Finance

How To Withdraw Money From Voya 401K

Modified: December 30, 2023

Learn how to withdraw money from your Voya 401K in a few simple steps. Manage your finances with ease and take control of your future.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Step 1: Understand the Voya 401K Withdrawal Rules

- Step 2: Review Your Vesting Schedule

- Step 3: Determine Your Withdrawal Options

- Step 4: Complete the Necessary Forms

- Step 5: Submit Your Withdrawal Request

- Step 6: Wait for Processing

- Step 7: Receive Your Funds

- Step 8: Consider Tax Implications

- Conclusion

Introduction

Withdrawing money from your Voya 401K can be a significant financial decision, whether it’s for an emergency expense or retirement planning. Understanding the process and rules involved is crucial to ensure a smooth and efficient withdrawal. In this guide, we will walk you through the steps of how to withdraw money from your Voya 401K.

Voya Financial is a trusted provider of retirement plans and offers a range of investment options to help individuals save for their future. However, accessing the funds in your 401K requires adhering to specific rules and procedures set forth by the Internal Revenue Service (IRS) and Voya. By following the correct steps, you can ensure that you make wise financial decisions and avoid any potential penalties or tax ramifications.

It’s important to note that withdrawing money from your Voya 401K should not be taken lightly. A 401K is designed to provide financial security during your retirement years, and early withdrawals can significantly impact your long-term savings goals. However, if you find yourself in a situation where you genuinely need to access your funds, it’s essential to do so with a clear understanding of the process.

In the following sections, we will outline the steps you should take to withdraw money from your Voya 401K, including understanding the withdrawal rules, reviewing your vesting schedule, determining your withdrawal options, completing the necessary forms, submitting your withdrawal request, waiting for processing, receiving your funds, and considering any tax implications.

It’s important to approach the withdrawal process with careful consideration and consult with a financial advisor or tax professional if needed. Now, let’s dive into the first step: understanding the Voya 401K withdrawal rules.

Step 1: Understand the Voya 401K Withdrawal Rules

Before withdrawing money from your Voya 401K, it is crucial to familiarize yourself with the withdrawal rules and regulations that govern your retirement account. The IRS sets specific guidelines for 401K withdrawals to ensure that individuals use these funds primarily for retirement purposes.

The first rule to understand is the age requirement for penalty-free withdrawals. Typically, you must be at least 59 ½ years old to withdraw funds from your Voya 401K without incurring a 10% early withdrawal penalty. However, there are exceptions to this rule, such as the IRS rule of “Rule of 55,” which allows penalty-free withdrawals if you leave your employer in the year you turn 55 or older.

Keep in mind that withdrawing money from your Voya 401K before reaching the age of 59 ½ will result in both income taxes and the early withdrawal penalty. Therefore, it is generally advisable to wait until retirement age to access these funds.

Another important factor to consider is whether your Voya 401K is a traditional or Roth account. Traditional 401K contributions are made with pre-tax dollars, meaning that withdrawals will be subject to ordinary income tax. On the other hand, Roth 401K contributions are made with after-tax dollars, so qualified withdrawals are tax-free.

Additional restrictions apply to early withdrawals from your Voya 401K in the form of required minimum distributions (RMDs). Starting at age 72 (or 70 ½ if you reached that age before January 1, 2020), you must begin taking RMDs from your traditional 401K. Failure to take the required distribution may result in a hefty penalty amounting to 50% of the required distribution amount.

It’s crucial to review and understand these withdrawal rules as they will dictate the timing and tax implications of your Voya 401K withdrawals. If you have any questions or need further clarification, don’t hesitate to contact Voya or consult with a financial advisor.

Step 2: Review Your Vesting Schedule

Understanding your vesting schedule is crucial when considering a withdrawal from your Voya 401K. Vesting refers to the ownership rights you have over your employer’s contributions to your retirement account.

Your vesting schedule determines how much of your employer’s contributions you are entitled to keep if you leave the company. Vesting schedules can vary, so it’s important to review your plan documents or contact Voya to determine your specific vesting status.

There are typically two types of vesting schedules: cliff vesting and graded vesting. In a cliff vesting schedule, you become fully vested in your employer’s contributions after a specific period, usually three to five years. Until the cliff period is reached, you may only be partially vested or have no ownership rights to your employer’s contributions.

On the other hand, a graded vesting schedule allows you to become partially vested over time. For example, your plan may stipulate that you become 20% vested after two years of service, 40% vested after three years, and so on until you are fully vested.

If you have not met your vesting requirements, withdrawing funds from your Voya 401K may result in forfeiting a portion of your employer’s contributions. It’s crucial to review your vesting schedule before making any withdrawal decisions to fully understand the impact on your retirement savings.

However, it’s worth noting that your own contributions and any associated investment gains are always 100% vested, meaning you have full ownership of these funds at all times.

In some cases, your employer may also offer a profit-sharing plan or employer match that is subject to a separate vesting schedule. Make sure to review both your 401K vesting schedule and any other retirement plans you may have to determine your overall vesting status.

By understanding your vesting schedule, you can make informed decisions when considering a withdrawal from your Voya 401K. It’s essential to evaluate the potential impact on your retirement savings based on your current vesting status and the associated forfeitures, if any.

Step 3: Determine Your Withdrawal Options

Once you understand the withdrawal rules and have reviewed your vesting schedule, the next step is to determine the available withdrawal options for your Voya 401K. Voya offers different withdrawal options, each with its own considerations and implications. Here are some common options to consider:

- Lump Sum Withdrawal: This option allows you to withdraw the entire balance of your Voya 401K in one lump sum. While this provides immediate access to your funds, it may have tax implications, as the withdrawal will be treated as taxable income. Additionally, withdrawing a large sum at once may impact your long-term financial goals and retirement security.

- Partial Withdrawal: If you only need a portion of your 401K funds, you can choose to make a partial withdrawal. This option allows you to access the needed funds while leaving the remaining balance in your account to continue growing tax-deferred. It’s important to carefully consider the amount you withdraw to ensure it meets your immediate needs without significantly impacting your retirement savings.

- Installment Payments: With the installment payment option, you can set up a regular schedule to receive recurring payments from your Voya 401K. This provides a steady stream of income and helps in managing your cash flow. However, it’s essential to review any associated fees or restrictions and consider the tax implications of each payment.

- 401K Loan: Depending on your plan’s provisions, you may have the option to take a loan from your Voya 401K. This allows you to borrow against your account balance and repay it over time, usually with interest. Keep in mind that 401K loans come with strict repayment terms, and failure to repay the loan may result in penalties and taxes.

- Rolling Over to an IRA: If you’re no longer employed with the company offering the Voya 401K plan, you may consider rolling over your funds into an Individual Retirement Account (IRA). This option allows for more investment flexibility and control over your retirement savings. However, consult with a financial advisor or tax professional to understand the potential tax consequences and eligibility requirements for an IRA rollover.

Each withdrawal option has its own benefits and considerations. It’s essential to evaluate your financial needs, long-term goals, and tax implications before deciding on the most suitable option for your situation.

Remember, choosing the right withdrawal option will have a significant impact on your financial future, so take the time to weigh the pros and cons of each option and seek professional guidance if needed.

Step 4: Complete the Necessary Forms

After determining your withdrawal option, the next step is to complete the necessary forms required by Voya to initiate the withdrawal process. These forms ensure that the correct instructions are followed and that your request is processed accurately. Here are the general steps to complete the forms:

- Contact Voya: Get in touch with Voya’s customer service team or visit their website to request the required withdrawal forms. They will guide you through the process and provide you with the necessary documents.

- Provide Personal Information: Fill out personal information such as your name, address, Social Security number, and contact details. This information is crucial for accurate identification and communication throughout the withdrawal process.

- Specify Withdrawal Option: Indicate the withdrawal option you have chosen from the available options provided by Voya. Be explicit in stating whether you prefer a lump sum, partial withdrawal, installment payments, or any other option offered by Voya.

- Provide Account Details: Include your Voya 401K account number and any other relevant account details to ensure that the funds are withdrawn from the correct account. Double-check the accuracy of this information to prevent any delays or errors.

- Attach Supporting Documentation: Depending on your withdrawal option, you may need to include additional documentation. For example, if you are making a hardship withdrawal, you may be required to provide supporting documents to validate your financial hardship, such as medical bills or eviction notices.

- Review and Sign: Carefully review the completed forms, ensuring that all information is accurate and complete. Sign and date the forms as required. This signature serves as your authorization for Voya to process the withdrawal request.

Keep in mind that the specific forms and requirements may vary depending on your plan and the withdrawal option chosen. Voya will provide you with the necessary forms tailored to your specific needs. It is crucial to carefully read the instructions provided by Voya and seek clarification from their customer service team if needed.

Once you have completed the forms, make copies for your records before submitting them to Voya for processing. This will serve as a backup in case any issues arise or if you need to reference the information in the future.

By completing the necessary forms accurately and providing all required information, you ensure a smooth and efficient withdrawal process with Voya.

Step 5: Submit Your Withdrawal Request

After completing the necessary forms, the next step is to submit your withdrawal request to Voya. This step is crucial as it initiates the process of accessing your funds. Follow these steps to ensure a successful submission:

- Gather the Required Documents: Double-check that you have all the required forms and supporting documentation ready for submission. Ensure that you have completed the forms accurately and signed them where necessary.

- Contact Voya: Reach out to Voya’s customer service team to inquire about the submission process and preferred method of submission. They will provide you with instructions on how to send your documents securely.

- Choose a Secure Delivery Method: Depending on Voya’s instructions, you may need to use a specific delivery method, such as mail, fax, or an online portal. Ensure that you follow their guidelines to protect the confidentiality and security of your personal information.

- Keep Copies for Your Records: Before submitting your withdrawal request, make copies of all the documents and supporting material for your own records. This will serve as a reference in case any issues or inquiries arise in the future.

- Confirm Receipt: After submitting your withdrawal request, contact Voya to confirm that they have received your documents. This step provides reassurance and allows you to track the progress of your request.

It’s important to note that the time it takes for Voya to process your withdrawal request may vary. Factors such as the complexity of your request, the volume of requests they are handling, and any additional requirements or documentation needed can impact the processing time. Be patient and allow sufficient time for Voya to complete the necessary steps.

During this time, it is recommended to refrain from making any changes to your 401K account or retirement plan. Making modifications or withdrawals from your account while a withdrawal request is in process may cause confusion or delays in processing your request.

By following the appropriate submission process and communicating with Voya, you can ensure that your withdrawal request is received and processed efficiently.

Step 6: Wait for Processing

After submitting your withdrawal request to Voya, the next step is to patiently wait for the processing of your request. While the exact processing time can vary depending on several factors, including the complexity of your request and Voya’s workload, it’s important to allow sufficient time for the process to be completed.

During this waiting period, it’s crucial to refrain from making any changes or additional requests regarding your Voya 401K account. Making modifications or withdrawals while your request is being processed may cause confusion and potential delays in the processing of your original withdrawal request.

Throughout the waiting period, Voya’s customer service team should be available to provide updates on the progress of your withdrawal request. Feel free to contact them if you have any concerns or questions regarding the status of your request.

It’s important to note that certain withdrawal options, such as lump-sum withdrawals or complex requests, may require additional time for processing. Be prepared to wait longer in such cases, as Voya needs to ensure proper verification and compliance with regulatory requirements.

Additionally, if there are any issues or discrepancies with your withdrawal request forms or supporting documentation, Voya may reach out to you for clarification or corrective action. Respond promptly and provide any requested information or updates to facilitate the processing of your request.

Remember, patience is key during this step. While waiting for your withdrawal request to be processed can be an anxious time, rest assured that Voya is working diligently to ensure the smooth and accurate completion of your request.

Once your withdrawal request has been processed, you can proceed to the final step and receive your funds.

Step 7: Receive Your Funds

After the processing of your withdrawal request, it’s time to receive your funds from your Voya 401K account. The method and timing of receiving your funds may vary depending on the withdrawal option you selected. Here’s what you need to know:

- Lump Sum Withdrawal: If you chose a lump sum withdrawal, Voya will typically issue a check for the total amount requested. The check will be sent to your designated mailing address. Ensure that your contact information is up to date to avoid any delays in receiving the check.

- Partial Withdrawal: For partial withdrawals, Voya will disburse the requested amount while leaving the remaining balance in your 401K account. The disbursement can be made through a check, direct deposit, or other electronic transfer methods, depending on your preference and Voya’s policies.

- Installment Payments: If you opted for installment payments, Voya will set up a recurring payment schedule based on the payment frequency you selected. These payments can be sent to you via check, direct deposit, or another agreed-upon method.

- 401K Loan Repayment: If you took a loan from your Voya 401K account and are in the repayment phase, the repayment amount will be automatically deducted from your future paychecks or handled according to your employer’s procedures.

- IRA Rollover: If you chose to roll over your Voya 401K funds into an Individual Retirement Account (IRA), Voya will facilitate the transfer of funds to your new IRA custodian. The timeline for receiving your funds in your IRA will depend on the processing time of the receiving institution.

It’s essential to review the disbursement method and ensure its compatibility with your financial needs. If you have specific instructions or preferences regarding the disbursement process, it’s advisable to communicate them to Voya beforehand.

Once you receive your funds, it’s important to manage them wisely according to your financial goals. You may choose to reinvest the funds, allocate them towards other investments, pay off debts, or use them for immediate financial needs. Consider consulting with a financial advisor to make informed decisions based on your specific financial circumstances.

Keep in mind that the receipt of funds may have tax implications. If you made contributions to your Voya 401K account with pre-tax dollars, the disbursement will be subject to ordinary income tax. It’s recommended to consult with a tax professional to understand the tax consequences of your withdrawal and ensure compliance with IRS regulations.

Congratulations on successfully receiving your funds from your Voya 401K account! Remember to track and document any tax-related information and retain records as necessary for future reference or tax filing purposes.

Step 8: Consider Tax Implications

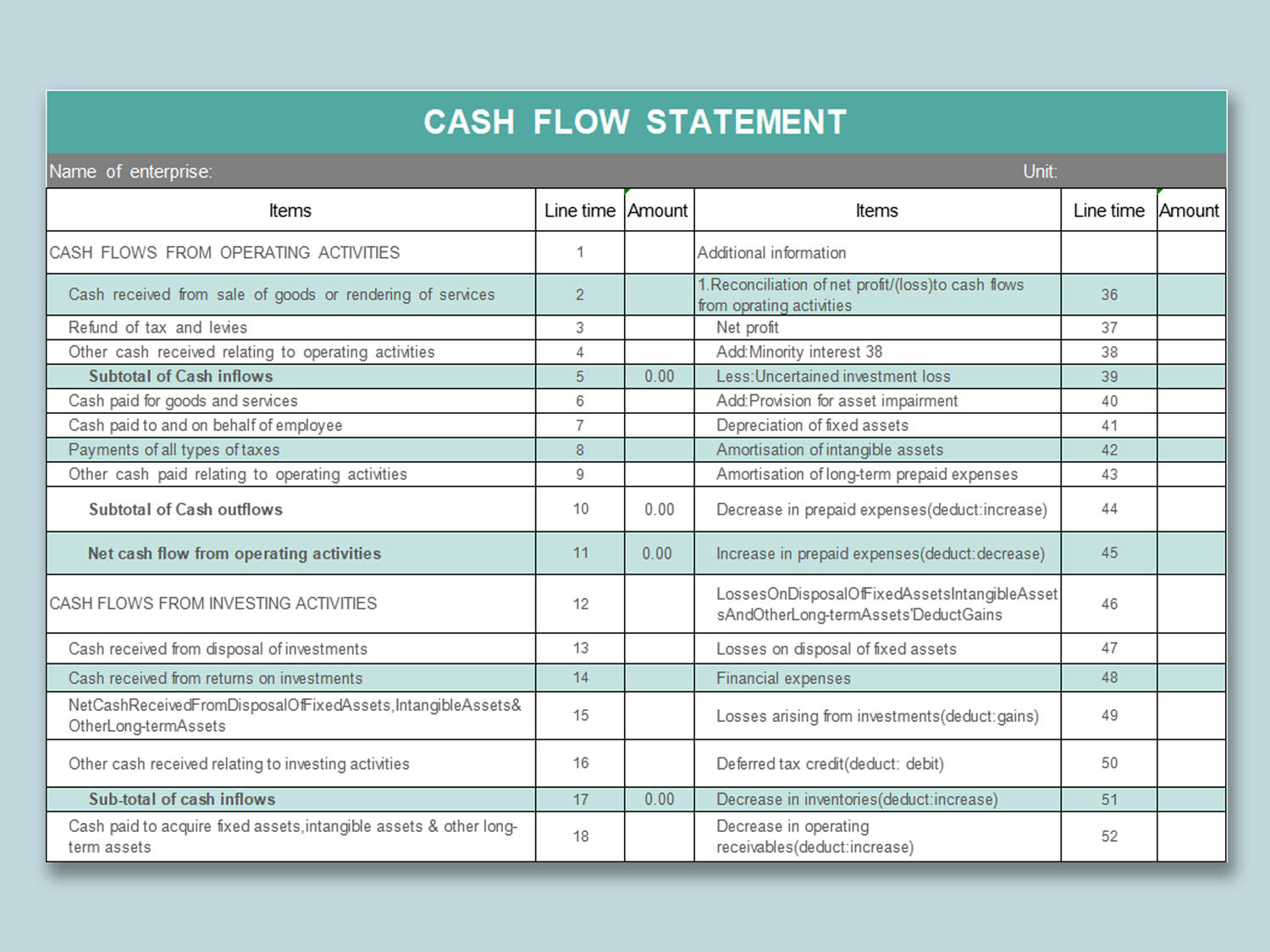

As you receive funds from your Voya 401K withdrawal, it’s crucial to consider the tax implications associated with these distributions. Understanding and planning for the tax consequences will help you make informed decisions and avoid any surprises come tax season. Here are some key tax considerations:

1. Income Tax: Withdrawals from a traditional 401K account are generally subject to ordinary income tax. The amount withdrawn will be added to your taxable income for the year in which the withdrawal occurs. It’s important to set aside a portion of the withdrawn funds to cover the tax liability.

2. Early Withdrawal Penalty: If you’re under the age of 59 ½ and you make a withdrawal from your Voya 401K, you may be subject to an additional 10% early withdrawal penalty. This penalty is in addition to the ordinary income tax and applies unless you qualify for an exception, such as the Rule of 55 or certain hardship withdrawals.

3. Roth 401K Withdrawals: If you made contributions to a Roth 401K account, qualified withdrawals are generally tax-free. However, it’s important to distinguish between the contributions and any associated investment earnings. While contributions can be withdrawn tax-free, earnings may be subject to income tax and the early withdrawal penalty if withdrawn before age 59 ½ or before the account has been open for five years.

4. Required Minimum Distributions (RMDs): Starting at age 72 (or 70 ½ if you reached that age before January 1, 2020), you must take RMDs from your traditional 401K. RMDs are subject to ordinary income tax and are calculated based on your account balance and life expectancy. Failure to take the required distribution may result in a substantial tax penalty.

5. Withholding Options: When you request a withdrawal from your Voya 401K, you may have the option to have income tax withheld from your distribution. This can be a helpful strategy to ensure that you have sufficient funds to cover your tax liabilities. Consider consulting with a tax professional to determine the appropriate withholding amount based on your individual circumstances.

Understanding the tax implications of your Voya 401K withdrawal is crucial for effective financial planning. It’s recommended to consult with a tax advisor or financial planner who can provide personalized guidance based on your specific situation. They can help you assess the impact on your overall tax position and assist in developing strategies to optimize your tax situation.

By considering the tax consequences of your Voya 401K withdrawal, you can make informed decisions that align with your financial goals and avoid any unnecessary tax burdens.

Conclusion

Withdrawing money from your Voya 401K is a significant financial decision that requires careful consideration and adherence to the applicable rules and procedures. By following the steps outlined in this guide, you can navigate the withdrawal process with confidence and make informed choices that align with your financial goals.

Understanding the withdrawal rules and reviewing your vesting schedule are crucial initial steps. These will help you determine the eligibility and potential impact of your withdrawal on your retirement savings. Evaluating the available withdrawal options allows you to choose the most suitable method that meets your immediate financial needs while considering the long-term implications.

Completing the necessary forms accurately and submitting them to Voya initiates the processing of your withdrawal request. Patience is essential during the waiting period, as the processing time may vary. Once the request has been processed, you can receive your funds based on the chosen withdrawal option.

Lastly, it’s important to consider the tax implications of your Voya 401K withdrawal. Understanding the potential tax liabilities, early withdrawal penalties, and required minimum distributions can help you plan and manage your funds effectively.

While this guide provides a comprehensive overview of the steps involved in making a Voya 401K withdrawal and considering the associated factors, it’s always advisable to consult with a financial advisor or tax professional. They can provide personalized guidance based on your unique financial situation and help ensure that your withdrawal aligns with your long-term financial goals.

Remember, your Voya 401K is designed to secure your financial future during retirement. Therefore, careful consideration should be given to the impact of any early withdrawal on your overall retirement savings. Striking a balance between present needs and long-term financial security is crucial when making withdrawal decisions.

By following the steps outlined in this guide and seeking professional advice, you can make informed choices as you navigate the process of withdrawing money from your Voya 401K.