Home>Finance>How To Turn Leads Into Clients For A Financial Advisor

Finance

How To Turn Leads Into Clients For A Financial Advisor

Modified: December 30, 2023

Learn the proven strategies to convert leads into loyal clients for financial advisors. Unlock the secret to success in the finance industry and maximize your client base today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding the Lead Conversion Process

- Building Trust with Potential Clients

- Effective Communication Strategies

- Identifying and Addressing Client Needs

- Presenting Value Propositions

- Handling Objections and Overcoming Resistance

- Closing the Sale and Gaining Commitment

- Following Up and Maintaining Client Relationships

- Conclusion

Introduction

Welcome to the world of financial advising, where turning leads into clients is a crucial aspect of success. As a financial advisor, you understand the importance of building relationships and establishing trust with potential clients. In this article, we will explore effective strategies to help you convert leads into loyal clients.

Converting leads into clients is not an easy task. It requires a combination of understanding client needs, effective communication, and a strong value proposition. This process begins with creating a sense of trust and credibility, which is essential in the financial industry.

Financial decisions can be daunting and overwhelming for many individuals. They are entrusting their hard-earned money to someone who they believe will guide them towards achieving their financial goals. Therefore, earning their trust is paramount.

In the following sections, we will delve deeper into the lead conversion process and explore various strategies to build trust, communicate effectively, identify client needs, present value propositions, handle objections, and ultimately close the sale. We will also touch upon the importance of follow-up and maintaining long-term client relationships.

So, whether you are a seasoned financial advisor looking to enhance your conversion skills or a new advisor seeking guidance, this article will provide you with valuable insights and actionable tips to turn leads into lifelong clients.

Understanding the Lead Conversion Process

Before diving into the strategies to convert leads into clients, it is crucial to understand the lead conversion process itself. In simple terms, lead conversion is the process of turning potential clients, or leads, into actual clients who trust you with their financial needs and goals.

The lead conversion process typically involves several stages, starting from the initial contact with a potential client to closing the sale and gaining their commitment. Understanding these stages will help you navigate the conversion process effectively.

1. Awareness: The first stage is creating awareness, where potential clients become aware of your services. This can be through various channels such as referrals, online marketing, or networking events. It is crucial to have a strong online presence and marketing strategy to increase awareness and attract leads.

2. Interest and Evaluation: Once potential clients are aware of your services, they move into the interest and evaluation stage. This is where they start researching and evaluating different financial advisors to determine who can best meet their needs. Building credibility and trust through testimonials, case studies, and a strong online reputation is essential at this stage.

3. Relationship Building: Once a potential client shows interest, the next stage is building a relationship. This involves establishing trust, rapport, and demonstrating your expertise. Building a connection with the client, understanding their goals and concerns, and addressing their needs are key elements in this stage.

4. Presentation of Value: Once a strong relationship is established, it is important to present your value proposition. This includes highlighting the unique benefits and solutions you can provide to address the client’s specific financial needs and goals. Presenting your value in a clear and compelling way is crucial to stand out from your competitors.

5. Addressing Objections: In this stage, potential clients might have concerns or objections that need to be addressed. It is important to listen actively, empathize with their concerns, and provide satisfactory answers. Overcoming objections is an opportunity to showcase your expertise and build trust.

6. Closing the Sale: Once you have addressed objections and built trust, it is time to close the sale. This involves asking for the commitment and guiding the potential client through the necessary paperwork and processes. A confident and transparent approach is vital to successfully close the deal.

7. Follow-up and Maintenance: The lead conversion process does not end with closing the sale; it extends to follow-up and maintaining client relationships. Regular check-ins, providing ongoing support, and delivering exceptional service are crucial to foster long-term client loyalty.

By understanding these stages and implementing effective strategies at each step, you can navigate the lead conversion process with confidence and success.

Building Trust with Potential Clients

Trust is the foundation of any successful client-advisor relationship. Potential clients need to feel confident that you are knowledgeable, reliable, and have their best interests at heart. Building trust is a crucial step in the lead conversion process. Here are some strategies to help you establish trust with potential clients:

1. Demonstrate Expertise: One of the most effective ways to build trust is by showcasing your expertise and knowledge in the financial industry. Position yourself as a thought leader by writing informative blog posts, publishing whitepapers, and speaking at industry events. Showcasing your expertise helps potential clients see you as a credible and trustworthy advisor.

2. Provide Testimonials and Case Studies: Testimonials and case studies from satisfied clients are powerful tools in building trust. Display these testimonials on your website and share success stories that highlight the positive outcomes you have achieved for your clients. Potential clients are more likely to trust you when they see evidence of your past successes.

3. Maintain Transparency: Transparency is key to building trust. Be open and transparent about your fees, investment strategies, and potential risks. Clearly explain how you will communicate with clients and keep them informed about their financial progress. When potential clients see that you are transparent and trustworthy, they will feel more comfortable entrusting you with their finances.

4. Act as a Fiduciary: Acting as a fiduciary means always putting your clients’ interests before your own. Make it clear that you are committed to acting in your clients’ best interests and providing unbiased advice. This can alleviate any concerns potential clients may have about potential conflicts of interest.

5. Listen and Empathize: Building trust requires active listening and empathizing with potential clients’ financial concerns. Take the time to understand their goals, fears, and challenges. Show genuine empathy and compassion for their financial situation. When potential clients feel heard and understood, they are more likely to trust you.

6. Establish Personal Connections: Building a personal connection with potential clients can go a long way in building trust. Take the time to get to know them on a personal level, such as their family, hobbies, or interests. Show genuine care and interest in their lives. This personal connection helps create a sense of trust and rapport.

7. Provide Clear Communication: Clear and consistent communication is essential in building trust. Keep potential clients informed about their financial progress and any changes in the market that may impact their investments. Be responsive to their inquiries and provide timely updates. When potential clients see that you are reliable and communicative, they will trust you more.

Remember, building trust takes time and consistent effort. By implementing these strategies, you can establish a solid foundation of trust with potential clients, increasing your chances of converting them into loyal clients.

Effective Communication Strategies

Effective communication is a critical component of the lead conversion process as it helps build rapport, understanding, and trust with potential clients. Here are some key communication strategies to employ:

1. Active Listening: Listening is the foundation of effective communication. Practice active listening by giving your full attention, maintaining eye contact, and focusing on what the potential client is saying. Avoid interrupting and ask clarifying questions to ensure you understand their needs and concerns.

2. Tailor Your Communication: Adapt your communication style to match the needs and preferences of the potential client. Some clients may prefer a formal approach, while others may respond better to a more casual and friendly tone. Pay attention to their cues and adjust accordingly to establish a deeper connection.

3. Use Clear and Concise Language: Avoid jargon and complex financial terms that may confuse potential clients. Use simple and concise language to explain financial concepts and strategies in a way that is easy to understand. Clarity in communication helps build trust and confidence in your expertise.

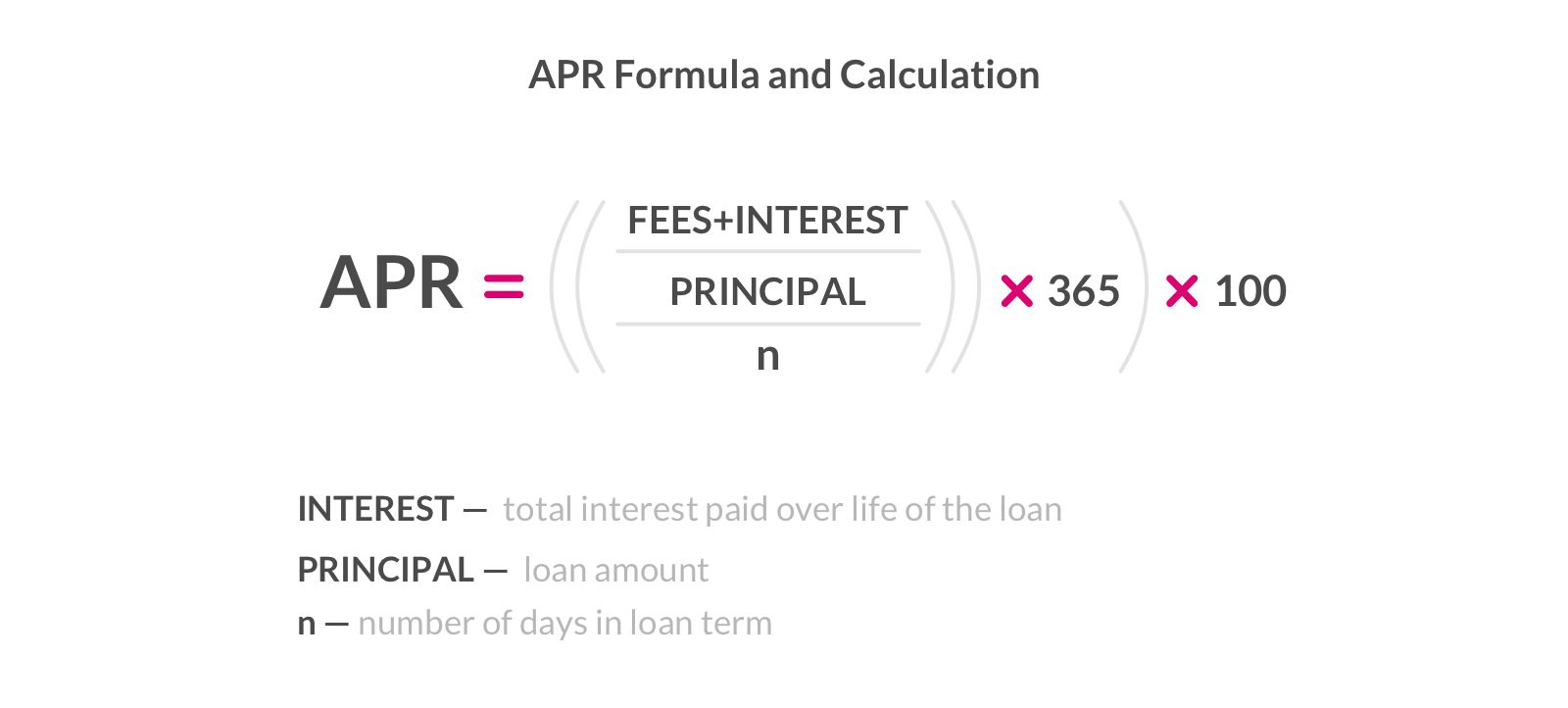

4. Utilize Visual Aids: Visual aids, such as charts, graphs, and illustrations, can help simplify complex concepts and enhance comprehension. Use visual aids during presentations or meetings to illustrate investment strategies, explain risk-reward profiles, and demonstrate potential outcomes. Visual aids can make communication more engaging and memorable for potential clients.

5. Be Responsive: Promptly respond to potential clients’ inquiries and requests for information. A timely response demonstrates your commitment and professionalism. Even if you don’t have an immediate answer, acknowledge the query and provide a timeline for when you will follow up with the requested information.

6. Build Rapport: Establishing a strong rapport is crucial for effective communication. Find common ground or shared interests with potential clients to build a personal connection. Engage in small talk and show genuine interest in their lives. Building rapport helps create a comfortable and trusting environment for open communication.

7. Use Non-Verbal Communication: Non-verbal cues, such as body language and facial expressions, play a significant role in communication. Maintain good posture, make appropriate eye contact, and use facial expressions to convey empathy and interest. Pay attention to potential clients’ non-verbal cues as well to gauge their engagement and understanding.

8. Follow Up in Writing: After meetings or conversations, follow up with a written summary of the discussed points, action items, and any additional information requested. This not only demonstrates your attention to detail but also ensures everyone is on the same page. Written follow-ups also serve as a reference for potential clients to review the discussed topics at their convenience.

9. Manage Expectations: Clear communication helps manage potential clients’ expectations. Be transparent about the timeframes, potential risks, and possible outcomes of different investment strategies. By setting realistic expectations from the beginning, you build trust and avoid misunderstandings down the line.

Effective communication is key to establishing trust and conveying your value as a financial advisor. By implementing these strategies, you can enhance your communication skills and increase your chances of converting potential clients into long-term partners.

Identifying and Addressing Client Needs

One of the fundamental steps in converting leads into clients is identifying and addressing their specific needs. Every potential client has unique financial goals, concerns, and priorities. Here are some strategies to help you effectively identify and address client needs:

1. Conduct a Comprehensive Discovery Process: Begin by conducting a thorough discovery process with potential clients. This involves asking probing questions to understand their financial situation, goals, risk tolerance, and time horizon. Actively listen to their responses and take detailed notes to ensure you have a comprehensive understanding of their individual needs.

2. Assess Risk Tolerance: Understanding a potential client’s risk tolerance is crucial in determining suitable investment strategies. Use risk assessment tools, questionnaires, and discussions to gauge their comfort level with risk. This information will help you tailor your recommendations to align with their risk preferences.

3. Analyze Their Financial Situation: Dive deep into potential clients’ financial situations. Evaluate their income, expenses, assets, liabilities, and existing investment portfolio. This analysis will help you gain insights into any gaps or areas for improvement that you can address with your recommendations.

4. Seek Clarity on Their Financial Goals: Ask potential clients specific questions about their short-term and long-term financial goals. Determine what they hope to achieve, such as retirement planning, education funding, or purchasing a home. Clarify the timeline and level of priority for each goal to guide your recommendations accordingly.

5. Understand Their Values and Beliefs: Dive beyond the numbers and understand the values and beliefs driving potential clients’ financial decisions. Some clients may prioritize ethical investing, while others may have a specific philanthropic focus. Incorporating their values into your recommendations demonstrates your attentiveness and enhances their connection to the proposed strategies.

6. Consider Their Life Stage and Life Events: Take into account potential clients’ life stages and anticipated life events. For example, a young professional may have different financial needs and goals compared to a couple planning for retirement. By understanding their life stage, you can tailor your advice to suit their specific circumstances.

7. Address Their Concerns and Pain Points: Explore potential clients’ concerns and pain points related to their financial situation. Are they worried about market volatility? Do they have concerns about not having enough saved for retirement? Address these concerns and provide practical solutions to alleviate their worries and demonstrate your expertise.

8. Provide Customized Solutions: Once you have gathered all the necessary information, develop customized solutions that address the specific needs and goals of potential clients. Tailor your recommendations to their risk tolerance, investment horizon, and financial objectives. Clearly explain how your proposed strategies align with their unique circumstances.

9. Continuously Review and Adjust: Financial circumstances and goals can evolve over time. Schedule regular reviews with clients to assess their progress and make necessary adjustments to their financial plans. By staying proactive and attentive to their changing needs, you can foster long-term relationships built on trust and continuing value.

By effectively identifying and addressing client needs, you can offer personalized solutions that resonate with potential clients and increase their likelihood of becoming loyal, long-term clients.

Presenting Value Propositions

Presenting a strong value proposition is crucial in convincing potential clients to choose you as their financial advisor. It is essential to highlight the unique benefits and value you can provide to address their financial needs and goals. Here are some strategies for effectively presenting your value proposition:

1. Clearly Define Your Unique Selling Points: Identify and articulate your unique selling points that differentiate you from other financial advisors. This could be your years of experience, specialized knowledge in a particular niche, or a track record of successful outcomes. Clearly communicate these points to potential clients to showcase the value you bring to the table.

2. Emphasize Your Expertise: Highlight your expertise and credentials to instill confidence in potential clients. Communicate your certifications, education, and continuous professional development efforts. Demonstrate your expertise by sharing relevant case studies or success stories that showcase how your advice has helped clients achieve their financial goals.

3. Showcase Your Comprehensive Approach: Present your comprehensive approach to financial planning and investment management. Explain how you take a holistic view of clients’ financial situations by considering their goals, risk tolerance, time horizon, and tax implications. Illustrate how this comprehensive approach allows you to develop tailored strategies to optimize their financial outcomes.

4. Highlight Technology and Tools: If you utilize state-of-the-art technology or specialized tools in your advisory process, emphasize how these resources enhance clients’ experience and outcomes. Highlight any tools for financial planning, risk analysis, or portfolio tracking that set you apart and provide added value to potential clients. Demonstrate how technology streamlines processes and improves efficiency in managing their finances.

5. Focus on Education and Communication: Position yourself as an educator by emphasizing your commitment to client education. Communicate how you provide educational resources, such as newsletters, webinars, or workshops, to empower clients to make informed financial decisions. Emphasize your dedication to clear and timely communication to ensure clients feel supported and informed throughout their financial journey.

6. Illustrate Cost-Effective Solutions: Incorporate cost-effective solutions into your value proposition. Explain how your fee structure provides transparency and aligns with clients’ best interests. Emphasize the potential cost savings and long-term benefits of your recommended strategies. By showcasing the value clients can receive for the fees they pay, you can demonstrate your commitment to their financial success.

7. Offer Personalized Service: Highlight your dedication to providing personalized service tailored to each client’s unique needs. Communicate how you take the time to understand their goals, concerns, and preferences to develop customized financial plans. Emphasize your ongoing support and availability to address their questions or concerns promptly. Show potential clients that they will receive dedicated attention and a high level of service.

8. Provide Social Proof: Social proof in the form of testimonials, client success stories, or reviews can validate your value proposition. Incorporate positive feedback from satisfied clients to demonstrate the value you have delivered in the past. Potential clients are more likely to trust and choose you as their financial advisor when they see evidence of your ability to meet their financial needs.

Presenting your value proposition effectively is essential in converting leads into clients. By clearly communicating the unique benefits and value you offer, you can stand out from the competition and build trust with potential clients.

Handling Objections and Overcoming Resistance

Objections and resistance are common during the lead conversion process, but they provide an opportunity for you to address concerns and build trust with potential clients. Here are some strategies to effectively handle objections and overcome resistance:

1. Active Listening and Empathy: When faced with an objection, practice active listening to fully understand the underlying concern. Show empathy and validate the potential client’s perspective. This helps establish a rapport and demonstrates your genuine interest in addressing their concerns.

2. Clarify the Objection: Before formulating a response, ensure you fully understand the objection. Ask follow-up questions to gain clarity and dig deeper into the underlying issue. This allows you to provide a more specific and targeted response.

3. Provide Evidence and Facts: Use relevant data, statistics, and case studies to support your position and alleviate potential clients’ concerns. Show how your strategies and recommendations have delivered positive outcomes for previous clients. Facts and evidence help build credibility and demonstrate the validity of your advice.

4. Address Perceived Risks: Many objections stem from perceived risks or fears. Address these concerns by providing a clear and thorough explanation of the associated risks and how you mitigate them in your investment strategies. Offer examples of how you have successfully navigated similar challenges in the past.

5. Tailor Your Response: Customize your response based on the specific objection raised by the potential client. Rather than providing a generic response, address their concerns directly and provide tailored solutions or alternatives. This shows that you have taken their unique situation into consideration.

6. Offer Comparisons: If potential clients are comparing your services to those of competitors, provide clear differentiators. Highlight the advantages and benefits you offer that set you apart. By showcasing your unique value proposition, you can help potential clients see why your services are superior.

7. Maintain Confidence and Calmness: During objections, it is essential to remain composed and maintain confidence in your recommendations. Responding in a calm and professional manner instills trust and reassures potential clients that you can handle any challenges that may arise.

8. Provide Alternate Perspectives and Options: If a potential client is resistant to a particular recommendation, offer alternative perspectives or options. Present different scenarios or strategies that align with their objectives while addressing their concerns. This shows flexibility and willingness to adapt to their needs.

9. Follow Up and Revisit Objections: If you cannot fully address an objection during the initial conversation, commit to following up with additional information or clarification. Revisit the objection at a later time to ensure that potential clients have all the information needed to make an informed decision.

10. Demonstrate Integrity and Trustworthiness: Above all, emphasize your integrity and trustworthiness in handling objections. Potential clients need to feel confident that you have their best interests at heart. By showcasing your commitment to transparency, ethical practices, and providing unbiased advice, you can overcome resistance and build trust.

Handling objections and overcoming resistance requires active listening, empathy, and providing tailored solutions. By addressing concerns directly and instilling confidence, you can navigate objections effectively and increase the likelihood of converting leads into loyal clients.

Closing the Sale and Gaining Commitment

The final stage of the lead conversion process is closing the sale and gaining commitment from potential clients. It is essential to guide them towards making a decision and solidifying their commitment to working with you as their financial advisor. Here are some strategies to help you effectively close the sale:

1. Recap and Summarize: Begin the closing process by summarizing the main points of your discussions and the benefits of working with you as their financial advisor. Recap the potential clients’ goals, concerns, and the personalized solutions you have developed for them. This reinforces the value you bring to their financial journey.

2. Address Any Remaining Concerns: Take the opportunity to address any remaining concerns or objections potential clients may have. Use the knowledge you have gained throughout the lead conversion process to demonstrate how you can alleviate their concerns and provide the necessary solutions.

3. Present a Clear Call-to-Action: Provide a clear call-to-action to guide potential clients towards making a decision. This can be scheduling a follow-up meeting, signing necessary documents, or initiating the transfer of funds. Clearly communicate the next steps and the timeline involved to manage their expectations and facilitate a smooth transition.

4. Demonstrate the Potential Impact: Show potential clients the potential impact of working with you as their financial advisor. Illustrate how your strategies can help them achieve their financial goals and address their concerns. Use visual aids, projections, and real-life examples to paint a vivid picture of the positive outcomes they can expect by choosing you.

5. Offer Incentives: In some cases, offering an incentive can help motivate potential clients to commit. This could be a reduced fee for the initial period, a complimentary service, or exclusive access to certain resources. Ensure any incentives align with your values and will provide value to the client over the long term.

6. Create a Sense of Urgency: Creating a sense of urgency can encourage potential clients to make a decision. Highlight time-sensitive factors such as limited availability, impending market changes, or the potential benefits of taking action sooner rather than later. However, be genuine and transparent when using this strategy.

7. Clarify the Benefits of Taking Action: Clearly communicate the benefits of taking action and the risks of delaying or not making a decision at all. Help potential clients understand the potential consequences of inaction and how your services can positively impact their financial well-being.

8. Use Trial Close Techniques: Utilize trial close techniques throughout the lead conversion process to gauge potential clients’ level of commitment. Ask questions that encourage them to visualize themselves as your client, such as “How do you envision working together to achieve your goals?” This helps reinforce their commitment and readiness to move forward.

9. Be Confident and Trustworthy: Confidence and trustworthiness are crucial when closing the sale. Maintain a professional and confident demeanor throughout the entire process. Reinforce your integrity, transparency, and commitment to acting in the best interests of potential clients. By demonstrating your trustworthiness, you increase their confidence in making a commitment.

10. Follow Up Promptly: After gaining commitment, follow up promptly to ensure a smooth transition and address any additional questions or concerns. Provide clear instructions on next steps and show your dedication to providing exceptional client service from the start.

By employing these strategies, you can confidently close the sale and gain commitment from potential clients. Remember to always prioritize their best interests and align your recommendations with their unique financial goals and needs.

Following Up and Maintaining Client Relationships

Following up and maintaining client relationships is crucial for long-term success as a financial advisor. It is essential to nurture the trust and rapport you have built during the lead conversion process and ensure ongoing client satisfaction. Here are some strategies to effectively follow up and maintain client relationships:

1. Schedule Regular Check-ins: Establish a schedule for regular check-ins with your clients. This could be quarterly, semi-annually, or annually, depending on their needs and preferences. These check-ins provide an opportunity to review their financial progress, address any concerns, and update their financial plans as necessary.

2. Actively Listen to Their Changing Needs: Continuously listen to your clients’ changing needs and goals. Pay attention to any life events, new financial priorities, or shifts in risk tolerance. This allows you to pivot and adapt your strategies accordingly, ensuring you are providing relevant and tailored advice.

3. Provide Ongoing Education and Market Updates: Keep your clients informed and engaged by providing ongoing education and market updates. This can be in the form of newsletters, webinars, or personalized reports. Sharing insights and knowledge demonstrates your commitment to their financial well-being and helps them make informed decisions.

4. Offer Exceptional Service and Responsiveness: Strive to provide exceptional service and responsiveness to your clients. Respond promptly to their inquiries, provide timely updates, and proactively communicate any changes or opportunities. Show your clients that their financial needs are a priority and that you are dedicated to their success.

5. Personalize Communications: Tailor your communication to each client’s preferences and needs. Some clients may prefer regular phone or video calls, while others may prefer email or in-person meetings. Customize your communication style and frequency to meet their preferences and ensure a personalized experience.

6. Anticipate and Address Potential Issues: Proactively address any potential issues or challenges that may arise. Stay informed about market trends, regulatory changes, and economic updates that may impact your clients’ investments. Provide reassurance and guidance during unpredictable times to help them navigate potential risks and uncertainties.

7. Review and Adjust Financial Plans: Regularly review and adjust your clients’ financial plans to ensure they align with their evolving goals and priorities. Life circumstances change, and financial plans should reflect these shifts. Discuss any necessary adjustments with your clients and work together to develop strategies that keep them on track towards their goals.

8. Foster a Holistic Relationship: Go beyond discussing only financial matters and strive to foster a holistic relationship with your clients. Show genuine interest in their lives, ask about their families, hobbies, and aspirations. Building a personal connection helps deepen the trust and loyalty they have in you as their financial advisor.

9. Continuously Add Value: Look for opportunities to add value to your clients’ lives beyond financial advice. Share relevant resources, introduce them to your professional network, or provide referrals for other services they may need. By going the extra mile, you demonstrate your commitment to their overall well-being.

10. Seek Client Feedback: Regularly seek feedback from your clients to ensure their satisfaction and identify areas for improvement. Conduct surveys, schedule feedback sessions, or simply ask for their thoughts during check-ins. Taking their feedback into consideration shows that you value their input and are committed to continuously improving their experience.

By effectively following up and maintaining client relationships, you can cultivate long-term partnerships built on trust and loyalty. Providing ongoing support, personalized communication, and exceptional service will ensure that your clients feel supported and confident in their financial journey with you.

Conclusion

The process of converting leads into clients for a financial advisor requires careful strategy, effective communication, and a focus on building trust. By understanding the lead conversion process, building trust with potential clients, identifying and addressing their needs, presenting strong value propositions, handling objections, closing the sale, and maintaining client relationships, you can increase your success in turning leads into lifelong clients.

Building trust is at the core of the lead conversion process. Demonstrating your expertise, providing testimonials from satisfied clients, maintaining transparency, and actively listening to potential clients’ concerns are all crucial in establishing trust and credibility. Effective communication strategies such as active listening, tailoring your communication, and utilizing visual aids help foster understanding and connection.

Identifying and addressing client needs is paramount to providing personalized solutions. A comprehensive discovery process, thorough analysis of their financial situation, and understanding their goals and concerns provide the foundation for tailored recommendations. Presenting value propositions that highlight your unique selling points, expertise, and comprehensive approach solidify your position as the best choice for potential clients.

Handling objections and overcoming resistance is a valuable skill in the lead conversion process. Actively listening, clarifying objections, providing evidence and addressing risks, and offering tailored responses are effective strategies. By demonstrating confidence, professionalism, and trustworthiness, you can alleviate concerns and build trust.

Finally, closing the sale and gaining commitment is the culmination of the lead conversion process. Recap and summarize discussions, address any remaining concerns, present a clear call-to-action, and illustrate the potential impact of working with you. Following up and maintaining client relationships is crucial for long-term success. Regular check-ins, ongoing education, exceptional service, and personalization help foster client loyalty and satisfaction.

In conclusion, successfully converting leads into clients requires a combination of trust building, effective communication, understanding client needs, presenting value propositions, handling objections, closing the sale, and maintaining client relationships. By employing these strategies, you can enhance your lead conversion efforts and build a thriving client base as a financial advisor.