction. Keep this for your records and future reference.

In-person transfers offer the advantage of direct assistance and guidance from a knowledgeable representative. If you have any questions or concerns throughout the transfer process, the branch staff will be able to provide immediate support.

Now that you are familiar with the steps involved in an in-person transfer, let’s explore some additional transfer options available at Suncoast Credit Union.

Step 6: Additional Transfer Options

In addition to online banking, mobile banking, and in-person transfers, Suncoast Credit Union offers some additional transfer options to suit varying needs. Let’s explore these alternative methods:

- Wire Transfers: If you need to send or receive funds quickly and securely, especially for larger amounts or international transfers, wire transfers are a reliable option. Suncoast Credit Union allows you to initiate incoming and outgoing wire transfers to and from your account. Contact Suncoast Credit Union for detailed instructions and information regarding fees and required documentation.

- Automatic Transfers: Suncoast Credit Union offers automatic transfer services that allow you to set up recurring transfers between your Suncoast accounts or external bank accounts. This can be beneficial for regular savings contributions, loan payments, or bill payments. Consult with Suncoast Credit Union to set up automatic transfers and ensure hassle-free management of your finances.

- Payroll Direct Deposit: By setting up payroll direct deposit, you can conveniently have your paycheck directly deposited into your Suncoast Credit Union account. This saves you time and provides immediate access to your funds without the need for physical check deposits.

- Mobile Payment Apps: Suncoast Credit Union offers compatibility with popular mobile payment apps such as Apple Pay, Google Pay, and Samsung Pay. These apps allow you to make quick and secure payments using your mobile device at participating merchants.

Each of these additional transfer options provides flexibility and convenience, allowing you to manage your finances in a way that suits your lifestyle and preferences. Whether you need to send money to another bank, set up automatic transfers, or access funds through mobile payment apps, Suncoast Credit Union has you covered.

As with any financial transaction, it’s essential to familiarize yourself with the terms, conditions, and any applicable fees associated with these additional transfer options. If you have any questions or require further assistance, reach out to Suncoast Credit Union’s customer support team for guidance.

Now that you are aware of the various transfer options available, you can confidently choose the method that best suits your needs and proceed with your money transfer to Suncoast Credit Union.

Conclusion

Transferring money to Suncoast Credit Union is a simple and secure process, offering various methods to suit your preferences and needs. Whether you choose online banking, mobile banking, in-person transfers, wire transfers, automatic transfers, or mobile payment apps, Suncoast Credit Union provides a range of options to make managing your finances convenient and hassle-free.

Throughout this article, we have guided you through the step-by-step process of transferring money to Suncoast Credit Union. We started by determining the transfer method that best suited your needs, whether it was online banking for the tech-savvy, mobile banking for those on the go, or in-person transfers for those who prefer a personal touch.

We emphasized the importance of gathering the necessary information, including Suncoast Credit Union account details, recipient information, transfer amount, and any additional verification details. Having all the required information readily available ensures a smooth transaction and minimizes any potential errors or delays.

We then explored the specific steps involved in online transfers, mobile banking transfers, and in-person transfers, providing detailed instructions to help you navigate each method effectively.

In addition to these primary methods, we discussed the availability of wire transfers for quick and secure transactions, automatic transfers for recurring transfers, and the convenience of mobile payment apps for seamless payments at participating merchants.

By understanding the diverse transfer options offered by Suncoast Credit Union, you can choose the one that best fits your requirements and preferences. Whether you are transferring money between Suncoast accounts, sending funds to another bank, or setting up automatic transfers, Suncoast Credit Union provides reliable and convenient solutions.

Remember to familiarize yourself with the specific terms, conditions, and any associated fees for each transfer method. If you have any questions or require assistance throughout the transfer process, never hesitate to reach out to Suncoast Credit Union’s customer support team. They are there to provide guidance and ensure a seamless experience.

Now that you have a comprehensive understanding of the different transfer options available, you can confidently take control of your finances and make secure transactions to Suncoast Credit Union.