Finance

How To Use Zulily Credit

Published: January 5, 2024

Learn how to effectively use your Zulily credit to manage your finances and make the most of your shopping experience.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Zulily Credit! If you’re an avid shopper, you’ve likely heard of Zulily – the online retailer known for its daily flash sales on a wide range of products, including clothing, accessories, toys, home décor, and more. But did you know that Zulily also offers its own line of credit for qualified customers?

Using Zulily Credit can provide you with a convenient and flexible payment option, allowing you to enjoy the exciting deals and discounts available on their website. Whether you want to revamp your wardrobe, redecorate your home, or find the perfect gift, Zulily Credit can help make your shopping experience even more enjoyable.

In this article, we will explore how to use Zulily Credit effectively, understanding the application process, credit terms, and rewards. By the end, you’ll be equipped with all the information you need to make the most out of your Zulily shopping experience and take advantage of the benefits that come with having a Zulily Credit account.

So, if you’re ready to discover how to make the most of your Zulily Credit, let’s jump right in and explore the ins and outs of this fantastic shopping tool.

Creating a Zulily Account

Before you can start using Zulily Credit, you’ll need to create an account on the Zulily website. Don’t worry—it’s a quick and easy process.

To get started, visit the Zulily website and locate the “Sign In” or “Join” button. Click on it to begin the account creation process. You’ll be prompted to enter your email address and create a password. Make sure to choose a strong password that is both secure and easy for you to remember.

Once you’ve entered your email and password, you will be asked to provide some additional information, such as your name and shipping address. It’s important to provide accurate information to ensure that your purchases and payments are processed correctly.

After entering your personal information, you can choose to receive email updates about new sales and promotions by checking the appropriate box. This will keep you informed about the latest deals and exciting offers from Zulily.

Finally, click on the “Create Account” or “Join Zulily” button to complete the registration process. You will then receive a confirmation email with a link to verify your account. Click on the link to activate your Zulily account and start exploring the fabulous products available.

Remember to keep your login credentials secure and always sign out of your account after each session, especially if you are using a shared device. This will help protect your personal information and prevent unauthorized access to your Zulily account.

Now that you have successfully created your Zulily account, you are ready to apply for Zulily Credit and take advantage of its benefits. Let’s move on to the next step—applying for Zulily Credit.

Applying for Zulily Credit

Once you have a Zulily account, applying for Zulily Credit is a breeze. Simply follow these steps to get started:

- Log in to your Zulily account using your email address and password.

- Go to the Zulily Credit section on the website. Look for the “Zulily Credit” or “Apply Now” button.

- Click on the button to start the application process.

- You will be asked to provide some personal and financial information, such as your name, address, annual income, and social security number. It’s important to ensure that all the information you provide is accurate and up-to-date.

- Once you have completed the application, click on the “Submit” or “Apply” button.

After submitting your application, the Zulily Credit team will review your information and assess your eligibility. The approval process typically takes a few minutes, but in some cases, it may take longer.

If your application is approved, you will receive a notification via email, and your Zulily Credit account will be activated. You can now start making purchases using your Zulily Credit.

It’s important to note that Zulily Credit is subject to credit approval, and not all applicants may be eligible. The terms and conditions of Zulily Credit, including the credit limit and interest rates, will be determined based on your creditworthiness.

If your application is not approved, don’t worry. You can still enjoy shopping on Zulily using alternative payment methods, such as credit cards or debit cards.

Now that you know how to apply for Zulily Credit, let’s move on to the next section, where we will explore the terms and conditions of Zulily Credit.

Understanding Zulily Credit Terms

Before you start using your Zulily Credit, it’s important to familiarize yourself with the terms and conditions associated with the credit account. Here’s what you need to know:

Credit limit: Your credit limit is the maximum amount of credit available to you on your Zulily Credit account. The credit limit is determined based on various factors, including your creditworthiness and financial history. It represents the total amount you can spend using your Zulily Credit.

Interest rates: Zulily Credit offers different interest rates based on your creditworthiness. The interest rate is the percentage of the outstanding balance that accrues as interest charges. It’s important to pay attention to the interest rates associated with your Zulily Credit account to understand how much it will cost you if you carry a balance.

Promotional offers: Zulily often provides promotional offers and discounts to its credit customers. These promotions can include special financing options, discounted rates, or exclusive deals. Keep an eye out for these offers to make the most of your Zulily Credit account.

Payment terms: Zulily Credit requires minimum monthly payments based on your outstanding balance. It’s important to make at least the minimum payment by the due date to avoid late fees and adverse effects on your credit score. Remember, paying off your balance in full each month can help you avoid accumulating interest charges.

Credit rewards: Zulily Credit offers rewards to its cardholders. You can earn rewards points for every dollar you spend using your Zulily Credit. These points can then be redeemed for discounts on future purchases, allowing you to save even more on your favorite products.

Annual fees: Zulily Credit does not charge any annual fees. This means you can enjoy the benefits of Zulily Credit without any additional costs.

Customer service: Zulily provides dedicated customer service for its credit customers. If you have any questions or need assistance with your Zulily Credit account, you can reach out to their customer service team for support.

By familiarizing yourself with these terms, you can manage your Zulily Credit account effectively and make the most of the benefits it offers. Now, let’s move on to the next section where we will explore how to make purchases using your Zulily Credit.

Making Purchases with Zulily Credit

Now that you have your Zulily Credit account set up and understand the terms, it’s time to start using it to make purchases. Here’s how:

- Browse the Zulily website and find the products you want to purchase. Zulily offers a wide range of items, from clothing and accessories to home décor and toys.

- Add the items to your shopping cart by clicking on the “Add to Cart” button. You can continue shopping and add multiple products to your cart.

- When you’re ready to proceed to checkout, click on the cart icon or the “Checkout” button.

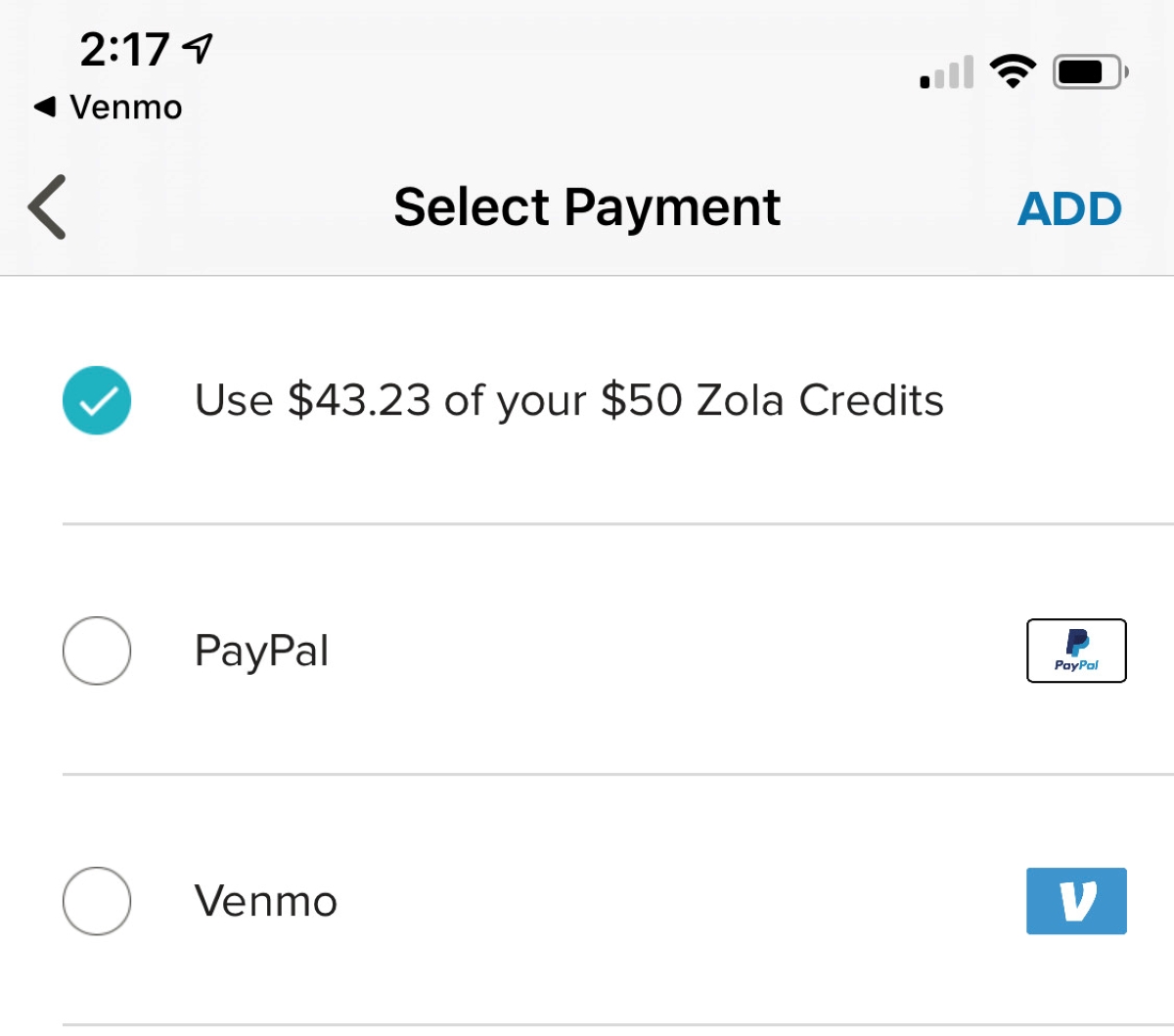

- On the checkout page, you’ll see the option to choose your payment method. Select “Zulily Credit” as your payment option.

- Enter your Zulily Credit card information, including the card number, expiration date, and security code.

- Review your order details, including the items, quantities, and prices.

- If everything looks correct, click on the “Place Order” or “Submit Payment” button to complete your purchase.

Once you’ve placed your order, the purchase amount will be charged to your Zulily Credit account. You can enjoy the convenience of paying off your balance over time, or you can choose to make a larger payment to reduce your outstanding balance.

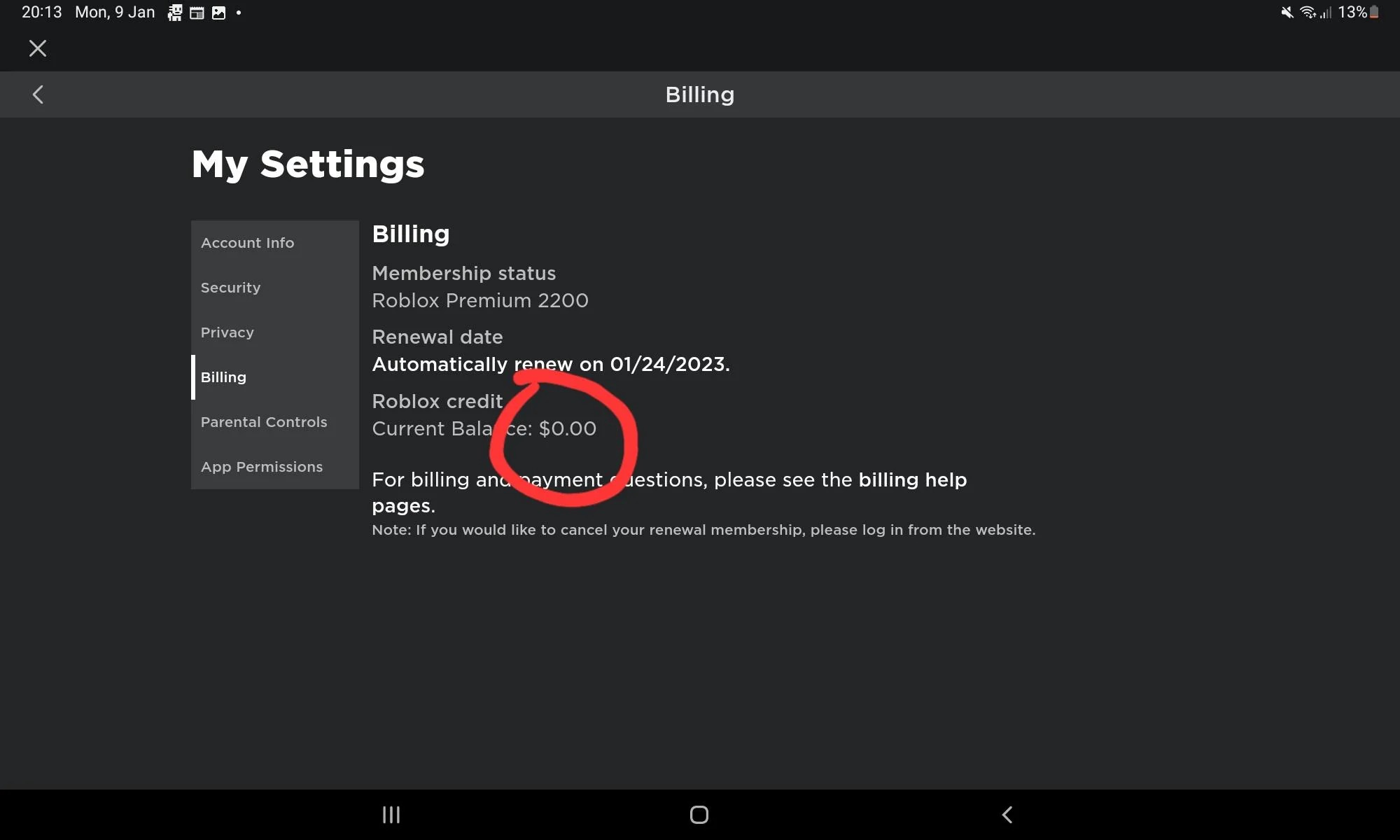

It’s important to keep track of your purchases and payments to stay within your credit limit and avoid overspending. Zulily provides account management tools on their website that allow you to view your recent transactions, check your balance, and make payments.

Remember, using your Zulily Credit responsibly and making timely payments will help you maintain a good credit score and enjoy the benefits of the credit account.

Now that you know how to make purchases with Zulily Credit, let’s move on to the next section where we will discuss managing your credit payments.

Managing Zulily Credit Payments

Managing your Zulily Credit payments is essential for maintaining a healthy credit account and avoiding unnecessary fees. Here are some tips to help you effectively manage your payments:

1. Understand your billing cycle: Familiarize yourself with your billing cycle and the due date for your monthly payments. This will ensure that you know when your payments are due and avoid any late fees or penalties.

2. Make timely payments: It’s important to make your Zulily Credit payments on time to avoid late fees and maintain a good credit score. Consider setting up automatic payments or setting reminders to help you stay on top of your payment schedule.

3. Pay more than the minimum amount: While making the minimum payment is required, paying more than the minimum can help you reduce your outstanding balance faster and save on interest charges. Aim to pay off your balance in full each month if possible.

4. Utilize online account management: Take advantage of the online account management tools provided by Zulily to track your payments, view your transaction history, and monitor your balance. Regularly check your account to ensure that your payments are reflected accurately.

5. Monitor your credit utilization: Keep an eye on your credit utilization ratio, which is the percentage of your available credit that you are using. Ideally, you should aim to keep your credit utilization below 30% to maintain a healthy credit profile.

6. Reach out for support: If you are facing financial difficulties and are unable to make your Zulily Credit payments, it’s important to reach out to their customer service team. They may be able to provide assistance or offer alternative payment solutions.

By effectively managing your Zulily Credit payments, you can maintain a positive credit history, avoid fees and penalties, and make the most of your credit account. Now let’s move on to the next section, where we will explore the rewards you can earn with Zulily Credit.

Tracking Zulily Credit Rewards

One of the benefits of using Zulily Credit is the opportunity to earn rewards on your purchases. Tracking and maximizing these rewards can help you save even more on your favorite products. Here’s how you can keep track of your Zulily Credit rewards:

1. Understand the rewards program: Familiarize yourself with the details of the Zulily Credit rewards program. This includes understanding how many points you earn for each dollar spent and the value of those points when redeemed for discounts.

2. Monitor your points balance: Zulily provides a dedicated section on their website where you can track your rewards points. Log in to your Zulily account and navigate to the rewards section to see your current points balance.

3. Redeem your rewards: Once you have accumulated enough points, you can redeem them for discounts on future purchases. Check for any available rewards or promotional offers that can further enhance the value of your points.

4. Keep an eye on promotions: Zulily often offers special promotions, such as double or triple rewards points on specific items or during specific periods. Stay updated on these promotions to maximize the benefits of your Zulily Credit rewards.

5. Utilize rewards strategically: Plan your purchases in a way that allows you to use your rewards effectively. For example, if you have a significant number of rewards points, consider using them for larger purchases or items that you have been eyeing for a while.

6. Maintain an active account: To continue earning rewards, make sure to use your Zulily Credit account regularly. Keep an eye out for new sales and promotions and make purchases using your Zulily Credit to accrue additional rewards points.

By actively tracking and utilizing your Zulily Credit rewards, you can enhance your shopping experience and enjoy additional savings on your purchases. Now let’s move on to the final section, where we will discuss the process of canceling your Zulily Credit account if needed.

Cancelling Zulily Credit

If for any reason you decide that Zulily Credit is no longer the right fit for you, it is possible to cancel your Zulily Credit account. Here are the steps to follow if you wish to cancel:

- Contact Zulily customer service: To initiate the cancellation process, reach out to Zulily’s customer service team. You can find their contact information on the Zulily website. Consider choosing a contact method that provides a written record of your request, such as email or online chat.

- Request cancellation: Inform the customer service representative of your intention to cancel your Zulily Credit account. Be prepared to provide your account details to assist in the process.

- Confirm the cancellation: The customer service representative will guide you through the cancellation process and provide any necessary information or instructions. Make sure to ask about any remaining balances, outstanding payments, or pending rewards.

- Follow up on the cancellation: After initiating the cancellation, it is important to monitor your account to ensure that it is properly closed. Check for any remaining charges or activities and contact customer service again if necessary.

It’s important to note that cancelling your Zulily Credit account will not affect your regular Zulily account. You will still be able to browse and make purchases on the Zulily website using alternative payment methods, such as credit cards or debit cards.

Before making a decision to cancel your Zulily Credit account, consider the impact it may have on your credit score. Closing a credit account can affect your credit utilization ratio and potentially impact your credit history. If you have concerns about how canceling Zulily Credit may affect your credit, it may be helpful to consult with a financial advisor or credit expert.

Now that you know how to cancel your Zulily Credit account, let’s wrap up our discussion.

Conclusion

Congratulations! You have now learned all about using Zulily Credit to enhance your shopping experience. From creating your Zulily account to understanding the credit terms, making purchases, managing payments, tracking rewards, and even canceling the credit account if needed, you are equipped with the knowledge to make the most of this convenient and flexible payment option.

By using Zulily Credit, you can take advantage of the exciting flash sales and daily deals offered on the Zulily website. Whether you’re looking for stylish fashion finds, unique home décor, or toys for your little ones, Zulily has something for everyone.

Remember to use your Zulily Credit responsibly by making timely payments and keeping track of your balance. This will not only help you avoid unnecessary fees but also enable you to maintain a positive credit history.

Don’t forget to take advantage of the rewards program offered by Zulily Credit. By earning and redeeming rewards points, you can enjoy additional savings on your future purchases and make your shopping experience even more rewarding.

Should you ever decide that Zulily Credit no longer suits your needs, follow the proper steps to cancel your account and explore alternative payment options offered by Zulily.

So, start exploring the fantastic deals on Zulily, apply for Zulily Credit, and enjoy the convenience and benefits it brings to your shopping journey. Happy shopping!