Finance

How To Use Samsung Credit

Published: January 5, 2024

Learn how to make the most of Samsung Credit for your financial needs. Explore our guide on managing and maximizing your Samsung finance options.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Samsung Credit! Whether you’re a proud owner of a Samsung device or considering purchasing one, understanding how to make the most of Samsung Credit can greatly enhance your overall experience. Samsung Credit offers a convenient and flexible way to finance your purchases and manage your finances within the Samsung ecosystem.

Imagine being able to buy the latest Samsung smartphone, tablet, or accessory and pay for it over time, all while enjoying affordable monthly payments. With Samsung Credit, this becomes a reality. But it’s not just limited to device purchases; you can use Samsung Credit for a wide range of products and services offered through the Samsung ecosystem.

In this comprehensive guide, we will walk you through everything you need to know about Samsung Credit – from accessing it on your device to making payments and managing your account. We’ll also provide you with tips and tricks on how to maximize the benefits of Samsung Credit, ensuring you get the most value out of your purchases.

So, whether you’re a tech enthusiast looking to upgrade your device or someone who wants to explore Samsung’s vast array of products and services, let’s dive in and discover how Samsung Credit can make your digital lifestyle more enjoyable and affordable.

What is Samsung Credit?

Samsung Credit is a financing program offered by Samsung that allows customers to make purchases and pay for them over time. It’s designed to provide flexibility and convenience when buying Samsung devices, accessories, and other products or services within the Samsung ecosystem.

When you use Samsung Credit, you have the option to spread out the cost of your purchase over several months or even years, depending on the financing terms available. This means that you can enjoy the latest Samsung devices, such as smartphones, tablets, wearables, and more, without having to pay the full amount upfront.

One of the key benefits of Samsung Credit is the low interest rates and affordable monthly payments. The financing terms are often competitive, making it an attractive option for budget-conscious consumers. Plus, by using Samsung Credit, you can avoid tying up your credit cards or depleting your savings, allowing you to maintain a healthy financial balance.

It’s important to note that Samsung Credit is not a credit card; it’s a financing program specific to Samsung purchases. Therefore, it can only be used at authorized Samsung retail partners or through the Samsung online store. This ensures that you can make your purchases with ease and have access to customer support should you have any questions or issues.

In addition to devices and accessories, Samsung Credit can also be used for other products and services within the Samsung ecosystem. This includes software subscriptions, digital content, and even repair services. The variety of available options allows you to customize your Samsung experience and make purchases that cater to your specific needs and interests.

Overall, Samsung Credit provides a convenient and affordable way to finance your Samsung purchases. Whether you’re an avid tech enthusiast or someone who wants to upgrade their current device, Samsung Credit offers a flexible solution to make your dream purchases a reality.

How to Access Samsung Credit

Accessing Samsung Credit is a straightforward process that can be done through your Samsung device. Here’s a step-by-step guide on how to access Samsung Credit:

- Make sure your Samsung device is connected to the internet.

- Go to the Samsung Pay app on your device. If you don’t have the app installed, you can download it from the Google Play Store.

- Open the Samsung Pay app and sign in to your Samsung account. If you don’t have an account, you can create one by following the on-screen instructions.

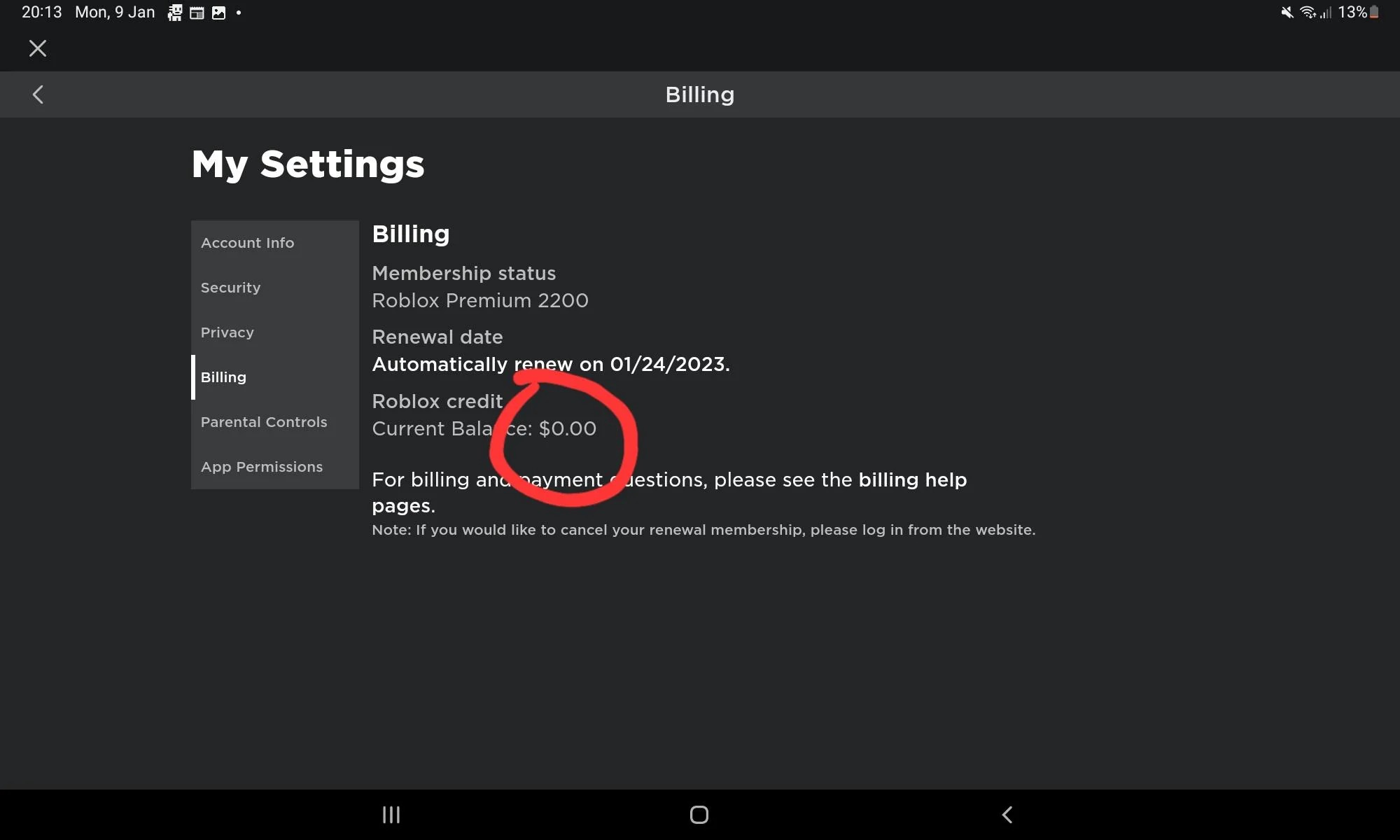

- Navigate to the “Wallet” tab in the Samsung Pay app. Here, you’ll find a list of payment options.

- Find and select the “Samsung Credit” option. This will take you to the Samsung Credit page.

- Once on the Samsung Credit page, you will be able to view details about your credit limit, outstanding balance, and available funds. You can also access payment options and manage your account settings.

It’s important to note that not all Samsung devices may have access to Samsung Credit. Make sure to check if your device is eligible by visiting the Samsung website or contacting customer support.

Once you have accessed Samsung Credit, you’ll be able to explore the various features and benefits it offers. This includes using your credit for purchases, making payments, and managing your account settings to ensure a seamless and enjoyable experience.

With Samsung Credit easily accessible on your device, you can take advantage of its financing options and make your desired purchases without hassle.

Understanding Samsung Credit Limit

When you access Samsung Credit, you will be assigned a credit limit that determines the maximum amount you can finance for your purchases. Understanding your Samsung Credit limit is essential in managing your purchases and payments effectively.

The Samsung Credit limit is influenced by several factors, including your credit history, income, and overall financial profile. Samsung will assess your eligibility for credit and assign a limit based on their evaluation.

It’s important to note that the Samsung Credit limit may vary from person to person. While one individual may have a higher credit limit, another may have a lower one. The credit limit is determined based on your financial standing and creditworthiness.

With your Samsung Credit limit, you can make purchases up to that amount using the financing option. For example, if your credit limit is $1,000, you can make a purchase of up to $1,000 and spread out the payment over the agreed-upon financing terms.

Monitoring your Samsung Credit limit is crucial to avoid overspending and stay within your budget. Before making a purchase, check your available credit to ensure that it’s sufficient to cover the cost of the item. You can easily view your available credit on the Samsung Credit page of your Samsung Pay app.

If you need to increase your Samsung Credit limit, you can contact Samsung customer support to discuss your options. They will guide you through the process and provide you with information on the necessary steps to potentially raise your credit limit.

Keeping track of your Samsung Credit limit and using it responsibly can contribute to maintaining a positive credit score and future credit opportunities. By staying within your limit and making timely payments, you demonstrate financial responsibility and increase your chances of maintaining or even improving your credit limit over time.

Understanding your Samsung Credit limit is essential for making informed purchasing decisions and managing your finances effectively. By staying mindful of your spending and credit usage, you can fully maximize the benefits of Samsung Credit while maintaining a healthy financial balance.

Using Samsung Credit for Purchases

One of the primary benefits of Samsung Credit is the ability to use it for purchases within the Samsung ecosystem. Whether you’re looking to upgrade your smartphone, buy accessories, or explore other products and services, Samsung Credit offers a convenient financing option. Here’s how you can use Samsung Credit for your purchases:

- Browse the Samsung website or visit an authorized Samsung retail partner to explore the wide range of products available.

- Select the item or items you wish to purchase and add them to your cart.

- During the checkout process, choose Samsung Credit as your payment option. This will allow you to finance the purchase rather than paying the full amount upfront.

- Review your order details and confirm the financing terms associated with your Samsung Credit.

- Complete the checkout process by providing any necessary information, such as shipping address and payment confirmation.

Once your purchase is complete, the financed amount will be added to your Samsung Credit balance, and the item will be shipped to you. Depending on the financing terms, you will be required to make monthly payments towards the balance, which may include interest charges.

It’s important to note that Samsung Credit can only be used for purchases within the Samsung ecosystem, including devices, accessories, software subscriptions, digital content, and repair services. Additionally, not all purchases may be eligible for financing, so it’s essential to review the terms and conditions associated with your specific financing offer.

By using Samsung Credit for your purchases, you can enjoy the convenience of affordable monthly payments and the flexibility to choose the products and services that best suit your needs. Whether you’re upgrading to the latest Samsung device or adding accessories to enhance your experience, Samsung Credit makes it easier to access the technology you love.

Making Payments with Samsung Credit

Managing your payments with Samsung Credit is an essential aspect of utilizing the financing program effectively. Making timely payments ensures that you stay on top of your outstanding balance and maintain a positive credit standing. Here’s what you need to know about making payments with Samsung Credit:

1. Payment Options: Samsung offers several convenient ways to make payments towards your Samsung Credit balance. You can make payments through the Samsung Pay app, online through the Samsung website, or by contacting Samsung customer support for assistance.

2. Automatic Payments: To simplify the payment process, you have the option to set up automatic payments through the Samsung Pay app. This ensures that your payments are made consistently and on time, reducing the risk of missing due dates. You can select the preferred payment method (such as a linked bank account or credit card) and choose the date on which the payments should be debited.

3. Manual Payments: If you prefer to make manual payments, you can do so by accessing the Samsung Pay app or visiting the Samsung website. Simply navigate to the Samsung Credit section and follow the prompts to make a payment. Ensure that you make your payments before the designated due dates to avoid any late fees.

4. Payment Frequency: Your specific payment frequency will depend on the financing terms associated with your Samsung Credit. It could be monthly, bi-monthly, or on another predefined schedule. Make sure to review your payment schedule and plan accordingly.

5. Early Payments: In some cases, you may have the option to make early or additional payments towards your Samsung Credit balance. This can help you reduce your outstanding balance faster and potentially save on interest charges. Check the terms and conditions of your financing agreement to see if early payments are allowed and if any penalties or fees apply.

6. Payment Allocations: When you make a payment towards your Samsung Credit balance, the allocated funds usually go towards paying off any accrued interest charges first. Any remaining amount will be applied towards reducing the principal balance. It’s important to understand the payment allocation process to effectively manage your balance and minimize interest costs over time.

Remember, making your payments on time is crucial for maintaining a positive credit standing and avoiding late fees or penalties. Regularly monitoring your Samsung Credit account, setting up payment reminders, and budgeting effectively can help ensure that you stay on top of your payments and maintain a healthy financial profile.

By understanding the payment options, frequency, and allocation process, you can effectively manage and repay your Samsung Credit balance while enjoying the benefits of flexible financing for your Samsung purchases.

Managing Samsung Credit Account

Managing your Samsung Credit account effectively is key to maintaining financial stability and maximizing the benefits of the financing program. Here are some essential tips for managing your Samsung Credit account:

1. Regularly Monitor Your Account: It’s important to stay on top of your Samsung Credit account by regularly monitoring your balance, available credit, and payment due dates. This can be done through the Samsung Pay app or by visiting the Samsung website. By keeping a close eye on your account, you can catch any discrepancies or issues early on and take the necessary action to resolve them.

2. Set Up Account Alerts: To stay informed about your Samsung Credit account activity, consider setting up account alerts. These alerts can be customized to notify you when payments are due, when transactions are made, or if you exceed a certain credit limit. Account alerts can help you stay organized and avoid late payments or potential overspending.

3. Review Statements and Transactions: Take the time to review your monthly statements and transaction history. This allows you to ensure that all charges and payments are accurately reflected. If you notice any discrepancies or unauthorized transactions, promptly contact Samsung customer support to address the issue.

4. Update Your Account Information: If there are any changes to your personal or financial information (such as address, phone number, or payment methods), make sure to update your Samsung Credit account accordingly. This ensures that your account remains up-to-date and that you receive important communications and notifications from Samsung.

5. Optimize Your Payment Strategy: Consider developing a payment strategy that aligns with your financial goals. You can choose to pay off your balance gradually or make additional payments to reduce the principal faster. Assess your budget, income, and other financial obligations to determine the best payment approach for your situation.

6. Contact Customer Support: If you have any questions, concerns, or need assistance with your Samsung Credit account, don’t hesitate to reach out to Samsung customer support. They can provide guidance, clarification, and help resolve any account-related issues.

7. Maintain Good Credit Habits: Managing your Samsung Credit account responsibly contributes to building and maintaining a positive credit history. Make timely payments, stay within your credit limit, and avoid taking on excessive debt. By practicing good credit habits, you not only maximize the benefits of Samsung Credit but also create a solid foundation for your overall financial well-being.

By actively managing your Samsung Credit account, you can enjoy a seamless and rewarding financing experience. By staying organized, proactive, and responsible, you can make the most of Samsung Credit and achieve your desired financial goals.

Tips for Maximizing Samsung Credit Benefits

Maximizing the benefits of Samsung Credit can help you make the most of your purchases and financial opportunities. Here are some valuable tips to enhance your experience with Samsung Credit:

1. Understand Financing Terms: Familiarize yourself with the specific financing terms associated with your Samsung Credit. This includes the interest rate, payment frequency, and duration of the financing period. Understanding these terms allows you to budget effectively and make informed purchasing decisions.

2. Plan Your Purchases: Before making a purchase, consider your needs, budget, and financing capabilities. It’s wise to plan your purchases strategically to ensure they align with your financial goals and avoid unnecessary debt. Prioritize items that are essential or provide long-term value to you.

3. Take Advantage of Promotions: Samsung frequently offers promotions and special financing deals for specific products or during certain periods. Keep an eye out for these promotions as they can provide additional benefits such as zero-down financing or reduced interest rates. This allows you to save money while enjoying the latest Samsung devices and accessories.

4. Pay On Time: Timely payments are crucial for maintaining a positive credit standing and avoiding late fees. Set up payment reminders or automatic payments to ensure you never miss a due date. Consistent on-time payments not only help establish good credit habits but may also increase your credit limit over time.

5. Pay More Than the Minimum: While meeting the minimum payment requirement is essential, consider paying more than the minimum whenever possible. By paying more, you can reduce the principal balance faster and potentially save on interest charges. This approach can help you clear your Samsung Credit balance sooner.

6. Avoid Overspending: It’s tempting to maximize your Samsung Credit by purchasing more than you need. However, it’s crucial to avoid overspending and only buy what aligns with your budget and priorities. Remember, each purchase increases your outstanding balance and monthly payment obligations.

7. Explore Samsung Ecosystem: Samsung Credit can be used for a wide range of products and services within the Samsung ecosystem. Take the opportunity to explore Samsung’s offerings, such as digital content, software subscriptions, or repair services. These options allow you to make the most of Samsung Credit beyond just device purchases.

8. Maintain Good Credit Habits: Using Samsung Credit responsibly contributes to building and maintaining a positive credit history. Make timely payments, keep your credit utilization ratio low, and avoid taking on excessive debt. Good credit habits not only benefit your Samsung Credit but also your overall financial health.

9. Stay Informed: Keep yourself updated on any changes or updates to your Samsung Credit terms and conditions. Regularly review communication from Samsung and be proactive in understanding your rights and responsibilities as a Samsung Credit user.

10. Seek Customer Support: If you have any questions, concerns, or need assistance with your Samsung Credit, don’t hesitate to reach out to Samsung customer support. They can provide clarity and guidance to ensure you have a smooth and satisfactory experience with your Samsung Credit account.

By following these tips, you can optimize your Samsung Credit benefits and make the most of your financing opportunities. Remember to use Samsung Credit responsibly and align your purchases with your financial goals and priorities.

Frequently Asked Questions (FAQs)

Here are answers to some common questions about Samsung Credit:

1. Can anyone apply for Samsung Credit?

Samsung Credit is available to eligible customers. The specific eligibility requirements may vary, but factors such as credit history, income, and other financial information are typically taken into account during the application process.

2. Can I use Samsung Credit for purchases outside of the Samsung ecosystem?

No, Samsung Credit can only be used for purchases within the Samsung ecosystem. This includes Samsung devices, accessories, software subscriptions, digital content, and repair services available through authorized Samsung retail partners or the Samsung online store.

3. Are there any interest charges associated with Samsung Credit?

Yes, depending on the financing terms and conditions, interest charges may apply to Samsung Credit purchases. It’s important to carefully review the terms associated with your specific financing offer to understand the interest rates and fees involved.

4. How can I increase my Samsung Credit limit?

To increase your Samsung Credit limit, you can contact Samsung customer support. They will assess your eligibility based on your financial profile and guide you through the necessary steps to potentially raise your credit limit.

5. Can I make early payments or pay off my Samsung Credit balance in full?

In some cases, you may have the option to make early payments or pay off your Samsung Credit balance before the agreed-upon financing term ends. Consult the terms and conditions of your financing agreement to understand if any penalties or fees apply for early payments.

6. What happens if I miss a payment?

If you miss a payment, you may incur late fees or penalties, and it could also negatively impact your credit score. It’s important to make your payments on time to avoid any adverse consequences. Consider setting up payment reminders or automatic payments to ensure timely payments.

7. Can I use Samsung Credit with other payment methods?

Yes, you can use Samsung Credit in combination with other payment methods, such as credit cards or gift cards, to complete your purchase. During the checkout process, you’ll have the option to choose Samsung Credit and additional payment methods if needed.

8. Can I transfer my Samsung Credit to someone else?

No, Samsung Credit is non-transferable. It can only be used by the account holder and is tied to their specific Samsung account.

9. Can I use Samsung Credit to make online purchases?

Yes, Samsung Credit can be used for online purchases through the Samsung online store or authorized Samsung retail partners. Simply select Samsung Credit as your payment option during the checkout process.

10. How long does it take to get approved for Samsung Credit?

The approval process for Samsung Credit may vary, but typically you will receive a decision shortly after submitting your application. The timeline may vary depending on factors such as verification requirements and any additional information that may be needed.

If you have any further questions or need more information on Samsung Credit, it’s recommended to reach out to Samsung customer support for assistance.

Conclusion

Samsung Credit offers a convenient and flexible financing option for customers within the Samsung ecosystem. Whether you’re interested in upgrading your device, purchasing accessories, or exploring the various products and services offered by Samsung, Samsung Credit provides a seamless way to manage your purchases and payments.

In this comprehensive guide, we’ve covered the basics of Samsung Credit, including how to access it on your device and understand your credit limit. We’ve also discussed how to use Samsung Credit for purchases, make payments, and manage your account effectively.

By following the tips provided, you can maximize the benefits of Samsung Credit. From planning your purchases strategically to making timely payments and maintaining good credit habits, you have the power to stay in control of your finances and make the most of your Samsung Credit experience.

If you have any additional questions or concerns, don’t hesitate to reach out to Samsung customer support. They are available to provide guidance, address any issues, and ensure that your Samsung Credit experience is smooth and satisfactory.

Remember, Samsung Credit is not just a financing program; it’s a gateway to exploring and enjoying the vast range of products and services offered by Samsung. With Samsung Credit, you can enhance your digital lifestyle while maintaining financial stability.

So, whether you’re looking to upgrade to the latest Samsung device or make the most of the Samsung ecosystem, take advantage of Samsung Credit and embark on a seamless and rewarding journey with Samsung.