Finance

How To Withdraw Money From Nationwide 401K

Published: October 17, 2023

Learn how to withdraw money from Nationwide 401K and manage your finance effectively with our step-by-step guide. Ensure a secure and hassle-free process for accessing your funds.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Nationwide 401K Withdrawal Options

- Assessing Eligibility for Withdrawal

- Required Minimum Distributions (RMDs)

- Withdrawal Rules and Penalties

- Early Withdrawal Options

- How to Initiate a Withdrawal from Nationwide 401K

- Forms and Documentation Required

- Tax Implications of 401K Withdrawals

- Considerations Before Withdrawing from Nationwide 401K

- Conclusion

Introduction

A Nationwide 401K account can serve as a valuable resource for building retirement savings. However, there may come a time when you need to withdraw money from your 401K. Whether it is for financial emergencies, major life events, or simply to cover day-to-day expenses in retirement, understanding the withdrawal options available to you is crucial.

In this article, we will explore the various ways you can withdraw money from your Nationwide 401K account, including eligibility requirements, rules, and potential penalties. We will also discuss the documentation and forms you may need to initiate a withdrawal, as well as the tax implications associated with 401K withdrawals. By the end, you should have a better understanding of how to navigate the withdrawal process and confidently make informed decisions regarding your Nationwide 401K.

It’s important to note that 401K withdrawals should be approached with careful consideration, as they can have long-term implications for your retirement savings. Before making any decisions, it is highly recommended to consult with a financial advisor to ensure you are fully aware of the potential consequences and to explore alternative options that may better suit your financial needs.

Understanding Nationwide 401K Withdrawal Options

When it comes to withdrawing money from your Nationwide 401K account, you have several options to consider. The specific options available to you will depend on various factors, such as your age, employment status, and the type of 401K plan you have. Let’s take a closer look at the most common Nationwide 401K withdrawal options:

- Lump-sum withdrawal: This is the simplest and most straightforward option. With a lump-sum withdrawal, you can take the entire balance of your 401K account in a single payment. However, keep in mind that withdrawing a large sum all at once may have tax implications, and you might lose the potential for further growth if the funds are not reinvested.

- Partial withdrawal: If you don’t need the full amount of your 401K balance, you can choose to withdraw only a portion of it. This can be helpful if you have specific financial needs or expenses to cover. By taking a partial withdrawal, you can leave the remaining funds in your account to continue growing.

- Periodic withdrawals: Rather than taking a lump sum or partial withdrawal, you may opt for periodic withdrawals. This allows you to receive a specified amount of money on a regular basis (e.g., monthly or annually) for a predetermined period or until your 401K balance is exhausted.

- IRA rollover: If you are leaving your current employer but would like to keep your retirement savings growing tax-deferred, you may consider rolling over your Nationwide 401K funds into an Individual Retirement Account (IRA). This allows you to maintain control over your retirement savings and provides more flexibility in investment options.

- Loans: In certain circumstances, you may be eligible to take a loan from your Nationwide 401K account. This can be a useful option if you need immediate funds but want to avoid early withdrawal penalties. However, it’s important to note that loans must be repaid with interest.

Each withdrawal option comes with its own set of advantages and considerations. Therefore, it’s crucial to carefully evaluate your financial situation, goals, and retirement needs before deciding which option is the most appropriate for you. Additionally, it’s always recommended to consult with a financial advisor to fully understand the potential impact of these withdrawal options on your overall retirement plan.

Assessing Eligibility for Withdrawal

Before you can withdraw money from your Nationwide 401K account, it’s important to determine if you meet the eligibility requirements. Eligibility for withdrawal can vary based on several factors, including age, employment status, and the specific rules outlined in your 401K plan. Let’s explore some of the key considerations:

Age restrictions: In most cases, you must reach a certain age before you can withdraw funds from your 401K without penalties. The age requirement is typically either 59 ½ or 55, depending on the provisions of your plan. Withdrawals made before reaching this age are generally considered early withdrawals and may be subject to additional taxes and penalties.

Employment status: Your employment status can also impact your eligibility for withdrawal. If you are still actively employed with the company that sponsors your 401K plan, you may have limited withdrawal options. Some plans allow in-service withdrawals, which means you can take out a portion of your funds while still working, while others restrict withdrawals until you retire or reach a certain age.

Plan rules: Each 401K plan has its own set of rules regarding eligibility for withdrawal. It’s essential to review the terms and conditions of your specific plan to understand the deadlines, restrictions, and any special provisions that may apply. Your plan administrator or human resources department can provide you with the necessary information to assess your eligibility.

It’s worth noting that depending on your circumstances, you may be eligible for certain exceptions or special provisions that allow for penalty-free withdrawals, such as financial hardship, disability, or certain medical expenses. It’s important to thoroughly review your plan’s documentation or consult with a financial advisor to understand these exceptions and determine if you meet the criteria.

Once you have confirmed your eligibility for withdrawal, it’s crucial to proceed with caution. Early withdrawals, even if allowed, can significantly impact your retirement savings and may result in tax liabilities and penalties. Therefore, it’s essential to evaluate your financial needs, consult with a professional advisor, and explore alternative options before making any withdrawals from your Nationwide 401K account.

Required Minimum Distributions (RMDs)

Once you reach a certain age, the Internal Revenue Service (IRS) requires you to start taking distributions from your Nationwide 401K account, known as Required Minimum Distributions (RMDs). RMDs are mandatory withdrawals that ensure individuals do not indefinitely defer their taxes on retirement savings. Here’s what you need to know about RMDs:

Age requirement: The age at which you must begin taking RMDs depends on whether you are the account owner or a beneficiary. As an account owner, you are generally required to start RMDs by April 1st following the year in which you turn 72. However, if you were born before July 1, 1949, you fall under the previous rules and have to start RMDs by April 1st following the year you turn 70 ½. If you are a beneficiary of a 401K account, the rules regarding RMDs vary depending on your relationship to the original account owner.

Calculating RMDs: The IRS provides a formula for calculating the annual amount you must withdraw for RMDs. The calculation takes into account your age, account balance, and life expectancy. The IRS provides a Uniform Lifetime Table that offers life expectancy figures for determining RMD amounts. Your plan administrator or a financial advisor can assist you with calculating your RMDs accurately.

Withdrawal options: When it comes to taking RMDs from your Nationwide 401K, you have some flexibility in how you receive the distributions. You can take the RMD amount in a lump sum or spread it out over the course of the year in periodic installments. It’s important to remember that RMDs are subject to income taxes, so it’s advisable to plan accordingly to manage tax implications.

Penalties for non-compliance: Failing to take the RMD amount by the required deadline can result in significant penalties. The IRS imposes a 50% excise tax on the difference between the RMD you should have taken and the amount you actually withdrew. To avoid penalties, it’s crucial to familiarize yourself with the RMD requirements and ensure you take the required distribution on time each year.

It’s important to note that RMDs only apply to traditional 401K accounts. If you have a Roth 401K, RMDs do not apply during your lifetime. However, if you inherit a Roth 401K account, you may be subject to certain distribution rules depending on the circumstances.

Understanding RMD regulations is essential to ensure compliance with IRS requirements and avoid penalties. If you have questions or need assistance, it’s recommended to consult with a financial advisor or tax professional who can guide you through the process and help you make informed decisions regarding your RMDs.

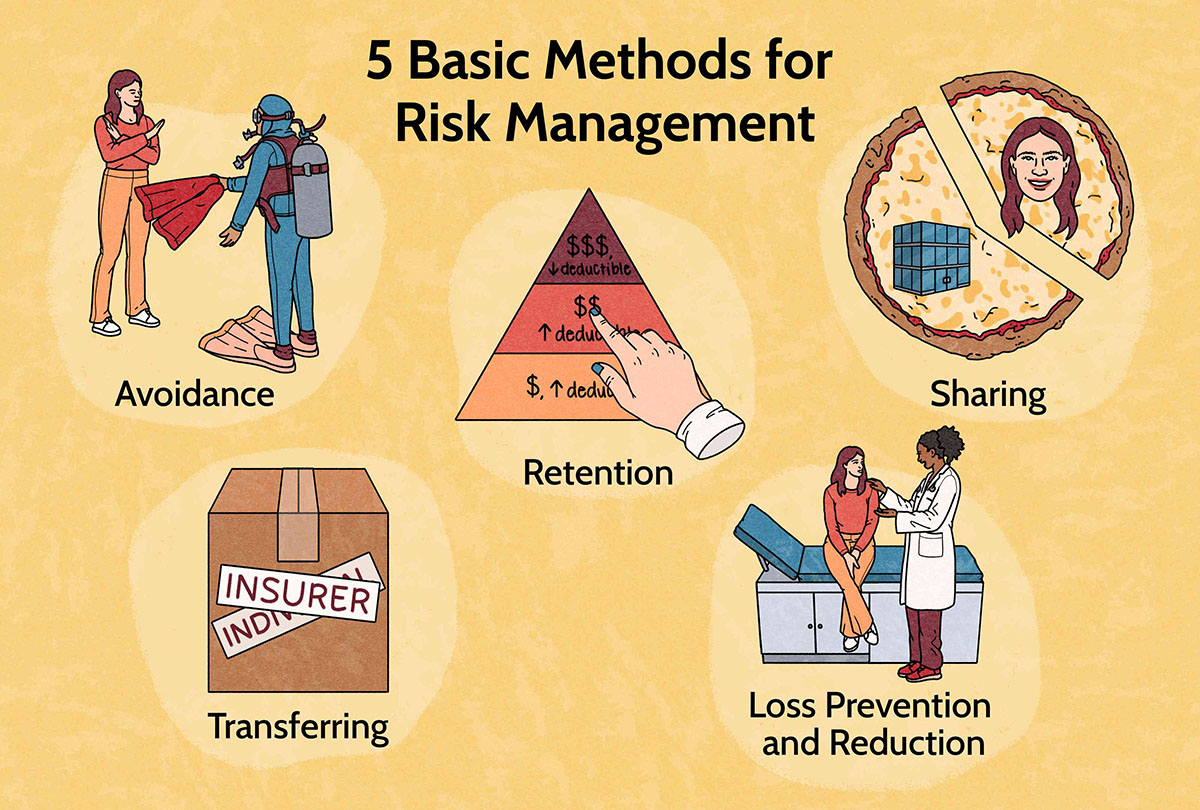

Withdrawal Rules and Penalties

When it comes to withdrawing money from your Nationwide 401K account, it’s important to understand the withdrawal rules and potential penalties that may apply. Each 401K plan has its own set of guidelines, but here are some general rules and penalties to be aware of:

Early withdrawal penalties: If you withdraw funds from your 401K before reaching the age of 59 ½, you will likely be subject to early withdrawal penalties. The IRS imposes a 10% penalty on the amount withdrawn, in addition to regular income taxes. It’s crucial to consider this penalty when contemplating early withdrawals, as it can significantly reduce the amount of money you receive.

Exceptions to early withdrawal penalties: While early withdrawal penalties generally apply, there are certain exceptions that allow you to avoid them. These exceptions include financial hardship, disability, medical expenses exceeding a certain threshold, qualified higher education expenses, and certain military service-related distributions. It’s important to review your plan’s documentation or consult with a financial advisor to determine if you qualify for any of these exceptions.

Required Minimum Distributions (RMDs): As mentioned in the previous section, once you reach a certain age, the IRS requires you to take minimum distributions from your 401K account. Failing to take these required distributions can result in a hefty penalty of 50% of the amount you should have withdrawn. It’s crucial to understand the RMD rules and ensure compliance to avoid this significant penalty.

Tax withholding: When you withdraw funds from your Nationwide 401K account, the plan administrator is required to withhold a certain percentage for federal income taxes. The withheld amount depends on the total withdrawal and your tax bracket. It’s essential to keep this in mind as it may impact the net amount you receive. Additionally, be aware that taxes on 401K withdrawals are due at the time of withdrawal, so it’s important to plan for these tax liabilities.

Plan-specific rules: While there are general withdrawal rules and penalties, it’s important to review the specific guidelines outlined in your Nationwide 401K plan. Each plan may have its own unique provisions, restrictions, and processes for initiating withdrawals. Familiarize yourself with your plan’s documentation or consult with the plan administrator to understand the specific rules that govern your withdrawal options.

Before making any withdrawals from your Nationwide 401K account, it’s advisable to carefully consider the potential penalties and tax implications. Early withdrawals should generally be avoided unless you have a compelling reason and meet one of the exceptions. It’s highly recommended to consult with a financial advisor or tax professional to assess the impact of withdrawal decisions on your overall financial plan and retirement goals.

Early Withdrawal Options

While early withdrawals from your Nationwide 401K account should generally be avoided due to potential penalties and tax implications, there are certain circumstances in which you may need to access the funds before reaching the age of 59 ½. Here are some early withdrawal options to consider:

Financial hardship withdrawal: If you are facing immediate and severe financial hardship, you may be eligible for a hardship withdrawal from your Nationwide 401K account. Examples of situations that may qualify as hardships include medical expenses, the purchase of a primary residence, tuition payments, and funeral expenses. However, it’s important to note that hardship withdrawals come with strict eligibility requirements and typically cannot exceed the amount needed to alleviate the hardship.

Substantially Equal Periodic Payments (SEPP): Under the SEPP rule, you can take early withdrawals from your 401K without incurring the 10% early withdrawal penalty. To qualify, you must set up scheduled periodic payments based on your life expectancy. The withdrawals must continue for at least five years or until you reach the age of 59 ½, whichever is longer. It’s important to carefully calculate the withdrawal amount, as changing the schedule or amount during the SEPP period can result in penalties.

IRA rollover: Instead of directly withdrawing funds from your Nationwide 401K account, you may choose to roll over the funds into an Individual Retirement Account (IRA). This can be a preferable option if you need early access to the funds but want to avoid penalties and preserve the tax-advantaged nature of your retirement savings. A direct rollover can be done without penalty, as long as the funds are deposited into the IRA within 60 days.

Loans from 401K: Some 401K plans allow participants to take loans from their accounts, which can be a viable option for short-term financial needs. The loan must be repaid within a specified period, typically five years, and is subject to interest. It’s vital to review your plan’s loan provisions, including interest rates and repayment terms, to determine if this is a suitable option for your situation.

When considering any early withdrawal option, it’s crucial to weigh the immediate financial need against the potential long-term impact on your retirement savings. Early withdrawals can significantly reduce the amount available for your retirement and can adversely affect the growth potential of your investments. It’s always recommended to consult with a financial advisor or tax professional to fully understand the implications of early withdrawals and explore alternative options that may better suit your financial needs and goals.

How to Initiate a Withdrawal from Nationwide 401K

When you’re ready to initiate a withdrawal from your Nationwide 401K account, it’s important to follow the proper process to ensure a smooth transaction. Here are the general steps to initiate a withdrawal:

- Contact your plan administrator: Begin by reaching out to your plan administrator or the human resources department of your employer. They will provide you with the necessary information and guide you through the withdrawal process. Make sure to inquire about any specific procedures or forms required by your plan.

- Review plan documentation: Familiarize yourself with your Nationwide 401K plan’s documentation, including the summary plan description or any plan amendments, to understand the rules and provisions that govern withdrawals. Pay special attention to any eligibility requirements, withdrawal options, and potential penalties.

- Complete the necessary forms: Your plan administrator will provide you with the appropriate forms to initiate a withdrawal request. These forms typically require you to provide personal information, specify the withdrawal amount, and indicate the preferred method of receiving the funds, such as a direct deposit into a bank account or a check mailed to your address.

- Submit the forms: Once you have completed the necessary forms, submit them to your plan administrator or follow the instructions provided. Make sure to double-check the forms for accuracy and include any supporting documentation that may be required, such as proof of age or documentation for hardship withdrawals.

- Verify completion: After submitting the withdrawal request, follow up with your plan administrator to ensure that your request has been received and processed. Keep track of any confirmation or reference numbers provided for future reference.

- Monitor your account: As the withdrawal request is being processed, keep an eye on your Nationwide 401K account to verify that the funds have been transferred or deducted accordingly. If you have opted for a direct deposit, check your bank account to confirm the receipt of the funds.

It’s important to note that the process of initiating a withdrawal may vary depending on your specific plan and the procedures established by your employer. Plan administrators are there to assist you throughout this process and answer any questions you may have.

Lastly, be mindful of any deadlines or timing considerations for withdrawals, as delays or failure to comply with withdrawal requirements could result in penalties or tax consequences. If you are unsure about any aspect of the withdrawal process, it’s always recommended to consult with a financial advisor or seek guidance from a professional to ensure a seamless and compliant withdrawal from your Nationwide 401K account.

Forms and Documentation Required

Initiating a withdrawal from your Nationwide 401K account typically requires specific forms and documentation to ensure compliance with plan rules and regulations. While the exact requirements may vary depending on your plan and the type of withdrawal you are requesting, there are some common forms and documentation that may be required. Here’s what you may need:

Withdrawal request form: This form, provided by your plan administrator, is the primary document used to initiate a withdrawal. It typically includes sections for personal information, withdrawal amount, preferred method of receiving funds, and any additional information required for specific types of withdrawals.

Proof of identification: To verify your identity, you may need to provide a copy of your valid government-issued identification, such as a driver’s license, passport, or Social Security card. This helps ensure that only authorized individuals can access and withdraw funds from your Nationwide 401K account.

Proof of age: Certain withdrawals, such as those taken under the age of 59 ½ or those required for a hardship withdrawal, may require proof of age. This can be provided through a copy of your birth certificate, passport, or other official documents that clearly state your date of birth.

Proof of financial hardship: If you are applying for a financial hardship withdrawal, you may be required to provide documentation to support your claim. This can include medical bills, housing-related documents, tuition invoices, or any relevant paperwork that demonstrates the financial difficulty you are facing.

Spousal consent form: If you are married and wish to withdraw funds from your Nationwide 401K account, your spouse may need to sign a spousal consent form, depending on the plan rules. This form acknowledges their awareness and agreement to the withdrawal and ensures that both spouses are informed about the financial decisions being made.

Direct deposit information: If you prefer to receive your withdrawal funds through a direct deposit into your bank account, you will need to provide your bank details. This information typically includes your bank name, account number, and routing number to facilitate the transfer of funds securely.

It’s important to consult with your plan administrator to determine the specific forms and documentation required for your Nationwide 401K withdrawal. They can provide you with the necessary paperwork and guide you through the process to ensure a smooth and compliant withdrawal.

Remember to carefully review all forms for accuracy and completeness before submitting them to avoid any delays or issues. When dealing with sensitive personal information, such as identification and financial documents, take appropriate measures to securely transmit and handle these materials.

By providing the required forms and documentation, you can ensure that your withdrawal request is processed efficiently and in compliance with the rules of your Nationwide 401K plan.

Tax Implications of 401K Withdrawals

When considering a withdrawal from your Nationwide 401K account, it is important to understand the tax implications associated with the distribution. Here are some key points to consider:

Income taxes: Withdrawals from a traditional 401K account are generally subject to income taxes. The funds you withdraw are treated as taxable income in the year you receive them. This means that the amount withdrawn will be added to your total income for that year, potentially pushing you into a higher tax bracket and resulting in a higher overall tax liability.

Early withdrawal penalties: If you withdraw funds from your 401K before reaching the age of 59 ½, you may also face an early withdrawal penalty of 10% imposed by the IRS. This penalty is in addition to any income taxes owed on the distribution. However, certain exceptions, such as financial hardship, disability, or qualified higher education expenses, may allow you to avoid the penalty.

Roth 401K tax treatment: If you have a Roth 401K account, the tax treatment differs. Qualified distributions from a Roth 401K are tax-free, as long as specific requirements are met. This means that you won’t owe income taxes on the withdrawn amount. However, it’s important to note that earnings on the contributions may be subject to taxes and penalties if withdrawn before meeting the requirements for a qualified distribution.

Required Minimum Distributions (RMDs): As discussed earlier, once you reach a certain age, the IRS requires you to start taking RMDs from your traditional 401K account. The amount of these distributions is taxable as ordinary income in the year you receive them. It’s important to plan for these tax obligations and account for the impact on your overall tax liability.

Tax withholding: When you initiate a withdrawal from your Nationwide 401K account, the plan administrator is required to withhold a certain percentage for federal income taxes. The amount withheld depends on the total withdrawal and your tax bracket. However, the withholding percentage may not fully cover your tax liability, especially if you are subject to higher taxes due to the distribution.

State taxes: In addition to federal taxes, you may also be subject to state income taxes on your 401K withdrawals, depending on the state in which you reside. State tax laws vary, so it’s important to understand the specific tax regulations and requirements in your state.

It’s essential to plan and budget accordingly for the tax implications of 401K withdrawals. Consider consulting with a tax professional or financial advisor who can help you understand the potential tax liabilities and assist in devising a strategy to minimize any adverse effects on your financial situation.

By being aware of the tax implications and taking proactive steps to manage them, you can make more informed decisions when it comes to withdrawing funds from your Nationwide 401K account and better prepare for the consequences on your overall tax situation.

Considerations Before Withdrawing from Nationwide 401K

Withdrawing funds from your Nationwide 401K account is a significant decision that can have lasting effects on your retirement savings. Before making the decision to withdraw, it’s important to carefully consider the following factors:

Retirement goals: Revisit your retirement goals and evaluate the impact of the withdrawal on your overall retirement plan. Will the withdrawal significantly impact your long-term financial security? Consider whether the immediate need for funds justifies potentially jeopardizing your retirement savings.

Financial needs and alternatives: Assess your financial situation and explore alternative options before deciding to withdraw from your 401K. Can you meet your needs through other means, such as reducing expenses, reallocating other assets, or seeking additional sources of income? Consider consulting with a financial advisor to identify potential alternatives that may be less impactful on your retirement savings.

Impact on retirement savings: Understand the long-term impact of a withdrawal on your retirement savings. Withdrawing funds early can reduce the overall growth potential of your investments, potentially leaving you with less money in retirement. Consider the potential opportunity cost of withdrawing now versus allowing your funds to grow tax-deferred until retirement.

Tax implications: Evaluate the tax implications associated with a withdrawal from your Nationwide 401K. With traditional 401K accounts, withdrawals are generally subject to income taxes, potentially pushing you into a higher tax bracket. It’s important to plan for these tax obligations and assess the net amount you will receive after taxes.

Penalties: Understand the potential penalties associated with early withdrawals. If you withdraw funds before the age of 59 ½, you may be subject to a 10% early withdrawal penalty from the IRS, in addition to income taxes. Explore whether you qualify for any exceptions to avoid penalties, such as financial hardship or qualified expenses.

Future needs and contingencies: Consider future needs and potential contingencies that may arise. Once withdrawn, the funds may no longer be available for future financial emergencies or unexpected expenses. Ensure that you have a comprehensive understanding of your current and future financial needs before making a withdrawal.

Expert advice: Seek the guidance of a financial advisor or retirement planning professional who can provide personalized advice based on your unique circumstances. They can help you assess the potential consequences of a withdrawal and explore alternative solutions to meet your financial needs without compromising your long-term retirement goals.

It’s important to approach the decision to withdraw from your Nationwide 401K with careful consideration. Taking the time to evaluate your financial situation, explore alternatives, and seek expert advice can help you make an informed decision that aligns with your overall financial goals and retirement objectives.

Conclusion

Withdrawing money from your Nationwide 401K account is a major decision that should not be taken lightly. It is essential to understand the withdrawal options, eligibility requirements, tax implications, and potential penalties associated with early withdrawals.

Before making a withdrawal, carefully consider your retirement goals, financial needs, and alternatives available to you. Evaluate the impact of a withdrawal on your retirement savings and analyze whether there are other ways to meet your financial obligations without jeopardizing your long-term financial security.

Take into account the potential tax liabilities and penalties that may arise from 401K withdrawals. Understand the rules regarding early withdrawals and assess whether you qualify for any exceptions that may exempt you from penalties

It’s also recommended to seek advice from a financial advisor or retirement planning professional who can provide personalized guidance based on your unique circumstances. They can help you navigate the withdrawal process, analyze the implications, and explore alternative solutions that may better suit your financial needs.

Remember, your Nationwide 401K account is designed to provide for a secure retirement. Considering the long-term implications of withdrawing funds prematurely will help you make informed decisions that align with your future financial goals.

With careful consideration, expert advice, and a comprehensive understanding of the withdrawal process, you can confidently navigate the withdrawal process should the need arise while maintaining the integrity and growth of your Nationwide 401K retirement savings.